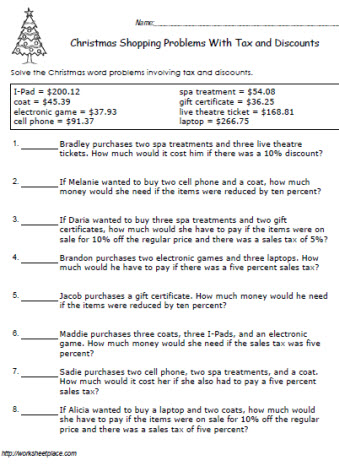

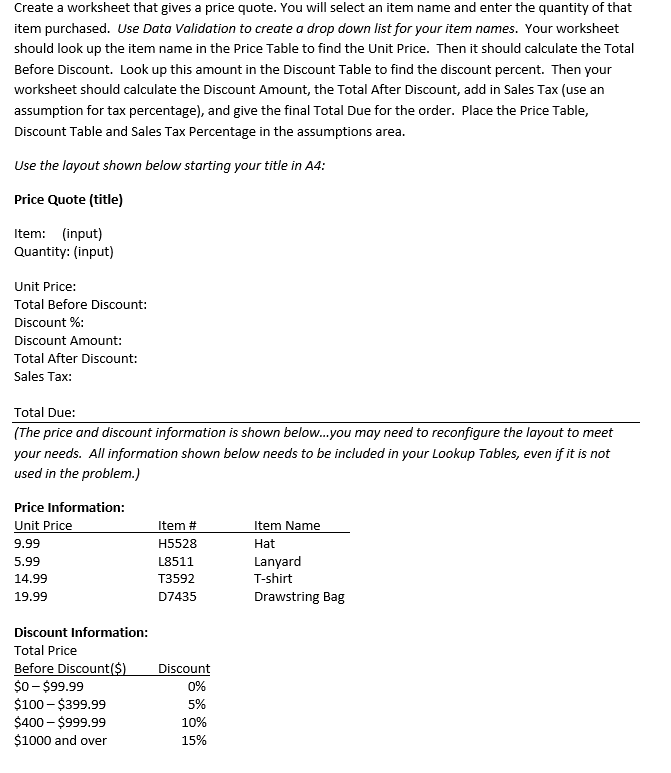

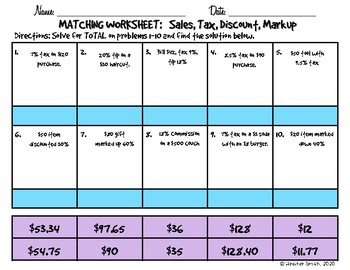

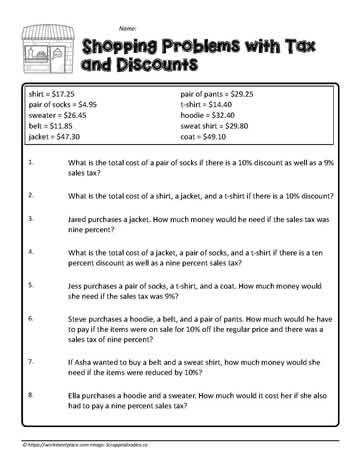

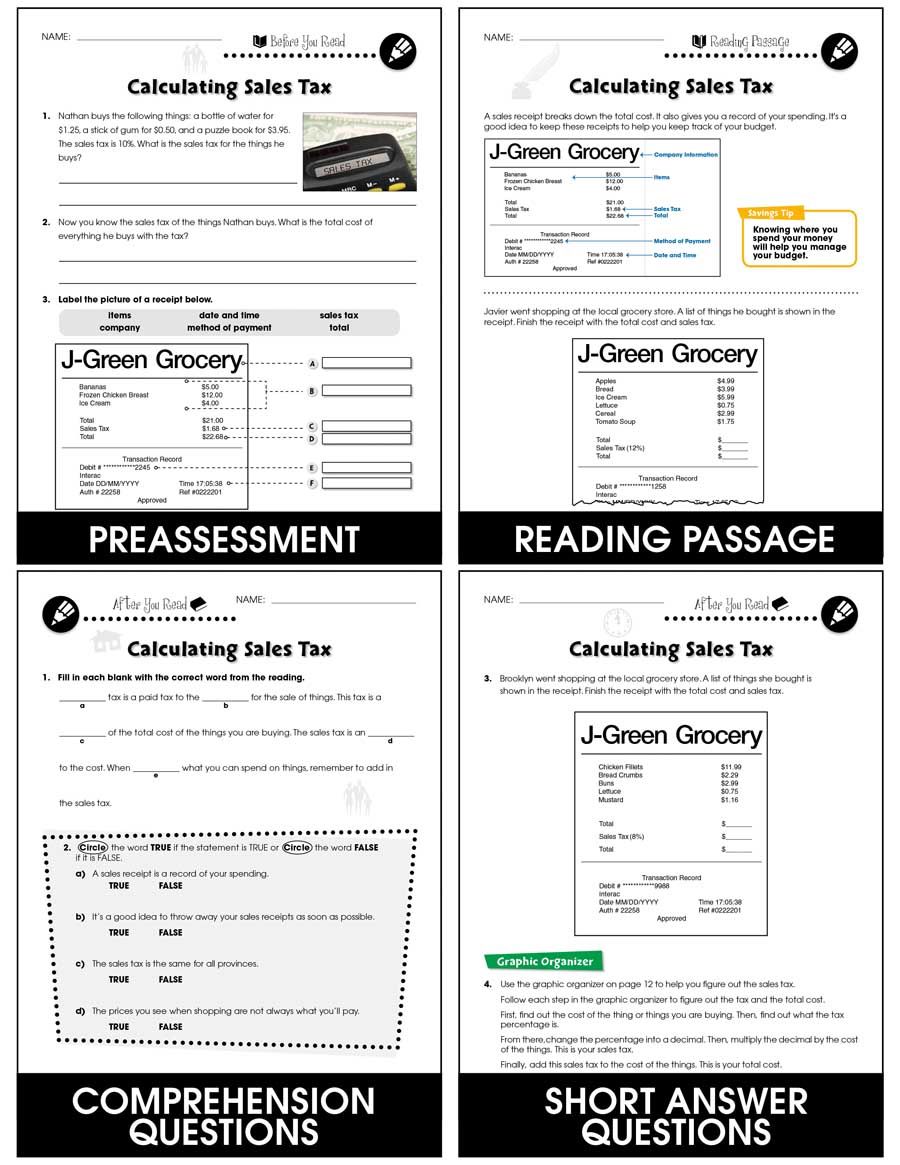

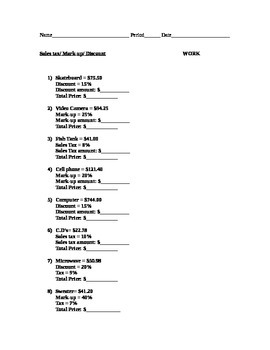

45 sales tax and discount worksheet

› sites › defaultForm ST-9, Virginia Retail Sales and Use Tax Apr 09, 2021 · 8 Dealer Discount. See Form ST-9A Worksheet. 8 9 Net State Tax. Line 7 minus Line 8. 9 10 Additional Regional State Sales Tax - See ST-9A Worksheet. 10a Northern Virginia Regional Transportation Sales Tax. Enter total taxable sales for this region in Column A. Multiply Column A by the rate of 0.7% (.007) and enter result in Column B. 10a x .007 = Sales Tax and Discount Worksheet Sales Tax and Discount Worksheet –Math 6. In a department store, a $50 dress is marked, "Save 25%." What is the discount? What is the sale price of the ...

› publications › p525Publication 525 (2021), Taxable and Nontaxable Income The FFCRA, as amended by the COVID-related Tax Relief Act of 2020, provides tax credits for self-employed individuals carrying on any trade or business within the meaning of section 1402 of the Internal Revenue Code if the self-employed individual would be entitled to receive paid leave under the FFCRA if the individual were an employee of an ...

Sales tax and discount worksheet

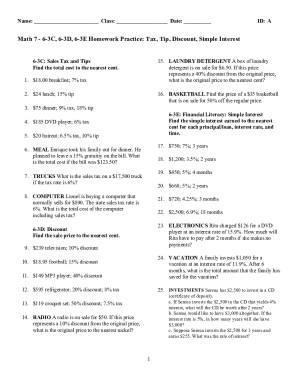

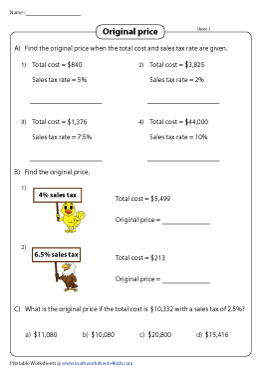

Sales Tax and Discount Worksheet Sales Tax and Discount Worksheet. 1) In a department store, a $40 dress is marked, "Save 25%." What is the discount? What is the sale price of the dress? floridarevenue.comFlorida Dept. of Revenue - Florida Dept. of Revenue Florida Department of Revenue Executive Director Jim Zingale issued Order of Emergency Waiver/Deviation #22-003 (Sales and Use Tax and Related Taxes), extending certain filing due dates for Florida businesses located in specific counties impacted by Hurricane Ian. The order extends the September 2022 and October 2022 reporting periods for sales ... Applying Taxes and Discounts Using Percentages - Worksheet Works Create a worksheet: Find the price of an item after tax and discount. ... to find the final price of various items after discounts and taxes are applied.

Sales tax and discount worksheet. Sales Tax and Discount Worksheet - The Wesley School Sales Tax and Discount Worksheet. Problem: In a video store, a DVD that sells for $15 is marked, "10% off". What is the discount? What is the sale price of ... Tax, Tip, and Discount Word Problems charged if the sales tax is 7%?. 3. John and his family went out to eat at their favorite restaurant. The bill for the food was $65.00, and ... › publications › p537Publication 537 (2021), Installment Sales | Internal Revenue ... Deferred Tax Liability: 4,736,683 Step 2: Compute the Applicable Percentage: The applicable percentage is computed in the year of sale and is used for all subsequent years. = Aggregate face amount of obligations arising in a tax year and outstanding as of the close of such tax year from dispositions with sales price > $150,000 – Sales Tax Worksheet Teaching Resources | Teachers Pay Teachers Results 1 - 24 of 66 ... This is a Sales, Tax, Discount handout. There is one problem with Commission as well as one each of Mark up and Mark Down. The problem with ...

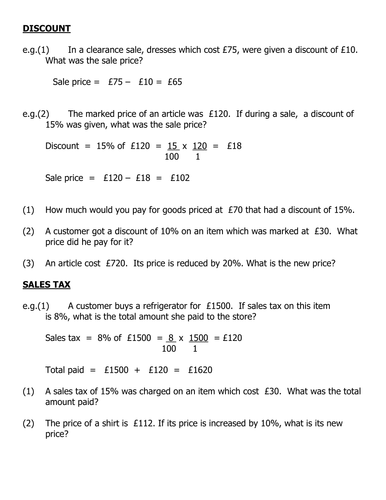

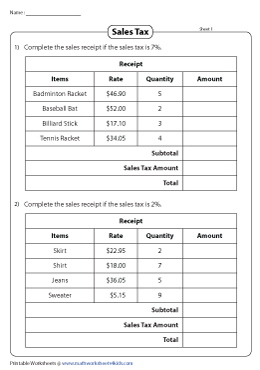

Sales Tax and Discount Worksheet Discount, Tax, and Tip Worksheet ... To find the sale price, subtract the discount from original price. Example: In a video store, a DVD that sells for $15 ... › publications › p334Publication 334 (2021), Tax Guide for Small Business Fiscal tax year. A fiscal tax year is 12 consecutive months ending on the last day of any month except December. A 52-53-week tax year is a fiscal tax year that varies from 52 to 53 weeks but does not have to end on the last day of a month. › instructions › i1040sd2021 Instructions for Schedule D (2021) | Internal Revenue ... If the amount on line 1 is less than $100,000, use the Tax Table to figure the tax. If the amount on line 1 is $100,000 or more, use the Tax Computation Worksheet: 46. _____ 47. Tax on all taxable income (including capital gains and qualified dividends). Enter the smaller of line 45 or line 46. Also, include this amount on Form 1040, 1040-SR ... Discount & sales tax worksheet - Liveworksheets.com Discounts online worksheet for 11. ... Students will be given a scenario and then asked to calculate the discount, sale price, tax and total cost.

› publications › p550Publication 550 (2021), Investment Income and Expenses ... Market discount. Market discount on a tax-exempt bond is not tax exempt. If you bought the bond after April 30, 1993, you can choose to accrue the market discount over the period you own the bond and include it in your income currently as taxable interest. See Market Discount Bonds, later. If you do not make that choice, or if you bought the ... Sales Tax Discount Teaching Resources | Teachers Pay Teachers Results 1 - 24 of 41 ... The problem with both tax and tip was solved with tipping on the original bill. This download is a three for one! Use as a worksheet with ... Discount and Sales Tax Worksheet The following items at Sam's ... Find the amount of discount, sale price, sales tax, and total cost for each item. Use a sales tax rate of 5%. Tennis Racquet: $100 at 30% off. Can of Tennis ... Applying Taxes and Discounts Using Percentages - Worksheet Works Create a worksheet: Find the price of an item after tax and discount. ... to find the final price of various items after discounts and taxes are applied.

floridarevenue.comFlorida Dept. of Revenue - Florida Dept. of Revenue Florida Department of Revenue Executive Director Jim Zingale issued Order of Emergency Waiver/Deviation #22-003 (Sales and Use Tax and Related Taxes), extending certain filing due dates for Florida businesses located in specific counties impacted by Hurricane Ian. The order extends the September 2022 and October 2022 reporting periods for sales ...

Sales Tax and Discount Worksheet Sales Tax and Discount Worksheet. 1) In a department store, a $40 dress is marked, "Save 25%." What is the discount? What is the sale price of the dress?

0 Response to "45 sales tax and discount worksheet"

Post a Comment