45 2015 qualified dividends and capital gain tax worksheet

Qualified Dividends and Capital Gain Tax - TaxAct Qualified Dividends and Capital Gain Tax. With the passing of the American Taxpayer Relief Act of 2012, certain taxpayers may now see a higher capital gains tax rate than they have in recent years. The new tax rates continue to include the 0% and the 15% rates; however, will also now include a 20% rate. The information from Form 1099-DIV ... Tax Calculator - Estimate Your Income Tax for 2022 - Free! Taxes. Tax Calculator. Tax Brackets. Capital Gains. Social Security. Tax Changes for 2013 - 2022. High incomes will pay an extra 3.8% Net Investment Income Tax as part of the new healthcare law , and be subject to limited deductions and phased-out exemptions (not shown here), in addition to paying a new 39.6% tax rate and 20% capital gains rate .

Dividends Qualified Capital Form Worksheet Gain Tax And ... Search: Form Qualified Dividends And Capital Gain Tax Worksheet

2015 qualified dividends and capital gain tax worksheet

Qualified Dividends And Capital Gain Tax Worksheet 2020 ... Schedule D Form 1040 Tax Worksheet 2020 Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero and lines 15 and 16 of Schedule D are gains or if you file Form 4952 and have an amount on line 4e and 4g even if you do not need to file Schedule D. Otherwise complete the Qualified Dividends and Capital. 35+ Ideas For Qualified Capital Gains Worksheet 2015 SEE ALSO : 40+ Get Inspired For Writing Number Expressions Worksheets. 30 Qualified Dividends And Capital Gain Tax Worksheet Calculator Worksheet Resource Plans. Dean Lance And Wanda 2015 Acc 321 Tax Accounting I Msu Studocu. Qualified Dividends And Capital Gain Tax Worksheet Chegg Com. PDF and Losses Capital Gains - IRS tax forms To report a gain or loss from a partnership, S corporation, estate or trust, To report capital gain distributions not reported directly on Form 1040, line 13 (or effectively connected capital gain distributions not reported directly on Form 1040NR, line 14), and To report a capital loss carryover from 2014 to 2015. Additional information.

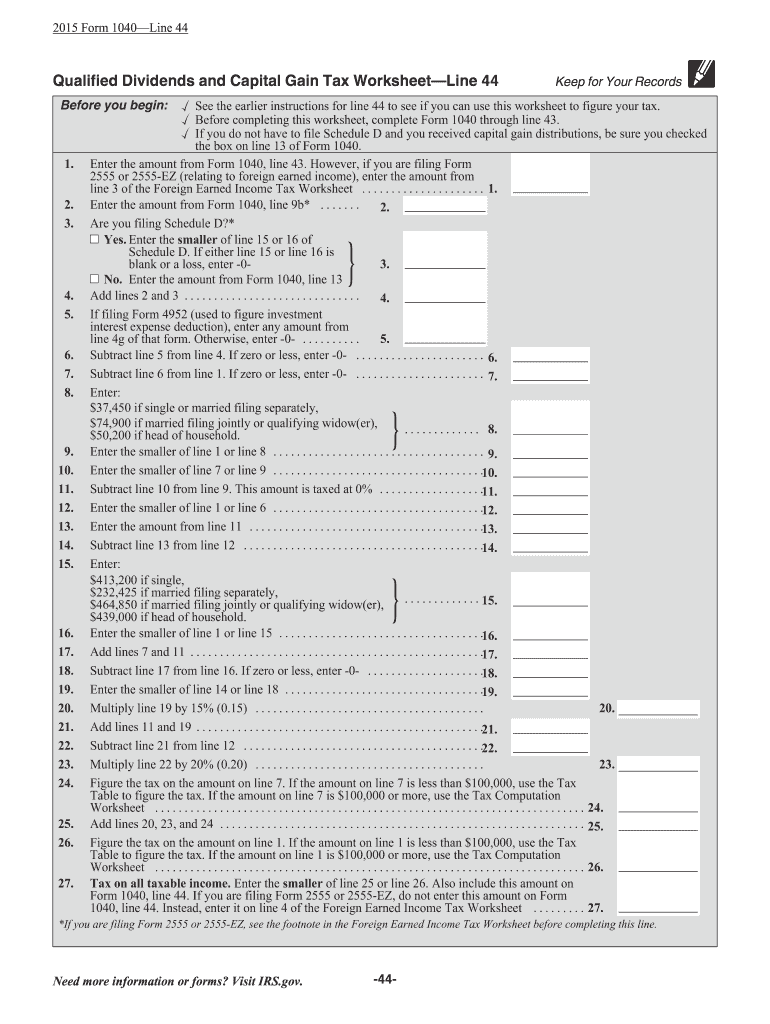

2015 qualified dividends and capital gain tax worksheet. Qualified Dividends and Capital Gains Worksheet.pdf - 2016 ... 2016 Form 1040—Line 44 Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records See the earlier instructions for line 44 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 43. If you do not have to file Schedule D and you received capital gain distributions, be sure you checked the box on line ... How to Figure the Qualified Dividends on a Tax Return ... Report your qualified dividends on line 9b of Form 1040 or 1040A. Use the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 or 1040a to figure your total tax ... Qualified Dividends and Capital Gain Tax Worksheet Form ... The sigNow extension was developed to help busy people like you to reduce the burden of signing documents. Start eSigning 2021 qualified dividends and capital gain tax worksheet by means of solution and become one of the millions of happy clients who've already experienced the key benefits of in-mail signing. Solved: Error in Turbotax - dividends and capital gains no... Turbo Tax calculates it right. Even though the total shows up as regular income on lines 3b and 7, If you have capital gains or qualified dividends the tax is not taken from the tax table but is calculated separately from Schedule D. The tax will be calculated on the Qualified Dividends and Capital Gain Tax Worksheet.

› publications › p505Publication 505 (2022), Tax Withholding and Estimated Tax ... Doesn’t include a net capital gain or qualified dividends and you didn’t exclude foreign earned income or exclude or deduct foreign housing in arriving at the amount on line 1, use Worksheet 1-4 to figure the tax to enter here. • Includes a net capital gain or qualified dividends, use Worksheet 2-5 to figure the tax to enter here. • How to Dismantle an Ugly IRS Worksheet | Tax Foundation The difficulty of the worksheet is not the fault of the IRS. If anything, the IRS put a very difficult concept into a one-page worksheet. But even with the worksheet's good design, it's still 27 lines. That's because the underlying tax code it deals with is not elegantly designed. The problem for the IRS is that we have two different sets ... PDF Capital Gain Tax Worksheet (PDF) - IRS tax forms Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. ... complete Form 1040 through line 10. If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the box ... enter the amount from line 3 of the Foreign Earned Income Tax Worksheet .....1. 2. Enter the amount from Form 1040, line 3a ... 2021 Instructions for Schedule D (2021) - IRS tax forms Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero and lines 15 and 16 of Schedule D are gains or if you file Form 4952 and you have an amount on line 4g, even if you don't need to file Schedule D. Otherwise, complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and ...

2015 Capital Gains Carryover Worksheet - Templates ... 2015 Capital Gains Carryover Worksheet. ... tax school december 3 3 21 3 individual in e tax returns irs qualified dividends and capital gains worksheet 2010 qualified dividends and capital gain tax worksheet line 44 2014 tax covers untitled ... Qualified Dividends and Capital Gains Worksheet - Page 33 ... Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records. See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b. en.wikipedia.org › wiki › Capital_gains_tax_in_theCapital gains tax in the United States - Wikipedia The Capital Gains and Qualified Dividends Worksheet in the Form 1040 instructions specifies a calculation that treats both long-term capital gains and qualified dividends as though they were the last income received, then applies the preferential tax rate as shown in the above table. Capital Gain Tax Worksheet - 2015 Form 1040Line 44 ... 2015 Form 1040—Line 44 Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records See the earlier instructions for line 44 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 43. If you do not have to file Schedule D and you received capital gain distributions, be sure you checked the box on line ...

Free Microsoft Excel-based 1040 form available ... Just in time for tax season, Glenn Reeves of Burlington, Kansas has created a free Microsoft Excel-based version of the 2008 U.S. Individual Tax Return, commonly known as Form 1040. The spreadsheet includes both pages of Form 1040, as well as these supplemental schedules: Schedule D - Capital Gains and Losses, along with its worksheet.

31 Qualified Dividends And Capital Gain Tax Worksheet Fillable - Notutahituq Worksheet Information

1040 (2021) | Internal Revenue Service - IRS tax forms Qualified Dividends and Capital Gain Tax Worksheet—Line 16; Line 19. Nonrefundable Child Tax Credit and Credit for Other Dependents. Form 8862, who must file. ... Use the Qualified Dividends and Capital Gain Tax Worksheet or the Schedule D Tax Worksheet, whichever applies, to figure your tax. See the instructions for line 16 for details..

Qualified Dividends And Capital Gains Worksheet ... Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero and lines 15 and 16 of Schedule D are gains or if you file Form 4952 and you have an amount on line 4e or 4g even if you dont need to file Schedule D. Qualified dividends and the capital gain tax worksheet is a good way to estimate the capital gain taxes.

united states - How to handle capital gains on a Virginia ... I reported capital gains (reported to me on a 1099-DIV) on my 2015 Form 1040A "U.S. Individual Income Tax Return" (line 10.) Using the "Qualified Dividends and Capital Gain Tax Worksheet" on p. 38 of the 2015 1040A instructions, these capital gains were taxed federally at a 15% rate, which is lower than my income tax rate for wages.

Qualified Dividends Tax Worksheet And Capital Form Gain ... Search: Form Qualified Dividends And Capital Gain Tax Worksheet. ... Schedule D Use this worksheet to gure capital loss carryovers from 2007 to 2008 if 2007 Schedule D, line form 1040 qualified dividends worksheet 2015 Form 1040 Line 44 Qualified Dividends and Capital Gain Tax Worksheet Line 44 Keep for Your. 7M. 6F ...

How Capital Gains and Dividends Are Taxed Differently In the case of qualified dividends, these are taxed the same as long-term capital gains. For 2021 and 2022, individuals in the 10% to 12% tax bracket are still exempt from any tax. Investors who ...

PDF Qualified Dividends and Capital Gain Tax Worksheet: An ... For 2003, the IRS added qualified dividends and the new rates to the worksheet so that millions of taxpayers will still be able to get their full tax benefits without the Schedule D. The worksheet is for taxpayers with dividend income only or those whose only capital gains are capital gain distributions reported in box 2a or 2b of Form 1099-DIV ...

united states - Personal Finance & Money Stack Exchange On schedule D, line 22, it says to Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, Line 44.. If I have reached line 22 on Schedule D, because Line 16 was either a gain or a loss, is Form 1040, Line 13 supposed to be filled from Line 16, or from the result of the Qualified Dividends and Capital Gain Tax Worksheet?

0 Response to "45 2015 qualified dividends and capital gain tax worksheet"

Post a Comment