45 tax write off worksheet

15 Tax Deductions and Benefits for the Self-Employed The self-employment tax rate is 15.3%: 12.4% for Social Security and 2.9% for Medicare. 8 Employers and employees share the self-employment tax. Each pays 7.65%. 9 People who are fully... Free Goodwill Donation Receipt Template - PDF - eForms How to Write. Download: Adobe PDF. 1 - Save The Goodwill Receipt Template. The receipt used to document a Goodwill donation can be accessed with the "Adobe PDF" link above. Select it then download this file. If you have compatible software, you may enter information onscreen however, many would consider it wise to have such paperwork in a ...

Free Clothing Donation Tax Receipt - PDF | Word - eForms Donating clothes can be a great tax write-off for any individual that pays income tax at the end of the year. It may not be much but commonly an organization that does take used clothing will "round up" or estimate the clothes to be at a higher price than they may actually be sold. Step 1 - Gather Usable Clothes

Tax write off worksheet

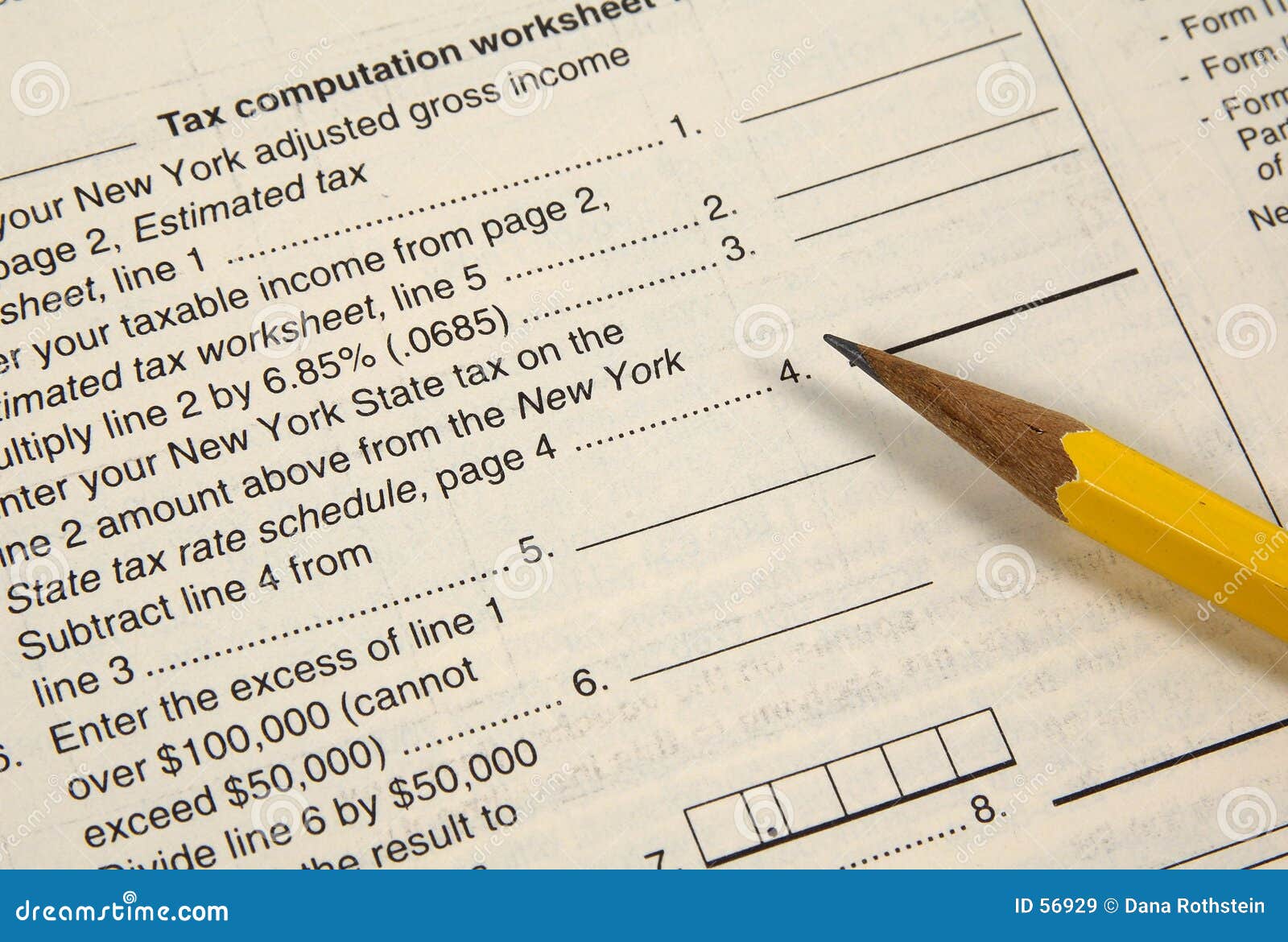

Instructions for Form 4562 (2021) - IRS tax forms Worksheet 1.Worksheet for Lines 1, 2, and 3 Line 5 Line 6 Column (a)—Description of property. Column (b)—Cost (business use only). Column (c)—Elected cost. Line 7 Line 10 Line 11 Individuals. Partnerships. S corporations. Corporations other than S corporations. Line 12 Part II. Special Depreciation Allowance and Other Depreciation Line 14 17 Big Tax Deductions for Small Businesses (2022) | Bench ... A tax deduction (or "tax write-off") is an expense that you can deduct from your taxable income. You take the amount of the expense and subtract that from your taxable income. Essentially, tax write-offs allow you to pay a smaller tax bill. But the expense has to fit the IRS criteria of a tax deduction. The Ultimate Small Business Tax Deductions Worksheet for ... According to Fundera, on average, the effective small business tax rate is 19.8%, adding that sole proprietorships pay a 13.3% tax rate and small partnerships pay a 23.6% tax rate. Assuming your effective tax rate is 20%, that $5,000 tax deduction will save you $1,000. Without deductions: $50,000 x .2 = $10,000.

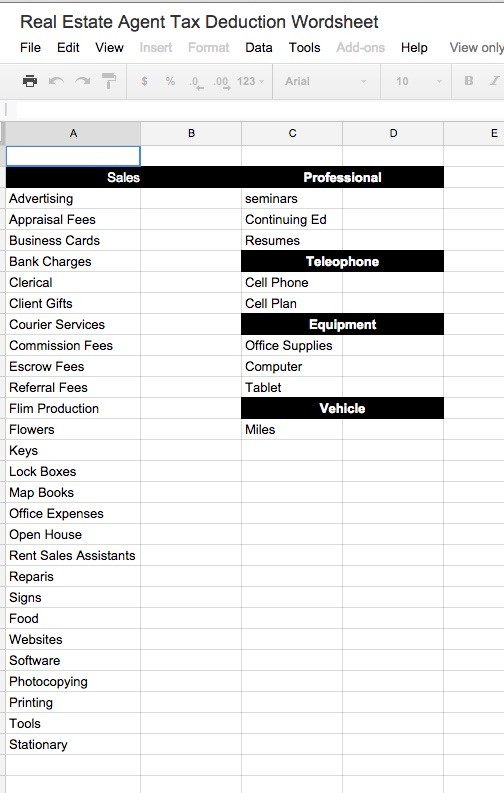

Tax write off worksheet. 19 Truck Driver Tax Deductions That Will Save You Money ... Like your cell phone plan, you can deduct the full cost of any phone, laptop, tablet, or other electronic device that you use only for work. If you use it for both business and personal reasons, you can deduct the portion related to work. So if your new laptop cost $1,000 and you use it for work 50% of the time, you can deduct $500. Education What Is Form 941 Worksheet 1 And How To Use It? - Tax1099 Blog Worksheet 1 of Form 941 allows the employer to figure the employer's portion of the social security tax and the paid time off provided to the employees in a quarter. It has two basic steps and a third step (which is extended to Worksheet 2 of Form 941) as follows. Step 1: Determine the employer's share of social security tax this quarter. 12 Biggest Tax Write Offs for LLC Small Businesses! 12 Biggest Tax Write Offs For LLC Businesses 1. Startup and Organizational Costs This write-off allows you to deduct up to $5,000 in startup costs and up to $5,000 in organizational costs. Startup costs include ALL costs incurred to get your business up and running. Examples include the money you spend on: researching your business, Sales Tax Deduction: How It Works, What to Deduct - NerdWallet State: $29.95 to $44.95. All filers get access to Xpert Assist for free until April 7. Promotion: NerdWallet users get 25% off federal and state filing costs. Get started. Federal: $39 to $119 ...

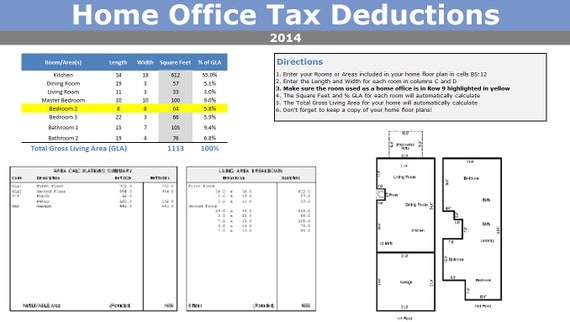

A Free Home Office Deduction Worksheet to ... - Keeper Tax The worksheet will automatically calculate your deductible amount for each purchase in Column F. If it's a "Direct Expense," 100% of your payment amount will be tax-deductible. If it's an expense in any other category, the sheet will figure out the deductible amount using your business-use percentage. Dragging down the deductible amount formula COVID-19-Related Tax Credits: Basic FAQs | Internal ... COVID-19-Related Tax Credits: Basic FAQs. These updated FAQs were released to the public in Fact Sheet 2022-16 PDF, March 3, 2022. Note that the American Rescue Plan Act of 2021, enacted March 11, 2021, amended and extended the tax credits (and the availability of advance payments of the tax credits) for paid sick and family leave for wages ... Rental Property Deduction Checklist: 21 Tax Deductions for ... 21 Tax Deductions for Landlords 1. Losses from Theft or Casualty 2. Property Depreciation 3. Repairs & Maintenance 4. Segmented Depreciation 5. Utilities 6. Home Office 7. Real Estate-Related Travel 8. Meals 9. Closing Costs 10. Property Management Fees 11. Rental Property Insurance & Rent Default Insurance 12. Mortgage Interest 13. Tax Tips for Freelance Writers and Self-Published Authors ... The amount you owe—15.3% as of the 2021 tax year—is based on the net amount of income you arrived at when you completed your Schedule C. The IRS gives a little back, however. You can deduct half of your self-employment tax on the first page of your tax return, reducing your overall taxable income. If You Also Earned Royalties

Tax Write-Offs You Can Deduct in 2019 - Due Tax day is right around the corner, and I bet you want to make the most out of tax write-offs. The idea of a tax write-off may be confusing to some. It's essentially an expense that you can deduct from your taxable income when you're filing your tax return. This guide will provide withhelpful information on some of the more popular write ... 53 tax deductions & tax credits you can take in 2022 ... 1. Recovery rebate credit. The IRS began paying the third coronavirus stimulus check (also called an economic impact payment) in March 2021. If you didn't receive the full value of your payment — up to $1,400 for an individual, $2,800 for a couple, and $1,400 per dependent — you can receive any missing amount on your 2021 tax return by claiming the recovery rebate credit. Hairstylist Tax Write Offs Checklist for 2022 | zolmi.com A tax write off for hairstylists allows you to claim different expenses as long as they are both necessary and ordinary- meaning that these things need to help you run your business and be related to or commonly accepted in your line of work. An Updated Tax Write-Off Worksheet, by the Nosiest ... An Updated Tax Write-Off Worksheet, by the Nosiest Employee at the IRS Who kept the dog? by Kelsey Harper | April 5, 2022; Did you receive a stimulus payment (Notice 1444-C or Letter 6475)? Did you receive wages (Form W-2)? Did you receive state and city refunds (Form 1099-G)?

Top 25 1099 Deductions For Independent ... - Keeper Tax 6.2% Social Security tax on the first $128,700 of taxable income 1.45% Medicare tax regardless of taxable income amount In 2018, the standard tax percentage for self-employed individuals is 15.3% (whereas a standard employee would pay 7.65% and their employer would also pay 7.65%).

Capital Gains Tax Calculation Worksheet - The Balance Long-term tax rates are lower in most cases, set at 0%, 15%, or 20% as of 2022. Short-term gains are taxed according to your tax bracket for your ordinary income. You can offset capital gains with capital losses, which can provide another nice tax break, although certain rules apply.

12 Common Tax Write-Offs You Can Deduct From Your Taxes ... For the 2021 tax year (filed in 2022), the standard deduction amounts are: $12,550 for single and married filing separate taxpayers $18,800 for head of household taxpayers $25,100 for married...

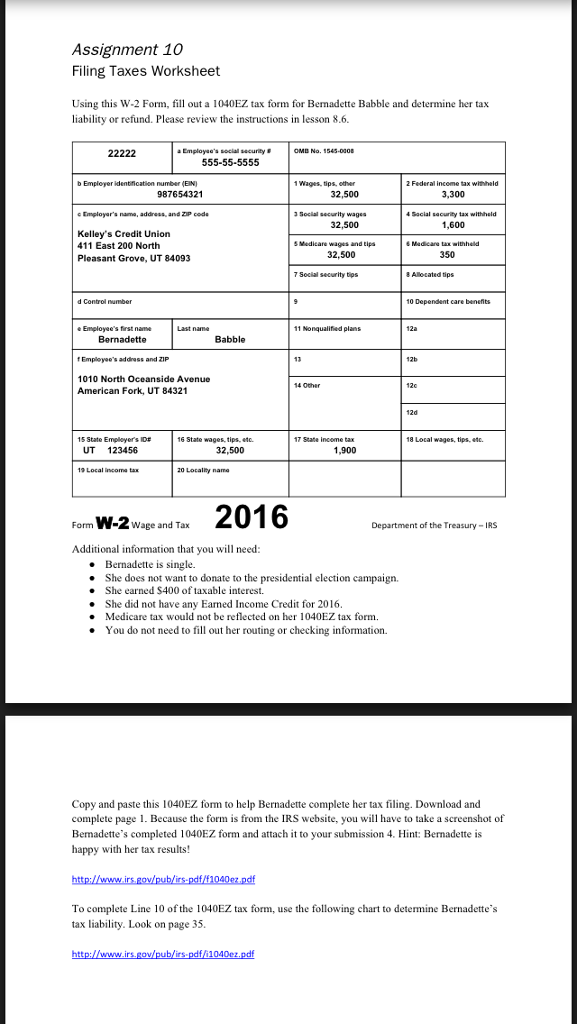

How Your Tax Is Calculated: Tax Table and Tax Computation ... The second worksheet is called the "Tax Computation Worksheet." It can be found in the instructions for 1040 Line 16. This second worksheet is used twice in the Qualified Dividends and Capital Gain Tax Worksheet to help taxpayers calculate the amount of income tax owed.

What Can I Write Off on My Taxes? A Guide to Tax ... The standard deduction for tax year 2021 is $25,100 for married couples filing jointly and for qualified widows and widowers under age 65 ($26,450 if age 65 or older). For single filers and married couples filing separately, the deduction is $12,550. If you file as head of household, you can deduct $18,800.

15 Self-Employment Tax Deductions in 2022 - NerdWallet Yes, you can deduct self-employment tax as a business expense. It's actually one of the most common self-employment tax deductions. The self-employment tax rate is 15.3% of net earnings. That rate...

Section 179 Deduction Vehicle List 2021-2022 - Tax Savers ... Internal Revenue Code, Section 179 Deduction allows you to expense up to $25,000 on Vehicles (One year) that are between 6000 Pounds and 14,000 Pounds or More in the year they are placed in service. If you are looking to write off the entire purchase price of G Wagon, look into Bonus depreciation rules that were passed under TCJA.

W-4 Form: How to Fill It Out in 2022 - Investopedia Assuming Spouse A makes $80,000 per year and Spouse B makes $50,000 per year, Spouse A would need to select $8,120 (the intersection of the $80,000-$99,999 row from the left-hand column and the...

The Home Office Deduction - TurboTax Tax Tips & Videos 34% of available hours x 40% of the house used for business = 13.6% business write-off percentage. Simplified square footage method Beginning with 2013 tax returns, the IRS began offering a simplified option for claiming the deduction. This new method uses a prescribed rate multiplied by the allowable square footage used in the home.

Top 8 lawn care and landscaping business tax deductions | NEXT No matter the size of the expenses, include them as landscaping tax deductions. You may also be able to write off equipment depreciation. 4. Rent expense deduction. You might not have a separate office space where you run your business, but some landscapers and lawn care professionals rent storage space to keep their equipment and supplies.

16 amazing tax deductions for independent contractors | NEXT Whatever the case, if the fees are a necessary expense related to operating your business, write them off. 14. Self-employment tax deduction. When filling out your tax form as a self-employed worker, self-employment taxes can be something of a shock. That's because you're paying both the employer and employee sides of Social Security tax and ...

The Ultimate Small Business Tax Deductions Worksheet for ... According to Fundera, on average, the effective small business tax rate is 19.8%, adding that sole proprietorships pay a 13.3% tax rate and small partnerships pay a 23.6% tax rate. Assuming your effective tax rate is 20%, that $5,000 tax deduction will save you $1,000. Without deductions: $50,000 x .2 = $10,000.

17 Big Tax Deductions for Small Businesses (2022) | Bench ... A tax deduction (or "tax write-off") is an expense that you can deduct from your taxable income. You take the amount of the expense and subtract that from your taxable income. Essentially, tax write-offs allow you to pay a smaller tax bill. But the expense has to fit the IRS criteria of a tax deduction.

Instructions for Form 4562 (2021) - IRS tax forms Worksheet 1.Worksheet for Lines 1, 2, and 3 Line 5 Line 6 Column (a)—Description of property. Column (b)—Cost (business use only). Column (c)—Elected cost. Line 7 Line 10 Line 11 Individuals. Partnerships. S corporations. Corporations other than S corporations. Line 12 Part II. Special Depreciation Allowance and Other Depreciation Line 14

7 Insanely Awesome Write-Offs that Solopreneurs Need to Know | Business tax, Tax write offs ...

0 Response to "45 tax write off worksheet"

Post a Comment