43 flsa professional exemption worksheet

› sites › dolgovFact Sheet #70 - DOL Fair Labor Standards Act (FLSA). The following information is intended to answer some of the most frequently asked questions that have arisen when private and public employers require employees to take furloughs and to take other reductions in pay and / or hours worked as businesses and State and local governments adjust to economic challenges. 1. Fact Sheet #70 - DOL do so constitutes a violation of the FLSA. When the correct amount of overtime compensation cannot be determined until sometime after the regular pay period, however, the requirements of the FLSA will be satisfied if the employer pays the excess overtime compensation as soon after the regular pay period as is practicable. 2. Is it legal for an ...

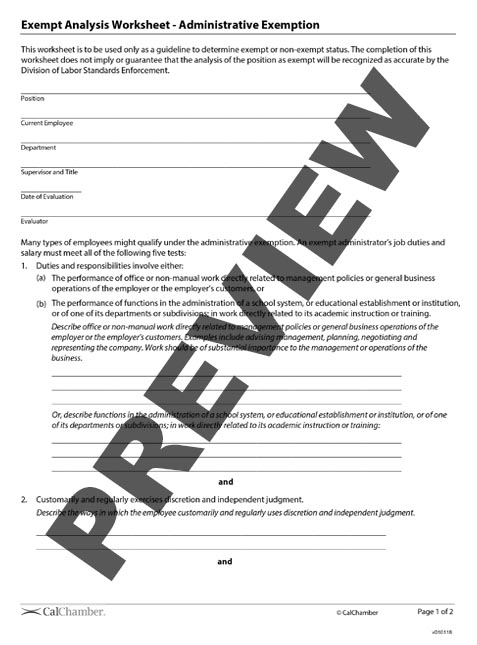

› administrative-employeeCalifornia's Administrative Employee Exemption, Explained (2022) Jun 14, 2022 · See, e.g., Cal. Code Regs., tit. 8, § 11010, subd. 1(A)(1)(e) [“The activities constituting exempt work and non-exempt work shall be construed in the same manner as such items are construed in the following regulations under the Fair Labor Standards Act effective as of the date of this order: 29 C.F.R. Sections 541.102, 541.104-111, and 541 ...

Flsa professional exemption worksheet

Access Denied - LiveJournal Hier sollte eine Beschreibung angezeigt werden, diese Seite lässt dies jedoch nicht zu. › agencies › whdFact Sheet 13: Employment Relationship Under the Fair Labor ... On March 14, 2022 a district court in the Eastern District of Texas vacated the Department’s Delay Rule, Independent Contractor Status Under the Fair Labor Standards Act (FLSA): Delay of Effective Date, 86 FR 12535 (Mar. 4, 2021), and the Withdrawal Rule, Independent Contractor Status Under the Fair Labor Standards Act (FLSA): Withdrawal, 86 FR 24303 (May 6, 2021). › flsa-statusFLSA Overtime Fact Sheet: HR Guide to Exemptions The FLSA Learned Professional Exemption includes primary duties which require advanced knowledge in order to perform including: Consistent exercise of judgment and discretion Advanced knowledge in the field of science or learning (including law, medicine, accounting, theology, actuarial computation, teaching, architecture, pharmacy, and other ...

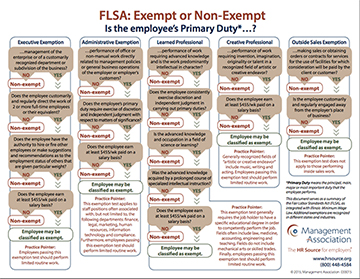

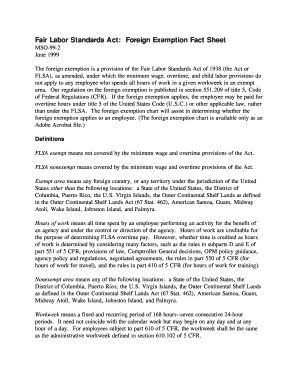

Flsa professional exemption worksheet. › flsa-exemption-testFLSA Exemption Test | UpCounsel 2022 The FLSA exemption test refers to the status of a job as outlined in the Fair Labor Standards Act. The FLSA determines whether a job is exempt or nonexempt as it relates to overtime obligations. The FLSA determines whether a job is exempt or nonexempt as it relates to overtime obligations. Federal Register :: Defining and Delimiting the Exemptions for ... 27.09.2019 · Section 13(a)(1) of the FLSA, commonly referred to as the “white collar” or “EAP” exemption, exempts from these minimum wage and overtime pay requirements “any employee employed in a bona fide executive, administrative, or professional capacity.” The statute delegates to the Secretary of Labor (Secretary) the authority to define and delimit the terms of … › comp-timeComp Time - Workplace Fairness An FLSA nonexempt employee must also use accrued comp time within 26 pay periods from the pay period during which they earned it. If it is not used within 26 pay periods or if the employee transfers to another agency before the 26 pay period, the employee must be paid for the earned comp time off at the overtime rate. Fact Sheet 13: Employment Relationship Under the Fair Labor … In the application of the FLSA an employee, as distinguished from a person who is engaged in a business of his or her own, is one who, as a matter of economic reality, follows the usual path of an employee and is dependent on the business which he or she serves. The employer-employee relationship under the FLSA is tested by "economic reality" rather than "technical concepts." It …

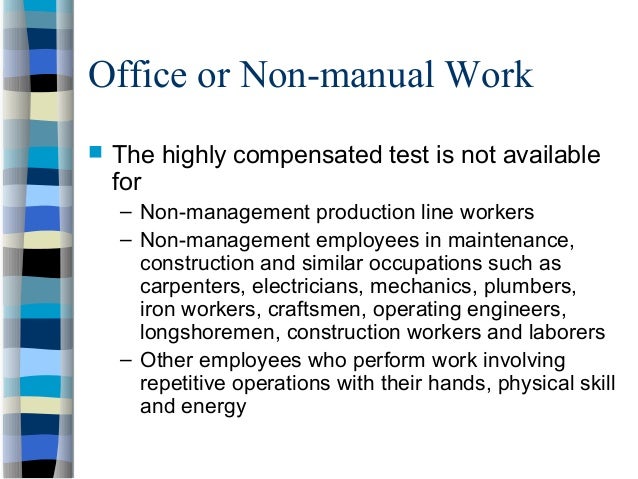

FLSA Overtime Fact Sheet: HR Guide to Exemptions FLSA NON-EXEMPT: The provisions of the FLSA cover non-exempt workers for minimum wage standards, overtime pay, and other labor standard protections. Employers must pay their FLSA non-exempt employees the federal minimum wage (at least) for hours worked. For all hours worked over 40 hours in a workweek, the employer must pay non-exempt employees overtime … Financial Accounting questions and answers - Essay Help 05.03.2022 · Actively managed portfolios, such as those run by professional money managers, tend to  A. underperform the market as a whole. B. remain uncorrelated to the market at all. C. perform the same as the… Hey, I need help with revision questions. It has 2 parts (A & B ). Please follow the format provided for both parts. Thanks Part A   ... Comp Time - Workplace Fairness Whether you are entitled to overtime pay for working more than 40 hours per week depends on your exemption status under the Fair Labor Standards Act (FLSA). Exempt employees are not entitled to overtime pay. Under the FLSA, exempt employees are only entitled to receive their base salary. Nonexempt employees must be paid overtime for time worked beyond 40 hours in … California's Administrative Employee Exemption, Explained … 14.06.2022 · The exemption applies to administrators, not to teachers, although teachers may be exempt under the professional employee exemption. ... Yosemite Water Co. (1999) 20 Cal.4th 785, 795 [“The FLSA explicitly permits greater employee protection under state law.”]. ↥. 29 C.F.R. § 778.5 [“Various Federal, State, and local laws require the payment of minimum hourly, …

HR Toolbox - Human Resources | University of South Carolina 18.07.2011 · As a Human Resource professional you support the needs of our university employees. Forms, documentation and other communication are essential to ensuring you have the resources you need to achieve success. COVID-19 Guidelines. Tips, resources and strategies to help departments and employees maintain a healthy campus. Note: In order to see the most … › documents › 2019/09/27Federal Register :: Defining and Delimiting the Exemptions ... Sep 27, 2019 · Start Preamble Start Printed Page 51230 AGENCY: Wage and Hour Division, Department of Labor. ACTION: Final rule. SUMMARY: The Department of Labor is updating and revising the regulations issued under the Fair Labor Standards Act implementing the exemptions from minimum wage and overtime pay requirements for executive, administrative, professional, outside sales, and computer employees. FLSA Exemption Test | UpCounsel 2022 What Is the FLSA Exemption Test?. The FLSA exemption test refers to the status of a job as outlined in the Fair Labor Standards Act.The FLSA determines whether a job is exempt or nonexempt as it relates to overtime obligations. Overtime pay, minimum wage, record requirements, age restrictions, and hours worked are some of the standards for employees … › flsa-statusFLSA Overtime Fact Sheet: HR Guide to Exemptions The FLSA Learned Professional Exemption includes primary duties which require advanced knowledge in order to perform including: Consistent exercise of judgment and discretion Advanced knowledge in the field of science or learning (including law, medicine, accounting, theology, actuarial computation, teaching, architecture, pharmacy, and other ...

› agencies › whdFact Sheet 13: Employment Relationship Under the Fair Labor ... On March 14, 2022 a district court in the Eastern District of Texas vacated the Department’s Delay Rule, Independent Contractor Status Under the Fair Labor Standards Act (FLSA): Delay of Effective Date, 86 FR 12535 (Mar. 4, 2021), and the Withdrawal Rule, Independent Contractor Status Under the Fair Labor Standards Act (FLSA): Withdrawal, 86 FR 24303 (May 6, 2021).

Access Denied - LiveJournal Hier sollte eine Beschreibung angezeigt werden, diese Seite lässt dies jedoch nicht zu.

0 Response to "43 flsa professional exemption worksheet"

Post a Comment