40 2012 child tax credit worksheet

PDF Introduction Objectives Topics - IRS tax forms Form 1040 Instructions, Child Tax Credit Worksheet Schedule 8812, Credits for Qualifying Children and Other Dependents Pub 17, Chapter 14, Child Tax Credit . TaxSlayer Demo: Entering Basic Credits, Verify the amount of the credit in TaxSlayer by viewing the return summary Determining Eligibility and Forms and Instructions (PDF) Additional Child Tax Credit Worksheet 0321 03/22/2021 Form 13424-J: Detailed Budget Worksheet 0518 05/13/2020 Form 15111 ... Form 15112: Earned Income Credit Worksheet (CP 27) 0321 03/22/2021 Form 14453: Penalty Computation Worksheet 1215 01/06/2016 Inst 1040 (Tax Tables) Tax Table, Tax Computation Worksheet, and EIC Table ...

Child Tax Credit Amount 2012 In 2012, the Child Tax Credit can be worth a maximum of $1,000 for each qualifying child below 17 years old. Depending on your income level, the Child Tax Credit may be used to lower your federal income tax by a specific amount. To qualify for Child Tax Credit, the child must meet the qualifying requirements as outlined by six tests: Age Test

2012 child tax credit worksheet

Child Tax Credit Amount 2012: Child Tax Credit Worksheet 1.The child is your son, daughter, stepchild, foster child, sister, brother, stepsister, stepbrother, or a descendant of any of them 2.The child must be UNDER the age of 17 by the end of the year 3.The child did not provide half of his or her own support for the year 4.The child must be claimed as a dependent on your income tax return Monthly Child Support Calculator | THE ATTORNEY GENERAL OF TEXAS Texas Family Code Sec. 154.125 Low-Income Child Support Guidelines are used in actions filed on or after 9/1/2021 Projected Monthly Child Support Obligation for net resources up to $9,200 **The Guidelines for the support of a child are specifically designed to apply to monthly net resources not greater than $9,200. nacac.org › help › adoption-tax-creditAdoption Tax Credit FAQs - The North American Council on ... In one year, taxpayers can use as much of the adoption tax credit as the full amount of their federal income tax liability, which is the amount on line 18 of the 2020 Form 1040 less certain other credits (such as the up to $600 of the Child Tax Credit per child and the Child and Dependent Care Expenses).

2012 child tax credit worksheet. nacac.org › help › adoption-tax-creditAdoption Tax Credit 2020 - The North American Council on ... Interaction with the Child Tax Credit . The Child Tax Credit changed in 2018. The amount is now $2,000 per child, but only $1,400 of it can become the refundable additional child tax credit (dependent on the family’s earned income), with the remaining $600 a non-refundable Child Tax Credit. This credit will supersede the adoption tax credit ... PDF 2017 Earned Income Credit/Child Tax Credit Eligibility Worksheet In general, to be a taxpayer's qualifying child, a person must satisfy four tests: •Relationship— the taxpayer's child or stepchild (whether by blood or adoption), foster child, sibling or stepsibling, or a descendant of one of these. •Residence— has the same principal residence as the taxpayer for more than half the tax year. PDF 2012 Louisiana Nonrefundable Child Care Credit Worksheet (For use with ... This amount is your unused Child Care Credit Carryforward from 2008 through 2011 that can be carried forward to 2013. Also, your entire Child Care Credit for 2012 (Line 2 or 2A above) will be carried forward to 2013. Stop here; you are finished with the worksheet. .00 Use Lines 11 through 15 to determine the amount of Child Care Credit Carryforward PDF 2012 Instruction 1040 Schedule - IRS tax forms All the days your child was present in 2012, and b. 1/3 of the days your child was present in 2011, and c. 1/6 of the days your child was present in 2010. Not all days that your dependent is physically present in the United States count as days of presence for the sub stantial presence test. See Days of Presence in the United States in Pub. 519.

PDF Child Tax Credit 2012 or 1040) Attach to Form 1040, Form 1040A, or Form ... 2012. 47. Name(s) shown on return . Your social security number . Part I Filers Who Have Certain Child Dependent(s) with an ITIN (Individual Taxpayer Identification Number) ... Enter the amount from line 6 of your Child Tax Credit Worksheet (see the Instructions for Form 1040, line 51). 1040A filers: PDF Forms 1040, 1040A, Child Tax Credit Worksheet 1040NR 2016 To be a qualifying child for the child tax credit, the child must be under age 17 at the end of 2016 and meet the other requirements listed earlier under Qualifying Child.Also see Taxpayer identification number needed by due date of return, earlier. If you do not have a qualifying child, you cannot claim the child tax credit. Free Child Tax Credit Worksheet and Calculator (Excel, Word, PDF) Child tax credit worksheet is a document used to provide a helpful lift to the income of parents or guardians who have dependents or children. The child tax credit received usually based on your income. It is just a tax credit not a deduction on taxes. This tax is directly subtracted from the total amount of taxes you would have to pay. Fillable Form 1040 2018 Child Tax Credit and Credit for Other ... The Form 1040 2018 Child Tax Credit and Credit for Other Dependents Worksheet line 12a form is 2 pages long and contains: 0 signatures; 8 check-boxes; 22 other fields; Country of origin: US File type: PDF Use our library of forms to quickly fill and sign your IRS forms online. ...

PDF Worksheet—Line 12a Keep for Your Records Draft as of - IRS tax forms 2018 Child Tax Credit and Credit for Other Dependents Worksheet—Line 12a Keep for Your Records 1. To be a qualifying child for the child tax credit, the child must be your dependent, under age 17 at the end of 2018, and meet all the conditions in Steps 1 through 3 under Who Quali es as Your Dependent. Make sure you checked the box in Instruction Changes for 2021 Individual Income Tax Returns - Idaho ... Worksheet 1. Enter the business information in the table below using information from your K-1s and federal Form 8995. Then add your totals for Column (c) and for Column (e). 2. Divide the total of Column (e) by the total of Column (c) for your Idaho percentage of qualified business income..... ___________ 3. Child Tax Credit Payment Calculator 2022 - Federal Tax Credits - TaxUni Since the child tax credit is now at a very large amount, it isn't a surprise for the government to send out advanced payments. It also makes sense as covering a child's expenses grows every year. The Internal Revenue Service rolled out the first advanced child tax credit payments in August. The payment amount is $250 per school-aged child ... Child Tax Credit Schedule 8812 | H&R Block If your Child Tax Credit is limited because of your tax liability, you might be able to claim the additional Child Tax Credit. To qualify, one of these must apply: Your earned income must be more than $2,500 for 2019. You must have three or more qualifying children. If you have at least one qualifying child, you can claim a credit of up to 15% ...

![23 Latest Child Tax Credit Worksheets [+Calculators & Froms] (With images) | Child tax credit ...](https://i.pinimg.com/originals/62/ca/2d/62ca2dab35d8bf39e8e93ad9531c84f3.jpg)

23 Latest Child Tax Credit Worksheets [+Calculators & Froms] (With images) | Child tax credit ...

2021 Schedule 8812 Form and Instructions - Income Tax Pro Form 1040 Schedule 8812, Credits for Qualifying Children and Other Dependents, asks that you first complete the Child Tax Credit and Credit for Other Dependents Worksheet. See the instructions for Form 1040, line 19, or Form 1040NR, line 19. The 2021 Schedule 8812 Instructions are published as a separate booklet which you can find below.

Forms and Publications (PDF) - IRS tax forms Child Tax Credit 2022 02/24/2022 Publ 972 (SP) Child Tax Credit (Spanish Version) 2022 02/25/2022 Form 1040-SS: U.S. Self-Employment Tax Return (Including the Additional Child Tax Credit for Bona Fide Residents of Puerto Rico) 2021 01/21/2022 Inst 1040-SS: Instructions for Form 1040-SS, U.S. Self-Employment Tax Return (Including the Additional ...

Child Tax Credit Vs Child Care Credit - Prepaid Cards Are Getting Better - Consumer Reports ...

Child Tax Credit Worksheet Fillable: Fill & Download for Free Click the Get Form or Get Form Now button to begin editing on Child Tax Credit Worksheet Fillable in CocoDoc PDF editor. Click on Sign in the tools pane on the top. A popup will open, click Add new signature button and you'll be given three options—Type, Draw, and Upload. Once you're done, click the Save button.

Summer day camp costs, even in coronavirus time, still eligible for a tax credit - Don't Mess ...

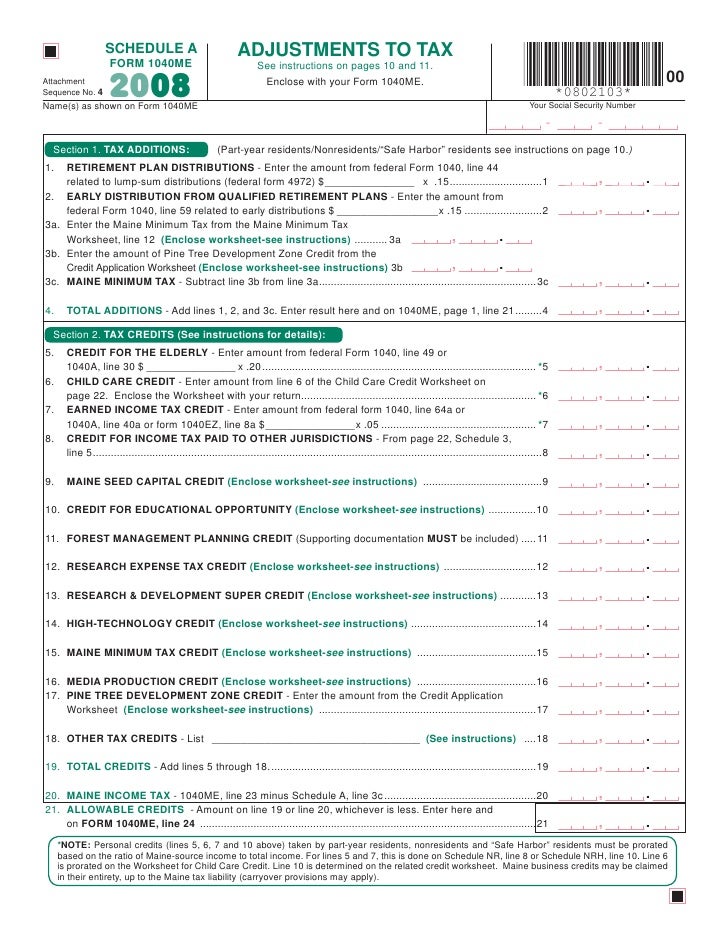

› revenue › tax-return-formsTax Return Forms | Maine Revenue Services Income/Estate Tax. Individual Income Tax (1040ME) Corporate Income Tax (1120ME) Estate Tax (706ME) Franchise Tax (1120B-ME) Fiduciary Income Tax (1041ME) Insurance Tax; Real Estate Withholding (REW) Worksheets for Tax Credits; Electronic Request Form to request individual income tax forms

› adoption-tax-credit-3193005The Qualifications for the Adoption Tax Credit Feb 07, 2022 · Adoptive parents may qualify for Adoption Tax Credit for their adoption-related out-of-pocket expenses. Adoption tax credit is capped at $14,440 per child for 2021 and $14,890 per child for 2022. Adoption tax credit is phased out based on your modified adjusted gross income (MAGI). The phase out MAGI range is $216,600 to $256,660 for 2021.

Schedule 8812 Line 5 Worksheet Under File \ Print, I selected the option to have TurboTax generate "Tax Return, all calculation worksheets". There is no Line 5 worksheet to be found anywhere. The worksheet is used to determine the child tax credit amount based on income limitations, so it's a key worksheet to have available. 0 11 2,628 Reply 11 Replies JohnB5677

› publications › p501Publication 501 (2021), Dependents, Standard ... - IRS tax forms If a child is treated as the qualifying child of the noncustodial parent under the rules described earlier for children of divorced or separated parents (or parents who live apart), only the noncustodial parent can claim the child as a dependent and claim the refundable child tax credit, nonrefundable child tax credit, additional child tax ...

Child Tax Credit Worksheet 2016 : 2014 Child Tax Credit Worksheet - 2014 Form IMOLine 52 2014 ...

Idaho Child Tax Credit Worksheets - K12 Workbook Displaying all worksheets related to - Idaho Child Tax Credit. Worksheets are Individual income tax instructions 2020, The idaho child support guidelines, 2019 form w 4, Form 43 part year resident and nonresident income tax, Work line 12a keep for your records, 2020 publication 972, Basic monthly child support, 2021 form w 4.

IRS Courseware - Link & Learn Taxes - IRS tax forms Certification Warm Up: Question 2 of 2. Jim and Pamela Greene are married and file a joint tax return. They claim their two children, ages 14 and 16, as dependents. Assuming their adjusted gross income is $101,000, what is the Greenes' allowable child tax credit? Click here to view the Child Tax Credit Worksheet.. $6,000. $4,000. $2,000.

Fillable Online revenue louisiana IT-540 2012 Louisiana Resident Income Tax Return Worksheets ...

Form 8812 Form - Fill Out and Sign Printable PDF Template | signNow How to generate an eSignature for the 2019 Schedule 8812 Form 1040 Or 1040sr Additional Child Tax Credit in the online mode form 8812 line 5 worksheet5 worksheet 8812? signNow combines ease of use, affordability and security in one online tool, all without forcing extra ddd on you. All you need is smooth internet connection and a device to work on.

PDF Suit Affecting the Parent-child Relationship Information Sheet Page 1 The Law Offices of Shelly B. West One Meadows Building 5005 Greenville Ave, Suite 200 Dallas, Texas 75206 214-373-9292

What Is Child Tax Credit Worksheet - SignNow The Child Tax Credit is being doubled for 2018 For 2018, the recently passed GOP tax reform bill doubles the amount of the Child Tax Credit from $1,000 to $2,000 per qualifying child. In other words, if you have one child, you'll be able to claim a ×2,000 credit. For two children, your credit is $4,000.

PDF ARE YOU ELIGIBLE - IRS tax forms • $36,920 ($42,130 for married filing jointly) if you have one qualifying child, or • $13,980 ($19,190 for married filing jointly) if you do not have a qualifying child. 2. You must have a valid social security number. 3. Your filing status cannot be "Married filing separately." 4. You must be a U.S. citizen or resident alien all year. 5.

› ESFederal (IRS) 1040-ES calculator (Estimated Tax Worksheet) 1040-ES Estimated Tax Worksheet 1040ES Choose: set to: ... (Child's Savings) $ $ Adding lines and $ Credits. $ $ ... 972 child tax credit $ $

› pub › irs-pdfCredit (EIC) Page 1 of 44 13:39 - 10-Jan-2022 Earned Income The earned income credit (EIC) is a tax credit for certain people who work and have earned income under $57,414. A tax credit usually means more money in your pocket. It reduces the amount of tax you owe. The EIC may also give you a refund. Can I Claim the EIC? To claim the EIC, you must meet certain rules. These rules are summarized in Table 1.

![23 Latest Child Tax Credit Worksheets [+Calculators & Froms]](https://templatearchive.com/wp-content/uploads/2017/05/child-tax-credit-worksheet-18.jpg)

0 Response to "40 2012 child tax credit worksheet"

Post a Comment