38 Qualified Dividends And Capital Gain Tax Worksheet Fillable

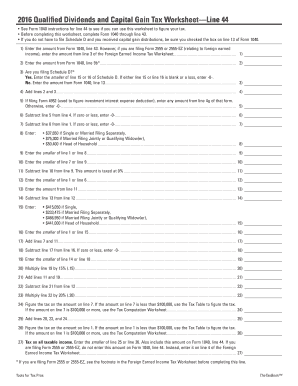

Achiever Student: Once payment has been made in full, your order will be assigned to the most qualified writer who majors in your subject. The writer does in-depth research and writes your paper to produce high-quality content. The order passes through our editing department after which it is delivered to you. How Your Tax Is Calculated: Qualified Dividends and ... For this reason, the first step of the Qualified Dividends and Capital Gain Tax Worksheet is to split those two separate types back out. Lines 1-5: Qualified Income & Ordinary Income Lines 1-5 of this worksheet calculate your total qualified income (line 4) and your total ordinary income (line 5), so they can be taxed at their different rates.

Fillable Form 1040 Qualified Dividends and Capital Gain ... Fill Online, Printable, Fillable, Blank Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 Form Use Fill to complete blank online IRS pdf forms for free. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018

Qualified dividends and capital gain tax worksheet fillable

38 Qualified Dividends And Capital Gain Tax Worksheet Fillable Qualified Dividends And Capital Gains Tax Worksheet 1-1 Form IRS Instruction 1 Line 1 Fill Online, Printable In Qualified Dividends And Capital Gains Tax Worksheet. Based on teacher views, the E-Worksheet may be very possible to be applied in online and face-to-face studying especially within the covid-19 pandemic era. Irs Qualified Dividends And Capital Gains Worksheet Irs Qualified Dividends And Capital Gains Worksheet. In Microsoft Excel, the sheet tabs appear beneath the worksheet grid space and permit you to swap from one worksheet to a different in a workbook. Fill is a function that can be used to quickly copy data from the anchor cell to an adjoining vary, updating the info if applicable. Dividends Qualified Tax Worksheet And Form Capital Gain ... The Qualified Dividends and Capital Gain Tax Worksheet , a return of capital) • Excess over basis is capital gain • Distributions from corporate earnings and profits (E & P) are treated as a dividend distribution, taxed as ordinary income • Distributions in excess of E & P are nontaxable to extent of shareholder's basis (i Ordinary ...

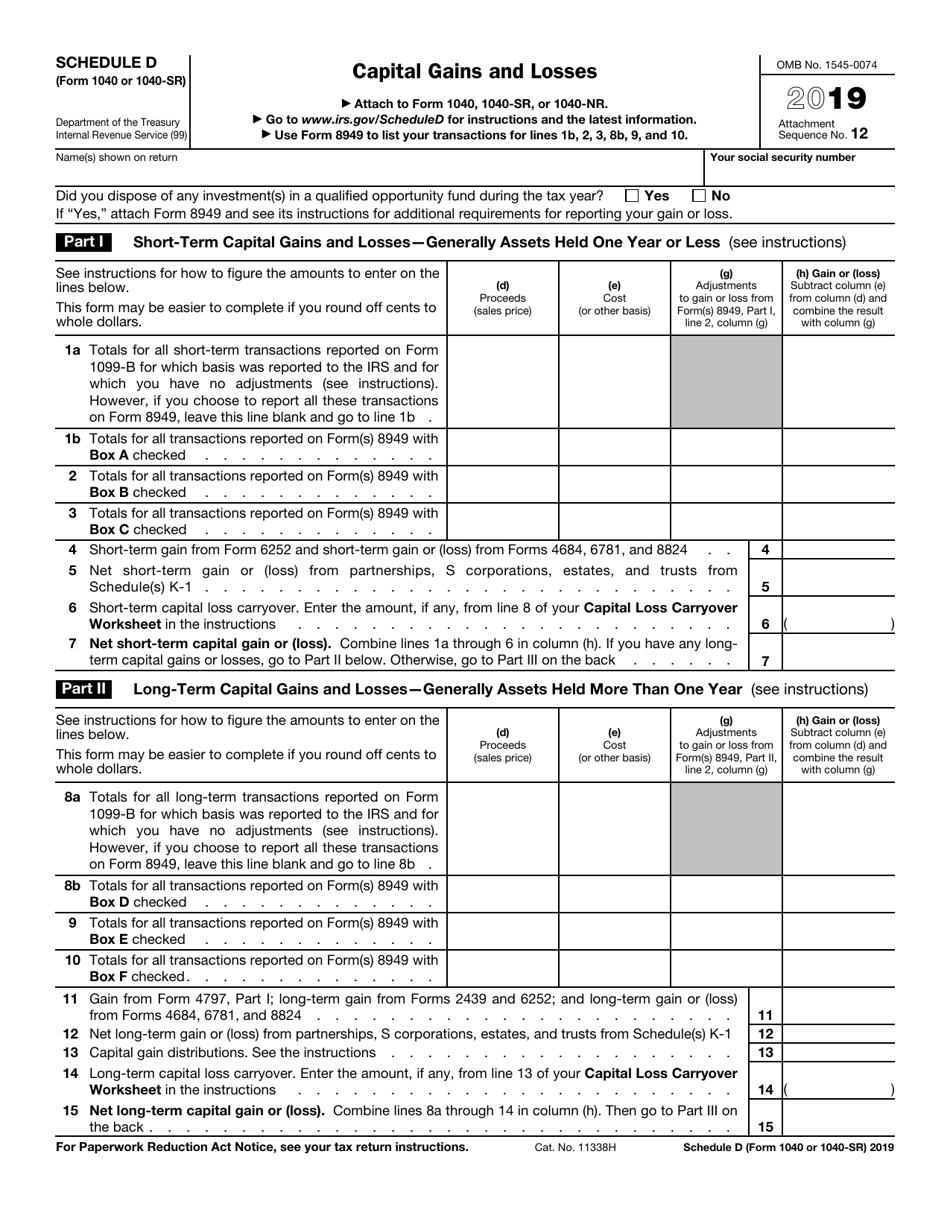

Qualified dividends and capital gain tax worksheet fillable. SCHEDULE D Capital Gains and Losses - IRS tax forms Did you dispose of any investment(s) in a qualified opportunity fund during the tax year? Yes. No. If “Yes,” attach Form 8949 and see its instructions for additional requirements for reporting your gain or loss. Part I Short-Term Capital Gains and Losses—Generally Assets Held One Year or Less (see instructions) Qualified Dividends And Capital Gain Worksheet Qualified Dividends And Capital Gain Tax Worksheet. 2015 2022 Form Irs Instruction 1040 Line 44 Fill Online Printable Fillable Blank Pdffiller. 2011 Form Irs Instruction 1040 Line 44 Fill Online Printable Fillable Blank Pdffiller. Review Alexander Smith S Information And The W2 Chegg Com. State of Oregon: Forms - 2018 Forms and Publications Worksheet OR-CRC, Claim of Right Income Repayments: 150-101-168: General: Form: Worksheet OR-FCG, Farm Liquidation Long-Term Capital Gain Tax Rate: 150-101-167: 2018: Form: Worksheet OR-WFHDC, Working Family Household and Dependent Care Credit for Prior Year Expenses: 150-101-197: 2018: Form: Your Rights as an Oregon Taxpayer: 150-800-406 ... Diy Qualified Dividends And Capital Gain Worksheet - The ... Qualified Dividends and Capital Gain Tax WorksheetLine 11a. File Form 1041 for 2021 by March 1 2022 and pay the total tax due. For tax year 2021 the 20 rate. Fill in all of the requested fields they are marked in yellow. Otherwise complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms.

THIS BOOKLET DOES NOT CONTAIN INSTRUCTIONS ... - IRS tax … questions will help ensure you get all the tax credits and deductions you are due. It s fast, safe, and free. You can review each software provider s criteria for free usage or use an online tool to nd which free software products match your situation. Some software providers offer state tax return preparation for free. Free File Fillable Forms. State of Oregon: Forms - 2019 Forms and Publications Worksheet OR-CRC, Claim of Right Income Repayments: 150-101-168: General: Form: Worksheet OR-FCG, Farm Liquidation Long-Term Capital Gain Tax Rate: 150-101-167: 2019: Form: Worksheet OR-WFHDC, Working Family Household and Dependent Care Credit for Prior Year Expenses: 150-101-197: 2019: Form: Your Rights as an Oregon Taxpayer: 150-800-406 ... Qualified Dividends and Capital Gain Tax Worksheet. - CCH Qualified Dividends and Capital Gain Tax Worksheet. Use the Qualified Dividends and Capital Gain Tax Worksheet to figure your tax, if you do not have to use the Schedule D Tax Worksheet and if any of the following applies. You reported qualified dividends on Form 1040, line 9b. All Department | Forms & Instructions | NH Department of ... To request forms, please email forms@dra.nh.gov or call the Forms Line at (603) 230-5001. If you have a substantive question or need assistance completing a form, please contact Taxpayer Services at (603) 230-5920.

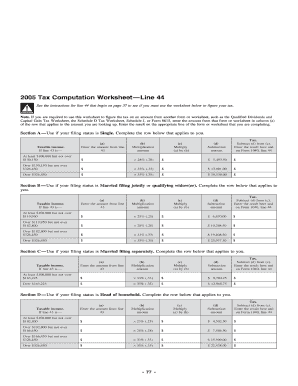

2020 Tax Computation Worksheet—Line 16 Note. If you are required to use this worksheet to figure the tax on an amount from another form or worksheet, such as the Qualified Dividends and Capital Gain Tax Worksheet, the Schedule D Tax Worksheet, Schedule J, Form 8615, or the Foreign Earned Income Tax Worksheet, enter What is a Qualified Dividend Worksheet? - Money Inc IRS introduced the qualified dividend and capital gain tax worksheet as an alternative to Schedule D and added the qualified dividends and new rates to the capital gains worksheet in 2003. The Forms 1040 and 1040A, therefore, help investors to take advantage of lower capital gains rates without having to fill out the Schedule D. 2021 Qualified Dividends And Capital Gains Worksheet and ... Qualified Dividends and Capital Gain Tax Worksheet for Forms 1040 and 1040-SR, line 12a (or in the instructions for Form 1040-NR, line 42). This worksheet derives only the self-employed income by analyzing Schedule C, F, K-1 (E), and 2106. 6%) were subject to the maximum long-term capital gains and qualified dividends rate (20%). 2020 Capital Loss Carryover Worksheet and Similar Products ... Qualified Dividends And Capital Gains Worksheet 2020. Irs Capital Gains Worksheet. Different Tax rates for short long term capital gains. IncomeCapital Gain and LossesCapital Gain and Loss Items. This is actually the biggest class of forms in IRS. Qualified Dividends and Capital Gain Tax Worksheet. How-ever beginning in 2018 the long-term.

Qualified Dividends And Capital Gain Tax Worksheet ... Send your new Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 in a digital form when you finish completing it. Your information is well-protected, as we adhere to the latest security criteria. Become one of millions of satisfied users who are already filling out legal templates straight from their houses. Get form

Tax Worksheet Instruction ≡ Fill Out Printable PDF Forms ... 1040 2020 Capital Gains And Dividends Worksheet Details. If you are looking for help preparing your taxes, the Tax Worksheet Instruction Form can be a valuable resource. This form provides clear and concise instructions on how to complete the tax worksheet, making the process simpler and easier to understand.

How to Figure the Qualified Dividends on a Tax Return ... Report your qualified dividends on line 9b of Form 1040 or 1040A. Use the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 or 1040a to figure your total tax...

Qualified Dividends Tax Worksheet ≡ Fill Out Printable PDF ... Qualified Dividends Tax Worksheet - Fill Out and Use. If you wish to acquire the qualified dividends tax worksheet PDF, our editor is what you need! By pressing the orange button below, you'll access the page where it's possible to edit, save, and print your document. Experience the simplicity of navigation and interface the tool boasts.

Qualified Dividends And Capital Gain Tax Worksheet 2021 ... 2020 qualified dividends and capital gain tax worksheetreate electronic signatures for signing a qualified dividends and capital gain tax worksheet 2021 in PDF format. signNow has paid close attention to iOS users and developed an application just for them. To find it, go to the AppStore and type signNow in the search field.

Qualified Dividends And Capital Gains Worksheet Calculator ... Use the qualified dividends and capital gain tax worksheet in the instructions for form 1040 or 1040a to figure your total tax amount. 1 don t churn your portfolio you want to pay the long term capital gains rate and pay that as infrequently as possible. Do the job from any device and share docs by email or fax.

Fillable 2020 QUALIFIED DIVIDENDS and CAPITAL GAIN TAX ... Fill Online, Printable, Fillable, Blank 2020 QUALIFIED DIVIDENDS and CAPITAL GAIN TAX WORKSHEET (H&Rblock) Form Use Fill to complete blank online H&RBLOCK pdf forms for free. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable.

Capital Gain Tax Worksheet (PDF) - IRS tax forms Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10.

I don't know how to fill out the schedule d tax worksheet ... I don't know how to fill out the schedule d tax worksheet or qualified dividends and capital gain tax worksheet. Accountant's Assistant: The Accountant will know how to help. Please tell me more, so we can help you best. I received a letter from the IRS about my 2016 return indicating that I should have filled that out and it would have reduced my tax obligation the gave me the reduction but I ...

Qualified Dividends And Capital Gain Tax Worksheet ... Qualified Dividends and Capital Gain Tax WorksheetLine 11a. Data put and request legally-binding digital signatures. See Before completing this worksheet complete Form 1040 through line 11b. In order to use the qualified dividends and capital gain tax worksheet you will need to separate your ordinary dividends from qualified dividends.

Creative Irs Capital Gains Worksheet - Labelco The Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 form is 1 page long and contains. 3500 inc gst there is so much more to calculating cgt than just deducting the price you paid from the selling price. Once completed you can sign your fillable form or send for signing.

2021 Schedule K-1 (Form 1041) Qualified dividends. 3 . Net short-term capital gain. 4a . Net long-term capital gain. 4b . 28% rate gain. 4c . Unrecaptured section 1250 gain. 5 . Other portfolio and nonbusiness income. 6 . Ordinary business income. 7 . Net rental real estate income. 8 . Other rental income. 9. Directly apportioned deductions. 10 . Estate tax deduction. 11 ...

When To Use Qualified Dividends And Capital Gain Tax ... When To Use Qualified Dividends And Capital Gain Tax Worksheet? By The Money Farm Team The worksheet is intended for taxpayers who only have dividend income or capital gains distributions recorded in boxes 2a or 2b on Form 1099-DIV from mutual funds, other regulated investment companies, or real estate investment trusts, respectively.

2021 Form 8801 - IRS tax forms Form 1040, 1040-SR, or 1040-NR filers, enter the amount from line 5 of your 2020 Qualified Dividends and Capital Gain Tax Worksheet or the amount from line 21 of your 2020 Schedule D Tax Worksheet, whichever applies. If you didn’t complete either worksheet, see instructions. Form 1041 filers, enter

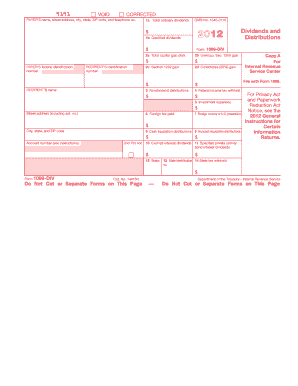

1040 (2021) | Internal Revenue Service - IRS tax forms Qualified Dividends. Enter your total qualified dividends on line 3a. Qualified dividends are also included in the ordinary dividend total required to be shown on line 3b. Qualified dividends are eligible for a lower tax rate than other ordinary income. Generally, these dividends are shown in box 1b of Form(s) 1099-DIV.

Solved: Qualified dividends and capital gain tax worksheet ... last updated June 07, 2019 4:58 PM Qualified dividends and capital gain tax worksheet has flawed logic on line 18. It reduces the 15% bracket by subtracting other taxable income. How do I get this fixed? This is not just a problem with Turbotax, the flawed logic is in the IRS worksheet included in the 1040 instructions.

2016 Qualified Dividends And Capital Gain Tax Worksheet ... Find the 2016 Qualified Dividends And Capital Gain Tax Worksheet ... you want. Open it up using the cloud-based editor and begin editing. Fill the blank fields; involved parties names, addresses and phone numbers etc. Customize the template with smart fillable fields. Put the date and place your electronic signature.

Qualified Dividends Gain And Tax Capital Worksheet Form ... If this is the case, you must figure your tax using the "Qualified Dividends and Capital Gain Tax Worksheet" on page 34 of the Instructions for Form 1040 Qualified dividends and capital gain tax worksheet line 44 If the investment is held for more than a year, any gains or losses are long term and normally taxed at the long-term capital gains ...

2021 Instructions for Schedule D (2021) - IRS tax forms Use Form 8960 to figure any net investment income tax relating to gains and losses reported on Schedule D, including gains and losses from a securities trading activity. Use Form 8997 to report each QOF investment you held at the beginning and end of the tax year and the deferred gains associated with each investment.

Dividends Qualified Tax Worksheet And Form Capital Gain ... The Qualified Dividends and Capital Gain Tax Worksheet , a return of capital) • Excess over basis is capital gain • Distributions from corporate earnings and profits (E & P) are treated as a dividend distribution, taxed as ordinary income • Distributions in excess of E & P are nontaxable to extent of shareholder's basis (i Ordinary ...

Irs Qualified Dividends And Capital Gains Worksheet Irs Qualified Dividends And Capital Gains Worksheet. In Microsoft Excel, the sheet tabs appear beneath the worksheet grid space and permit you to swap from one worksheet to a different in a workbook. Fill is a function that can be used to quickly copy data from the anchor cell to an adjoining vary, updating the info if applicable.

38 Qualified Dividends And Capital Gain Tax Worksheet Fillable Qualified Dividends And Capital Gains Tax Worksheet 1-1 Form IRS Instruction 1 Line 1 Fill Online, Printable In Qualified Dividends And Capital Gains Tax Worksheet. Based on teacher views, the E-Worksheet may be very possible to be applied in online and face-to-face studying especially within the covid-19 pandemic era.

/IRSForm8949-d55e89f19d8043719e68055fdd8dad41.jpg)

0 Response to "38 Qualified Dividends And Capital Gain Tax Worksheet Fillable"

Post a Comment