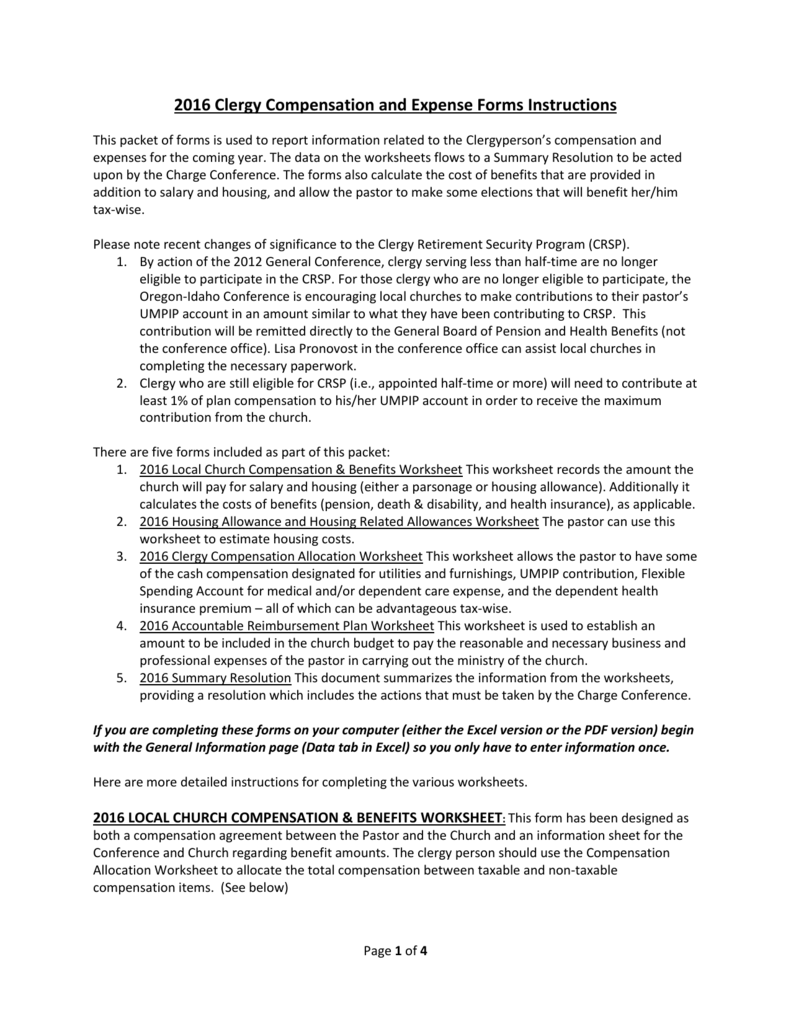

40 clergy housing allowance worksheet

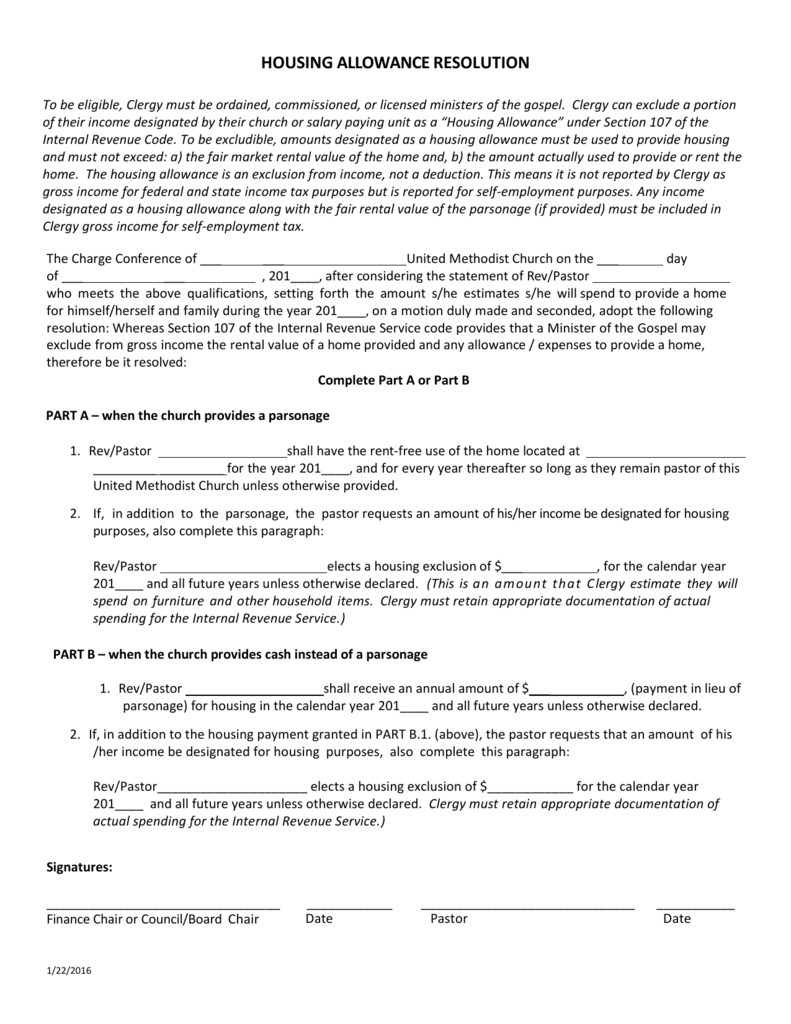

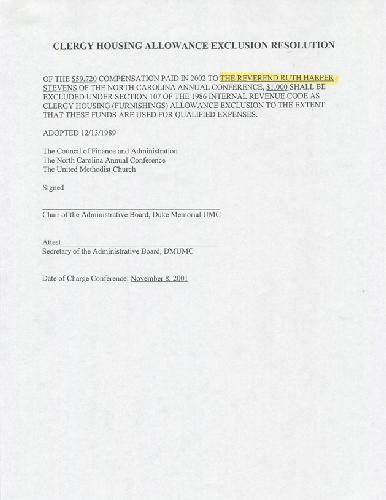

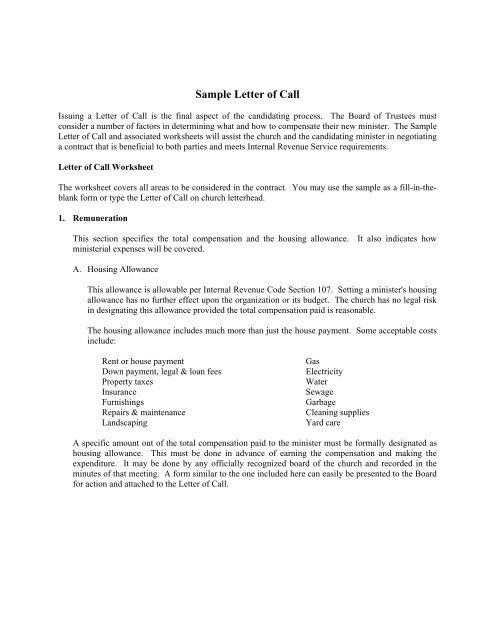

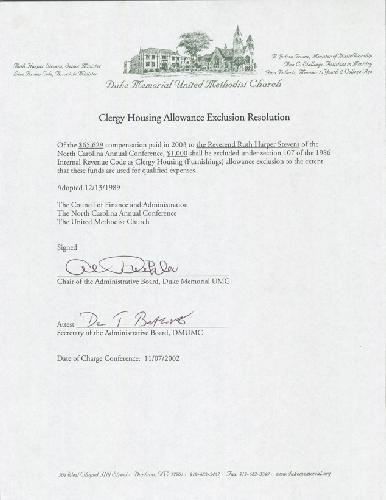

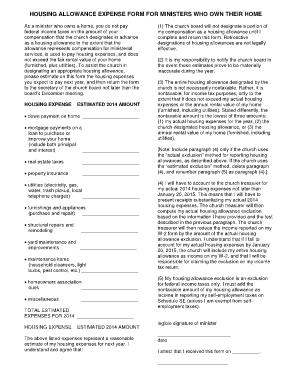

Creative Clergy Housing Allowance Worksheet - Goal keeping ... Clergy housing allowance worksheet.It is time again to make sure you update your housing allowance resolution. According to tax law if you are planning to claim a housing allowance deduction actually an exclusion for the upcoming calendar year your Session is required to designate the specific amount to be paid to you as housing allowance prior to the beginning of that. 2021 Housing Allowance - nccumc.org Housing Allowance. WORKSHEET FOR DETERMINING HOUSING ALLOWANCE EXCLUSION. 2021. This worksheet is designed to help a clergyperson determine the amount which he/she may exclude from gross income pursuant to the provisions of Section 107 of the Internal . Revenue Code. Those provisions provide that “a minister of the gospel” may exclude a

Housing Allowance For Pastors 2022 - Sdnu 40 clergy tax deductions worksheet Worksheet Live from vintage-shoppe.blogspot.com. Therefore, current and retired pastors can receive a housing allowance. The housing allowance for pastors is not and can never be a retroactive. The housing allowance is the most

Clergy housing allowance worksheet

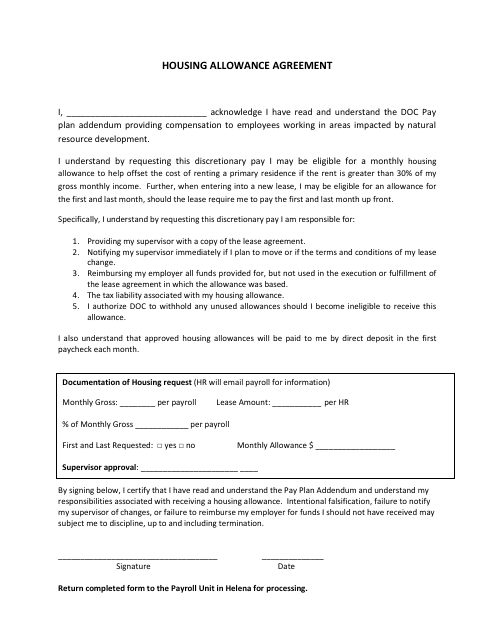

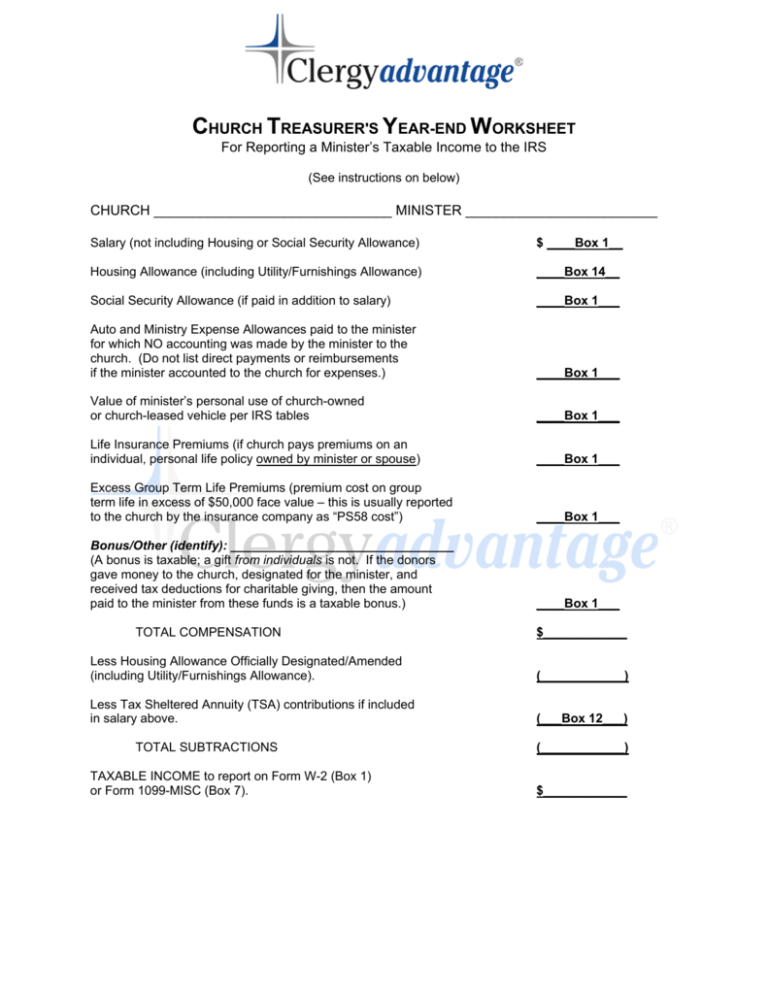

Housing Allowance Worksheet - Fill Out and Sign Printable ... Follow the step-by-step instructions below to eSign your clergy housing allowance worksheet: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of eSignature to create. There are three variants; a typed, drawn or uploaded signature. Create your eSignature and click Ok. Press Done. 40 clergy tax deductions worksheet - Worksheet Live PDF Clergy Income & Expense Worksheet Year CLERGY BUSINESS EXPENSES (continued) EQUIPMENT PURCHASED Musical instruments, office equipment, office furniture, professional library, etc. Item Purchased Date Purchased Cost (including sales tax) Item Traded Additional Cash Paid Business Use Other Information 1099s: Amounts of $600.00 or more paid to individuals (not Housing Allowance For Pastors ... PDF Ministers' Housing Allowance Resource Kit A housing allowance is a portion of clergy income that may be excluded from income for federal income tax purposes (W-2 " ox 1" wages) under Section 107 of the Internal Revenue ode. To be eligible, the pastor/clergy must be a "minister of the gospel" and be ordained, licensed, or commissioned by a church, convention or association of churches. 2.

Clergy housing allowance worksheet. CLERGY HOUSING ALLOWANCE WORKSHEET - Indiana-Kentucky Synod CLERGY HOUSING ALLOWANCE WORKSHEET tax return for year 200____ NOTE: This worksheet is provided for educational purposes only. You should discuss your specific situation with your professional advisors, including the individual who assists with preparation of your final tax return. METHOD 1: Amount actually spent for housing this year: CLERGY HOUSING ALLOWANCE WORKSHEET EXCLUDABLE HOUSING ALLOWANCE FOR TAX YEAR 201_____: Your excludable housing allowance will be the smallest of Methods 1, 2 or 3. NOTE: This worksheet is provided for educational and tax preparation purposes only. You should discuss your specific situation with your professional tax advisors. Clergy Financial Resources Ministers' Compensation & Housing Allowance | Internal ... For more information on a minister's housing allowance, refer to Publication 517, Social Security and Other Information for Members of the Clergy and Religious Workers. For information on earnings for clergy and reporting of self-employment tax, refer to Tax Topic 417, Earnings for Clergy. Clergy Housing Allowances | Arkansas Conference of the ... Clergy Housing Allowance Worksheet (from Clergy Financial Resources) Creating vital congregations that make disciples of Jesus Christ, who make disciples equipped and sent to transform lives, communities and the world! Arkansas Conference of the United Methodist Church

Clergy - Housing Allowance - TaxAct The housing allowance will transfer to the Self-Employment Tax Adjustment Worksheet The excess housing allowance will transfer to Form 1040, Line 1 as wages. Refer to IRS Publication 517 Social Security and Other Information for Members of the Clergy and Religious Workers for additional information. PDF CLERGY/PASTOR HOUSING ALLOWANCE FAQ's - AccuPay A housing allowance is a portion of clergy income that may be excluded from income for federal ... ChurchPay Pros' Housing Allowance Worksheet, is an excellent starting point for determining housing allowance amounts. The worksheet is available at . PDF CLERGY INCOME AND EXPENSE WORKSHEET - Donuts CLERGY INCOME AND EXPENSE WORKSHEET . NAME ... Housing allowance (see below) Speaking engagements Business expense reimbursement ... Miscellaneous supplies Allowance exceeds the lesser of amount paid By minister or RFV. CAR AND TRUCK EXPENSES . Year and make of vehicle MINISTER’S HOUSING EXPENSES WORKSHEET minister retired for purposes of the housing allowance and the favorable SECA tax treatment. Similarly, the IRS may view ministers as not retired if they have not had a meaningful break in service or change in work duties.

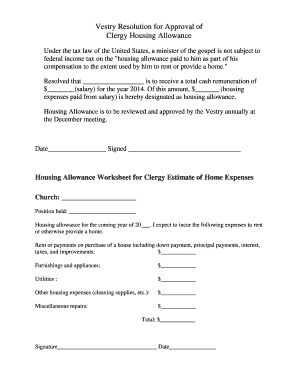

PDF Housing Allowance Exclusion in Retirement - FLUMC HOUSING ALLOWANCE EXCLUSION WORKSHEET This worksheet is designed to help a retired clergyperson determine the amount that he or she may exclude from gross income pursuant to the provisions of section 107 of the Code. Those provisions provide that "a minister of the gospel" may exclude a "housing allowance" from his or her gross income. Housing Allowance Exclusion Worksheet Housing Allowance Exclusion Worksheet. This worksheet is designed to help a clergyperson determine the amount that he or she may exclude from gross income . pursuant to the provisions of Section 107 of the Internal Revenue Code (Code). Those provisions provide that “a minister of Ministerial Housing Allowance Worksheet - Miller Management Mar 15, 2019 · What is a housing allowance? A housing allowance is an annual amount of compensation that is set aside by the church to cover the cost of housing related expenses for its ministers. The amount spent on housing reduces a qualifying minister’s federal and state income tax burden. Section 107 of the Internal Revenue Code (IRC) states that: Housing Allowance For Pastors Worksheet - Soapboxed Housing Allowance For Pastors Worksheet.District superintendent, pastor, church treasurer, recording secretary housing allowance worksheet to provide an estimate of actual costs which should be used to assist the pastor and local congregation to determine an appropriate housing allowance, one of the following figures should be used: Click the link for more information!

Minister's Housing Expenses Worksheet - AGFinancial Get the most out of your Minister's Housing Allowance. This worksheet will help you determine your specific housing expenses when filing your annual tax return. Minister's Housing Expenses Worksheet Download the free resource now. Did you know we have a wide array of products and services to help you on your financial journey?

Clergy Housing Allowance Worksheet - cchwebsites.com Clergy Housing Allowance Worksheet. Use this calculator to help determine the amount that a member of the clergy can claim as a housing allowance. By changing any value in the following form fields, calculated values are immediately provided for displayed output values. Click the view report button to see all of your results.

Housing Allowance Worksheet - The Anglican Diocese South ... Clergy Employment. Commission on Ministry. Clergy Compensation Guidelines. Clergy Salary Allowance Worksheet. Ordination Process. Sample Letter of Agreement. Housing Allowance Worksheet. Sabbatical Guidelines. Sample Housing Resolutions.

2022 Clergy Compensation Worksheet 2022 Clergy Compensation Worksheet. This form is for submitting the approved clergy compensation package for a pastor to the Benefits office. A final clergy compensation form will be sent to pastors and the church in December that will include the withholding amounts for the pension and health plans. Contact the Finance and Benefits offices at ...

PDF Housing Exclusion Worksheet Housing Exclusion Worksheet Minister Living in Home Minister Owns or Is Buying Minister's name:_____ ... Properly designated housing allowance $ _____(B) The amount excludable from income for federal income tax purposes is the lower of A or B (or reasonable compensation). Title:

PDF Ministers' Housing Allowance Resource Kit A housing allowance is a portion of clergy income that may be excluded from income for federal income tax purposes (W-2 " ox 1" wages) under Section 107 of the Internal Revenue ode. To be eligible, the pastor/clergy must be a "minister of the gospel" and be ordained, licensed, or commissioned by a church, convention or association of churches. 2.

40 clergy tax deductions worksheet - Worksheet Live PDF Clergy Income & Expense Worksheet Year CLERGY BUSINESS EXPENSES (continued) EQUIPMENT PURCHASED Musical instruments, office equipment, office furniture, professional library, etc. Item Purchased Date Purchased Cost (including sales tax) Item Traded Additional Cash Paid Business Use Other Information 1099s: Amounts of $600.00 or more paid to individuals (not Housing Allowance For Pastors ...

Housing Allowance Worksheet - Fill Out and Sign Printable ... Follow the step-by-step instructions below to eSign your clergy housing allowance worksheet: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of eSignature to create. There are three variants; a typed, drawn or uploaded signature. Create your eSignature and click Ok. Press Done.

0 Response to "40 clergy housing allowance worksheet"

Post a Comment