42 1040 qualified dividends and capital gains worksheet

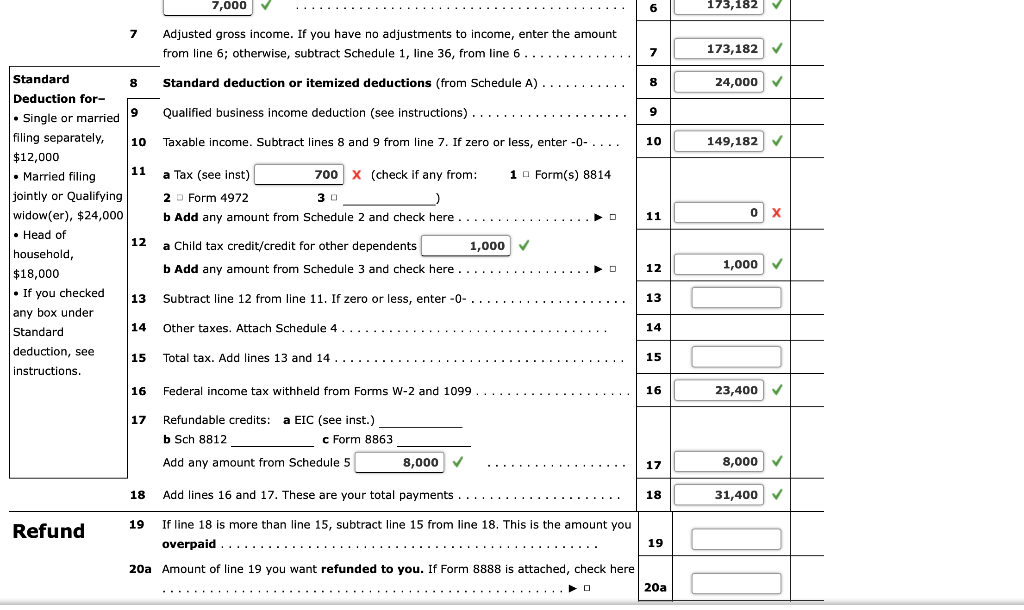

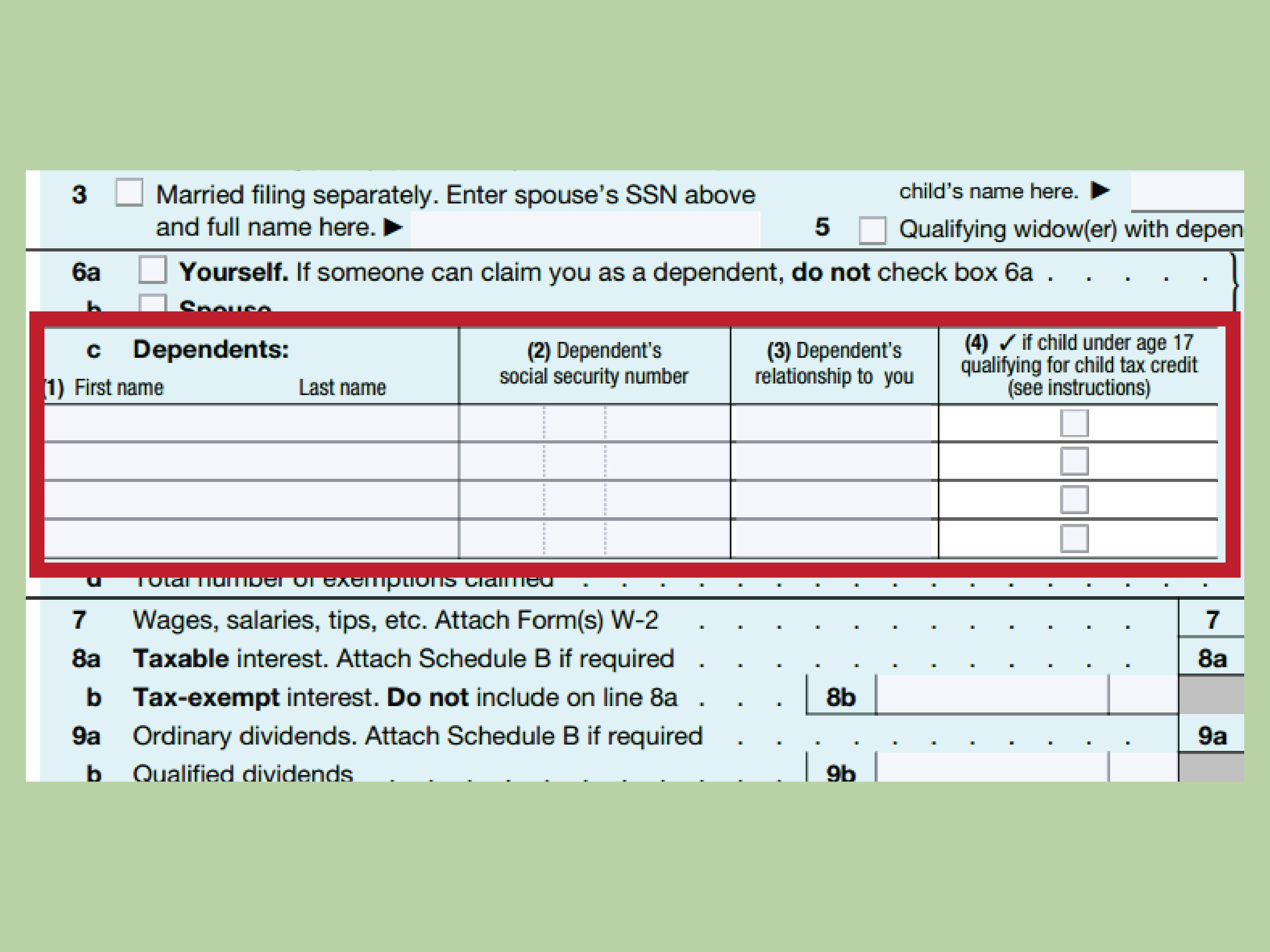

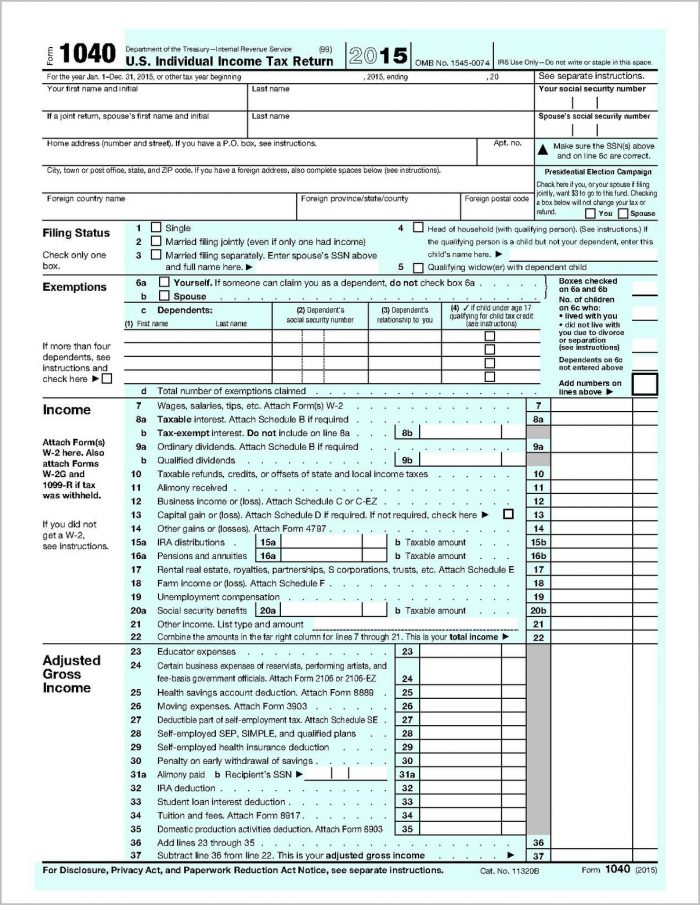

IRS Form 1040 Qualified Dividends Capital Gains Worksheet Form 1040 Form is an IRS needed tax form needed from the US government for federal income taxes filed by citizens of United States. Total capital gain or loss from Schedule D is entered on a different line of Form 1040. Please show how the results from the Qualified Dividends and Capital Gain Tax worksheet are applied to the 1040 Forms. The 1040 form is treating all my qualified dividends and capital gains as taxable at ordinary rates.

Qualified Dividends and Capital Gain Tax Worksheet: in the instructions for Forms 1040 and 1040-SR, line 16. ... Do you have qualified dividends on Form 1040, 1040-SR, or 1040-NR, line 3a? Yes. Complete the : Qualified Dividends and Capital Gain Tax Worksheet: in the instructions for Forms 1040 and 1040-SR, line 16. No. Complete the rest of ...

1040 qualified dividends and capital gains worksheet

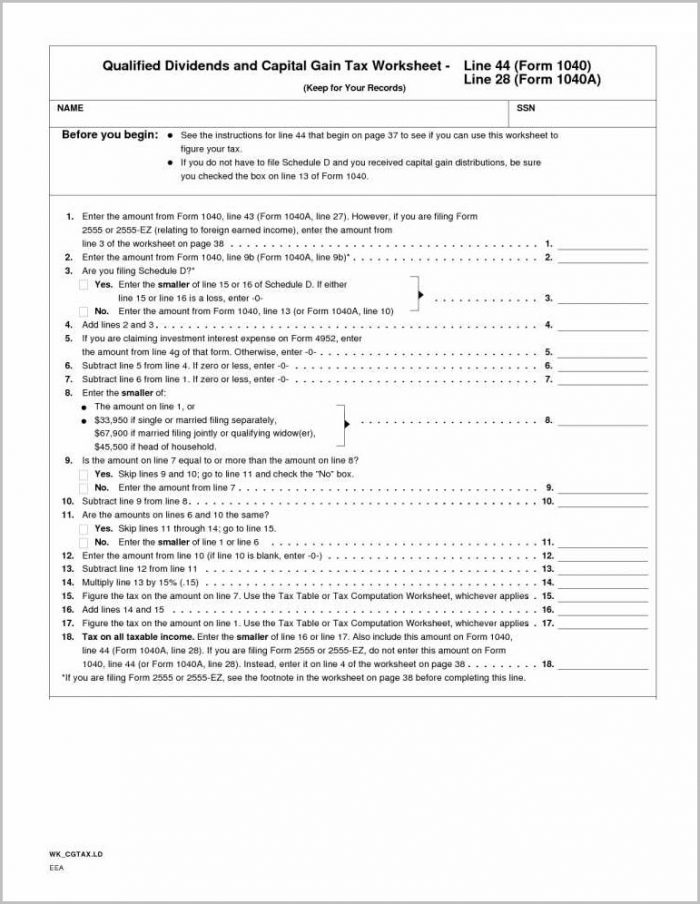

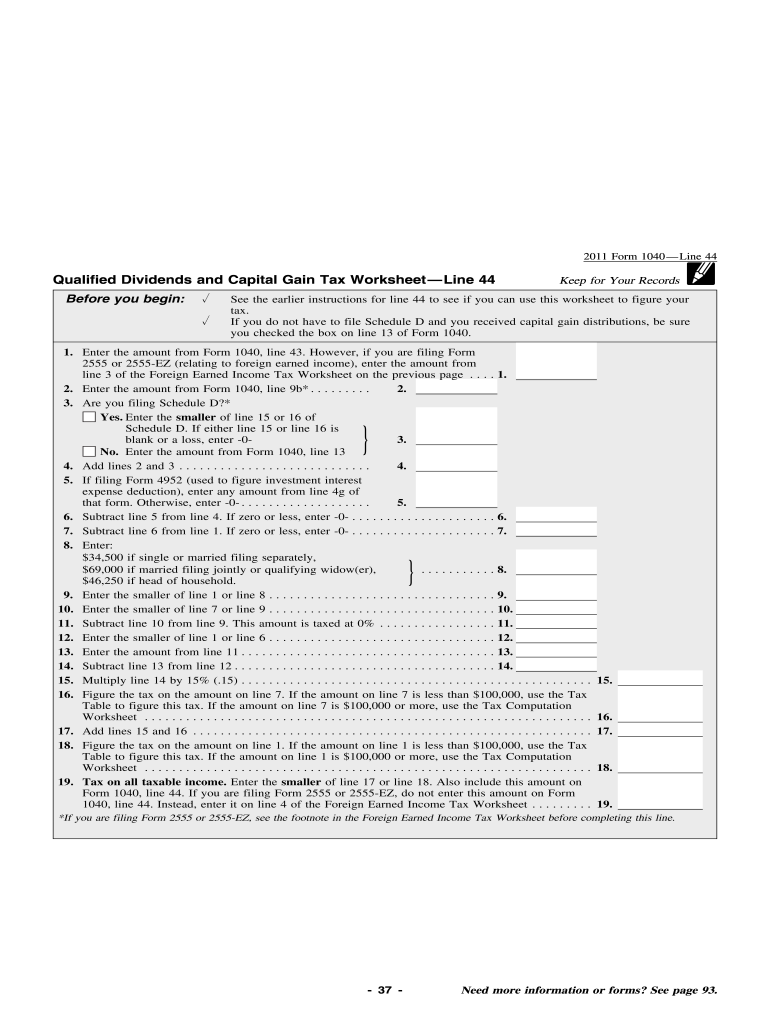

Qualified Dividends and Capital Gain Tax Worksheet : An Alternative to Schedule D. 225 specifies only capital gains are to be considered. It takes 27 lines in the IRS qualified dividends and capital gain tax worksheet to work through the computations (Form 1040. Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b. IRS introduced the qualified dividend and capital gain tax worksheet as an alternative to Schedule D and added the qualified dividends and new rates to the capital gains worksheet in 2003. The Forms 1040 and 1040A, therefore, help investors to take advantage of lower capital gains rates without having to fill out the Schedule D.

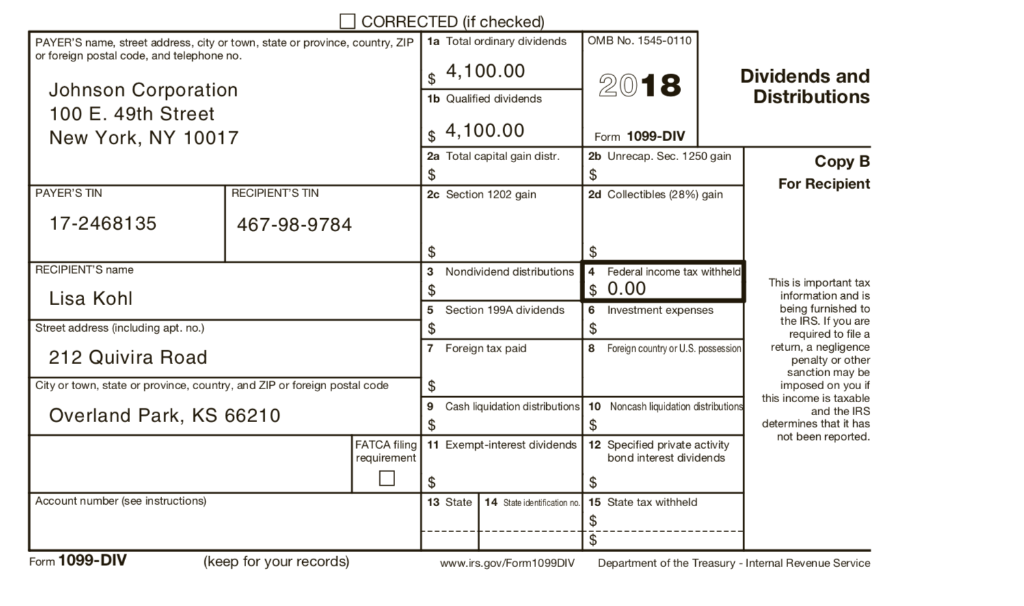

1040 qualified dividends and capital gains worksheet. See the instructions for line 44 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 43. If you do not have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of Form 1040. Enter the amount from Form 1040, line 43 (Form ... This is not just a problem with Turbotax, the flawed logic is in the IRS worksheet included in the 1040 instructions. I am attaching a hypothetical example of a completed worksheet. As noted in my question, the flaw occurs on line 18 where you subtract line 17 (effectively taxable income that is not qualified dividends or capital gains ) from the 15% bracket threshold (in the example, $479,000 ... ABC Mutual Fund paid a cash dividend of 10 cents a share. The ex-dividend date was July 16, 2021. The ABC Mutual Fund advises you that the part of the dividend eligible to be treated as qualified dividends equals 2 cents a share. Your Form 1099-DIV from ABC Mutual Fund shows total ordinary dividends of $1,000 and qualified dividends of $200. Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero and lines 15 and 16 of Schedule D are gains or if you file Form 4952 and you have an amount on line 4g, even if you don’t need to file Schedule D. Otherwise, complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and 1040-SR, line 16 (or in the instructions for Form 1040-NR, line 16) to figure your tax.

Qualified dividends are reported on Line 3a of your Form 1040. You can use the Qualified Dividends and Capital Gain Tax Worksheet found in the instructions for Form 1040 to figure out the tax on qualified dividends at the preferred tax rates. 7 Non-dividend distributions can reduce your cost basis in the stock by the amount of the distribution. Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records 2010 Form 1040—Line 44 Before you begin: See the instructions for line 44 on page 35 to see if you can use this worksheet to figure your tax. If you do not have to file Schedule D and you received capital gain distributions, be sure Qualified Dividends and Capital Gain Tax Worksheet (2020) • See Form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer’s tax. • Before completing this worksheet, complete Form 1040 through line 15. • If the taxpayer does not have to file Schedule D (Form 1040) and received capital gain distributions, be sure the box on line 7, Form 1040, is checked. IRS Form 1040 Qualified Dividends Capital Gains Worksheet Form 1040 Form is an IRS needed tax form needed from the US government for federal income taxes filed by citizens of United States. The qualified dividends and capital gain tax worksheet can be separated into different lines in order to make it easier for you.

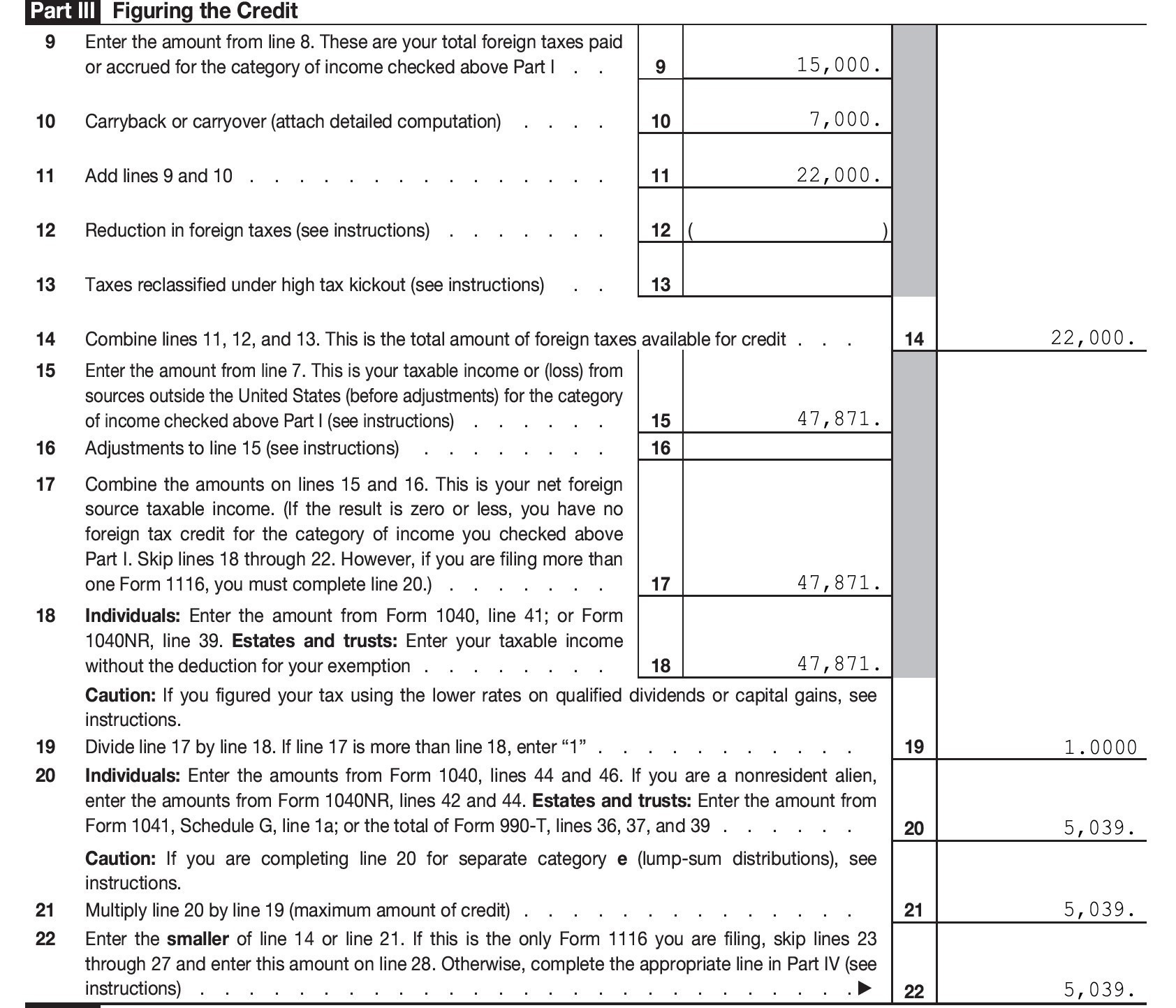

In situations where the qualified dividends and/or capital gains are taxed in multiple tax brackets, the program calculates the adjustment for Form 1116, Foreign Tax Credit, Line 1a based on a ratio of rates between 5% and 15%. The ratio is calculated from the Qualified Dividends and Capital Gain Tax Worksheet or the Schedule D Tax Worksheet. IRS Form 1040 Qualified Dividends Capital Gains Worksheet Form 1040 Form is an IRS needed tax form needed from the US government for federal income taxes filed by citizens of United States. In cell A1 insert the worldwide ordinary dividends. Capital gains and qualified dividends. 2020 QUALIFIED DIVIDENDS and CAPITAL GAIN TAX WORKSHEET -LINE 16 Keep for Your Records Before you begin: J See the instructions for line 16 in the instructions to see if you can use this worksheet to figure your tax. J Before completing this worksheet, complete Form 1040 or 1040-SR through line 15. J If you do not have to file Schedule D and you received capital gain distributions, A gain from Form 2439, Notice to Shareholder of Undistributed Long-Term Capital Gains, Form 6252, Installment Sale Income, or Part I of Form 4797, Sales of Business Property A gain or loss from Form 4684 , Casualties and Thefts, Form 6781 , Gains and Losses From Section 1256 Contracts and Straddles, or Form 8824 , Like-Kind Exchanges As seen in the chart to the right, rare-earth elements are ...

Use the Qualified Dividends and Capital Gain Tax Worksheet to figure your tax, if you do not have to use the Schedule D Tax Worksheet and if any of the following applies. You reported qualified dividends on Form 1040, line 9b. You do not have to file Schedule D and you reported capital gain distributions on Form 1040, line 13.

Report your qualified dividends on line 9b of Form 1040 or 1040A. Use the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 or 1040a to figure your total tax...

It is important to note that “qualified dividends” are ordinary dividends that meet specified criteria and are taxed at the lower long-term capital gains tax rates, rather than the higher tax rates for individuals’ ordinary income. Qualified dividends are taxed at rates ranging from 0% to 23.88%.

Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 . On average this form takes 7 minutes to complete. The Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 form is 1 page long and contains: 0 signatures; 2 check-boxes

2018 Form 1040—Line 11a Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10.

2020. Form 1040 (Schedule D) Capital Gains and Losses. 2019. Inst 1040 (Schedule D) Instructions for Schedule D (Form 1040 or Form 1040-SR), Capital Gains and Losses. 2019. Form 1040 (Schedule D) Capital Gains and Losses.

Use the Qualifying Dividends and Capital Gains Tax Worksheet provided in the instructions for Form 1040 to calculate the tax on qualified dividends at the selected tax rate. Where do qualified dividends go on the Schedule B? On a Schedule B, dividends that are not qualified are taxed. Your taxable income includes the dividends.

• Before completing this worksheet, complete Form 1040 or 1040-SR through line 15. • If you don’t have to file Schedule D and you received capital gain distributions, be sure you checked the box on Form 1040 or 1040-SR, line 7. Enter the amount from Form 1040 or 1040-SR, line 15. However, if you are filing Form 2555 (relating to foreign earned income), enter the amount from

Instead, 1040 Line 16 “Tax” asks you to “see instructions.” In those instructions, there is a 25-line worksheet called the Qualified Dividends and Capital Gain Tax Worksheet, which is how you actually calculate your Line 16 tax. The 25 lines are so simplified, they end up being difficult to follow what exactly they do.

Zona Central de São Paulo a região administrada pela Subprefeitura da Sé, que engloba os distritos da Bela Vista, Bom Retiro, Cambuci, Consolação, Liberdade, República, Sé e Santa CecÃlia. Centro de São Paulo - Capital Instagram @anderson.nikon Fotos Coloridas @anderson.psd Fotos Preto e Branco @anderson.models @recolorizacaofotografica twitter.com anderson_psd

IRS introduced the qualified dividend and capital gain tax worksheet as an alternative to Schedule D and added the qualified dividends and new rates to the capital gains worksheet in 2003. The Forms 1040 and 1040A, therefore, help investors to take advantage of lower capital gains rates without having to fill out the Schedule D.

Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b.

Qualified Dividends and Capital Gain Tax Worksheet : An Alternative to Schedule D. 225 specifies only capital gains are to be considered. It takes 27 lines in the IRS qualified dividends and capital gain tax worksheet to work through the computations (Form 1040.

Zona Central de São Paulo a região administrada pela Subprefeitura da Sé, que engloba os distritos da Bela Vista, Bom Retiro, Cambuci, Consolação, Liberdade, República, Sé e Santa CecÃlia. Centro de São Paulo - Capital Instagram @anderson.nikon Fotos Coloridas @anderson.psd Fotos Preto e Branco @anderson.models @recolorizacaofotografica twitter.com anderson_psd

Zona Central de São Paulo a região administrada pela Subprefeitura da Sé, que engloba os distritos da Bela Vista, Bom Retiro, Cambuci, Consolação, Liberdade, República, Sé e Santa CecÃlia. Centro de São Paulo - Capital Instagram @anderson.nikon Fotos Coloridas @anderson.psd Fotos Preto e Branco @anderson.models @recolorizacaofotografica twitter.com anderson_psd

/ScreenShot2020-02-03at11.15.35AM-a3c24d655e9748e19bab699b55c1b7b6.png)

0 Response to "42 1040 qualified dividends and capital gains worksheet"

Post a Comment