42 funding 401ks and iras worksheet answers

Funding 401ks And Roth Iras Worksheet Answers - Nidecmege Funding 401ks and iras worksheet and best 25 retirement savings amp. We think it bring interesting things for funding 401 k s and roth iras worksheet answers along with assignment create a roth ira assignment create a. Excel 2007 along with the newest 2010 improve break the previous hurdles about the range of columns and rows available. Roth IRAs and 401(k)s: Answers to Readers' Questions - WSJ Roth IRAs and 401(k)s: Answers to Readers' Questions By Laura Saunders. Updated Jan. 7, 2015 8:42 am ET A recent Weekend Investor cover story asked, "Is a Roth Account ...

Bill Nye Waves Worksheet Answers - Studying Worksheets Bill nye waves worksheet answers. This is a worksheet intended to be done while watching bill nye s simple machines video season 1 episode 10. Water moves every time there is a _____. A 10kg box sits on the floor. Bill nye storms worksheet bill nye waves worksheet answers and bill nye video worksheet answer key are.

Funding 401ks and iras worksheet answers

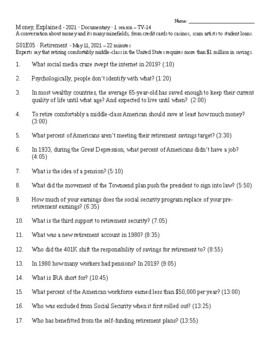

Funding 401K And Roth Ira Worksheet - Free Gold IRA ... Funding 401K And Roth Ira Worksheet Overview Funding 401K And Roth Ira Worksheet A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the value of the accounts balance. The IRA owns shares in a company, also referred to as "protocol shares." It works Funding 401 K S and Roth Iras Worksheet Answers or A Sure ... If you want to download the image of Funding 401 K S and Roth Iras Worksheet Answers or A Sure Way to An Unsure Future is to Put Off Planning for Retirement, simply right click the image and choose "Save As". Download by size: Handphone Tablet Desktop (Original Size) Back To Funding 401 K S and Roth IRAs Worksheet Answers Solved Activity: Funding 401(k)s and Roth IRAs Objective ... Finance questions and answers; Activity: Funding 401(k)s and Roth IRAs Objective: The purpose of this activity is to learn to calculate 15% of an income to save for retirement and to understand how to fund retirement investments. Directions: Complete the investment chart based on the facts given for each situation.

Funding 401ks and iras worksheet answers. 401(k) and roth ira Flashcards | Quizlet 1. calculate target amount to invest (15%) 2. fund our 401(k) up to the match 3. Above the match, fund roth ira 4. complete 15% of income by going back to 401(k) › sep-ira-rules-contribution-s-corpSEP IRA for an S Corp: The #1 Contribution Guide for 2021 Mar 27, 2022 · No catch-up contributions: Unlike traditional IRAs and 401ks, you will not be able to make catch-up contributions when you reach age 50. Same percentage contributions for employees: You will have to make similar percentage contributions to the SEP IRAs of qualified employees, making the plan somewhat expensive. › backdooBackdoor Roth IRA 2022: A Step by Step ... - Physician on FIRE Jan 06, 2022 · Note that inherited IRAs are a non-issue. If the balances in your IRA or IRAs are small and you can afford the taxes on the conversion, you can convert it all to Roth and just pay tax on the conversion. This could be a good idea for those in lower tax brackets — residents and students, for example. Funding a 401 K and Roth - financial lit Flashcards | Quizlet -They match what you put into your 401 (k) -Up to 3% of your salary -If you make $100,000 and you put $3,000 or more into your 401 (k) -Your company will also put $3,000 into your 401 (k) FOLLOW THESE STEPS TO FUND YOUR 401 (K) & ROTH IRA -Calculate 15% or your income >>This is the total you want to invest in your retirement accounts

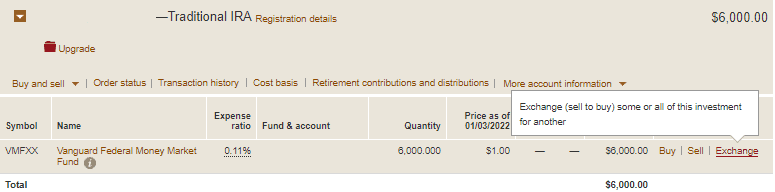

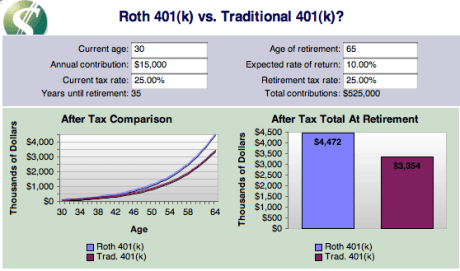

Is Your 401(k) Enough for Retirement? | RamseySolutions.com The contribution limit for Roth IRAs in 2021 and 2022 is $6,000 per individual, and it increases to $7,000 if you're 50 or older. 2 It's possible that you might not reach 15% of your income in your Roth IRA. If that happens, go back to your 401 (k) and invest the remainder to take advantage of your 401 (k)'s tax deferral. PDF Roth 401(k) Contributions Questions and answers to help ... tax-free nature of the Roth IRA, and the fact that there are no required minimum withdrawals, very attractive. Now, if you don't qualify for a Roth IRA, or just want to save more for retirement, you can take advantage of many Roth features inside your 401(k) plan. The combination of regular 401(k) and Roth 401(k) contributions is Amazing Funding 401ks And Iras Worksheet - The Blackness ... Truly we have been remarked that funding 401 k s and roth iras worksheet answers is being just about the most popular issue on the subject of document sample right now. Ad Download over 20000 K-8 worksheets covering math reading social studies and more. The estimating worksheet is designed to direct you through the estimation practice. PDF Roth vs. Traditional 401(k) Worksheet Roth vs. Traditional 401(k) Worksheet An increasing number of 401(k) ... Do you already have a lot of assets in a traditional IRA and/or 401(k)? ... p If most of your answers fell under the ...

PDF NAME: DATE: Funding 401(k)s and Roth IRAs - Weebly Funding 401(k)s and Roth IRAs Directions Complete the investment chart based on the facts given for each situation. Assume each person is following Dave's advice of investing 15% of their annual household income. Remember to follow the sequence of contributions recommended in the chapter. Funding 401 K S and Roth Iras Worksheet Answers A Funding 401 K Sage IRA Worksheet answers some common questions of IRA conversions and IRA custodians. The worksheet answers the following questions: "What is a Conversion?" A conversion is an IRA investment in a non-qualified or non-elective account that is converted to a qualified plan account. Funding 401ks And Roth Iras Worksheet - Studying Worksheets Funding 401ks and Roth IRAs Directions Complete the investment chart based on the facts given for each situation. Funding 401ks and roth iras worksheet answers chapter 8. There are worksheets for trying to map photos lines along with alphabet letters. 401(k) and IRA Contributions: You Can Do Both Key Takeaways Having a 401 (k) account at work doesn't affect your eligibility to make IRA contributions. Your income determines whether your traditional IRA contributions are deductible. 2 The...

Copy of Funding 401(k)'s and Roth IRA's - WORKSHEET ... View Copy of Funding 401(k)'s and Roth IRA's - WORKSHEET from MATH 12345 at New Life Academy, Woodbury. Investment Joe Melissa Tyler & Megan Adrian David & Britney Brandon Chelsea Annual

Complete Funding 401ks and Roth IRAs Worksheet.jpg - NAME ... View Complete Funding 401ks and Roth IRAs Worksheet.jpg from AA 1NAME: DATE: Funding 401(k)s and Roth IRAs Directions Complete the investment chart based on the facts given for each situation. Assume

401(k) vs. Roth IRA: What's the Difference? - Investopedia 401(k) vs. Roth IRA: An Overview Both 401(k)s and Roth IRAs are popular tax-advantaged retirement savings accounts that differ in tax treatment, investment options, and employer contributions.

Funding 401ks and Roth Iras Worksheet - Briefencounters The worksheets have many uses. A 401k worksheet is a good resource for determining the amount you need to contribute in order to fund a Roth IRA. A 401k worksheet is useful for funding a Roth IRA. For more information about funding a 401k, visit the official website. The Funding 401ks and Roth IIRAs Worksheet is a very useful tool for employees.

Chapter 3 Business Transactions And The Accounting ... Chapter 3 Business Transactions And The Accounting Equation Worksheet Answers - A multiplication worksheet for youngsters will certainly recommend your child with the procedure step-by-step. Those few sheets will be less complicated, and so as your child boosts, you can disrupt the advancement of the worksheets.

Funding 401(K)S And Roth Iras Worksheet Answers Chapter 8 ... Funding 401(K)S And Roth Iras Worksheet Answers Chapter 8 Overview. Funding 401(K)S And Roth Iras Worksheet Answers Chapter 8 A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the value of the accounts balance. The IRA owns shares in a company, also referred to as "protocol shares."

39 funding 401ks and roth iras worksheet - Worksheet Was Here PDF Funding 401ks and roth iras worksheet answers Funding 401ks and roth iras worksheet answers Funding 401ks and roth iras worksheet answers chapter 8. Funding 401ks and roth iras worksheet answers pdf. If you even behave carefully, it is likely to be able to locate all to have fun and still have enough money to pay the rental in time and get ...

Funding 401 K S and Roth IRAs Worksheet Answers Funding 401 K S and Roth Iras Worksheet Answers and 218 Best 401k Images On Pinterest Your contributions could be tax-deductible, lowering your present tax invoice. Non-deductible IRA contributions are. The most important advantage of the 401 (k) plan is the sum of money you may add to the plan.

Quiz & Worksheet - Roth IRA Rules & Benefits | Study.com In order to pass the quiz, you will need to know characteristics of Roth IRAs and different publication numbers that should be reviewed prior to funding a Roth IRA. Quiz & Worksheet Goals Use this ...

Solved Activity: Funding 401(k)s and Roth IRAs Objective ... Finance questions and answers; Activity: Funding 401(k)s and Roth IRAs Objective: The purpose of this activity is to learn to calculate 15% of an income to save for retirement and to understand how to fund retirement investments. Directions: Complete the investment chart based on the facts given for each situation.

Funding 401 K S and Roth Iras Worksheet Answers or A Sure ... If you want to download the image of Funding 401 K S and Roth Iras Worksheet Answers or A Sure Way to An Unsure Future is to Put Off Planning for Retirement, simply right click the image and choose "Save As". Download by size: Handphone Tablet Desktop (Original Size) Back To Funding 401 K S and Roth IRAs Worksheet Answers

Funding 401K And Roth Ira Worksheet - Free Gold IRA ... Funding 401K And Roth Ira Worksheet Overview Funding 401K And Roth Ira Worksheet A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the value of the accounts balance. The IRA owns shares in a company, also referred to as "protocol shares." It works

/roth_ira_401k_nesteggs_istock466132651-5bfc328ec9e77c00519bf2e6.jpg)

![How To Do A Backdoor Roth IRA [Step-by-Step Guide] | White ...](https://www.whitecoatinvestor.com/wp-content/uploads/2018/09/Backdoor-Roth-2020.png)

![How To Do A Backdoor Roth IRA [Step-by-Step Guide] | White ...](https://www.whitecoatinvestor.com/wp-content/uploads/2021/01/form-8606-p1.png)

0 Response to "42 funding 401ks and iras worksheet answers"

Post a Comment