42 capital gain worksheet 2015

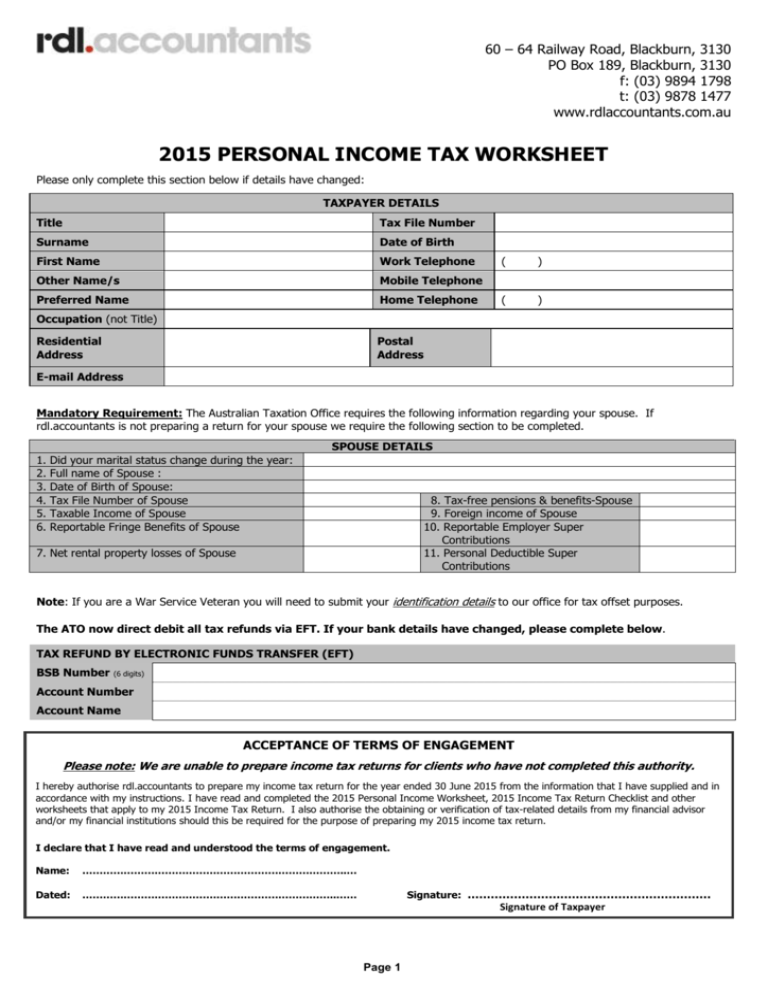

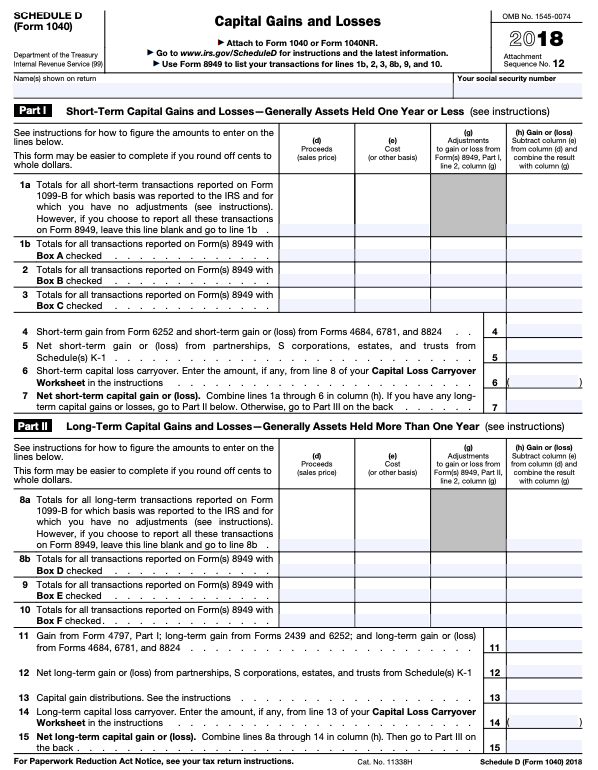

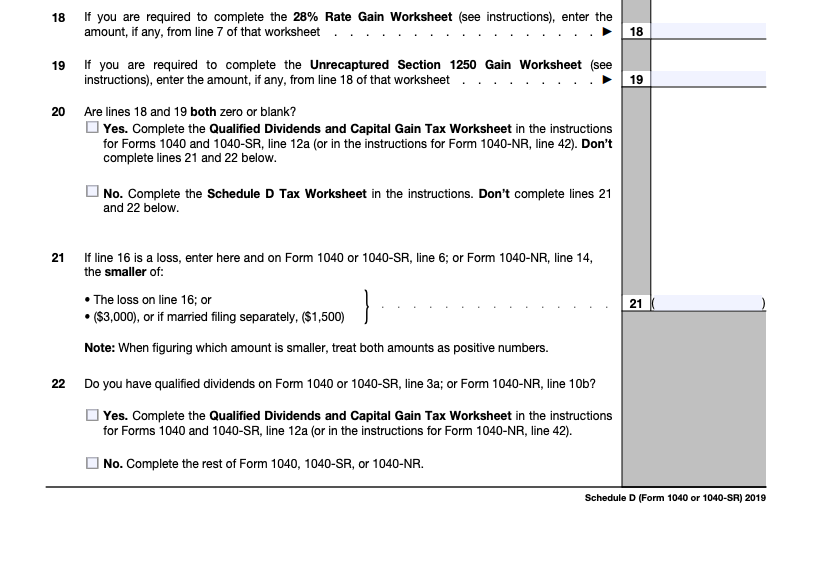

PDF Cgt summary worksheet for 2015 tax returns All entities complete tables 1 to 8 of this worksheet. Where a step does not apply to you simply enter zeros in the labels. *If you have total capital losses from collectables (including current year and prior year losses) greater than your current year capital gains from collectables you need to complete... What is a Qualified Dividend Worksheet? | Money Inc Those investors whose capital gains included capital gain distributions indicated in Form 1099-DIV, specifically in box 2a and 2b could also use the worksheet. Schedule D (Form 1040) is for reporting capital gains distributions, gains from involuntary conversions, exchange or sale of capital assets...

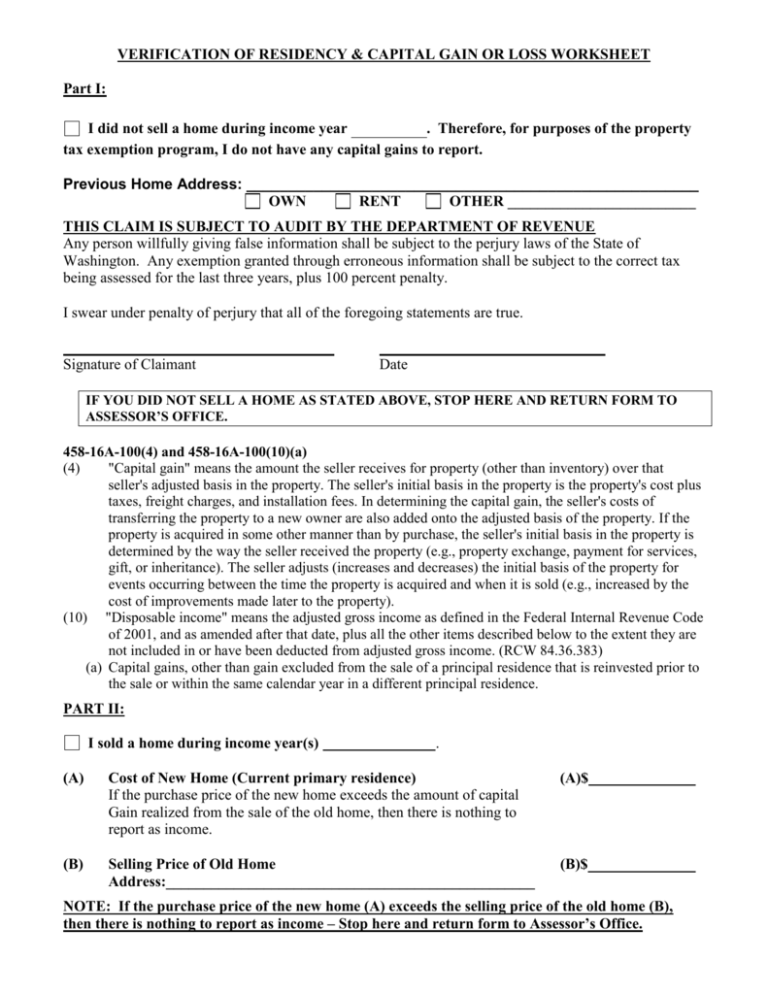

Capital Gains Worksheet Pdf, Jobs EcityWorks Capital Gain Worksheet Sale of Depreciable Real Estate Calculation of Adjusted Basis - Purchase price $ (1) Qualified Dividends And Capital Gains Worksheet 2019. Fill out, securely sign, print or email your qualified dividends tax worksheetpdffillercom 2015-2020 form instantly with SignNow.

Capital gain worksheet 2015

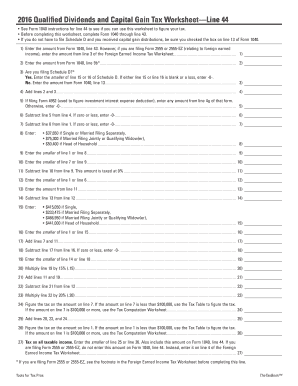

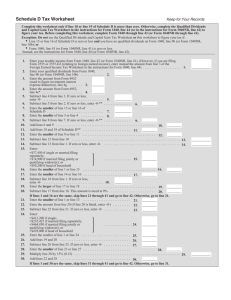

Qualified And Capital Gains Worksheets - Lesson Worksheets Showing 8 worksheets for Qualified And Capital Gains. Worksheets are 44 of 107, 2017 qualified dividends and capital gain tax work, Qualified dividend... Capital Gain Tax Worksheet - 2015 Form 1040Line 44... | Course Hero 2015 Form 1040—Line 44 Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records See the earlier instructions for line 44 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 43. Long-Term Capital Gains Worksheet for Residents of Vanguard 2002 Long-Term Capital Gains Distributions Worksheet for Residents of Massachusetts Column: Month and Year of Distribution Vanguard Fund Name Fund Number* California Intermediate-Term Tax-Exempt Fund 0100 12/2002 California Long-Term...

Capital gain worksheet 2015. Capital Gain Worksheets - Kiddy Math Capital Gain - Displaying top 8 worksheets found for this concept. Found worksheet you are looking for? To download/print, click on pop-out icon or print icon to worksheet to print or download. qualified dividends and capital gain tax worksheet - Search Aug 04, 2021 · qualified dividends and capital gain tax worksheet 2019 Capital Loss Carryover Worksheet Lines 6 and 14, Schedule D Use this worksheet to gure capital loss carryovers from 2007 to 2008 if 2007 Schedule D, line form 1040 qualified dividends worksheet 2015 Form 1040 Line 44... Working Capital: Working Capital Worksheet Capital Gain Worksheet Capital Gain Worksheet Sale of Depreciable Real Estate Calculation of Adjusted Basis - Purchase price $ (1) Improvements added after purchase (2) ... Fetch Full Source. Capital Needs Analysis Worksheet - Watermark Employee Benefits A678S Capital Needs Analysis... Capital Gains Worksheet | Ftax Support Capital Gains Worksheet. We are very grateful to our clients for their comments and suggestions, without which these guides would not be possible. This guide is an overview of the Capital Gains Worksheet which is found in the Ftax SA100 form. If the tax filer has capital gains to declare, then...

PDF Qualified Dividends and Capital Gain Tax Worksheet—Line 11a Before completing this worksheet, complete Form 1040 through line 10. If you don't have to file Schedule D and you received capital gain distributions, be sure you * If you are filing Form 2555 or 2555-EZ, see the footnote in the Foreign Earned Income Tax Worksheet before completing this line. Schedule D: How To Report Your Capital Gains... | Bankrate Those who have realized capital gains or losses from a partnership, estate, trust or S corporation will need to report those to the IRS on this form. But if you sold stock or other property, don't be tempted to ignore Form 8949, Schedule D, the associated tax worksheets and all the extra calculations. qualified dividends tax worksheet. Search, Edit, Fill, Sign, Fax & Save... Fill Qualified Dividends And Capital Gain Tax Worksheet Instructions, download blank or editable online. Fill qualified dividends tax worksheet 2015-2017 form irs instantly, download blank or editable online. Qualified Dividends And Capital Gain Tax Worksheet 2015 Must be removed before printing. Enter the amount from line 27 of the qualified dividends and capital gain tax worksheet orline 16 of the w...

Unrecaptured Section 1250 Gain Worksheet Capital Gain Distributions from Form 8824 - enter on this line the total of the collectibles gain or loss from Form 8824. This line also includes Note: This is a guide to entering information on the 28% Rate Gain Worksheet and the Unrecaptured Section 1250 Gain Worksheet in the TaxSlayer Pro program. Qualified Dividends And Capital Gain Tax Worksheet 2015 Capital Gains Tax Worksheet 2014 Tahiro Info. 2017 Qualified Dividends And Capital Gain Tax Worksheet. Use Excel To File 2015 Form 1040 And Related Schedules. Capital Gains Tax In The United States Wikipedia. Prepare 2016 Forms 1040 And 8949 Prepare 2016 Sche Chegg Com. How Your Tax Is Calculated: Qualified Dividends and Capital Gains... For this reason, the first step of the Qualified Dividends and Capital Gain Tax Worksheet is to split those two separate types back out. Lines 1-5 of this worksheet calculate your total qualified income (line 4) and your total ordinary income (line 5), so they can be taxed at their different rates. Dividends And Capital Gains Worksheet 2015 - Uncategorized... 21 Posts Related to Dividends And Capital Gains Worksheet 2015.

FAQs qualified dividends and capital gain tax worksheet 2020 Qualified Dividends and Capital Gains Worksheet 2021. Get and Sign. Qualified Dividends and Capital Gain Tax Worksheet 2015-2022 Form. Use this step-by-step guide to fill out the Qualified dividends tax worksheetsignNowcom 2015-2019 form promptly and with perfect accuracy.

PDF 2009 Instruction 1040 Schedule D | Capital Gain Distributions Generally, gain from the sale or exchange of a capital asset held for personal use is a capital gain. Report it on Schedule D, Part I or Part II. Use this worksheet to figure your capital loss carryovers from 2008 to 2009 if your 2008 Schedule D, line 21, is a loss and (a) that loss is a smaller loss than...

PDF 2015 Publication 929 Publication 929 (2015). capital gain distributions, or Alaska Permanent Fund divi-dends, see chapter 3 of Publication 550 for information about how to figure the limit. If line 8 includes any net capital gain or qualified divi-dends, use the Qualified Dividends and Capital Gain Tax Worksheet to figure this tax.

Solved: I can't find the Qualified Dividends and Capital G... - Intuit... : ProSeries Tax Discussions. : I can't find the Qualified Dividends and Capital G...

Capital Gain Worksheet 2015 - worksheet 2015 qualified dividends and capital gain tax worksheet. Capital gain worksheet purchase price improvements deferred gain from previous 1031 exchange depreciation taken during ownership replacement property sales price transaction costs mortgage balance calculation of adjusted basis...

2021-22 Capital Gains Tax Rates and Calculator - NerdWallet Capital gains are the profits from the sale of an asset — shares of stock, a piece of land, a business — and generally are considered taxable income. How much these gains are taxed depends a lot on how long you held the asset before selling. In 2021, the capital gains tax rates are either 0...

Download Tax Filing Software Easy, Fast, Affordable - TaxAct 2015 Worksheets. Form 40 and 40NR. Additional Dependents Worksheet. Electronic Filing Worksheet. Net-Long Term Capital Gain Subtraction for Assets Acquired after 12/31/2011. Resident, Part-Year Resident and Nonresident Worksheet.

PDF Capital Gain Worksheet Capital Gain Worksheet. Sale of Depreciable Real Estate. Calculation of Adjusted Basis -. Purchase price Improvements added after purchase Deferred gain from previous 1031 exchange, if any Less depreciation taken during ownership.

How to Use The Capital Gains Worksheet | Passiv Introducing The Capital Gains Worksheet. Calculating capital gains is painful because unlike dividends and interest incomes, brokers dont supply us with tax slips that summarize our gains and losses. Instead, they provide us with a history of past trades and we are expected to calculate the...

Capital Gains Tax Calculation Worksheet Building a worksheet to calculate capital gains shows how the math works. It also illustrates how you can organize your investment data for tax purposes. When it comes time to calculate your capital gains tax liability, you'll add together all of the numbers in the gain/loss column of your worksheet.

capital gain worksheet - mallard.iworksheet.co Capital gain or capital loss worksheet. How Your Tax Is Calculated: Understanding the Qualified Dividends and Capital Gains Worksheet - Marotta On Money. qualified dividends and capital gain tax worksheet. IN C++ Please Create a Function to Certify the | Chegg.com.

Long-Term Capital Gains Worksheet for Residents of Vanguard 2002 Long-Term Capital Gains Distributions Worksheet for Residents of Massachusetts Column: Month and Year of Distribution Vanguard Fund Name Fund Number* California Intermediate-Term Tax-Exempt Fund 0100 12/2002 California Long-Term...

Capital Gain Tax Worksheet - 2015 Form 1040Line 44... | Course Hero 2015 Form 1040—Line 44 Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records See the earlier instructions for line 44 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 43.

Qualified And Capital Gains Worksheets - Lesson Worksheets Showing 8 worksheets for Qualified And Capital Gains. Worksheets are 44 of 107, 2017 qualified dividends and capital gain tax work, Qualified dividend...

/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

0 Response to "42 capital gain worksheet 2015"

Post a Comment