42 calculating sales tax worksheet

Calculating Tax Worksheet Teaching Resources | Teachers ... Calculating Sales Tax Printable Worksheet Bundle by Life Skills Made Easier 1 $12.00 $9.60 Bundle This bundle consists of receive 4 printable pdf files. There are 4 themes. PDF Calculating Sales Tax - raymondgeddes.com • Identify the sales tax rate in your state. Ohio's State tax is 5.5 % which is .055 • Multiply this percentage by the retail price of the item(s). This amount is the sales tax. .055 x cost of Twister Eraser .35 = .02 • Add the sales tax to the retail price of the item(s) to determine the total price of the purchase. .02 = .35 = .37

Icons - Orthodox Icon Cross - Vatican Please use the Shipping Calculator below for costs. I do not charge any handling costs for the items. I just charge the exact shipping costs. Return Policy If you are not pleased with your purchase. Please notify us within 7 days and we will refund your bid price and sales tax(if applicable) The shipping and handling will not be refunded.

Calculating sales tax worksheet

Sales Tax Problems Worksheets - K12 Workbook Displaying all worksheets related to - Sales Tax Problems. Worksheets are Sales tax practice work, Sales tax and discount work, Sales tax and discount work, Tax problems work sales tax problems, Taxes tips and sales, Discount tax and tip, Tip and tax homework work, Markup discount and tax. *Click on Open button to open and print to worksheet. 1. Use the Sales Tax Deduction Calculator | Internal Revenue ... The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A (Forms 1040 or 1040-SR). Your total deduction for state and local income, sales and property taxes is limited to a combined, total deduction of $10,000 ($5,000 if married filing separately). Adding Taxes Using Percentages - WorksheetWorks.com Using Percentages. Find the price of an item including taxes. Students use a variety of prices and tax rates to find total values.

Calculating sales tax worksheet. Calculating Sales Tax | Worksheet | Education.com To figure it out, you'll have to practice calculating sales tax. Catered to fifth-grade students, this math worksheet shows kids the steps to find the amount something costs with tax. This process uses decimal numbers, rounding, and division. Students practice what they learn in both straightforward calculations and in word problems. Calculating Sales Tax Worksheets - Kiddy Math Calculating Sales Tax - Displaying top 8 worksheets found for this concept. Some of the worksheets for this concept are Sales tax and discount work, Sales tax practice work, Calculating sales tax, Calculating sales tax, Calculating sales tax, Unit 3, Sales tax tips and discounts, Sales tax tips and discounts. Found worksheet you are looking for? Calculating Sales Tax Worksheets Calculating Sales Tax Worksheets A worksheet is the grid of columns and rows that information is inputted into. In many spreadsheet applications one file — referred to as a workbook — can contain several worksheets. Worksheets could be named using the sheet tabs of the underside of the spreadsheet window. √ 20 Calculating Sales Tax Worksheet | Simple Template Design Tax Problems Worksheet Sales Tax Problems from calculating sales tax worksheet, image source: taxproblemsnigengo.blogspot.com. calculating sales tax worksheet to figure it out you'll have to practice calculating sales tax catered to fifth grade students this math worksheet shows kids the steps to find the amount something costs with tax this process uses decimal numbers rounding and division ...

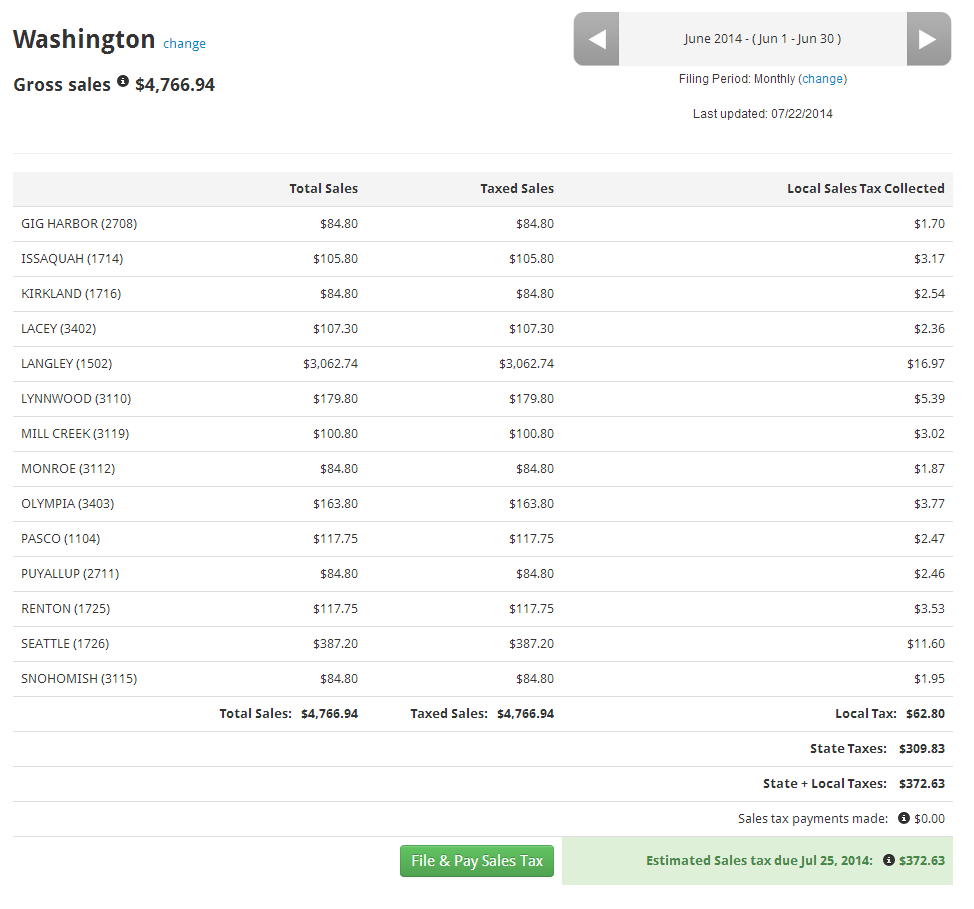

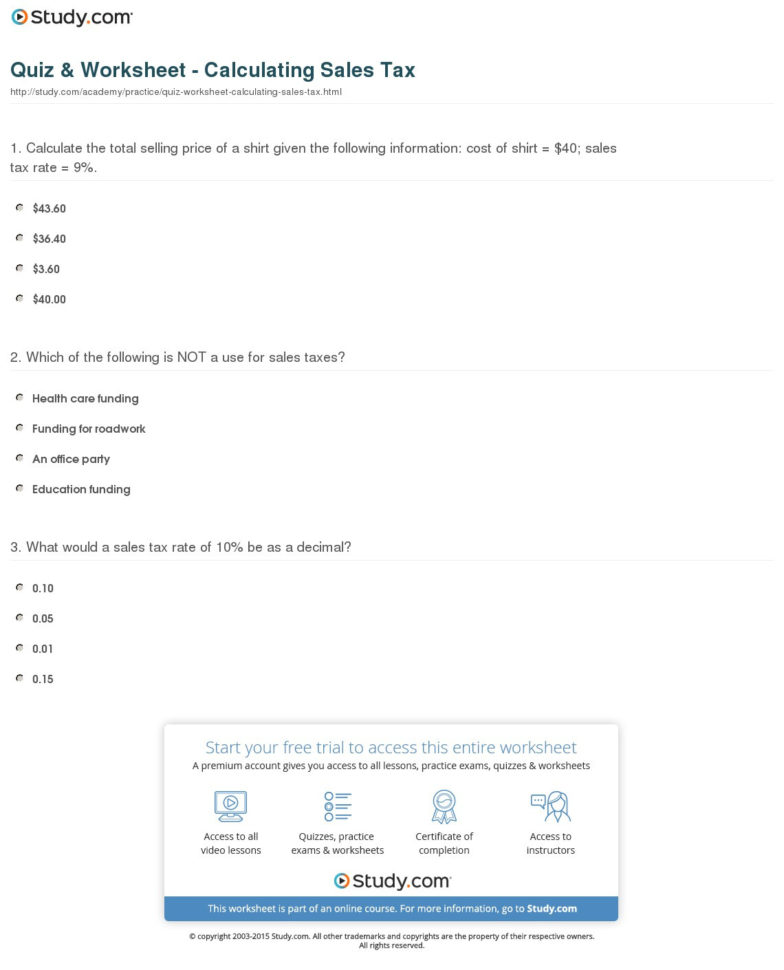

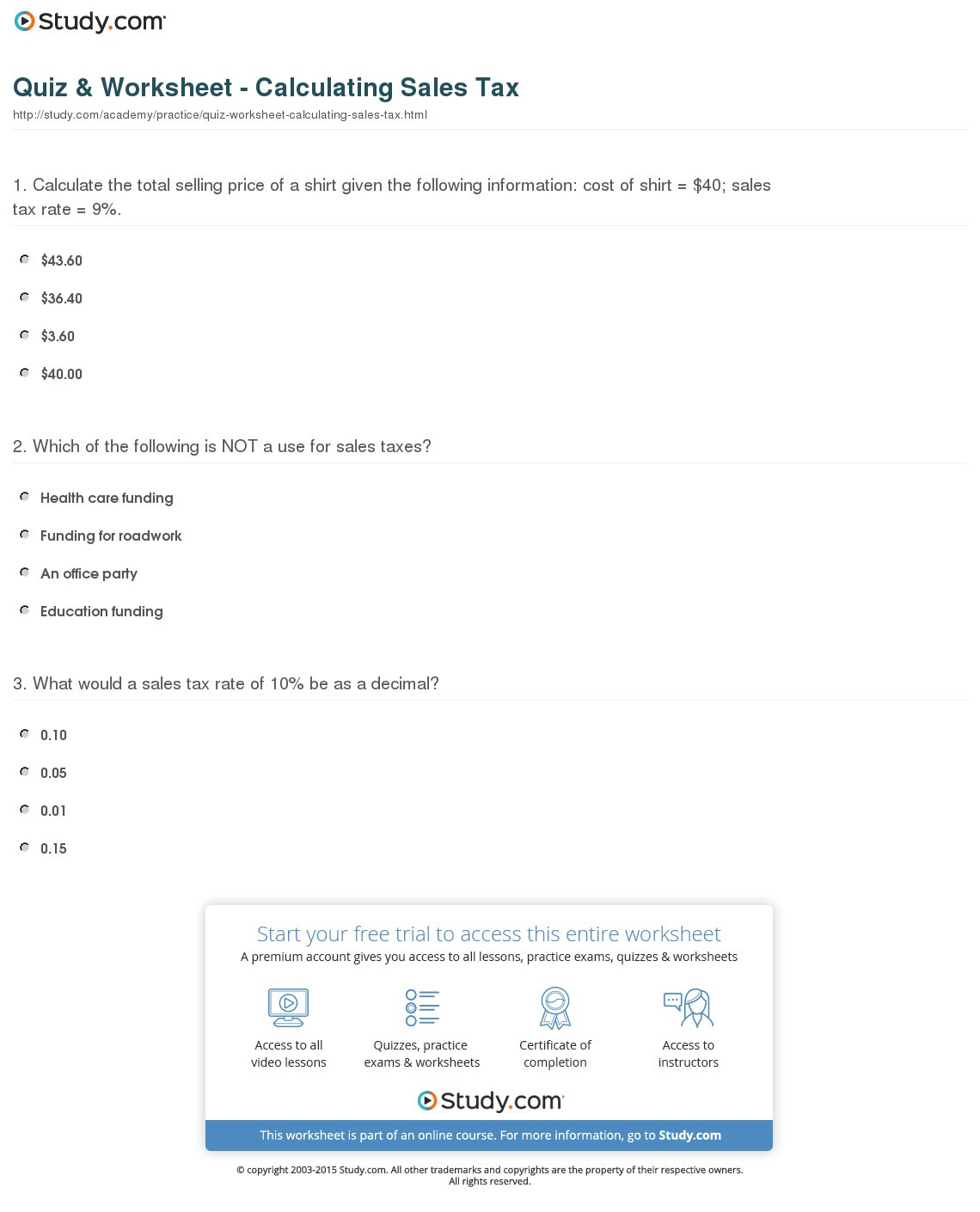

Calculating Total Cost after Sales Tax worksheet ID: 839531 Language: English School subject: Math Grade/level: Grade 5 Age: 7-15 Main content: Percentage Other contents: Sales Tax Add to my workbooks (33) Download file pdf Embed in my website or blog Add to Google Classroom PDF Sales Tax and Discount Worksheet - psd202.org 2.To find the tax, multiply the rate (as a decimal) by the original price. 3.To find the total cost, add the tax to the original price. 5) If the sales tax rate is 7.25% in California, then how much would you pay in Los Angeles for a pair of shoes that cost $39.00? 6) The price of a new car is $29,990. If the sales tax rate is 6.5%, then how ... PDF Calculating Sales Tax Calculating Sales Tax Sales Receipt Worksheet Complete each sales receipt by calculating total prices for each item of the receipt, the subtotal amount, the sales tax amount, and the total purchase amount. Sales Tax Rate: ____ Sales Tax Rate Converted to Decimal: ___ Receipt #5 Customer Name: Marcus Quiz & Worksheet - Calculating Sales Tax | Study.com Worksheet 1. Which of the following is NOT a use for sales taxes? Health care funding Education funding Funding for roadwork An office party 2. Calculate the total sale amount of a shirt given the...

How To Calculate Sales Tax Worksheets - Learny Kids some of the worksheets for this concept are sales tax and discount work, 2019 tax rate calculation work date 08282019 0813, calculating sales tax, personal income tax work 2019, sales tax practice problems, tax simple interest markups and mark downs, work a b sale of motor vehicle to nonresident under, how to calculate discount and sales tax how … Calculating The Total Price Of A Purchase Worksheets - K12 ... Displaying all worksheets related to - Calculating The Total Price Of A Purchase. Worksheets are Work, Sales tax and total purchase price version 2 answer keys, Sales tax and discount work, Calculating sales tax, Sales tax practice work, Money, Work forms, Hire purchase formulas. *Click on Open button to open and print to worksheet. Kauf Dinkelsbühl (Bavaria) MACD Zeitraum, Standard: 6) ExPSlowWeight 2 (EMAslow 1) PerWeight 2 (MacDper 1) ExPFastWeight 2 (EMAfAst 1) Set ws ThisWorkbook. Worksheets (VBA) oder genau zum Beispiel Blattnamen verwenden ThisWorkbook. worksheet ( Sheet1) langsam 160.160.160.160 Mit ws 160160160160LR. Cells (Rows. Calculating Sales Tax Worksheets - dontrabajo.com The Schedule D tax worksheet helps investors amount out the taxes for appropriate types of advance sales, including absolute acreage barrio that accept attenuated and collectible items, such as art or coins. In adjustment to complete this worksheet, you will charge to complete Anatomy 1040 through band 43 to account your taxable income.

Calculating Sales Tax Worksheets - Learny Kids Calculating Sales Tax Displaying top 8 worksheets found for - Calculating Sales Tax. Some of the worksheets for this concept are Sales tax and discount work, Sales tax practice work, Calculating sales tax, Calculating sales tax, Calculating sales tax, Unit 3, Sales tax tips and discounts, Sales tax tips and discounts.

No Prep, Print and Go! Calculating Sales Tax worksheets with prompts on each page reminding kids ...

Calculating Sales Tax Lesson Plans & Worksheets Reviewed ... Discount and Sales Tax For Students 8th - 9th In this Algebra I worksheet, students work with a family member to find the percent of discount and sales tax of three items that are on sale. The twopage worksheet contains fourquestions. Answers are not included. + Lesson Planet: Curated OER Calculate Percentages For Teachers 6th - 7th

Use this Sales Tax Calculator to figure sales tax or VAT/GST at a rate of 7.75%. Free to ...

PDF Calculating Sales Tax - Denton ISD Sales Tax, Tip and Commission •Sales Tax - Percentage of the cost of a good or service paid to a seller. (added to the total cost of the bill) •Tip - a gratuity or a voluntary additional payment made for a service. •Commission - The amount of money that an individual receives based on a percentage of sales he or she has obtained. (added to

Calculating Sales Tax Worksheet - gartnerlee.com Calculating Sales Tax Worksheet March 1, 2022 admin Fabulous Calculating Sales Tax Worksheet - Therefore, an accounting worksheet is a straightforward representation within the type of a spreadsheet that helps track each step throughout the accounting cycle.

DOC Sales Tax and Discount Worksheet - Chester Sales Tax and Discount Worksheet -Math 6. In a department store, a $50 dress is marked, "Save 25%." What is the discount? What is the sale price of the dress? In a grocery store, a $21 case of toilet paper is labeled, "Get a 20% discount." What is the discount? What is the sale price of the toilet paper?

PDF Sales Tax Practice Worksheet - MATH IN DEMAND Sales Tax = $65 x 0.06 Sales Tax = $3.90 Sales Tax = $1.80 If a shirt costs $20 and the sales tax is 9%, how much money do you need to Sales Tax = $20 x 0.09 Total Cost = $20 + $1.80 Total Cost = $21.80 socks that cost $4. If there is an 8% sales tax, how Sales Tax = $4 x 0.08 Sales Tax = $0.32 Total Cost = $4 + $0.32 Total Cost = $4.32

To Sales Tax Code Java Calculate [O8A2RL] Tax Calculator Basic sales tax is applicable at a rate of 10% on all goods, except books, food, and medical products that are exempt. Position Desc. Free source code and tutorials for Software developers and Architects. 00 and they should be charged 8. This code prompts the user to enter item price and the code adds the markup price and tax rate.

Worksheet 2: Cash Flow Statement & NPV Calculation | UCL BRITS cell therapy project planning and ...

Calculate Sales Tax | Worksheet | Education.com Worksheet Calculate Sales Tax. It would be great if we never had to learn about sales tax, but since we do, 4th grade is as good a time as any! Throw in some favorite baseball game snacks for fun and get cracking. Add the sales tax and find how much each person's meal will cost.

Calculating Sales Tax Ontario Worksheets & Teaching ... Math Moji Digital Calculating Sales Tax Online Game 2020 Ontario Math Curriculum. by. Dr SillyPants Classroom Resources. 3. $4.50. Zip. Google Apps™. Internet Activities. The Math Moji Digital Series is an online, interactive game series that students can play independently in the classroom or as part of at home study.

Discount allowed and discount received - AccountingTools Accounting for the Discount Allowed and Discount Received. When the seller allows a discount, this is recorded as a reduction of revenues, and is typically a debit to a contra revenue account. For example, the seller allows a $50 discount from the billed price of $1,000 in services that it has provided to a customer.

Adding Taxes Using Percentages - WorksheetWorks.com Using Percentages. Find the price of an item including taxes. Students use a variety of prices and tax rates to find total values.

Use the Sales Tax Deduction Calculator | Internal Revenue ... The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A (Forms 1040 or 1040-SR). Your total deduction for state and local income, sales and property taxes is limited to a combined, total deduction of $10,000 ($5,000 if married filing separately).

Sales Tax Problems Worksheets - K12 Workbook Displaying all worksheets related to - Sales Tax Problems. Worksheets are Sales tax practice work, Sales tax and discount work, Sales tax and discount work, Tax problems work sales tax problems, Taxes tips and sales, Discount tax and tip, Tip and tax homework work, Markup discount and tax. *Click on Open button to open and print to worksheet. 1.

0 Response to "42 calculating sales tax worksheet"

Post a Comment