41 nol calculation worksheet excel

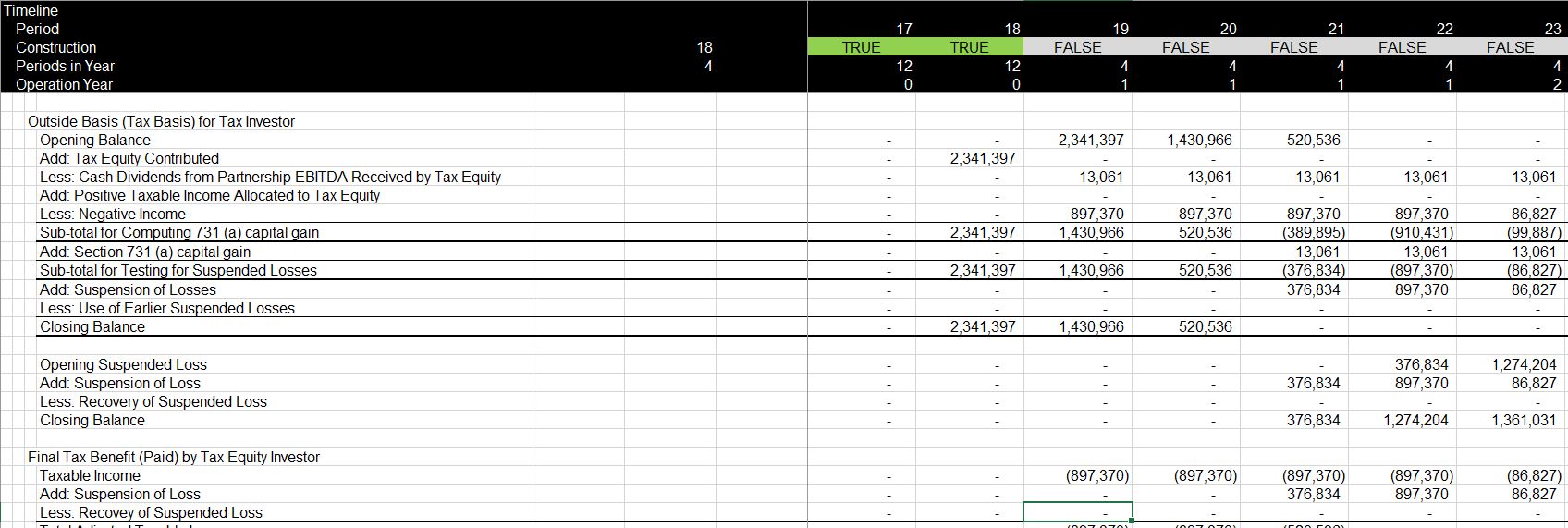

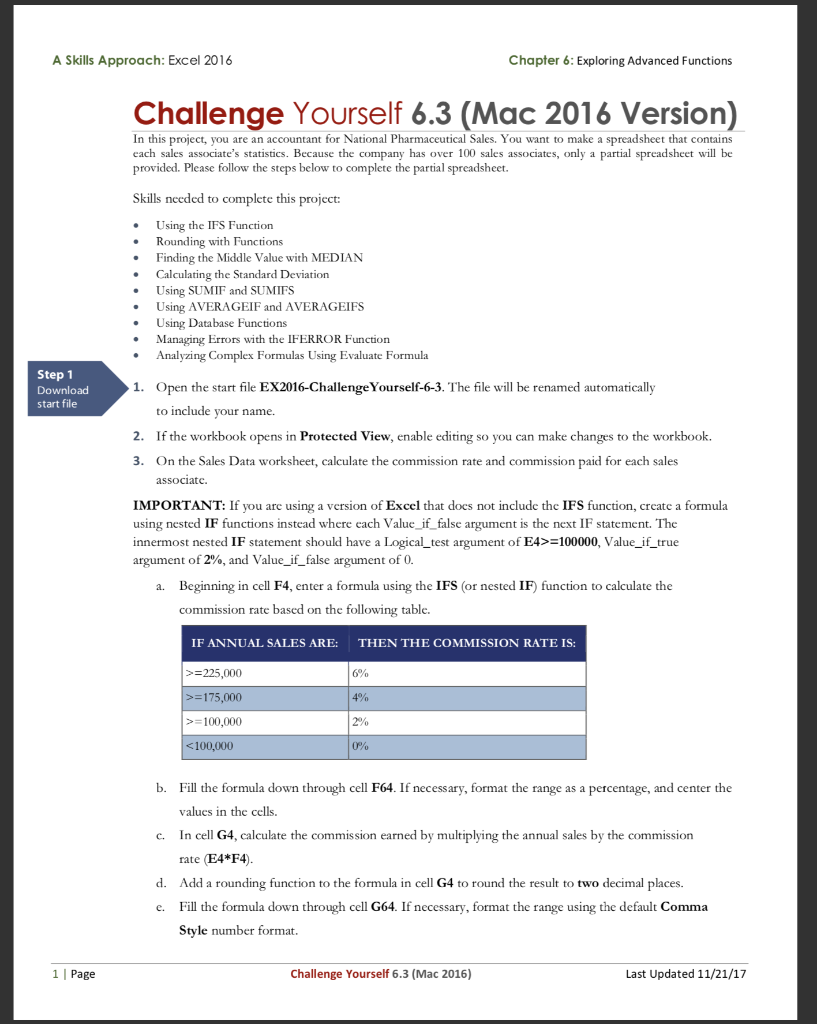

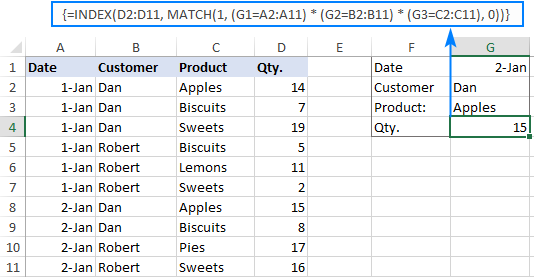

47+ Excel Formula To Calculate Commission On Sales Pics - Nol 47+ Excel Formula To Calculate Commission On Sales Pics - Nol - https: ... In the sales commission worksheet insert a formula in cell g4 that references the data in the total sales column (column e) and the commission rate (cell i2) in cell j3. ... Excel calculate a sales commission excel articles. Source: . Net Operating Loss (NOL) - Calculation Worksheet This tax worksheet calculates a personal income tax current year net operating loss and carryover. If a taxpayer's deductions for the year are more than their income for the year, the taxpayer may have an NOL. For further assistance on this topic, click the Tax Forms item group button and view the following tax form:

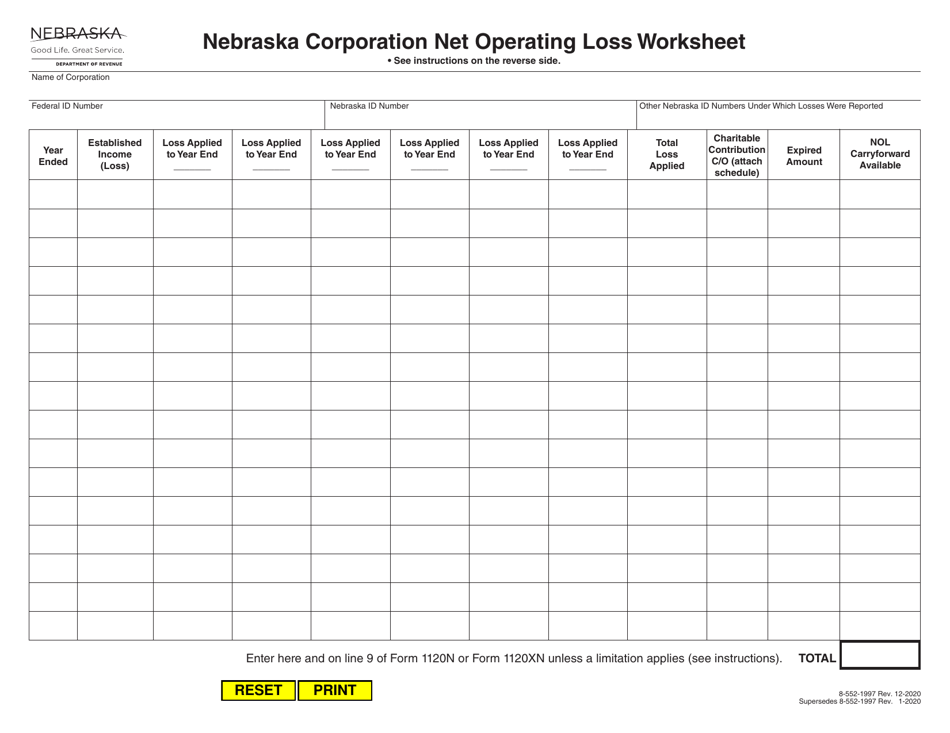

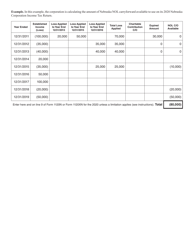

Publication 536 (2021), Net Operating Losses (NOLs) for ... Worksheet 1. Figuring Your NOL. Nonbusiness capital losses (line 2). Nonbusiness deductions (line 6). Nonbusiness income (line 7). Adjustment for section 1202 exclusion (line 17). Adjustments for capital losses (lines 19-22). NOLs from other years (line 23). Worksheet 1. Figuring Your NOL Worksheet 1. Figuring Your NOL Example When To Use an NOL

Nol calculation worksheet excel

PDF 382 Limits on NOL Usage an Ownership Change ― NOL, tax credit, capital loss or other attribute carryforward ― Net unrealized built-in loss • 5% shareholders ― Any person holding 5% or more during the testing period • Testing period ― Begins on the first day of the tax year in which carryforward begins ― Three-year "rolling" period, unless change occurs Net Income Template - Download Free Excel Template Net income is the amount of accounting profit a company has left over after paying off all its expenses. Net income is found by taking sales revenue Sales Revenue Sales revenue is the income received by a company from its sales of goods or the provision of services. In accounting, the terms sales and and subtracting COGS, SG&A SG&A SG&A includes all non-production expenses incurred by a ... PDF Optional Worksheet for Calculating Call Report Applicable ... Generally, an NOL that occurs when loss carrybacks are not available becomes an NOL carryforward. The CARES Act (1) repeals the 80 percent taxable income limitation for NOL carryback and carryforward ... This optional worksheet assists in the calculation of applicable income taxes on the amount reported in Schedule RI, item 8.c, "Income (loss)

Nol calculation worksheet excel. 39 like kind exchange worksheet excel - Worksheet Online Worksheets and checklists available for free to NATP members include: mid- year tax planning checklist, tax preparer worksheet, per diem rates, like -kind exchange worksheet, NOL allocation, NOL/AMTNOL calculation and carryover, partner's outside basis, standard mileage rates and more. mexpeters.nl 2 days ago · To see the calculation of the dependent information, refer to Worksheet 6 Apr 06, 2020 · His form has total monthly enrollment premiums of ,923, SLCSP of ,586, and advance payment of PTC of ,812. Design and create web forms with simple fields, advanced fields, formula fields, eSignatures, and conditional logic. Because of 2020 law change, 8962 is not needed … Tax Principles (part 2): Valuing NOLs - Multiple Expansion The annual use of NOLs are a function of the company's profitability. If the company is projected to be highly profitable, it will be able to use the NOL balance more quickly, and vice versa. To calculate the annual cash flow, the formula is simple: Annual cash value of NOL = taxes shielded = NOL balance used x Tax Rate. Newsletter Signup - Hollywood.com Newsletter sign up. In subscribing to our newsletter by entering your email address you confirm you are over the age of 18 (or have obtained your parent’s/guardian’s permission to subscribe ...

Flour Mill Rye [4MH368] Search: Rye Flour Mill. What is Rye Flour Mill. Every flour has its own unique properties. Sourdough Rye using your flour and some crushed organic caraway seeds has lifted my Sourdough Rye to a new level!! Excel Sheet Online - Page 59 of 67 - 1000 + Printable ... Nol Carryover Worksheet Excel - Worksheets that call for multiplication are included in this collection. We developed a sailor-shaped multiplication worksheet to make an on-line beginning to read more enjoyable. This will certainly stimulate the children's rate of interest in understanding and expedition, and also… 1040 - Net Operating Loss FAQs (NOL, ScheduleC, ScheduleE ... Wks NOL (WK_NOL in Drake15 and prior) worksheet. This worksheet is what next year's LOSS screen will look like when the return is updated, including the carryforward. Wks NOLCO (WK_NOLCO in Drake15 and prior) worksheet. This displays any prior-year NOL to be carried forward. PDF A net operating loss (NOL) deduction can offset vidual taxpayer and claiming the NOL deduction must be carried out in the following four steps. 1. Determine eligibility 2. Compute the NOL 3. Distribute the NOL to carryback and carry - forward years 4. Recalculate taxes in the carryback years and calculate taxes in the carryforward years Estate and Trusts

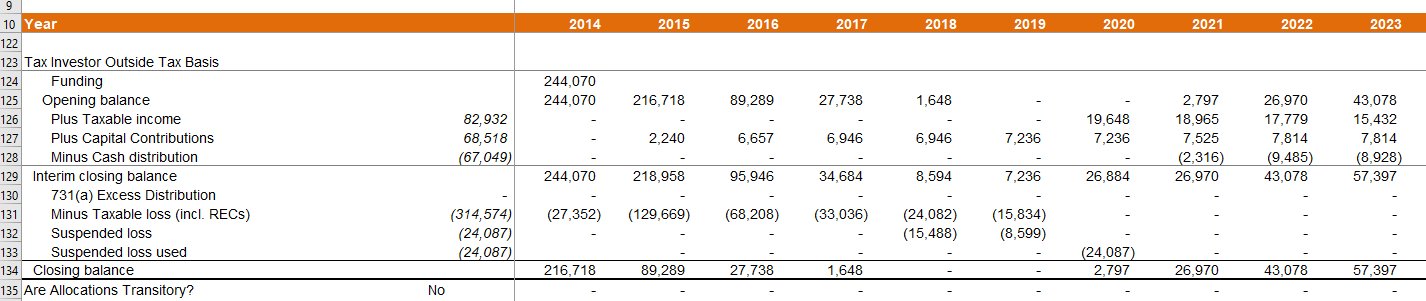

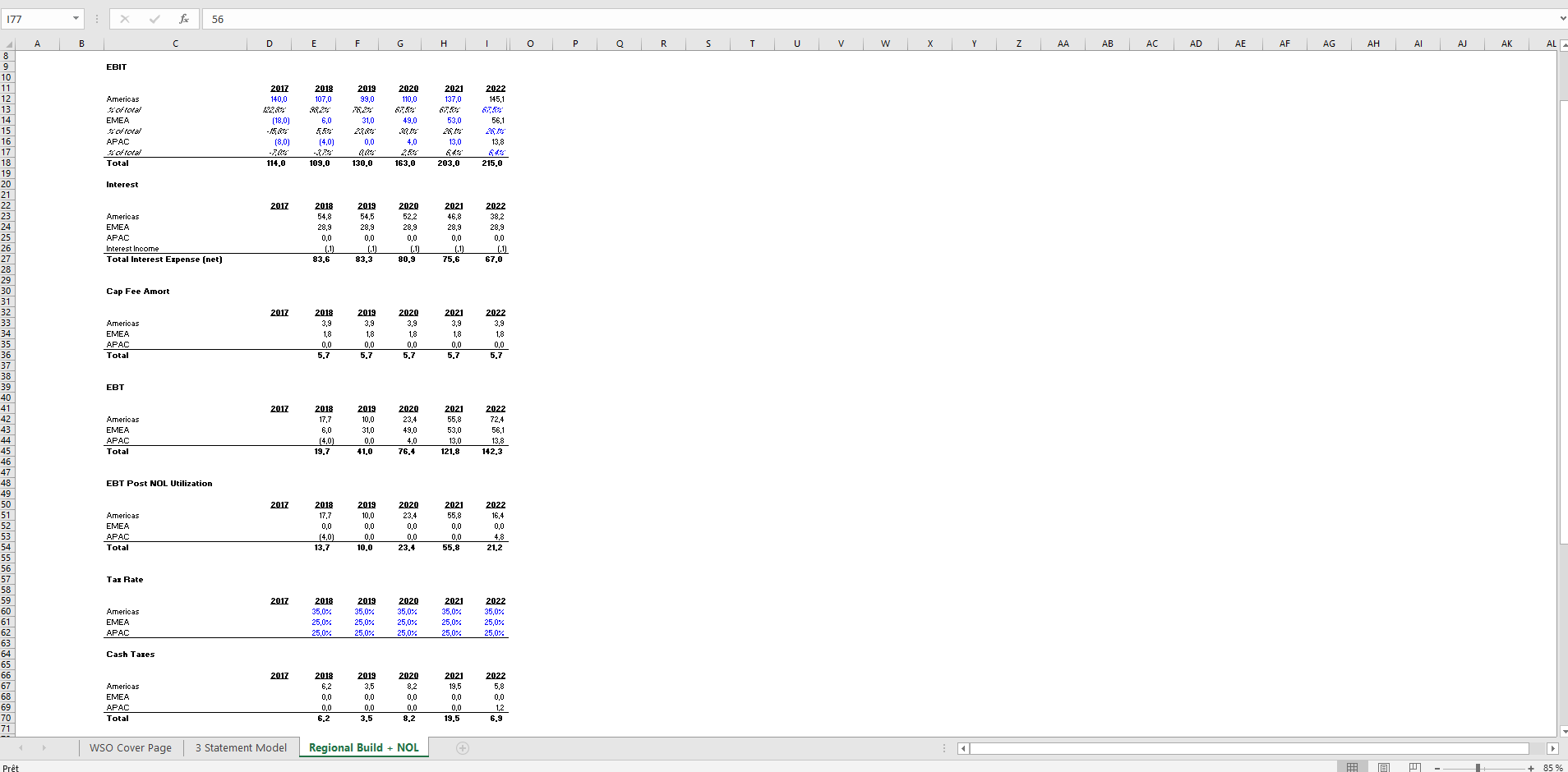

XLSX Home Page - Weststar Mortgage 66. Net Operating Loss and Special Deductions 67. Mortgage or Notes Payable in Less than 1 year 68. Meals and Entertainment Exclusion 69. Subtotal 70. Subtotal Multiplied by Ownership Percentage 71. Less: Dividends Paid to Borrower 72. Corporation Total Taxes Insurance Total Monthly Debt Payment Social Security Base Income Paid Weekly Paid Semi ... PDF Income Calculations - Freddie Mac Income Calculations (Schedule Analysis Method) Form 91 is to be used to document the Seller's calculation of the income for a self-employed Borrower. This form is a tool to help the Seller calculate the income for a self-employed Borrower; the Seller's calculations NOL | Net Operating Loss - Macabacus where $1.75 = ($3.0 + $2.0) × 35% tax rate, $1.05 = $3.0 NOL carried forward × 35% tax rate, and $2.80 = $8.0 pre-tax loss × 35% tax rate. You could assume that the income tax receivable is immediately recognized as cash, so that you don't have to worry about swapping the receivable for cash in a future period. NOL -- Net Operating Loss -- Definition & Example ... What is Net Operating Loss (NOL)? A net operating loss (NOL) is a negative profit for tax purposes. It usually occurs when a company's tax deductions exceed its taxable income, making the company unprofitable.. How Does Net Operating Loss (NOL) Work? Net operating losses can be used to reduce future tax payments. For example, let's assume Company XYZ has taxable income of $1,000,000 and tax ...

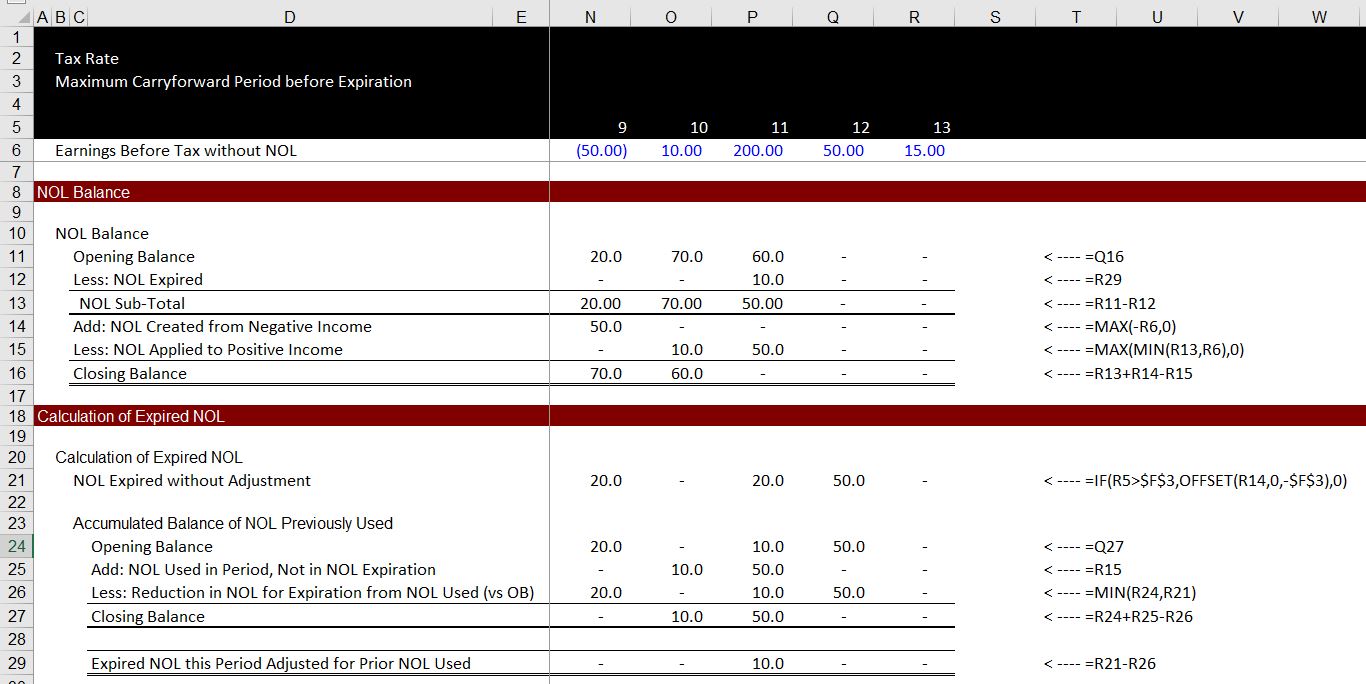

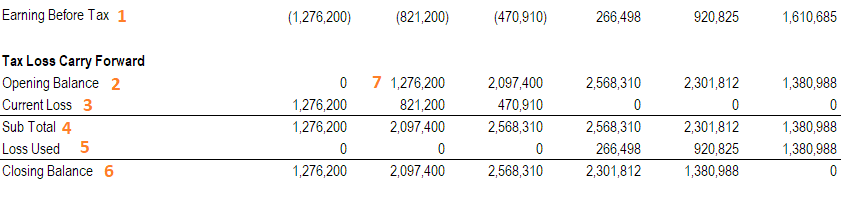

Net Operating Losses (NOLs): Carry-Forward and Carry-Backs Net Operating Losses (NOLs) Example Calculation For our illustrative modeling exercise, our company has the following assumptions. Model Assumptions Taxable Income 2017 to 2018 = $250k Taxable Income in 2019 = Negative $1m Tax Rate = 21%

PDF 2015 Publication 536 - IRS tax forms Step 2. Determine whether you have an NOL and its amount. See How To Figure an NOL, later. If you do not have an NOL, stop here. Step 3. Decide whether to carry the NOL back to a past year or to waive the carryback period and instead carry the NOL forward to a future year. See When To Use an NOL, later. Step 4. Deduct the NOL in the carryback or

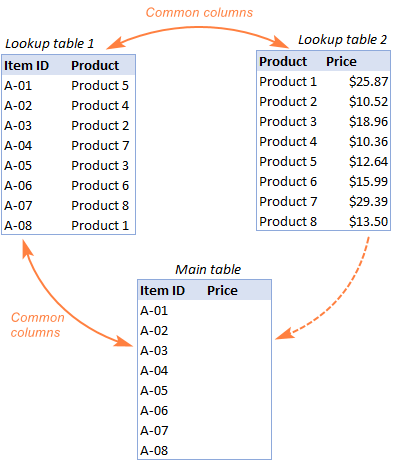

Net Operating Loss (NOL) Carryforward - Excel Model Template ... Apr 02, 2020 · nol net operating loss carryforward 3 statement model three statement model balance sheet income statement cash flow statement. Description. This is a professional Net Operating Loss Carryforward template for financial modelling. Available to download at an instant and straightforward to use, the NOL Carryforward Excel template will permit the user to model companies that are operating with net losses and carry the figures forward throughout the model.

Find Jobs in Germany: Job Search - Expatica Browse our listings to find jobs in Germany for expats, including jobs for English speakers or those in your native language.

Discover What's New in ProSeries | Intuit Accountants You can also do sizing similar with Excel. Filter (now available for ProSeries Basic): You can filter your HomeBase by clicking on the fliter icon on the HomeBase view. if you want to remove the filter you can click the X at the bottom right of the screen. Note—you can’t do a custom view in E-file Center. You can also reset the filter by going to HomeBase drop-down menu and click …

Tax Loss Carryforward - How an NOL Carryforward Can Lower ... Create a subtotal line Create a line to calculate the loss used in the period with a formula stating that "if the current period has taxable income, reduce it by the lesser of the taxable income in the period and the remaining balance in the TLCF. Create a closing balance line equal to the subtotal less any loss used in the period

Net Operating Loss Worksheet / Form 1045 - Support From the Main Menu of the Tax Return (Form 1040) select: Miscellaneous Forms. Net Operating Loss Worksheet/Form 1045. Form 1045 - Application for Tentative Refund. Enter the number of years you wish to carry back the NOL. Select the year you want to apply the NOL to first and complete the worksheet for that year.

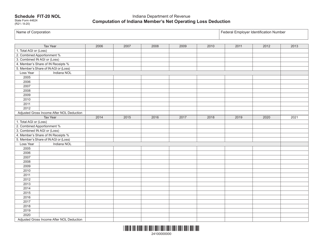

NJ Division of Taxation - Latest News & Updates 2022-01-19 · Notice: NOL Conversion Worksheet 500-P: 12/10/2018: TB-84(R) - Changes to the New Jersey Corporation Business Tax: 10/24/2018: Automatic Extension for NJ 2018 CBT-100 and CBT100-S Filers: 10/11/2018: Automatic 30-Day Penalty Relief for Corporation Business Tax Filing Due October 15, 2018: 08/24/2018

PDF Worksheet for Apportionment of Net Operating Loss (Nol) Enter this tax period's NOL as defined in the United States Income Tax Regulations relative to IRC § 172 in effect pursuant to RSA 77-A:4, XIII. If a gain or zero, DO NOT use this worksheet. (Business organizations not qualifying for treatment as a Subchapter "C" Corporation under the IRC should calculate their NOL as if the business

How to Calculate Net Operating Loss: A Step-By-Step Guide Mar 28, 2019 · How to Calculate Net Operating Loss? On a business expense sheet, the net operating loss is calculated by subtracting itemized deductions from adjusted gross income. If the result is a negative number, you have net operating losses. This item is displayed on line 41 on Form 1040, U.S. Individual Income Tax Return.

1040-US: NOL Carryover Calculation Worksheet 1, line 2 ... Answer. The amount is calculated as follows: Form 1040, line 11b (taxable income) + NOL deduction = NOL Carryover Calculation Worksheet 1, line 2. Note: The NOL deduction can be found on NOL Carryover Calculation Worksheet 1, line 1. For additional information on the calculation of the NOL worksheets, see IRS Publication 536, Net Operating Losses (NOLs) for Individuals, Estates, and Trusts.

Is there a spreadsheet to assist in calculating NOL ... Clients are retired in their 70's. They have a NOL Clients are retired in their 70's.They have a NOL carryforward from 2019 of $22,213 and a loss on Sch E in 2020 of $8,184. Their income is $22,407 … read more Carter McBride LLM 8,698 satisfied customers For 2019 we had a Ponzi scheme loss which exceeds our

Bing Microsoft Translator Quickly translate words and phrases between English and over 100 languages.

PDF Global Cashflow Worksheet - Lender's Online Training 1040 SChEDULE C CAShFLOW WORkShEET COMMENTS: * Some secondary-market mortgage lenders do not add back interest or subtract business debt. ** Subtract annual debt payments for net cashflows to owner. Omit debt if calculating cashflow available to pay debt. CAUTION: Need Owner's Draws to calculate debt coverage. Partial comments from Excel ...

Coursework Hero - We provide solutions to students We provide solutions to students. Please Use Our Service If You’re: Wishing for a unique insight into a subject matter for your subsequent individual research;

Celebrities Archives | Hollywood.com Click to get the latest Celebrities content. Sign up for your weekly dose of feel-good entertainment and movie content!

Nol carryover worksheet excel - strongpointmarketing.net the worksheet 1 to calculate its nol. The detailed deduction for medical expenses. Procedure. In general, if you have a nol for a fiscal exercise that ends in 2020, it is possible to report the entire amount of the NOL to 5 years before the year NOL (carry-over) and report any remaining nol in time indeterminate (carry-over). Deposit module 1045 with

Solved: NOL Carryforward worksheet or statement NOL Carryforward worksheet or statement. To enter your 2018 NOL into TurboTax, type NOL in the search bar at the top right of your screen. Then choose the "Jump To" Link. It will take you to the screen below to enter that information. @5Wilgm. **Say "Thanks" by clicking the thumb icon in a post.

Net Operating Loss Carryback/Carryover Calculator This calculator helps you calculate your NOL deduction and any remaining NOL that you may carry to another year. Net Operating Loss Carryback/Carryover Calculator Definitions Year in which the NOL occurred Year in which you had a Net Operating Loss (NOL). Year to which the NOL is being carried (Carried Year)

XLS 2021 Cash Flow Analysis Calculator - Essent Mortgage Insurance calculating the dollar difference between the two years; and dividing the dollar difference by the previous year's gross income. Gross Income Expenses Step 1. Determine what percentage expenses are of gross income by dividing the expense amount by the dollar amount of gross income for each year. Enter the results where indicated. Step 3.

PDF Optional Worksheet for Calculating Call Report Applicable ... Generally, an NOL that occurs when loss carrybacks are not available becomes an NOL carryforward. The CARES Act (1) repeals the 80 percent taxable income limitation for NOL carryback and carryforward ... This optional worksheet assists in the calculation of applicable income taxes on the amount reported in Schedule RI, item 8.c, "Income (loss)

Net Income Template - Download Free Excel Template Net income is the amount of accounting profit a company has left over after paying off all its expenses. Net income is found by taking sales revenue Sales Revenue Sales revenue is the income received by a company from its sales of goods or the provision of services. In accounting, the terms sales and and subtracting COGS, SG&A SG&A SG&A includes all non-production expenses incurred by a ...

PDF 382 Limits on NOL Usage an Ownership Change ― NOL, tax credit, capital loss or other attribute carryforward ― Net unrealized built-in loss • 5% shareholders ― Any person holding 5% or more during the testing period • Testing period ― Begins on the first day of the tax year in which carryforward begins ― Three-year "rolling" period, unless change occurs

![Free Tax Estimate Excel Spreadsheet for 2019/2020/2021 [Download]](https://cdn.michaelkummer.com/wp-content/uploads/2014/12/2014-12-10-at-7.59-PM-600x201.png?strip=all&lossy=1&ssl=1)

![Free Tax Estimate Excel Spreadsheet for 2019/2020/2021 [Download]](https://cdn.michaelkummer.com/wp-content/uploads/2014/12/calculate-tax-facebook.jpg?strip=all&lossy=1&ssl=1)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/BusinessWomanCalculating-de2459cb42b04268a7e3de6e5c4be9cf.jpg)

0 Response to "41 nol calculation worksheet excel"

Post a Comment