38 calculating sales tax worksheet pdf

Qualified Dividends and Capital Gain Tax Worksheet. - CCH Why is form 1040 line 44 calculating tax using the Qualified Dividends & Capital Gain worksheet instead of the tax tables in ATX™. According to the IRS Form 1040 instructions for line 44: Schedule D Tax Worksheet If you have to file Schedule D, and line 18 or 19 of Schedule D is more than zero, use the Schedule D Tax Worksheet in the Instructions for Schedule D to … Sales Tax and Discount Worksheet - psd202.org 2.To find the tax, multiply the rate (as a decimal) by the original price. 3.To find the total cost, add the tax to the original price. 5) If the sales tax rate is 7.25% in California, then how much would you pay in Los Angeles for a pair of shoes that cost $39.00? 6) The price of a new car is $29,990. If the sales tax rate is 6.5%, then how ...

PDF Name Period Date Tax, Tip, and Discount Word Problems Find the discount and the sales price if a customer buys an item that normally sells for $365. 7. Jean Junction is selling jeans at 15% off the regular price. The regular price is $25.00 per pair. What is the discount amount? 8. If the sales tax for the city of Los Angeles is 9.75%, how much tax would you pay for an item that costs $200.00? 9. Mrs.

Calculating sales tax worksheet pdf

Welcome to the Illinois Department of Revenue FY 2022-19 Sales Tax Rate Change Summary, Effective July 1, 2022 4/22/2022 5:00:00 AM FY 2022-18 Simplified Municipal Telecommunications Tax Rate Changes Effective July 1, 2022 PDF Calculating Sales Tax - raymondgeddes.com • Identify the sales tax rate in your state. Ohio's State tax is 5.5 % which is .055 • Multiply this percentage by the retail price of the item(s). This amount is the sales tax. .055 x cost of Twister Eraser .35 = .02 • Add the sales tax to the retail price of the item(s) to determine the total price of the purchase. .02 = .35 = .37 PDF Lesson Understanding and Calculating Sales Tax Sales Tax! Find the sales tax on different items— then learn a quick mental math strategy for calculating percentages. Video game $39.00 $11.00 $55.00 $44.00 Item Item Cost Sales Tax % Sales Tax Amount Total Cost Set of markers Skateboard Set of books Activity Roll a number cube and write the number in the sales tax percentage column.

Calculating sales tax worksheet pdf. PDF Percent discount Worksheet - Math Goodies Percent discount Worksheet. Search form. Search . To print this worksheet: click the "printer" icon in toolbar below. To save, click the "download" icon. Sign Up For Our FREE Newsletter! * By signing up, you agree to receive useful information and to our privacy policy ... Taxes Lesson Plans, Income Tax Worksheets, Teaching Activities A basic worksheet to help teach young students the concept of paying taxes while practicing basic math. SALES TAX. Discount and Sales Tax Lesson Plan. Students learn about sales tax and discounts. Lesson includes changing percents and calculating total cost. Includes a teaching lesson plan, lesson, and worksheet. Sales Tax Introduction (Level 1) PDF Sales Tax Discount Worksheet - Cooper Blog Discount and Sales Tax Worksheet The following items at Sam's Sports Palace are on sale. Find the amount of discount, sale price, sales tax, and total cost for each item. Use a sales tax rate of 5%. Tennis Racquet: $100 at 30% off Can of Tennis Balls: $4.00 at 25% off Basketball: $10.95 at 20% off Baseball Glove: $44.50 at 10% off PDF Calculating Sales Tax Calculating Sales Tax Sales Receipt Worksheet Complete each sales receipt by calculating total prices for each item of the receipt, the subtotal amount, the sales tax amount, and the total purchase amount. Sales Tax Rate: ____ Sales Tax Rate Converted to Decimal: ___ Receipt #5 Customer Name: Marcus

PDF Sales Tax Practice Worksheet - MATH IN DEMAND Sales Tax = $65 x 0.06 Sales Tax = $3.90 Sales Tax = $1.80 If a shirt costs $20 and the sales tax is 9%, how much money do you need to Sales Tax = $20 x 0.09 Total Cost = $20 + $1.80 Total Cost = $21.80 socks that cost $4. If there is an 8% sales tax, how Sales Tax = $4 x 0.08 Sales Tax = $0.32 Total Cost = $4 + $0.32 Total Cost = $4.32 PDF Sales Tax and Discount Worksheet - Loudoun County Public ... 8) At best buy they have a 42" TV that sells for $1250 and is on sale for 15% and sales tax is 6.5%. What is the final cost? 9) If your cell phone bill was $67.82 and there was a 7.5% late fee, how much was the charge for the cell phone bill? Individual Income Tax Forms - 2021 | Maine Revenue Services Property Tax Fairness Credit and Sales Tax Fairness Credit: Included : Schedule A (PDF) Adjustments to Tax / Child Care Credit Worksheet: See 1040ME General Instructions: Worksheet for "Other" Tax Credits (PDF) Other Tax Credits Worksheet Worksheet for Form 1040ME, Schedule A, lines 6 and 20: Included: Tax Credit Worksheets: Worksheets for Tax … Calculating Sales Tax Worksheet - gartnerlee.com These columns majorly embody Trial Balance, Adjusting Entries, Adjusted Trial Balance, Income Statement and Balance Sheet. If you need, you probably can transfer a number of worksheets directly. Just hold down the Ctrl key, and choose all the worksheets you want to move or copy. [newline]Right-click the choice, and then select Move or Copy.

PDF Calculating sales tax and discounts worksheet Calculating sales tax and discounts worksheet. Is sales tax calculated before or after discounts. It is also known as a "designated provision at the table". Reasonable compensation The value that will normally be paid for services as similar companies in similar circumstances. Some donors or laws may require a portion of income, earnings or ... Calculating Total Cost after Sales Tax worksheet Close. Live worksheets > English > Math > Percentage > Calculating Total Cost after Sales Tax. Calculating Total Cost after Sales Tax. Finding Sales Tax and Total Cost after it is applied. ID: 839531. Language: English. School subject: Math. Grade/level: Grade 5. Age: 7-15. Calculating Tax Worksheet Teaching Resources | Teachers ... This bundle consists of receive 4 printable pdf files. There are 4 themes. Each theme has different problems.Each activity packet is designed for students needing to learn to convert percents to decimals, as well as perform calculations to determine the final price after sales tax. There are 8 pages and 3 sections to this product. Step 4: Calculating purchases using the calculation ... Step 4: Calculating purchases using the calculation worksheet. If you use this method, the amounts you report at all these labels must include GST: G12 Subtotal (G10+G11) G13 Purchases for making input taxed sales – fringe benefits; G14 Purchases without GST in the price; G15 Estimated purchases for private use or not income tax deductible

PDF Sales Tax and Total Purchase Price Version 2 + Answer Keys a) What is the sales tax? b) What is the total purchase price? 2) Martin bought an iPhone for $649.99 in California, where the sales tax rate is 7.5%. a) What is the sales tax? b) What is the total purchase price? 3) Mike purchased two blankets at $44.99 each, one mattress for $59.00 and two bed sheets for a total of $9.99.The sales tax rate is ...

Corporate Income Tax Forms - 2021 | Maine Revenue Services 1120W-ME (PDF) Worksheet for Calculating Estimated Tax Payments: Included: 1120EXT-ME (PDF) Extension Payment Voucher: Included: Other. FORM NUMBER FORM TITLE INSTRUCTIONS; Corporate Unitary Questionnaire (PDF) Worksheet to Help Determine the Degree to Which a Unitary Business Exists: Included: Corporate Nexus Questionnaire (PDF) …

PDF Calculating Sales Tax - Denton ISD The sales tax is 5%. What is the total cost of the meal? Steps: 1) Find the tip. **You can either multiply $12 by .20 or divide $12 by 5 2) Find the sales tax. 3) Add the bill, tip, and tax. 20% ∙ 12= $2.40 5% ∙ 12= $0.60 The total cost is $15 = $15 $12 + $2.40 + $0.60 **You multiply $12 by .05 Finding Sales Tax and Tip

PDF Grade Level: 7 You Can't Hide from Taxes Lesson: 1 tax and Medicare tax using the standard percentage; and calculate other deductions to find the net income. Finally, the students will play a game to practice calculating sales tax and payroll tax. Texas Essential Knowledge and Skills (Target standards) PFL Math 7.13A: Calculate the sales tax for a given purchase and calculate

PDF Tip and Tax Homework Worksheet - Kyrene School District Name:&_____H our:&_____& & Tip&and&Tax&Worksheet& Find&the&price&of&the&meal&with&the&given&information.& & 1) Food&bill&before&tax:&$30& & & 2)&&Food&bill&before&tax ...

PDF How to calculate Discount and Sales Tax How much does that ... We will use the following formula to calculate the sales tax: Sales Tax = Sales Tax rate * Sale Price In our example we found the Sale Price to be $17.21 and we will use a Sales Tax rate of 5%. Convert the 5% to a decimal. 5% = 0.05 Sales Tax = 0.05 * $17.21 = $0.8605 = $0.86 Lastly, the Total Cost = Sale Price + Sales Tax

Utah Use Tax - Utah Income Taxes If you do not have a Utah sales tax license/account, report the use tax on line 31 of TC-40. You may take a credit for sales or use tax paid to another state (but not a foreign country). The credit may not be greater than the Utah use tax you owe. If you paid sales tax to more than one state, complete the Use Tax Worksheet below for each state ...

PDF Scarf T-shirt Jeans Sweater Shorts $63 $286 Using the price list, calculate the answer for each question. 1. If there is 5.2% sales tax on a pair of jeans? How much is the total tax? 2. 40% discount on a pair of shorts. What is the discount? 3. You want to buy a T-shirt and a Jacket. If the sales tax is 3.6%, what is your after-tax total cost? 4. What is 6% sales tax on a Scarf? 5.

Worksheet C, Sale of Motor Vehicle to Nonresident Under A ... NOTE: The imposition of CITY PRIVILEGE (“SALES”) TAX is NOT affected by A.R.S. § 42-5061(U), and applies at the full rate. As this worksheet computes only STATE and COUNTY tax, city tax must be computed separately. This is a for fillable version used for a fillable, calculating pdf. Please do not overwrite this page; edit only.

Form ST-101-ATT New York State and Local Annual Sales and ... Annual Sales and Use Tax Credit Worksheet ST-101-ATT (2/22) Page 1 of 1 Credit summary – Enter the total amount of taxable receipts (for all jurisdictions). These are the amounts you used to reduce your taxable sales or purchases subject to tax when calculating the tax due for each jurisdiction. If you claimed credits against your taxable sales or purchases subject to use tax …

PDF Name: Date: Practice: Tax, Tip and Commission 1. Percentsare used to calculate sales tax. 2. Sales tax: A tax put on a good that goes to the government to pay for programs 3. To calculate sales tax, find the tax rateof the price. 4. Then, add the sales tax to the original price. 5. A shirt costs $25.50. If the sales tax rate is 8.5%, what is the total cost to purchase the shirt?

Sales Tax Spreadsheet Printable Spreadshee Sales Tax Spreadsheet Templates. washington state ...

Calculating Sales Tax Worksheets & Teaching Resources | TpT PDF This is a real-world situation activity where students will work within a budget and calculate percents of a number, discounts, sales tax and totals. It can be used as an in-class assignment, homework or as a review. Students can also be placed in groups and complete cooperatively!SKILL-Finding perc Subjects:

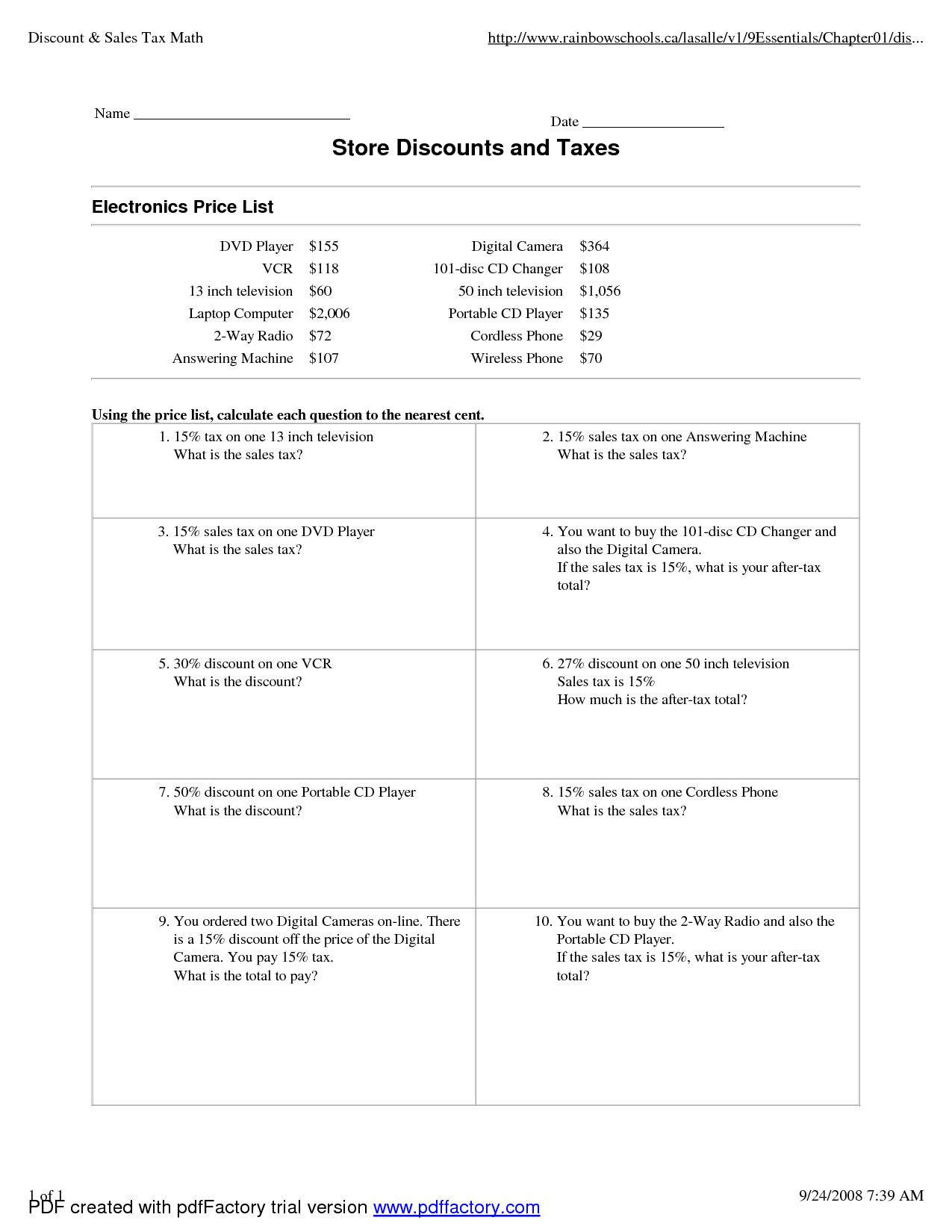

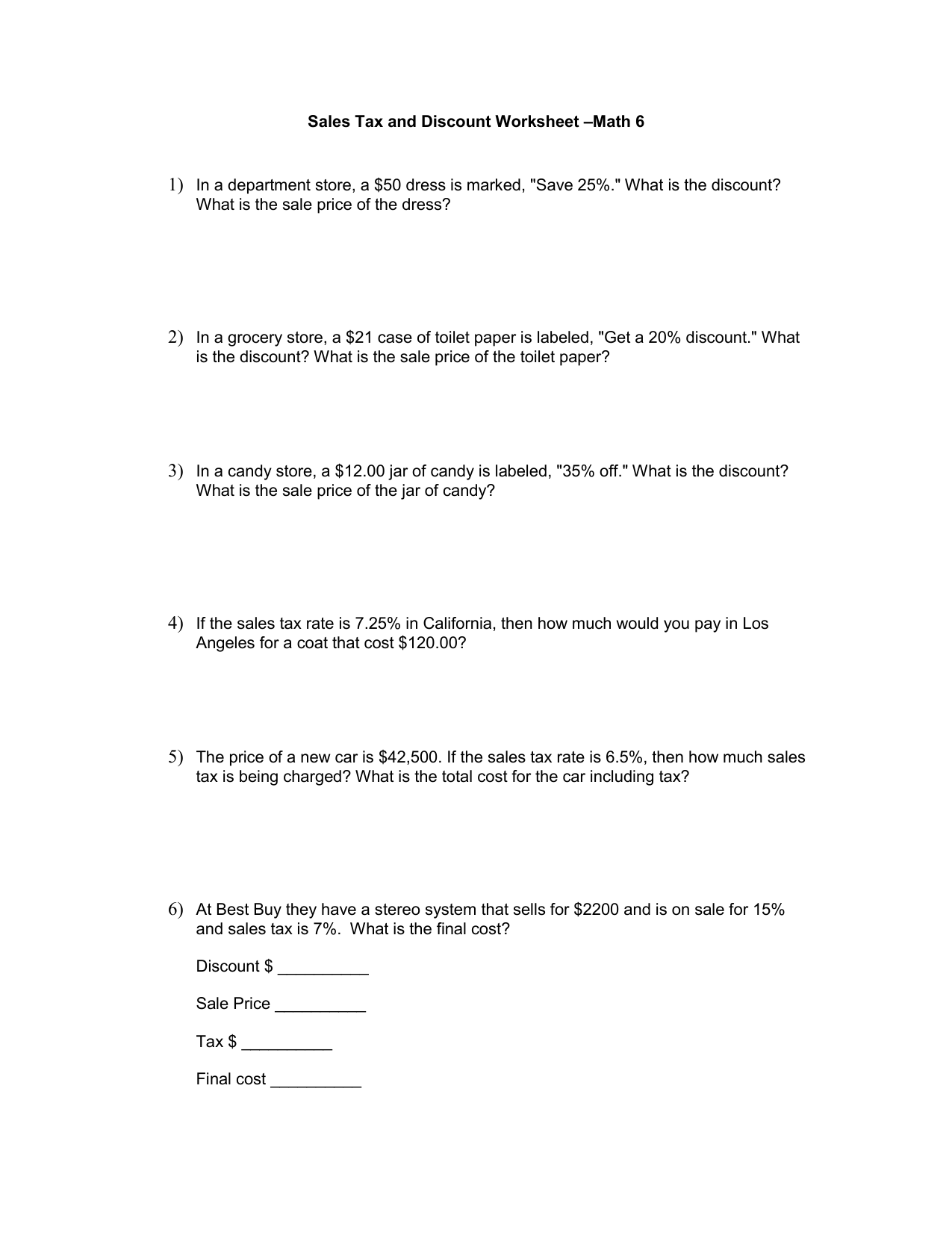

DOC Sales Tax and Discount Worksheet - Chester Sales Tax and Discount Worksheet -Math 6. In a department store, a $50 dress is marked, "Save 25%." What is the discount? What is the sale price of the dress? In a grocery store, a $21 case of toilet paper is labeled, "Get a 20% discount." What is the discount? What is the sale price of the toilet paper?

PDF Lesson Understanding and Calculating Sales Tax Sales Tax! Find the sales tax on different items— then learn a quick mental math strategy for calculating percentages. Video game $39.00 $11.00 $55.00 $44.00 Item Item Cost Sales Tax % Sales Tax Amount Total Cost Set of markers Skateboard Set of books Activity Roll a number cube and write the number in the sales tax percentage column.

12 Printable sales receipt pdf Forms and Templates - Fillable Samples in PDF, Word to Download ...

PDF Calculating Sales Tax - raymondgeddes.com • Identify the sales tax rate in your state. Ohio's State tax is 5.5 % which is .055 • Multiply this percentage by the retail price of the item(s). This amount is the sales tax. .055 x cost of Twister Eraser .35 = .02 • Add the sales tax to the retail price of the item(s) to determine the total price of the purchase. .02 = .35 = .37

Welcome to the Illinois Department of Revenue FY 2022-19 Sales Tax Rate Change Summary, Effective July 1, 2022 4/22/2022 5:00:00 AM FY 2022-18 Simplified Municipal Telecommunications Tax Rate Changes Effective July 1, 2022

0 Response to "38 calculating sales tax worksheet pdf"

Post a Comment