42 nc-4 allowance worksheet

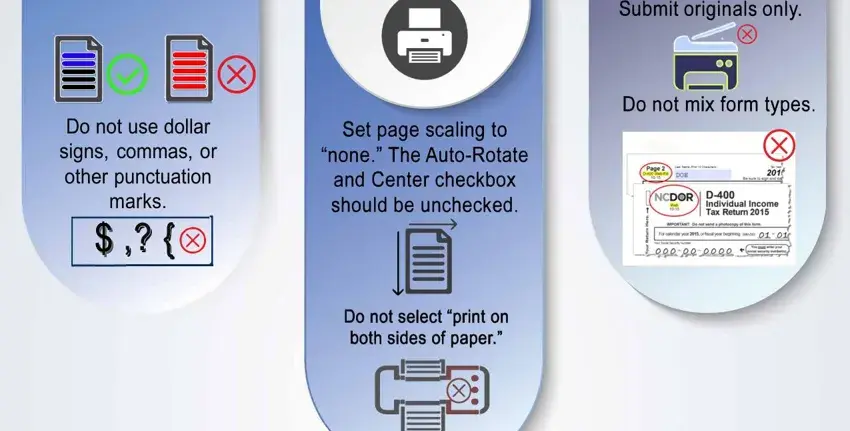

NC-4 Department of Revenue Employee's Withholding Allowance Certificate NC-4 Department of Revenue Employee's Withholding Allowance Certificate. Files. NC-4.pdf. NC-4 Department of Revenue Employee's Withholding Allowance Certificate. PDF • 488.48 KB - February 22, 2022 Share this page: Facebook; Twitter; Email; How can we make this page better for you? Back to top. Contact. North Carolina Office of State Human ... PDF Form NC-4 Instructions for Completing Form NC-4 Employee's Withholding ... BASIC INSTRUCTIONS- Complete the Personal Allowances Worksheeton Page 2 of Form NC-4. An additional worksheet is provided on Page 2 for employees to adjust their withholding allowances based on itemized deductions, adjustments to income, or tax credits.

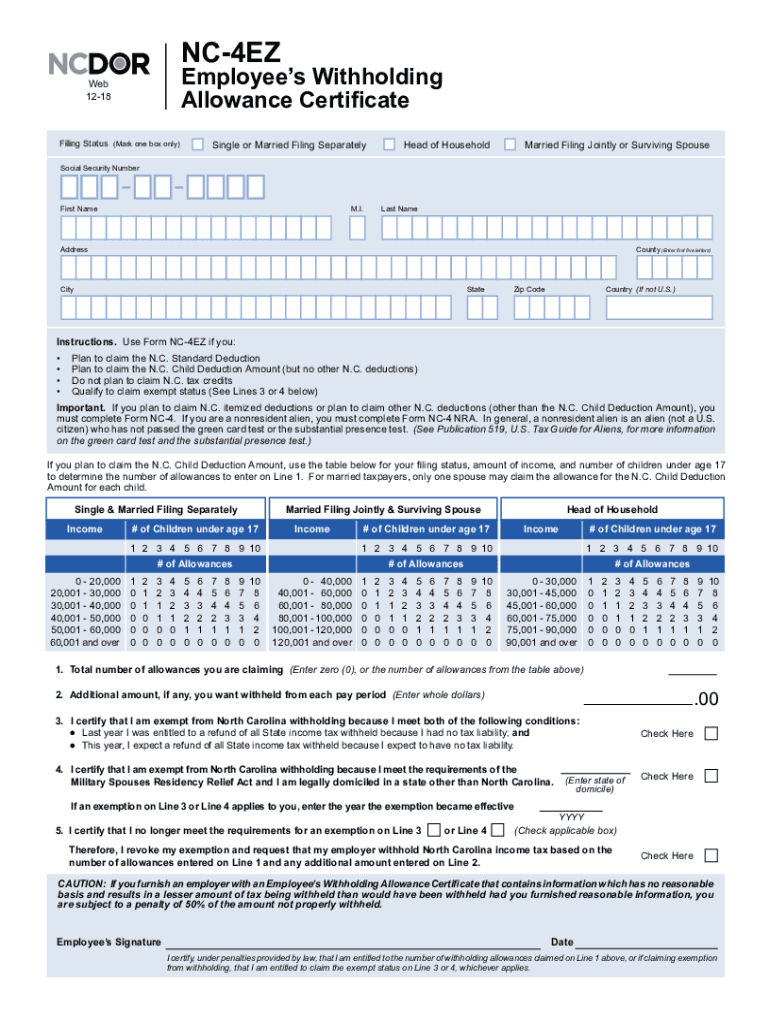

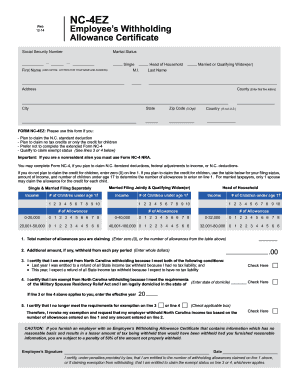

PDF NC-4EZ Employee's Withholding Allowance Certificate Important: If you are a nonresident alien you must use Form NC-4 NRA. You may complete Form NC-4, if you plan to claim N.C. itemized deductions, federal adjustments to income, or N.C. deductions. ... Allowance Certificate NC-4EZ Web 12-14. Created Date: 12/18/2014 9:05:45 AM ...

Nc-4 allowance worksheet

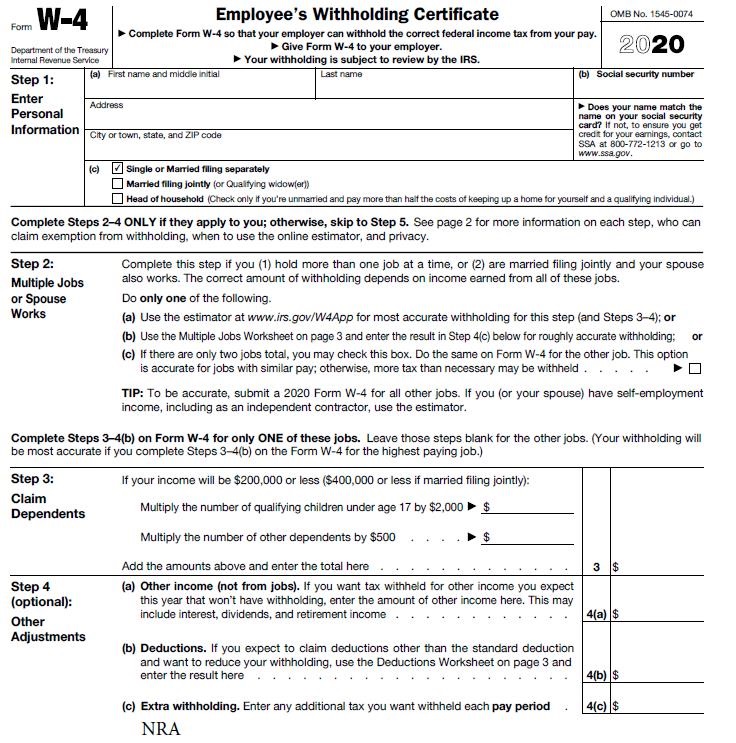

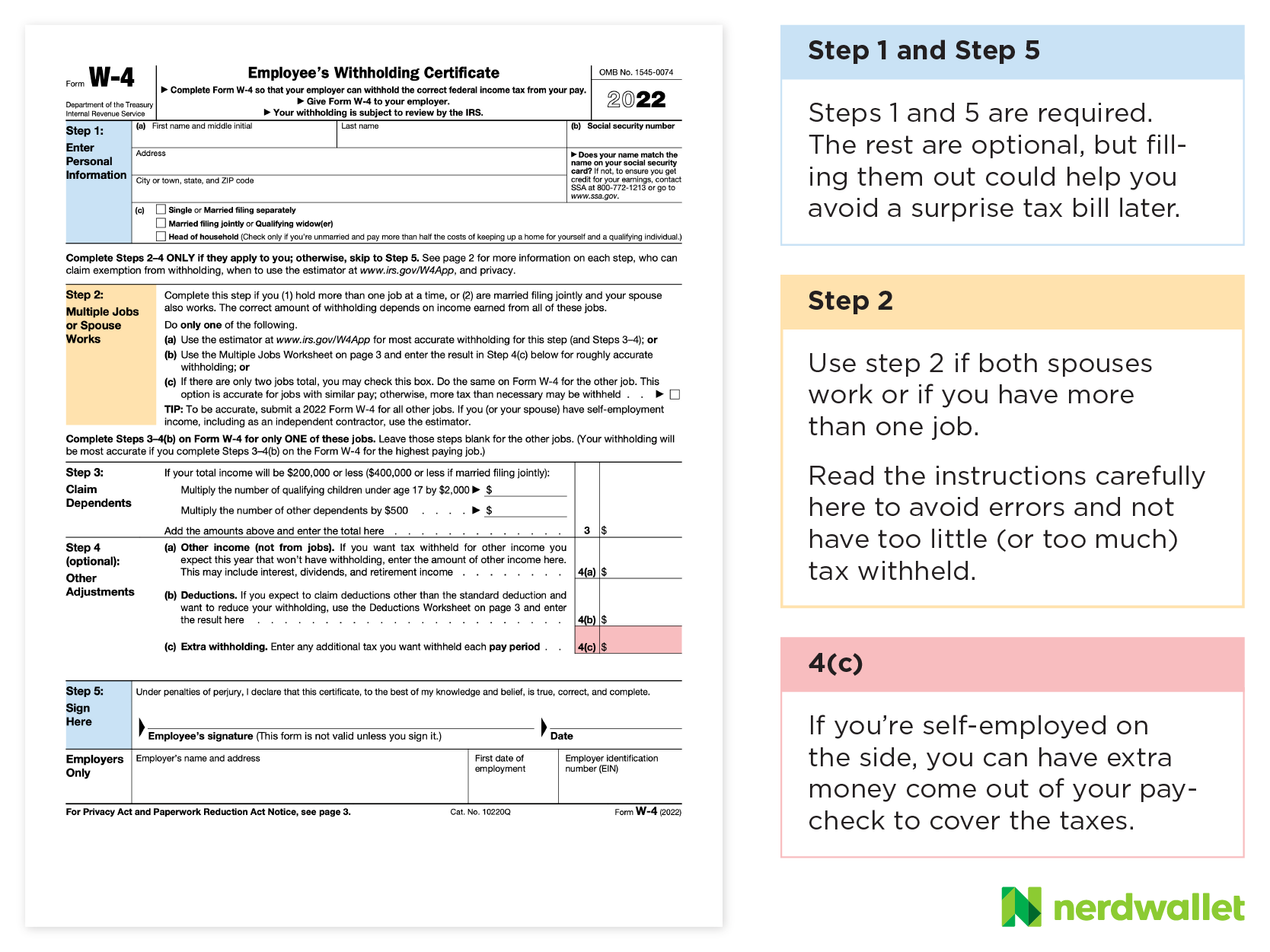

PDF NC-4 NRA Nonresident Alien Employee's Withholding Allowance Certificate NC-4 NRA Allowance Worksheet Answer all of the following questions: 1. Will your charitable contributions exceed $2,499? Yes o No o 2. Will you have adjustments or deductions from income, see Page 3, Schedule 1? Yes o No o 3. Will you be able to claim any N.C. tax credits or tax credit carryovers from Page 4, Schedule 3? Form W-4: How Many Allowances Should I Claim in 2022? + FAQs - Tax Shark Claiming 1 Allowance Claiming 1 allowance is typically a good idea if you are single and you only have one job. You should claim 1 allowance if you are married and filing jointly. If you are filing as the head of the household, then you would also claim 1 allowance. You will likely be getting a refund back come tax time. Claiming 2 Allowances › pub › irs-pdf2022 Form W-4 - IRS tax forms Step 2(b)—Multiple Jobs Worksheet (Keep for your records.) If you choose the option in Step 2(b) on Form W-4, complete this worksheet (which calculates the total extra tax for all jobs) on only ONE Form W-4. Withholding will be most accurate if you complete the worksheet and enter the result on the Form W-4 for the highest paying job. Note:

Nc-4 allowance worksheet. PDF How to fill out the NC-4 - One Source Payroll Items needed to fill out NC-4 Form NC-4 With Allowance Worksheet/schedules Copy of previous year Federal 1040, 1040A, or 1040 EZ Used to estimate income and deductions for 2014 Line 1 of NC-4 You are no longer allowed to claim a N.C. withholding allowance for yourself, your spouse, your children, or any other dependents. NC-4 - Jotform Employee's Withholding Allowance Certificate North Carolina Department of Revenue. 1. Total number of allowances you are claiming (Enter zero (0), or the number of allowances from Page 2, line 16 of the NC-4 Allowance Worksheet) 2. Additional amount, if any, withheld from each pay period (Enter whole dollars) Employee's Withholding Allowance Certificate NC-4 | NCDOR Form NC-4 Employee's Withholding Allowance Certificate. GET THE LATEST INFORMATION Most Service Centers are now open to the public for walk-in traffic on a limited schedule. Appointments are recommended and walk-ins are first come, first serve. PDF NC-4 Employee's Withholding 11-15 Allowance Certificate NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the Multiple Jobs Table to determine the additional amount to be withheld on line 2 of Form NC-4 (See Allowance Worksheet).

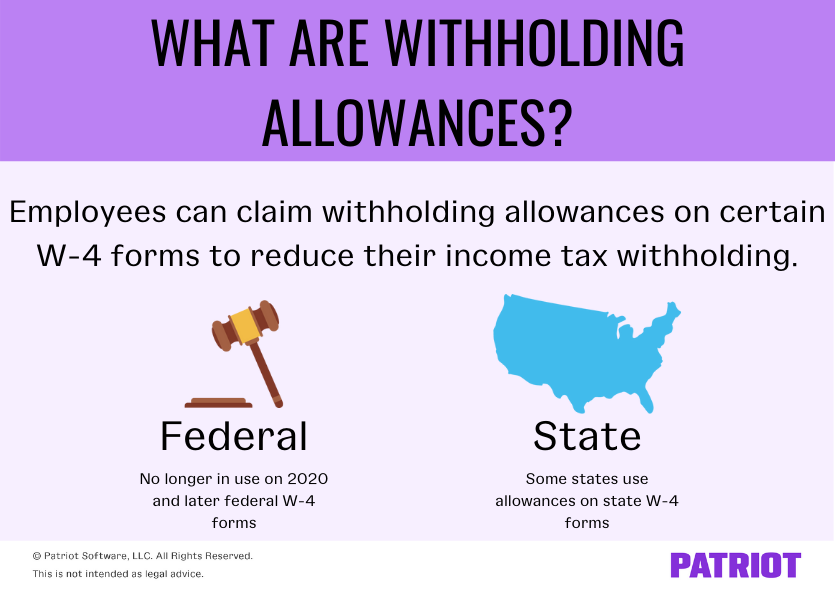

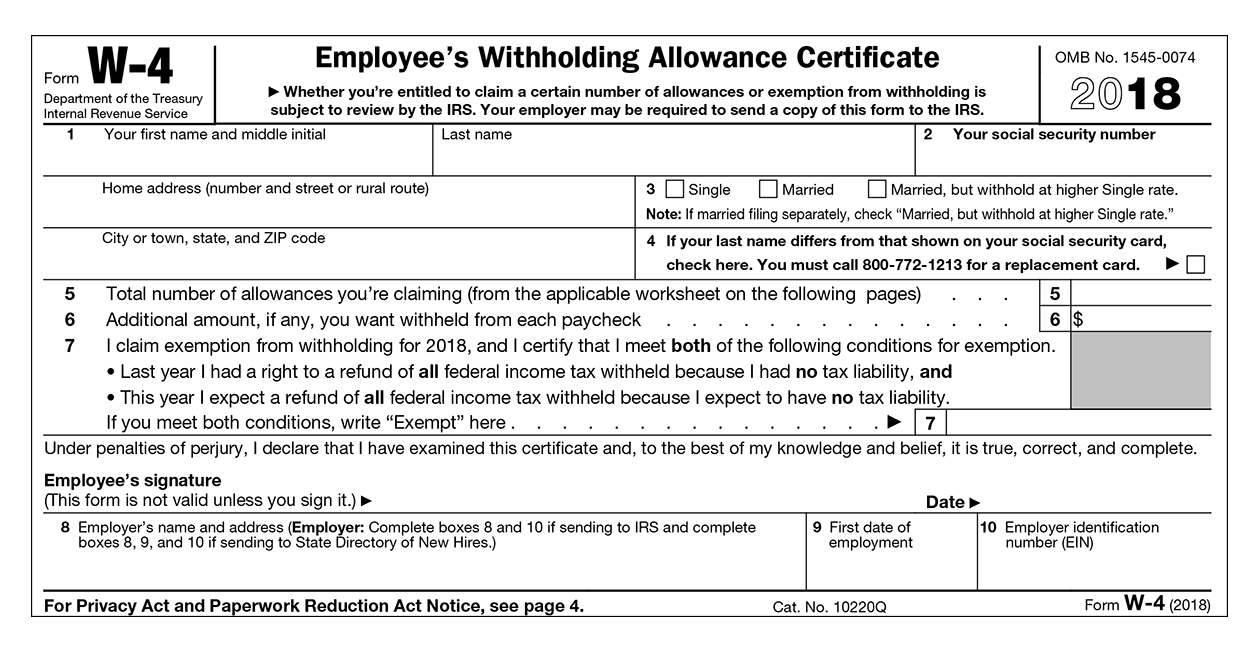

W-4 and NC-4 Forms | NC OSC Physical Address 3512 Bush Street Raleigh, NC 27609 Map It! Mailing Address 1410 Mail Service Center Raleigh, NC 27699-1410. State Courier: 56-50-10. OSC Training Center PDF NC-4 North Carolina Department of Revenue - Accuchex Payroll may claim fewer allowances if you wish to increase the tax withheld during the year. If your withholding allowances decrease, you must file a new NC-4 with your employer within 10 days after the change occurs except that a new NC-4 is not required until the next year in the followng cases: 1. When a dependent dies during the year. 2. How to Fill Out The Personal Allowances Worksheet (W-4 Worksheet) for ... The first few lines (1 -4) of the Form W-4 are used to convey personal identification. W-4 Line 5. Use W-4 line 5 to indicate the total number of allowances you're claiming (from the applicable worksheet on the following pages). W-4 Line 6. Use W-4 Line 6 to indicate an additional amount, if any, you want withheld from each paycheck. W-4 Line 7 PDF NC-4 Web Employee's Withholding Allowance Certificate - Human Resources Allowance Certificate NC-4 Web 2-15 1.Total number of allowances you are claiming (Enter zero (0), or the number of allowances from Page 2, line 16 of the NC-4 Allowance Worksheet) 2.Additional amount, if any, withheld from each pay period (Enter whole dollars) Single Head of Household Married or Qualifying Widow(er) Marital Status

Nc 4 Allowance Worksheet - Addition Worksheets Pictures 2020 Form nc 4 employees withholding allowance certificate. You should also refer to the multiple jobs table to determine the additional amount to be withheld on line 2 of form nc 4 see allowance worksheet. The nc 4 is designed for people that want to be more precise about their nc income tax. It will send you to the nc 4 allowance worksheet to ... Nc4 Form - Fill Out and Sign Printable PDF Template | signNow Follow the step-by-step instructions below to design your 2015 nc4 form: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature. Create your signature and click Ok. Press Done. After that, your 2015 nc4 form is ready. How to Complete your NC Withholding Allowance Form (NC-4) Starting a new job or need to change the amount of withholding from your paycheck? The NC-4 video will help you fill out the NC-4 form to make sure you are h... PDF Frequently Asked Questions Re: Employee's Withholding Allowance ... completing the NC-4 Allowance worksheet? A15. No. Pre-tax items are not included in taxable income and similarly should not be included when completing the NC-4 Allowance worksheet. Q16. When do we send a NC-4EZ or NC-4 to the Department? A16. If an employee claims more than 10 allowances, you should forward this document to

PDF NC-4 Employee's Withholding 10-17 Allowance Certicate - Just For The ... NC-4 Allowance Worksheet Answer all of the following questions for your ling status. Single - 1. Will your N.C. itemized deductions from Page 3, Schedule 1 exceed $11,249? Yes o No o 2. Will your N.C. Child Deduction Amount from Page 3, Schedule 2 exceed $2,499? Yes o No o 3.

Employee's Withholding Allowance Certificate NC-4 | NCDOR Form NC-4 Employee's Withholding Allowance Certificate. NC-4-Web.pdf. PDF • 429.87 KB - January 04, 2021 Withholding, Individual Income Tax. Categorization and Details. Forms. Document Entity Terms. Withholding. Individual Income Tax. Document Organization. files. Date Published: Last Updated: January 4, 2021.

PDF NC-4 Employee's Withholding 9-16 Allowance Certificate NC-4 NC-4 Allowance Worksheet Answer allof the following questions for your filing status. Single - 1. Will your N.C. itemized deductions from Page 3, Schedule 1 exceed $11,249? Yes o No o 2. Will you have adjustments or deductions from income from Page 3, Schedule 2? Yes o No o 3.

Nc 4 Allowance Worksheet Form - Fill Out and Sign Printable PDF ... Open the nc 4 form and follow the instructions Easily sign the nc w 4 with your finger Send filled & signed nc 4 form 2020 printable or save Rate the nc4 allowance worksheet 4.9 Satisfied 60 votes How to create an eSignature for the nc w4

› w-4-tax-withholding-forms-by-statesTax Withholding Forms by States for Employees to Submit - e-File Colorado Income Tax Withholding Worksheet for Employers Form DR 1098. Connecticut. ... Employee’s Withholding Allowance Certificate Form NC-4. North Dakota.

NC-4 Employee's Withholding - University of Colorado NC-4 Allowance Worksheet Answer allof the following questions for your filing status. Single - 1. Will your N.C. itemized deductions from Page 3, Schedule 1 exceed $12,499? Yes o No o 2. Will your N.C. Child Deduction Amount from Page 3, Schedule 2 exceed $2,499? Yes o No o 3. Will you have federal adjustments or State deductions from income?

Nc 4 Allowance Worksheet : How To Fill Out A W 4 Form And Keep More ... Taxes on lodging may be reimbursed in addition to maximums 9. Personal allowances worksheet (everyone is responsible for filling this out). I just started a new job and i am required to fill out a personal allowances worksheet. Whenever you get paid, your employer removes, or withholds, a certain amount of money from your paycheck.

PDF NC-4 Employee's Withholding Allowance Certificate NC-4 Employee's Withholding Allowance Certificate 1. Total number of allowances you are claiming for 2014 (Enter zero (0), or the number of allowances from Page 2, line 16 of the NC-4 Allowance Worksheet) 2. Additional amount, if any, withheld from each pay period (Enter whole dollars),. 00 Single Head of Household Married or Qualifying Widow(er)

NC-4 Employee's Withholding - Symmetry Software NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the "Multiple Jobs Table" to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 4).

emcfp.id-consulting.pl › tax-withholding-formTax withholding form - emcfp.id-consulting.pl Feb 15, 2022 · TSD_Employees_Withholding_Allowance_Certificate_G-4.pdf (775.89 KB).State Tax Withholding Form: Employee's Withholding Allowance Certificate Form NC-4. State: North Dakota. State Tax Withholding Form: North Dakota relies on the federal Form W-4 for.

The History of nc 4 allowance worksheet - App Compact This nc4 allowance worksheet is a quick, fun worksheet for those new to nc4. It's perfect for those who are going in with little to no idea of all the

PDF NC-4 - iCIMS NC-4 Allowance Certificate 1. Total number of allowances you are claiming (Enter zero (0), or the number of allowances from Page 2, line 17 of the NC-4 Allowance Worksheet) 2. Additional amount, if any, withheld from each pay period (Enter whole dollars) .00 Social Security Number Filing Status

Nc 4 Allowance Worksheet - being-rejected.blogspot.com It will send you to the nc 4 allowance worksheet to determine the number to enter here. 2017 corporate income franchise and insurance tax rules and bulletins. The nc 4 is designed for people that want to be more precise about their nc income tax. Form nc 4 employees withholding allowance certificate.

PDF How to fill out the NC-4 EZ - One Source Payroll Form NC-4 With Allowance Worksheet/schedules Copy of previous year Federal 1040, 1040A, or 1040 EZ Used to estimate income and deductions for 2014 Please fill out header Be sure to fill in Marital Status Header 3 Line 1 of NC-4 EZ Enter zero (0) or the number of allowances from the table on the next slide. 4

› pub › irs-pdf2022 Form W-4 - IRS tax forms Step 2(b)—Multiple Jobs Worksheet (Keep for your records.) If you choose the option in Step 2(b) on Form W-4, complete this worksheet (which calculates the total extra tax for all jobs) on only ONE Form W-4. Withholding will be most accurate if you complete the worksheet and enter the result on the Form W-4 for the highest paying job. Note:

Form W-4: How Many Allowances Should I Claim in 2022? + FAQs - Tax Shark Claiming 1 Allowance Claiming 1 allowance is typically a good idea if you are single and you only have one job. You should claim 1 allowance if you are married and filing jointly. If you are filing as the head of the household, then you would also claim 1 allowance. You will likely be getting a refund back come tax time. Claiming 2 Allowances

PDF NC-4 NRA Nonresident Alien Employee's Withholding Allowance Certificate NC-4 NRA Allowance Worksheet Answer all of the following questions: 1. Will your charitable contributions exceed $2,499? Yes o No o 2. Will you have adjustments or deductions from income, see Page 3, Schedule 1? Yes o No o 3. Will you be able to claim any N.C. tax credits or tax credit carryovers from Page 4, Schedule 3?

/cloudfront-us-east-1.images.arcpublishing.com/gray/XDQFMUVP4NFPXECEUEKYBL5SIE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/gray/XDQFMUVP4NFPXECEUEKYBL5SIE.jpg)

0 Response to "42 nc-4 allowance worksheet"

Post a Comment