42 itemized deductions worksheet 2015

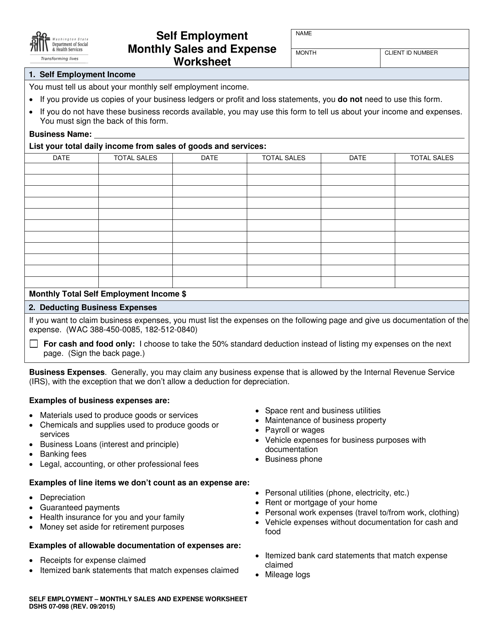

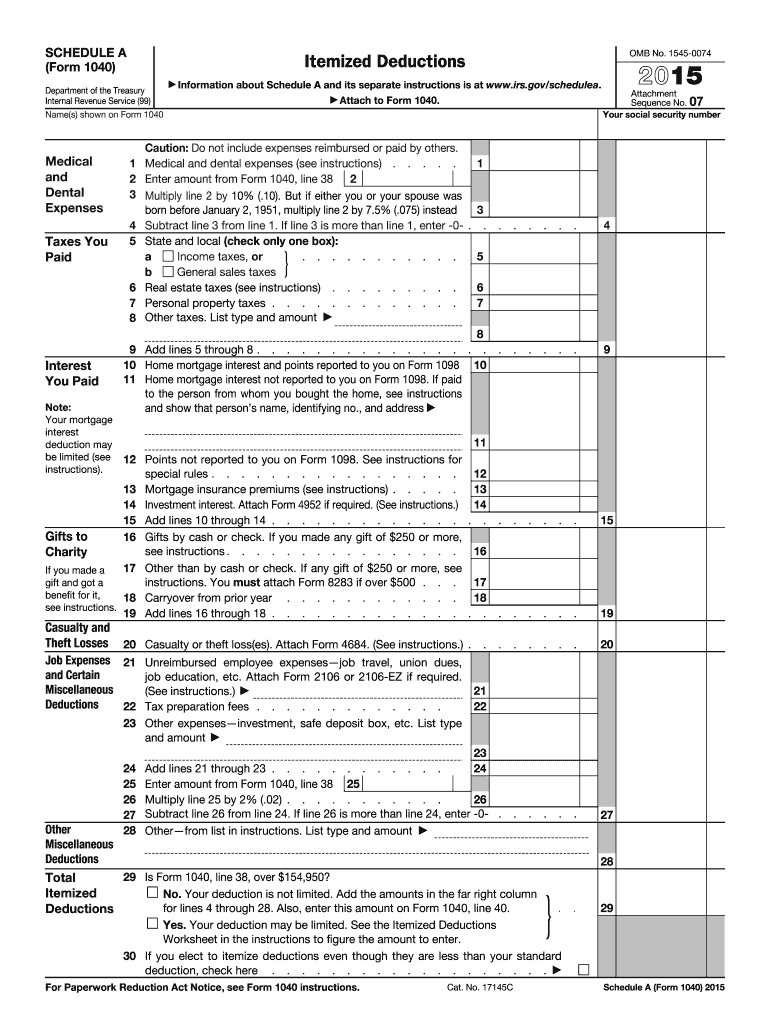

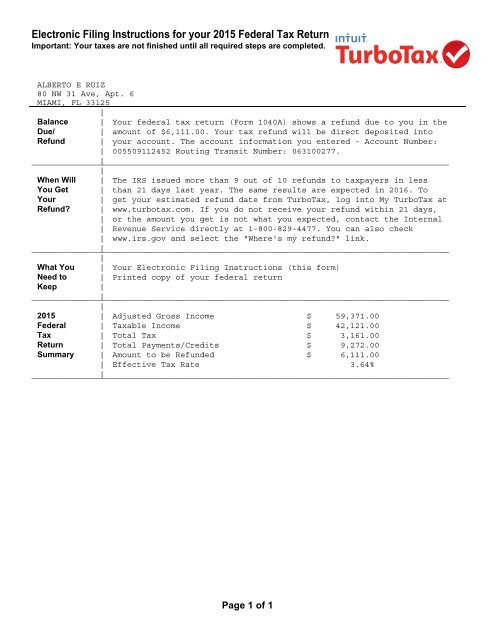

PDF Qualified Health Ins Premiums Worksheet 2015 - Missouri QUALIFIED HEALTH INSURANCE PREMIUMS WORKSHEET FOR MO-A, LINE 12 Complete this worksheet and attach it, along with proof of premiums paid, to Form MO-1040 if you included health insurance premiums paid as an itemized deduction or had health insurance premiums withheld from your social security benefits. 42 itemized deductions worksheet 2015 - Worksheet Information Itemized deductions worksheet 2015. 2015 Instructions for Schedule A (Form 1040) - Internal ... Jan 11, 2016 — In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction.

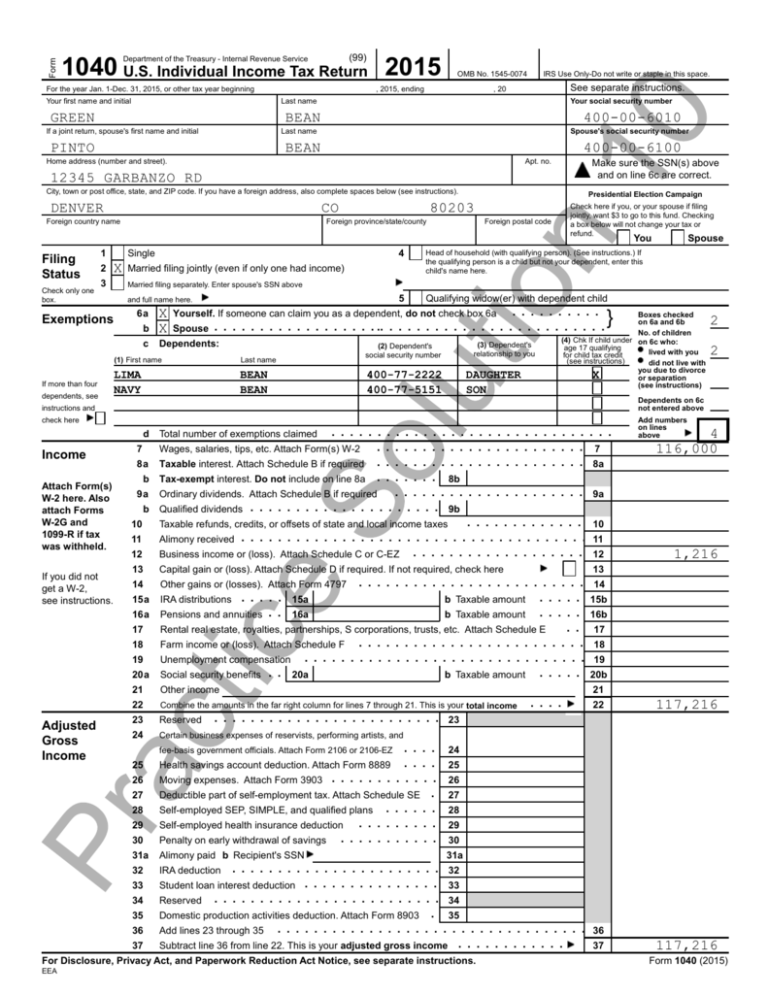

Prior Year Products - IRS tax forms 2021. Form 1040 (Schedule A) Itemized Deductions. 2021. Inst 1040 (Schedule A) Instructions for Schedule A (Form 1040 or Form 1040-SR), Itemized Deductions. 2020. Form 1040 (Schedule A) Itemized Deductions.

Itemized deductions worksheet 2015

A Complete List of Itemized Deductions to Consider for ... An itemized deduction is exactly what it sounds like: an itemized list of the deductions that qualify for tax breaks. You choose between the two based on whether your standard deduction is higher or lower than your itemized deduction list. If the standard deduction is higher, you will opt for that one since it gives you the biggest break. 2015 Schedule A Itemized Deductions Worksheet - Math ... 2015-Schedule-A-Limit-Worksheet - Itemized Deductions WorksheetLine 29 Keep for Your Records 1 Enter the total of the amounts from Schedule A lines 4 9. Additions Line 1 Itemized Deduction Limitation Complete the worksheet for line 1 on this page if your federal adjusted gross income is more than 184000 92000 if married filing separate and you ... PDF Deductions (Form 1040) Itemized - IRS tax forms 2015 Instructions for Schedule A (Form 1040)Itemized Deductions Use Schedule A (Form 1040) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. If you itemize, you can deduct a part of your medical and dental expenses and unre-

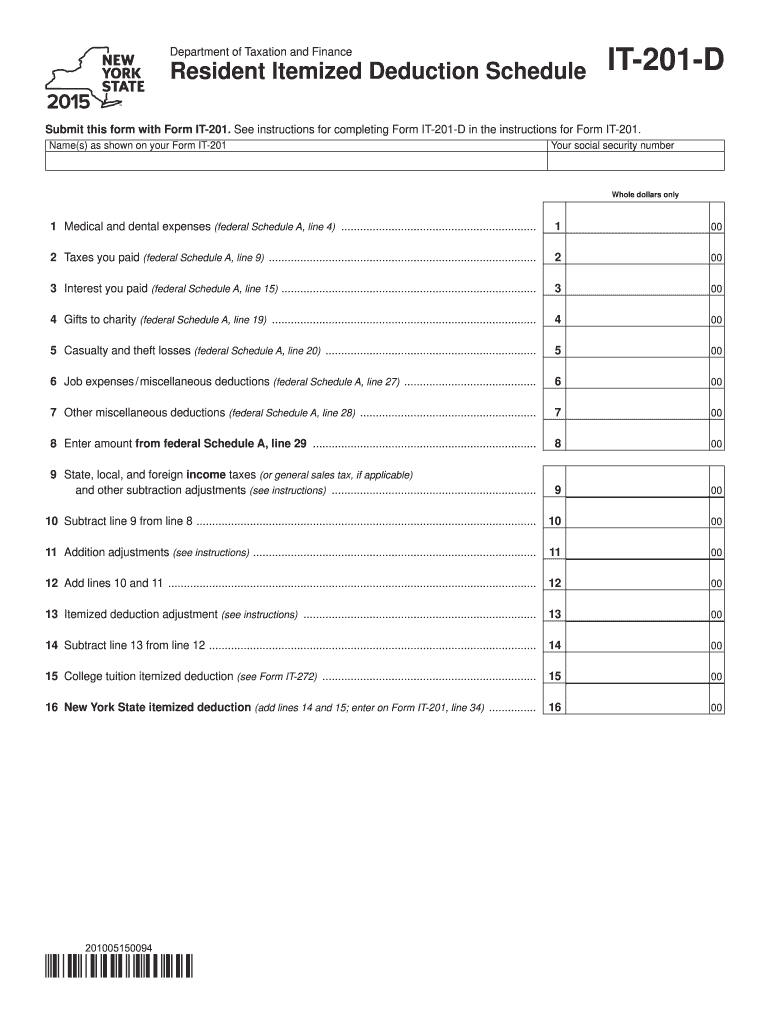

Itemized deductions worksheet 2015. PDF Iowa Department of Revenue 2015 IA 104 2015 IA 104 Iowa Itemized Deductions Worksheet 41-104 (09/08/15) Use only if your federal AGI, plus bonus depreciation/section 179 adjustment from the IA 1040, line 14, is more than: $309,900 for married filing jointly or qualifying widow(er); $284,050 for head of charitable-worksheet.pdffiller.comDonation Value Guide 2020 Excel Spreadsheet - Fill Online ... When the deductions a contributor wants to claim exceed $500, they should also file the IRS Form 8283. When is Non Cash Charitable Contributions/Donations Worksheet due? The Salvation Army Donation Value Guide should be referred to and the 8283 Form (if applicable) should be submitted when the contributor is filing their yearly tax return. PDF Department of Taxation and Finance Instructions for Form ... Part 4 - College tuition itemized deduction election If you itemized deductions on your federal return, you may receive a greater tax benefit from the college tuition itemized deduction. To compute your college tuition itemized deduction, complete Worksheet 1 below. Note: If the amount on Form IT-201, line 33, is more than $1,000,000, PDF 2015 Form MO-1040A Individual Income Tax Return Single ... Worksheet For Net State Income Taxes, Line 9 of Missouri Itemized Deductions 2015 TAX CHART If Missouri taxable income from Form MO-1040A, Line 10, is less than $9,000, use the chart to figure tax;

› publications › p529Publication 529 (12/2020), Miscellaneous Deductions ... Miscellaneous itemized deductions are those deductions that would have been subject to the 2%-of-adjusted-gross-income (AGI) limitation. You can still claim certain expenses as itemized deductions on Schedule A (Form 1040), Schedule A (1040-NR), or as an adjustment to income on Form 1040 or 1040-SR. This publication covers the following topics. Forms | Virginia Tax CU-7 and Instructions Package. 2021. Form & Instructions for Virginia Consumer's Use Tax Return for Individuals. 762. 2021. Return of Tangible Personal Property, Machinery and Tools, and Merchant's Capital - for local taxation only. 500ES and Instructions. 2021. Forms and Instructions for Declaration of Estimated Income Tax. PDF K-40 2015 Kansas Individual Income Tax You must have been a Kansas resident for ALL of 2015. K-40 2015. 114515 (Rev. 7/15) KANSAS INDIVIDUAL INCOME TAX . DO NOT STAPLE . Your First Name Initial Last Name Spouse's First Name Initial Last Name Mailing Address (Number and Street, including Rural Route) School District No. City, Town, or Post Ofice State Zip Code County Abbreviation 41 itemized deduction worksheet 2015 - Worksheet For Fun 2015 ITEMIZED DEDUCTIONS WORKSHEET For 2015 the "Standard Deduction" is $12,600 on a Joint Return, $9,250 for a Head of Household, and $6,300 if you are Single. If you normally itemize your personal deductions or even think that itemized deductions might benefit you this year, we will need to know the following expenses.

PDF 2015 Form W-4P - IUPAT Enter an estimate of your 2015 itemized deductions. These include qualifying home mortgage interest, charitable contributions, state and local taxes, medical expenses in excess of 10% (7.5% if either you or your spouse was born before January 2, 1951) of your income, and miscellaneous deductions. For PDF Itemized Deduction Worksheet TAX YEAR - Maceyko Tax Itemized Deduction Worksheet Medical Expenses. Must exceed 7.5% of income to be a benefit. Include cost for dependents-do not include any expenses that were reimbursed by insurance Dentists $ Hospitals $ Doctors $ Insurance $ Equipment $ Prescriptions $ Eyeglasses $ Other $ Medical Miles _____ 42 itemized deduction worksheet 2015 - Worksheet Was Here Itemized deduction worksheet 2015. Schedule A - Itemized Deductions (continued) To enter multiple expenses of a single type, click on the small calculator icon beside the line. Enter the first description, the amount, and Continue. Enter the information for the next item. They will be totaled on the input line and carried to Schedule A. PDF Itemized Deductions Checklist - Affordable Tax Itemized Deductions Checklist Medical Expenses Medical expenses are generally deductible if they exceed 10% of your income or 7.5% of your income if you are over the age of 65. Some common medical expenses: Doctor/Dentist Fees Drug/Alcohol Treatment Cost of Guide Dogs Handicap Access Devices for Disabled Hospital Fees

PDF QPE Table of Contents - static.store.tax.thomsonreuters.com Itemized Deductions Worksheet 2015 State and Local Sales Tax Deduction Health Coverage Exemptions Where to File 2015 Form 1040, 1040A, 1040EZ Where to File Form 1040-ES for 2016 Where to File Form 4868 for 2015 Return Tab 4 2015 Form 1040—Line-By-Line Line-By-Line Quick Reference to 2015 Form 1040

› instructions › i1040sca2021 Instructions for Schedule A (2021) | Internal Revenue ... If you and your spouse paid expenses jointly and are filing separate returns for 2021, see Pub. 504 to figure the portion of joint expenses that you can claim as itemized deductions. Don't include on Schedule A items deducted elsewhere, such as on Form 1040, Form 1040-SR, or Schedule C, E, or F. .

PDF Itemized Deductions Limitation Worksheet - 1040.com Total itemized deductions from Schedule A (Form 1040), line 29 (line 28 for 2005 and 2006), or Schedule A (Form 1040NR), line 15 (line 17 for 2006 through 2010) (or as previously adjusted) Subtract line 11 from line 1 Subtract line 13 from line 12. Enter the difference here and on line 7 of Form 1045, Schedule B WK_1045.LD

PDF FORM K-40 LINE-BY-LINE INSTRUCTIONS - Kansas Department of ... Refer to your federal itemized deductions worksheet, in your federal 1040 instruction book, not the Federal Schedule A. 1) Divide line 11* of the Federal Itemized Deductions Worksheet by line 3* of that worksheet (cannot exceed 100%). 2) Enter the amount from line 5 of federal

PDF Form IT-196 New York Resident, Nonresident, and Part-Year ... If No, your deduction is not limited. Add the amounts in the far right column for lines 4 through 39 and enter the amount on line 40. If Yes, your deduction may be limited. See the Line 40, Total itemized deductions worksheet, in the instructions to compute the amount to enter on line 40.

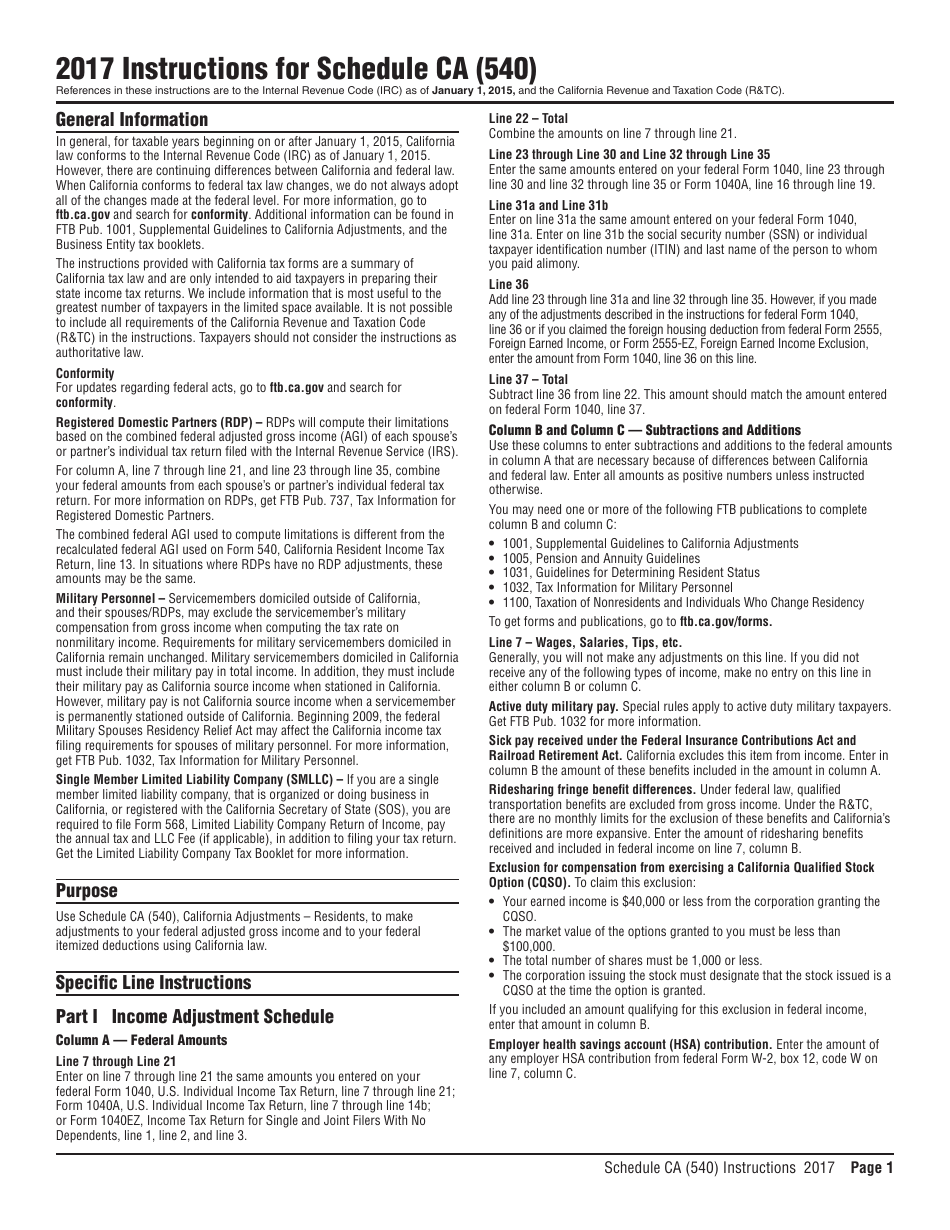

PDF 2015 SCHEDULE CA (540) California Adjustments - Residents Schedule CA (540) 2015 Side 1 TAXABLE YEAR 2015 California Adjustments — Residents SCHEDULE CA (540) Important: Attach this schedule behind Form 540, Side 5 as a supporting California schedule. Name(s) as shown on tax return. SSN or ITIN. Part I. Income Adjustment Schedule Section A - Income. A

PDF Attach to Form 1040. Your deduction is not limited. Add the amounts in the far right column for lines 4 through 28. Also, enter this amount on Form 1040, line 40.}.. Yes. Your deduction may be limited. See the Itemized Deductions Worksheet in the instructions to figure the amount to enter. 30 . If you elect to itemize deductions even though they are less than your ...

PDF Table of Contents - Iowa There is a limitation on the amount of itemized deductions that can be claimed for certain high-income taxpayers. The calculation is done on the Iowa Itemized Deductions Worksheet, form IA104. If one spouse itemizes deductions, then both spouses must itemize, even if separate Iowa returns are filed.

PDF Forms & Instructions California 540 2015 Personal Income ... Last day to file or e-file your 2015 tax return to avoid a late filing penalty and interest computed from the original due date : ... deduction or itemized deductions you can claim . Computing your tax: ... (Use the California Standard Deduction Worksheet for Dependents on page 11 to figure your standard deduction.)

› taxes › sales-tax-deductionSales Tax Deduction: What It Is, How To Take Advantage - Bankrate Sep 22, 2021 · Use Schedule A: The form Schedule A is used for making itemized tax deductions. Near the bottom of the instructions in this form are the optional state sales tax tables formulated by the IRS.

PDF Itemized Deductions Worksheet - integrityintaxllc.com Itemized Deductions Worksheet You will need: Tax information documents (Receipts, Statements, Invoices, Vouchers) for your own records. Otherwise, reporting total figures on this form indicates your acknowledgement that such figures are accurate and that you vouch for their accuracy as reported on your Federal and/or State return.

Worksheet for Itemized Deductions - Google Sheets Text r otation . Conditional f ormatting. A l ternating colors. C lear formatting Ctrl+\. Sort sheet by column A, A → Z. Sort sheet by column A, Z → A. So r t range by column A, A → Z. Sor t range by column A, Z → A. S ort range.

PDF 2015 Itemized Deductions Worksheet 2015 ITEMIZED DEDUCTIONS WORKSHEET For 2015 the "Standard Deduction" is $12,600 on a Joint Return, $9,250 for a Head of Household, and $6,300 if you are Single. If you normally itemize your personal deductions or even think that itemized deductions might benefit you this year, we will need to know the following expenses.

PDF Schedule A - Itemized Deductions - IRS tax forms Schedule A - Itemized Deductions (continued) To enter multiple expenses of a single type, click on the small calculator icon beside the line. Enter the first description, the amount, and Continue. Enter the information for the next item. They will be totaled on the input line and carried to Schedule A. If taxpayer has medical insurance

PDF Deductions (Form 1040) Itemized - IRS tax forms 2015 Instructions for Schedule A (Form 1040)Itemized Deductions Use Schedule A (Form 1040) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. If you itemize, you can deduct a part of your medical and dental expenses and unre-

2015 Schedule A Itemized Deductions Worksheet - Math ... 2015-Schedule-A-Limit-Worksheet - Itemized Deductions WorksheetLine 29 Keep for Your Records 1 Enter the total of the amounts from Schedule A lines 4 9. Additions Line 1 Itemized Deduction Limitation Complete the worksheet for line 1 on this page if your federal adjusted gross income is more than 184000 92000 if married filing separate and you ...

A Complete List of Itemized Deductions to Consider for ... An itemized deduction is exactly what it sounds like: an itemized list of the deductions that qualify for tax breaks. You choose between the two based on whether your standard deduction is higher or lower than your itemized deduction list. If the standard deduction is higher, you will opt for that one since it gives you the biggest break.

0 Response to "42 itemized deductions worksheet 2015"

Post a Comment