41 money instructor insurance worksheet answers

Insurance for the Family - Utah Education Network Renters Insurance Worksheet (pdf) Personal Property Worksheet (pdf) Option 2: Auto Insurance Lesson Plan Use the Auto Insurance Lesson Plan (pdf). The teacher will present the "Don't Risk It: Cover Your Car" Worksheet and use it to provide orientation to the subject matter. Next, students will learn financial responsibility requirements form ... Money Instructor - Lessons and Worksheets Hand out the worksheet below (see the GET LESSON button near the bottom of the page). Show students the video and have and have them complete the worksheet. Then have a discussion about interest and how it relates to money, saving, and borrowing. Review the questions on the worksheet. What is Interest | Money Instructor What is Interest?

PDF Lesson 3 Understanding Insurance - Hands on Banking Understanding Insurance 2. Then ask students if they can think of ways to cover these losses other than by having the person pay them. Answers might include insurance benefits, or help from government organizations (e.g., FEMA in the case of natural disasters) and charitable relief organizations. 3. Ask what the class thinks insurance is.

Money instructor insurance worksheet answers

PDF How Health Insurance Works - Rutgers University The main reason to purchase insurance is to protect your money, your health, and your assets. Risk is a part of life and there are three common types of risk: Personal risk includes loss of income due to death, illness, disability or unemployment. ♦ Property risk is loss of or damage to property by fire, theft, and storms ♦ Liability PDF Budgeting - Practical Money Skills Set guidelines on how much money should go toward different expenses and financial goals. 2. Add Up Your Income To set a monthly budget, you need to know how much money you're earning. Make sure you include all income like salary from a part-time job, interest and any other sources. 3. Gambling — Risky Business - Money Instructor Many young people graduate without a basic understanding of money and money management, business, the economy, and investing. We hope to help teachers, parents, individuals, and institutions teach these skills, while reinforcing basic math, reading, vocabulary, and other important skills. Click here to register for Money Instructor.

Money instructor insurance worksheet answers. TeachersFirst Review - Money Instructor Categories include basic money skills, earning/spending, saving/investing, and careers/business. Elementary lessons include worksheets, coloring pages, and activities that include printables and online games. Other categories include lessons on taxes, insurance, investing, using an ATM and much more. This site includes advertising. 14 Free Financial Literacy Worksheets PDF (Middle & High School) Here you'll find some great free PDFs all about helping kids to understand how to save money and how to set money saving goals. 1. FDIC's Money Smart Worksheets Suggested Age: 3-5 grade and 6-8 grade This is an entire money curriculum from the FDIC (the people who insure our savings accounts), for various grade ranges. Solved: Insurance Premium WorksheetProblem: You are a part-time ... - Chegg Perform the following tasks: 1. Enter and format the worksheet title Aylin Insurance and worksheet subtitle Premium Analysis in cells A1 and A2. Change the theme of the worksheet to the Berlin theme. Apply the Title cell style to cells A1 and A2. Change the font size in cell A1 to 26 points, and change the font size in cell A2 to 18 points. Money Instructor - Personal Finance, Business, Careers, Life Skills Lessons Money Instructor©. Many young people graduate without a basic understanding of money and money management, business, the economy, and investing. We hope to help teachers, parents, individuals, and institutions teach these skills, while reinforcing basic math, reading, vocabulary, and other important skills.

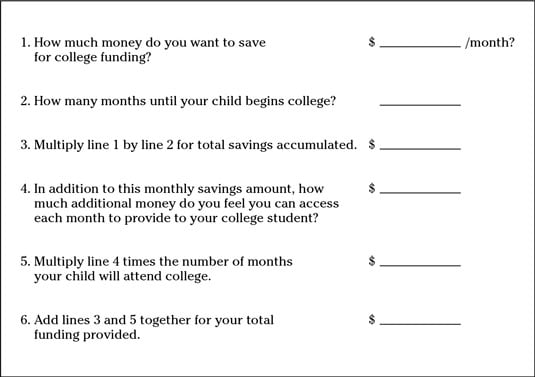

PDF Lesson Three The Art of Budgeting - Practical Money Skills A. "To save money for college for the next five years" B.C "To pay off credit card bills" C. "To invest in an international mutual fund for retirement" D. "To establish an emergency fund of $4,000 in 18 months" 9. An example of a fixed expense is: A. clothing B. auto insurance C. an electric bill D. educational expenses PDF Module 4: Money Matters Instructor Guide - University of North Texas Module 4: Money Matters Instructor Guide Money Smart for Adults Curriculum Page 9 of 39 Pre-Test Test your knowledge about managing money and preparing a spending plan before you go through the course. 1. Following a spending plan helps you: a. Meet expenses in a given period of time b. The Personal Management Merit Badge: Your Ultimate Guide In 2022 1a) Choose an item that your family might want to purchase that is considered a major expense. 1b) Write a plan that tells how your family would save money for the purchase identified in requirement 1a. 1b I) Discuss the plan with your merit badge counselor. 1b II) Discuss the plan with your family. PDF The Basics of Saving Investing Time Value of Money (Chart and Worksheet) Rule of 72 (Worksheet) UNIT TEST: (Test and Answer Key) For Instructors ... buy life insurance, and make other financial decisions. That is why the teaching guide you are now reading focuses on one thing and one thing only: investor

Quiz & Worksheet - Basics of Health Insurance & Health Care - Study.com 1. Susie selects a health insurance plan through her employer where she makes a $200 payment in full each month for her health care benefits to remain completely active. This payment is known as:... MODULE 11: Protecting Your Identity and Other Assets How Insurance Works 34 Types of Insurance 36 Getting Insurance 37. ... Money mart or Adults. Instructor Guide. Participant Guide PowerPoint slides. Guide to Presenting Money . Smart for Adults. ... The answer key is at the end of this Instructor Guide, but don't share the answers now. Lesson Plans - FITC - Finance in the Classroom Point out that insurance is available for many types of risks. Have students read pages 25-28 in Building Wealth. Distribute copies of Insurance Worksheet, and have students answer the questions in the spaces provided. Insurance Worksheet (pdf) In small group discussions, have students analyze why we buy various types of insurance. Teacher Printables - FITC - Finance in the Classroom Money Instructor - Color the Money Printable money identification pages . K-6 Grades. ... Insurance. 10-12 Grades. Building Wealth: Protect Your Wealth (pdf) ... Time Value of Money Worksheet (pdf) Why Study the Stock Market (pdf) Loans and Borrowing Money. 10-12 Grades.

MODULE 1: Your Money Values and Influences - Federal Deposit Insurance ... Your Money Values and . Influences. INSTRUCTOR GUIDE. MONEY SMART for Adults. SEPTEMBER 2018. The Federal Deposit Insurance Corporation is an independent agency created by . the Congress to maintain stability and public confidence in the nation's financial ... The answer key is at the end of this Instructor Guide, but don't share the

What is Insurance? - Money Instructor If you have a $500 auto policy deductible and have damages of $2,000, you will be responsible for $500, and your insurance company for $1,500. Some policies allow you to choose your deductible. A higher deductible usually means a lower premium. It is important that you carefully read the policy before you purchase it.

PDF Project-Based Learning for the Personal Finance Classroom: Projects: 03 ... Renter's insurance $20 Automobile loan payment $150 Automobile insurance $50 Medical insurance $75 Revolving savings fund $100 Federal income tax $150 State income tax $50 Social Security tax $150 Total Fixed Expenses $1,195 Variable Expenses Food $200 + $25 = $225 Utilities $125 Gasoline and maintenance $75 + $75 = $150

PDF Managing Money Lesson 2009 copy - Consumer Action • Money is safe from fire, loss or theft • Each account is insured by the federal government for up to $100,000 • Canceled checks are proof that you paid a bill • Using check-cashing stores and money orders is more expensive than paying bank fees Once you have an account, write down and deduct in your checkbook:

Quiz & Worksheet - Underwriting in Insurance | Study.com Instructions: Choose an answer and hit 'next'. You will receive your score and answers at the end. question 1 of 3 Which of the following factors would the underwriter NOT consider as part of the...

K-12 Student Financial Literacy Lesson Plans - Mortgage Calculator Students answer a series of questions in a computer-based activity, and upon completion are asked to identify names of local goods and services providers. Source: Econ EdLink; Spending Goals — An easy lesson to implement, this worksheet asks students to identify their goals for short-term and long-term spending, as well as sharing goals. This ...

Solved Case Study 3.4 Calculating Insurance Math Worksheet - Chegg INSTRUCTIONS: Calculate the insurance in each of the following situations. Upload your completed worksheet to the 3.4 Case Study dropbox. A. A patient's insurance policy states: Annual deductible: $300.00 Coinsurance: 70-30 This year the patient has made payments totaling $533 to all providers. Today the patient has an office visit (fee: S80).

Insurance - Money Instructor These are all common questions and there are easy to understand answers. Insurance can seem complicated and confusing because you are paying for something that you don't intend to use. Nobody wants to have something terrible happen to them. ... Money Instructor® Money lessons, lesson plans, worksheets, interactive lessons, and informative ...

FDIC: Teach Money Smart - Federal Deposit Insurance Corporation We designed the instructor-led versions of Money Smart for use by staff from banks, non-profit organizations, government agencies, and schools. Instructors can customize the materials to meet the needs and interests of people they serve. The FDIC encourages Money Smart training to be connected to low or no-cost deposit accounts and services.

16 Free Banking Worksheets PDF (Teach Kids how to Use Banks) 1. TD's How to Write a Check. Suggested Age: 4-5 grades. Use this lesson plan and worksheet to teach kids how to write a check. Very important banking life skill! 2. TD's How to Balance a Checkbook. Suggested Age: 6-8 grades. Use this TD lesson plan and worksheet to teach students how to balance a checkbook.

Insurance Lesson Plans, Teaching Lessons, Worksheets, Activities Lessons and Worksheets Teach and learn basic insurance policy types, concepts, and principles. Insurance helps provide financial protection for unforeseen losses for you and your family. Insurance is coverage by contract that offers financial protection in case of an unforeseeable tragedy.

Gambling — Risky Business - Money Instructor Many young people graduate without a basic understanding of money and money management, business, the economy, and investing. We hope to help teachers, parents, individuals, and institutions teach these skills, while reinforcing basic math, reading, vocabulary, and other important skills. Click here to register for Money Instructor.

0 Response to "41 money instructor insurance worksheet answers"

Post a Comment