40 worksheet for figuring net earnings loss from self employment

5 Look at the Worksheet for Figuring Net Earnings Loss from Self ... Look at the Worksheet for Figuring Net Earnings (Loss) from Self-Employment (p. 35 for 2014) of the Form 1065 instructions. What lines from Schedule K are, in general, involved in the calculation of Self-Employment income? What guaranteed payments are included in a partner's self-employment income? Impact of Self-Employment Loss on Earned Income The worksheet says, "Generally, your earned income is the total of the amounts reported on form 1040, lines 7 (wages), 12 (business income or loss), and 18 (farm income or loss) minus the amount, if any, on line 27 (self-employment tax deduction).". In Allyson Christina Briggs v. Commissioner, TC summary opinion 2004-22, the issue for the ...

How to Calculate Lost Earnings if You're Self Employed So if the accident left you unable to work for 3 months, you could easily establish lost income earnings of $15,000. There are a few potential problems with this approach. First, this method does not account for seasonal income fluctuations. For example, suppose you earn 70% of your total 1099 income in the summer months.

Worksheet for figuring net earnings loss from self employment

PDF Income Calculations - Freddie Mac Form 91 is to be used to document the Seller's calculation of the income for a self-employed Borrower. This form is a tool to help the Seller calculate the income for a self-employed Borrower; the Seller's calculations must be based on the requirements and guidance for the determination of stable monthly income in Topic 5300. 1040-US: Net earnings (loss) from self-employment field on Screen K1-4 Use the Net earnings (loss) from self-employment field on Screen K1-4, located under the K1 1065, 1120S folder, to enter the partnership income, including guaranteed payments to partners, that is subject to the self-employment tax. This information transfers to Schedule SE and is also used in the calculation of Keogh/SEP/SIMPLE and IRA contribution limitations, Schedule EIC, child tax credit ... 1065-US: Calculating Schedule K, line 14a - Net earnings from self ... Answer UltraTax CS calculates self-employment earnings (SE) per activity for partners in the Partner's Self-Employment Worksheet based on the type of partner selected in the Partner tab in the Partner Information window in View > Partner Information. General Partner and LLC Member (SE Income) calculate SE for all applicable items.

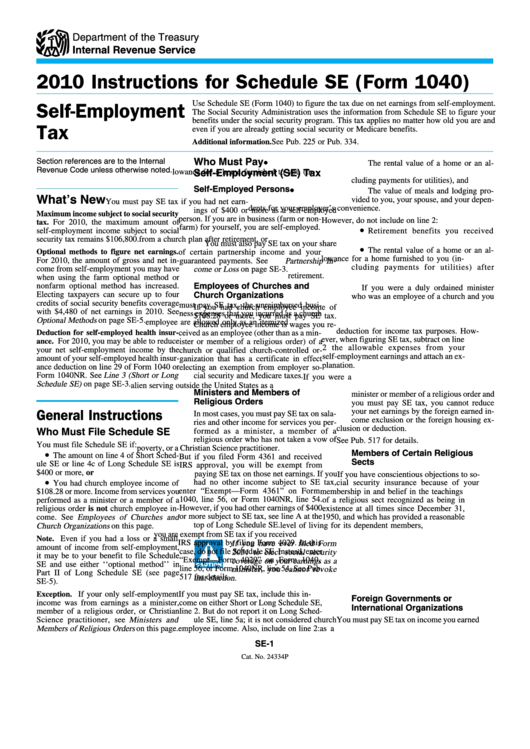

Worksheet for figuring net earnings loss from self employment. Schedule K Line 14a (Form 1065) Calculating Self-Employment Earnings Lacerte computes line 14a using the Worksheet for Figuring Net Earnings (Loss) From Self-Employment from page 41 of the 1065 form instructions. To generate Lacerte's version of the Self-Employment worksheet: Click on Settings. Click on Options. Select the Tax Return tab. Scroll down to the Federal Tax Options section. Simple Profit and Loss Statement for the Self-Employed If your Total Operating Expenses were more than your Total Gross Revenue, you would have made a net loss. At the very bottom is the net profit/ (loss) percent. This tells you the percentage of the total revenue you get to keep after all costs and taxes have been paid. How to Personalize Your Profit and Loss Statement Your Business Logo and Name PDF SEP IRA CONTRIBUTION WORKSHEET - Fidelity Investments Calculating Your Contribution if You Are Self-Employed Individuals with self-employed income must base their contributions on "earned income." For self-employed individu - als, earned income refers to net business profits derived from the business, reduced by a deduction of one-half of your self-employment tax, less your SEP IRA contribution. 2021 Instructions for Schedule SE (2021) - Internal Revenue Service Use Schedule SE (Form 1040) to figure the tax due on net earnings from self-employment. The Social Security Administration uses the information from Schedule SE to figure your benefits under the social security program. This tax applies no matter how old you are and even if you are already getting social security or Medicare benefits.

Understanding Schedule K-1 self-employment income for partners ... - Intuit The program creates a worksheet to show the calculation of net earnings from self-employment. Follow these steps to view the Self-Employment Worksheet: Go to the Forms tab. Select Worksheets from the left-side Form window. Select Self-Emp. Worksheet from the left-side Page window. How do I enter adjustments or overrides for self-employment income? Self-Employed Individuals - Calculating Your Own Retirement-Plan ... You can use the Table and Worksheets for the Self-Employed (Publication 560) to find the reduced plan contribution rate to calculate the plan contribution and deduction for yourself. Deducting retirement plan contributions Total limits on plan contributions depend in part on your plan type. See the contribution limits for your plan. Schedule K-1 (Form 1065) - Self-Employment Earnings (Loss) SELF-EMPLOYMENT EARNINGS (LOSS) Line 14A - Net Earnings (Loss) from Self-Employment - Amounts reported in Box 14, Code A represent the amount of net earnings from self-employment. For Limited Partners this amount generally includes any guaranteed payments received for services rendered to or on behalf of the partnership. Net Earnings from Self-Employment - SocialSecurityHop.com Net earnings also include any ordinary income or loss from partnerships. If any part of your income is included in gross earnings from self-employment, expenses connected with this income cannot be deducted. 1200.2 Are there other ways of calculating net earnings from self-employment? Under certain circumstances, optional methods of computing ...

Calculating Net Earnings for Business Taxes The net earnings amount is the basis for calculating your business income tax. For all business legal types, the amount of tax the business pays begins with the calculation of net earnings. If you are self-employed, your net earnings from self-employment are used to calculate your Self-employment Taxes. Self-employment tax is the tax that self ... self employed income calculation worksheet freespreadsheet.net. self income employed employment worksheet spreadsheet sheet expenses excel monthly expense bookkeeping simple debt tab pay along. Worksheet For Figuring Net Earnings Loss From Self Employment nofisunthi.blogspot.com. figuring deduction employed. Self Employed Income Worksheet - Fill Out And Sign Printable PDF ... Benefits Planner: Retirement | Calculate Your Net Earnings from Self ... You must complete the following federal tax forms by April 15 following any year in which you have net earnings of $400 or more: Form 1040 (U.S. Individual Income Tax Return). Schedule C (Profit or Loss from Business) or Schedule F (Profit or Loss from Farming) as appropriate. Schedule SE (Self-Employment Tax). Look at the Worksheet for Figuring Net Earnings Loss from Self ... California State University, Fullerton • ACCT 578. PLLC_Chapter4_Solutions.pdf. The Land

1200. Net Earnings from Self-Employment - Social Security Administration To calculate the net earnings from self-employment, follow the steps below: Add up your total gross income as calculated under the income tax law. Include income from all your trades and businesses. Subtract all the deductions, including the allowances for depreciation that you are allowed when you calculate your income tax from the result in (A).

Self Employed Profit and Loss Statement Template Your net profit (or loss) is the bottom line of your P&L statement. This is used to determine if the business is profitable or not and by how much. If the result indicates a profit, it means you made more money than you spent. If the results show a loss, it means you spent more than you earned. To manage your business accordingly, creating a ...

Knowledge Base Solution - CCH Go to the Income/Deductions > Partnership Passthrough worksheet. Select section 1 - General . Enter line 73 - Net earnings (loss) from self-employment. Farm Income: Go to the Income/Deductions > Farm/4835 worksheet. Select section 3 - Income . Enter line 3 - Sales of livestock, produce, grains, etc. you raised (cash method only).

PDF Self Employment Income Worksheet - Tacoma Public Utilities Total Net Profit (line 3 minus line 18) 19a. NOTE: If a loss occurred in any of the months, the income will be counted as ZERO. USE THESE FIGURES ON THE WORKSHEET ↑↑↑↑ ↑↑ ↑↑ ↑↑ ... Self Employment Income Worksheet Author: Robi Robertson Created Date:

0 Response to "40 worksheet for figuring net earnings loss from self employment"

Post a Comment