41 1120s other deductions worksheet

2022.01.08 - Drake21 Updates - kb.drakesoftware.com 1120 Program Update 2. Form 1120, line 26, Statement 05, "Other Deductions," will now include all entries and amounts, as expected. Prior to this update, some entries for Statement 05 were printed on an overflow statement. 1120S Program Update 2. General program update. 990 Program Update 2. General program update. Virginia Update 1 What Is a Schedule E IRS Form? - TurboTax Tax Tips & Videos A Schedule E does not only report income. You might use it to report a net loss from your particular business activity. Generally, when you engage in an activity for profit, the IRS limits your deductible loss to the amount you are "at-risk" for. To illustrate, if you invest $50,000 in a partnership and at the end of the year your share of ...

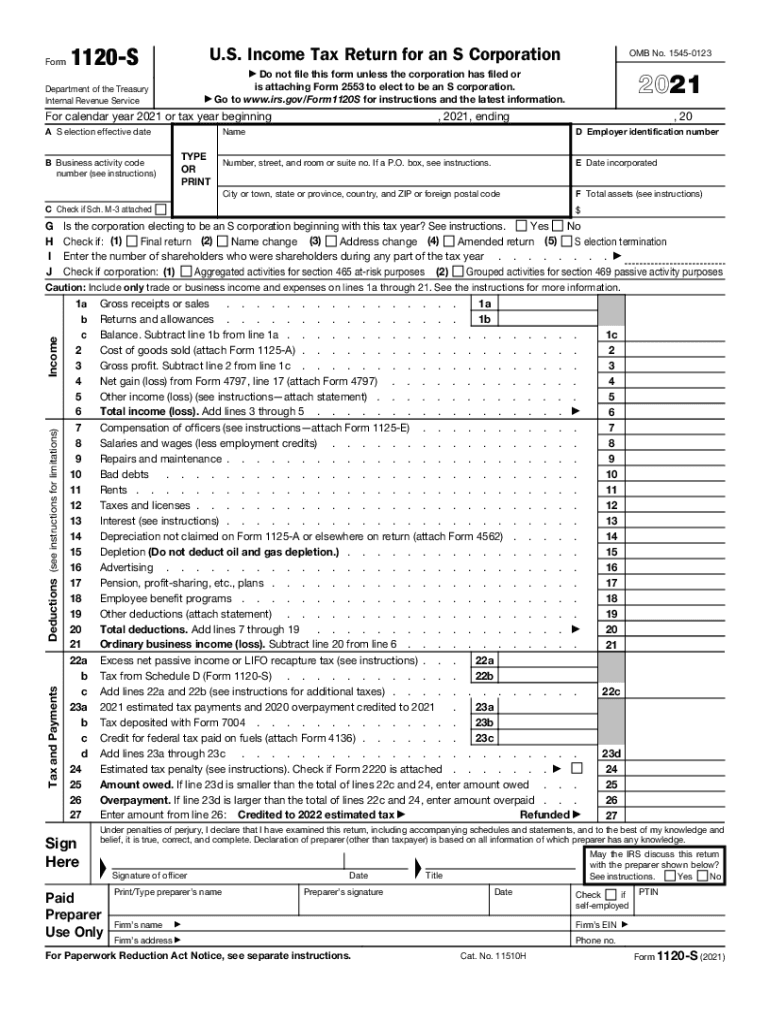

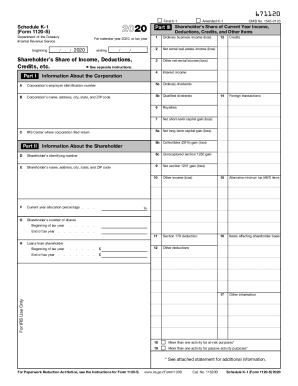

IRS Expands on Reporting Expenses Used to Obtain PPP Loan ... Form 1120S (2021), Schedule M-2 Line 2 of Schedule M-2 places the net ordinary income from line 1, page 21 into the AAA column and that will generally already be reduced by the expenses used for forgiveness which, though related to tax exempt income, were made deductible by the Comprehensive Appropriations Act, 2021 (CAA) in December 2020.

1120s other deductions worksheet

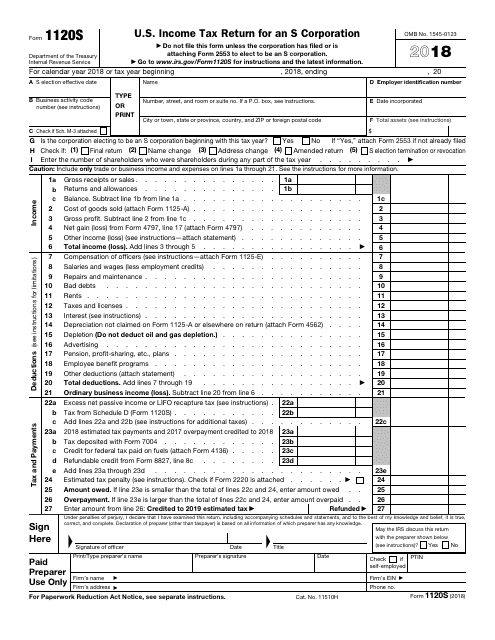

2019 1120S-CM - CNMI Department of Finance 1120S-CM. Sign. Here. Paid. Preparer. Use Only. Income. Deductions ... Other income (loss) (see instruction-attach statement) . . . . . Total income (loss).2 pages Form 1120-S: U.S. Income Tax Return for an S Corporation ... Form 1120S: A tax document used to report the income, losses and dividends of S corporation shareholders; it is an S corporation's tax return . Form 1120S is part of the Schedule K-1 document. It ... How To Report Relief Of Indebtedness On A Partnership ... How Do I Record A Ppp Loan Forgiveness On Form 1120S? There is an income statement listed for books not on return on Schedule M-1. If you are a corporation with S corporations, the money will qualify as other exemptions. The Schedule K line #16b reads "E.". Box 16B of Schedule K-1, titled "A" in English.

1120s other deductions worksheet. Form 1120 Line 26 Other Deductions Worksheet - Live ... Form 1120 Line 26 Other Deductions Worksheet This worksheet would certainly then assist your child begin with sentence rearranging. The example functions as an overview for the trainees as they try to solve the issues that comply with. Your youngster might have a hard time adapting to a new kind of exercise, such as rearranging sentences. Shareholder's Basis Computation Worksheet Shareholder's Basis Computation Worksheet. In MOST cases it needs to be filed with your tax return (most shareholders receive a Distribution, and those who don't receive a Distribution usually don't because the business is running at a loss, which also usually requires the form). But in the event you are not required to file it, yes, just keep ... How to complete Form 7203 in ProConnect The S-Corporate module in the program generates the Shareholder Basis Computation worksheet.Below are instructions on how to enter the information from the S Corporation worksheet into the S-Corp Info (1120S K-1) screen of the individual module. Click the three dots at the top of this screen and select Basis Information.. The line numbers in the following table refer to the line numbers on the ... Forms and Instructions (PDF) Inst 1120-W: Instructions for Form 1120-W, Estimated Tax for Corporations 2022 11/24/2021 Form 1040 (Schedule H) Household Employment Taxes 2021 11/24/2021 Form 8865 (Schedule K-1) Partner's Share of Income, Deductions, Credits, etc. 2021 11/23/2021 Form 8804 (Schedule A)

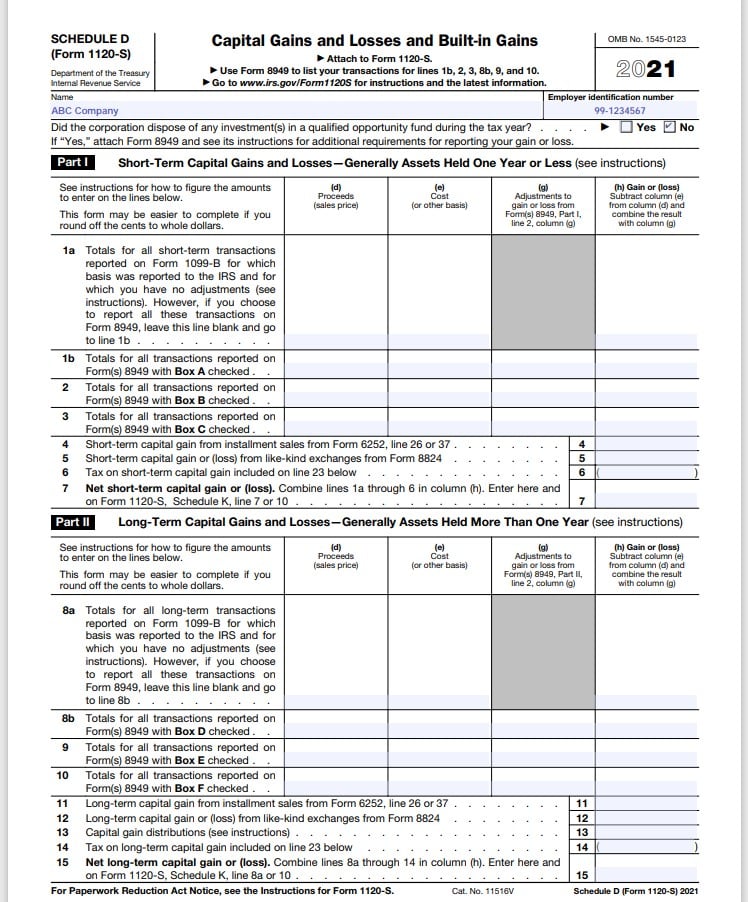

Instructions for Form 4562 (2021) | Internal Revenue Service A deduction for any vehicle reported on a form other than Schedule C (Form 1040), Profit or Loss From Business. Any depreciation on a corporate income tax return (other than Form 1120-S). Amortization of costs that begins during the 2021 tax year. solution13.pdf - Drake Support Dec 26, 2019 — Other deductions (attach statement). Total deductions. Add lines 7 through 19. Ordinary business income (loss). Subtract line 20 from line 6.23 pages 2022.02.17 - Drake21 Updates - kb.drakesoftware.com The calculation for line 4, "Deductions per Schedule K, federal 1120S," of Worksheet A, City of Detroit Corporate Income Tax Return (DT WK A), has been updated to include the following lines from federal Schedule K (Form 1120-S): Line 12b, "Investment interest expense" Line 12c, "Section 59 (e) (2) expenditures Line 12d, "Other deductions" Of The Best Self Employment Earnings Worksheet - Labelco S Corporation Schedule K-1 Form 1120S and Form 1120S Assigned Number Title Version Date Publication Type Other Location Language. Who have 25 or greater Who are employed by Who are paid Who own rental property. This worksheet may be used to prepare a written evaluation of the analysis of income related to self-employment.

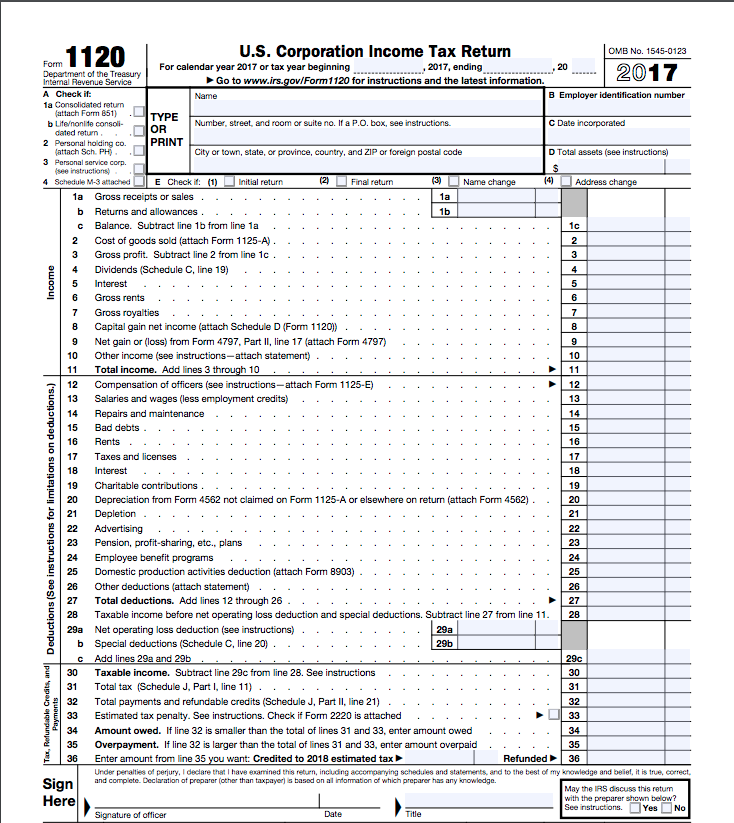

Pass-through Entity Information (Publication 129) - Tax ... Pass-through entity tax is an elective tax on partnerships (other than a publicly traded partnership under Internal Revenue Code (IRC) Section 7704) and Subchapter S corporations effective for tax years ending on or after December 31, 2021, and beginning before January 1, 2026. Form 1120 Line 26 Other Deductions Worksheet - Printable ... Form 1120 Line 26 Other Deductions Worksheet - Many thanks to cost-free printable worksheets, learning can be made much easier. When teaching advanced reproduction, educators can use vocabulary words they've just recently covered in course to produce worksheets. Form 1120 Line 26 Other Deductions Worksheet Specific Heat Problems Worksheet - Studying Worksheets Specific heat worksheet answer key together with calculating specific heat worksheet best specific heat worksheet. Show all work and units. Specific heat practice problems worksheet with answers. A 1675-g piece of iron absorbs 98675 joules of heat energy and its temperature changes from 25 C to 175 C. Answers are provided at the end of the ... B3-3.4-03, Analyzing Returns for a Corporation (06/05/2019) Corporations use IRS Form 1120 to report their taxes. ... casualty losses, net operating losses, and other special deductions that are not consistent and recurring. The following items should be subtracted from the business cash flow: travel and meals exclusion,

U.S. Income Tax Return for an S Corporation - IRS Video Portal attaching Form 2553 to elect to be an S corporation. ... Other deductions (attach statement) . ... b Tax from Schedule D (Form 1120S) .4 pages

Partner's Instructions for Schedule K-3 (Form 1065) (2021 ...

Form 1120 Line 26 Other Deductions Worksheet - Studying ... Form 1120 line 26 other deductions worksheet. Subpart F inclusions derived from the sale by a controlled. Line 36 Form 1120 Line 32 Form 1120-A Direct Deposit of Refund If the corporation wants its refund directly deposited into its checking or savings account at any US.

How to Report ERTC on tax return | TallyTaxMan ... Instead, item (1) reduces your deduction for wages on lines 7 and 8, and item (2) must be reported as income on line 5.". You can access the instruction here: This means that you will reduce the reported wages paid by the amount of ERTC. You will report the Qualified Sick & Family leave credit as additional, "Other" income.

Form 4562: A Simple Guide to the IRS Depreciation ... - Bench Depreciation is the act of writing off a tangible asset over multiple tax years. Depending on your business structure, you list your depreciation deduction each year on Form 1040 (Schedule C), Form 1120/1120S, or Form 1065. When you make a big purchase, its value may be too large—according to IRS rules—to write off all in one year.

Why does Form 1120 show a statement for deductions on Line 26? Per IRS instructions, Lacerte generates a statement for Form 1120, line 26, listing all allowable deductions that aren't deductible elsewhere on the form. To generate a statement for line 26: Enter deduction type and amounts in the Other (Ctrl+E) field in Screen 20.1, Deductions.

Federal Depreciation Schedule Worksheet No but do then amortize on federal depreciation schedule worksheet. 1120s other deductions worksheet 2019. Table that determine your federal tax while the solution schedule Federal. 1 Depreciation...

Knowledge Base Solution - Updates to 2020 Maryland Form ... State special Allocation code 22815 "Maryland > Income / Deductions worksheet > Section 3 - Other Subtractions and Overrides > Line 5 - State and Local tax Addback override (Interview Forms: MD4, box 85)." is available in both 1065 and 1120S systems. MD Form 511, Schedule B, Part I and Part III, Distributive or Pro Rata Share of Tax Paid

Help with Weighted Average Ownership Percentage Worksheet ... Help with Weighted Average Ownership Percentage Worksheet on 1120S. We received PPP money in 2020. It was forgiven in March of 2021. After researching it and asking questions to the community, I entered it as a liability (SBA PPP Loan) on the 2020 S-Corp business taxes as it was not forgiven yet. It showed up on Schedule L, line 21.

Knowledge Base Solution - What is the calculation of ... An override for this calculation is available on Maryland > Income / Deductions > Other Adjustments and Overrides > State or local tax addback - override. Prior to this release: MD electing PTE instructions, page 5 and 6 discuss how Form 511, line 2 should be derived, specific to 1120S, Schedule K, lines 1-10, plus taxes based on net income ...

Can You Claim The Qualified Business Income Deduction? Form 1120-S, Schedule K-1: Box 17, Code V - Qualified Business Income; Form 1041, Schedule K-1: Box 14, Code I; The QBID is a "below the line" deduction that reduces taxable income. It does not reduce adjustable gross income. It is available to taxpayers that itemize deductions, as well as those that take the standard deduction.

How to File S Corp Taxes & Maximize Deductions | White ... Now repeat the process for any other shareholders (luckily since we're 50/50, this is very easy to do for us) and compile your return. It should look like this: Form 1120S pages 1-5; Form 1125-A; Form 1125-E; Statement of Explanation for 2019 Form 1120S Line 19 Other Deductions; Statement of Explanation for 2019 Form 1120S Schedule L Line 14 ...

Schedule K-2 and K-3 Will Be Required to Be Provided ... The IRS made modifications to the instructions for new partnership Schedules K-2 and K-3 (Form 1065) that will require partnerships to either have all partners certify that certain information will not be necessary to complete some international tax related items on their return (including the Foreign Tax Credit) or complete the relevant portions of Schedule K-2 and K-3 and provide them to all ...

State Program Updates - TaxAct Modification made to Form 84-132 Other Income and Other Deductions Worksheets. Modification made to Form 84-131. E-file now available. 03/01/2021 - Version 1.02 of TaxAct 2020 Missouri 1120S Edition. Version 1.02 includes the following minor changes: General bug fixes and performance improvements.

Deducting Miscellaneous Business Expenses If you're a sole proprietor, miscellaneous expenses are listed on line 27a of Schedule C. These expenses are categorized in Part V of Schedule C, then totaled and entered on line 27a. On Form 1120 for corporations, line 26 is for "other deductions," and you must attach a statement detailing those deductions.

How To Report Relief Of Indebtedness On A Partnership ... How Do I Record A Ppp Loan Forgiveness On Form 1120S? There is an income statement listed for books not on return on Schedule M-1. If you are a corporation with S corporations, the money will qualify as other exemptions. The Schedule K line #16b reads "E.". Box 16B of Schedule K-1, titled "A" in English.

Form 1120-S: U.S. Income Tax Return for an S Corporation ... Form 1120S: A tax document used to report the income, losses and dividends of S corporation shareholders; it is an S corporation's tax return . Form 1120S is part of the Schedule K-1 document. It ...

2019 1120S-CM - CNMI Department of Finance 1120S-CM. Sign. Here. Paid. Preparer. Use Only. Income. Deductions ... Other income (loss) (see instruction-attach statement) . . . . . Total income (loss).2 pages

/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

0 Response to "41 1120s other deductions worksheet"

Post a Comment