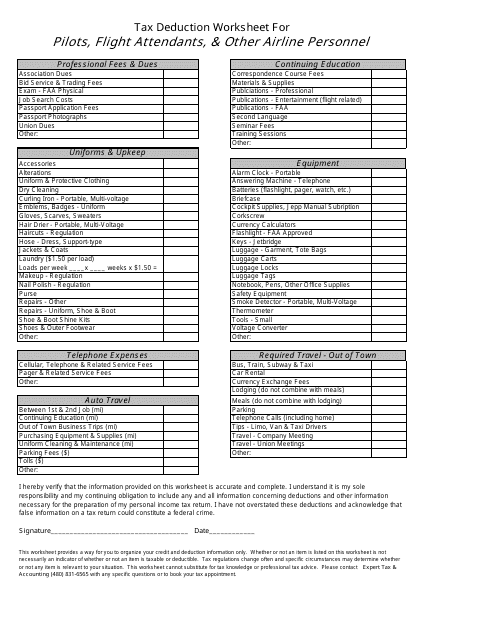

44 flight attendant tax deductions worksheet

This payroll This calculator will give you an estimate of your gross pay based on your net pay for a particular pay period (weekly, fortnightly or monthly). Follow these simple steps to calculate your salary after tax in Austria using the Austria Salary Calculator 2020 which is updated with the 2020/21 tax tables.; PRACTICAL EXERCISE 1.4 A Payroll consists of Basic Pay, Allowances, Gross Salary, … eCFR :: 7 CFR Part 273 -- Certification of Eligible Households (2) Elderly and disabled persons. Notwithstanding the provisions of paragraph (a) of this section, an otherwise eligible member of a household who is 60 years of age or older and is unable to purchase and prepare meals because he or she suffers from a disability considered permanent under the Social Security Act or a non disease-related, severe, permanent disability may be considered, together ...

Join LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols;

Flight attendant tax deductions worksheet

Publication 525 (2021), Taxable and Nontaxable Income You're employed as a flight attendant for a company that owns both an airline and a hotel chain. Your employer allows you to take personal flights (if there is an unoccupied seat) and stay in any one of their hotels (if there is an unoccupied room) at no cost to you. The value of the personal flight isn't included in your income. MA000119: Restaurant Industry Award 2020 31. Deductions for breakages or cashiering underings. 31.1 Right to make deductions. Subject to clauses 31.2 and 31.3,an employer must not deduct any sum from the wages due to an employee under this award in respect of breakages or cashiering underings except in the case of wilful misconduct. 31.2 Deductions to be reasonable and proportionate MA000009: Hospitality Industry (General) Award 2020 37.6 Deductions for accommodation or accommodation and meals—employees on junior rates [37.6 varied by PR718826 , PR729263 , PR740684 ppc 01Oct22] An employer may deduct from the wages of a junior employee on junior rates,aged as specified in column 2 of Table 16—Employees on junior rates ,the amount specified in column 4 for the service specified provided by the …

Flight attendant tax deductions worksheet. Occupation and industry specific guides - Australian Taxation Office Fire fighter deductions (PDF, 320KB) This link will download a file. Fitness and sporting industry employees. Fitness employee deductions (PDF, 302KB) This link will download a file. Flight Crew. Flight crew deductions (PDF, 336KB) This link will download a file. Gaming attendants. Gaming attendant deductions (PDF, 296KB) This link will ... 1.32.1 IRS Local Travel Guide | Internal Revenue Service Oct 21, 2021 · Attendant-- An individual who provides personal care and travels with an authorized IRS traveler who has a disability or special need. Automatic teller machine (ATM) travel advance-- Contractor-provided service that allows cash withdrawals from participating ATMs. The cash withdrawal and associated fees are charged to the Standard Travel Card ... CBS MoneyWatch Tax agency wants to avoid "bracket creep," or when workers get pushed into higher tax brackets due to inflation. 18H ago; Taylor Swift follows "Midnights" release with "3am edition" Singer's ... Claims pages depreciation calculator 15.2.2022 · You depreciated it for tax purposes at a rate of $5,400 a year for five years. You were in the 32% tax bracket in each of those years, so you avoided $1,728 each year in taxes that you didn't have to pay: 32% of $5,400, for a total of $8,640 in savings. You've claimed a total of $27,000 in depreciation over five years of ownership: $5,400.

Publication 463 (2021), Travel, Gift, and Car Expenses - IRS tax … Don’t send tax questions, tax returns, or payments to the above address. Getting answers to your tax questions. If you have a tax question not answered by this publication or the How To Get Tax Help section at the end of this publication, go to the IRS Interactive Tax Assistant page at IRS.gov/ Help/ITA where you can find topics by using the search feature or viewing the categories listed. MA000009: Hospitality Industry (General) Award 2020 37.6 Deductions for accommodation or accommodation and meals—employees on junior rates [37.6 varied by PR718826 , PR729263 , PR740684 ppc 01Oct22] An employer may deduct from the wages of a junior employee on junior rates,aged as specified in column 2 of Table 16—Employees on junior rates ,the amount specified in column 4 for the service specified provided by the … MA000119: Restaurant Industry Award 2020 31. Deductions for breakages or cashiering underings. 31.1 Right to make deductions. Subject to clauses 31.2 and 31.3,an employer must not deduct any sum from the wages due to an employee under this award in respect of breakages or cashiering underings except in the case of wilful misconduct. 31.2 Deductions to be reasonable and proportionate Publication 525 (2021), Taxable and Nontaxable Income You're employed as a flight attendant for a company that owns both an airline and a hotel chain. Your employer allows you to take personal flights (if there is an unoccupied seat) and stay in any one of their hotels (if there is an unoccupied room) at no cost to you. The value of the personal flight isn't included in your income.

0 Response to "44 flight attendant tax deductions worksheet"

Post a Comment