42 itemized deduction worksheet 2015

PDF Deductions (Form 1040) Itemized - IRS tax forms The amount you can deduct for qualified long-term care in- surance contracts (as defined in Pub. 502) depends on the age, at the end of 2015, of the person for whom the premi- ums were paid. See the following chart for details. IF the person was, at the end of 2015, age . . . THEN the most you can deduct is . . . 40 or under $ 380. Fill - Free fillable Form 2015: Itemized Deductions Dental ... Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. Form 2015: Itemized Deductions Dental Medical (Form 1040) (IRS) On average this form takes 18 minutes to complete. The Form 2015: Itemized Deductions Dental Medical (Form 1040) (IRS) form is 1 page long and contains: 0 signatures.

PDF 2015 SCHEDULE CA (540) California Adjustments - Residents 2015 California Adjustments — Residents SCHEDULE CA (540) Important: Attach this schedule behind Form 540, Side 5 as a supporting California schedule. Name(s) as shown on tax return SSN or ITIN Part I Income Adjustment Schedule Section A - Income A Federal Amounts (taxable amounts from your federal tax return) B Subtractions See instructions

Itemized deduction worksheet 2015

PDF Iowa Department of Revenue 2015 IA 104 This worksheet computes the amount of itemized deductions to enter on line 26 of the IA Schedule A. Step 1 Complete the IA Schedule A, lines 1-25. Step 2 Re-compute the federal Itemized Deduction Worksheet: 1. Enter the sum of lines 3, 8, 13, 17, 18, 24, and 25 from the IA Schedule A .................1. 2. PDF 2015 Extended Organizer Blank Forms - Intuit NOTE: No deduction is allowed for contributions of clothing and household items that are not in good used condition or better, in addition, a deduction for any item with minimal monetary value may be denied. Attach Forms 1098 1040 US Tax Organizer Tax Organizer ORGANIZER 2015 2015 Amount 2014 Amount FREE 2015 Printable Tax Forms | Income Tax Pro File federal Form 1040A if you met these requirements for 2015: Taxable income less than $100,000. No itemized deductions, mortgage interest, property tax, etc. No capital gain or loss, no other gains or losses. No business income or loss, self-employed, LLC, etc. No farm or fisherman income or loss.

Itemized deduction worksheet 2015. Since you repaid the taxable amounts in 2015, the amounts... Since you repaid the taxable amounts in 2015, the amounts repaid are entered as an itemized deduction on Schedule A or as a tax credit on Form 1040 Line 73d as a Claim of Right IRC 1341, depending on the amount repaid. To report the repayment of taxable income as an itemized deduction on Schedule A -. Click on Federal Taxes (Personal using Home ... PDF QPE Table of Contents Itemized Deductions Worksheet 2015 State and Local Sales Tax Deduction Health Coverage Exemptions Where to File 2015 Form 1040, 1040A, 1040EZ Where to File Form 1040-ES for 2016 Where to File Form 4868 for 2015 Return Tab 4 2015 Form 1040—Line-By-Line Line-By-Line Quick Reference to 2015 Form 1040 PDF 2015 *VA760P115888* 760PY - Virginia 2015 Virginia Part-Year Resident Income Tax Return Due May 2, 2016 Form *VA760P115888* 760PY Page 1 Your Birth Date (mm-dd-yyyy) Spouse's Birth Date (mm-dd-yyyy) B Spouse Filing Status 4 ONLY A You Include Spouse if Filing Status 2 Complete the Schedule of Income first and submit it with your Form 760PY. 00 00 1 PDF K-40 2015 Kansas Individual Income Tax Standard deduction OR itemized deductions (if itemizing, complete Part C of Schedule S) 4 00 5. Exemption allowance ($2,250 x number of exemptions claimed) ............................................. 5 00 6. Total deductions (add lines 4 and 5) 6 00 7. Taxable income (subtract line 6 from line 3; if less than zero, enter 0) 7 00 Tax

IRS 1040 - Schedule A 2015 - Fill and Sign Printable ... What itemized deductions are allowed in 2019? The standard deduction amounts will increase to $12,200 for individuals, $18,350 for heads of household, and $24,400 for married couples filing jointly and surviving spouses. PDF Attach to Form 1040. - IRS tax forms Your deduction is not limited. Add the amounts in the far right column for lines 4 through 28. Also, enter this amount on Form 1040, line 40.}.. Yes. Your deduction may be limited. See the Itemized Deductions Worksheet in the instructions to figure the amount to enter. 30 . If you elect to itemize deductions even though they are less than your ... PDF 2015 Form MO-1040A Individual Income Tax Return Single ... Complete this worksheet only if your federal adjusted gross income from federal Form 1040, Line 37 is more than $309,900 if married filing combined or qualifying widow(er), $284,050 if head of household, $258,250 if single or claimed as a dependent, or $154,950 if married filing separate. PDF Qualified Health Ins Premiums Worksheet 2015 - Missouri QUALIFIED HEALTH INSURANCE PREMIUMS WORKSHEET FOR MO-A, LINE 12 Complete this worksheet and attach it, along with proof of premiums paid, to Form MO-1040 if you included health insurance premiums paid as an itemized deduction or had health insurance premiums withheld from your social security benefits.

PDF 2015 I-128 Instructions for Completing Wisconsin Schedule I 2015 HSA Worksheet 1. Balance of HSA as of December 31, 2010, less amount distributed in 2011-2014. (This is the amount from line 3 of the worksheet in the 2014 Schedule I instructions.) ............. 1. 2. 2015 distributions from the HSA. Do not fill in more than the amount on line 1 ... 2. 3. Subtract line 2 from line 1 ........... 3. 4. PDF Form IT-203-B:2015:Nonresident and Part-Year Resident ... And College Tuition Itemized Deduction Worksheet Name(s) and occupation(s) as shown on Form IT-203 Your social security number Complete all parts that apply to you; see instructions (Form IT-203-I). Submit this form with your Form IT-203. Schedule A - Allocation of wage and salary income to New York State Nonworking days included in line 1a: 2015 personal income tax forms - Government of New York IT-2658-I (Instructions) Attachment to Form IT-2658, Report of Estimated Personal Income Tax for Nonresident Individuals; Payments due April 15, June 15, September 15, 2015, and January 15, 2016. IT-2658-E (Fill-in) (10/13) Instructions on form. Certificate of Exemption from Partnership or New York S Corporation Estimated Tax Paid on Behalf of ... PDF 2015 M1M, Income Additions and Subtractions Itemized Deduction Limitation Complete the worksheet for line 1 on this page if your federal adjusted gross income is more than $184,000 ($92,000 if married filing separate) and you filed federal Schedule A. Line 2 Personal and Dependent Exemption Phase Out Complete the worksheet for line 2 (on the next page) if your federal adjusted gross

Itemized Deductions Spreadsheet Printable Spreadshee Itemized Deductions Spreadsheet. itemized ...

PDF 2015 Itemized Deductions Worksheet 2015 ITEMIZED DEDUCTIONS WORKSHEET For 2015 the "Standard Deduction" is $12,600 on a Joint Return, $9,250 for a Head of Household, and $6,300 if you are Single. If you normally itemize your personal deductions or even think that itemized deductions might benefit you this year, we will need to know the following expenses.

PDF SCHEDULE 2 ITEMIZED DEDUCTIONS FORM 1040ME for ... - Maine 2015 Worksheet for Maine Schedule 2, line 2a For individuals whose federal adjusted gross income exceeds $309,900 if married fi ling jointly or qualifying widow(er), $284,050 if head-of-household, ... 2 Enter federal itemized deductions subject to reduction (from federal itemized deductions worksheet, line 3) ...

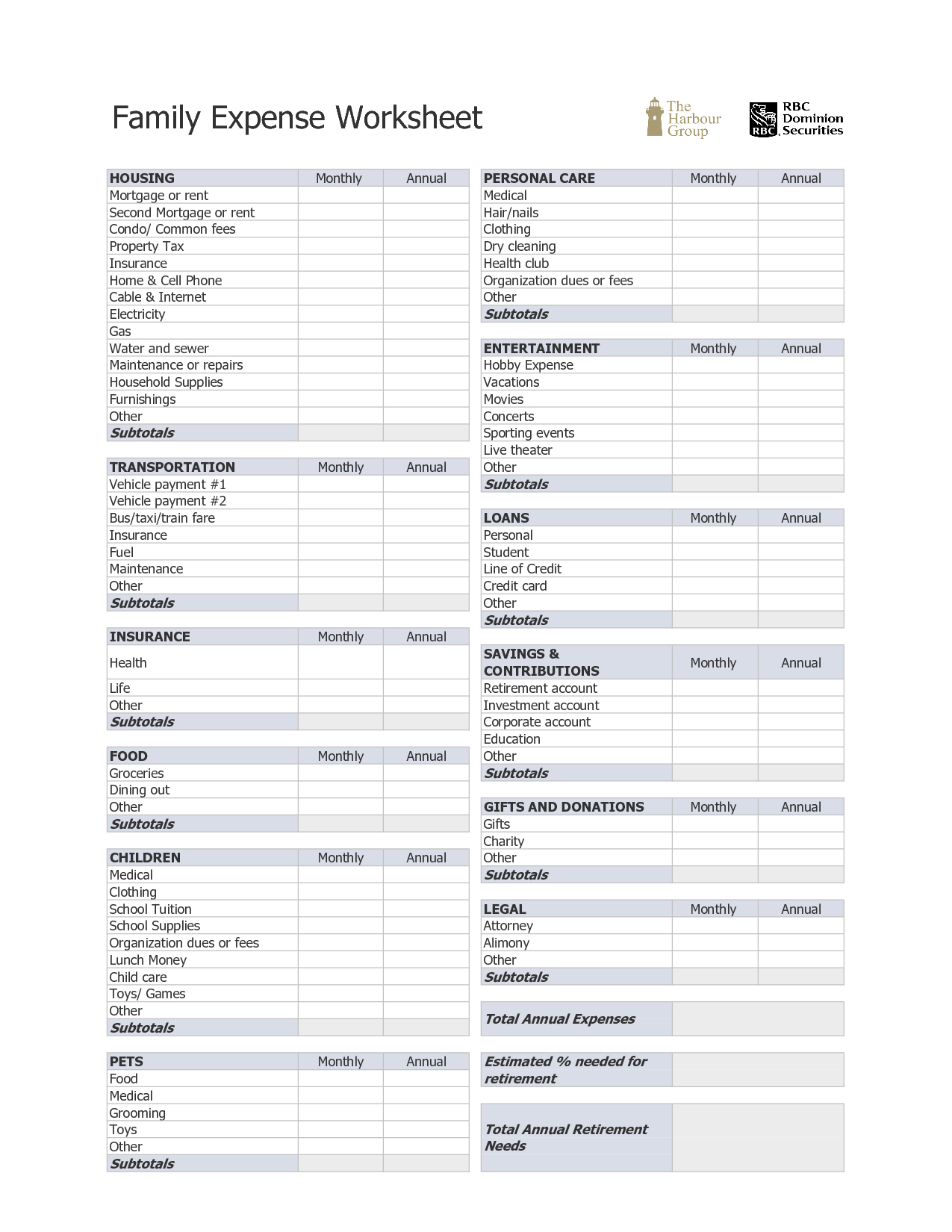

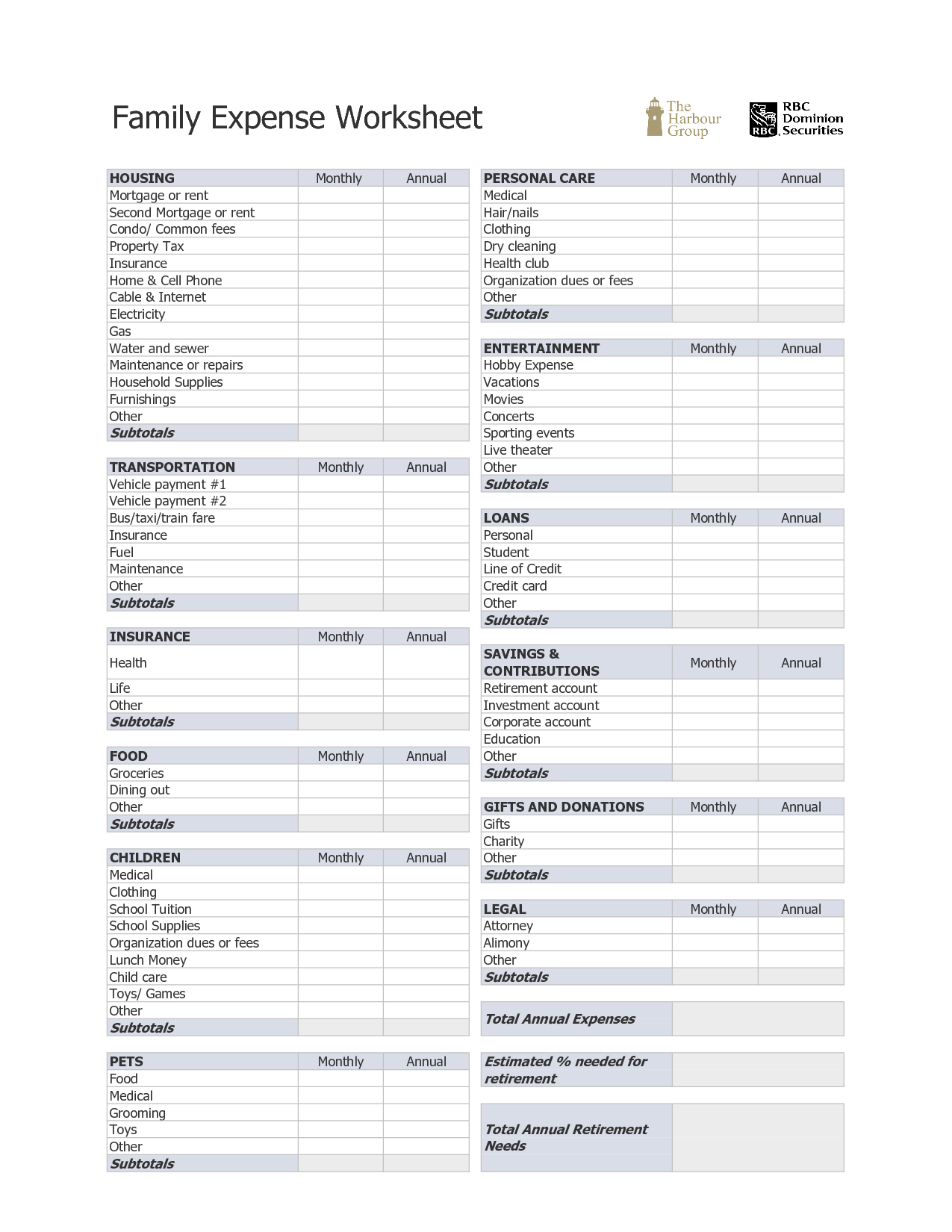

16 Best Images of Free Income And Expense Worksheet - Blank Monthly Budget Spreadsheet, Business ...

2015 Individual Income Tax Forms - Maryland Office of the ... Maryland Nonresident Itemized Deduction Worksheet: Worksheet for nonresident taxpayers who were required to reduce their federal itemized deductions. Resident Individuals Income Tax Forms. Number ... Form and instructions to be used by resident individuals for amending any item of a Maryland return for tax year 2015. 588:

PDF Itemized deductions worksheet ca 540 Itemized deductions worksheet in the instructions for schedule ca (540nr). Line 7 - Unemployment Compensation California excludes unemployment compensation from taxable income. Line 23, column C to Form 540, line 16 If column C is a negative number, transfer the amount as a positive number to Form 540, line 14.

PDF 2015 State and Local Income Tax Refund Worksheet 2016 1 Enter the amount from line 3, worksheet 3 above 1 2 Enter your total allowable itemized deductions from your 2015 Schedule A line 29 2 Note. If your 2015 filing status was MFS and your spouse itemized deductions in 2015, skip lines 3, 4, and 5, and enter the amount from line 2 on line 6 below. 3 Enter the amount shown below for the filing ...

PDF Itemized Deductions Detail Worksheet (PDF) - IRS tax forms Schedule A - Itemized Deductions (continued) To enter multiple expenses of a single type, click on the small calculator icon beside the line. Enter the first description, the amount, and Continue. Enter the information for the next item. They will be totaled on the input line and carried to Schedule A. If taxpayer has medical insurance

PDF Itemized Deductions - IRS tax forms Itemized Deductions 20-1 Itemized Deductions Introduction This lesson will assist you in determining if a taxpayer should itemize deductions. Generally, taxpayers should itemize if their total allowable deductions are higher than the standard deduction amount. Objectives At the end of this lesson, using your resource materials, you will be able to:

Deduction | Iowa Department Of Revenue For tax year 2015, the itemized deduction for state sales and use tax is allowed on the Iowa Schedule A. If a taxpayer claimed an itemized deduction for state sales and use tax paid on the Federal return, the taxpayer must claim the itemized deduction for state sales and use tax paid on the Iowa return.

PDF Forms & Instructions California 540 2015 Personal Income ... • See Form 540, line 18 instructions and worksheets for the amount of standard deduction or itemized deductions you can claim . Computing your tax: • Verify the total tax amount on Form 540, line 64 is calculated correctly . • Go to ftb.ca.gov and search for tax calculator to compute your tax with the tax calculator or with the tax tables .

16 Best Images of Free Income And Expense Worksheet - Blank Monthly Budget Spreadsheet, Business ...

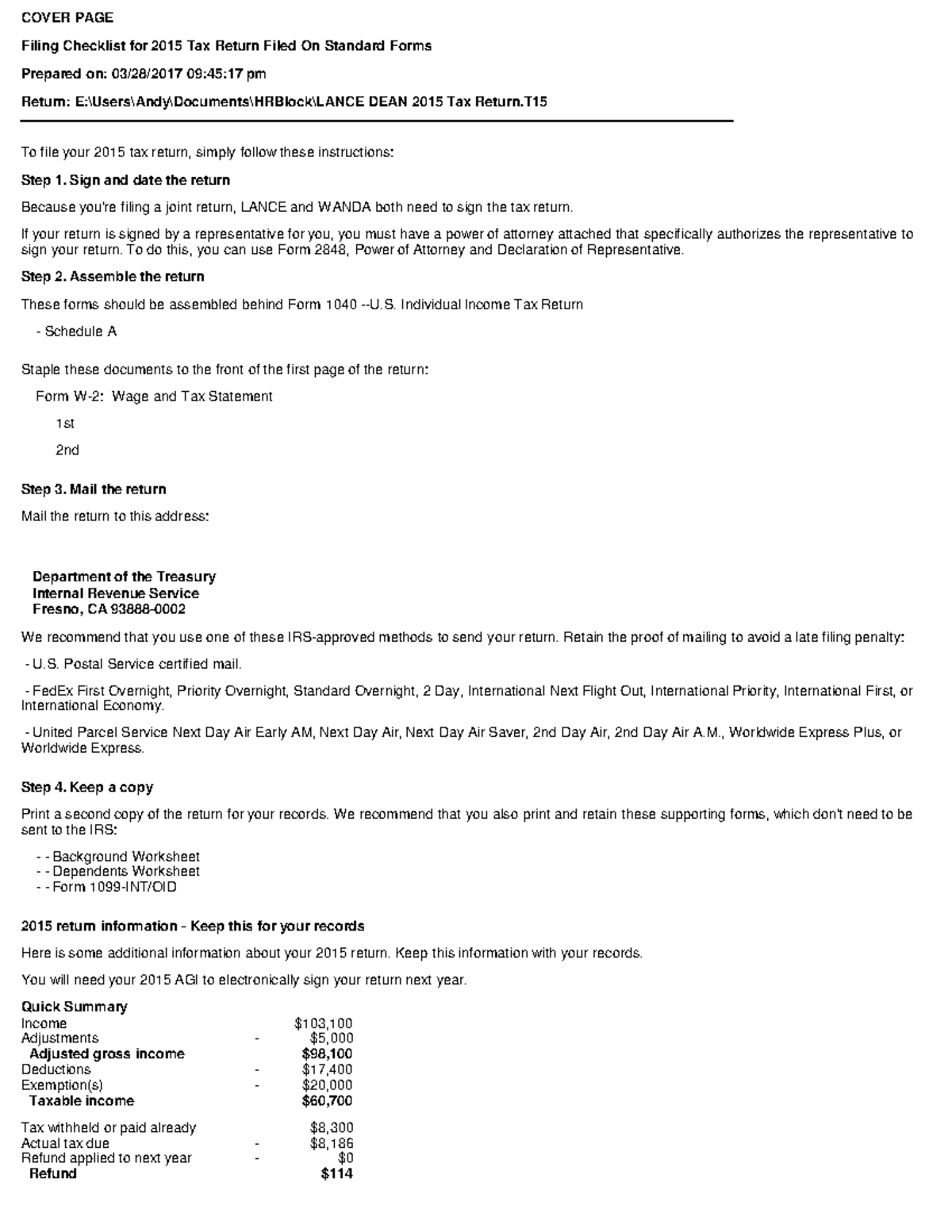

FREE 2015 Printable Tax Forms | Income Tax Pro File federal Form 1040A if you met these requirements for 2015: Taxable income less than $100,000. No itemized deductions, mortgage interest, property tax, etc. No capital gain or loss, no other gains or losses. No business income or loss, self-employed, LLC, etc. No farm or fisherman income or loss.

Itemized Deductions Spreadsheet Printable Spreadshee Itemized Deductions Spreadsheet. itemized ...

PDF 2015 Extended Organizer Blank Forms - Intuit NOTE: No deduction is allowed for contributions of clothing and household items that are not in good used condition or better, in addition, a deduction for any item with minimal monetary value may be denied. Attach Forms 1098 1040 US Tax Organizer Tax Organizer ORGANIZER 2015 2015 Amount 2014 Amount

PDF Iowa Department of Revenue 2015 IA 104 This worksheet computes the amount of itemized deductions to enter on line 26 of the IA Schedule A. Step 1 Complete the IA Schedule A, lines 1-25. Step 2 Re-compute the federal Itemized Deduction Worksheet: 1. Enter the sum of lines 3, 8, 13, 17, 18, 24, and 25 from the IA Schedule A .................1. 2.

0 Response to "42 itemized deduction worksheet 2015"

Post a Comment