43 interest rate reduction refinance loan worksheet

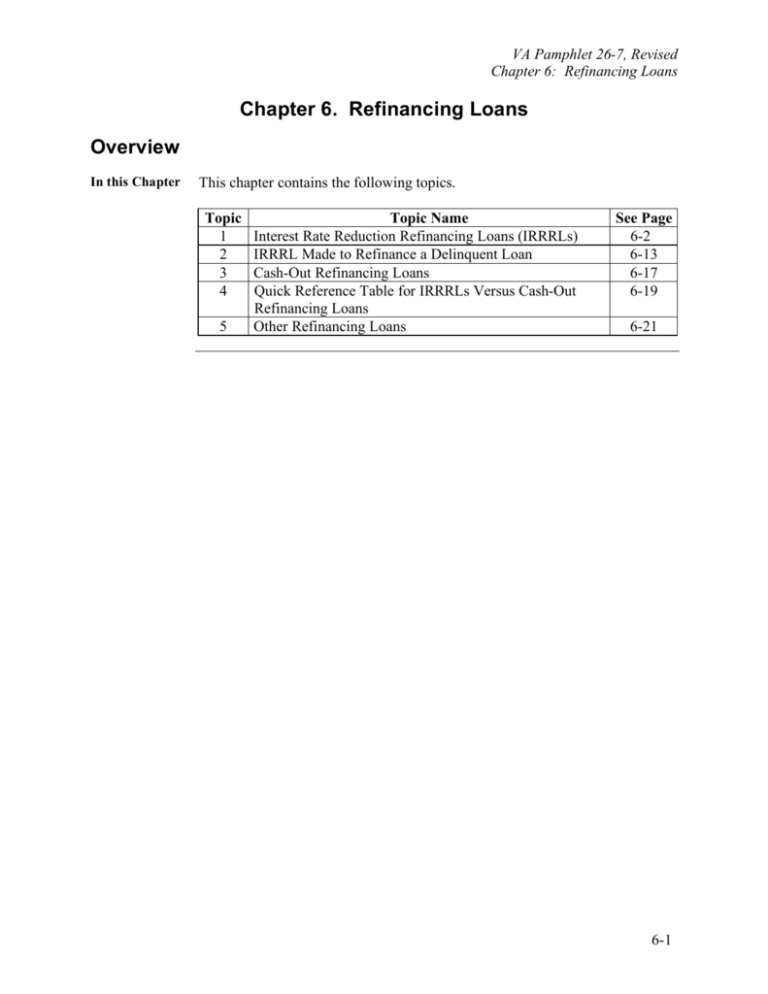

Best VA Interest Rate Reduction Refinance Loans (IRRRL) CURRENT VA INTEREST RATE REDUCTION REFINANCE LOAN RATES. Before we dive into how a VA IRRRL works and the pros and cons, let's look at VA streamline refinance interest rates. Just like interest rates for VA home loans, IRRRL rates can jump from one day to the next. That's why working with the right lender is so important. PDF VETERAN'S AFFAIRS Interest Rate Reduction Refinance (IRRRL ... Interest Rate Reduction Refinance (IRRRL) Guide ... The maximum loan amount is determined by completing the IRRRL worksheet, VA Form 26-8923. ... The interest rate on the new loan must be a lower interest rate than the loan being refinanced and is subject to the net tangible benefit test.

Interest Rate Reduction Refinancing Loan Tips - Military.com An Interest Rate Reduction Refinancing Loan (IRRRL) can be done only when the veteran already has his or her entitlement used for a VA loan on the property to be refinanced. In other words, it must...

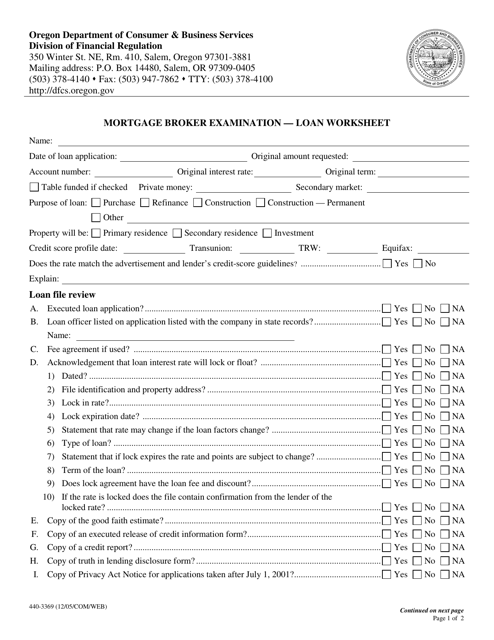

Interest rate reduction refinance loan worksheet

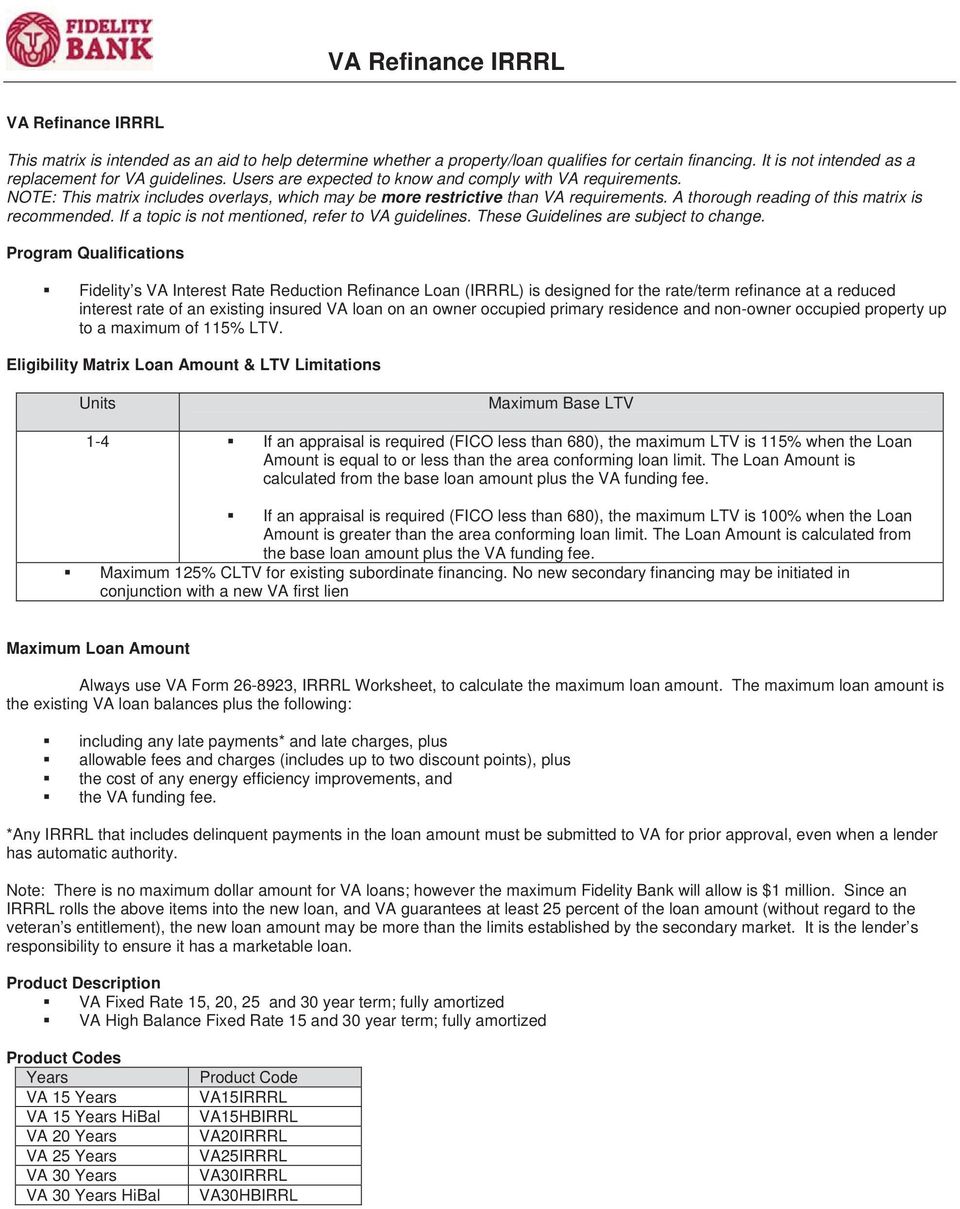

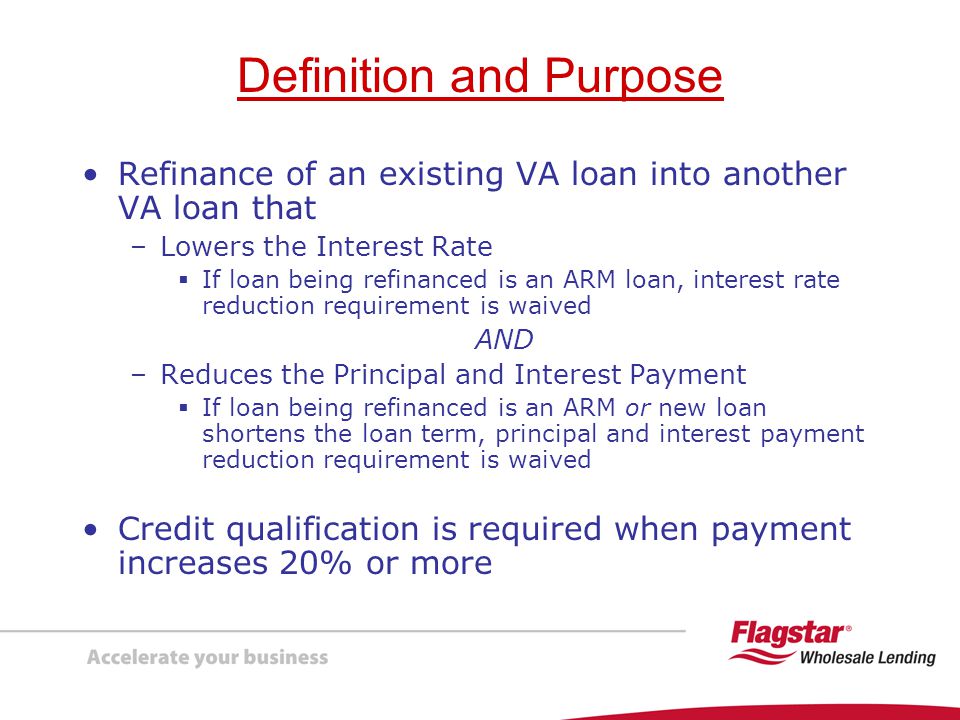

VA Interest Rate Reduction Refinance Loan (IRRRL) Program ... An Interest Rate Reduction Refinance Loan (IRRRL) is a VA-guaranteed loan made to refinance an existing VA-guaranteed loan, generally at a lower interest rate than the existing VA loan, and with a lower principal and interest payment than the existing VA loan. Section 2 Product Codes PDF Underwriting Guidelines— VA Interest Rate Reduction ... An IRRRL must bear a lower interest rate than the loan it is refinancing, unless the loan it is refinancing is an adjustable rate mortgage (ARM). Payment Decrease/Increase Requirements The principal and interest payment on an IRRRL must be less than the principal and interest payment on the loan being refinanced, unless one of the following Interest Rate Reduction Refinance Loan - MilitaryBenefits.info The VA Interest Rate Reduction Refinance Loan: Basic Rules. The VA IRRRL is only approved for a home you have purchased with a VA mortgage. These refi loans are known as VA-to-VA refinance loans. These loans must result in a tangible benefit to the borrower in a specific form. That can be lower monthly payments, a lower interest rate, getting ...

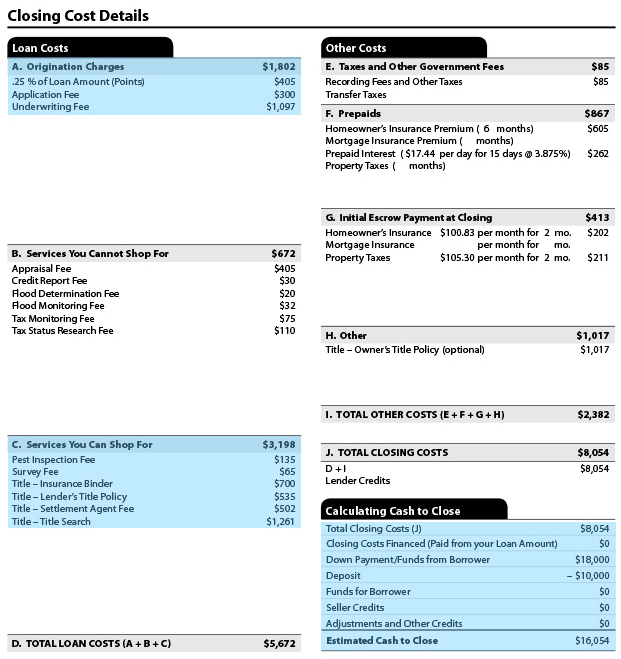

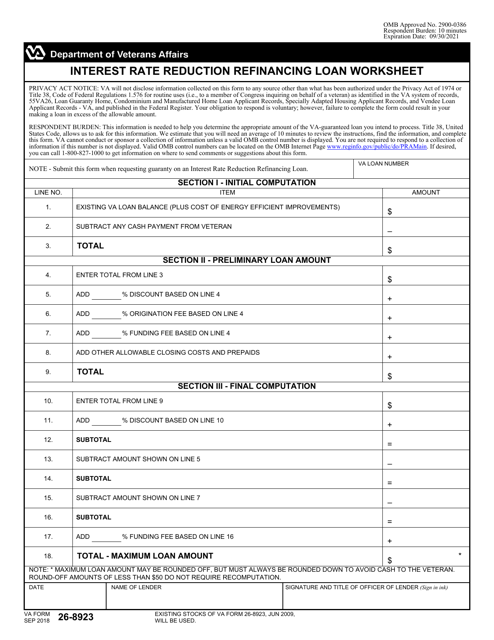

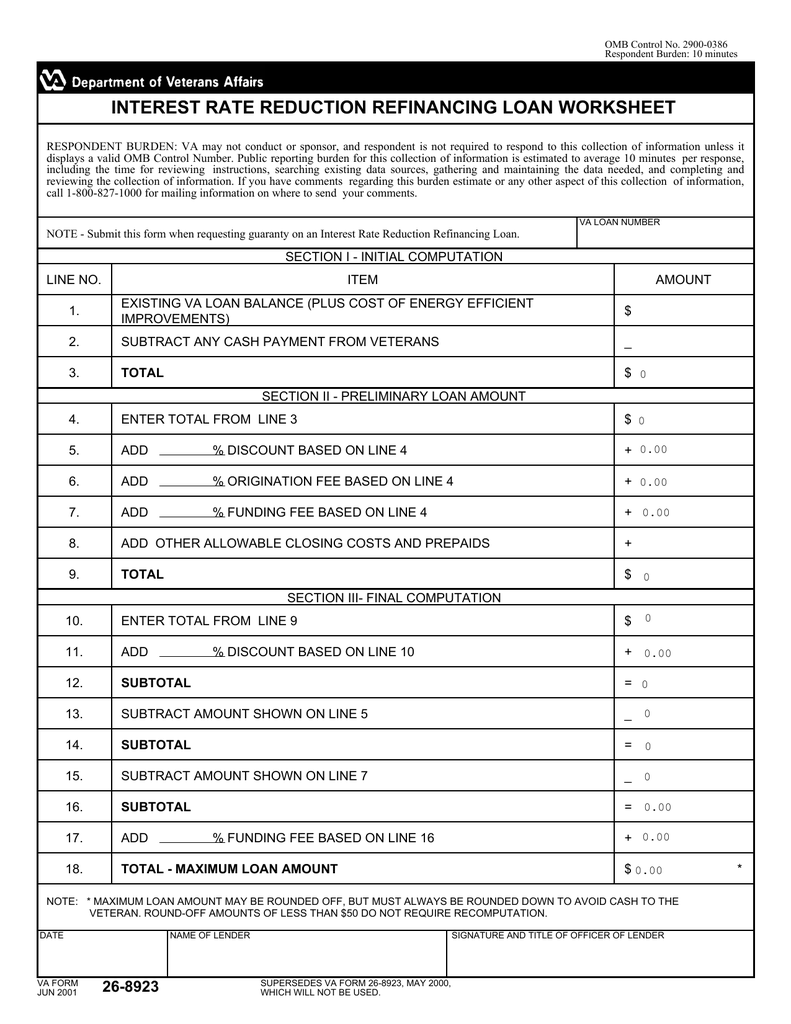

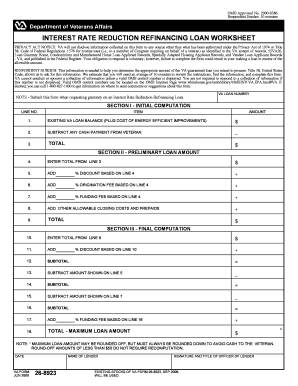

Interest rate reduction refinance loan worksheet. VA Clarifies and Establishes ... - Loan Audit Software existing loan balance allowable, Interest Rate Reduction Refinancing Loan Worksheet, maximum allowable closing costs, maximum loan amount, principal reduction from veteran VA issued Circular 26-17-12, clarifying and establishing requirements with respect to completion of VA Form 26-8923 (Interest Rate Reduction Refinancing Loan Worksheet). INTEREST RATE REDUCTION REFINANCING LOAN ... INTEREST RATE REDUCTION REFINANCING LOAN WORKSHEET. RESPONDENT BURDEN: VA may not conduct or sponsor, and respondent is not required to respond to this ...1 page Interest Rate Reduction Refinance Loan - FDIC Rate Reduction Refinance Loan (IRRRL) generally lowers the interest rate by refinancing an existing VA home loan. By obtaining a lower interest rate, the monthly mortgage payment should decrease. Eligible borrowers can also refinance an adjustable-rate mort - gage (ARM) into a fixed-rate mortgage. The interest rate reduction refinance loan (IRRRL) for VA ... The VA-guaranteed Interest Rate Reduction Refinance Loan (IRRRL) was created to refinance an existing VA-guaranteed home mortgage, at a lower interest rate. It's the VA's version of a rate-and-term refinance. [VA Pamphlet 26-7 Chapter 6.1.a] IRRRLs may not be used to cash out equity. IRRRL proceeds may only be applied towards:

PDF Insert Date 60 Days After Date of Publication in The ... Title: Interest Rate Reduction Refinancing Loan Worksheet (VA 26-8923) OMB Control Number: 2900-0386. Type of Review: Revision. Abstract: VA is revising this information collection to incorporate regulatory collection requirements previously captured under OMB control number 2900-0601. The purpose Interest Rate Reduction Refinance Loan | Veterans Affairs Interest rate reduction refinance loan. If you have an existing VA-backed home loan and you want to reduce your monthly mortgage payments—or make your payments more stable—an interest rate reduction refinance loan (IRRRL) may be right for you. Refinancing lets you replace your current loan with a new one under different terms. va worksheet Archives - IRRRL - 2021 VA Loan Refinance ... Interest Rate Reduction Refinance Loan. Determining the Max Loan Amount Using the VA IRRRL Worksheet. March 20, 2017 By JMcHood. The VA IRRRL program allows you to refinance your existing VA loan with very little verification. Lenders do not need to check your credit, income, or employment to qualify for the loan. In fact, they do not even need ... Simple loan calculator and amortization table Know at a glance your balance and interest payments on any loan with this simple loan calculator in Excel. Just enter the loan amount, interest rate, loan duration, and start date into the Excel loan calculator. It will calculate each monthly principal and interest cost through the final payment. Great for both short-term and long-term loans, the loan repayment calculator in Excel can be a ...

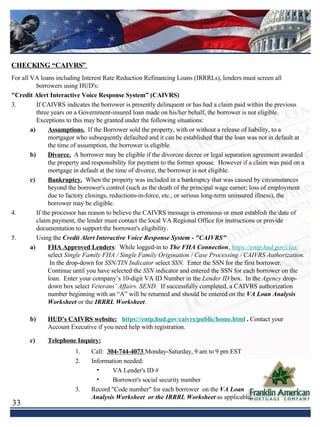

Document Update: VA IRRRL Loan Comparison Statement ... The "VA IRRRL Loan Comparison Statement" (Cx14501, renamed from "VA Refinance Loan Comparison") has been modified as follows: Updated the title at the top of the document to "VA Interest Rate Reduction Refinancing Loan Comparison Statement". Matched the labeling and format of the "Previous Loan", "Proposed Loan", and "Time ... VA IRRRL Cost Recoupment Worksheet VA IRRRL Cost Recoupment Worksheet This worksheet is REQUIRED for all VA Interest Rate Reduction Refinance loans. File Name: Loan Number: MONTHS TO RECOUP The following calculates the total number of months to recoup all fees and charges financed as part of the loan or paid at closing. VA Interest Rate Reduction Refinance Loans (IRRRL) The VA does not require credit underwriting or an appraisal for an Interest Rate Reduction Refinance Loan. But some lenders may require both, depending on their guidelines and each homeowner's specific situation. Veterans United currently requires a 620 FICO score in most cases. We also require loans to be current with no 30-day late payments ... VA IRRRL Worksheet - What is it and How Do I Use It? In order to get VA approval and a VA guarantee for your Interest Rate Reduction Refinance Loan, your lender must fill out and accurately complete a VA IRRRL worksheet. The worksheet is quite simple and shouldn't take more than a few minutes for an experienced VA expert, like those at Low VA Rates, to fill out.

Agency Information Collection Activity: Interest Rate ... Title: Interest Rate Reduction Refinancing Loan Worksheet (VA Form 26-8923). OMB Control Number: 2900-0386. Type of Review: Revision of a currently approved collection.

About VA Form 26-8923 - Veterans Affairs About VA Form 26-8923. Form name: Interest Rate Reduction Refinancing Loan Worksheet. Related to: Housing assistance. Form last updated: January 4, 2022.

PDF Interest Rate Reduction Refinance Loan Worksheet regarding the completion of VA Form 26-8923, Interest Rate Reduction Refinancing Loan Worksheet, effective for all Interest Rate Reduction Refinance L oan (IRRRL) applications originated (initial Fannie Mae Form 1003 application date) on or after July 2, 2017. 2. Background. VA has received many inquiries from mortgage lenders on the proper ...

VA Form 26-8923 INTEREST RATE REDUCTION REFINANCING LOAN WORKSHEET. VA will not disclose information collected on this form to any source other than what has been ...

VA Provides Instructions for Completion of VA Form 26-8923 ... VA Provides Instructions for Completion of VA Form 26-8923, Interest Rate Reduction Refinance Loan Worksheet 19 Apr 2017 In their Circular 26-17-12 dated April 12, 2017, the Department of Veterans Affairs (VA) clarified the requirements regarding completing VA Form 26-8923, Interest Rate Reduction Refinancing Loan Worksheet (worksheet).

Interest Rate Reduction Refinance Loan - VA Home Loans Public Law 116-23 established a new VA funding fee rate table for loans closed on or after January 1, 2020, and these rates vary based on loan type, down payment amount, and first versus subsequent use of the benefit. For loans made to purchase or build a home, funding fee rates may be reduced with a down payment of five percent or more of the ...

PDF Interest Rate Reduction Refinancing Loan Worksheet INTEREST RATE REDUCTION REFINANCING LOAN WORKSHEET. ... NOTE - Submit this form when requesting guaranty on an Interest Rate Reduction Refinancing Loan. 18. EXISTING VA LOAN BALANCE (PLUS COST OF ENERGY EFFICIENT IMPROVEMENTS) $ 2. 3. SUBTOTAL $ ADD % DISCOUNT BASED ON LINE 4.

va maximum loan amount Archives - IRRRL Interest Rate Reduction Refinance Loan. Determining the Max Loan Amount Using the VA IRRRL Worksheet. March 20, 2017 By JMcHood. The VA IRRRL program allows you to refinance your existing VA loan with very little verification. Lenders do not need to check your credit, income, or employment to qualify for the loan. In fact, they do not even need ...

Agency Information Collection Activity: Interest Rate ... Title: Interest Rate Reduction Refinancing Loan Worksheet (VA 26-8923). OMB Control Number: 2900-0386. Type of Review: Revision. Abstract: VA is revising this information collection to incorporate regulatory collection requirements previously captured under OMB control number 2900-0601. The purpose is to consolidate information collection ...

Interest Rate Reduction Refinance Loan - MilitaryBenefits.info The VA Interest Rate Reduction Refinance Loan: Basic Rules. The VA IRRRL is only approved for a home you have purchased with a VA mortgage. These refi loans are known as VA-to-VA refinance loans. These loans must result in a tangible benefit to the borrower in a specific form. That can be lower monthly payments, a lower interest rate, getting ...

PDF Underwriting Guidelines— VA Interest Rate Reduction ... An IRRRL must bear a lower interest rate than the loan it is refinancing, unless the loan it is refinancing is an adjustable rate mortgage (ARM). Payment Decrease/Increase Requirements The principal and interest payment on an IRRRL must be less than the principal and interest payment on the loan being refinanced, unless one of the following

VA Interest Rate Reduction Refinance Loan (IRRRL) Program ... An Interest Rate Reduction Refinance Loan (IRRRL) is a VA-guaranteed loan made to refinance an existing VA-guaranteed loan, generally at a lower interest rate than the existing VA loan, and with a lower principal and interest payment than the existing VA loan. Section 2 Product Codes

0 Response to "43 interest rate reduction refinance loan worksheet"

Post a Comment