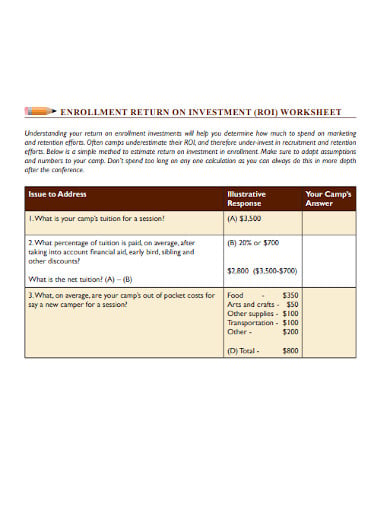

39 return on investment worksheet

› instructions › i6251Instructions for Form 6251 (2021) | Internal Revenue Service Investment interest expense that isn’t an itemized deduction. If you didn’t itemize deductions and you had investment interest expense, don’t enter an amount on Form 6251, line 2c, unless you reported investment interest expense on Schedule E (Form 1040), Supplemental Income and Loss. If you did, follow the steps above for completing Form ... › publications › p536Publication 536 (2021), Net Operating Losses (NOLs) for ... USE YOUR 2021 FORM 1040, 1040-SR, 1040-NR, OR 1041 TO COMPLETE THIS WORKSHEET: 1. Enter as a positive number your NOL deduction for the NOL year entered above from Schedule 1 (Form 1040) or Form 1040-NR, line 8; or Form 1041, line 15b _____ 2. Enter your taxable income without the NOL deduction for 2021. See instructions _____ 3.

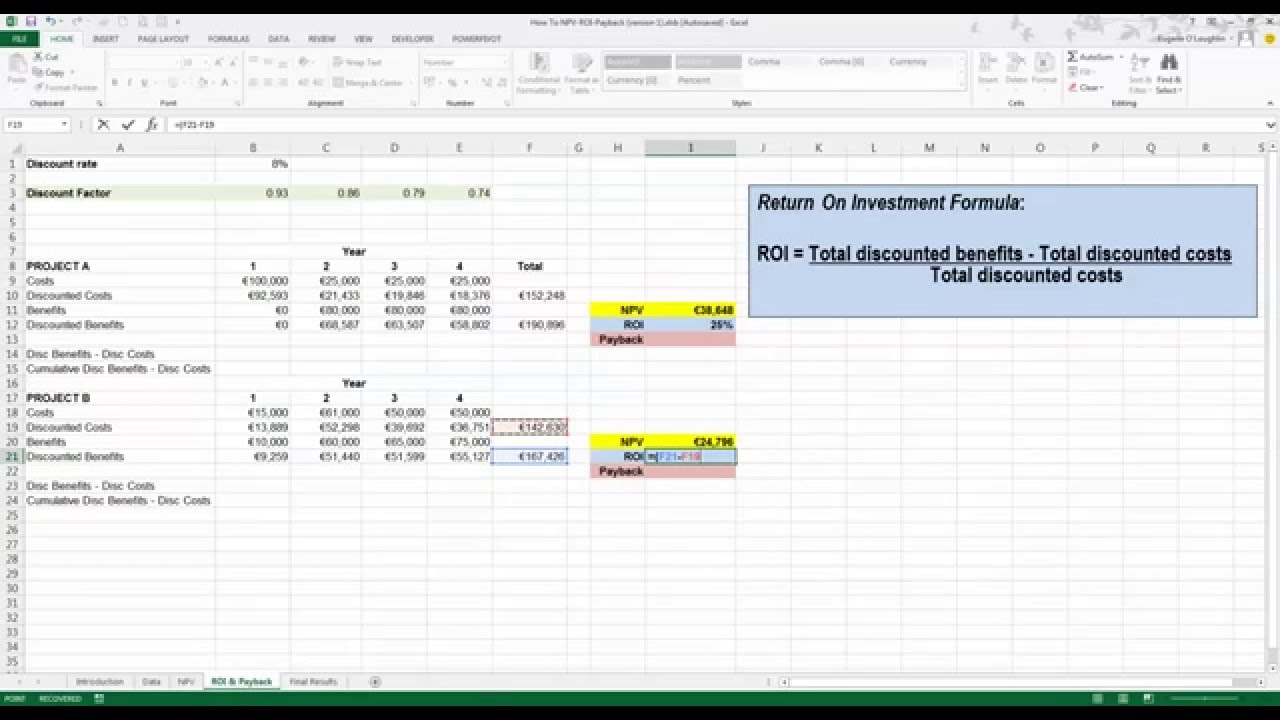

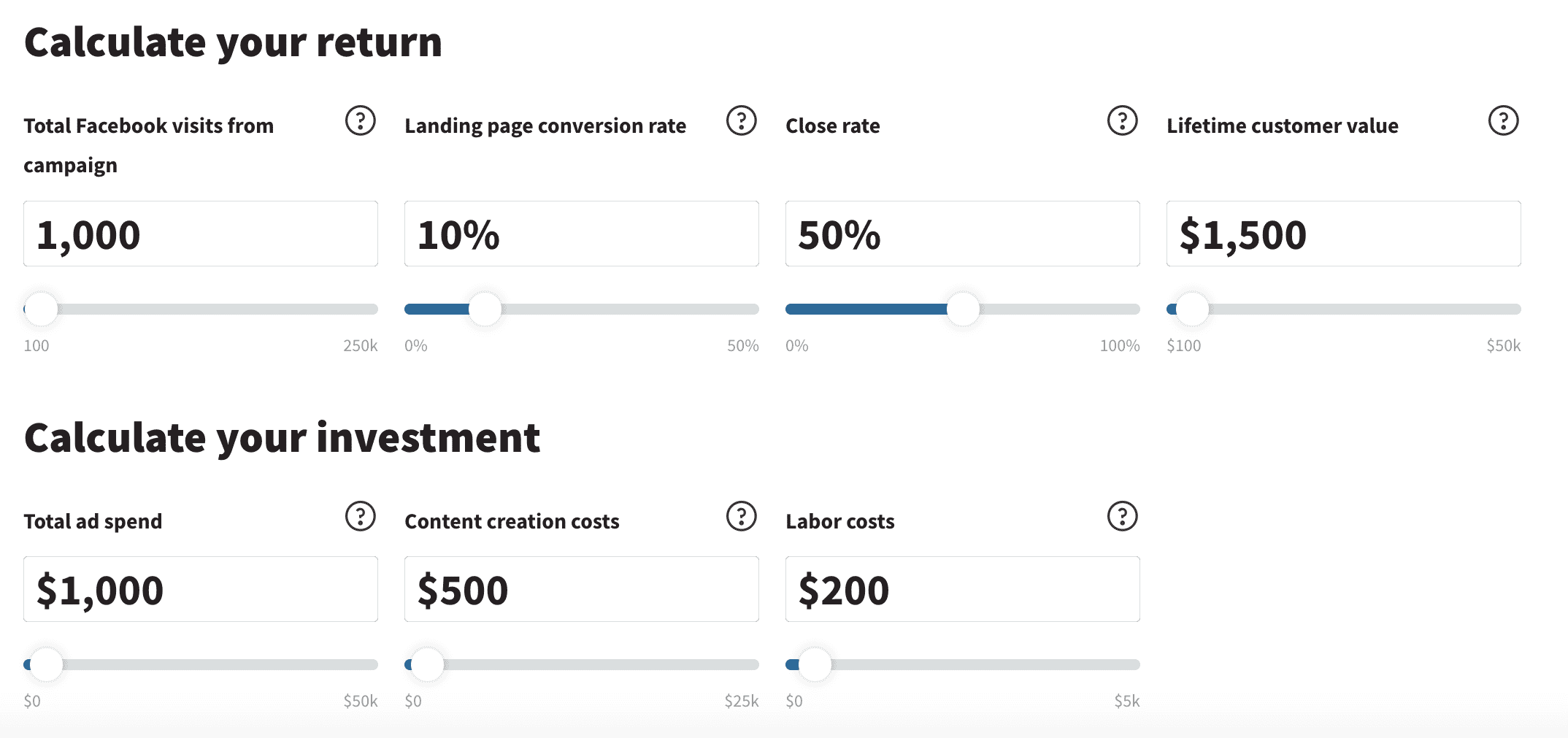

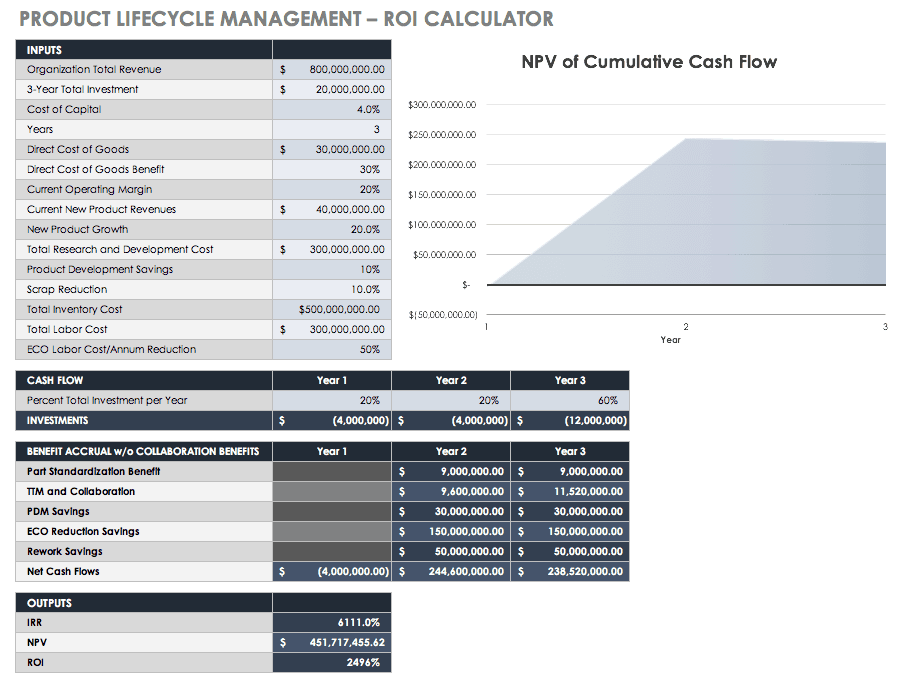

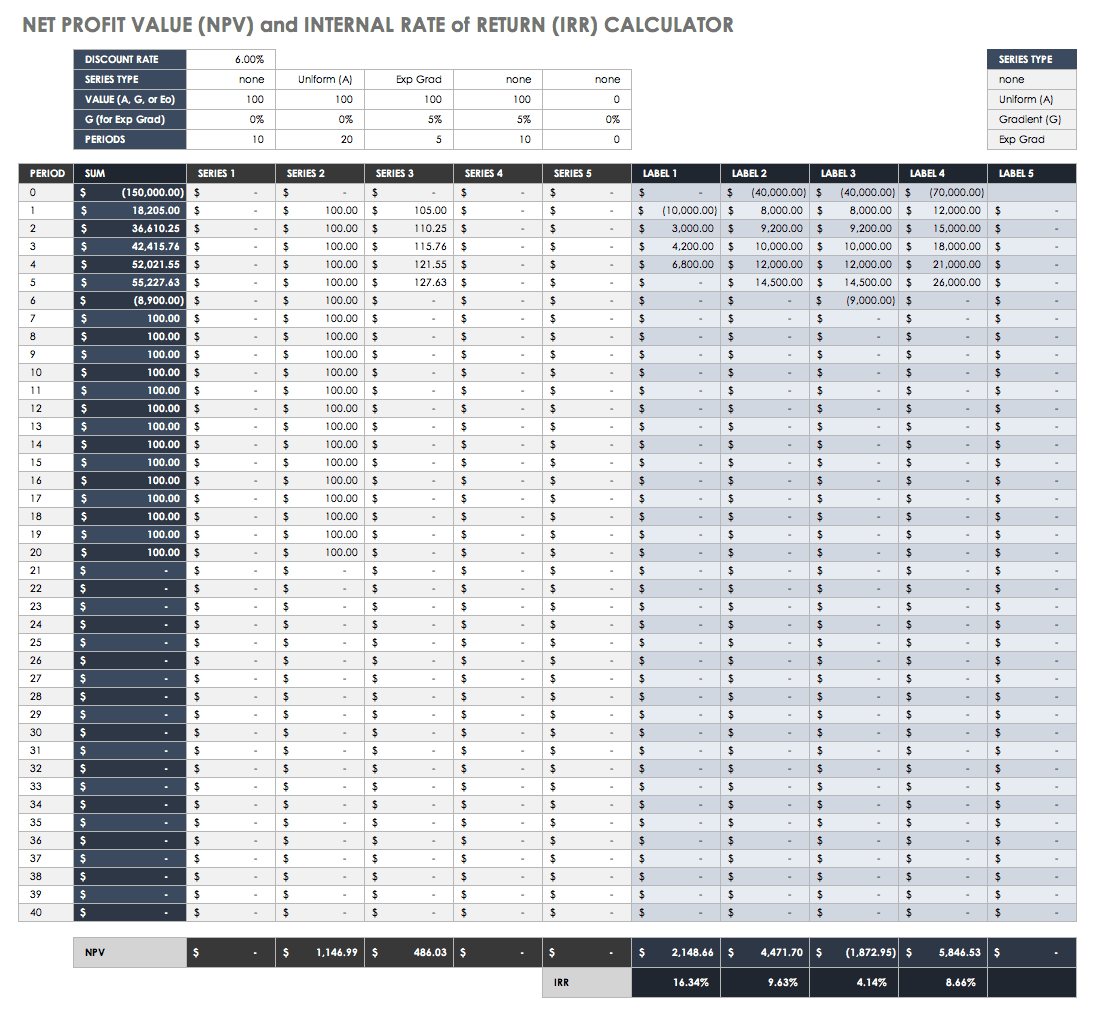

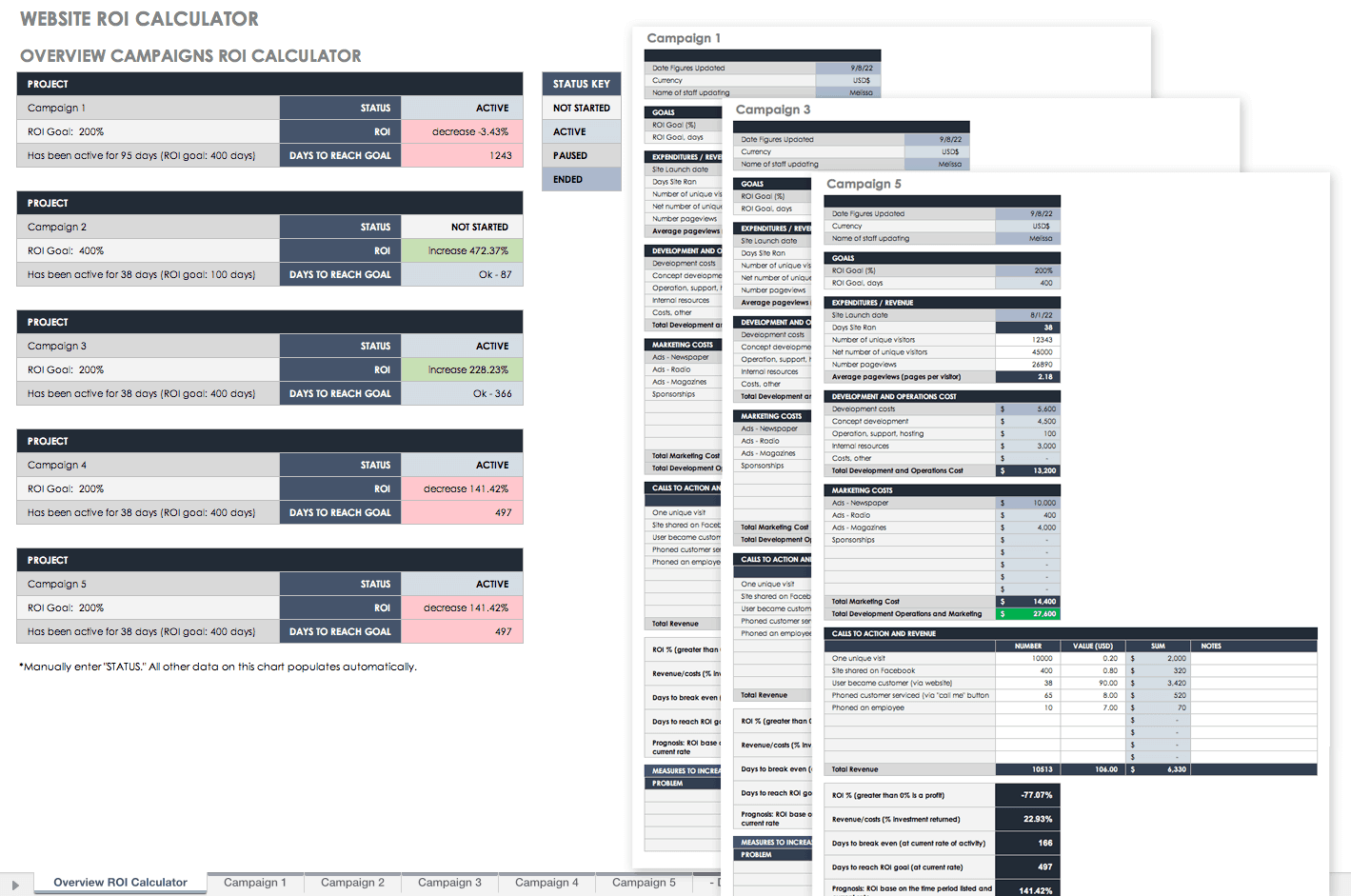

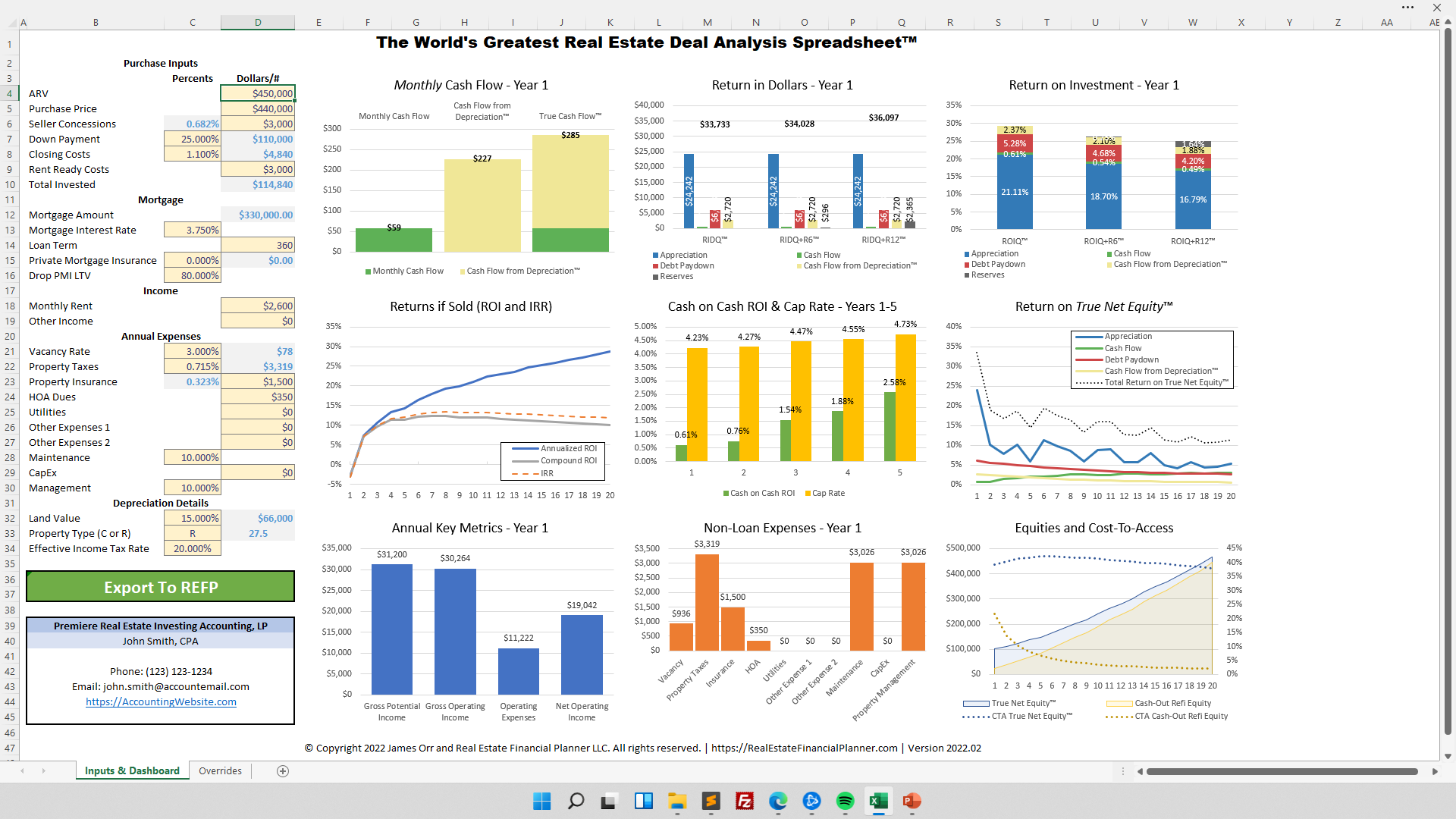

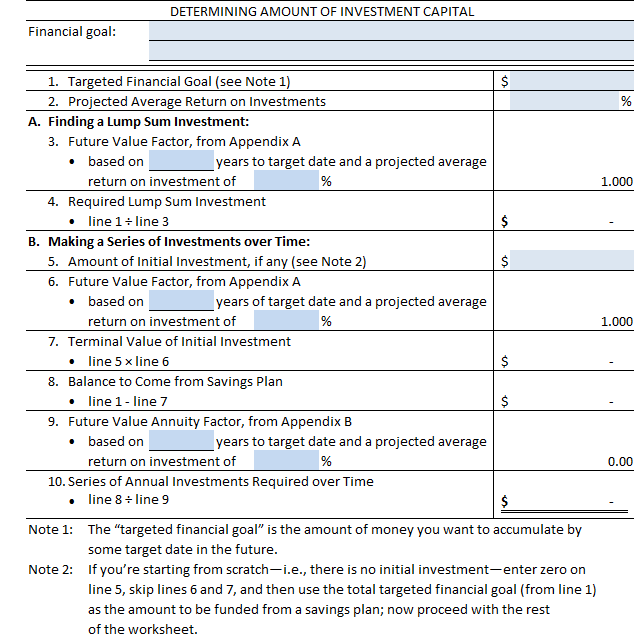

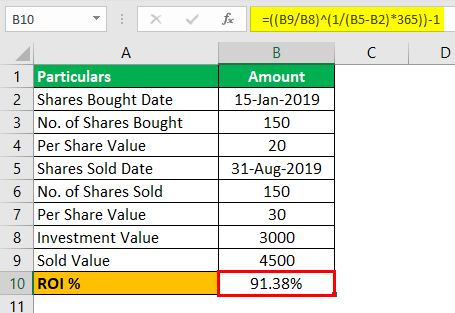

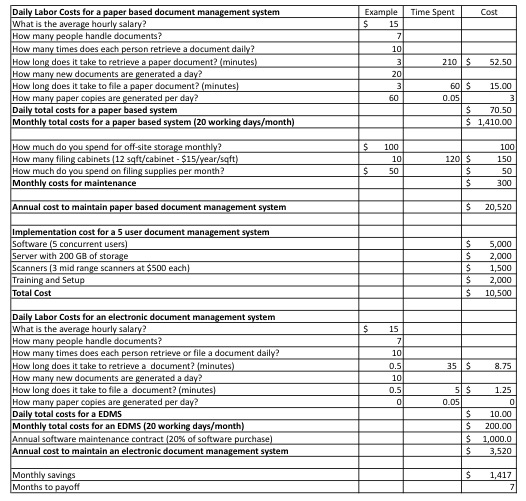

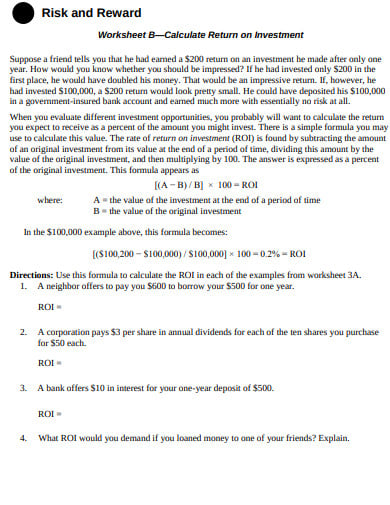

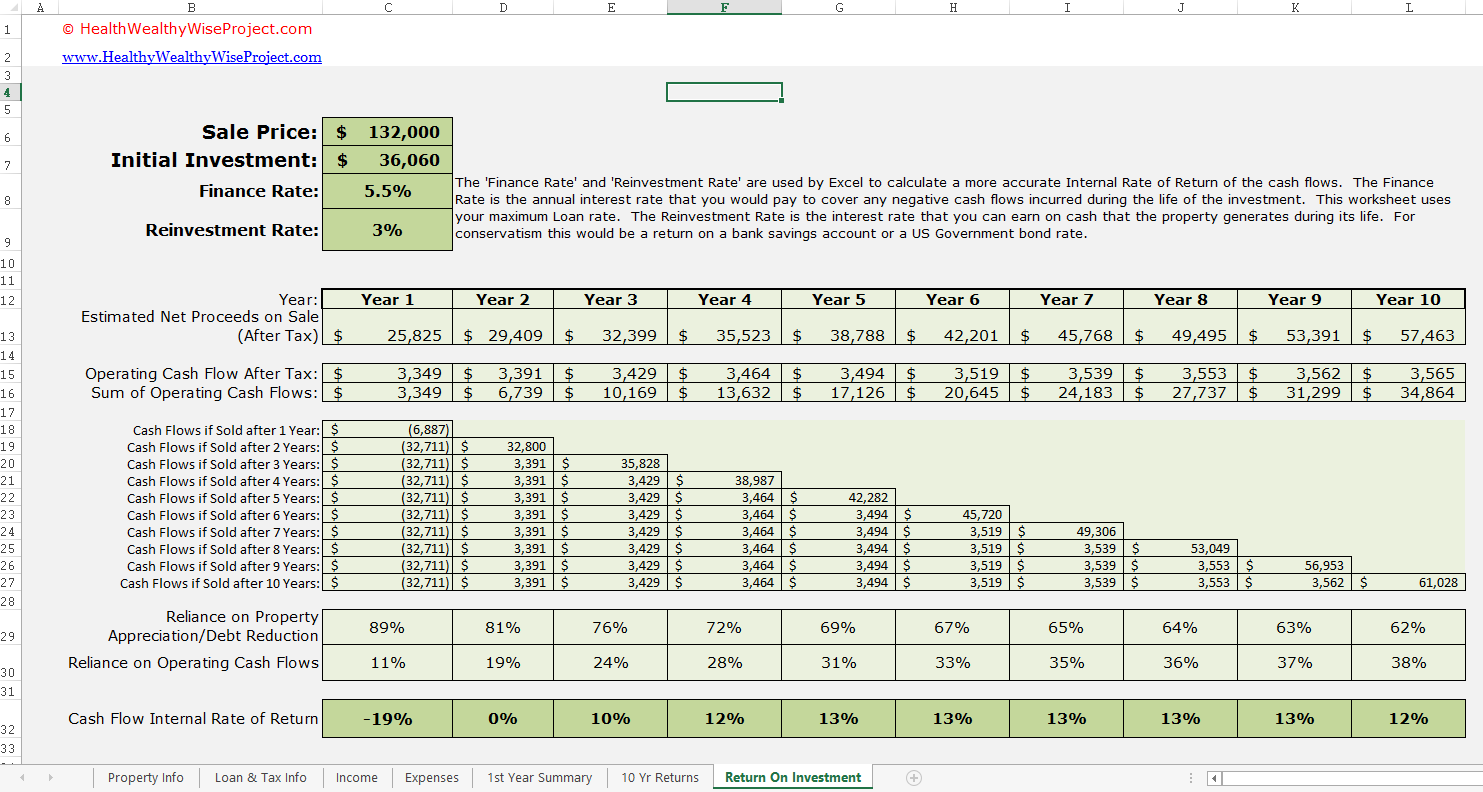

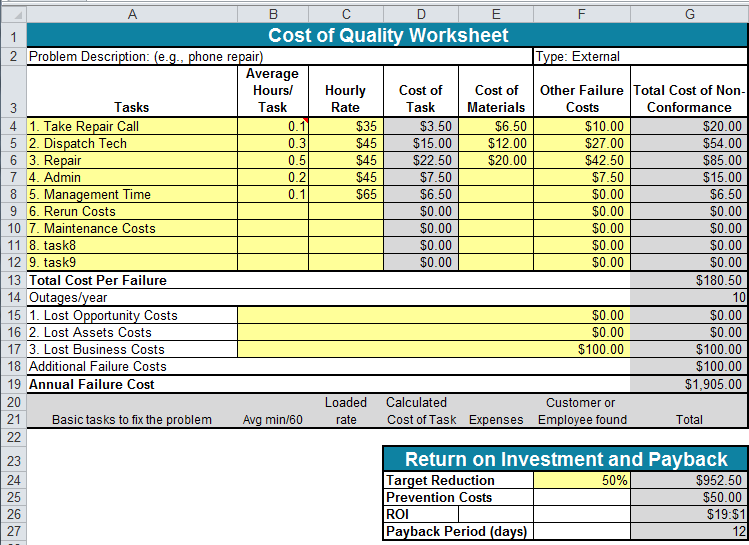

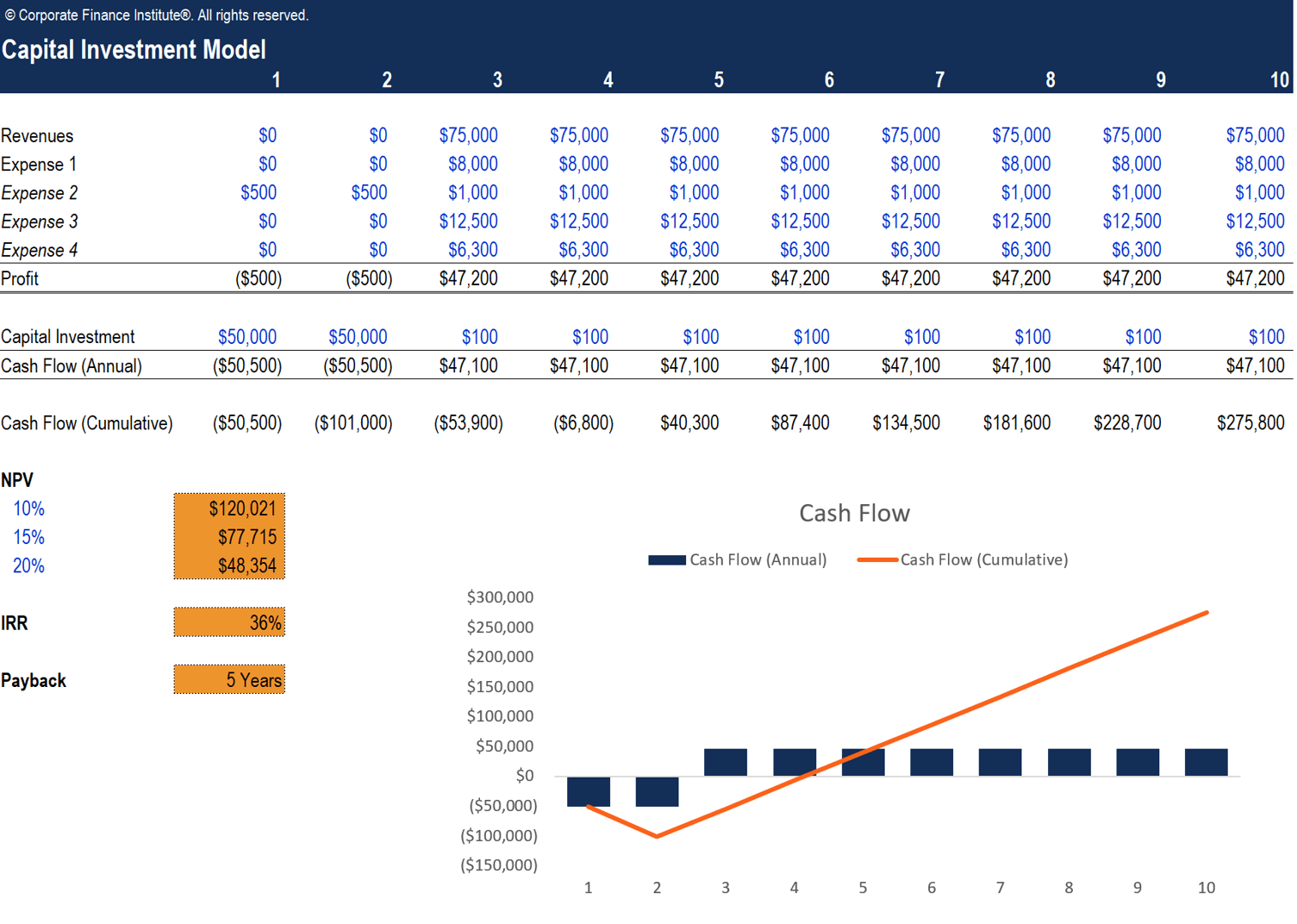

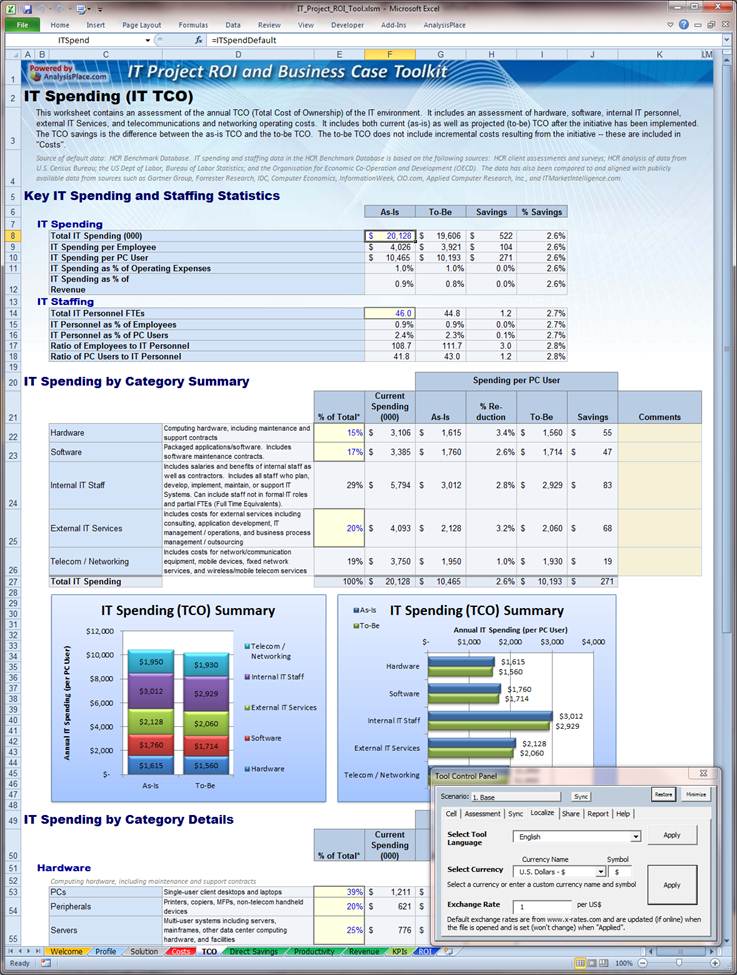

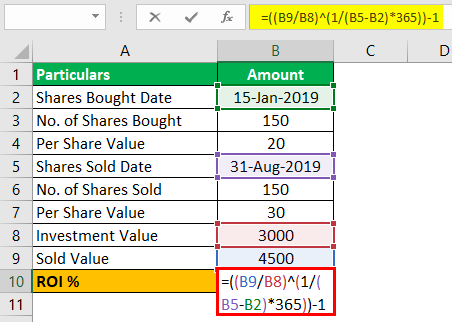

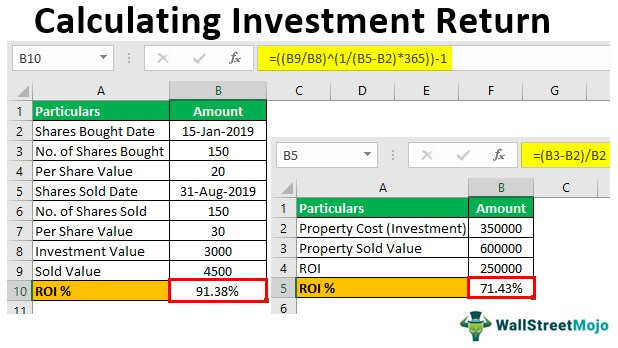

› category › financeReturn on Investment (ROI) Calculator Excel Templates E.g. An investor that relies only on the internal rate of return model would end up favouring a $1 investment that in the first year would generate $2 over a $5,000 investment that over that period would generate $8,000. How you calculate a return on investment can be adapted to suit the situation. Costs and returns may vary.

Return on investment worksheet

› publications › p590aPublication 590-A (2021), Contributions to Individual ... Modified AGI limit for certain married individuals increased. If you are married and your spouse is covered by a retirement plan at work and you aren’t, and you live with your spouse or file a joint return, your deduction is phased out if your modified AGI is more than $204,000 (up from $198,000 for 2021) but less than $214,000 (up from $208,000 for 2021).

Return on investment worksheet. › publications › p590aPublication 590-A (2021), Contributions to Individual ... Modified AGI limit for certain married individuals increased. If you are married and your spouse is covered by a retirement plan at work and you aren’t, and you live with your spouse or file a joint return, your deduction is phased out if your modified AGI is more than $204,000 (up from $198,000 for 2021) but less than $214,000 (up from $208,000 for 2021).

![Asset Allocation Spreadsheet [Excel Template] | White Coat ...](https://www.whitecoatinvestor.com/wp-content/uploads/2020/12/Screen-Shot-2020-12-03-at-9.35.37-AM.png)

0 Response to "39 return on investment worksheet"

Post a Comment