38 gross pay vs net pay worksheet

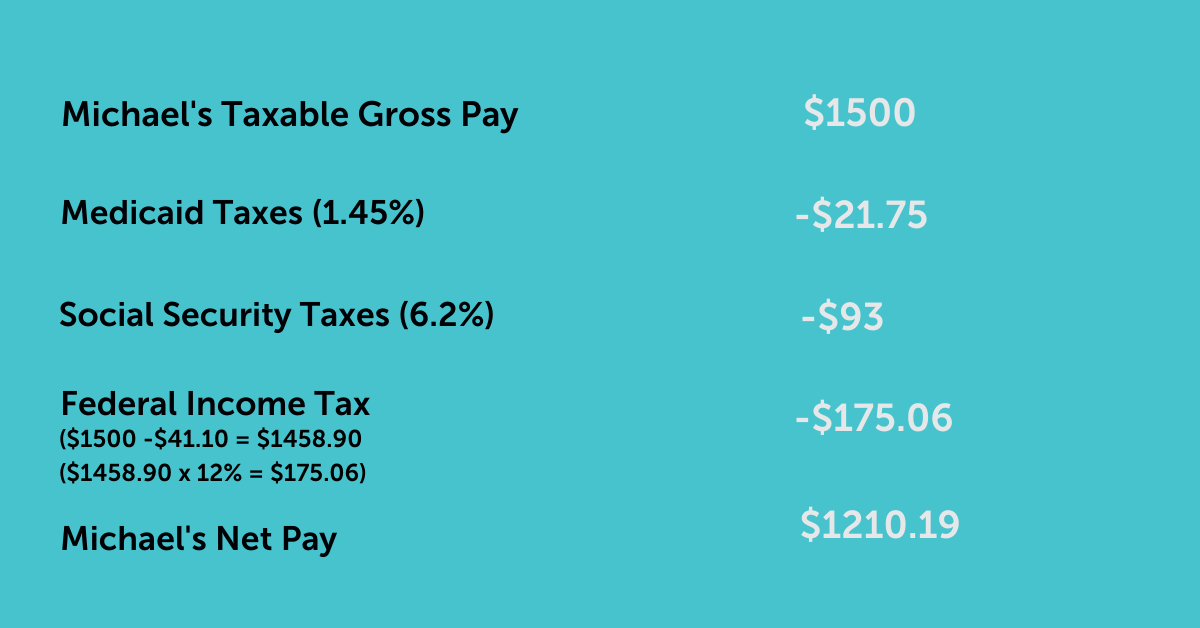

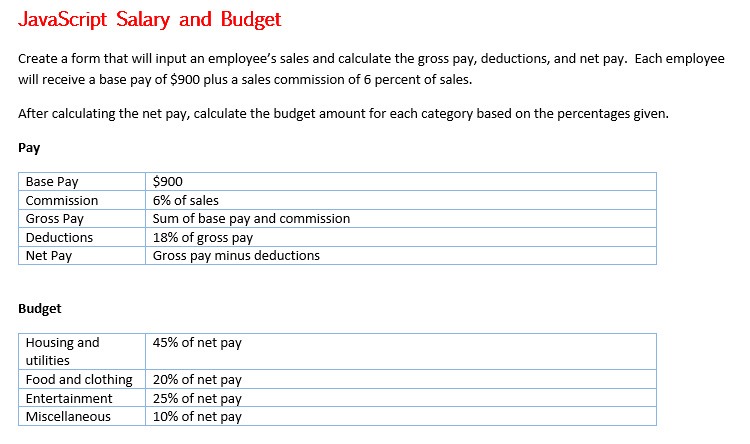

How to Calculate Net Pay | Step-by-step Example - Patriot Software 2. Subtract deductions to find net pay. To calculate net pay, deduct FICA tax; federal, state, and local income taxes; and health insurance from the employee's gross pay. Using the formula to calculate net pay, determine the employee's net pay. Net Pay = Gross Pay - Deductions. Gross And Net Pay Teaching Resources | Teachers Pay Teachers Net and Gross Pay (Workbook- 4 Worksheets) by. Sophie's Stuff. 4.9. (9) $2.00. PDF. This is a workbook I created to teach my special education students about net and gross pay. On the first worksheet, students are given the deductions in dollar amounts.

blog.taxact.com › capital-gains-tax-applyWhen Does Capital Gains Tax Apply? - TaxAct Blog Another way to quickly determine how much tax you’ll pay on a sale is to estimate the gain based on your tax rate. If you sell a capital asset you owned for one year or less, you will pay tax at your ordinary income tax rate. For example, say you sold stock at a profit of $10,000. You held the stock for six months.

Gross pay vs net pay worksheet

Gross Pay vs Net Pay: How to Calculate the Difference Gross pay, also called gross wages, is the amount an employee would receive before payroll taxes and other deductions. By contrast, net pay is the amount left over after deductions have been taken from an employee's gross pay. Net pay is sometimes called take-home pay. PDF Bring Home The Gold - National Payroll Week Worksheet 1 9 Exercise 2 Questions 1. What is gross pay? 2. What is net pay? 3. True or False? Your paycheck = total hours worked x rate of pay. 4. Name two mandatory deductions. 5. Name three other deductions. 10 Calculating a Paycheck #1 EMPLOYEE AT A GOURMET COFFEE Employee's name: gross pay worksheet - printablenathan.z21.web.core.windows.net dinosaur printables dice motor gross activities dinosaurs. 32 Gross Pay Vs Net Pay Worksheet - Support Worksheet martindxmguide.blogspot.com. gross worksheets wages. Gross Pay Vs Net Pay Worksheet - Worksheet List nofisunthi.blogspot.com. pay gross worksheet vs deductions practical marks exercise tax. 6+ Payroll Template - Free Excel And Word ...

Gross pay vs net pay worksheet. Taxes Definition - Investopedia 27.06.2022 · Taxes are generally an involuntary fee levied on individuals or corporations that is enforced by a government entity, whether local, regional or national in order to finance government activities ... When Does Capital Gains Tax Apply? - TaxAct Blog Another way to quickly determine how much tax you’ll pay on a sale is to estimate the gain based on your tax rate. If you sell a capital asset you owned for one year or less, you will pay tax at your ordinary income tax rate. For example, say you sold stock at a profit of $10,000. You held the stock for six months. If your federal income tax ... What Is Provisional Income? - The Balance 03.02.2022 · If your provisional income exceeds these thresholds, you’ll compare 50% of your benefits amount to 50% of your provisional income that exceeds the threshold. You’ll pay tax on whichever amount is smaller. It gets more complicated if your provisional income exceeds a second threshold: You’ll pay tax on up to 85% of your benefits. quickbooks.intuit.com › r › payrollPayroll ledger template: What is a payroll ledger? - Article Aug 02, 2021 · After this step, create a series of columns that reflect the different pay information that may apply. For example, this might include “Hourly Rate” or “Rate Per Word,” or “Overtime Rate.” Be sure each has its own column. Create a column for “Date.” Create columns titled “Net Pay” and “Gross Pay.”

Wisconsin Child Support Calculator - Divergent Family Law If the paying parent’s gross income is $7000/month ($84,000/year) or more, your child support obligation may be based on the high-income payer worksheet for primary placement or shared placement. In Wisconsin, the use of the high-income formula for primary placement or shared placement is at the discretion of the courts. PDF It's Your Paycheck! Lesson 2: 'W' is for Wages, W-4, and W-2 Gross pay is the amount people earn per pay period before any deductions or taxes are paid. Net pay is the amount people receive after taxes and other deductions are taken out of gross pay. 6. Explain that one tax people pay is federal income tax. Income tax is a tax on the amount of income people earn. People pay a percentage of their income ... Calculating the numbers in your paycheck | Consumer Financial ... Understand what types of taxes are deducted from a paycheck; Calculate the difference between gross income and net income; What students will do. Review information on how to read a pay stub and answer questions about earnings and deductions. Calculate tax withholdings, deductions, and the difference between gross income and net income. Publication 590-A (2021), Contributions to Individual Retirement ... Modified AGI limit for certain married individuals increased. If you are married and your spouse is covered by a retirement plan at work and you aren’t, and you live with your spouse or file a joint return, your deduction is phased out if your modified AGI is more than $204,000 (up from $198,000 for 2021) but less than $214,000 (up from $208,000 for 2021).

How To Calculate Your Savings Rate… And Why It’s Important 02.05.2022 · You can adjust to net income by deducting the taxes you pay from your gross income. Let’s say hypothetically you make a $100,000 salary and you pay $15,000 in taxes of all types. Your net income in this case would be $85,000 and would be the denominator you use in the Savings/Income = Saving Rate calculation. Self-Employment Tax: Everything You Need to Know - SmartAsset 07.01.2022 · Other situations may require you to pay self-employment tax. For one, you still need to pay even if you are a U.S. citizen employed by a foreign government. You must also pay self-employment taxes if you earn more than $108.28 as an employee of a church. If you earn untaxed income in these situations and are unsure whether it’s subject to ... Lesson Plan: Calculating Gross and Net Pay - Scholastic Use the example of a $740 laptop computer in a state with 5% sales tax. First, show how 5% is converted to the decimal .05 and multiplied by $740 to arrive at a sales tax of $37. Adding the price of the laptop ($740) and the sales tax ($37) results in the total cost of $777. Step 3: While sales tax is added to the starting amount of a purchase ... Payroll ledger template: What is a payroll ledger? - Article - QuickBooks After this step, create a series of columns that reflect the different pay information that may apply. For example, this might include “Hourly Rate” or “Rate Per Word,” or “Overtime Rate.” Be sure each has its own column. Create a column for “Date.” Create columns titled …

Gross Pay vs. Net Pay: Definitions and Examples | Indeed.com Gross pay is the total amount of money an employee receives before taxes and deductions are taken out. For example, when an employer pays you an annual salary of $40,000 per year, this means you have earned $40,000 in gross pay. Gross pay vs. net pay. Your gross pay will often appear as the highest number you see on your pay statement.

paychecks math worksheet answers Paycheck Insurance / Paycheck To Budget Worksheet Spreadsheet Template fortheloveofhealth2011.blogspot.com. paycheck. Gross Pay Vs Net Pay Worksheet - Ivuyteq ivuyteq.blogspot.com. worksheet assume earns. Civics/Econ - HHSResourceProgram sites.google.com. economics guided reading activity civics history econ k12 hilmar week. Gross pay vs net ...

Gross Pay vs. Net Pay: Explanation and Examples Gross monthly income is all of the pay an employee receives as compensation for their work. Net pay is the total income minus any deductions. As stated above, apart from some very unusual circumstances, net pay is lower than gross pay. Deductions from gross pay fall into two categories: voluntary and involuntary deductions.

The Most Important Liquor Cost Formulas The profit margin on alcohol sales by taking the gross profit from a sale of drink like a cocktail or bottle of wine, and subtracting the liquor cost from that gross profit to provide the net profit margin. How to Calculate Liquor Cost . This is a pretty common question we hear at Backbar. And it's a good one.

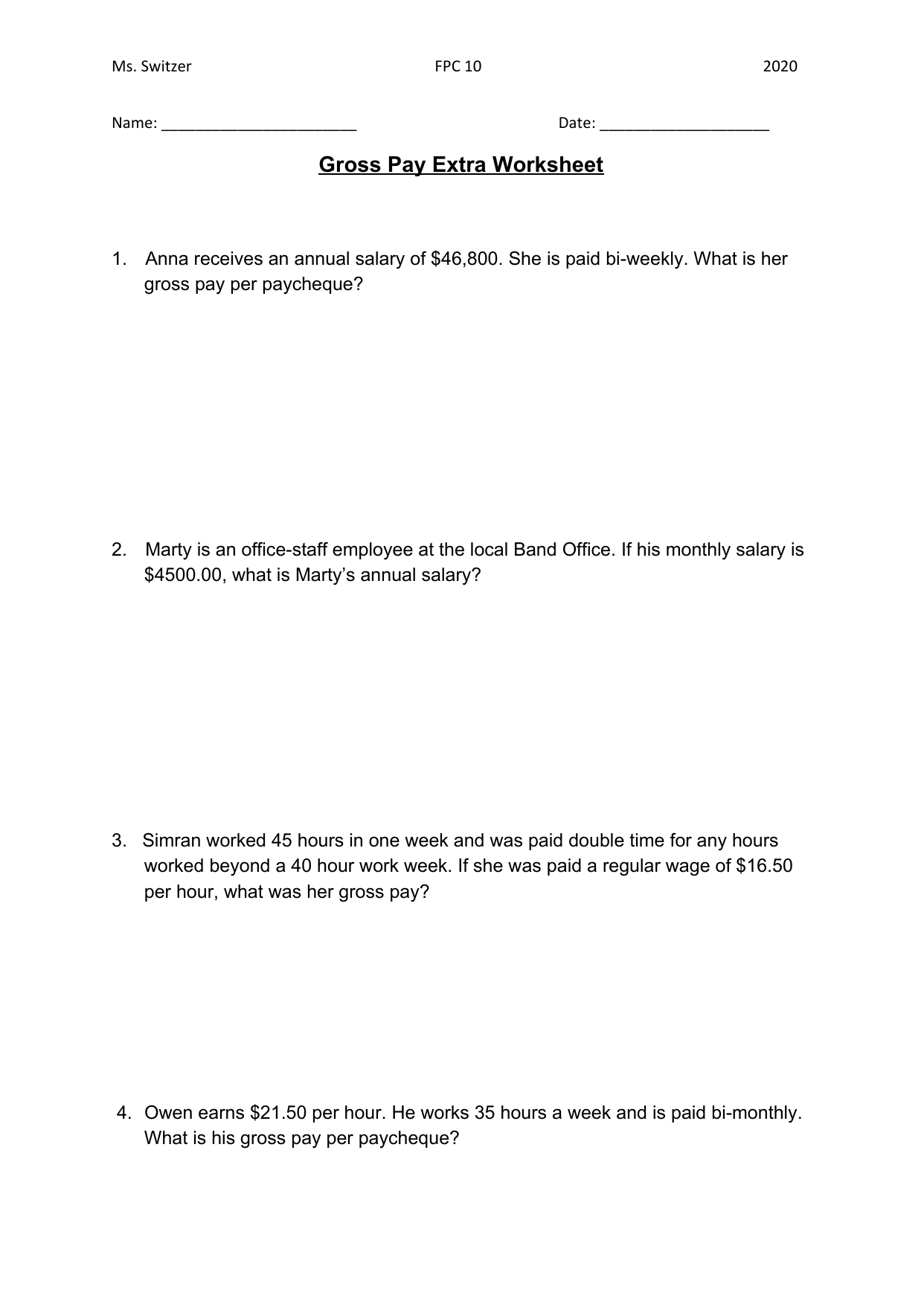

PDF Calculating Gross and Weekly Wages Worksheet - Scholastic 1. Isabel drives truck for $8.75 an hour. If she worked 40 hours, what would her gross earnings be for one week? 2. Manual is a word-processor operator. He makes $11.50 an hour. Determine his gross earnings for a week if he worked 52 hours. C. Straight Commission 1. A real estate agent earns 2.4% on the sale of a house priced at $89,950.

› publications › p590aPublication 590-A (2021), Contributions to Individual ... Modified AGI limit for certain married individuals increased. If you are married and your spouse is covered by a retirement plan at work and you aren’t, and you live with your spouse or file a joint return, your deduction is phased out if your modified AGI is more than $204,000 (up from $198,000 for 2021) but less than $214,000 (up from $208,000 for 2021).

gross pay worksheet - printablefull101.z21.web.core.windows.net 11+ Payroll Worksheet Templates In Google Docs | Google Sheets | XLS . payroll mml xls. Gross Pay Vs Net Pay Worksheet - Worksheet List nofisunthi.blogspot.com. pay gross worksheet vs workbook worksheets tpt sophie stuff. General Ledger Mapping help.timetrex.com. mapping ledger general worksheet gl

Gross Pay To Net Pay Teaching Resources | Teachers Pay Teachers No prep lesson uses realistic paystubs to teach students how to understand their paycheck including gross vs. net pay, deductions, taxes and more. ... (FICA). The first slide/worksheet is a practice pay stub, which helps students practice identifying before and after taxes amounts. Then there are follow up questions/scenarios. Think of this as ...

gross pay worksheet - printablenathan.z21.web.core.windows.net dinosaur printables dice motor gross activities dinosaurs. 32 Gross Pay Vs Net Pay Worksheet - Support Worksheet martindxmguide.blogspot.com. gross worksheets wages. Gross Pay Vs Net Pay Worksheet - Worksheet List nofisunthi.blogspot.com. pay gross worksheet vs deductions practical marks exercise tax. 6+ Payroll Template - Free Excel And Word ...

PDF Bring Home The Gold - National Payroll Week Worksheet 1 9 Exercise 2 Questions 1. What is gross pay? 2. What is net pay? 3. True or False? Your paycheck = total hours worked x rate of pay. 4. Name two mandatory deductions. 5. Name three other deductions. 10 Calculating a Paycheck #1 EMPLOYEE AT A GOURMET COFFEE Employee's name:

Gross Pay vs Net Pay: How to Calculate the Difference Gross pay, also called gross wages, is the amount an employee would receive before payroll taxes and other deductions. By contrast, net pay is the amount left over after deductions have been taken from an employee's gross pay. Net pay is sometimes called take-home pay.

0 Response to "38 gross pay vs net pay worksheet"

Post a Comment