39 like kind exchange worksheet

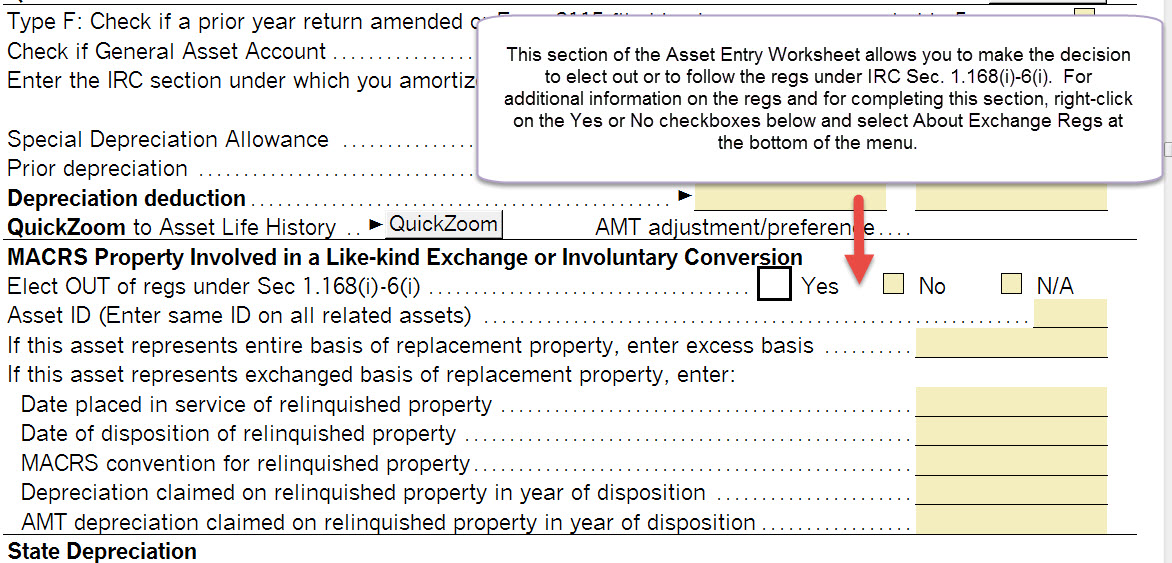

Completing a like-kind exchange in the 1040 return - Intuit A like-kind exchange consists of three main steps. All three steps must be completed for the tax return to contain the correct information. Step 1: Disposing of the original asset Open the Asset Entry Worksheet for the asset being traded. Scroll down to the Dispositions section. Like-Kind Exchange (Meaning, Rules)| How Does 1031 Works? Like-kind exchange, also known as the 1031 exchange, is a transaction or a combination of transactions that prevents the current tax liability under the United States Tax Laws on the sale of an asset because another similar asset is acquired in place of the existing asset. Table of contents What is the Like-Kind Exchange? Explanation Features

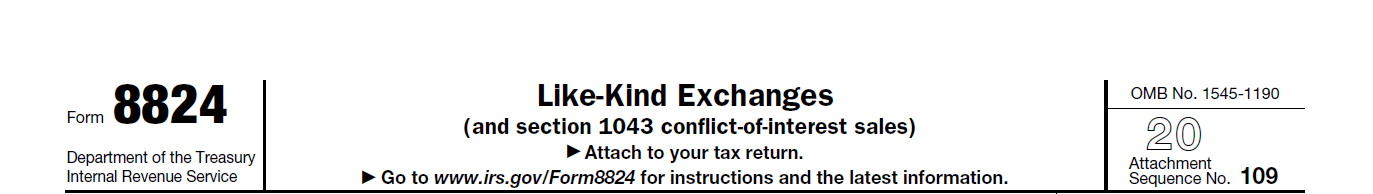

8824 - Like-Kind Exchange - Drake Software A like-kind exchange, also known as a Section 1031 exchange, is a way of trading or exchanging assets and, in many cases, deferring gain on the trade (or exchange). "Like-kind" means that the property you trade must be of the same type as the property you receive. Due to changes to Section 1031 exchanges listed in the Tax Cuts and Jobs Act ...

Like kind exchange worksheet

IA 8824 Like Kind Exchange Worksheet 45-017 Stay informed, subscribe to receive updates. Subscribe to Updates. Footer menu. About; Contact Us; Taxpayer Rights; Website Policies PDF WorkSheets & Forms - 1031 Exchange Experts Line 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21 A. Depreciation taken in prior years from WorkSheet #1 (Line D)$ _____ B. Taxable gain from WorkSheet #7 (Line J) $_____ PDF Like-Kind Exchanges Under IRC Section 1031 - IRS tax forms as part of a qualifying like-kind exchange. Gain deferred in a like-kind exchange under IRC Section 1031 is tax-deferred, but it is not tax-free. The exchange can include like-kind property exclusively or it can include like-kind property along with cash, liabilities and property that are not like-kind. If you receive cash, relief from debt, or

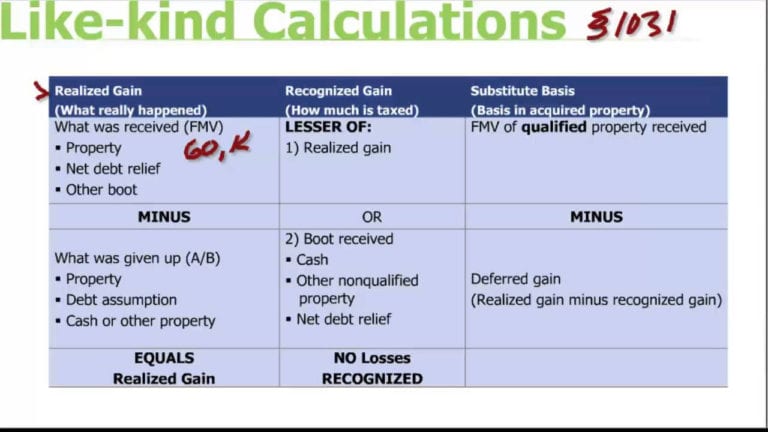

Like kind exchange worksheet. WorkSheets & Forms - 1031 Exchange Experts WorkSheet #2 - Calculation of Exchange Expenses. HUD-1. Line #. A. Exchange expenses from sale of Old Property ... Not applicable to 1031 exchanges. 1031 Exchange Examples: Like-Kind Examples to Study & Learn From Example 1. You own a $3,000,000 investment property with a tax basis of $2,600,000 — meaning that you have a $400,000 capital gain. You would like to do a 1031 exchange into a $2,500,000 Starbucks in Clearwater, Oklahoma. You exchange your $3,000,000 property for the $2,500,000 Starbucks. Therefore, a taxable cash boot of $500,000 is realized. Form 8824 - IRS Part I. Information on the Like-Kind Exchange. Note: Generally, only real property should be described on lines 1 and 2. However, you may describe personal ... Like Kind Exchange Worksheet - The Math Worksheets Like-Kind Exchange Worksheet This tax worksheet examines the disposal of an asset and the acquisition of a replacement like-kind asset while postponing or deferring the gain from the sale if proceeds are re-invested in the replacement asset. It was coming from reputable online resource which we like it.

IRC 1031 Like-Kind Exchange Calculator Everything You Need to Know About 1031 Exchanges. 1031 tax-deferred swaps allow real estate investors to defer paying capital gains taxes when they sell a property that is used "for productive use in a trade or business," or for investment.This is due to IRC Section 1031, and when structured correctly, it lets you sell a property and reinvest the proceeds in a new property - while deferring ... What is IRS Form 8824: Like-Kind Exchange - TurboTax Say you paid $20,000 for a piece of business or investment real estate and sold it for $30,000 ($30,000 - $20,000 = $10,000 capital gain). Rather than have the $10,000 profit taxed as a capital gain, the like-kind exchange allows the gain to be "passed on" to the new property used for business. The $10,000 gain will be factored into the tax ... How to Calculate Basis on Like Kind Exchange | Pocketsense Figuring in the Replacement Property Total the replacement property's purchase price with its closing costs. If you buy a $192,000 threeplex and pay $5,150 in closing costs, its cost basis, leaving the exchange aside for the moment, would be $197,150. Finding the New Cost Basis Completing a Like Kind Exchange for business returns in ProSeries A like-kind exchange consists of three main steps. All three steps must be completed for the tax return to contain the correct information. Step 1: Disposing of the original asset Open the Asset Entry Worksheet for the asset being traded. Scroll down to the Dispositions section.

LIKE-KIND EXCHANGE WORKSHEET LIKE-KIND EXCHANGE WORKSHEET. A. Realized Gain. 1. + FMV of all property received. 2. + Total cash received. 3. + Liabilities transferred. 1031 Exchange Examples | 2022 Like Kind Exchange Example The IRS considers all "Investment Properties" to be "Like-Kind." Properties do not need to be the same type. For example, raw land can be exchanged for an office building, a warehouse can be exchanged for NNN retail property, or a rental house for a Replacement Property Interest in a 300-unit apartment complex. About Form 8824, Like-Kind Exchanges | Internal Revenue Service About Form 8824, Like-Kind Exchanges Use Parts I, II, and III of Form 8824 to report each exchange of business or investment property for property of a like kind. Certain members of the executive branch of the Federal Government and judicial officers of the Federal Government use Part IV to elect to defer gain on conflict-of-interest sales. Like-Kind Exchange Worksheet - CS Professional Suite Like-Kind Exchange Worksheet This tax worksheet examines the disposal of an asset and the acquisition of a replacement "like-kind" asset while postponing or deferring the gain from the sale if proceeds are re-invested in the replacement asset. Qualifying property must be held for use in a trade or business or for investment.

1031 Like Kind Exchange Worksheet And Form 8824 Worksheet Template We always effort to reveal a picture with high resolution or with perfect images. 1031 Like Kind Exchange Worksheet And Form 8824 Worksheet Template can be valuable inspiration for people who seek an image according specific topic, you will find it in this website. Finally all pictures we have been displayed in this website will inspire you all.

Like Kind Exchange Calculator - cchwebsites.com Description of Like Kind Property Brief description of the property involved in this exchange. Sales Price or Fair Market Value The sales price or Fair Market Value (FMV) of the property sold. Purchase Price or Fair Market Value The purchase price or Fair Market Value (FMV) of the property received. Less Liabilities/Mortgages

1031 Like Kind Exchange Calculator - Excel Worksheet 1031 Like Kind Exchange Calculator - Excel Worksheet Smart 1031 Exchange Investments We don't think 1031 exchange investing should be so difficult That's why we're giving you the same 1031 exchange calculator our exchange experts use to help investors find smarter investments. Requires only 10 inputs into a simple Excel spreadsheet.

Like Kind Exchange Vehicle Worksheet And Like Kind Exchange Example ... Like Kind Exchange Vehicle Worksheet And Like Kind Exchange Example With Boot can be valuable inspiration for those who seek a picture according specific categories, you can find it in this website. Finally all pictures we've been displayed in this website will inspire you all. Thank you. Download by size: Handphone Tablet Desktop (Original Size)

Like-kind Exchanges of Personal Property | IDR - Iowa The Department has created the IA 8824 worksheet for use in tax years 2017, 2018, and 2019, to aid taxpayers in applying and documenting like-kind exchanges of personal property for Iowa tax purposes, and in calculating and reporting the required Iowa income tax adjustments resulting from such exchanges. Taxpayers who elect a tax-deferred like ...

Knowledge Base Solution - How do I complete a like-kind exchange in a ... Note the schedule and entity number of the like-kind exchange. Example: Schedule E entity 1 Go to the Income/Deductions > Rent and Royalty worksheet. Select section 7 - Depreciation and Amortizationand select Detail. Select section 1 - General. Line 23 - Sale Number, input the number of the sale.

PDF FORM 8824 WORKSHEET Worksheet 1 Tax Deferred Exchanges Under IRC § 1031 Before preparing Worksheet 1, read the attached Instructions for Preparation Of Form 8824 Worksheets. Then, prepare Worksheet 1 after you have finished the preparation of worksheets 2 and 3. _____ 1031 Corporation - Longmont/Boulder, CO 303-402-1031 (Local) 888-367-1031 (Toll Free)

Accounting for 1031 Like-Kind Exchange - BKPR Doing a like-kind exchange can have a lot of benefits. Aside from deferring capital gains tax, you may be exempt from paying state mandatory withholding. For tax reporting purposes, you need to report a like-kind exchange using Form 8824. The form itself can be confusing. Tax reporting for a Section 1031 exchange can be tricky.

PDF Reporting the Like-Kind Exchange of Real Estate Using IRS Form 8824 - 1031 Reporting the Like-Kind Exchange of Real Estate Using IRS Form 8824 7400 Heritage Village Plaza, Suite 102 Gainesville, VA 20155 800-795-0769 703-754-9411 Fax 703-754-0754 Compliments of Realty Exchange Corporation Your Nationwide Qualified Intermediary for the Tax Deferred Exchange of Real Estate

Like-kind exchanges of real property: New final regs. Existing Regs. Sec. 1.1031 (k)- 1 (c) (5) permits taxpayers to identify a large unit of real property for a like - kind exchange that includes incidental personal property constituting up to 15% of the aggregate fair market value. For example, a taxpayer may identify a hotel it will acquire for $1,000,000 as replacement property, even if the ...

PDF Reporting the Like-Kind Exchange of Real Estate Using IRS Form 8824 ... Like-Kind Exchanges. The Form 8824 is divided into four parts: Part I. Information on the Like-Kind Exchange Part II. Related Party Exchange Information Part III. Realized Gain or (Loss), Recognized Gain, and Basis of Like-Kind Property Received Part IV. Not used for 1031 Exchange - Used only for Section 1043 Conflict of Interest Sales.

Reporting the Like-Kind Exchange of Real Estate Using IRS ... The cash down payment was $370,000 and exchange expenses were $5,000. Page 4. The Worksheet is broken down into four steps as follows: STEP 1 IT IS ...

PDF NATP offers series of worksheets, charts for tax pros to use during tax ... Worksheets include AMT NOL loss computation, like-kind exchange and due diligence questionnaire . APPLETON, Wis. (Feb. 11, 2021) - Individuals preparing tax returns for 2021 are encouraged to take advantage of the abundance of resources NATP offers, including . worksheets, charts and more. Additionally, NATP offers a . due diligence worksheet

Asset Worksheet for Like-Kind Exchange - Intuit Asset Worksheet for Like-Kind Exchange. I have exchanged a rental property, which had Asset Worksheets (for example) for House, Renovation, Roof, and Land. The new property has Building (27.5 yrs), Site Improvements (15 yrs), and Land. I've got the entries in Schedule E for both the relinquished and replacement properties, as well as the 8824 ...

PDF Like-Kind Exchanges Under IRC Section 1031 - IRS tax forms as part of a qualifying like-kind exchange. Gain deferred in a like-kind exchange under IRC Section 1031 is tax-deferred, but it is not tax-free. The exchange can include like-kind property exclusively or it can include like-kind property along with cash, liabilities and property that are not like-kind. If you receive cash, relief from debt, or

0 Response to "39 like kind exchange worksheet"

Post a Comment