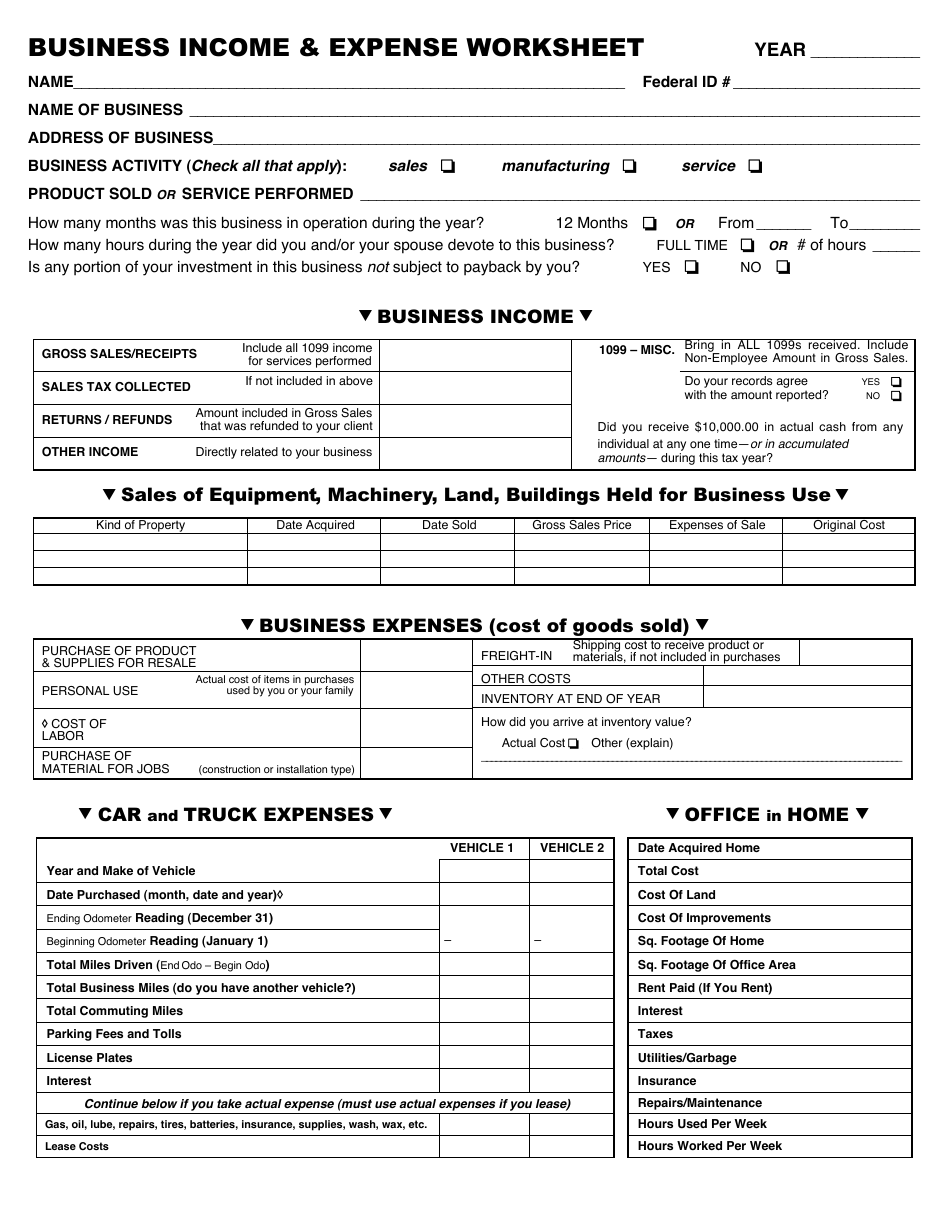

40 business income insurance worksheet

There is a worksheet in the IRS instructions for Schedule 1 (which are within the main Form 1040 instructions) to help you determine how much income you need to report here. There are a few exceptions, which the instructions outline. Line 2 has two parts. Line 2a is for alimony or separate maintenance payments that you received in 2018 or earlier. The worksheet is not filed with the IRS. Line 4c of the worksheet should be corrected to the following: Add line 4b to line 4a. If the result is less than zero, include this amount on line 10. The third sentence of line 10 should be corrected to the following: Include business interest expense as a separate loss class.

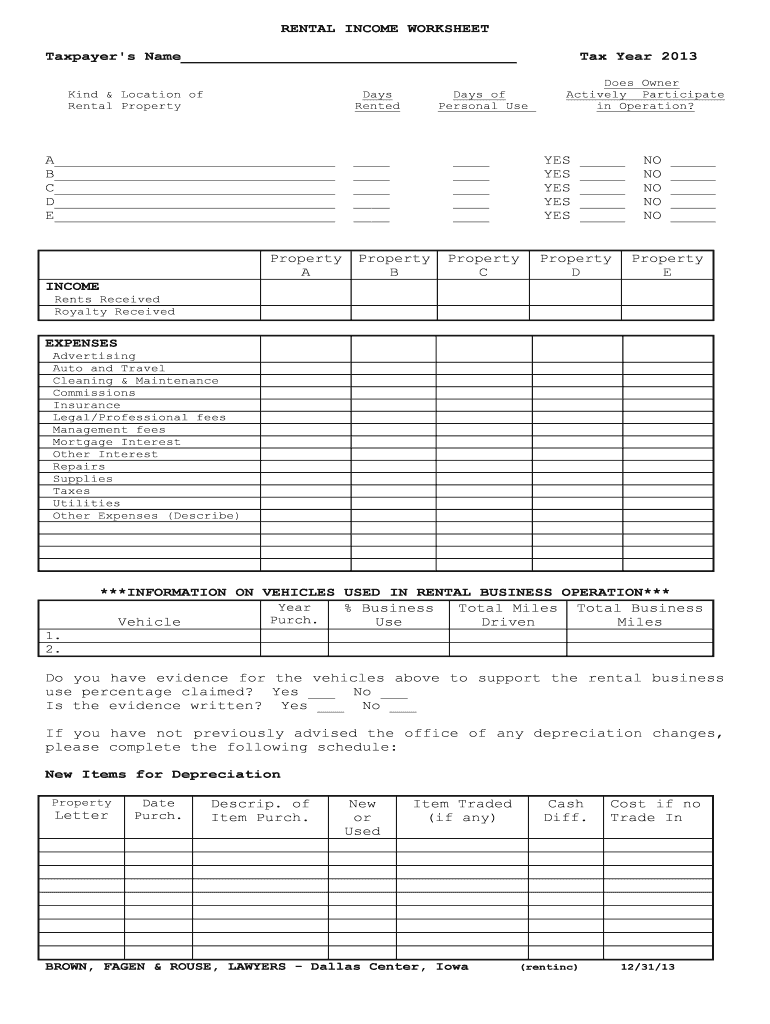

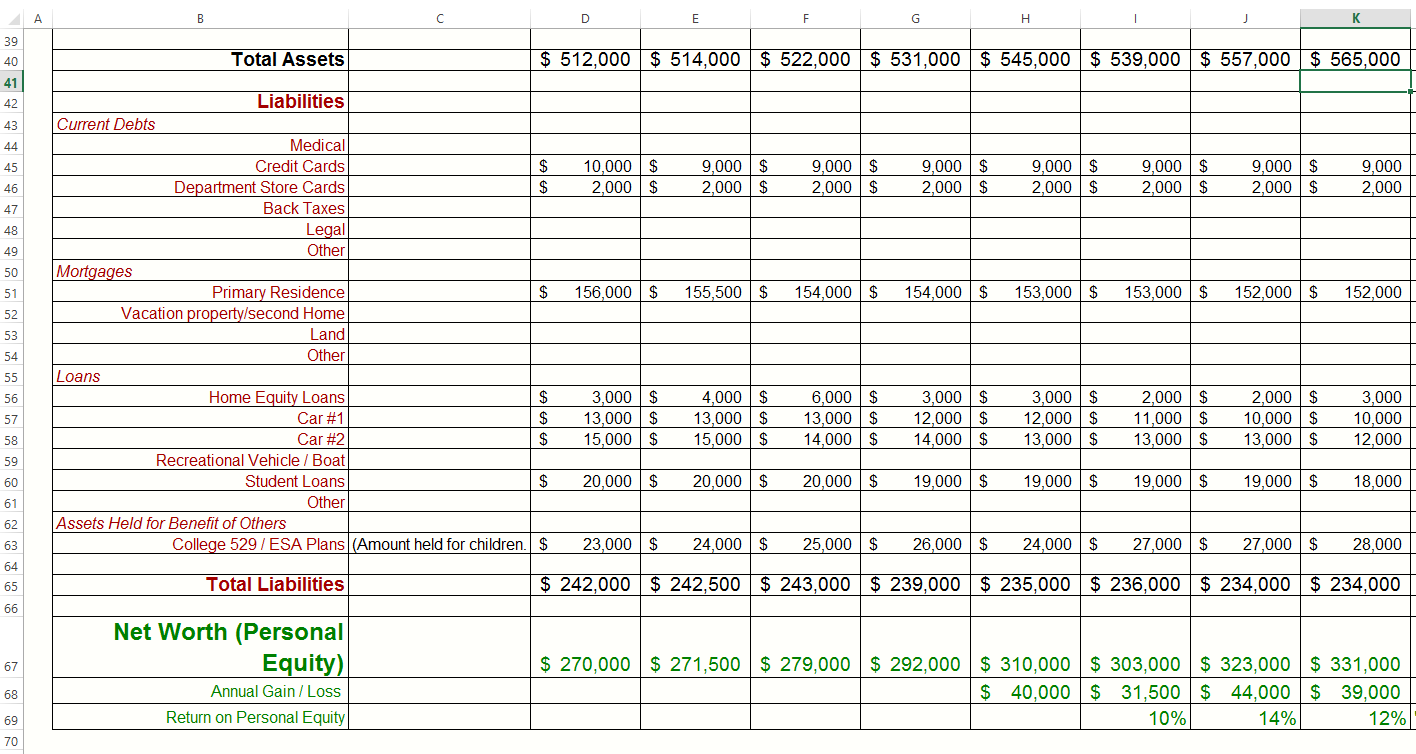

For borrowers who have less than 25% ownership of a partnership, S corporation, or limited liability company (LLC), ordinary income, net rental real estate income, and other net rental income reported on IRS Form 1065 or IRS Form 1120S, Schedule K-1 may be used in qualifying the borrower provided the lender can confirm the business has adequate ...

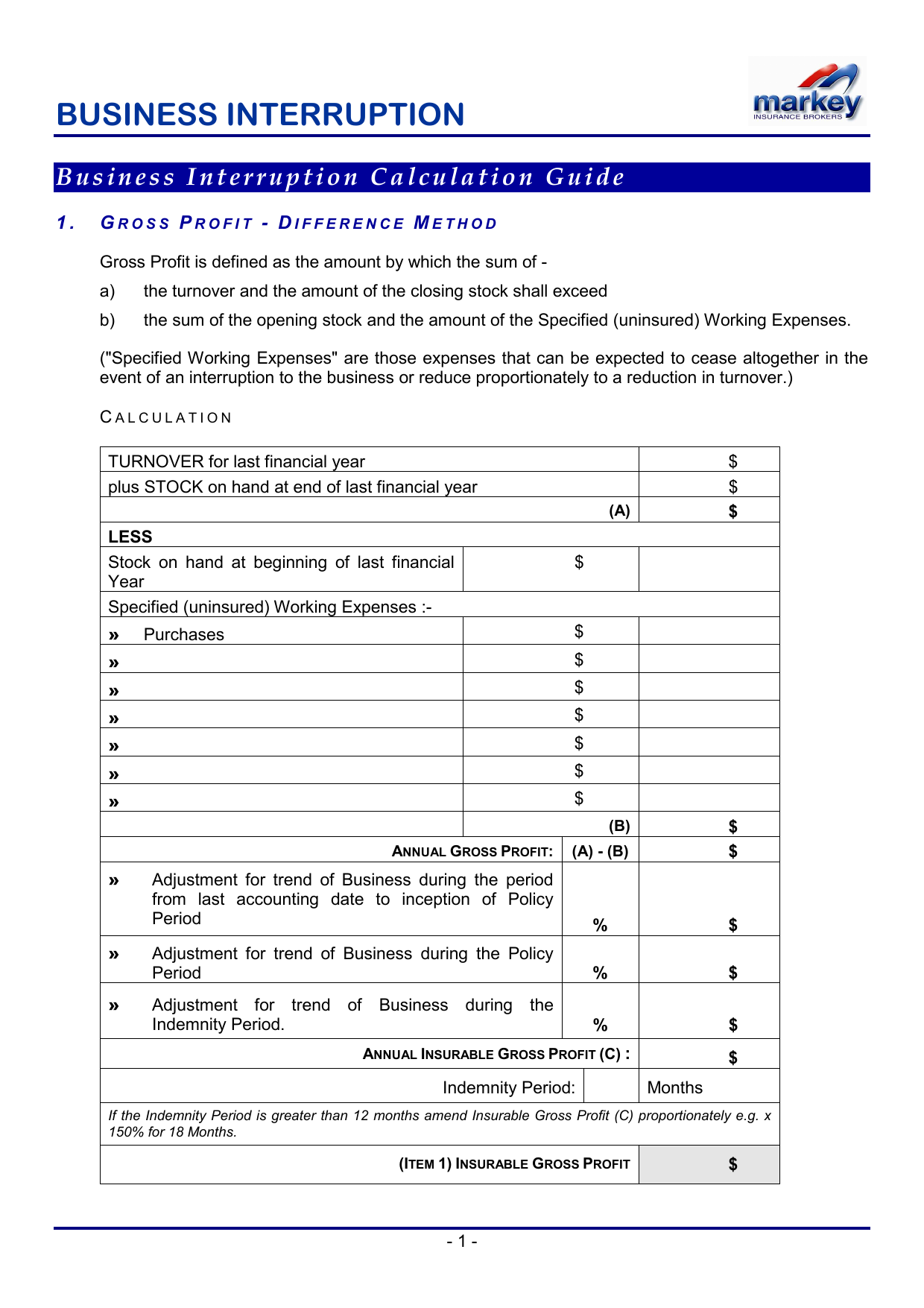

Business income insurance worksheet

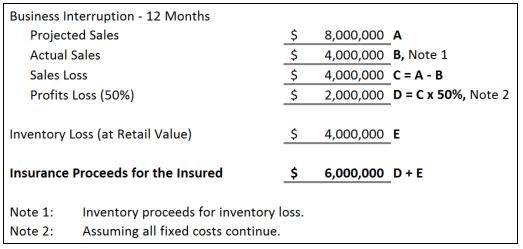

Business interruption insurance may sound fantastic, but with a national average cost of $1200 per year, the question remains - who foots the bill?If owners have a well-drafted lease, both landlords and tenants can split the cost of a business interruption insurance policy.If you have commercial tenants, it is good to require them to carry their own business income coverage. Residents - Include gross income from all sources, both in and out of Massachusetts.. Part-year residents - Include gross income from all sources during your residency period.. Nonresidents - Include gross income from sources in Massachusetts.This includes income related to: Any trade of business, including any employment you carried on in Massachusetts, whether or not you actively engaged in ... and beyond your regular expenses. The purpose of this worksheet is to estimate the potential expsoure/expenses incurred as your business continues operations while trying to get back to normal after a loss. Business Income insurance covers what the business would have earned if no loss had occurred. Extra Expense covers the

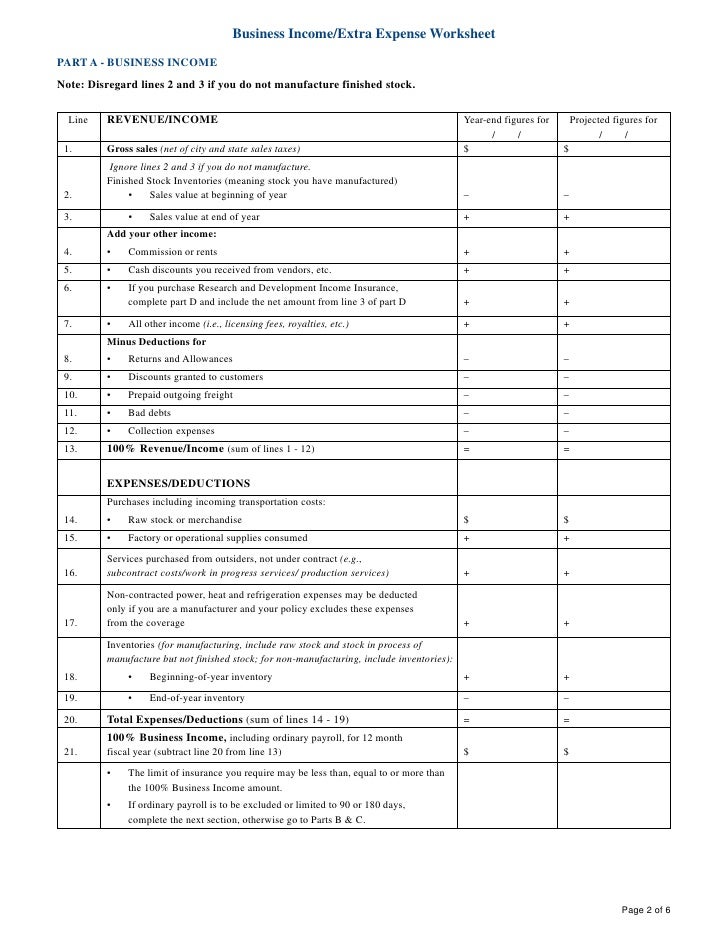

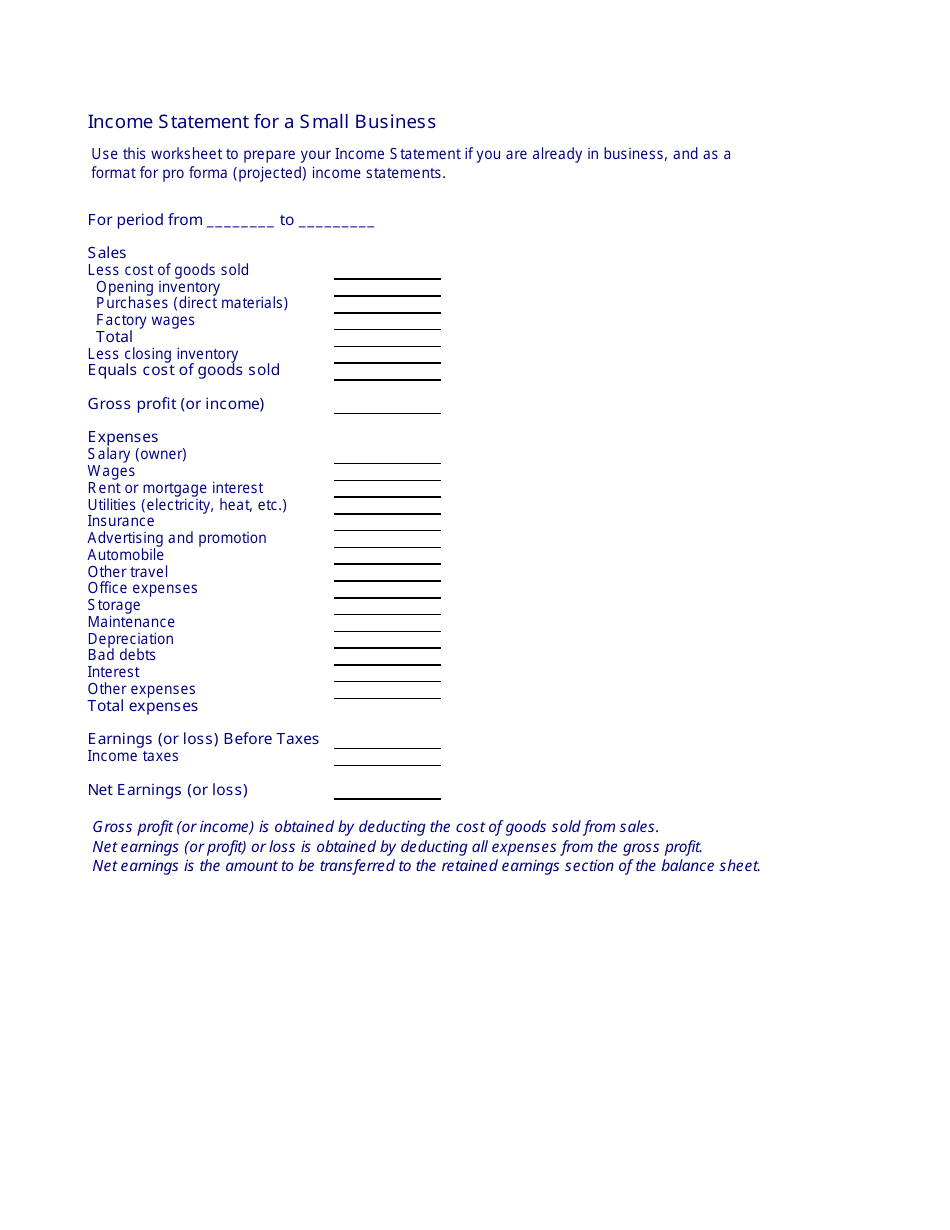

Business income insurance worksheet. business income worksheet must be submitted to and accepted by us prior to a loss. A new worksheet must be submitted if you (1) change the limit of insurance mid-term, or (2) at the end of each 12 month policy period. Chubb Business Income Worksheet Fill Online Printable An envelope. It indicates the ability to send an email. A simplified explanation of how self-employment tax is calculated: Enter your business net income. Multiply this income by 92.35% (0.9235) Multiply this number by 15.3% (the self-employment tax rate) to get your self-employment tax liability amount. Home; NJ Income Tax - Business Income; NJ Income Tax - Business Income. If you have losses in certain business-related categories of income, you may be able to use those losses to calculate an adjustment to your taxable income (Alternative Business Calculation Adjustment).In addition, you can carry forward unused losses in those categories for 20 years to calculate future adjustments. The "Income Statement" (i.e. profit and loss) template is a fundamental business document, especially for small businesses looking for a loan from a credit institution. This income statement template calculates the operating income so businesses know exactly where their finances stand.

In order to generate monthly Income Statements, you'll need separate sheets for each month. Make twelve copies of the original income statement, one for each month in the year. Then, on each Income Statement sheet, change the Date Range (Beginning Rate and End Date) to cover the relevant month. Name the sheet after the month it covers. 5. For example, if a company evaluates its exposure and determines its MFL to be less than one year's earnings and reports this amount on the business interruption (BI) worksheet, this amount may be appropriate for establishing policy limits, but it may not be the proper basis for determination of percent-of-value deductibles or ADV deductibles. This video shows how to prepare the Qualified Business Income Deduction or QBID (Section 199A) worksheets in a 1040 return using interview forms. QBI-1 is used to get the QBID (199A) output worksheet(s) to print and populate by labeling an income producing activity/entity as Qualified Business or Qualified Service activity. business income worksheet must be submitted to and accepted by us prior to a loss. A new worksheet must be submitted if you (1) change the limit of insurance mid-term, or (2) at the end of each 12 month policy period. Failure to submit a signed current worksheet will automatically reinstate the Coinsurance Provision for the period going forward.

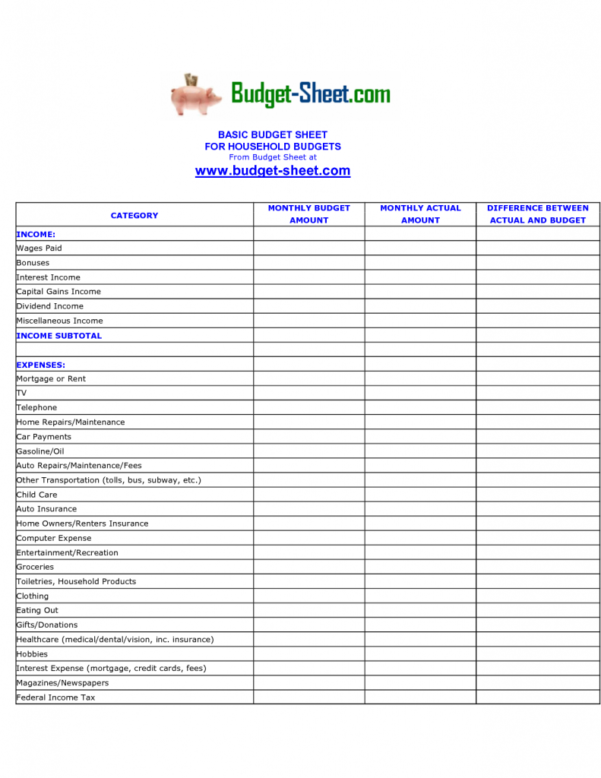

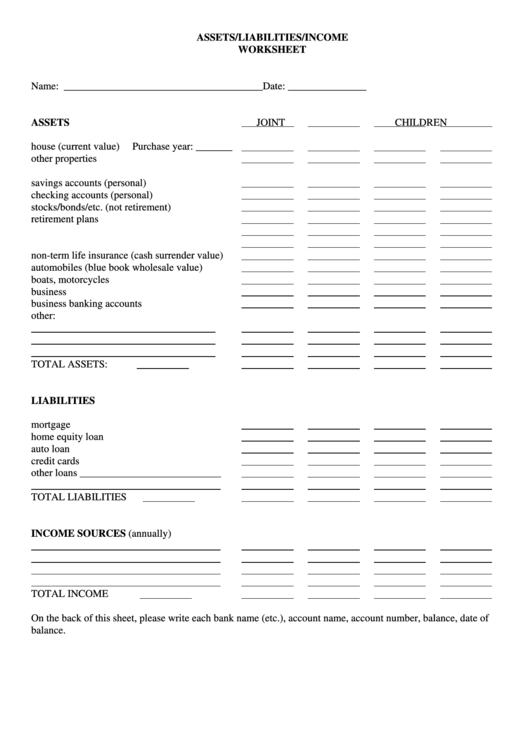

Key takeaways. For the self-employed, health insurance premiums became 100% deductible in 2003. The deduction that allows self-employed people to reduce their adjusted gross income by the amount they pay in health insurance premiums during a given year.; If you have an S-corp, you should be aware of a 2015 notice regarding reimbursement for health premiums. Completing a business income worksheet can help you accurately estimate how much business income coverage you may need. Together with a sound business continuity plan, it serves as a critical planning tool to help your business recover from unplanned business interruptions. To get started, choose from the industry selections below: Wilma makes $100,000 in net business income from her sole proprietorship but also deducts $5,000 for self-employed health insurance, $7,065 for self-employment taxes and $10,000 for a SEP IRA. These are not business deductions- they are adjustments on Form 1040 to calculate adjusted gross income. Description. This spreadsheet contains two sample business budgets designed for companies providing services or selling products. Service Providers: The Services worksheet is a simple business budget that separates income and business expenses into categories that closely match those used in an income statement. The categories are fairly comprehensive, but it is also easy to add, remove, and ...

VANTREO Insurance Brokerage License #0F69776 ___ SIMPLIFIED BUSINESS INCOME AND EXTRA EXPENSE WORKSHEET This worksheet is designed to help determine a 12-month business income and extra expense exposure. Business income, in general, pays for net income (or loss) the insured would have earned or incurred, plus continuing normal

Business interruption insurance also goes by a different title, business income insurance. Extra expense coverage, on the other hand, is a component of business interruption insurance. It allows your business to be reimbursed for relocation costs and other expenses if you need to temporarily operate out of another location during a closure.

Self-Employed Health Insurance Deduction Worksheet - 2020. A self-employed health insurance adjustment is listed in Line 16 of Schedule 1. What is meant by an adjustment is that this will reduce taxable income in your return so that you will have less tax liability. This is normal as this how your self-employed premium is handled on a federal ...

Business income coverage (BIC) form is a type of property insurance policy, which covers a company's loss of income due to a slowdown or temporary suspension of normal operations, which stem from...

Gusto provides a free spreadsheet template to track business income and expenses as simply as possible. With a page for each month, it makes it easy to get your business finances in order. Make it even easier by logging each payment and expense as you go rather than pouring over bank or credit card statements and receipts at a later date.

this worksheet is an all-in-one tool for calculating and understanding business income and extra expense coverage. • Page 1 calculates a 12-month bi/ee exposure • Page 2 shows how to calculate a limit of insurance/coinsurance

Business Income Insurance (58 cards) 2019-04-13 1 . Businessowners Policies (15 cards) 2019-04-13 1 . Causes of Loss Forms (25 cards) 2018-08-09 1 . Ch 1 (19 cards) 2014-03-25 1 . Chaper 7 Notes (31 cards ...

To learn more about church insurance or business interruption insurance, contact our Texas church attorneys today: 888-614-7730. The Voss Law Firm, P.C. represents clients on a local, national and international basis. We proudly serve companies and individuals along the Gulf Coast and around the globe on a contingency fee basis.

Business Income Insurance vs. Extra Expense Coverage. Extra expense coverage is an additional, optional coverage that can cover extra expenses to keep your business running after an accident or disaster. It is valuable for businesses that need to operate right away after a disaster, or who can move to a temporary location to avoid a shutdown.

The shareholder's share of income or loss is carried over to IRS Form 1040, Schedule E. See B3-3.2-02, Business Structures, for more information on S corporations. A borrower with an ownership interest in an S corporation or LLC may receive income in the form of wages or dividends in addition to his or her proportionate share of business ...

Notes: An entry in the Qualified option in the Qualified Business Income section of the worksheets is mandatory to include that activity, using it's entity type and it's entity number in the calculation.; For return types 1065, 1120, and 1120S, an entry for the Code to print QBI schedule is used to produce the 199A output worksheet(s) by labeling an income producing activity/entity as ...

At first, you should separate business and personal expenses. Don't combine these two ever. You will have a better understanding of business costs if you keep them separate. Furthermore, it also acts as a guarantee that you will claim the accurate amount of tax-deductible expenses during income tax season.

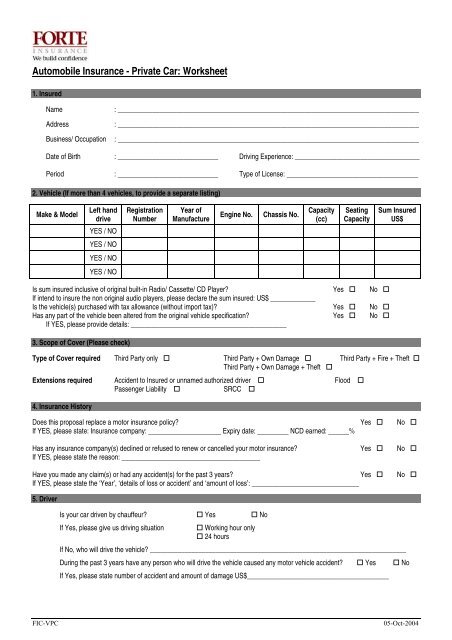

Business income worksheet insurance. It is required if the policy provides agreed amount. Business income insurance, also known as business interruption coverage, helps cover lost income and additional expenses when your business is shut down from a covered loss.

Net income formula. Net income is your company's total profits after deducting all business expenses. Some people refer to net income as net earnings, net profit, or simply your "bottom line" (nicknamed from its location at the bottom of the income statement).It's the amount of money you have left to pay shareholders, invest in new projects or equipment, pay off debts, or save for ...

FAST Tools. FAST (Farm Analysis Solution Tools) are a suite of Microsoft Excel spreadsheets designed to assist those in agriculture make better decisions via user-friendly computer programs. FAST aids users in performing financial analysis, assessing investment decisions, and evaluating the impacts of various management decisions.

Total insurable value (TIV) is the value of property, inventory, equipment, and business income covered in an insurance policy. ... The insurer may provide worksheets to help organize inventory.

and beyond your regular expenses. The purpose of this worksheet is to estimate the potential expsoure/expenses incurred as your business continues operations while trying to get back to normal after a loss. Business Income insurance covers what the business would have earned if no loss had occurred. Extra Expense covers the

Residents - Include gross income from all sources, both in and out of Massachusetts.. Part-year residents - Include gross income from all sources during your residency period.. Nonresidents - Include gross income from sources in Massachusetts.This includes income related to: Any trade of business, including any employment you carried on in Massachusetts, whether or not you actively engaged in ...

Business interruption insurance may sound fantastic, but with a national average cost of $1200 per year, the question remains - who foots the bill?If owners have a well-drafted lease, both landlords and tenants can split the cost of a business interruption insurance policy.If you have commercial tenants, it is good to require them to carry their own business income coverage.

0 Response to "40 business income insurance worksheet"

Post a Comment