40 same day tax payment worksheet

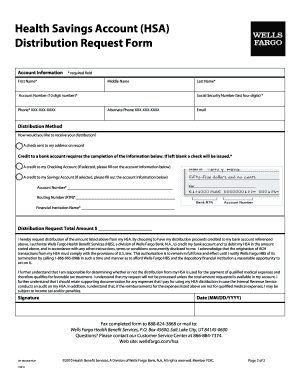

Same Day Payment Worksheet. To arrange an electronic same-day federal tax payment, complete this form and present it at your financial institution. Same Day Payment Worksheet. EFTPS Fact Sheet. Learn basic information about EFTPS, enrolling, and making a tax payment using this one page document. In order to complete an international wire transfer through your foreign bank, you will need to complete the Same-Day Taxpayer Payment Worksheet PDF with the proper Tax Type Code and tax period (year and/or quarter) so that the funds will be properly applied to your IRS tax liability. After you have completed the worksheet, take it to your bank ...

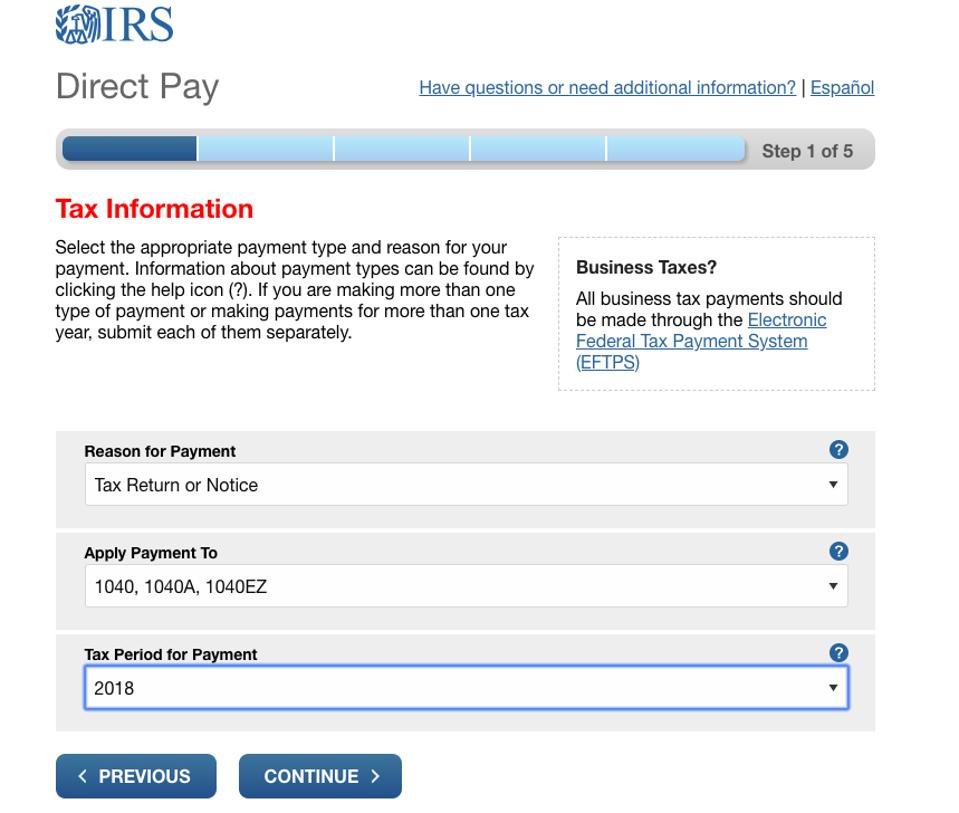

Electronic Federal Tax Payment System. A free way for the public, businesses, and federal agencies to pay their taxes online. Visit EFTPS. Quick, secure, and accurate payments. Available 24 hours a day, 7 days a week. Schedule payments up to a year in advance.

Same day tax payment worksheet

Download the Same-Day Taxpayer Worksheet. Complete it and take it to your financial institution. Complete it and take it to your financial institution. If you are paying for more than one tax form or tax period, complete a separate worksheet for each payment. other tax forms, repeat tax form number from TXP02. "*" $$$$$¢¢–If there are no subcategory or IRS Number amounts, this is the same amount as in field "6" of the ACH Entry Detail Record (6 record). If subcategories are reported, then the amount fields TXP05, TXP07, and TXP09 must balance to the tax payment amount in field "6" of the ACH The IRS asks that you fill out the Same-Day Taxpayer Worksheet and bring it to your financial institution to assist in making the transfer. You'll document your total tax payment, your taxpayer identification number, the first four letters of your business name -- if applicable -- and your name or the full business name.

Same day tax payment worksheet. Same-Day Payment Worksheet To help make a same-day tax payment, take the Same-Day Payment Worksheet to a financial institution. Call the financial institution first to learn whether they can send the payment, what the cutoff time is for initiating the payment, and what fees might be associated with the payment. Get and Sign Same Day Taxpayer Worksheet Form . Digits) see Common IRS Tax Type table below OPTIONAL INFORMATION: If the payment includes tax, interest, and penalty: NOTE: The sum of lines 8-10 must equal the amount in line 1. Nov 19, 2021 · Download the Same-Day Taxpayer Worksheet PDF. Complete it and take it to your financial institution. If you are paying for more than one tax form or tax period, complete a separate worksheet for each payment. Financial institutions can refer to the Financial Institution Handbook PDF for help with formatting and processing information. SAME-DAY TAXPAYER WORKSHEET To arrange an electronic same-day federal tax payment, complete this form and present it at your inancial institution. Please type or print clearly. 1 Total tax payment: (Include interest and penalty if applicable) $ 2 Taxpayer identiication number: 3 Taxpayer name control: (the irst four letters of your business ...

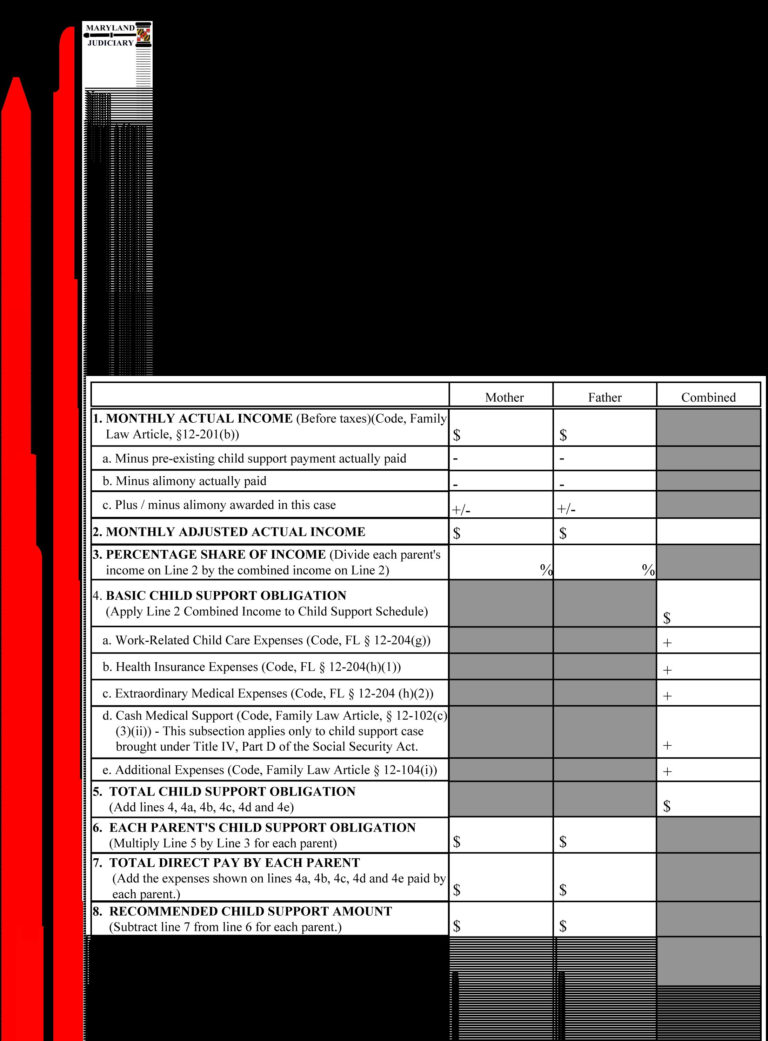

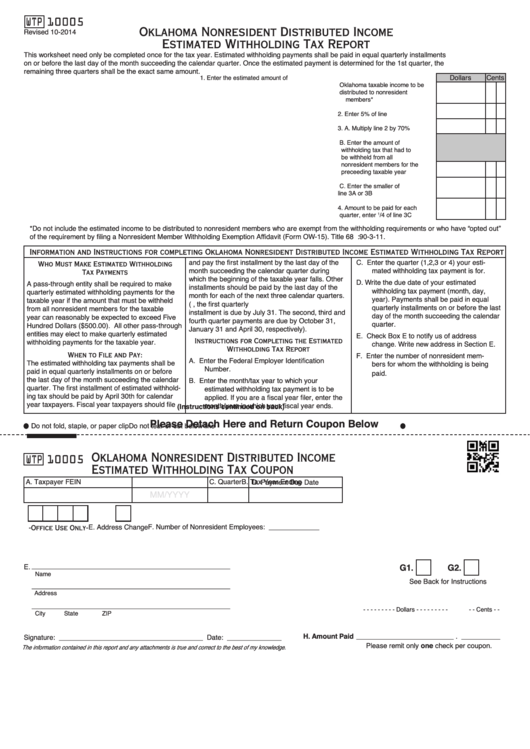

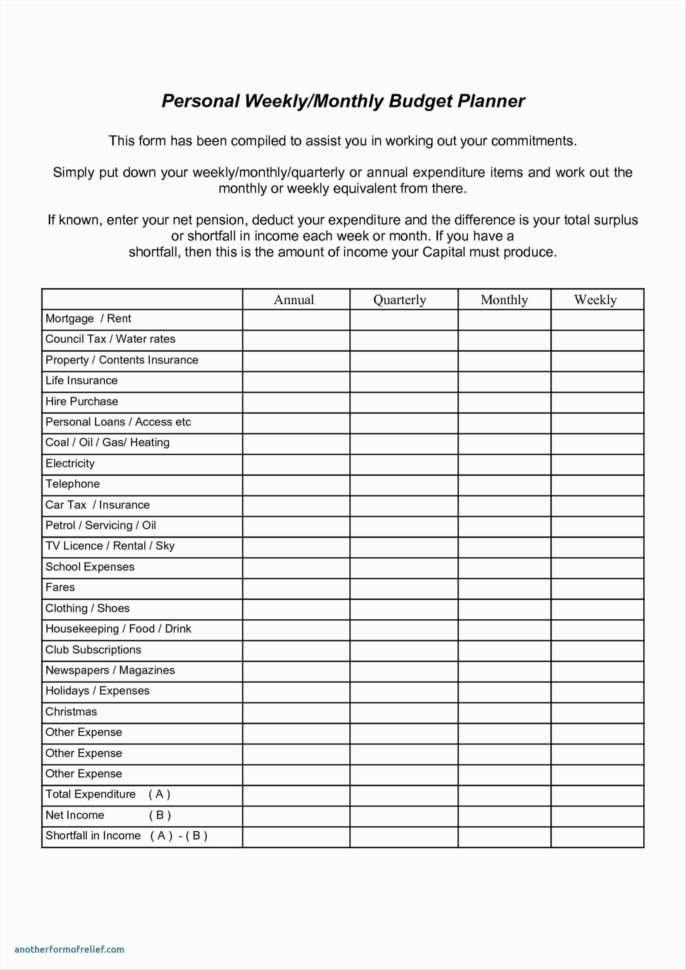

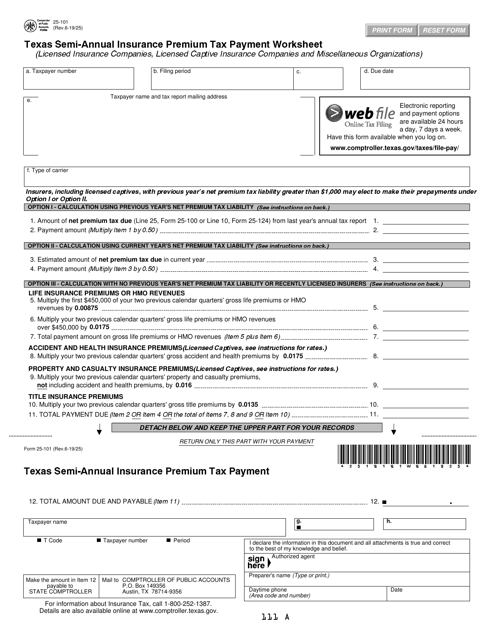

VRS EFTPS-Direct Payment Worksheet - long form (continued) Further breakout for the following tax forms: For Tax Form 720, you are requested to report IRS numbers and amounts, and the IRS number amounts must balance to the Tax Form 720 payment amount. For Tax Form 941 and CT-1, you are requested to report Use Fill to complete blank online OTHERS pdf forms for free. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. Same- Day Taxpayer Worksheet. On average this form takes 3 minutes to complete. The Same- Day Taxpayer Worksheet form is 2 pages long and contains: 0 signatures. 0 check-boxes. other tax forms, repeat tax form number from TXP02. "*" $$$$$¢¢–If there are no subcategory or IRS Number amounts, this is the same amount as in field "6" of the ACH Entry Detail Record (6 record). If subcategories are reported, then the amount fields TXP05, TXP07, and TXP09 must balance to the tax payment amount in field "6" of the ACH When to Make Payments: Quarterly payments of the estimated franchise and excise taxes are to be made as follows: Payment Due Date 1st Payment The 15th day of the 4th month of the current taxable year 2nd Payment The 15th day of the 6th month of the current taxable year 3rd Payment The 15th day of the 9th month of the current taxable year

SAME-DAY TAXPAYER WORKSHEET To arrange an electronic same-day federal tax payment, complete this form and present it at your financial institution. Please type or print clearly. 1 Total tax payment: (Include interest and penalty if applicable) $ 2 Taxpayer identification number: Payments can also be made by making same day payment or using your payroll company. The cost of the same day payment is typically higher than the other payment methods. Please, check with your financial institution for its fees. If you choose to allow your payroll company to make tax payments on your behalf, check What do I put on the Same-Day Taxpayer Worksheet under tax/month quarter for a 1040X. My preparer told me to use 10 and I did but now I'm thinking it may have Also, it may arrange for its financial institution to initiate a same-day tax wire payment (discussed below) on its behalf. EFTPS is a free service provided by the Department of the Treasury. Services provided by a tax professional, financial institution, payroll service, or other third party may have a fee.

2 Call the EFTPS Tax Payment toll-free number (available 24 hours a day, 7 days a week): 1.800.555.3453 3 Follow the voice prompts to select the tax form, payment type, tax period, and amount (and subcategory

SAME-DAY TAXPAYER WORKSHEET To arrange an electronic same-day federal tax payment, complete this form and present it at your financial institution. Please type or print clearly. 1 Total tax payment: (Include interest and penalty if applicable) 2 Taxpayer identification number: 3 Taxpayer name control: (the first four letters of your business ...

The Electronic Federal Tax Payment System® tax payment service is provided ... about ACH Credit or same-day wire payments, or consult a tax professional or ...

6 days ago — 3. Make an IRS payment with a same-day wire transfer · Your financial institution decides the availability, cost and cut-off times for the wire.

Tax payments must be received or postmarked by the due date to avoid penalties. If a payment is received after the due date, with no postmark, the payment is considered late and penalties will be imposed. Make check/money order payable to "SF Tax Collector". Include Block and Lot number on memo line.

To begin a new session, click the 'back' button on your browser and then press the 'shift' key and click the 'refresh' icon. Click here to begin a new session. For assistance call Customer service at 1 800 555-8778.

To arrange an electronic same-day federal tax payment, complete this form and present it at your financial institution. Please type or print clearly. Legend for Tax Type Suffixes (the one character suffix follows the 4-digit form number for the tax type): Suffix Type Suffix Type 0 Amended 6 Estimated

The IRS asks that you fill out the Same-Day Taxpayer Worksheet and bring it to your financial institution to assist in making the transfer. You'll document your total tax payment, your taxpayer identification number, the first four letters of your business name -- if applicable -- and your name or the full business name.

other tax forms, repeat tax form number from TXP02. "*" $$$$$¢¢–If there are no subcategory or IRS Number amounts, this is the same amount as in field "6" of the ACH Entry Detail Record (6 record). If subcategories are reported, then the amount fields TXP05, TXP07, and TXP09 must balance to the tax payment amount in field "6" of the ACH

Download the Same-Day Taxpayer Worksheet. Complete it and take it to your financial institution. Complete it and take it to your financial institution. If you are paying for more than one tax form or tax period, complete a separate worksheet for each payment.

0 Response to "40 same day tax payment worksheet"

Post a Comment