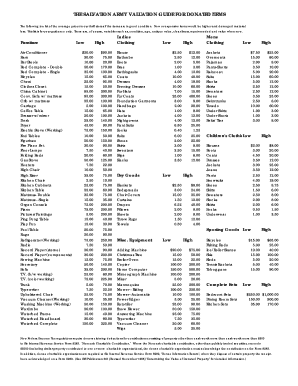

43 non cash charitable contributions donations worksheet

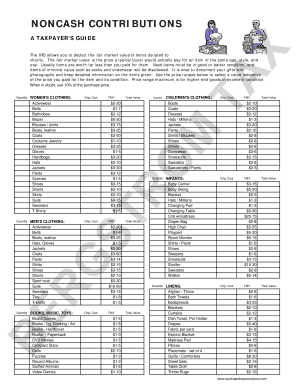

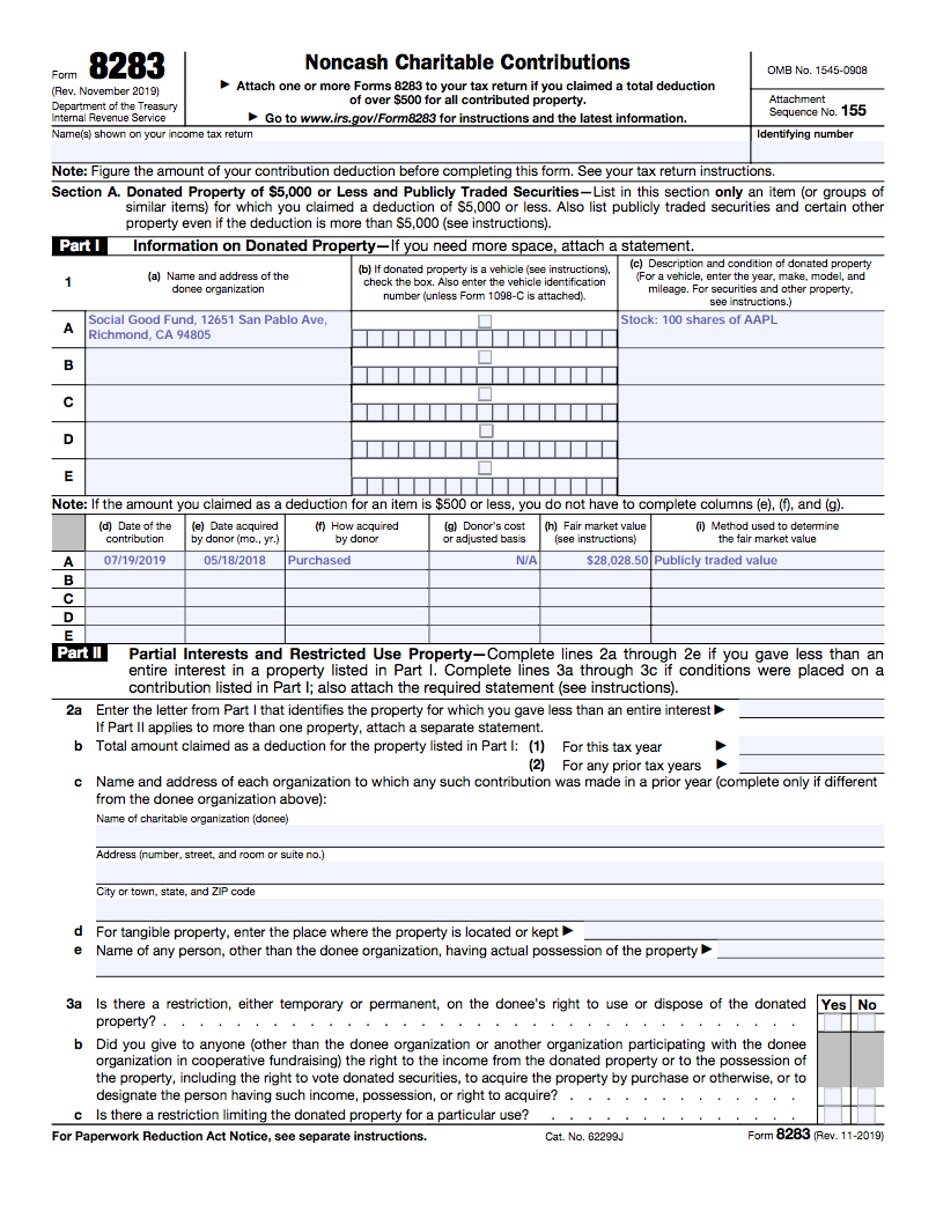

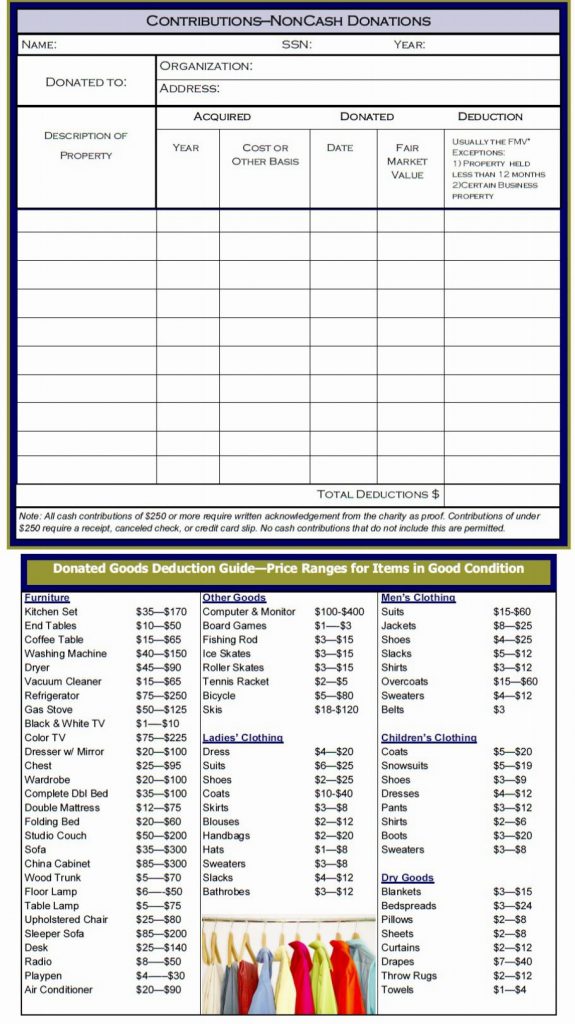

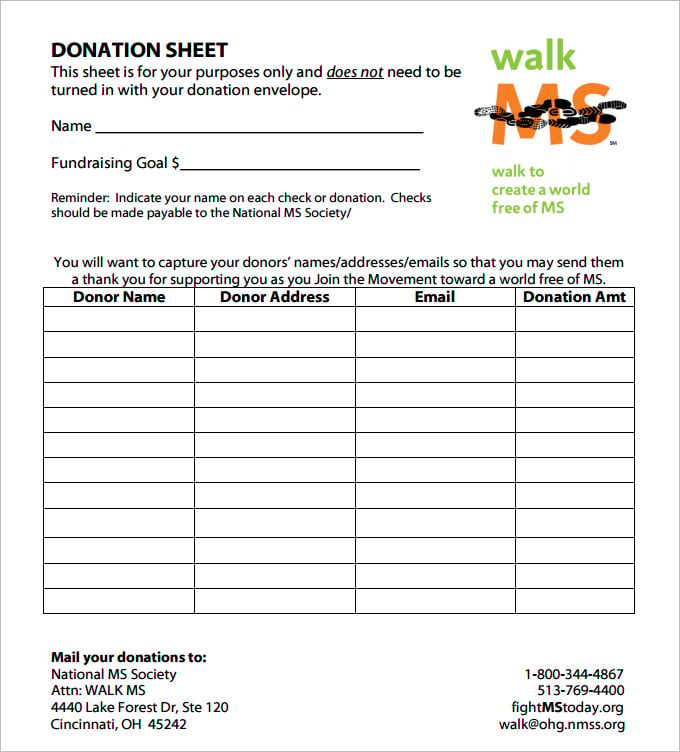

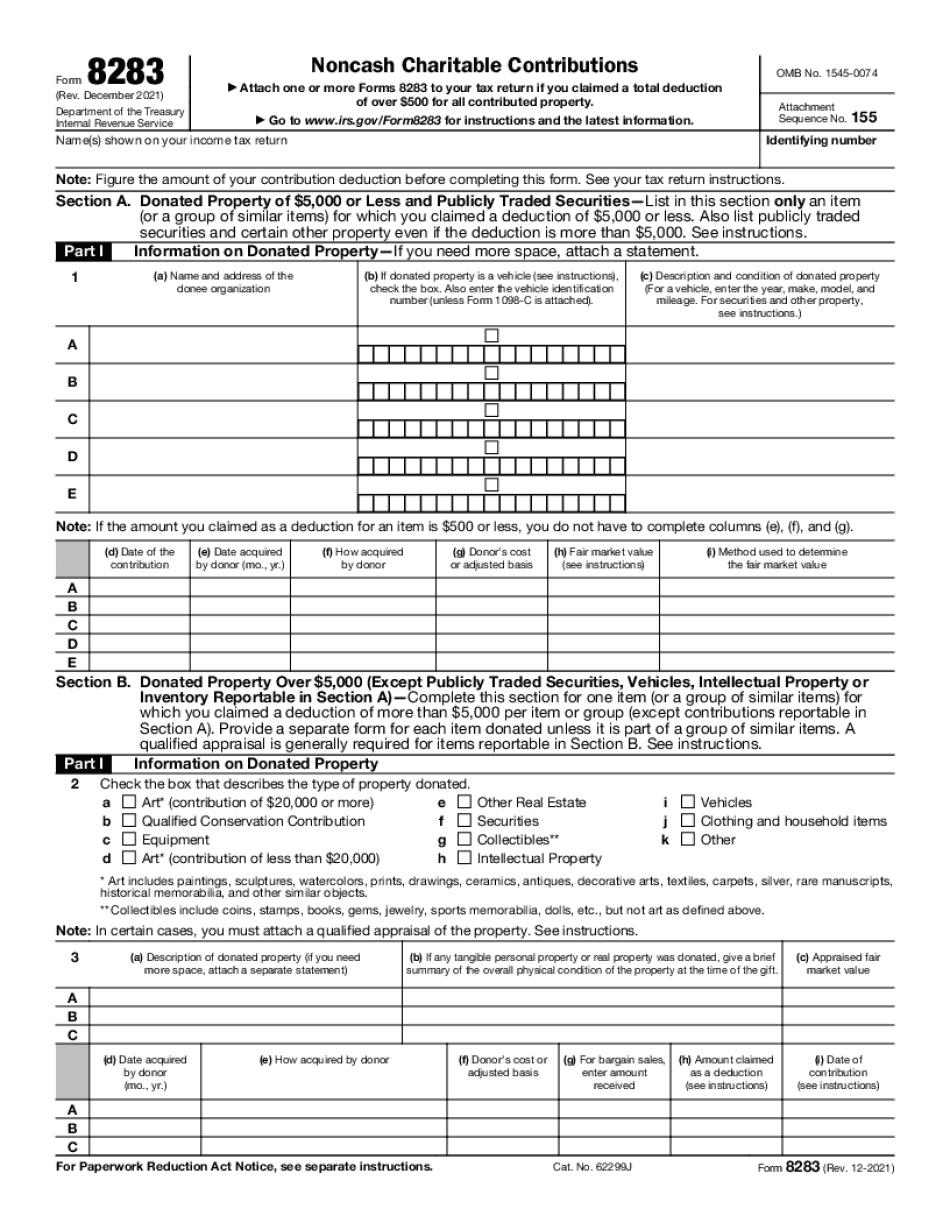

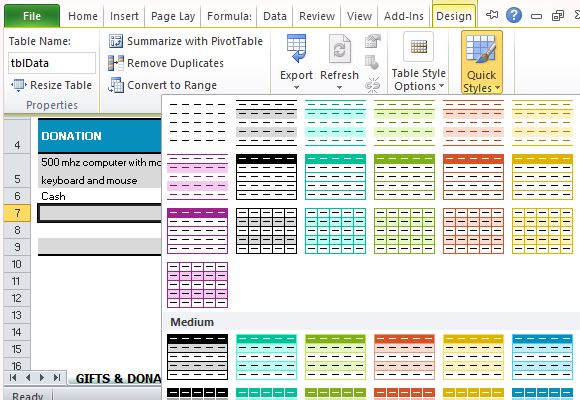

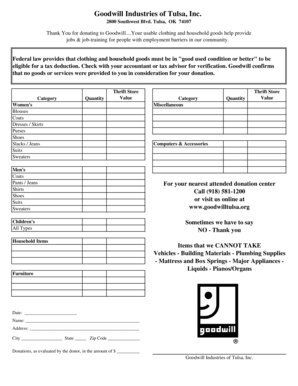

NON-CASH CHARITABLE CONTRIBUTION WORKSHEET non-cash charitable contribution worksheet date _____ organization _____ address_____ the following tables are estimates only. actual fmv may vary significantly. women’s clothing qty amount qty amount subtotal bathrobe 12.00 x = 9.00 x = Noncash charitable deductions worksheet. Note: This worksheet is provided as a convenience and aide in calculating most common non cash charitable donations. The source information used is from a Salvation Army "Valuation Guide" published several years ago and updated for assumed inflation. Although the Retain this worksheet with your receipts in your tax file.

Publication 526 (2021), Charitable Contributions | Internal ... The amount of your charitable contribution to charity X is reduced by $700 (70% of $1,000). The result is your charitable contribution deduction to charity X can’t exceed $300 ($1,000 donation - $700 state tax credit). The reduction applies even if you can’t claim the state tax credit for that year.

Non cash charitable contributions donations worksheet

What Is a Non-Profit Business? - Definition & Example ... 14.9.2021 · A non-profit business is a tax-exempt organization formed for religious, charitable, literary, artistic, scientific, or educational purposes. Its shareholders or … NON-CASH CHARITABLE CONTRIBUTIONS / DONATIONS WORKSHEET Note: This worksheet is provided as a convenience and aid in calculating most common non-cash charitable donations. The source The source information used is from a Salvation Army "Valuation Guide" published several years ago and updated for assumed inflation. NON-CASH DONATION WORKSHEET (Based on Salvation Army average ... NON-CASH DONATION WORKSHEET (Based on Salvation Army average prices for items in Good Condition) DONATED TO: DONATION DATE: CHILDREN'S CLOTHING LOW HIGH AVG QTY AMOUNT VALUE Blouses 2.40 9.60 6.00 Boots 3.60 24.00 13.80 Coats 5.40 24.00 14.70 Dresses 4.20 14.40 9.30 Jackets 3.60 30.00 16.80 Jeans 4.20 14.40 9.30 Pants 3.00 14.40 8.70 Snowsuits ...

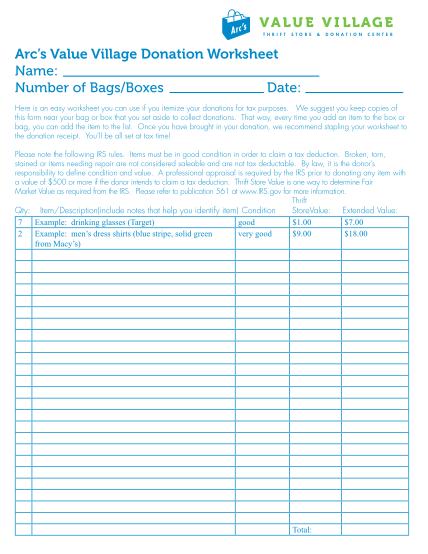

Non cash charitable contributions donations worksheet. Online Donation Value Guide Spreadsheet - Printable and ... Submit non cash charitable contributions / donations worksheet 2022 in minutes, not hours. Save your time needed to printing, signing, and scanning a paper copy of non cash charitable contributions / donations worksheet 2017. Stay effective online! ... Noncash charitable deductions worksheet. IMPORTANT! One should prepare a list for EACH separate entity and date donations are made. For example: If one made a donation Boitnott & Schaben LLC Phone 540-966-0114 For more information about Charitable Contributions & Non-Cash Donations see IRS Publication 526: $2.00 $7.00 2.00 $12.00 $0.00 $5.00 $10.00 2.00 $15.00 $0 ... NON-CASH DONATION WORKSHEET (Based on Salvation Army average ... NON-CASH DONATION WORKSHEET (Based on Salvation Army average prices for items in Good Condition) DONATED TO: DONATION DATE: CHILDREN'S CLOTHING LOW HIGH AVG QTY AMOUNT VALUE Blouses 2.40 9.60 6.00 Boots 3.60 24.00 13.80 Coats 5.40 24.00 14.70 Dresses 4.20 14.40 9.30 Jackets 3.60 30.00 16.80 Jeans 4.20 14.40 9.30 Pants 3.00 14.40 8.70 Snowsuits ... NON-CASH CHARITABLE CONTRIBUTIONS / DONATIONS WORKSHEET Note: This worksheet is provided as a convenience and aid in calculating most common non-cash charitable donations. The source The source information used is from a Salvation Army "Valuation Guide" published several years ago and updated for assumed inflation.

What Is a Non-Profit Business? - Definition & Example ... 14.9.2021 · A non-profit business is a tax-exempt organization formed for religious, charitable, literary, artistic, scientific, or educational purposes. Its shareholders or …

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/xlmedia/NRING3A7HVENNGTFLES5VGHIUI.png)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/DonationValueGuide-b579c88c32b0475493318c9efdea92fb.jpeg)

0 Response to "43 non cash charitable contributions donations worksheet"

Post a Comment