38 colorado pension and annuity exclusion worksheet

Success Essays - Assisting students with assignments online Get 24⁄7 customer support help when you place a homework help service order with us. We will guide you on how to place your essay help, proofreading and editing your draft – fixing the grammar, spelling, or formatting of your paper easily and cheaply. Colorado's Pension and Annuity Subtraction - Jim Saulnier, CFP If you are 65 or older you can subtract up to $24,000 of income If you are between 55 and 65 you can subtract up to $20,000 If you are under 55 years old (utilizing the beneficiary exception) you can subtract up to $20,000 Considering the Centennial State has a flat income tax of 4.63% these subtractions often translate to substantial tax savings.

2021 Instructions for Schedule H (2021) | Internal Revenue ... For 2021, the monthly exclusion for qualified parking is $270 and the monthly exclusion for commuter highway vehicle transportation and transit passes is $270. Credit reduction state. A state that hasn't repaid money it borrowed from the federal government to pay unemployment benefits is a “credit reduction state.”

Colorado pension and annuity exclusion worksheet

Colorado Pension and Annuity Exclusion pre-populates ... On the Colorado Pension Exclusion Worksheet, the bottom line 6, should be showing the $20,000 limit on yours. It is showing on mine. However, why your wife shows such an odd amount is another story. Since my program is working correctly, I can't diagnose your issue without your help. PDF Common questions and answers about pension subtraction adjustments CO-60 (11/18) (page 4 of 4) Rollovers Q: If a qualifying pension is rolled over into an annuity, will the distribution from the annuity qualify for the $20,000 pension and annuity income exclusion? A: Yes, if the income was included in FAGI and provided all other requirements are met (over 59½, periodic payments, attributable to personal services performed before retirement and an employer- What is an Annuity Exclusion Ratio? How Does It Work? If you purchase a variable annuity for $100,000 with a payment period of 10 years or 120 months, you would calculate your exclusion ratio by dividing your initial investment by your number of payment periods, or $100,000 divided by 120. Each month your exclusion ratio would be around $833 and any gains earned would be considered taxable income.

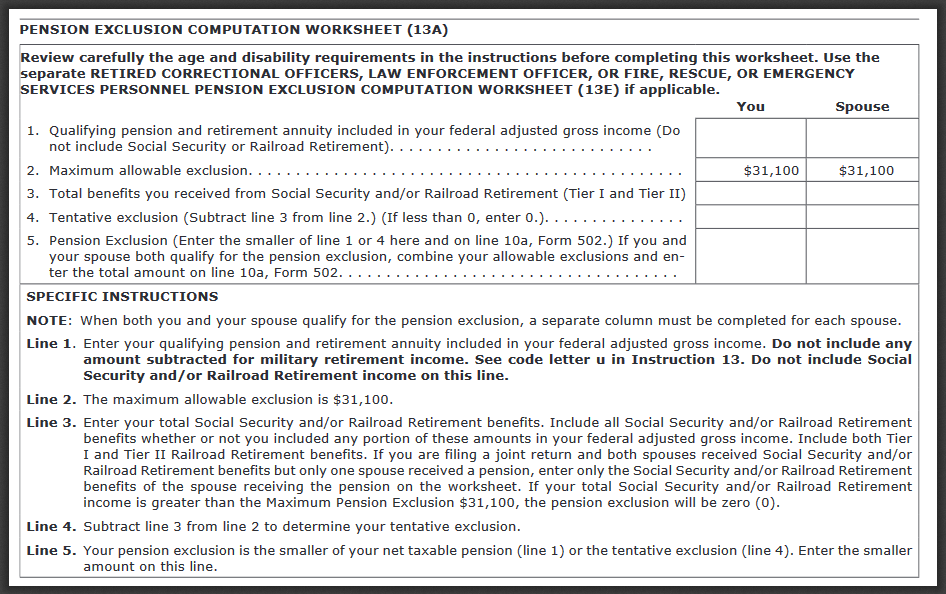

Colorado pension and annuity exclusion worksheet. Line-by-Line Instructions for the DR 0104AD - Colorado tax This subtraction is allowed only for pension or annuity income that is included in your federal taxable income. The amount of subtraction you can claim is also ...5 pages Pension Tax By State - Retired Public Employees Association Feb 24, 2022 · Exclusion reduced to $31,110 for pension and annuity. Tax info: 502-564-4581 or revenue.ky.gov: Louisiana: Yes: Yes: Yes: No: Over 65 retirement income exclusion up to $6,000 (single). Visit revenue.louisiana.gov: Maine: Yes: Yes: Yes: No: Deduct up to $10,000 of pension and annuity income; reduced by social security received. Tax info: 207-626 ... Pension and Annuity Subtraction - Colorado.gov No information is available for this page.Learn why4 pages DR0104Book_2021_V3.pdf - Colorado tax 18 Jan 2022 — to exclude amounts withheld from Colorado real ... your taxable pension/annuity income, whichever is smaller; or.48 pages

Income 25: Pension and Annuity Subtraction - FreeTaxUSA Jamie has a total of $20,400 income that is eligible for the pension and annuity subtraction: $2,400 of Social Security benefits and $18,000 of pension income. However, Jamie's pension and annuity subtraction is limited to $20,000 because Jamie is under the age of 65. Screen 1099R - Pension and Annuity Information (1040) - Thomson Reuters Use to indicate an early (but not premature) IRA distribution qualifies for exclusion. When using this code, the distribution is used on the Colorado Pension-Annuity Subtraction Worksheet, line f, federal qualified IRA distributions line. The distribution code entered in the federal 1099R screen, box 7 is ignored if "1" or "2" is used. Connecticut Individual Income Tax Guide | Department of Revenue Colorado income tax is based generally on federal taxable income, although various modifications and adjustments are made in the calculation of Colorado income ... New York Pension and Annuity Income (Exclusion) - LiveHelpNow If you received pension and annuity income and are married, or received pension and annuity income as a beneficiary, see below. $20,000 limit - You may not take a pension and annuity income exclusion that exceeds $20,000, regardless of the source (s) of the income. • periodic payments for services you performed as an employee before you ...

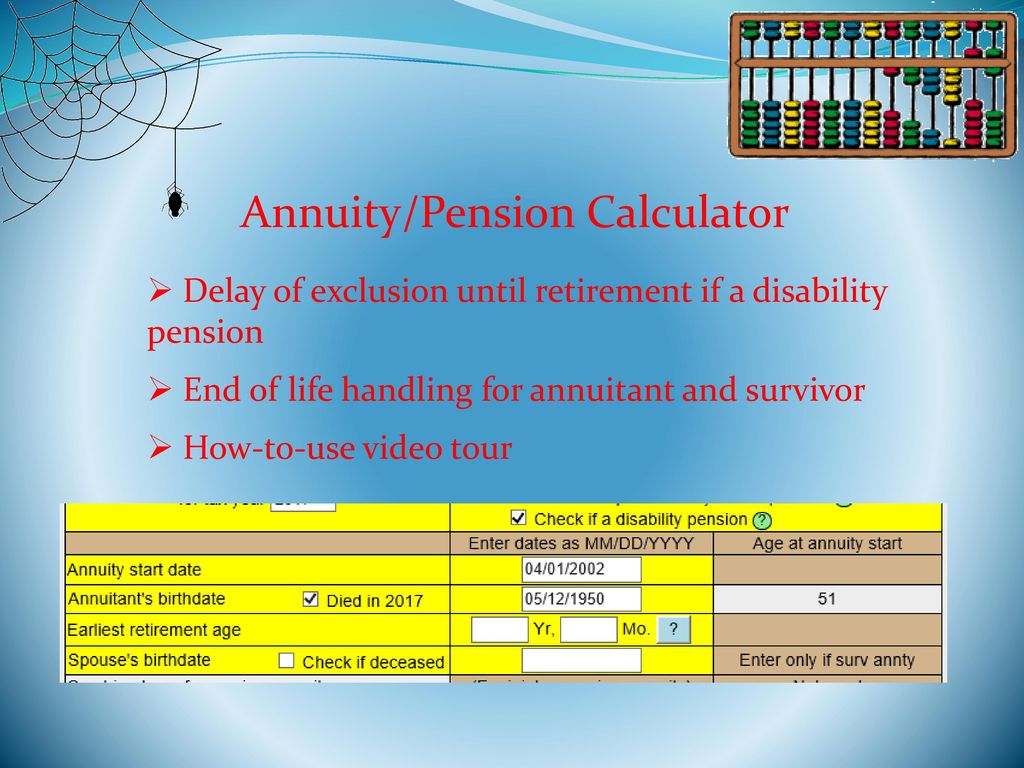

Income 25: Pension and Annuity Subtraction | Colorado tax If you meet certain qualifications, you can subtract some or all of your pension and annuity income on your Colorado individual income tax return (Form 104) ...4 pages PDF Line by Line Instructions for Preparing Form 104 LINE 11 PENSION AND ANNUITY EXCLUSION - SPOUSE. If you are filing a joint return, enter your spouse's pension or annuity exclusion, if any, on line 11. See instruction 10 for a definition of excludible pension/annuity income. Your spouse also must be 55 years of age by December 31, 1998 to claim the pension exclusion. AARP Tax-Aide Tool List - Colorado Tax-Aide Resources This worksheet determines the amounts that should be removed from the pension exclusion and calculates the amount that should be added as the RRB benefits line on the State Return section of TaxSlayer. Although designed specifically for Colorado it may work for other states if the problem is the same. Sales Tax Deduction Worksheet Pension Exclusion Calculator - cotaxaide.org Annuity/Pension Exclusion Calculator. Clear and reset calculator. ... no pension exclusion but, exclude 0 Public Safety Officer insurance #2: as pension income (Form 1040 line ... Enter Taxable Amount directly or use the worksheet: Form RRB-1099-R: 3 Total employee contributions : 0: 7 Total Gross Paid 0: 7a Taxable Amount: 0: Enter Taxable ...

Simplified Method for Pensions and Annuities - TaxAct On your annuity starting date, either you were under age 75 or the number of years of guaranteed payments was fewer than 5. See IRS Publication 575 Pension and Annuity Income for the definition of guaranteed payments. The Simplified Method Worksheet helps you figure the taxable and tax-free parts of your annuity payments each year.

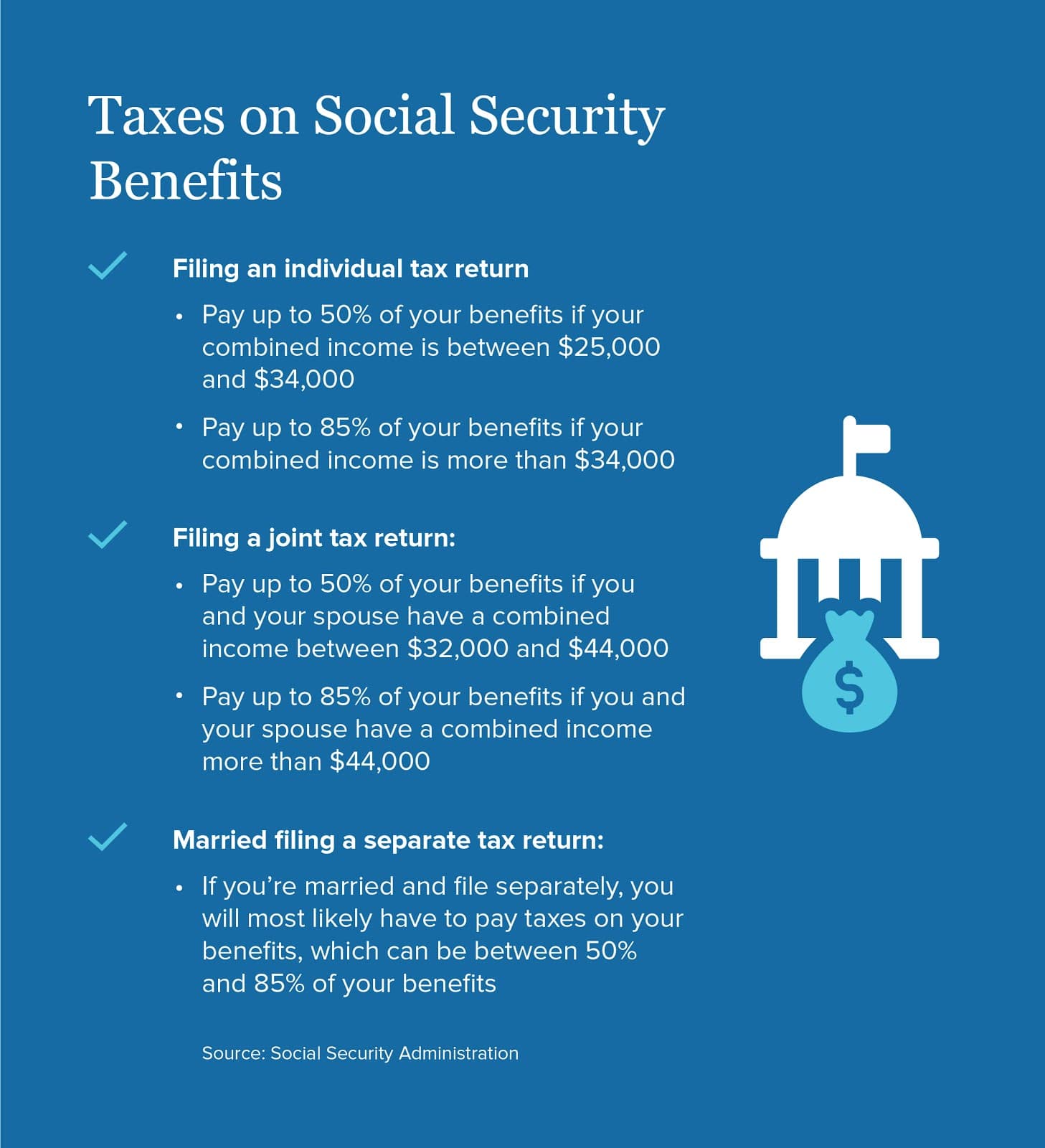

Publication 525 (2021), Taxable and Nontaxable Income 575 Pension and Annuity Income. 907 Tax Highlights for Persons With Disabilities. 915 Social Security and Equivalent Railroad Retirement Benefits. 970 Tax Benefits for Education. 4681 Canceled Debts, Foreclosures, Repossessions, and Abandonments

Achiever Papers - We help students improve their academic ... Professional academic writers. Our global writing staff includes experienced ENL & ESL academic writers in a variety of disciplines. This lets us find the most appropriate writer for any type of assignment.

pension worksheet template excel 31 Colorado Pension And Annuity Exclusion Worksheet - Free Worksheet. 9 Images about 31 Colorado Pension And Annuity Exclusion Worksheet - Free Worksheet : Perfect Storm Prompts Changes in Pension Accounting, FREE 12+ Expense Worksheet Samples & Templates in PSD | PDF and also Mechanical Engineering Spreadsheets Free Download pertaining to 5 Free.

Colorado Form 104 Instructions - eSmart Tax Any qualifying spouse pension/annuity income should be reported on line 8. TIP: Submit copies of all 1099R and SSA-1099 statements with your return. Submit using Revenue Online or attach to your paper return. Line 8 Spouse Pension and Annuity Subtraction. If the secondary taxpayer listed on a jointly filed return is eligible for the pension and ...

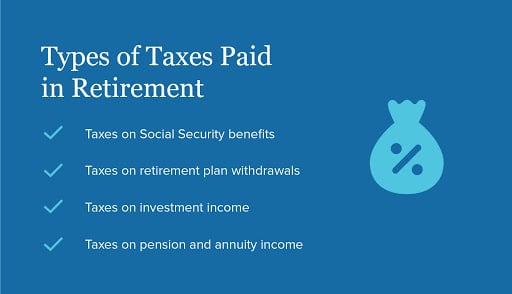

Publication 575 (2021), Pension and Annuity Income A tax-sheltered annuity plan (often referred to as a 403 (b) plan or a tax-deferred annuity plan) is a retirement plan for employees of public schools and certain tax-exempt organizations. Generally, a tax-sheltered annuity plan provides retirement benefits by purchasing annuity contracts for its participants. Types of pensions and annuities.

Retirement Income Exclusion | Georgia Department of Revenue Taxpayers who are 62 or older, or permanently and totally disabled regardless of age, may be eligible for a retirement income adjustment on their Georgia tax return. Retirement income includes: Income from pensions and annuities. Interest income. Dividend income. Net income from rental property. Capital gains income. Income from royalties.

What is the pension and annuity income exclusion on Colorado ... - Intuit As I understand the Colorado Pension & Annuity Exclusion, each individual can exempt up to $24,000 per year on his/her Colorado State return for retirement income such as IRA distributions and Social Security benefits. For married couples, each can exempt up to $24,000, for a total of $48,000 per couple.

Assignment Essays - Best Custom Writing Services Get 24⁄7 customer support help when you place a homework help service order with us. We will guide you on how to place your essay help, proofreading and editing your draft – fixing the grammar, spelling, or formatting of your paper easily and cheaply.

co-60.pdf - Common questions and answers about pension... However, if the taxpayer reached age 59½, the pension may qualify for a pension and annuity income exclusion under Tax Law section 612 (c) (3-a), up to $20,000. A : No. To qualify for full exclusion , the pension must be from a NYS or local government pension plan or a federal pension plan .

Arrest made in 1981 killing of Cherry Hills Village woman - KMGH CHERRY HILLS VILLAGE, Colo. — Sylvia Quayle's father found her dead at her home in Cherry Hills Village on Aug. 4, 1981. Nearly 40 years later, Quayle's family is finally getting closure. Police on Thursday announced the arrest of a Nebraska man in Quayle's killing, a suspect investigators found through genealogy analysis of a DNA sample ...

How Much of Your Pensions and Annuities Income Is Taxable? - The Balance The IRS provides a Simplified Method Worksheet to help you along. 2 1 How to Report Pension and Annuity Income Separate any 1099-R statements you receive into two piles: those from your IRA and those from your pension or annuity plans. You'll report your IRA distributions on lines 4a and 4b of the 2021 Form 1040.

PDF 2021 Publication 575 - IRS tax forms This is the method generally used to determine the tax treatment of pension and annuity in- come from nonqualified plans (including commercial an- nuities). For a qualified plan, you can't generally use the General Rule unless your annuity starting date is before November 19, 1996.

Taxes on Benefits - Colorado PERA Colorado law excludes from Colorado state income tax total pension income up to $20,000 per year per person for those retirees age 55 through 64, or $24,000 for ...

Income 25: Pension and Annuity Subtraction - Tax Colorado If you meet certain qualifications, you can subtract some or all of your pension and annuity income on your Colorado individual income tax return (Form 104). You must be at least 55 years of age unless you receive pension and annuity income as a death benefit. You can claim the subtraction only for pension and annuity income that is included in ...

Screen 1099R - Pension and Annuity Information (1040) - Thomson Reuters Use to indicate an early (but not premature) IRA distribution qualifies for exclusion. When using this code, the distribution is used on the Colorado Pension-Annuity Subtraction Worksheet, line f, federal qualified IRA distributions line. The distribution code entered in the federal 1099R screen, box 7 is ignored if "1" or "2" is used. Connecticut

Individual Income Tax | Information for Retirees Colorado allows a pension/annuity subtraction for: Taxpayers who are at least 55 years of age as of the last day of the tax year Beneficiaries of any age (such as a widowed spouse or orphan child) who are receiving a pension or annuity because of the death of the person who earned the pension Subtraction Amounts

pension worksheet template excel - Microsoft 31 colorado pension and annuity exclusion worksheet - free worksheet. 15 images about 31 colorado pension and annuity exclusion worksheet - free worksheet : free 12+ expense worksheet samples & templates in psd | pdf, free retirement excel spreadsheet in retirement planning worksheets and also tournament spreadsheet throughout template tournament …

PDF 2020 SIMPLIFIED METHOD WORKSHEET - a and 2020 SIMPLIFIED METHOD WORKSHEET - LINES 5a and 5 b Keep for Your Records Publication 575 Note: If you had more than one partially taxable pension or annuity, figure the taxable part of each separately. Enter the total of the taxable parts on Form 1040 or 1040-SR, line 5b. ... *A death benefit exclusion (up to $5,000) applied to certain ...

How do I report UK pension income on Form 1040 line 5b? You would think PS would have a worksheet option to report pensions from other countries. The solutions from the Community say to report it as Other Income on the 1040. However, I can see the client getting a letter from the CO Dept. of Rev. denying the pension exclusion reported on 104AD since that amount doesn't appear on the TP's 1040 line 5b.

PENSION OR ANNUITY DEDUCTION pension and annuity income, which may help them cover essential expenses, ... We examined the 40 other states (excluding Colorado) and the District.20 pages

What is an Annuity Exclusion Ratio? How Does It Work? If you purchase a variable annuity for $100,000 with a payment period of 10 years or 120 months, you would calculate your exclusion ratio by dividing your initial investment by your number of payment periods, or $100,000 divided by 120. Each month your exclusion ratio would be around $833 and any gains earned would be considered taxable income.

PDF Common questions and answers about pension subtraction adjustments CO-60 (11/18) (page 4 of 4) Rollovers Q: If a qualifying pension is rolled over into an annuity, will the distribution from the annuity qualify for the $20,000 pension and annuity income exclusion? A: Yes, if the income was included in FAGI and provided all other requirements are met (over 59½, periodic payments, attributable to personal services performed before retirement and an employer-

Colorado Pension and Annuity Exclusion pre-populates ... On the Colorado Pension Exclusion Worksheet, the bottom line 6, should be showing the $20,000 limit on yours. It is showing on mine. However, why your wife shows such an odd amount is another story. Since my program is working correctly, I can't diagnose your issue without your help.

![[ Offshore Tax ] Today's Thought - What Is Foreign Earned Income Exclusion?](https://i.ytimg.com/vi/gtRwnEyLUrg/maxresdefault.jpg)

:max_bytes(150000):strip_icc()/taxes-in-retirement-how-much-will-you-pay-2388083v-6-5b4cba9fc9e77c0037315bd8-8ed4f6b983744e1ba2e910636aa65873.png)

0 Response to "38 colorado pension and annuity exclusion worksheet"

Post a Comment