39 chapter 7 federal income tax worksheet answers

226 Payroll Accounting Chapter 7: Comprehensive Projects ... - Course Hero Answer to 226 Payroll Accounting Chapter 7: Comprehensive Projects-Paper-Based Versions One-Month Project NOTE! ... Please answer the question from 1 to 8. I tried to attach excel worksheet to provide templet but its not letting me upload that. ... When calculating federal income tax withholding, use the withholding tables where possible, and ... Publication 505 (2022), Tax Withholding and Estimated Tax Use Worksheet 1-2 if you are a dependent for 2022 and, for 2021, you had a refund of all federal income tax withheld because of no tax liability. Worksheet 1-3 Projected Tax for 2022: Project the taxable income you will have for 2022 and figure the amount of tax you will have to pay on that income. Worksheet 1-4 Tax Computation Worksheets for 2022

Lesson 2.3 Federal Income Taxes Worksheet Answers Chapter 7 Federal Income Tax Worksheet Answers. Our Federal Income Tax Plan Worksheet Answers. Section 2 1 Federal Income Tax Worksheet Answers. ... Chapter 13 Lab From Dna To Protein Synthesis Worksheet Answers. Monthly Retirement Planning Worksheet Chapter 8 Answers. Federal Income Tax Ez Form.

Chapter 7 federal income tax worksheet answers

Our Federal Income Tax Plan Worksheet Answers - Worksheet : Resume ... Chapter 7 Federal Income Tax Worksheet Answers. Section 2 1 Federal Income Tax Worksheet Answers. ... Monthly Retirement Planning Worksheet Chapter 8 Answers. Federal Income Tax Ez Form. Income Tax Organizer Worksheet. Federal Income Tax Form 1040 Pdf. Federal Income Tax Form 1040a. PDF Chapter Answer Key For Income Tax Fundamentals Federal Income Tax Form 1040a. Chapter 7 Federal Income Tax Worksheet Answers - Worksheet ... Answer Key Chapter 15 - Principles of Microeconomics 2e | OpenStax. 1. Poverty falls, inequality rises. Poverty rises, inequality falls. 2. Jonathon's options for working and total income are shown in the following table. His labor-leisure diagram is ... Income Tax Worksheets Teaching Resources - Teachers Pay Teachers Elena Teixeira. $1.75. Word Document File. This worksheet will take your students through a step-by-step simulation of calculating their net income from a gross income starting point. This is a great starting point for a budgeting lesson, as students experience the effect of taxes prior to budgeting for needs and wants.

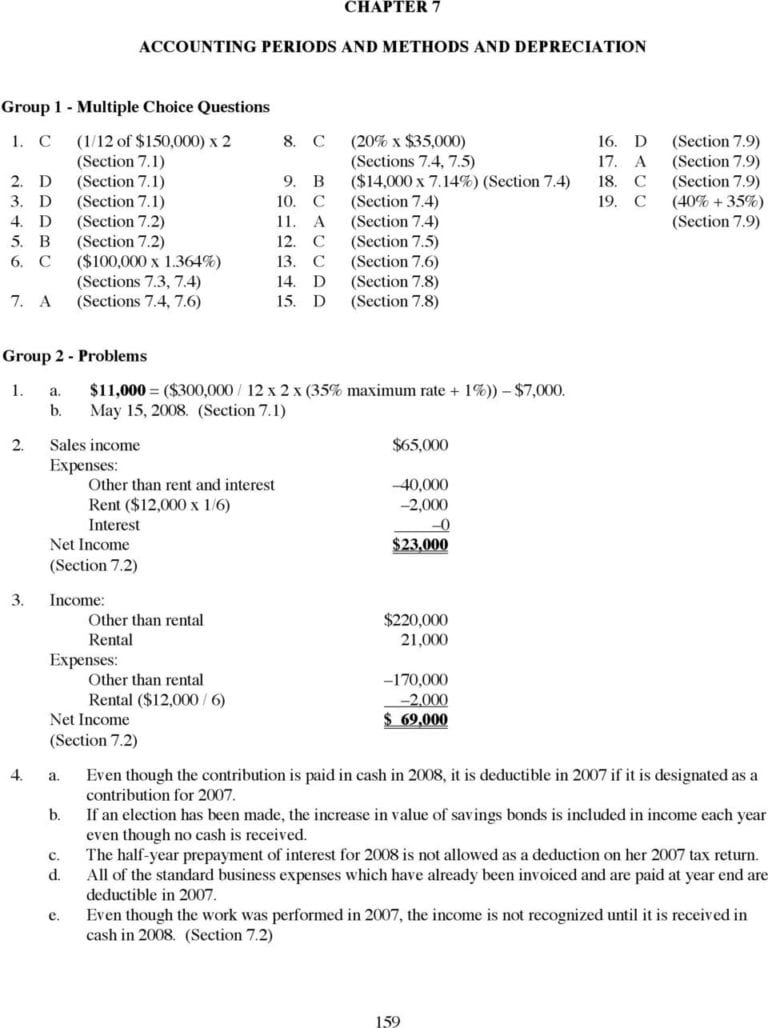

Chapter 7 federal income tax worksheet answers. Chapter 7, Income Taxes Video Solutions, Financial Algebra - Numerade A taxpayer has a taxable income of $ 39, 800. What is her tax? b. A taxpayer will owe $ 21, 197. What is his taxable income? c. What is the approximate tax for an income of $ 30, 000? d. What is the approximate tax for an income of $ 99, 000? e. Nick is paid every other week. He has $ 390 taken out of each paycheck for federal taxes. income tax chapter 7 Flashcards and Study Sets | Quizlet Income Tax - Chapter 7 1. How are the terms basis, adjusted ba… 2. What is meant by the terms realized… 3. How can the gain from the sale of pr… Proceeds are FMV ... gain and loss = Act realized (Proceeds) - Ad… Realized is what you calculate and recognized is what you put… 1. ordinary income ... 2. Capital assets... 3. Trade or business 80 Terms Chapter 7 Federal Income Tax Worksheet Answers - Worksheet : Resume ... 21 Gallery of Chapter 7 Federal Income Tax Worksheet AnswersOur Federal Income Tax Plan Worksheet AnswersSection 2 1 Federal Income Tax Worksheet AnswersLesson 2.1 Federal Income Taxes Worksheet AnswersLesson 2.3 Federal Income Taxes Worksheet AnswersChapter 13 Lab From Dna To Protein Synthesis Worksheet AnswersMonthly Retirement Planning ... Solved Refer to your course textbook! Chapter 7 - Chegg.com Chapter 7 - Cumulative Problem #59 - Jane Smith Requirements You are required to prepare all necessary 2015 forms and schedules using the PDF forms provided at the IRS website. DO NOT USE TAX SOFTWARE Show detailed calculations for partial credit and receipt of useful feedback. Attach your tax return as a PDF file Attach your

Chapter 7 Section 3 Money Elections Worksheet Answers (PDF) - sonar ... quickly download this Chapter 7 Section 3 Money Elections Worksheet Answers after getting deal. So, similar to you require the ebook swiftly, you can straight acquire it. Its as a result certainly simple and hence fats, isnt it? You have to favor to in this declare Congressional Record United States. Congress 1969 The PDF Name Date Worksheet Solutions s - IRS tax forms Answer Key: A.Personal computer B. Tax Professional ABram is unmarried and has no children. His only source of income is from his after- school job at a retirement home. Bram loves computers, technology, and problem solving. BLee and Nu are married and have two children. They own their own business, a bakery. Quiz & Worksheet - Taxation Principles & Structures | Study.com About This Quiz & Worksheet. Use this quiz/worksheet combo to gauge your knowledge of different taxation principles. Practice questions assess your understanding of income taxes and federal tax ... Lesson 2.1 Federal Income Taxes Worksheet Answers - Worksheet : Resume ... Chapter 7 Federal Income Tax Worksheet Answers. Our Federal Income Tax Plan Worksheet Answers. Section 2 1 Federal Income Tax Worksheet Answers. ... Chapter 13 Lab From Dna To Protein Synthesis Worksheet Answers. Monthly Retirement Planning Worksheet Chapter 8 Answers. Federal Income Tax Ez Form.

Personal Finance Chapter 7 Vocabulary Flashcards | Quizlet Chapter 7 Vocabulary- Federal Income Tax FLASHCARDS LEARN WRITE SPELL TEST MATCH GRAVITY Upgrade to remove ads Only $1/month revenue CLICK THE CARD TO FLIP IT Money collected by the government by citizens and businesses in the form of taxes CLICK THE ARROWS BELOW TO ADVANCE 1/17 Terms in this set (17) revenue Publication 970 (2021), Tax Benefits for Education | Internal ... Refunds received after 2021 and after your income tax return is filed. If anyone receives a refund after 2021 of qualified education expenses paid on behalf of a student in 2021 and the refund is paid after you file an income tax return for 2021, you may need to repay some or all of the credit. See Credit recapture next. Chapter 7: Federal Income Tax Flashcards | Quizlet A tax system that is based on ______ requires all citizens to be responsible for preparing and filling their tax returns on time and paying taxes due. proportional tax A type of tax for which the rate stays the same regardless of income is called ______. tax credit A ________ is an amount subtracted directly from tax owed. Chapter 7: Federal Income Tax Flashcards | Quizlet Chapter 7: Federal Income Tax STUDY Flashcards Learn Write Spell Test PLAY Match Gravity Created by gerite1025 Terms in this set (35) revenue Money collected by the government from various sources is known as ______. progressive A tax that increases in proportion to increase in income is known as a _____ tax. taxable

PDF What You'll Learn Section 2-1 Section 2-2 Section 2-3 Section 2-4 116 Chapter 2 Net Income Federal Income Tax Federal prosecutors convict those who fail to file a tax return. The average sentence is more than three years. ... Complete the problems, then check your answers at the end of the chapter. Find the amount withheld annually for state tax. 3. Gross pay: $23,760. 4. Gross pay: $43,300. Married, 3 ...

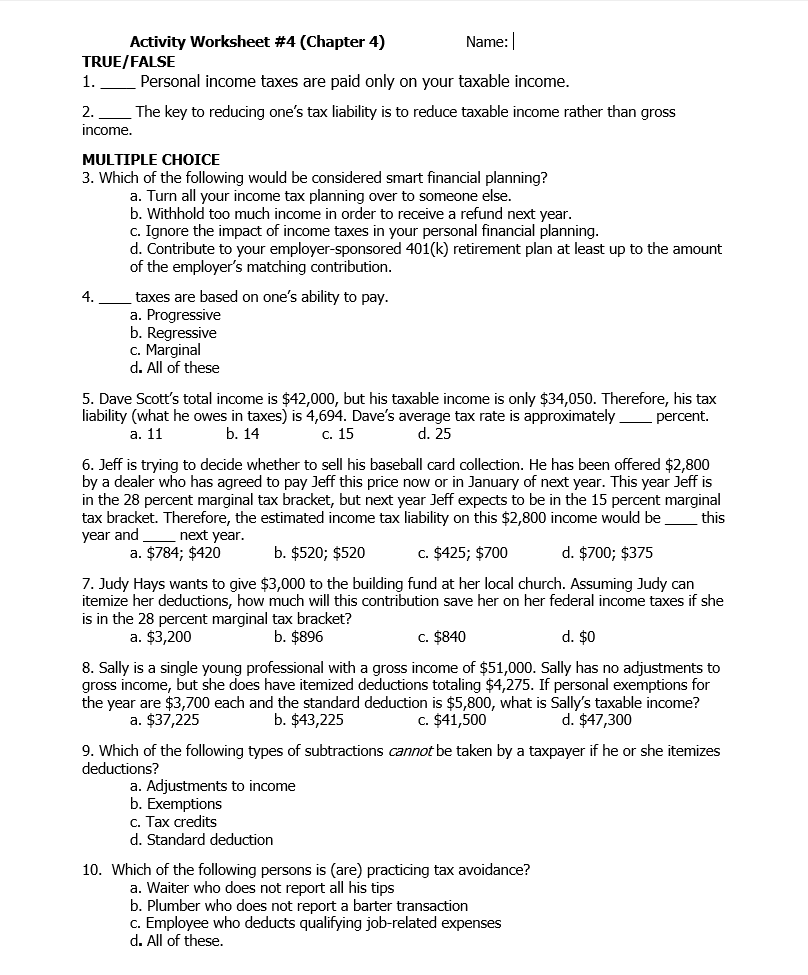

Quiz & Worksheet - Federal Income Tax Returns | Study.com Work through our quiz and worksheet to test your knowledge of how to file a federal income tax return. Some topics you will need to understand for the multiple-choice quiz include different tax ...

Payroll Projec.docx - Payroll Accounting 2019 Bieg/Toland... complete the Federal Deposit Information Worksheet. No. 31Deposit with the city of Philadelphia the amount of city income taxes withheld from the December payrolls. 7-4d February 1 LO 5 No. 32Prepare Form 941, Employer's Quarterly Federal Tax Return, with respect to wages paid during the last calendar quarter.

Use this tax computation worksheet to answer Exercises 11-14. Use this tax computation worksheet to answer Exercises 11-14. ... Watch More Solved Questions in Chapter 7. Problem 1. Problem 2. Problem 3. Problem 4. Problem 5. Problem 6. Problem 7. Problem 8. Problem 9. ... Federal Income Tax Two 2014 Tax Rate Schedules are given in the accompanying…

federal tax worksheet for answers .pdf - Name _ Tax Tasks... Task L Did you record your client's Standard Deduction? Task M What number did youenter on 1040 Line 11b? Task N What number did youenter on 1040 Line 12a? Task O What number did you enter on 1040 Line 16? Task P What number did you enter on 1040 Lines 17 & 19? Task Q Did your client underpay or overpay?

Use this tax computation worksheet to answer Exercises 11-14. Calculate the tax for each of the taxable incomes of a head of house-hold taxpayer. a. $ 400, 000 b. $ 108, 962 c. $ 201, 102 d. $ 106, 000 Answer a. $ 115, 409.00 b. $ 22, 303.00 c. $ 48, 926.66 d. $ 21, 562.50 View Answer Discussion You must be signed in to discuss. Watch More Solved Questions in Chapter 7 Problem 1 Problem 2 Problem 3 Problem 4

Payroll CH7.pdf - Course Hero Also, complete the Federal Deposit Information Worksheet, using the blank form reproduced. a. Total wages for the first three quarters was $142,224.57. FUTA taxable wages for the first three quarters was $65,490.00. b. FUTA tax liability by quarter: 1st quarter-$204.53, 2nd quarter-$105.25, 3rd quarter-$83.16. The first FUTA deposit is now due.

PDF 2021 Publication 17 - IRS tax forms 2021 Tax Computation Worksheet..... 123 2021 Tax Rate Schedules..... 123 Your Rights as a Taxpayer ... The Income Tax Return. Chapter 1. Filing Information. Chapter 2. Filing Status. Chapter 3. Dependents. ... federal income tax return. You can use the Get An IP PIN tool on IRS.gov to request an IP PIN, file ...

Chapter 7 - Federal Income Tax Flashcards | Quizlet All the taxable income received during the year, including wages, tips, salaries, interest, dividends, alimony, and unemployment compensation. itemized deductions A listing of allowable deductions such as medical expenses, mortgage interest and tax payments, and contributions.

PDF 7-1 Tax Tables, Worksheets, and Schedules Use the portion of the tax table shown here to answer Exercises 1 - 7. Abe is single. His taxable income is $83,492. How much does Abe owe in taxes? $17,351 2. Roberta is married and ling a joint return with her husband Steve. Their combined taxable income is $80,997. How much do they owe in taxes? $12,931

Publication 590-A (2021), Contributions to ... - IRS tax forms Modified AGI limit for certain married individuals increased. If you are married and your spouse is covered by a retirement plan at work and you aren’t, and you live with your spouse or file a joint return, your deduction is phased out if your modified AGI is more than $204,000 (up from $198,000 for 2021) but less than $214,000 (up from $208,000 for 2021).

hello,i need the answers for Chapter 7 | Chegg.com In computing the federal income taxes to be withheld, the wage-bracket tables in Tax Table B at the back of the book were used. Each payday, $8 was deducted from the earnings of the two plant workers for union dues (Bonno and Ryan). Payroll check numbers were assigned beginning with check no. 672.

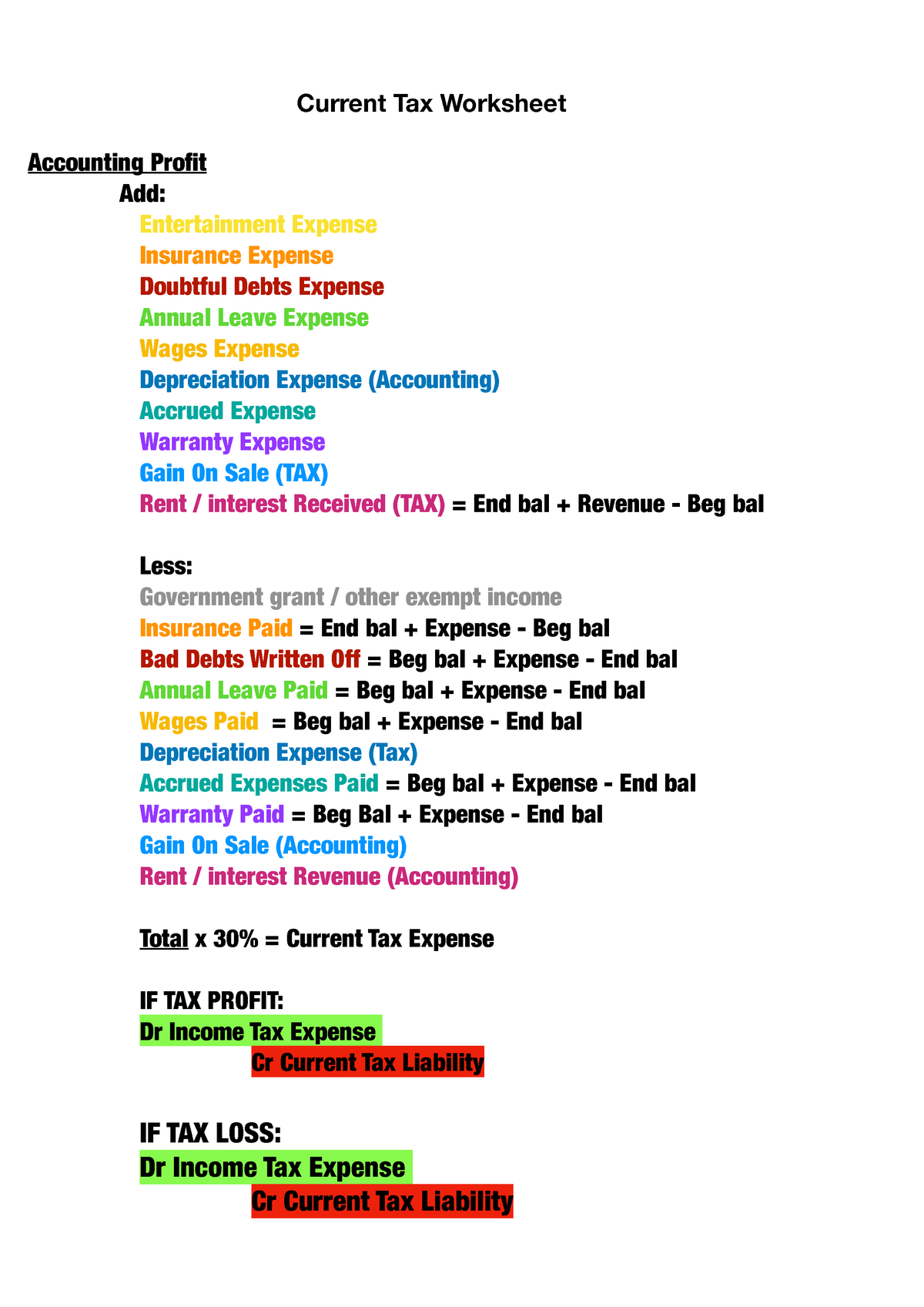

Chapter 4 Income Tax.pdf - Chapter 4C Income Tax Learning... View Chapter 4 Income Tax.pdf from AC TAXATION at Canadian Business College. Chapter 4C Income Tax Learning Objectives: Upon completion of this chapter, you should be able to: 1. Identify the

Income Tax Worksheets Teaching Resources - Teachers Pay Teachers Elena Teixeira. $1.75. Word Document File. This worksheet will take your students through a step-by-step simulation of calculating their net income from a gross income starting point. This is a great starting point for a budgeting lesson, as students experience the effect of taxes prior to budgeting for needs and wants.

PDF Chapter Answer Key For Income Tax Fundamentals Federal Income Tax Form 1040a. Chapter 7 Federal Income Tax Worksheet Answers - Worksheet ... Answer Key Chapter 15 - Principles of Microeconomics 2e | OpenStax. 1. Poverty falls, inequality rises. Poverty rises, inequality falls. 2. Jonathon's options for working and total income are shown in the following table. His labor-leisure diagram is ...

![[Solved] Chapter 7, Problem 7.2 - Income Tax Fundamentals 2019 (37th ...](https://www.coursehero.com/questions/images/0AZ/03062_07_unf16-t2.png)

0 Response to "39 chapter 7 federal income tax worksheet answers"

Post a Comment