41 vanguard retirement expense worksheet

Tax Loss Harvesting with Vanguard: A Step by Step Guide In tax-advantaged retirement accounts, such as an IRA, 401(k), 403(b) or similar accounts, there are no tax implications when buying and selling within the account, and you cannot tax loss harvest to your benefit. Vanguard - See what you spend - Vanguard - Retirement Plans If you chronically spend more than you earn, try to cut out some frivolous expenses. A luxury item like a new TV is not necessarily a need on the same level as, say, a car repair or a doctor's bill. Prioritize your expenses in this order: Short-term needs (repairs and maintenance). Long-term needs (retirement and education).

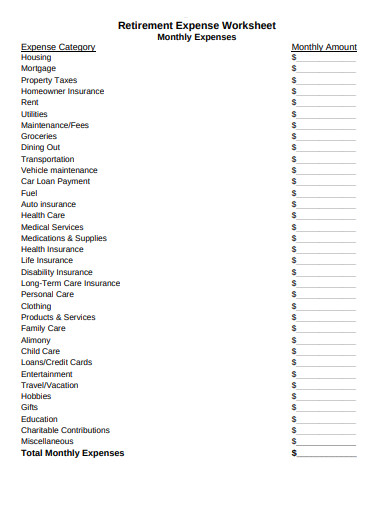

Retirement Expenses Worksheet | Vanguard You'll have important bills and expenses to pay in retirement. Use this interactive worksheet to help you estimate your monthly retirement expenses. Still need help? Consider our advisor services. Vanguard Personal Advisor Services® One-on-one expert advice to fit your needs. To get started, call us at 800-523-9447 to speak with an investment professional or click the link …

Vanguard retirement expense worksheet

Thinking about early retirement? | Vanguard Our retirement expenses worksheet can help you visualize where your money goes. Fill it out now as a pre-retiree, and then estimate what your financial situation may look like once you're retired. Plan to replace 85% to 100% of your pre-retirement income in retirement. Your Market Downturn Tool Kit | Morningstar 12.05.2021 · For the truly time-pressed, Vanguard's Retirement Nest Egg Calculator and the Fidelity Retirement Score tool are worth checking out. All calculators require you to plug in some return assumptions ... 11+ Retirement Expense Worksheet Templates in PDF | DOC ... The expenses worksheet is the sheet that has the detail of the premiums you need to pay. The retirement expense also has the expenditure for fulfilling the hobbies and wishes. The worksheet is for the expenses or for the plan that you need for retirement. Therefore there is the retirement expense sheet template that is there for download. 4.

Vanguard retirement expense worksheet. PDF Budgeting & savings guide - The Vanguard Group Income Amount Expenses (annually) Amount Annual salary* $55,000 Rent/mortgage $26,000 Quarterly trust distributions $10,000 Car expenses $6,200 Annual gifts $30,000 Insurance $2,200 Credit card $72,000 (entertainment) $38,000 (clothing) Electric/gas bills $2,400 Savings $3,000 Charitable donations $1,600 Annual total $95,000 Annual total $151,400 PDF Retirement Budget Worksheet - GetSmarterAboutMoney.ca Title: Retirement budget worksheet Author: GetSmarterAboutMoney.ca Subject: Calculator Keywords: retirement, worksheet, calculator, budget, plan, housing, expenses ... PDF Retirement Expense Worksheet - Capital Advantage Retirement Expense Worksheet Es mate the expenses you have before re rement and those you will have during re rement (if you are currently re red, es mate your current expenses only). Keep in mind that during re rement, some of your expenses may decrease (i.e. dry PDF How to use Monthly budget worksheet this worksheet ... of the worksheet, plug those subtotals into the simple equation and you'll find out what your monthly income—after expenses—could be! Transfer Subtotal A and Subtotal B to their spaces on the next page. Essential Budget Items (A) Household Expenses Mortgage/Rent $ Utilities/Telephone $ Gas/Oil/Water $ General Maintenance $

How to Plan for the Biggest Change in Retirement Expenses ... It's the Vanguard retirement expenses worksheet, so that's one. You can just Google for other ones. I would say really what it comes down to is listing out all your expenses that you have today,... How Much is TOO MUCH in your 401(k)? - Mr. Money Mustache 11.11.2011 · My own strategy was in Vanguard index funds, a paid-off house, and some rental properties, but you will surely find other places depending on your own interests. Since I’m still over 22 years from 401k eligibility myself, I must admit that I haven’t done a huge amount of research into even more advanced strategies involving tax-deferred accounts. Some of you are … PDF Build your Social Security strategy - The Vanguard Group retirement? Use our retirement expenses worksheet Calculate your annual retirement surplus or gap: E F E F C B A D - Enter the higher number = Your retirement savings plus your annual income = could provide this much income each year: Annual Social Security bene˜ts Multiply your monthly estimates by 12. Age 62 You Spouse Full retirement age ... Tools and Calculators Overview | Vanguard Compare the features of a Vanguard-associated 529 savings plan to another state-sponsored 529 plan. Get Started. Tax tools (1) Tax-deferred savings calculator See how the tax deferral you get with a 529 savings plan can add up. Get started. Investment analysis (2) Whether you're a beginner or a seasoned investor, you can make smarter financial decisions with these …

Vanguard - Retirement Expense Worksheet Retirement plan participants. For people who invest through their employer in a Vanguard 401(k), 403(b), or other retirement plan. Institutional investors. For retirement plan sponsors, consultants, and nonprofit representatives. Financial advisors. For broker-dealers, registered investment advisors, and trust or bank brokerage professionals. Use a retirement planning worksheet | Vanguard Life insurance, if you decide to drop it once you retire. Make your retirement budget Our retirement planning worksheet makes it easy to get a complete picture of your retirement budget. Calculate your retirement expenses We're here to help Talk with one of our investment specialists Call 1-888-200-8352 Monday through Friday Tools and Calculators Overview | Vanguard Retirement expense worksheet Create a realistic budget for retirement that includes basic and discretionary expenses. Get started. ... Check to see if your state offers a tax benefit for qualified education expenses and/or Vanguard investments. Get started. College cost projector PDF Retirement income planning worksheet - Merrill Additional Expenses (including one-time purchases) $ Expected Pay Offs $ After you've documented your expenses in retirement and income sources, your Merrill Lynch Wealth Management Advisor can work with you to create a retirement income plan that seeks to align your portfolio and the income it generates to your individual goals and situation.

Is It Better to Do Pre-tax Or Roth 401k? - RetireWire 06.11.2020 · The best retirement clients that we’ve done retirement planning for over the years that come to us, they have a very healthy mix of both pre-tax contributions to their 401(k)/IRA rollover and Roth after-tax contributions. A 50/50 mix is absolutely ideal. But even if it’s 70/30, pre-tax, now this brings up some planning maneuvers that you ...

Use a retirement planning worksheet | Vanguard Use a retirement planning worksheet | Vanguard Figure out your expenses in retirement See what new expenses you might have once you retire—and which ones you can forget about. Potential new costs to consider Health care expenses Once you reach age 65, you qualify for Medicare, the federal health insurance program.

Solved: How to report withdrawal of excess IRA contributio... 09.03.2021 · The 5329 is not required if all 1099-R's have a code 1 - it simply goes on the 1040 Schedule 2 line 6. 5329 instructions: You received a distribution subject to the tax on early distributions from a qualified retirement plan (other than a Roth IRA). However, if distribution code 1 is correctly shown in box 7 of all your Forms 1099-R and you owe the additional tax on …

Retirement Expenses Worksheet | Vanguard You'll have important bills and expenses to pay in retirement. Use this interactive worksheet to help you estimate your monthly retirement expenses. Your expenses Choose the way you want to enter your expense Monthly Annually Enter your estimated expenses for each category, then click Calculate at the bottom to see your total.

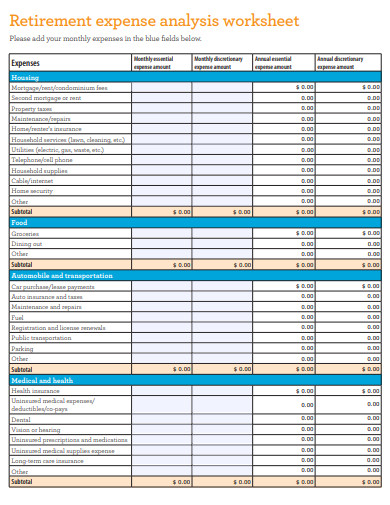

XLSX Annuity Watch USA | Annuity and Retirement Planning Education MEDICAL EXPENSES Medical Insurance, Medigap, Part D, etc. Prescription Drugs Out-of-Pocket Medical Expenses & Monthly Bill Payments RETIREMENT BUDGET SUMMARY Total Retirement Income Total Retirement Expenses Income Surplus or Shortfall Retirement Budget Worksheet by AnnuityWatchUSA.com

Retirement Calculator - Free Retirement Savings Calculator ... Retirement Expenses Worksheet - personal.vanguard.com - This worksheet has you estimate your retirement budget by entering housing costs, personal expenses, living expenses, medical expenses, etc. A good place to start to figure out how long your retirement income is going to last.

Map out your retirement budget - Principal This worksheet (PDF) helps you examine for income sources and detailed expenses more closely. Before you start plotting your budget in detail, know that for most people, different types of retirement income cover different expenses. A typical retirement budget may look like this: Build your budget Fill out this printable budget worksheet (PDF)

PDF Retirement expense worksheet - Wells Fargo And while this worksheet can help you budget for essential and discretionary retirement expenses, be sure to also set aside money to cover unexpected expenses. Investment products and services are offered through Financial Advisors at Wells Fargo Advisors.

How to Plan a Retirement Budget (Free Worksheets) Excel | PDF A retirement budget worksheet is divided into a number of sub-sections so as to record the types of earnings and spending. The templates are designed by professionals and are easy to use. You enter your today's age of retirement, and then the sheets calculate the years you have to plan for your retirement automatically.

SEP vs. SIMPLE vs. Solo 401(k) — Oblivious Investor There’s obviously a lot going on here. Fortunately, you can use the “Deduction Worksheet for Self-employed” from IRS Publication 560 to walk you through the math. I’ve also made a solo 401(k) calculator that you can use. EXAMPLE: You’re under 50 years old, and you have a business with no employees. Your net earnings from self-employment are $100,000 for 2021. If …

Vanguard - Create your retirement spending plan Start by estimating what your retirement will cost. If you're the kind of person who makes budgets, create a spreadsheet of your expenses today and how you expect them to change in retirement. Otherwise, you can take a back-of-the-envelope approach: Take what you spend today and multiply it by 85% or 90%.

Retirement Income Calculator - The Vanguard Group Retirement income calculator. Your retirement is on the horizon, but how far away? You can use this calculator to help you see where you stand in relation to your retirement goal and map out different paths to reach your target. You can print the results for future reference, and rest assured your data will not be saved online.

Retirement income worksheet | Vanguard Use this interactive worksheet to estimate your total monthly income in retirement and determine if you're on track to meeting your financial needs. Rest assured, your data won't be saved online. Taxes and expenses If you included income sources for both you and your spouse, enter your combined estimated taxes and expenses below.

Vanguard - Tools and calculators - Retirement Plans Use this calculator to find out how much you need to contribute each pay period to reach the IRS savings limit by year-end. Start Plan savings Use this tool to determine the effect saving more can have on your paycheck and the amount of income you may expect in retirement. Start Rollover questionnaire

0 Response to "41 vanguard retirement expense worksheet"

Post a Comment