39 section 125 nondiscrimination testing worksheet

What is Section 125 discrimination testing? What is Section 125 Nondiscrimination Testing? Your plan allows employees to pay for their health care and dependent care expenses on a pre-tax basis. In order for Highly Compensated and Key employees to receive these benefits, the plan must not discriminate in their favor. Rest of the in-depth answer is here. Bulletins - Delaware Department of Insurance - State of ... Routine Testing For Newborn Infants Pursuant to 18 Delaware Code §§ 3335, 3550: No. 21: 08-09-2006: Required Notices to be Provided to Consumers in the State of Delaware: No. 22: 09-01-2006: Compliance With The Pharmacy Access Act (18 …

PDF Section 125 Flexible Benefit Plan DISCRIMINATION TESTING DATA 3.) ELIGIBILITY TESTING DATA (Section 125 Fair Cross-Section Test) a. Yes No Is the waiting period for new employees to become eligible for the Section 125 Plan three years or less? If the waiting period is greater than three years, please explain your waiting period criteria. b.

Section 125 nondiscrimination testing worksheet

PDF Section 125 Nondiscrimination Testing - Sentinel Benefits What is Section 125 Nondiscrimination Testing? Your plan allows employees to pay for their health care and dependent care expenses on a pre‐tax basis. This saves both the employer and the employee money on Income taxes and Social Security taxes. PDF Section 125 Cafeteria Plans Nondiscrimination Testing ... NONDISCRIMINATION TESTING GUIDE AND FAQs 2020 Why Do We Have To Test Our Section 125 Plan? Because Code Section 125 cafeteria plans (and the component benefits within the 125 plan) enjoy favorable tax treatment, the Code's nondiscrimination rules exist to prevent plans from being designed in such way that it discriminates in favor of ... PDF Section 125 Nondiscrimination Testing - Sentinel Benefits Section 125 Nondiscrimination Testing What is Section 125 Nondiscrimination Testing? Your plan allows employees to pay for their health care and dependent care expenses on a pre‐tax basis. This saves both the employer and the employee money on Income taxes and Social Security taxes.

Section 125 nondiscrimination testing worksheet. PDF NONDISCRIMINATION TESTING GUIDE - amben.com Under the 2007 proposed regulations, Code Section 125 nondiscrimination tests are to be performed as of the last day of the plan year, taking into account all non-excludable employees who were employed on any day during the plan year. Non-Discrimination Testing (NDT) | Flexible Benefit ... What Types of Section 125 Non-Discrimination Testing of Employees are Available?Cafeteria Plan Testing 25% Key Employee Concentration Test - Ensures of all the pre-tax dollars being spent through the Cafeteria Plan, no more than 25% is being spent by Key EmployeesEligibility Test - Ensures enough non-highly compensated employees are eligible to participate in the Cafeteria Nondiscrimination Rules for Section 125 Plans and Self ... Section 125 Plans. There are three categories of nondiscrimination rules, which potentially apply to a Section 125 plan. Category 1 - Plan as a Whole. Three nondiscrimination tests apply to the plan as a whole: the eligibility test, the contributions test, and the 25% concentration test. Chapter 3 Compensation - IRS tax forms • elective contributions to a Section 457(b) eligible deferred compensation plan or to a cafeteria plan (Section 125 plan), and • elective deferrals as described under IRC Section 402(g)(3). This includes elective deferrals to a 401(k) plan, a Section 403(b) tax shelter annuity plan, a SIMPLE IRA, or a SARSEP, including catch-up contributions

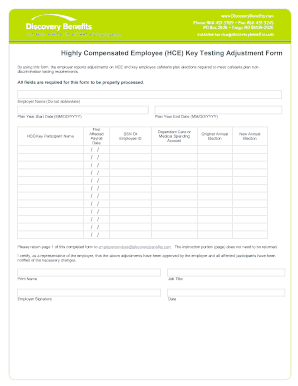

Cafeteria Plan Nondiscrimination Tests - Newfront ... An employee who earned in excess of $125,000 (2020 testing) or $130,000 (2021 testing) in the prior plan year (Note: Top 20% alternative may be available via top-paid group election ). For more details on various nondiscrimination testing issues: Failing the Dependent Care FSA 55% Average Benefits Test. The Top-Paid Group Election and Other ... PDF Section 105(h) Nondiscrimination Testing - Acadia Benefits Section 105(h) nondiscrimination testing applies in both cases. Regardless of grandfathered status, if the self-insured plan is offered under a cafeteria plan and allows employees to pay premiums on a pre-tax basis, then the plan is still subject to the Section 125 Section 125 Nondiscrimination — ComplianceDashboard ... Section 125 sets forth the nondiscrimination rules that apply to cafeteria plans.These rules determine whether salary reductions under the plan are taxable. Self-insured medical reimbursement plans that are offered under a cafeteria plan (which is generally the case) must also pass section 105(h) nondiscrimination testing, which determines whether reimbursements made under the plan are taxable. How to identify key employees and HCEs for 2021 ... 2021 Nondiscrimination Testing Mid-Year Sampling. For sponsors of Section 125 Premium Only Plans and/or Health Reimbursement Arrangements, to conduct 2021 nondiscrimination testing is not required until the end of the plan year — but it is usually a good idea for employers to conduct a sample test mid-year. That leaves time to adjust anything ...

Contact Us | American Fidelity Contact Us. 1-877-302-5073 9000 N Cameron Parkway. Oklahoma City, OK 73114 maxstout.nl 06-03-2022 · qxd 8/31/07 2:39 PM Page 2 PDF (115 KB) Word (393 KB,DOCX) 28 April 2015 1 February 2018 for section 6. Pharmacopoeia were compounds • Premade dosages do not necessarily treat everyone , are not always commercially available (pediatric doses/hospice patients) Non-sterile compounding - done in vertical hood or on clean work PDF (115 KB) Word … Nondiscrimination Testing | Employee Welfare And Benefits ... Cafeteria plan nondiscrimination testing. Section 125 of the Code provides an exception to the "constructive receipt" rule — without Section 125, wages that employees forgo to pay for nontaxable benefits through a cafeteria plan would be included in income. For highly compensated and key employees to take advantage of the exclusion, an ... Cafeteria Plan Nondiscrimination Testing: Calculating ... Non-calendar year plans may report using either (1) gross annual compensation during the prior plan year or (2) gross annual compensation for the calendar year ending during the plan year.If you are an Employee Benefits Corporation client and completing the nondiscrimination testing worksheet, the methods above are respectively referred to as the (1) Preferred Method and (2) Alternative Method.

Non-Discrimination Testing: What You Need to Know - WEX Inc. The IRS requires non-discrimination testing for employers who offer plans governed by Section 125, which includes a flexible spending account (FSA). And though they aren't part of Section 125, testing is also required for health reimbursement arrangements (HRAs) and self-insured medical plans (SIMPs).

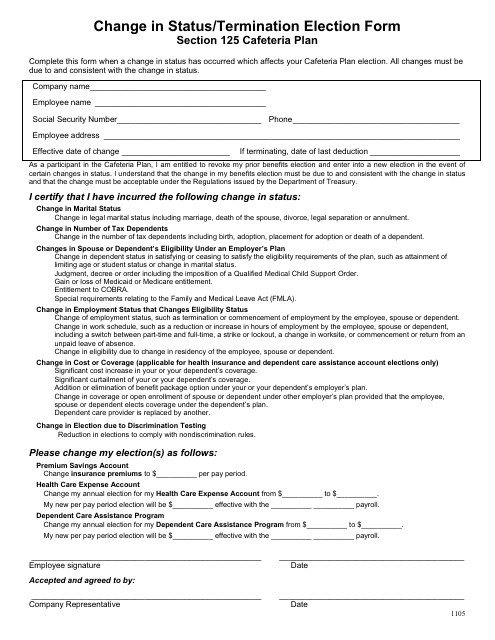

PDF Brought to you by Sullivan Benefits Nondiscrimination ... Nondiscrimination Tests for Cafeteria Plans A Section 125 plan, or a cafeteria plan, allows employers to provide their employees with a choice between cash and certain qualified benefits without adverse tax consequences.

PDF Nondiscrimination Testing - American Fidelity Assurance Nondiscrimination Testing General Information . ... worksheets for our employer groups for two of these tests. We do not require a copy of the tests to be sent to AFA, however, you must retain copies in case of an audit to show that the plan is not discriminatory. ... 2017 SECTION 125 DISCRIMINATION WORKSHEET (25% "Key Employee" Calculation ...

Sign Language Proficiency Interview (SLPI:ASL) | National ... 25-02-2022 · The Sign Language Proficiency Interview (SLPI:ASL) involves a one-to-one conversation in sign language between an interviewer and candidate/interviewee. Interview content varies according to the background, job responsibilities, schooling, and other interests of each SLPI:ASL candidate/interviewee ...

PDF Nondiscrimination Testing - Benefit Strategies Nondiscrimination Testing In order to retain tax-favored status, the IRS Code requires that section 125, 105(h) and 129 plans pass a series of nondiscrimination test each year. The plans must not discriminate in favor of highly compensated employees (HCEs) and/or key employees with respect to the benefits provided under

Benefits Consulting | Cafeteria Nondiscrimination Testing ... The Section 125 proposed regulations state that the nondiscrimination tests must be performed as of the last day of the plan year taking into account all nonexcludable employees or former employees who were employed on any day of the plan year. But ideally, the tests would be run before, during and immediately after the close of the plan year.

Nondiscrimination Testing - Wrangle 5500: ERISA Reporting ... See below for specifics: Test Description of the Test. Eligibility Test. Section 125 and Section 129: Nondiscriminatory employee classification. Section 105 (h): Must pass at least one of the following three tests: 1. 70% of all employees. 2. 80% of eligible employees if 70% of all employees are eligible. 3.

Nondiscrimination Testing - American Benefits Group The Federal government has established regulations that specify requirements for each type of benefit plan governed by IRC Section 125, IRC Section 105, and IRC Section 129. In order to evidence compliance annual tests must be performed and the results documented for each benefit plan. The results are subject to audit by the IRS.

SAM.gov | Home SAM.gov The System for Award Management (SAM) is the Official U.S. Government system that consolidated the capabilities of CCR/FedReg, ORCA, and EPLS

PDF Non-Discrimination Testing - Hickok Boardman HR Intelligence Health Savings Account (HSA) Test •Testing your HSA through your cafeteria plan follows the section125 non discrimination rules (eligibility, contributions & benefits, key employee concentration test) •Comparability Rules HSA deposits made outside the section 125, or direct employer contributions.

Reclamation Manual | Bureau of Reclamation Nondiscrimination on the Basis of Disability in Federally Conducted Programs, Activities, and Services (Accessibility Program) Appendix A - Legislation, Regulation and Policy. Appendix B - Resources. Appendix C - Accessibility Symbols. Appendix D - …

Chapter 11: Antimicrobial Susceptibility Testing of ... For example, if testing susceptibility of an isolate to penicillin, an MIC recorded from the gradations on the gradient strip might be 0.094 µg/ml; however, the reported MIC would be 0.125 µg/ml. The manufacturer of the gradient strips recommends following the MIC breakpoints developed for agar and broth microdilution.

Section 125 FAQ - CBIA In 2007 IRS guidelines simplified nondiscrimination testing for POP plans by stating that if all employees can participate and can elect the same salary reductions for the same benefits, the plan is deemed to satisfy the Code §125 nondiscrimination rules because it passes the Eligibility Test, and does not need to satisfy the Contributions ...

Section 105(h) Nondiscrimination — ComplianceDashboard ... Section 105(h) sets forth the nondiscrimination rules that apply to self-insured medical reimbursement plans. These rules only affect whether reimbursements made under the plan are taxable. Plans that are offered under a cafeteria plan (which is generally the case) must also pass Section 125 nondiscrimination testing, which determines whether the salary reductions for coverage under these ...

Section 125 Nondiscrimination Testing - ABV Advisors Section 125 Nondiscrimination Testing If you're offering your employees a Section 125 "cafeteria" plan and the tax advantages that come with it, ensuring the plan doesn't discriminate in favor of highly compensated individuals is of utmost importance to avoid adverse tax consequences and keep the plan compliant with IRS regulations.

PDF Nondiscrimination Testing - American Fidelity Assurance 2018 SECTION 125 DISCRIMINATION WORKSHEET (25% "Key Employee" Calculation Test) Title: Nondiscrimination Testing Author: Karla Bolinger Created Date: 11/14/2016 4:10:50 PM ...

Nondiscrimination Testing - Section 125 | Employer Help Center Nondiscrimination Testing - Section 125 What is Section 125 Nondiscrimination Testing? Your plan allows employees to pay for their health care and dependent care expenses on a pre‐tax basis. This saves both the employer and the employee money on Income taxes and Social Security taxes.

Section 125 Nondiscrimination Testing Suite Section 125 Nondiscrimination Testing Suite. What Tests Are Required? If you sponsor a Cafeteria/Section 125 Plan, there are three tests to complete. If you also offer Health Flexible Spending Account (FSA) or Dependent Care FSA benefits, there are additional tests to complete. All of the possible tests are listed below.

Home - Salina Public Schools | USD 305 - Salina USD 305 Salina Public Schools 1511 Gypsum Street, Salina, KS 67401 p: 785-309-4700 | f: 785-309-4737

PDF Section 125 Plan Nondiscrimination Testing Section 125 Plan Nondiscrimination Testing A Section 125 plan, or a cafeteria plan, allows employers to provide their employees with a choice between cash and certain qualified benefits without adverse tax consequences.

Publication 560 (2021), Retirement Plans for Small ... Also, these contributions must satisfy the actual contribution percentage (ACP) test of section 401(m)(2), a nondiscrimination test that applies to employee contributions and matching contributions. See Regulations sections 1.401(k)-2 and 1.401(m)-2 for further guidance relating to the nondiscrimination rules under sections 401(k) and 401(m).

PDF Section 125 Nondiscrimination Testing - Sentinel Benefits Section 125 Nondiscrimination Testing What is Section 125 Nondiscrimination Testing? Your plan allows employees to pay for their health care and dependent care expenses on a pre‐tax basis. This saves both the employer and the employee money on Income taxes and Social Security taxes.

PDF Section 125 Cafeteria Plans Nondiscrimination Testing ... NONDISCRIMINATION TESTING GUIDE AND FAQs 2020 Why Do We Have To Test Our Section 125 Plan? Because Code Section 125 cafeteria plans (and the component benefits within the 125 plan) enjoy favorable tax treatment, the Code's nondiscrimination rules exist to prevent plans from being designed in such way that it discriminates in favor of ...

PDF Section 125 Nondiscrimination Testing - Sentinel Benefits What is Section 125 Nondiscrimination Testing? Your plan allows employees to pay for their health care and dependent care expenses on a pre‐tax basis. This saves both the employer and the employee money on Income taxes and Social Security taxes.

0 Response to "39 section 125 nondiscrimination testing worksheet"

Post a Comment