41 1120s other deductions worksheet

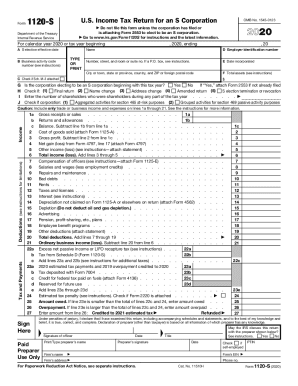

For 2021, a corporation that (a) is required to file Schedule M-3 (Form 1120-S), Net Income (Loss) Reconciliation for S Corporations With Total Assets of $10 Million or More, and has less than $50 million total assets at the end of the tax year, or (b) isn't required to file Schedule M-3 (Form 1120-S) and voluntarily files Schedule M-3 (Form 1120-S), must either complete Schedule M-3 (Form 1120-S) entirely or complete Schedule M-3 (Form 1120-S) through Part I and complete Form 1120-S ... The corporation uses Schedule K-1 to report your share of the corporation's income, deductions, credits, and other items. Keep it for your records. Don't file ...

form 1120 line 26 other deductions worksheet - Fill Online, Printable, Fillable Blank | form-1120-a.com form 1120 line 26 other deductions worksheet 2006-2021 Online solutions help you to manage your record administration along with raise the efficiency of the workflows.

1120s other deductions worksheet

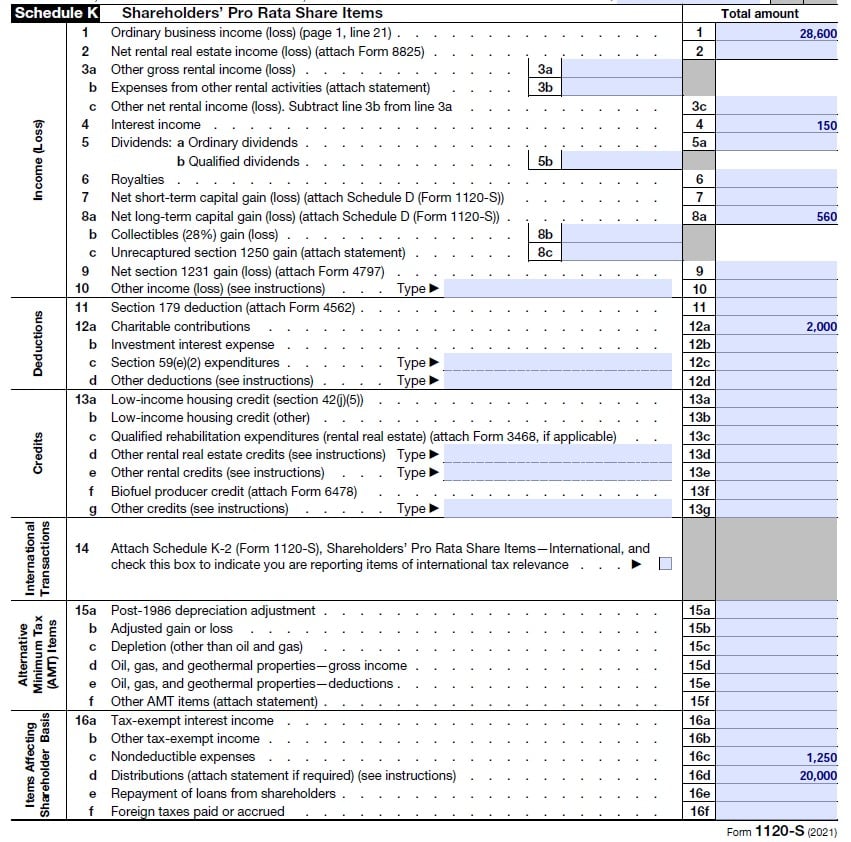

Other income (loss) 11 . Section 179 deduction . 12 . Other deductions . 13 . Credits . 14 . Foreign transactions . 15 . Alternative minimum tax (AMT) items. 16 . Items affecting shareholder basis . 17 . Other information * See attached statement for additional information. For Paperwork Reduction Act Notice, see the Instructions for Form 1120S ... An official website of the United States Government · Contents of Directory irs-pdf September 21, 2021 - Online Location near you By U.S. mail By phone · Send us your tax form improvement suggestions

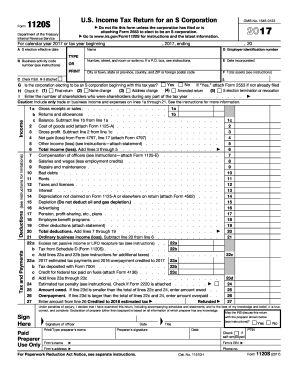

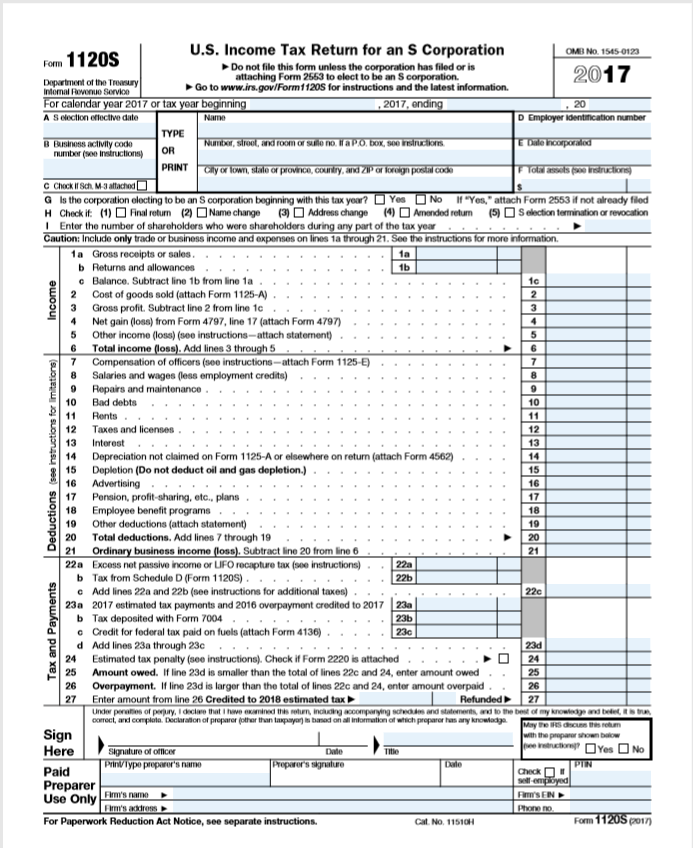

1120s other deductions worksheet. 1120s Other Deductions. Showing top 8 worksheets in the category - 1120s Other Deductions. Some of the worksheets displayed are 2020 instructions for form 1120 s, Forms required attachments, Us 1120s line 19, Arthur dimarsky 32 eric ln staten island ny 10308 646 637, Corporation tax organizer form 1120, Self employment income work s corporation schedule, Instructions and work to schedule k 1, 2018 net profit booklet 11 18. Dec 22, 2021 — Use Form 1120-S to report the income, gains, losses, deductions, credits, and other information of a domestic corporation or other entity ... Use Form 1120-S to report the income, gains, losses, deductions, credits, etc., of a domestic corporation or other entity for any tax year covered by an ... is attaching Form 2553 to elect to be an S corporation. ... Depletion (Do not deduct oil and gas depletion.) . ... Other deductions (attach statement) .

Displaying top 8 worksheets found for - Other Deductions Supporting Details For Form 1120. Some of the worksheets for this concept are Us 1120s line 19, Corporate 1120, 1120s income tax return for an s corporation omb no, 2019 form 1120 w work, Instructions for filing 2010 federal form 1065 sample return, Instructions for form 1120s, 6717 form 1120s 2018 part i shareholders share of ... Use this step-by-step guide to fill out the Form 1120 other deductions worksheet swiftly and with ideal precision. How to complete the 1120 fillable form online: To start the form, utilize the Fill & Sign Online button or tick the preview image of the blank. The advanced tools of the editor will lead you through the editable PDF template. Use Form 1120-S to report the income, gains, losses, deductions, credits, and other information of a domestic corporation or other entity for any tax year covered by an election to be an S corporation. How To Make the Election. For details about the election, see Form 2553, Election by a Small Business Corporation, and the Instructions for Form ... Information about Form 1120-S, U.S. Income Tax Return for an S Corporation, including recent updates, related forms, and instructions on how to file. Form 1120-S is used by corporations that elect to be S corporations to report income, deductions, gains, losses, etc.

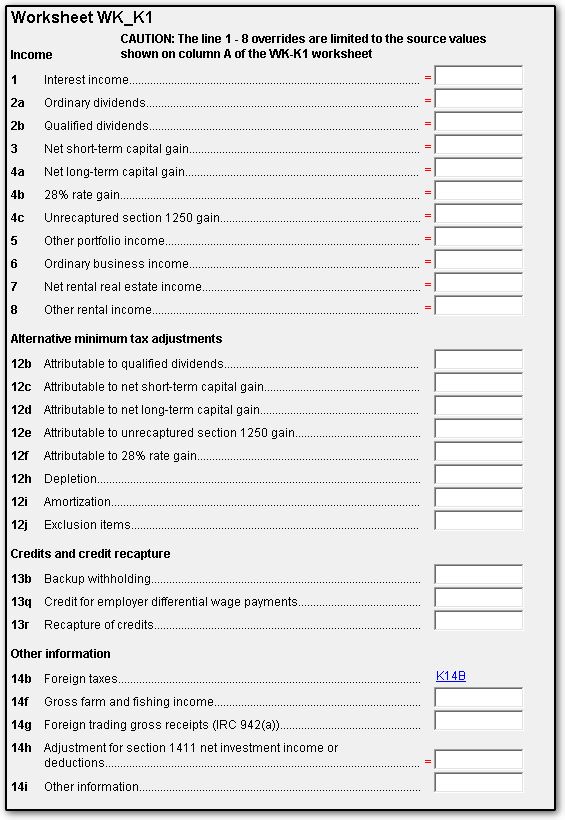

Novogradac is a national professional services organization that consists of affiliates and divisions providing professional services that include certified public accounting, valuation and consulting with more than 25 offices nationwide. Our clients represent a broad range of industries, with ... 1120s line 19 - other deductions worksheet 2018. Create this form in 5 minutes! Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms. Get Form. How to create an eSignature for the s corp tax form. The K-1 1120S Edit Screen. has two distinct sections entitled ‘Heading Information’ and ‘Income, Deductions, Credits, and Other Items.’ The K-1 1120S Edit Screen in Keystone Tax Solutions Pro has an entry for each box on found on the Schedule K-1 (Form 1120S) that the taxpayer received. Easily complete a printable IRS 1120S Form 2020 online. Get ready for this year's Tax Season quickly and safely with pdfFiller! Create a blank & editable 1120S form, fill it out and send it instantly to the IRS. Download & print with other fillable US tax forms in PDF.

Line 26. Other Deductions. Attach a statement, listing by type and amount, all allowable deductions that are not deductible elsewhere on Form 1120. Enter the total on line 26. Examples of other deductions include the following. See Pub. 535 for details on other deductions that may apply to corporations.

Shareholder's Share of Current Year Income, Deductions, Credits, and Other Items. The amounts shown in boxes 1 through 17 reflect your share of income, loss, deductions, credits, and other items, from corporate business or rental activities without reference to limitations on losses, credits, or other items that may have to be adjusted because of:

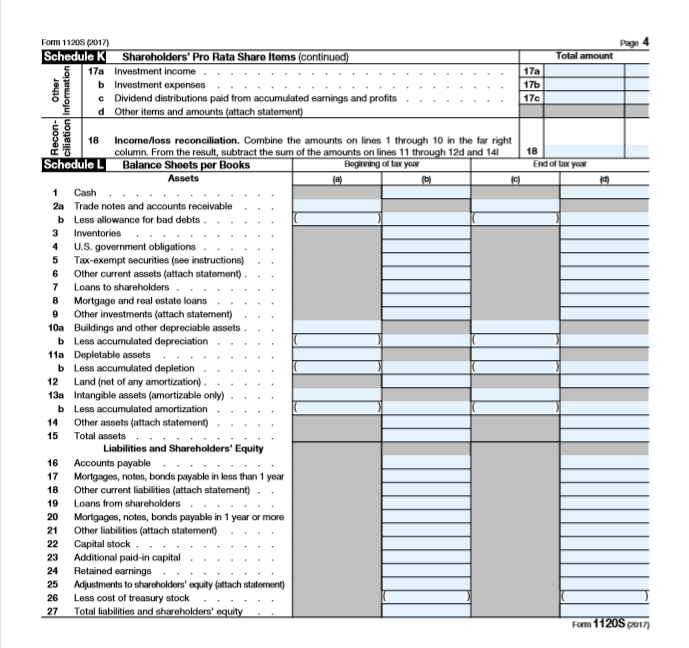

Attachment 5, Form 1120S, Schedule L Balance Sheets per Books, Line 14 (b): Other assets at beginning of tax year (ItemizedOtherAssetsSchedule) Description Beginning Amount Spec House 913 . Attachment 6, Form 1120S, Schedule L Balance Sheets per Books, Line 18 (b) & (d): Other current Liabilities

In our centralized library, you can find all forms produced by DHS.

An official website of the United States Government · Contents of Directory irs-pdf

Form 1120S Department of the Treasury Internal Revenue Service U.S. Income Tax Return for an S Corporation Do not file this form unless the corporation has filed or is attaching Form 2553 to elect to be an S corporation. ... Other deductions (see instructions) . . .

Executive Order 12866 directs agencies to follow certain principles in rulemaking, such as consideration of alternatives and analysis of benefits and costs, and describes OIRA's role in the rulemaking process. Regulations under EO 12866 Review Regulatory Reviews Completed in Last 30 Days · ...

This article focuses solely on the entry of the Deduction items which are found on Boxes 11 and 12 of the Schedule K-1 (Form 1120-S) Shareholder's Share of Income, Deductions, Credits, etc. For ad...

Missouri Department of Revenue, find information about motor vehicle and driver licensing services and taxation and collection services for the state of Missouri.

Form 1120 Line 26 Other Deductions Worksheet To stay clear of terrifying the youngster away, these questions aren't indicated to be specifically challenging. Nevertheless, if a principle is used over and over again, the infant may end up being bored as well as try to distance themselves.

33 1120s Other Deductions Worksheet - Worksheet Database Source 2020 Visually enhanced, image enriched topic search for 33 1120s Other Deductions Worksheet - Worksheet Database Source 2020 243. Mungfali.com 2017

Schedule K-1 (Form 1120-S) - Health Deduction Worksheet. Health Insurance Premiums for a more than 2% shareholder of a S-Corporation are reported in Box 14 of the individual's Form W-2 Wage and Tax Statement. To get the amount reported in Box 14 to transfer to Line 16 of the individual's Schedule 1 (Form 1040) Additional Income and Adjustments ...

Other deductions (attach statement) Total deductions. Add lines 7 through 19 Ordinary business income (loss). Subtract line 20 from line 6 Excess net passive income or LIFO recapture tax (see instructions) Tax from Schedule D (Form 1120S) Add lines 22a and 22b (see instructions for additional taxes)

US 1120S Line 19 - Other Deductions 2015 Type: Created Date: 5/3/2016 10:10:40 AM ...

2020 Us 1120s Line 19 Other Deductions - Displaying top 8 worksheets found for this concept.. Some of the worksheets for this concept are 2020 instructions for form 1120 s, Forms required attachments, Fannie mae cash flow analysis calculator, Partners adjusted basis work outside basis tax, Fnma self employed income, Calculating income from 1040 k1 1120s s corporation, Tax work for self ...

1120s Other Deductions 2020 - Displaying top 8 worksheets found for this concept. Some of the worksheets for this concept are 2020 instructions for form 1120 s, Corporation tax organizer form 1120, 2020 ia 1120s income tax return for s corporations, 20 purpose of schedule k 1 general instructions, Engagement letter for 2020 s, Schedule a itemized deductions, Fannie mae cash flow analysis calculator, Tax work for self employed independent contractors.

The K-1 Edit Screen has two distinct sections entitled ‘Heading Information’ and ‘Income, Deductions, Credits, and Other Items.’ The K-1 1120-S Edit Screen has a line for each box on found on the Schedule K-1 (Form 1120-S) that the taxpayer received. A description of the items contained in boxes 11 and 12, including each of the Codes ...

Instructions for Schedule H (Form 1120-F), Deductions Allocated To Effectively Connected Income Under Regulations Section 1.861-8 2021 12/20/2021 Form 1120-F (Schedule I) Interest Expense Allocation Under Regulations Section 1.882-5 2021 12/16/2021 Inst 1120-F (Schedule I) ...

Form 1120S Department of the Treasury Internal Revenue Service U.S. Income Tax Return for an S Corporation Do not file this form unless the corporation has filed or is

1120s Other Deductions - Displaying top 8 worksheets found for this concept.. Some of the worksheets for this concept are 2020 instructions for form 1120 s, Forms required attachments, Us 1120s line 19, Arthur dimarsky 32 eric ln staten island ny 10308 646 637, Corporation tax organizer form 1120, Self employment income work s corporation schedule, Instructions and work to schedule k 1, 2018 ...

December 26, 2019 - You have entered an invalid efin or password · This account is not eligible for online renewal due to being a multi-site or a new sale

1120s Other Deductions. Displaying all worksheets related to - 1120s Other Deductions. Worksheets are 2020 instructions for form 1120 s, Forms required attachments, Us 1120s line 19, Arthur dimarsky 32 eric ln staten island ny 10308 646 637, Corporation tax organizer form 1120, Self employment income work s corporation schedule, Instructions and work to schedule k 1, …

Form 1120-S is a federal income tax return designed for use specifically by s-corps.

2018 1120s Other Deductions - Displaying top 8 worksheets found for this concept.. Some of the worksheets for this concept are 2018 form 1120s, 6717 form 1120s 2018 part i shareholders share of, Instructions and work to schedule k 1, 1120s income tax return for an s corporation omb no, 2018 il 1120 instructions, Basis reporting required for 2018 draft form schedule e, 2018 net …

is attaching Form 2553 to elect to be an S corporation. ... Depletion (Do not deduct oil and gas depletion.) . ... Other deductions (attach statement) .

An override for this calculation is available on Maryland > Income / Deductions > Other Adjustments and Overrides > State or local tax addback - override. Prior to this release: MD electing PTE instructions, page 5 and 6 discuss how Form 511, line 2 should be derived, specific to 1120S, Schedule K, lines 1-10, plus taxes based on net income ...

This article focuses solely on the entry of the Other Information Items which are found on Box 17 of the Schedule K-1 (Form 1120S) Shareholder's Share of Income, Deductions, Credits, etc. For addi...

September 21, 2021 - Online Location near you By U.S. mail By phone · Send us your tax form improvement suggestions

An official website of the United States Government · Contents of Directory irs-pdf

Other income (loss) 11 . Section 179 deduction . 12 . Other deductions . 13 . Credits . 14 . Foreign transactions . 15 . Alternative minimum tax (AMT) items. 16 . Items affecting shareholder basis . 17 . Other information * See attached statement for additional information. For Paperwork Reduction Act Notice, see the Instructions for Form 1120S ...

/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

0 Response to "41 1120s other deductions worksheet"

Post a Comment