40 sale of rental property worksheet

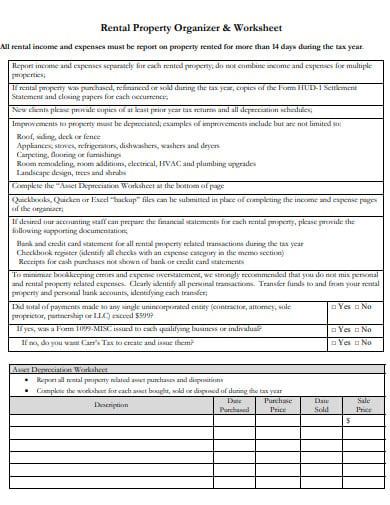

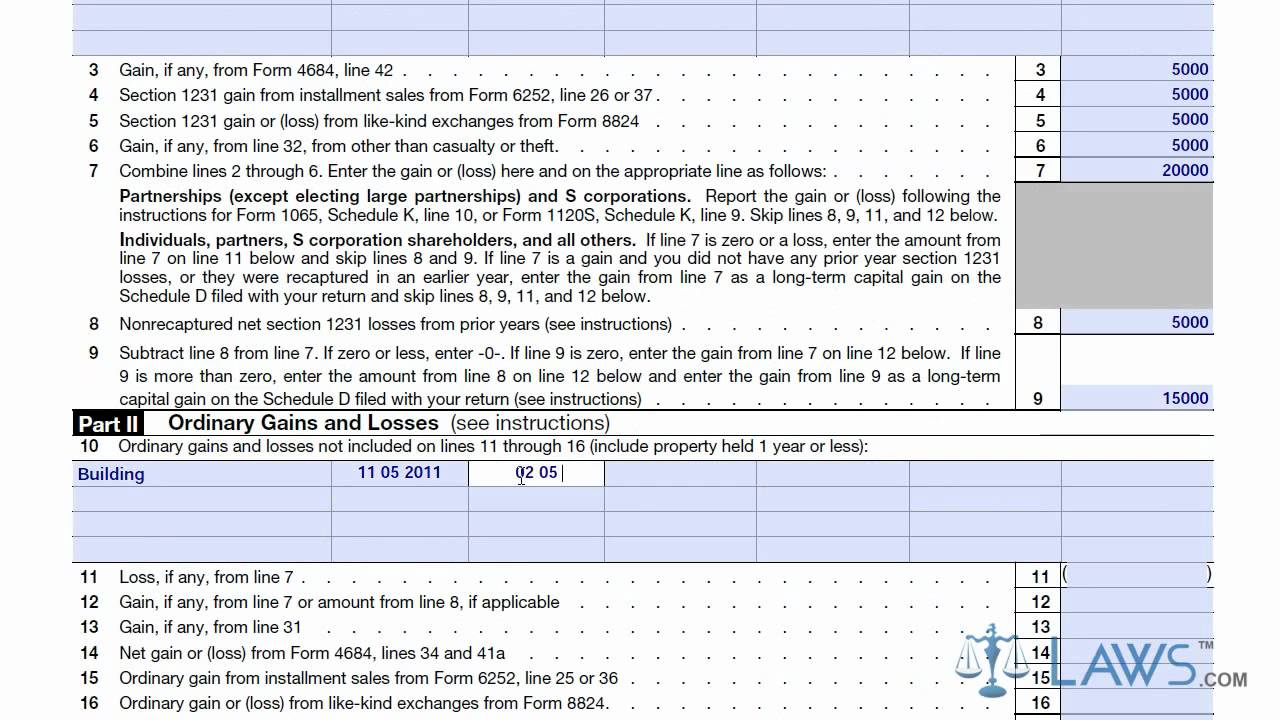

Free Property Sale Agreement Template & FAQs | Rocket Lawyer This document will define the obligations of both parties when a piece of property is being sold and will get you one step closer to selling or buying property. Property Sale Agreements will generally include details concerning the total purchase price of the property, closing costs, title requirements, and warranties. Publication 537 (2021), Installment Sales | Internal Revenue Service An installment sale of property used in your business or that earns rent or royalty income may result in a capital gain, an ordinary gain, or both. All or part of any gain from the disposition of the property may be ordinary gain from depreciation recapture. For trade or business property held for more than 1 year, enter the amount from line 26 ...

B3-6-06, Qualifying Impact of Other Real Estate Owned (06/30 ... Sep 07, 2022 · an existing investment property or a current principal residence converting to investment use, the borrower must be qualified in accordance with, but not limited to, the policies in topics B3-3.1-08, Rental Income, B3-4.1-01, Minimum Reserve Requirements, and, if applicable B2-2-03, Multiple Financed Properties for the Same Borrower;

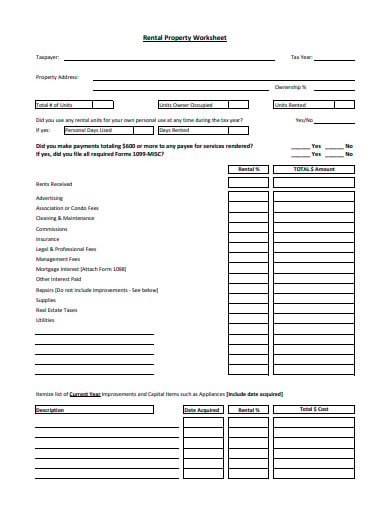

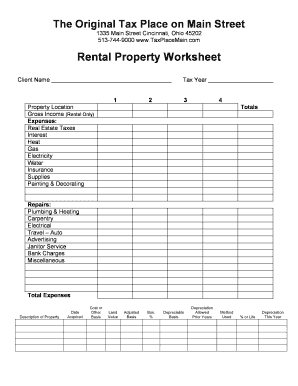

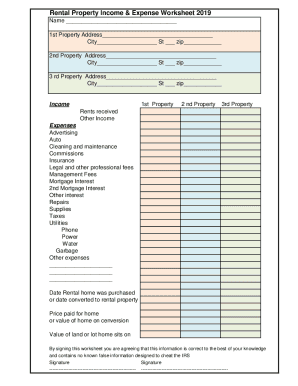

Sale of rental property worksheet

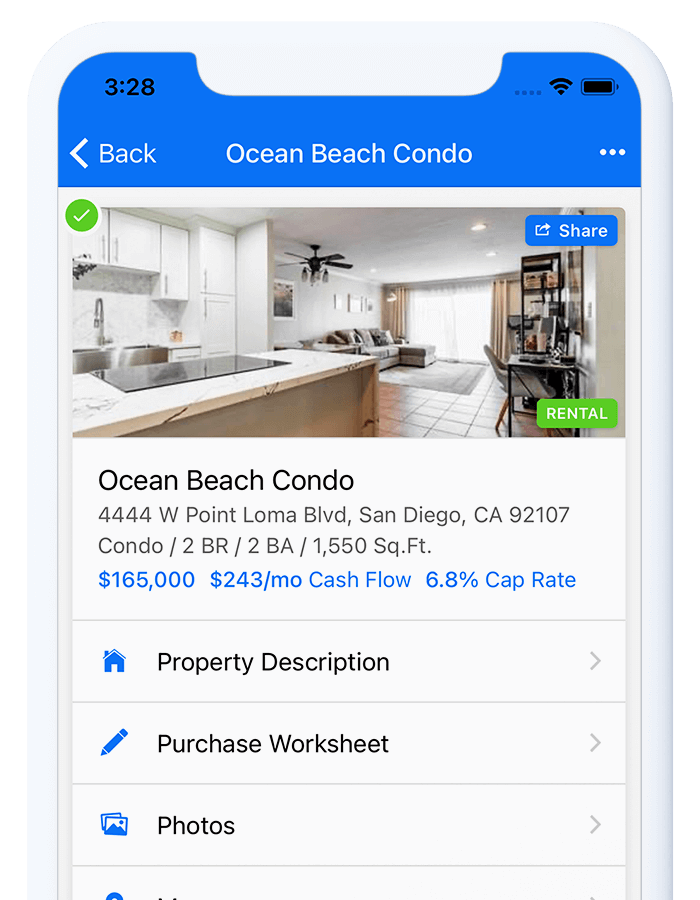

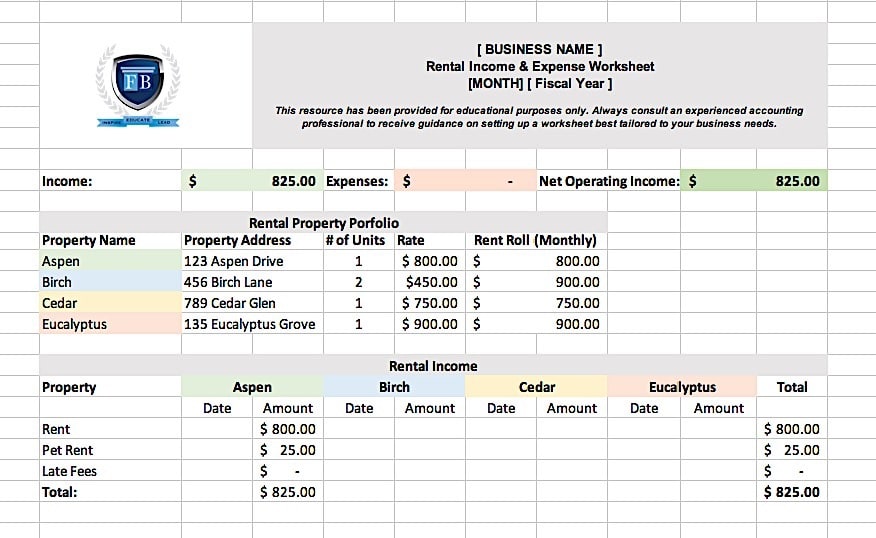

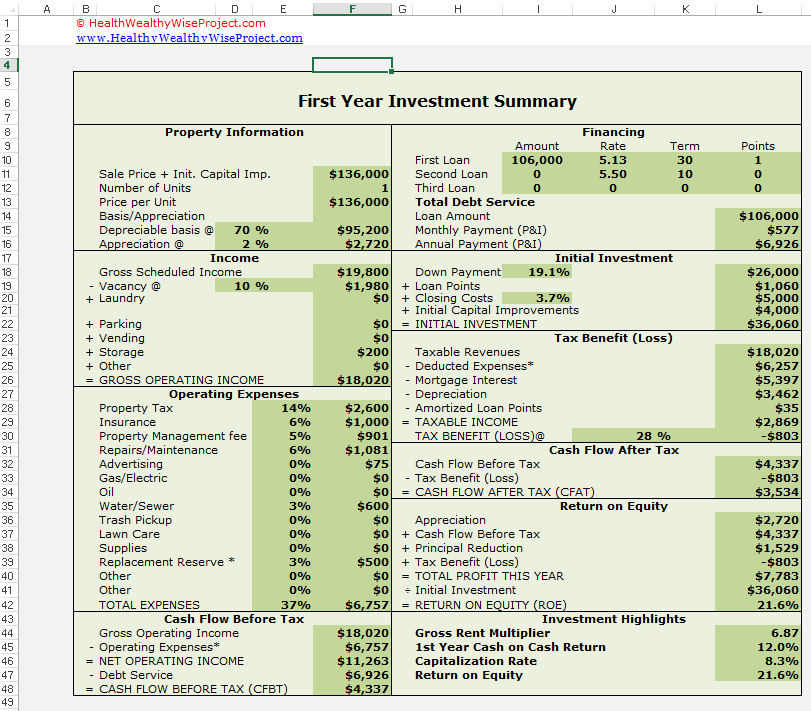

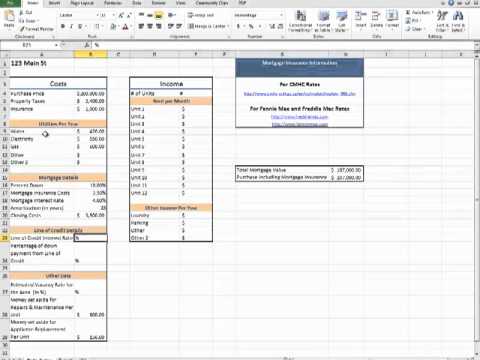

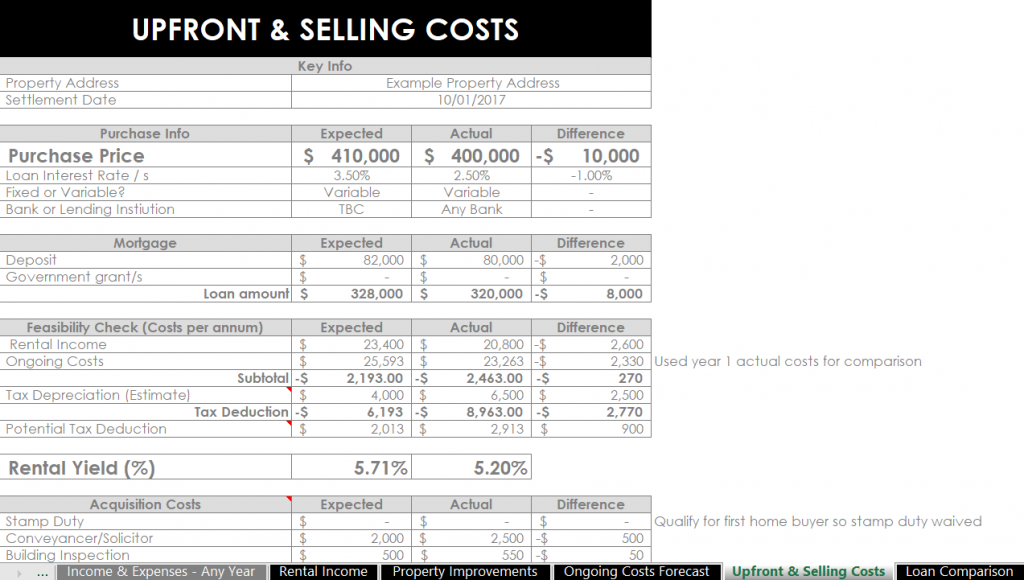

Rental Property Calculator | Zillow Rental Manager Aug 13, 2021 · The amount of money earned from the rental property is considered the total investment gain or profit. Here are the typical gains that may come out of a rental property investment: Rent: A tenant’s regular monthly payment to a landlord for the use of the property or land. Rent is generally the primary source of income on a rental property. Net Gains (Losses) from the Sale, Exchange, or Disposition of Property Net gains and losses on the sales of tangible and intangible personal property, including the sale of rights, royalties, patents and copyrights, used in a trade or business or that are part of a rental property or royalty business, are required to be reported as gains or losses on PA Schedule D if property of a similar nature is not purchased or obtained to replace the disposed property. In ... Do You Have to Pay Capital Gains Tax on a Home Sale? 02.03.2022 · You may be able to do so, however, on investment property or rental property. Keep in mind that gains from the sale of one asset can be offset by losses on other asset sales up to $3,000 or your ...

Sale of rental property worksheet. Publication 527 (2020), Residential Rental Property Sale of main home used as rental property. For information on how to figure and report any gain or loss from the sale or other disposition of your main home that you also used as rental property, see Pub. 523. Tax-free exchange of rental property occasionally used for personal purposes. If you meet certain qualifying use standards, you may qualify for a tax-free exchange (a like-kind … How to report sale of decedent's residence on form 1041 - Intuit May 31, 2019 · If you have not been claiming Rental Income/Expenses, you would enter the sale as a 'Sale of Business Property' on Form 4797 for an ordinary loss. If you have, click this link for info on How to Enter Sale of Rental Property. Click this link for more info on Rental Property in Trust. Do You Have to Pay Capital Gains Tax on a Home Sale? 02.03.2022 · You may be able to do so, however, on investment property or rental property. Keep in mind that gains from the sale of one asset can be offset by losses on other asset sales up to $3,000 or your ... Net Gains (Losses) from the Sale, Exchange, or Disposition of Property Net gains and losses on the sales of tangible and intangible personal property, including the sale of rights, royalties, patents and copyrights, used in a trade or business or that are part of a rental property or royalty business, are required to be reported as gains or losses on PA Schedule D if property of a similar nature is not purchased or obtained to replace the disposed property. In ...

Rental Property Calculator | Zillow Rental Manager Aug 13, 2021 · The amount of money earned from the rental property is considered the total investment gain or profit. Here are the typical gains that may come out of a rental property investment: Rent: A tenant’s regular monthly payment to a landlord for the use of the property or land. Rent is generally the primary source of income on a rental property.

![2022 Rental Property Analysis Spreadsheet [Free Template]](https://wp-assets.stessa.com/wp-content/uploads/2021/06/13170845/Property_Analysis_Spreadsheet__Stessa_.png)

0 Response to "40 sale of rental property worksheet"

Post a Comment