45 social security worksheet for 1040a

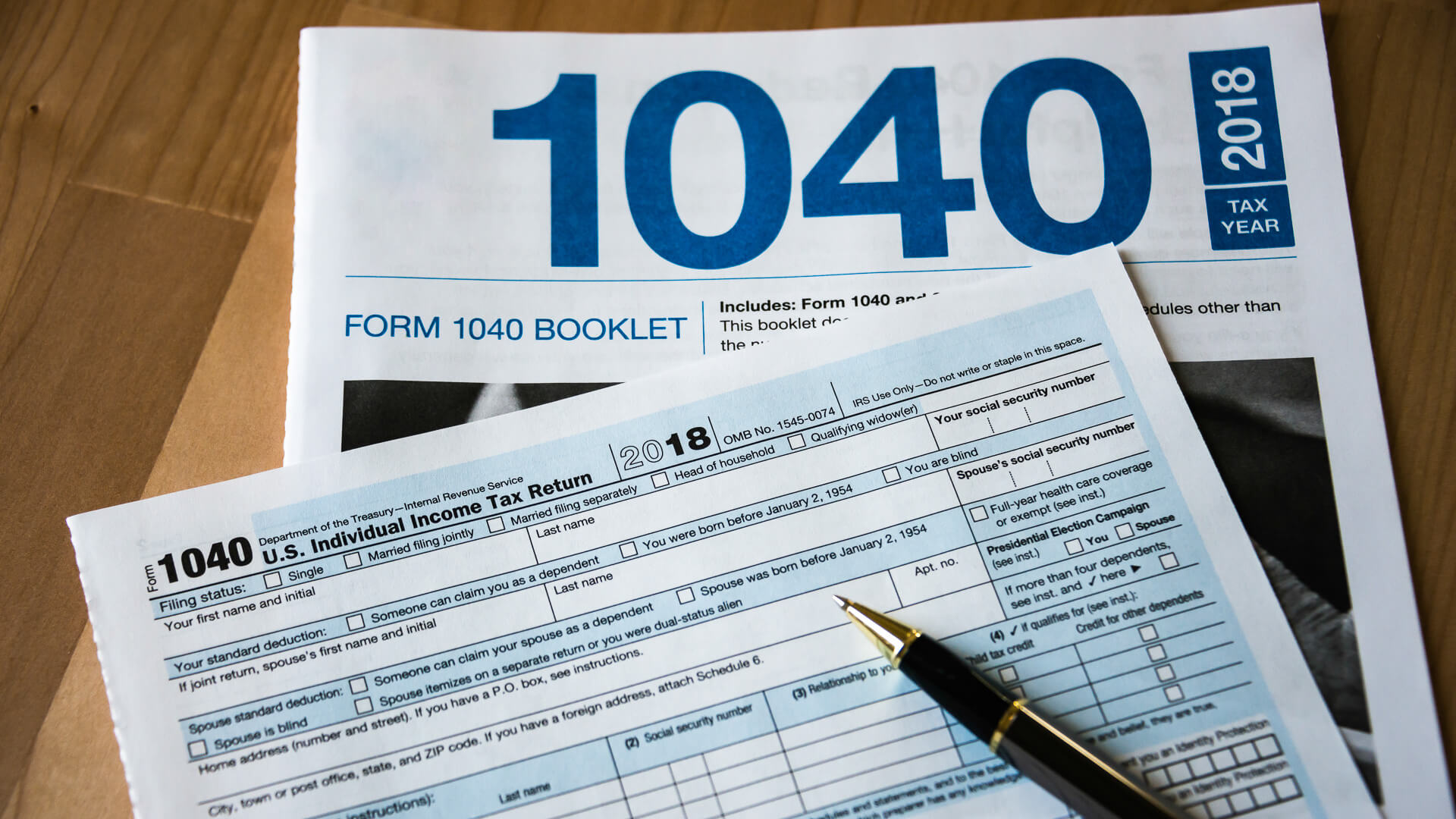

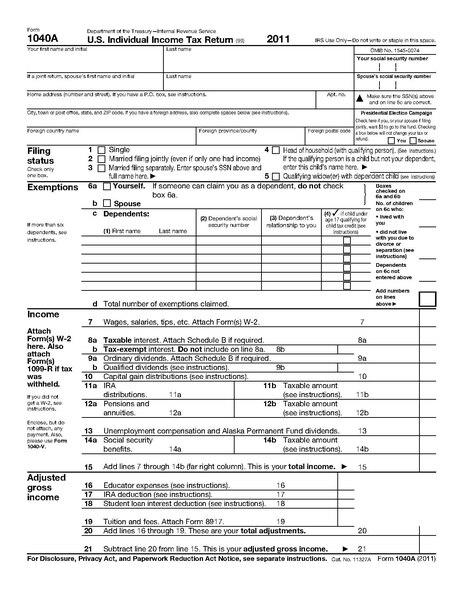

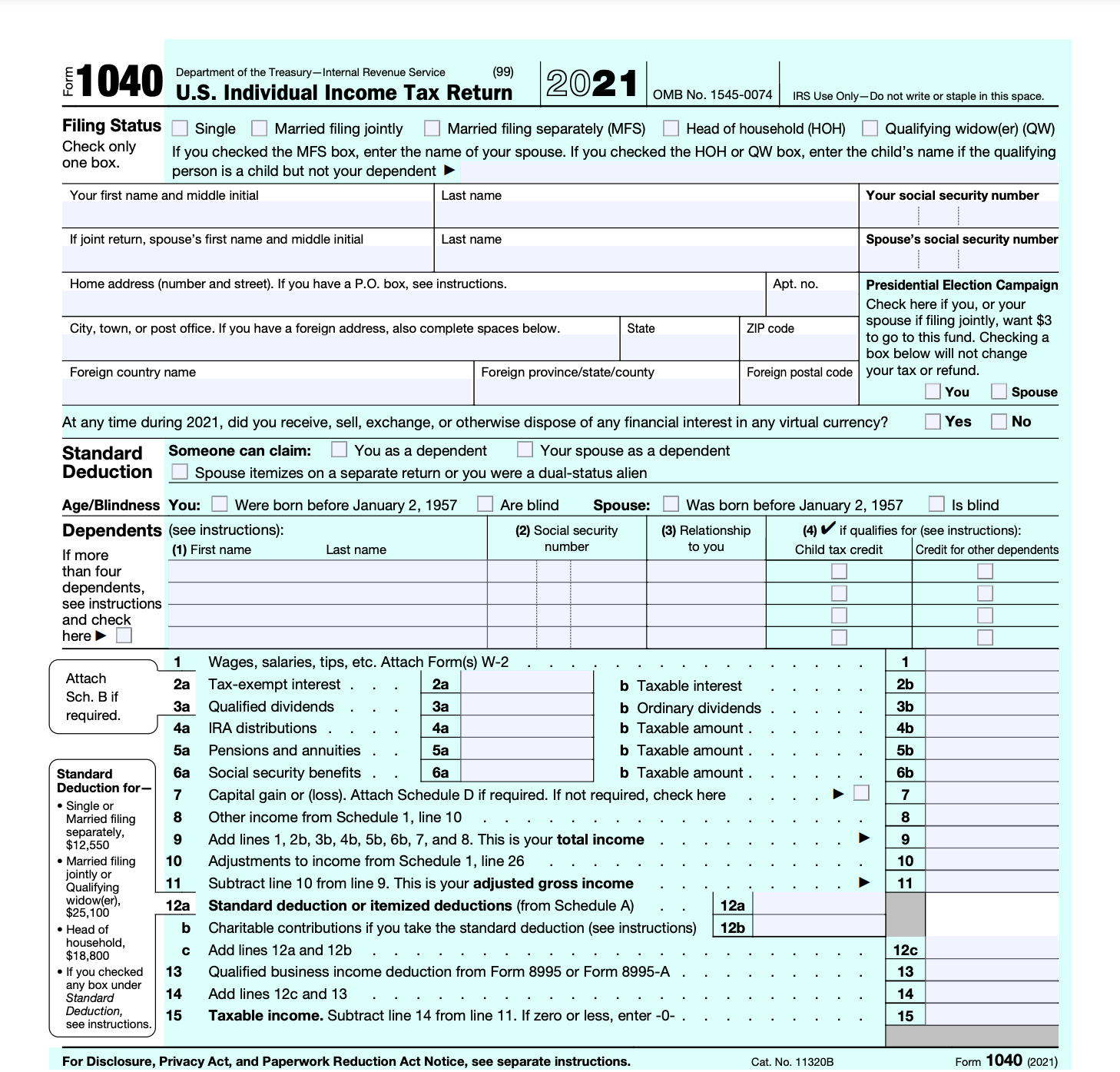

› forms-pubs › about-schedule-a-form-1040About Schedule A (Form 1040), Itemized Deductions Oct 04, 2022 · Use Schedule A (Form 1040 or 1040-SR) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. Social Security Worksheet_Layout 1 State of Rhode Island Division of Taxation. 2021 Modification Worksheet. Taxable Social Security Income Worksheet. Enter your spouse's date of birth, ...

Alabama Tax Forms and Instructions for 2021 (Form 40) - Income … 18/04/2022 · Remember that federal tax forms 1040EZ and 1040A have been discontinued. ... Open the PDF file and print the worksheet and form pages that you need. Then, fill in and mail the vouchers to the Alabama Department of Revenue. Alabama estimated income tax payment due dates are the same as the federal Form 1040-ES payment due dates. For the 2022 tax …

Social security worksheet for 1040a

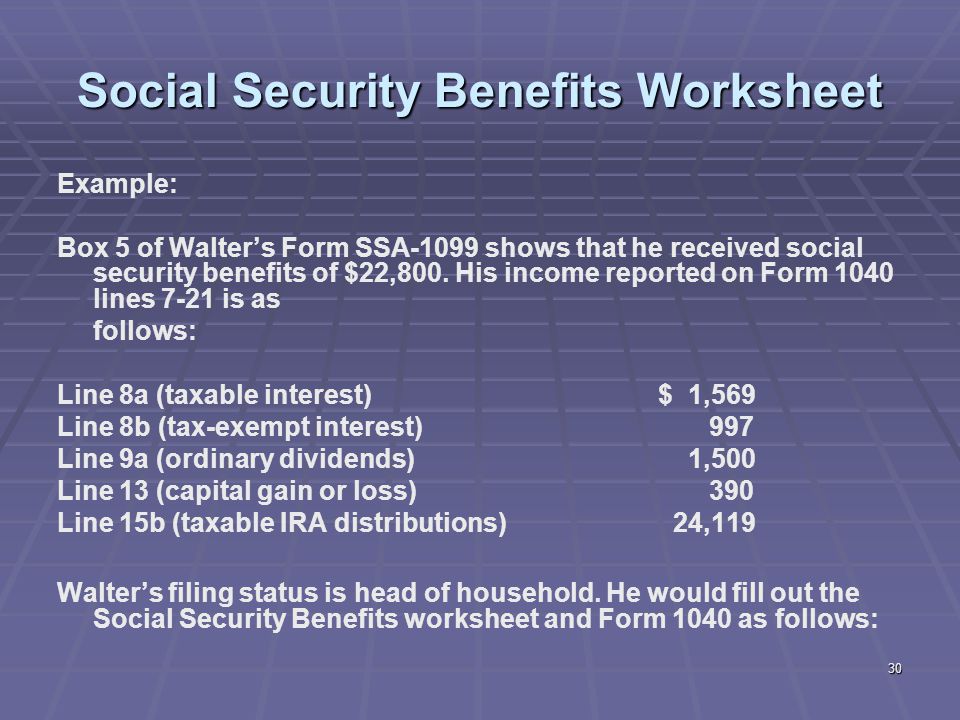

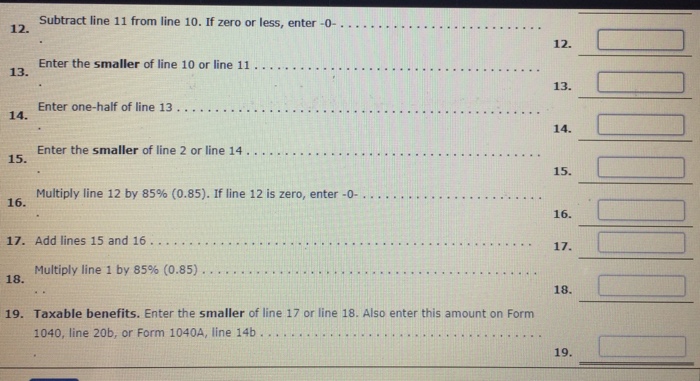

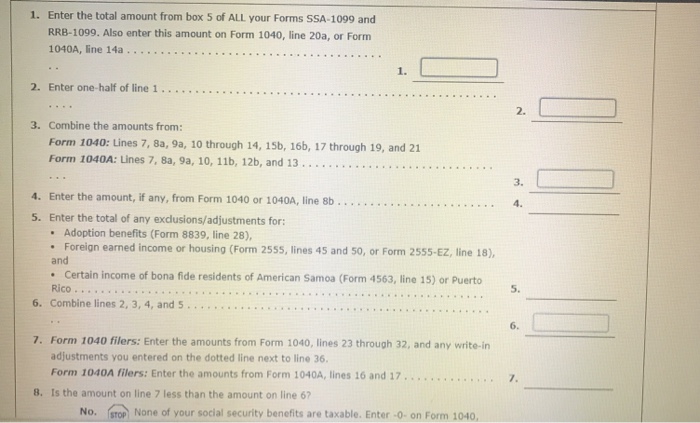

Social Security Benefits Worksheet (2019) Social Security Benefits Worksheet (2019). Caution: Do not use this worksheet if any of the following apply. 1) If the taxpayer made a 2019 traditional IRA ... › Benefits › TXL-1099Explanation of Form RRB 1099 Tax Statement | RRB.Gov Dec 07, 2017 · To determine if your SSEB payments and social security benefits are taxable, refer to the Social Security Benefits worksheet in the Instructions for Form 1040 and/or Form 1040A Booklet(s). For more detailed information about SSEB benefits and Form RRB-1099, get IRS Publication 915, Social Security and Equivalent Railroad Retirement Benefits. › publications › p915Publication 915 (2021), Social Security and Equivalent ... In 2020, she applied for social security disability benefits but was told she was ineligible. She appealed the decision and won. In 2021, she received a lump-sum payment of $6,000, of which $2,000 was for 2020 and $4,000 was for 2021. Jane also received $5,000 in social security benefits in 2021, so her total benefits in 2021 were $11,000.

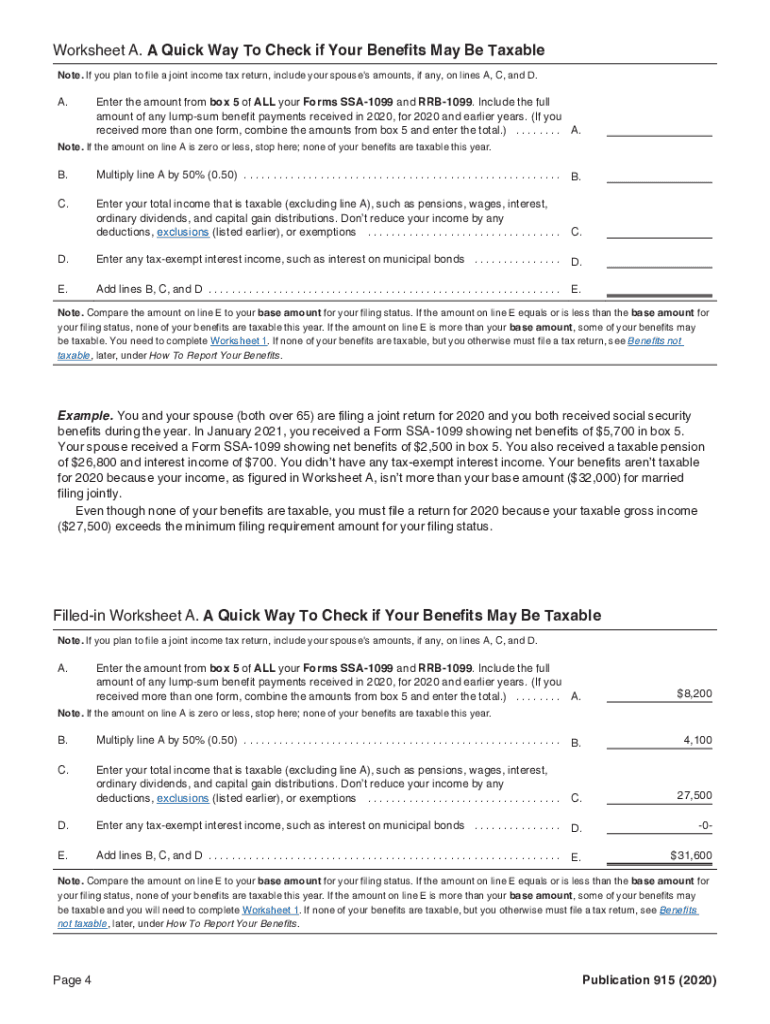

Social security worksheet for 1040a. Form 1040: Your Complete 2021 & 2022 Guide - Policygenius 22/12/2021 · Read more about Social Security payment schedules. Line 7 asks about your capital gains or losses from the past year. Two common reasons to have capital gains are that you sold stock investments or you sold your house. You likely received a 1099-B or 1099-S if you had capital gains, and you will probably need to attach Schedule D to your 1040. To learn … apps.irs.gov › app › understandingTaxesUnderstanding Taxes - Simulations - IRS tax forms Jacob HastingsSimulation 12: Completing a Tax Return Using Form 1040A to Claim a Dependent Alicia Garcia Simulation 6: Identifying Filing Status, Dependents, and Exemptions Madison Mailey Simulation 13: Completing a Tax Return Using Head of Household Filing Status 2021 Instructions for Schedule R (2021) | Internal Revenue Service If your social security or equivalent railroad retirement benefits are reduced because of workers' compensation benefits, treat the workers' compensation benefits as social security benefits when completing Schedule R (Form 1040), line 13a.. Line 13b. Enter the total of the following types of income that you (and your spouse if filing jointly) received for 2021. Veterans' pensions … Social Security Taxable Benefits Worksheet (2020) Instead, use the worksheet in IRS Pub. 915, Social Security and Equivalent Rail- road Retirement Benefits. 1) Enter the total amount from box 5 of all Forms SSA ...

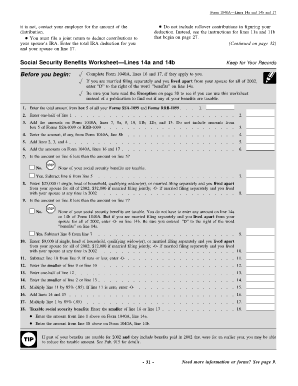

Social Security Benefits Worksheet - Taxable Amount - TaxAct If your income is modest, it is likely that none of your Social Security benefits are taxable. As your gross income increases, a higher percentage of your ... › individual › incomeFiling Information for Individual Income Tax - Marylandtaxes.gov Part-year residents with pensions should complete the pension exclusion worksheet using total taxable pension and total Social Security and Railroad Retirement benefits as if you were a full-year resident. Prorate the amount on line 5 by the number of months of Maryland residence divided by 12. Federally Taxable Social Security - CT.gov If you received social security benefits and any of those benefits were subject ... for the Social Security Benefit Adjustment Worksheet in Form CT-1040 or ... Social Security Benefits Worksheet—Lines 14a and 14b No. None of your social security benefits are taxable. You do not have to enter any amount on line 14a or 14b of Form 1040A. But if you are married filing ...

About Form 1040, U.S. Individual Income Tax Return Using a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) When Filing Your Tax Return-- 25 JUNE-2021. Unemployment Exclusion Update for married taxpayers living in a community property state-- 24-MAY-2021. Tax Treatment of Unemployment Benefits. Form 1040, 1040-SR, or 1040-NR, line 3a, Qualified dividends-- 06-APR ... › content › taxguideWorksheet to Figure Taxable Social Security Benefits Many of those who receive Social Security retirement benefits will have to pay income tax on some or all of those payments. More specifically, if your total taxable income (wages, pensions, interest, dividends, etc.) plus any tax-exempt income, plus half of your Social Security benefits exceed $25,000 for singles, $32,000 for marrieds filing jointly, and $0 for marrieds filing separately, the ... › 100269931-ssataxpdf-2021Social Security Benefits Worksheet 2021 Pdf - pdfFiller Once your fillable social security benefits worksheet 2021 form is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. 2021 Publication 915 - IRS Jan 6, 2022 ... Social security benefits include monthly retirement, sur- ... 1040. You can use either that worksheet or Worksheet 1.

Notice 703 (Rev. October 2022) - IRS Read This To See if Your Social Security Benefits May Be Taxable. If your social ... We developed this worksheet for ... line A above on Form 1040 or.

Social Security Benefit Adjustment Worksheet - dir.ct.gov Enter below the amount reported on your 2017 Social Security Benefits Worksheet. Press the Calculate Your Social Security Adjustment button when complete. 1.

› publications › p915Publication 915 (2021), Social Security and Equivalent ... In 2020, she applied for social security disability benefits but was told she was ineligible. She appealed the decision and won. In 2021, she received a lump-sum payment of $6,000, of which $2,000 was for 2020 and $4,000 was for 2021. Jane also received $5,000 in social security benefits in 2021, so her total benefits in 2021 were $11,000.

› Benefits › TXL-1099Explanation of Form RRB 1099 Tax Statement | RRB.Gov Dec 07, 2017 · To determine if your SSEB payments and social security benefits are taxable, refer to the Social Security Benefits worksheet in the Instructions for Form 1040 and/or Form 1040A Booklet(s). For more detailed information about SSEB benefits and Form RRB-1099, get IRS Publication 915, Social Security and Equivalent Railroad Retirement Benefits.

Social Security Benefits Worksheet (2019) Social Security Benefits Worksheet (2019). Caution: Do not use this worksheet if any of the following apply. 1) If the taxpayer made a 2019 traditional IRA ...

/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

0 Response to "45 social security worksheet for 1040a"

Post a Comment