45 nebraska inheritance tax worksheet

Nebraska Forms | Nebraska Department of Revenue Income Tax Withholding Monthly, quarterly, and annual reporting forms for Nebraska employers. Individual Income Tax Forms specific to the current tax year. Nebraska Incentives Credit Computation, Form 3800N Motor Fuels Forms Applications and reporting forms for all of the Motor Fuels programs administered by the Department of Revenue. Inheritance Tax Review | Sarpy County, NE Inheritance Tax Review Inheritance Tax Review Inheritance tax petitions are generally reviewed between the hours of 9 to 4 Monday through Friday, however, attorney availability is not guaranteed. Please make an appointment or call 402-593-2230 to confirm availability prior to arriving at the Courthouse.

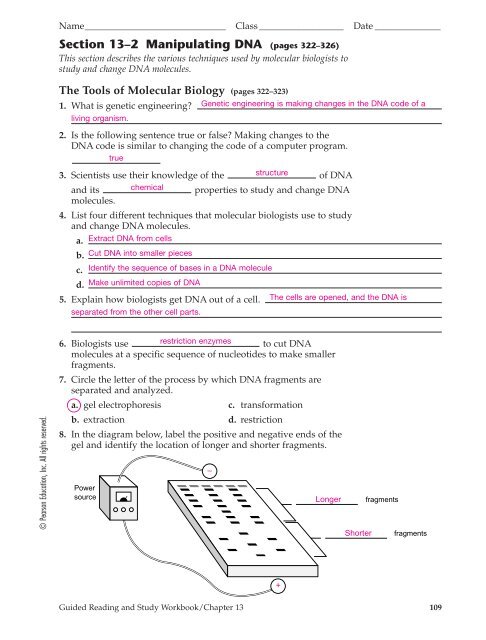

Forms | Lancaster County, NE Form 451 - Exemption Application (PDF) Form 451A - Reaffirmation of Exemption Application (PDF) Form 402 - Improvements on Leased Land (PDF) Form 456 - Special Valuation (Greenbelt) Application (PDF) Form 191 - Vacant or Unimproved Lot Application (PDF) Form 425 - Report of Destroyed Real Property (PDF) Conservation Reserve Program Questionnaire

Nebraska inheritance tax worksheet

Nebraska Tax Forms and Instructions for 2021 (Form 1040N) - Income Tax Pro Printable Nebraska state tax forms for the 2021 tax year will be based on income earned between January 1, 2021 through December 31, 2021. The Nebraska income tax rate for tax year 2021 is progressive from a low of 2.46% to a high of 6.84%. The state income tax table can be found inside the Nebraska Form 1040N instructions booklet. PDF Nebraska Inheritance Tax 2015 - Center For Rural Affairs The tax is a state of Nebraska inheritance tax but the county receives the money. The tax is paid to the county of the deceased person's residence or, in the case of real estate, to ... In some estates this may require appraisals. An inheritance tax worksheet must be completed (essentially an inheritance tax return) and an effort Nebraska inheritance tax worksheet - CocoDoc How to Edit and fill out Nebraska inheritance tax worksheet Online. To start with, look for the "Get Form" button and tap it. Wait until Nebraska inheritance tax worksheet is ready. Customize your document by using the toolbar on the top. Download your completed form and share it as you needed.

Nebraska inheritance tax worksheet. Chapter 17 - Inheritance Tax | Nebraska Department of Revenue Nebraska inheritance tax is computed on the fair market value of annuities, life estates, terms for years, remainders, and reversionary interests. The fair market value is the present value as determined under the provisions of the Internal Revenue Code of 1986, as amended, and its applicable regulations with respect to estate tax. The Nuts And Bolts Of Nebraska's Inheritance Tax Once the amount of the inheritance tax is determined, an inheritance tax worksheet must be completed and presented to the appropriate county attorney (s) for audit. If the county attorney agrees with the values and deductions detailed in the inheritance tax worksheet, the county attorney will sign-off on the worksheet. Nebraska Inheritance Tax Worksheet 2021 Form - signNow Follow the step-by-step instructions below to design your nebraska inheritance tax worksheet: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature. Create your signature ... Homeschool Math Worksheets - Blogger Primary Maths Worksheets Maths Worksheets For Ki... Bettie Raymond. September 07, 2021. 0 Read more » jiji math What Is Jiji Math? The description of ST JiJi Math. What is JiJi math. Jiji Travels To Seoul Korea Propelled By Student St Math Progress Of 80 Third Grade Ma... Bettie Raymond. September 06, 2021. 0

Does Nebraska Have an Inheritance Tax? - Hightower Reff Law On the inheritance tax worksheet, the filing party can also take deductions for things like attorney fees, accountant fees, other administrative expenses, and paid claims and bills of the decedent. There are also other applicable deductions that come into play for children, such as an exempt property deduction. What You Need to Know About Nebraska's Inheritance Tax The burden of paying Nebraska's inheritance tax ultimately falls upon those who inherit the property, not the estate. Beneficiaries inheriting property pay an inheritance tax over the value that exceeds their exemption amount, which ranges between $10,000 and $40,000. Activity Sheets For Grade 4 Based On Melc - Homeschool Math Worksheets These activity sheetsworksheets are made for the 1st quarter of this school year in GRADE 1. Preparation of the Key Stage 2 Grades 4-6 and Key Stage 3 Junior HS and Key Stage 4 Senior HS shall be based on the agreed distribution per grade levels. These learning activity sheets are ready to print and may be. Nebraska Inheritance Tax Worksheet Instructions ? - 50.iucnredlist nebraska-inheritance-tax-worksheet-instructions 2/4 Downloaded from 50.iucnredlist.org on July 10, 2022 by guest straightforward estate, allow this book to explain all the basics you need to know to tackle this project on your own, saving you thousands in the process. In this book, you will learn about identifying the different types of trusts ...

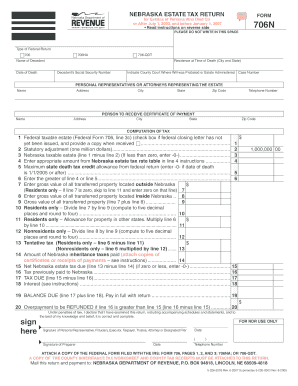

Nebraska Estate Tax: Everything You Need to Know - SmartAsset The inheritance tax is levied on money already passed from an estate to a person's heirs. Beneficiaries are responsible for paying the inheritance tax on the assets they inherit. Nebraska Inheritance and Gift Tax. Nebraska does have an inheritance tax. The rate depends on your relationship to your benefactor. If you leave money to your spouse ... Nebraska Inheritance Tax Worksheet Form - Fill and Sign Printable ... The following tips will allow you to fill out Nebraska Inheritance Tax Worksheet Form easily and quickly: Open the document in the full-fledged online editor by hitting Get form. Fill in the required boxes that are marked in yellow. Click the arrow with the inscription Next to move from one field to ... Nebraska Inheritance Tax Updates — Erickson & Sederstrom The inheritance tax must be filed in and paid to the county in which the decedent resided or within the county in which his or her real property was located. The inheritance tax is due and payable within twelve (12) months of the decedent's date of death, and failure to timely file and pay the requisite tax may result in interest and penalties. Get Nebraska Probate Form 500 Inheritance Tax - US Legal Forms Stick to these simple guidelines to get Nebraska Probate Form 500 Inheritance Tax prepared for sending: Get the form you require in the library of legal forms. Open the template in our online editing tool. Look through the instructions to learn which data you must provide. Click the fillable fields and put the necessary data.

Nebraska Legislature 30-2322. Homestead allowance. A surviving spouse of a decedent who was domiciled in this state is entitled to a homestead allowance of seven thousand five hundred dollars for a decedent who dies before January 1, 2011, and twenty thousand dollars for a decedent who dies on or after January 1, 2011.

Death and Taxes: Nebraska's Inheritance Tax - Platte Institute Nebraska's inheritance tax was adopted in 1901, before the state had a sales or income tax, and has remained relatively the same for the last 120 years. The unique feature about Nebraska's inheritance tax is that it was and still is the only state in the nation to use this tax as a local revenue source. The inheritance tax, which is levied ...

Nebraska Inheritance Tax | Nolo Others pay 18% tax after $10,000. Any person or organization that doesn't fall within these categories owes inheritance tax on amounts over $10,000. The tax rate is 18%. (Neb. Rev. Stat. Ann. § 77-2006.) Example: Annabel left $100,000 to various family members and friends when she died.

Nebraska Legislature In all proceedings for the determination of inheritance tax, the following deductions from the value of the property subject to Nebraska inheritance taxation shall be allowed to the extent paid from, chargeable to, paid, payable, or expected to become payable with respect to property subject to Nebraska inheritance taxation:

Don't die in Nebraska: How the county inheritance tax works In short, if a resident of Nebraska dies and their property goes to their spouse, no inheritance tax is due. If it goes to their parents, grandparents, siblings, children, or a lineal decedent (or their spouse) then the tax is applied to anything over $40,000 at a rate of 1%. If it goes to an aunt, uncle, niece, nephew, or any lineal decedent ...

Master Forms List | Nebraska Judicial Branch - Nebraska Supreme Court Certificate of Mailing a Notice of Filing a Petition For The Determination of Inheritance Tax: CC 15:5 : English : Mar 2019: Certificate of Mailing, Annual Budget Reporting Forms ... Worksheet, Information Worksheet: DC 19:27 ... the Nebraska judicial system has two other courts - the separate juvenile courts located in Douglas, Lancaster ...

Nebraska Inheritance Laws: What You Should Know - SmartAsset For Nebraskans, your specific relation to the decedent is what will determine how your inheritance from the estate is taxed. This differs from estate taxes in that they are based on what the heir receives, rather than the entirety of the estate prior to any inheritances. More specifically, these taxes go as follows: Nebraska has no estate tax.

PDF Nebraska Inheritance Tax Update - University of Nebraska-Lincoln Currently the first $10,000 of the inheritance is not taxed. Anything above $10,000 in value is subject to a 18% inheritance tax. How is this changed by LB310? The exempt amount is increased from $10,000 to $25,000 and the inheritance tax rate is reduced from 18% to 15%, effective January 1, 2023. How is inheritance tax paid?

The Basics of Intestate Heir Law - The Balance The order in which heirs inherit from a decedent's estate when he has no estate plan is called "intestate succession." It's a list of kin who have the first right to inherit. Someone further down on the list typically will not inherit anything if those who are ahead of him are still living. A surviving spouse almost invariably receives at least ...

Additional Information: Estates | Nebraska Judicial Branch Settling an estate can be complicated, and completion of the Inheritance tax form and Probate Inventory Worksheet can be difficult. Because of the complexity of estates, this Self-Help Center cannot provide forms for all possible situations in this process. You have the option to hire a lawyer to do only part of your case.

Nebraska inheritance tax worksheet - CocoDoc How to Edit and fill out Nebraska inheritance tax worksheet Online. To start with, look for the "Get Form" button and tap it. Wait until Nebraska inheritance tax worksheet is ready. Customize your document by using the toolbar on the top. Download your completed form and share it as you needed.

PDF Nebraska Inheritance Tax 2015 - Center For Rural Affairs The tax is a state of Nebraska inheritance tax but the county receives the money. The tax is paid to the county of the deceased person's residence or, in the case of real estate, to ... In some estates this may require appraisals. An inheritance tax worksheet must be completed (essentially an inheritance tax return) and an effort

Nebraska Tax Forms and Instructions for 2021 (Form 1040N) - Income Tax Pro Printable Nebraska state tax forms for the 2021 tax year will be based on income earned between January 1, 2021 through December 31, 2021. The Nebraska income tax rate for tax year 2021 is progressive from a low of 2.46% to a high of 6.84%. The state income tax table can be found inside the Nebraska Form 1040N instructions booklet.

0 Response to "45 nebraska inheritance tax worksheet"

Post a Comment