42 payroll reconciliation excel worksheet

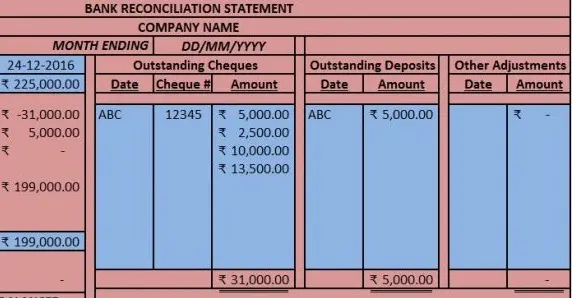

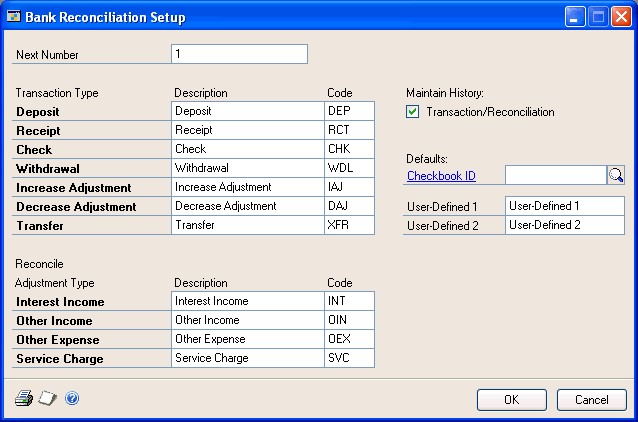

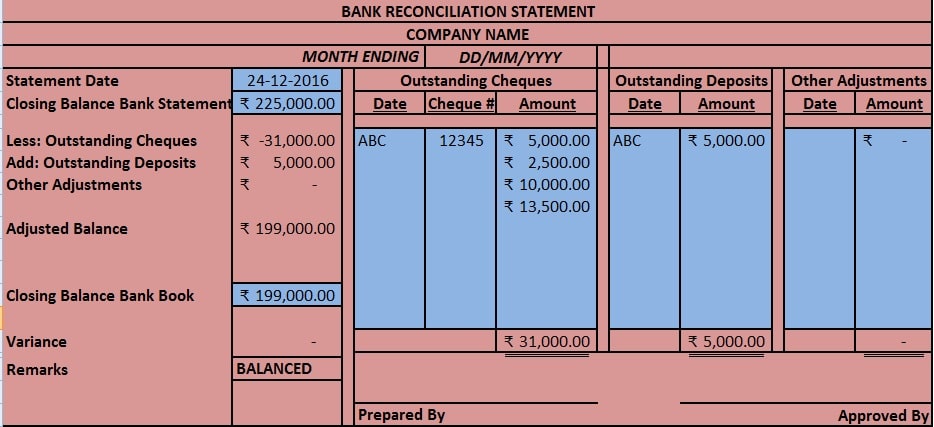

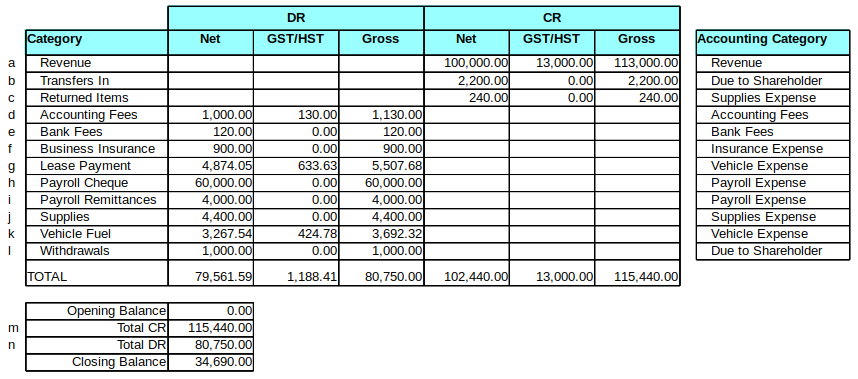

W2 Reconciliation Worksheet - LACA 1, W2 Reconciliation Worksheet ... 6, will be calculated by Excel. Balance the YTD amounts to the Taxable Gross and Tax ... 11, Federal Wages, 0, 0, 0. How to Do a Bank Reconciliation: Step-By-Step Process 16/06/2022 · To do this, a reconciliation statement known as the bank reconciliation statement is prepared. Bank Reconciliation: A Step-by-Step Guide. You receive a bank statement, typically at the end of each month, from the bank. The statement itemizes the cash and other deposits made into the checking account of the business. The statement also includes ...

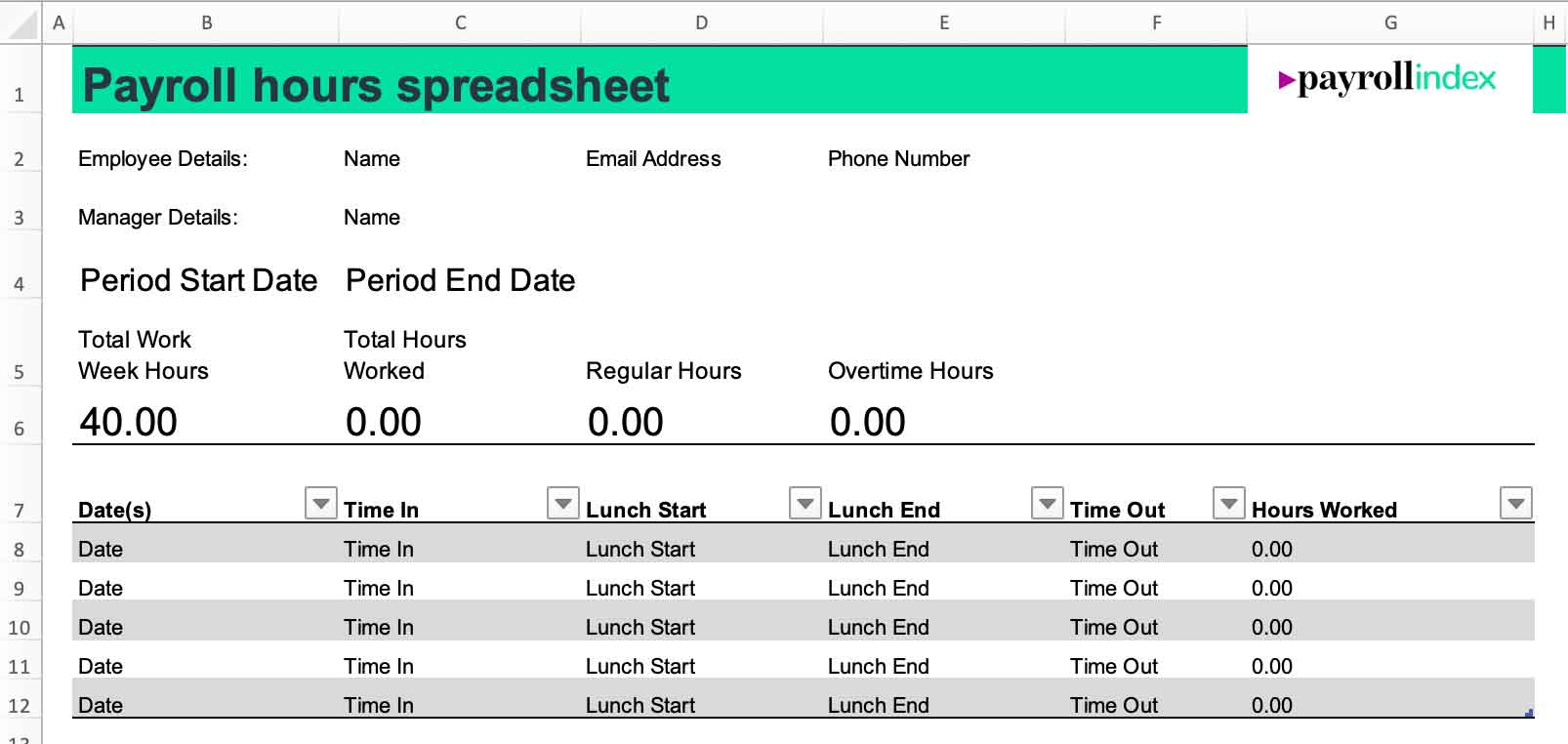

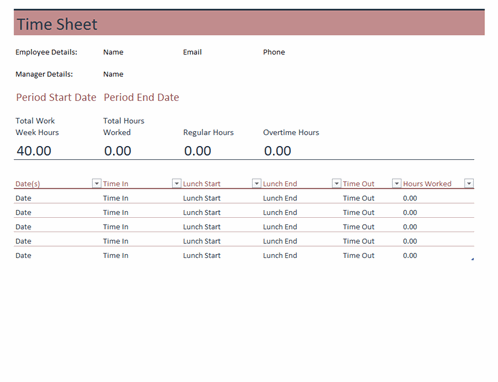

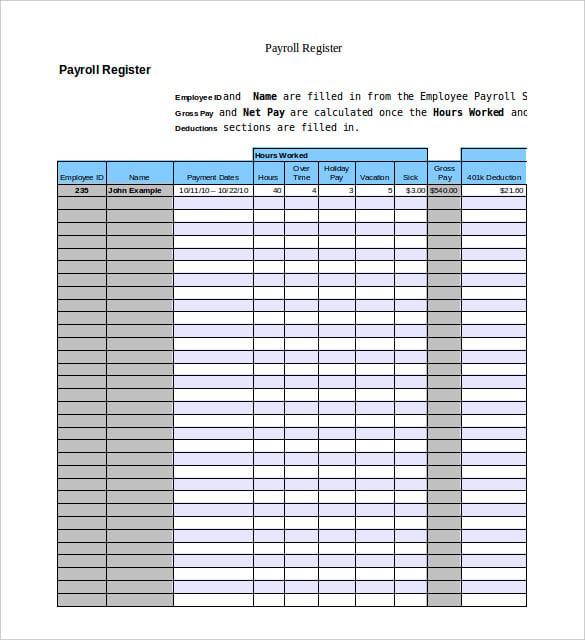

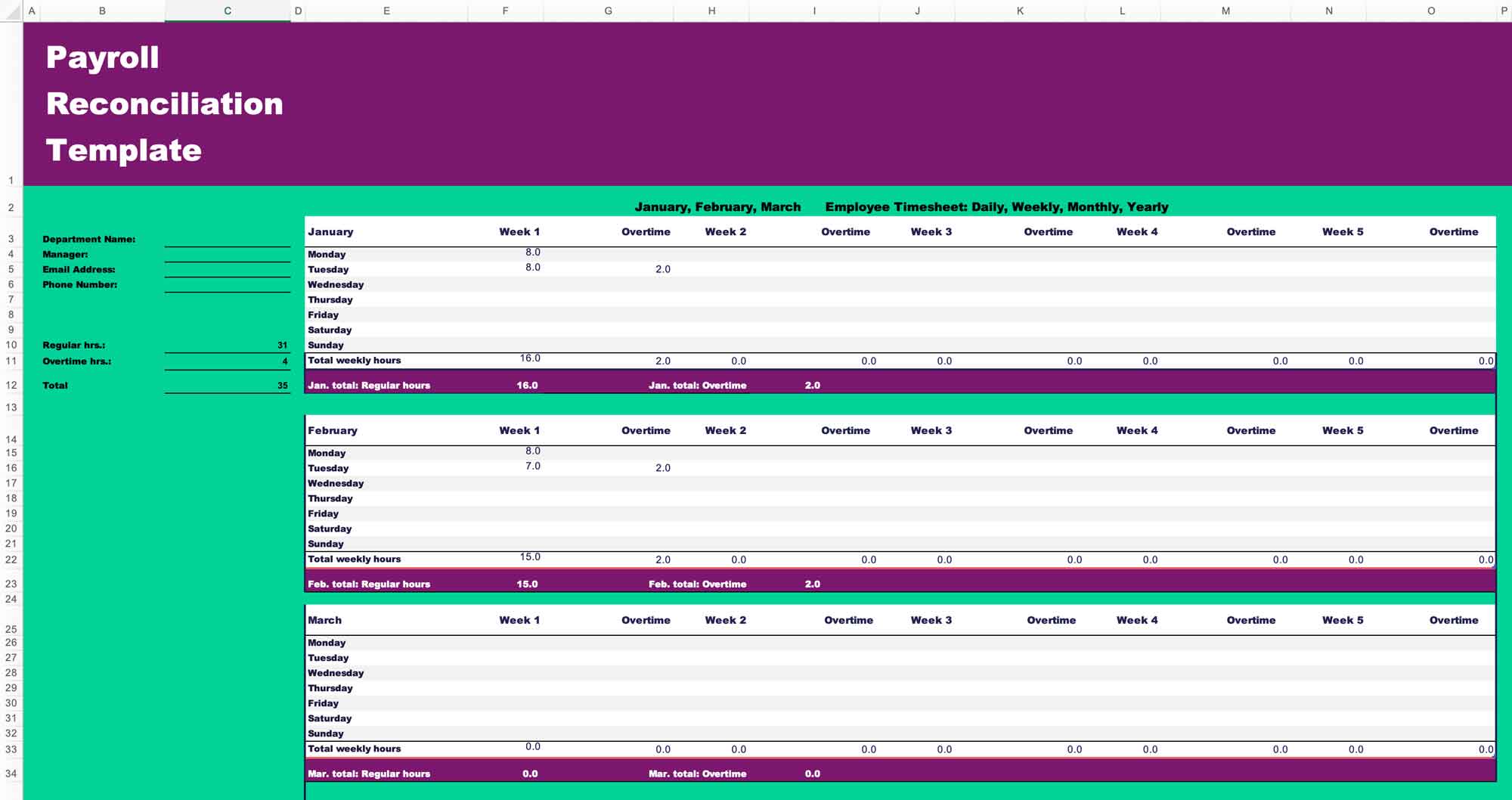

Payroll Template - Free Employee Payroll Template for Excel - Vertex42.com Employee Payroll Template. Download a free Employee Payroll Register Spreadsheet for Excel® - Updated 4/11/2022. As a new employer, I set out to create a Payroll Calculator but in the process learned that there were too many laws and regulations associated with payroll to risk using a spreadsheet for calculating payroll.

Payroll reconciliation excel worksheet

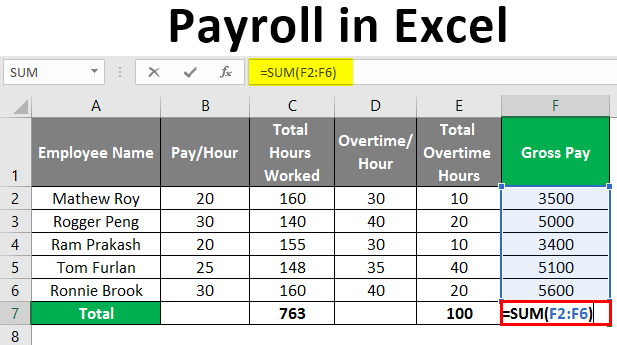

Using Excel to Process Payroll DYI - Pinterest Mar 15, 2016 - • Free, Simple, Easy, and Reliable Payroll System• Prints payroll ... Excel Template Best Templates, Report Template, Account Reconciliation,. DOC GL-Payroll Reconciliation Basic Reconciliation-option 1 Report 1 totals should balance totals on Report 2 8-11 Trial balance in GL (Report 2) should balance Payroll Summary report (Report 1). If so, payroll/GL reconciliation is complete. Basic Reconciliation-option 2 Query 3 totals should balance totals on query 4 12-14 Payroll in Excel | How to Create Payroll in Excel (With Steps) - EDUCBA Let's understand how to create the Payroll in Excel with a few steps. You can download this Payroll Excel Template here - Payroll Excel Template Step 1: Open a new blank excel spreadsheet. Go to Search Box. Type "Excel" and double click on the match found under the search box to open a blank excel file.

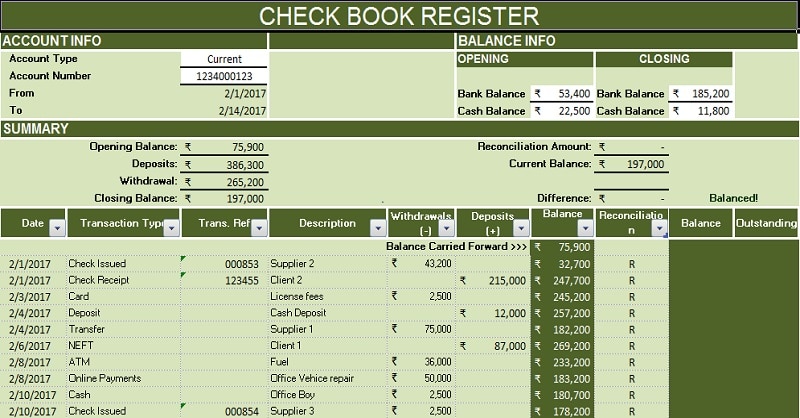

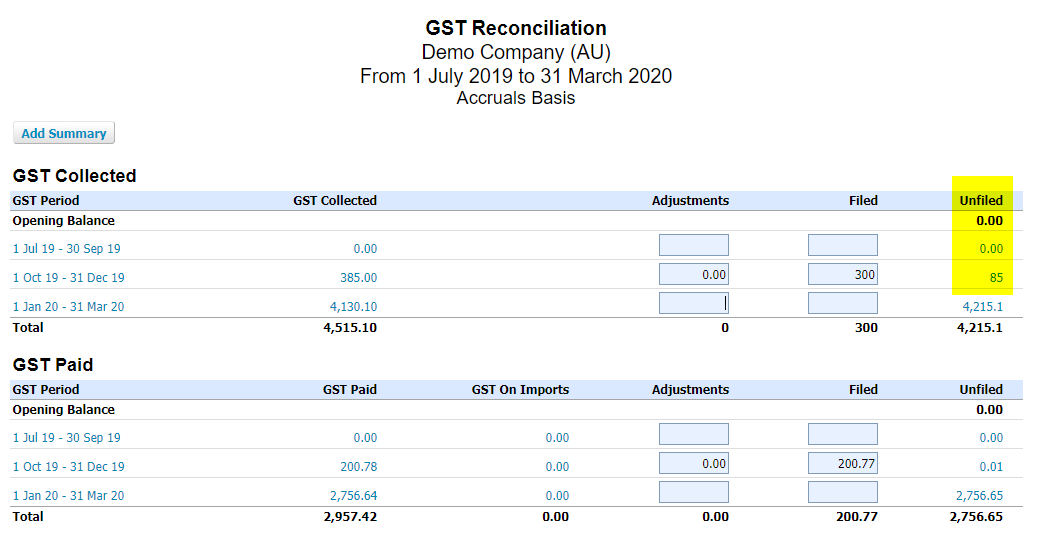

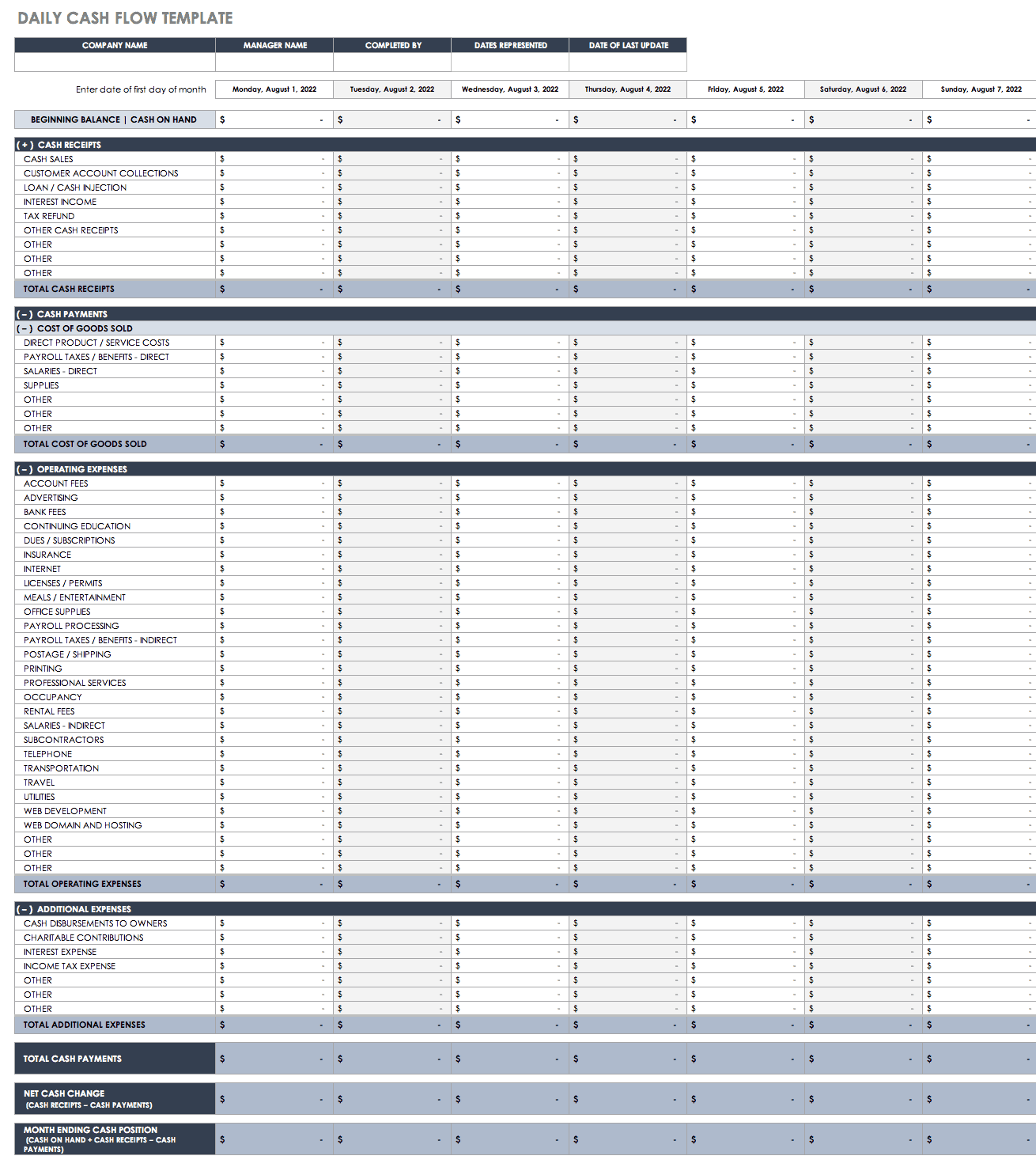

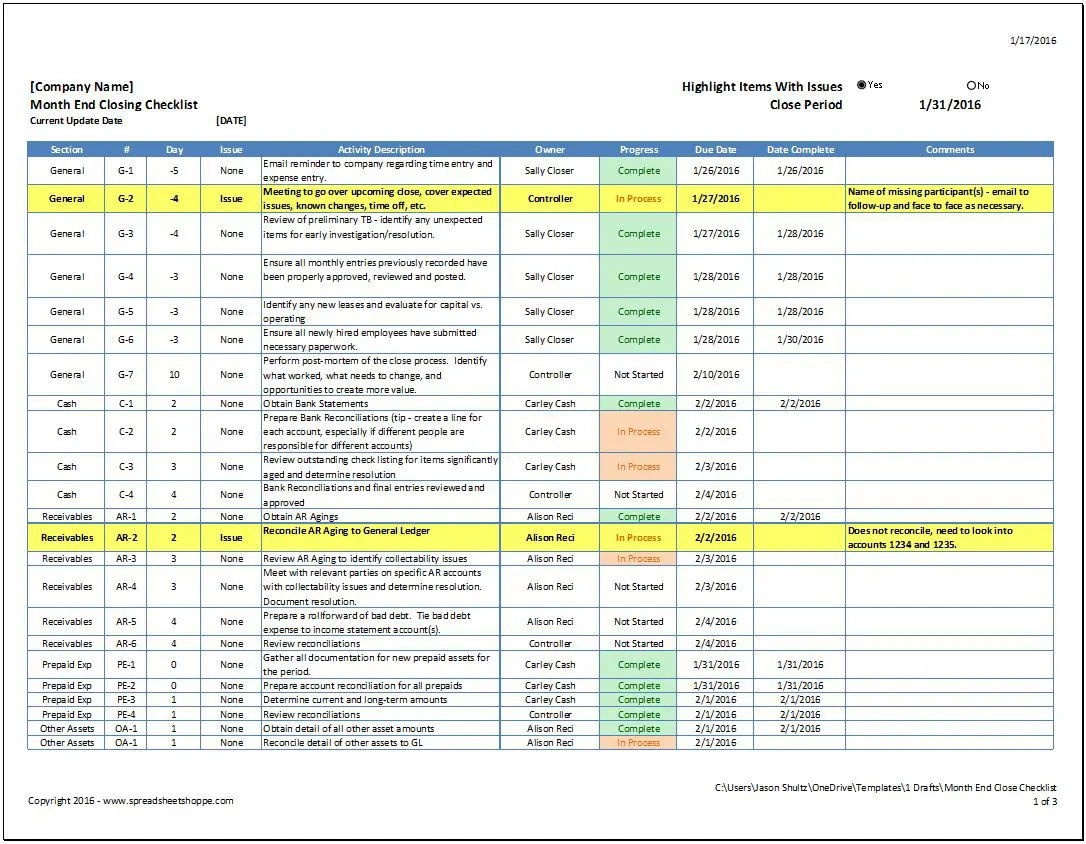

Payroll reconciliation excel worksheet. Best Bank Reconciliation Template for Excel(With Automation) To produce a bank reconciliation statement, follow the following steps: 1. Supply all the data, such as book debits, bank credits, book credits, and bank debits. For multiple accounts, be sure to check the account number in the book and the bank matched. 2. Monthly bank reconciliation - templates.office.com Monthly bank reconciliation Monthly bank reconciliation This monthly bank reconciliation template allows the user to reconcile a bank statement with current checking account records. Use this bank reconciliation example template to help rectify any errors in your financial statement. This is an accessible template. Excel Download Open in browser Top 10 payroll reconciliation template Excel download 2022 Below are the best free online top 10 payroll reconciliation template Excel. 1. Employee Payroll Calculator With payroll templates, you can record your employees' salaries and calculate hourly rates. With this free downloadable payroll template, you can calculate wages based on regular hours and overtime. 2. Employee Payroll Calculator 15 Free Payroll Templates | Smartsheet Download Corporate Payroll Check Template - Excel Designed for corporate settings, this payroll check template provides traditional pay stub formatting and covers current and year-to-date payroll data. Fields are included for an employee ID number and check number for reference and easy tracking.

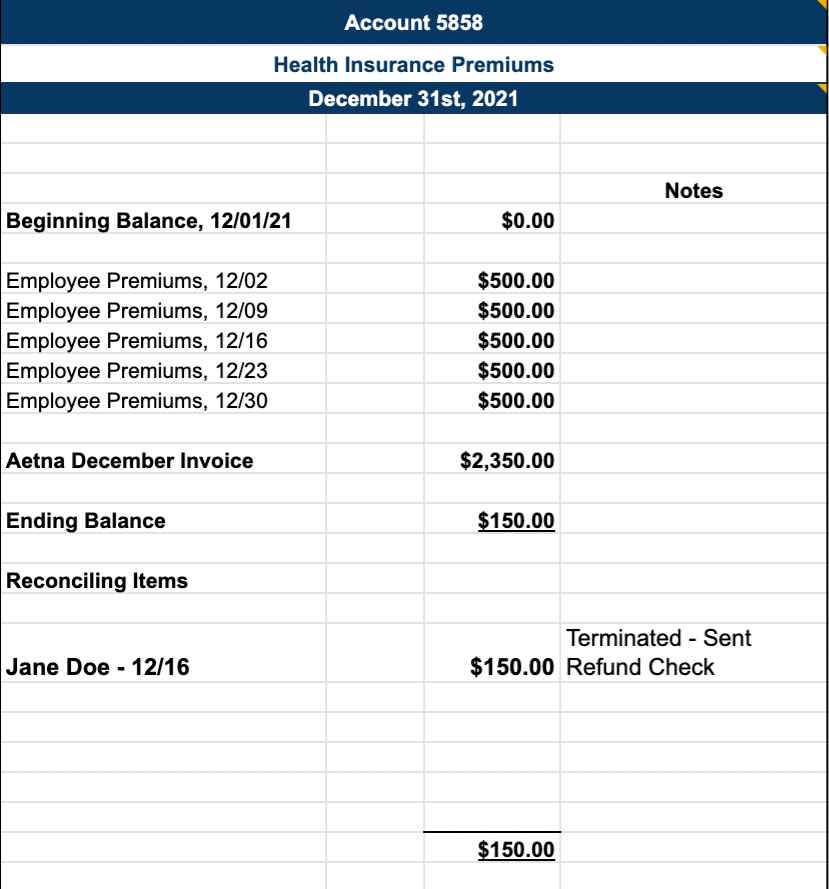

Payroll Reconciliation Spreadsheet | Etsy Sweden Check out our payroll reconciliation spreadsheet selection for the very best in unique or custom, handmade pieces from our shops. Reconciliation | Office of Financial Management - Washington Below are instructions and worksheets to help agencies reconcile the state payroll revolving account and federal tax deposits. Account 035 - State payroll revolving account Health insurance sample reconciliation and instructions Health insurance mid-period transfer template Reconciliation template Rapid reference guide How to reconcile payroll: A step-by-step process - Article - QuickBooks Payroll reconciliation is when you compare your payroll register with the amount you're planning to pay out to your employees to confirm those numbers match. The simplest way to think about it is double-checking your math to ensure that you pay your employees correctly. Payroll reconciliation should happen frequently. You'll need to do it: payroll reconciliation To run the macro, in the Excel ribbon go to 'VIEW' and click 'Macros'. 333, This will prompt a screen with all the Macros in this worksheet.

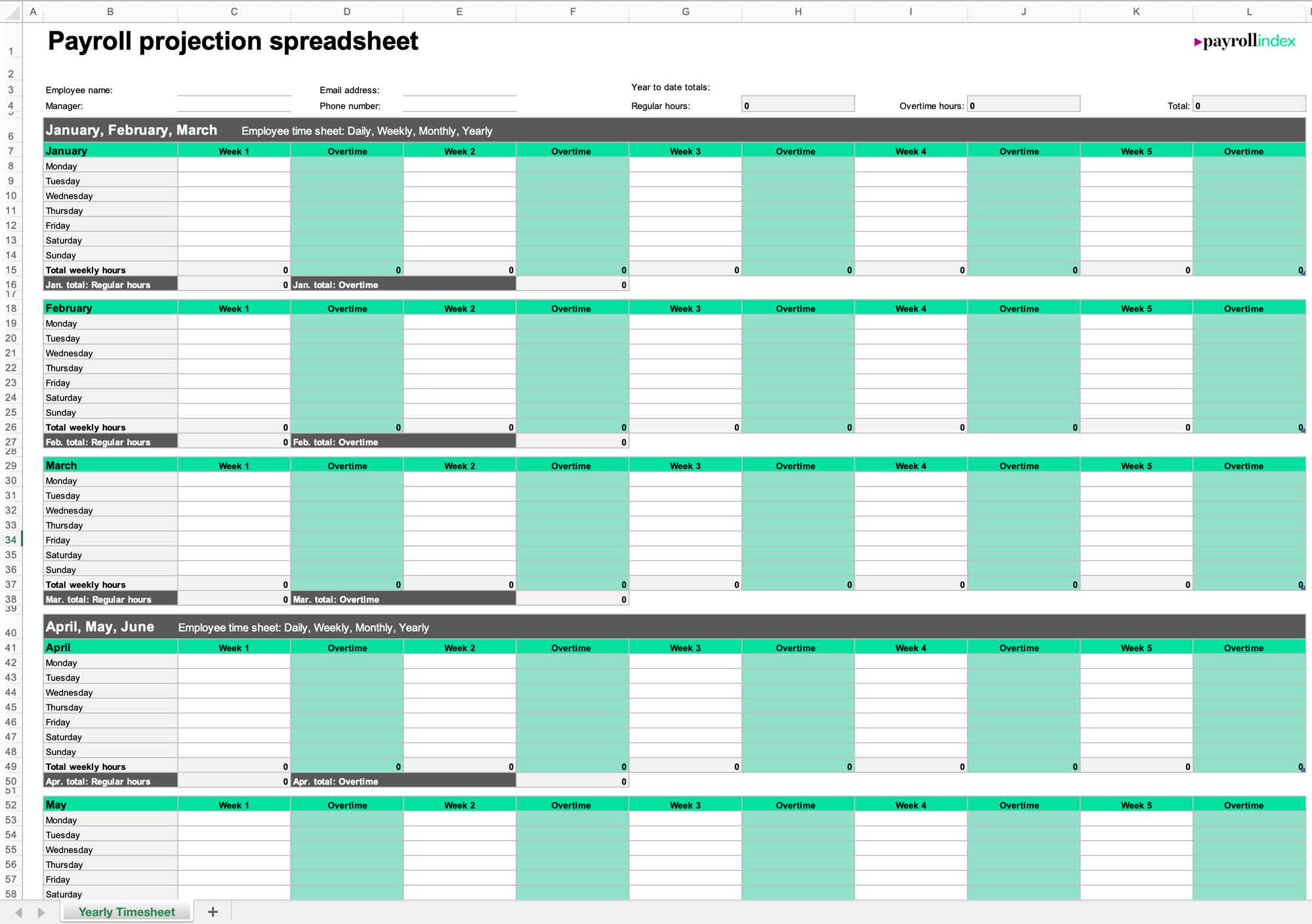

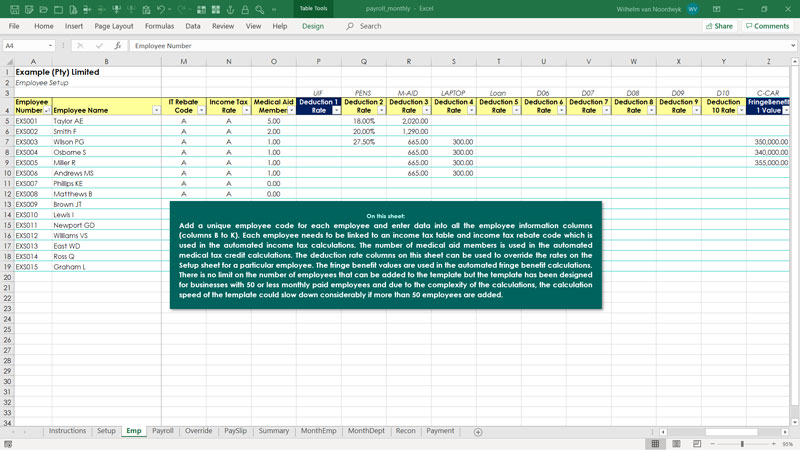

Excel Payroll Software Template - Excel Skills Note: All the data on the Payroll sheet have been included in an Excel table. This feature is extremely useful when entering data in a table format because the table extends automatically when you enter data in the first blank row below the table. ... Payroll Reconciliation. The Recon sheet includes a reconciliation between the monthly payroll ... Payroll Reconciliation spreadsheet (XLSX) - Gov.bc.ca It is important to remember that the spreadsheet is meant to reconcile the amount of gross wages you are claiming for reimbursement. Account 035 Reconciliation - Template - WA.gov 10, 5124, ACCRUED SALARIES AND FRINGE BENEFITS PAYABLE, 0.00, 0.00, 0.00 ... with this worksheet, please contact OFM Statewide Accounting at 360-725-0226, ... Payroll Reconciliation and Maintaining Accurate Accounting Books The reconciliation of payroll doesn't have to be difficult for small business owners. Use the following steps to reconcile payroll. 1. Print out your payroll register. The payroll register summarizes each employee's wages and deductions for the pay period. 2. Match each hourly employee's time card to the pay register.

Reconciliation of Payroll - IRS tax forms Step one is to determine your gross payroll amount. Gross payroll includes all payments and benefits given to your employees including salaries, hourly pay and overtime, sick and vacation leave, allowances like vehicles and uniforms, taxable group term life insurance and the other payments like bonuses or taxable benefits unique to your employees.

Free Account Reconciliation Templates | Smartsheet This simple bank reconciliation template is designed for personal or business use, and you can download it as an Excel file or Google Sheets template. Enter your financial details, and the template will automatically calculate totals so that you can quickly see whether your bank statement and accounting journal are reconciled.

25+ Payroll Templates - PDF, Word, Excel | Free & Premium Templates The payroll calendar template intimates the manager that it's time for that employee's pay needs to be calculated and paid on the due date. Pick the template that suits your purpose and your requirement. These templates come with numerous format options like MS Word, PSD, PDF, and more. 2016 Biweekly Pay Calendar Layout Template Printable

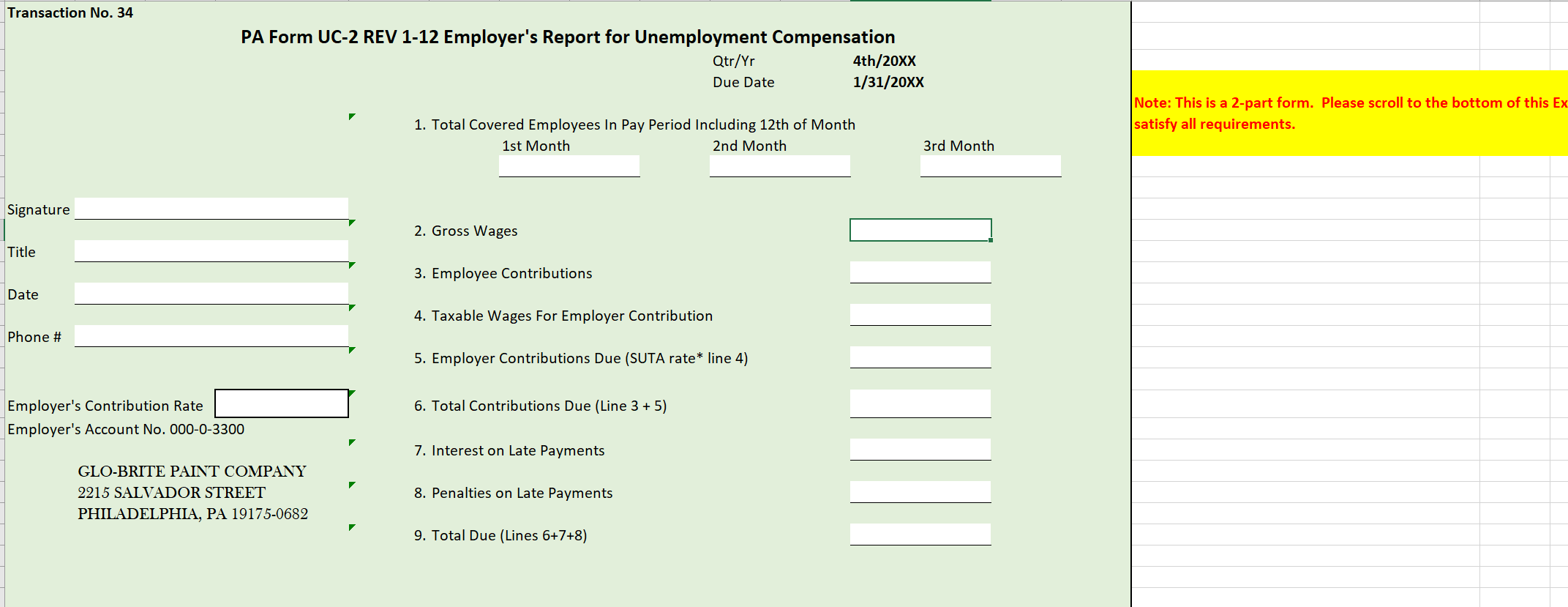

How to Do a Payroll Reconciliation for Your Small Business Step 6: Run a payroll tax report and remit taxes due. You'll use the information in the journal entries you create each payroll to file your quarterly Form 941, which reports the amount withheld ...

State Accounting Office of Georgia EXAMPLE SPREADSHEET FOR RECONCILING PAYROLL TOTALS TO W-2 TOTALS GTW=Gross Taxable Wages W/H=Withholding Pay Cycle 1/15/20xx 1/31/20xx 2/15/20xx 2/28/20xx 3/15/20xx 3/31/20xx 1st Qtr Totals (Box 1) (Box 2) (Box 3) (Box 4) (Box 5) (Box 6) (Box 9) (Box 10) (Box 12c) (Box 12d) (Box 12e) (Box 12g) (Box 12p) (Box 14y) (Box 14z) (Box 16) (Box 17)

6 Best Microsoft Excel Templates for Payroll Management - Guiding Tech The payroll management template spreads across three worksheets. There is one each for employee wage and taxes, payroll based on employees' clocked hours, and last to create pay stubs. The...

How to Do Payroll Reconciliation for Small Businesses [+ Free ... Dec 20, 2021 ... How to Do Payroll Reconciliation for Small Businesses [+ Free Spreadsheet Template] · Step 1: List Your Payroll Balance Sheet Accounts · Step 2: ...

What to Know About Form 941 Reconciliation | Steps - Patriot Software You might use a mixture of both spreadsheets and software to reconcile Form 941. Compare the spreadsheet to totals in your software for reconciliation. Steps to reconciling Form 941 Follow these five simple steps to reconcile Form 941. 1. Gather payroll registers from the current quarter

Payroll Reconciliation Spreadsheet - Etsy Payroll Reconciliation Spreadsheet (1 - 1 of 1 results) Price ($) under $25 $25 - $50 Shipping ETA by Oct 6 ETA by Oct 9 Summary Payroll Report, Easy to Use Employee Payroll Tracker, Summarize Each Payroll Check into One Report, Excel Payroll Spreadsheet TheBusinessMogulHQ (5) $7.99 1 Common questions

Quick Guide: Spot-Checking the Payroll Reconciliation Report Right-click and select "Delete" Add a filter to the report. Go to the "Data" tab at the top and click on "Filter" Spot-Check the Payroll Reconciliation Sort and Spot-Check by Name Go to the "Data" tab at the top and click on "Sort" Click the drop-down next to "Sort by" and select "Name Field" and "OK." All other values will default.

Payroll spreadsheet templates for Excel - free UK downloads Payroll reconciliation template - Excel A payroll reconciliation template is a type of spreadsheet that is used to help businesses reconcile their payroll expenses. This type of template can be used to track employee pay rates, hours worked, and other payroll-related information. Download Employee absence tracker spreadsheet template

PDF Payroll Reconciliation Toolkit - Ucsd PAYROLL RECONCILIATION TOOLKIT- 3/08/21 1 PAYROLL RECONCILIATION TOOLKIT . This Toolkit is a step-by-step guide to assist you in identifying and correcting discrepancies between the UCPath Labor Ledger (DOPES) and the OFC GL/PPM. These mismatches are caused by OFC and/or UCPath

The Beginners Guide to Payroll Reconciliation - QuickSprout Therefore, payroll reconciliation means ensuring that the amount you're planning to pay your employees exactly matches the payroll in your general ledger. Payroll reconciliation is crucial for keeping accurate account records. You'll need correct records when filing taxes, during audits, and when assessing the financial health of your organization.

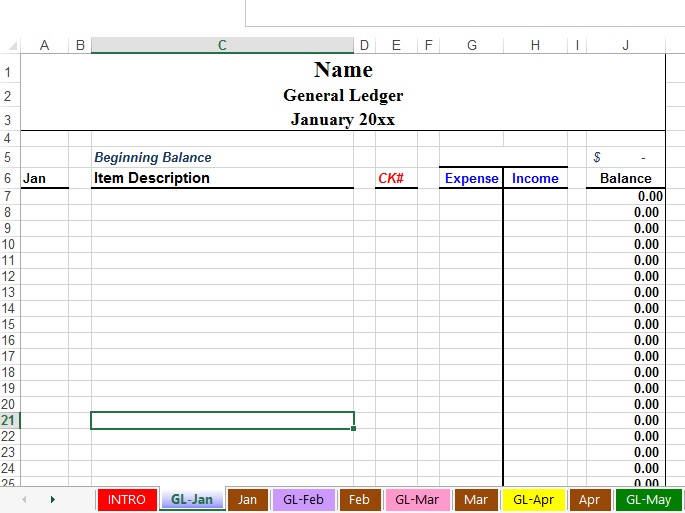

GL Payroll Reconciliation Tool - University of California, Los Angeles How to Use the GL Payroll Reconciliation Tool Download the Excel Template. Run reports in CDW. Copy and Paste data in predefined formats and spaces. Review the "Difference" column. Rows that have a non-zero value has a variance between the General Ledger and the UCPath Labor Ledgers.

Payroll Reconciliation: How to Do It in 6 Easy Steps At the end of each payroll period Step 1: Make sure your payroll register accurately reflects wages and hours You need to reconcile payroll each pay period before checks actually go out, as it's much harder to correct any mistakes once people have gotten paid. The first step is to make sure everyone is getting paid the right amount.

Payrolls - Office.com Excel payroll templates help you to quickly calculate your employees' income, withholdings, and payroll taxes. Use payroll stub templates to conveniently generate detailed pay stubs for each of your employees. Templates for payroll stub can be used to give your employees their pay stubs in both manual and electronic formats.

9+ Balance Sheet Reconciliation Templates in PDF Balance Sheet Account Reconciliations Policy. finance.vanderbilt.edu. Details. File Format. PDF. Size: 191.2 KB. Download. Our Balance Sheet Account Reconciliations Policy is an appropriate sheet template that is provided with all the necessary elements needed for balance sheet reconciliation. You will also find multiple other sheet templates ...

PDF Year-end Reconciliation Worksheet for Forms 941, W-2, and W-3 Annual amounts from payroll records should match the total amounts reported on all Forms 941 for the year. ... Year-end Reconciliation Worksheet for Forms 941, W-2, and W-3 Author: Internal Revenue Service Created Date: 10/3/2011 11:31:08 AM ...

Payroll in Excel | How to Create Payroll in Excel (With Steps) - EDUCBA Let's understand how to create the Payroll in Excel with a few steps. You can download this Payroll Excel Template here - Payroll Excel Template Step 1: Open a new blank excel spreadsheet. Go to Search Box. Type "Excel" and double click on the match found under the search box to open a blank excel file.

DOC GL-Payroll Reconciliation Basic Reconciliation-option 1 Report 1 totals should balance totals on Report 2 8-11 Trial balance in GL (Report 2) should balance Payroll Summary report (Report 1). If so, payroll/GL reconciliation is complete. Basic Reconciliation-option 2 Query 3 totals should balance totals on query 4 12-14

Using Excel to Process Payroll DYI - Pinterest Mar 15, 2016 - • Free, Simple, Easy, and Reliable Payroll System• Prints payroll ... Excel Template Best Templates, Report Template, Account Reconciliation,.

0 Response to "42 payroll reconciliation excel worksheet"

Post a Comment