38 income tax deduction worksheet

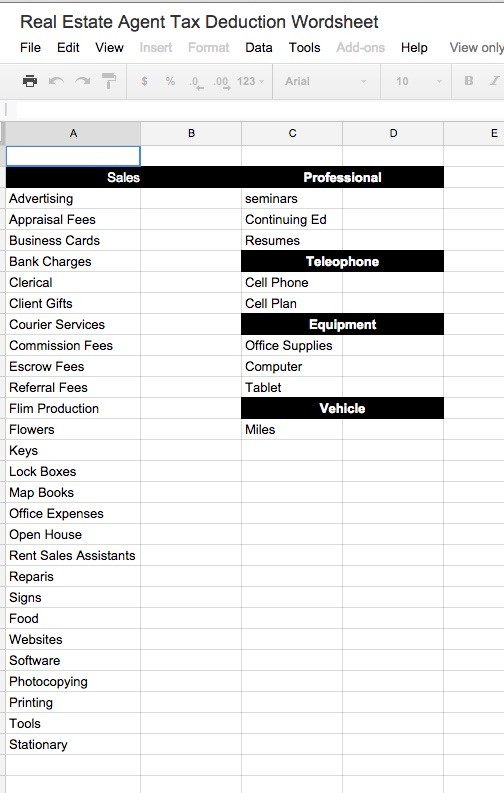

AL - Federal Income Tax Deduction Worksheet Changes (Drake21) The recent Alabama Act 2022-37 modified the guidelines for the Alabama federal income tax deduction worksheet. Part II now states "Pursuant to Act 2022-37 (HB 231) which provides that any federal income tax reductions attributable to the federal child tax credit, the earned income tax credit, and the federal child and dependent care tax credits, the federal income tax deduction shall be ... Tax Deductions Worksheets - K12 Workbook Worksheets are Tax deduction work, Truckers work on what you can deduct, Realtors tax deductions work, Realtor, Schedule a tax deduction work, Rental property tax deduction work, Day care income and expense work year, Work to estimate federal tax withholding year 2019. *Click on Open button to open and print to worksheet. 1. Tax Deduction Worksheet

Worksheet 2 (Tier 3 Michigan Standard Deduction) Estimator if the older of you or your spouse (if married filing jointly) was born during the period january 1, 1953 through january 1, 1954, and reached the age of 67 on or before december 31, 2020, you may deduct the personal exemption amount and taxable social security benefits, military compensation (including retirement benefits), michigan national …

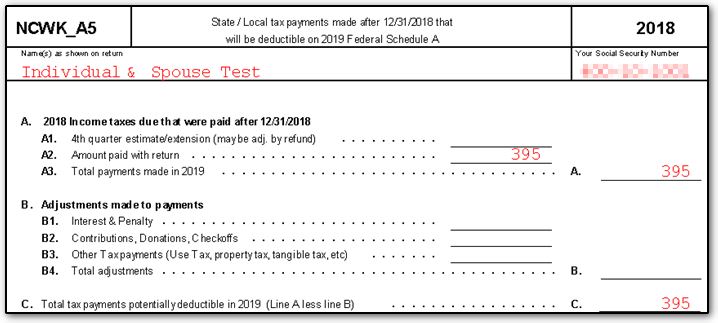

Income tax deduction worksheet

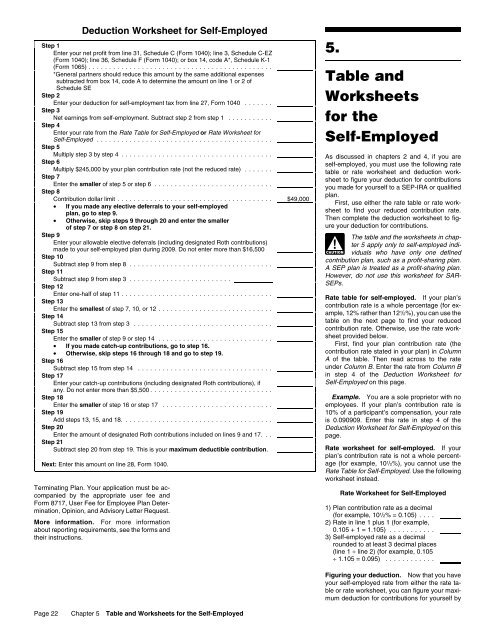

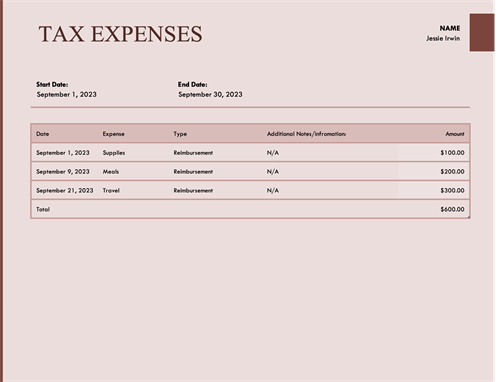

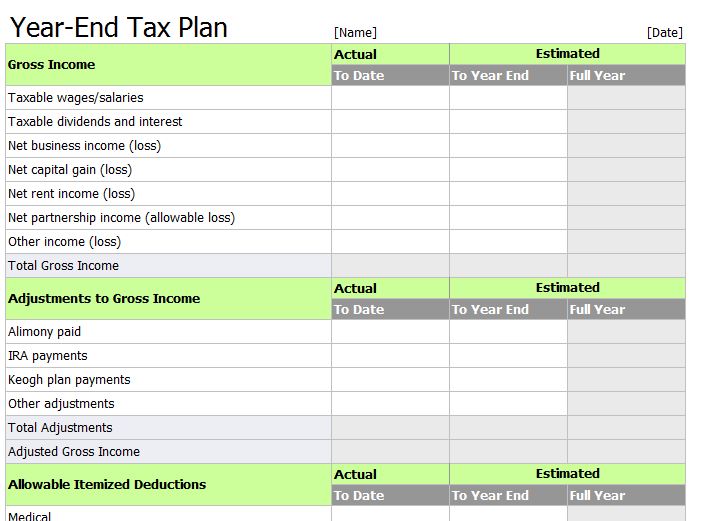

Self-Employed Tax Deductions Worksheet (Download FREE) - Bonsai Internet and phone bills - The cost of wifi and a portion of your phone bill may qualify as a deductible expense Deduct the cost of meals - meals with clients or any meetings where you discuss work may count as a deduction. Travel costs - If you have to travel for your work/services, you can deduct the fees related to traveling PDF 2 Deductions and Adjustments Worksheet - Internal Revenue Service of your income, and miscellaneous deductions. (For 1997, you may have to reduce your itemized deductions if your income is over $121,200 ($60,600 if married filing separately). Get Pub. 919 for details.) 1 1 $ $6,900 if married filing jointly or qualifying widow(er) $6,050 if head of household 2 $ 2 Enter: $4,150 if single $3,450 if married ... Publication 505 (2022), Tax Withholding and Estimated Tax Project the taxable income you will have for 2022 and figure the amount of tax you will have to pay on that income. Worksheet 1-4 Tax Computation Worksheets for 2022: ... When figuring your 2022 estimated tax, it may be helpful to use your income, deductions, and credits for 2021 as a starting point. Use your 2021 federal tax return as a guide ...

Income tax deduction worksheet. Deductions | FTB.ca.gov - California Franchise Tax Board 1. Enter your income from: line 2 of the "Standard Deduction Worksheet for Dependents" in the instructions for federal Form 1040 or 1040-SR. 1. 2. Minimum standard deduction 2. $1,100 3. Enter the larger of line 1 or line 2 here 3. 4. Enter amount shown for your filing status: Single or married/RDP filing separately, enter $4,803 rental property tax deductions worksheet Small Business Tax Deductions Worksheet briefencounters.ca. worksheet deductions expenses deduct briefencounters spreadsheet. Fillable Online Police Officer Tax Deduction Worksheet — Db-excel.com db-excel.com. tax worksheet deduction police officer fillable deductions excel db. Self Employed Tax Deductions Worksheet 2019 December 2020 ... Tax Withholding Estimator | Internal Revenue Service See how your withholding affects your refund, take-home pay or tax due. How It Works Use this tool to: Estimate your federal income tax withholding See how your refund, take-home pay or tax due are affected by withholding amount Choose an estimated withholding amount that works for you Results are as accurate as the information you enter. The Ultimate Small Business Tax Deductions Worksheet for 2022 Assuming your effective tax rate is 20%, that $5,000 tax deduction will save you $1,000. Without deductions: $50,000 x .2 = $10,000 With deductions: $45,000 x .2 = $9,000 Savings: $10,000 - $9,000 = $1,000 Over the course of the tax year, record business-related expenses so you can easily tell which costs are deductible when it's tax time.

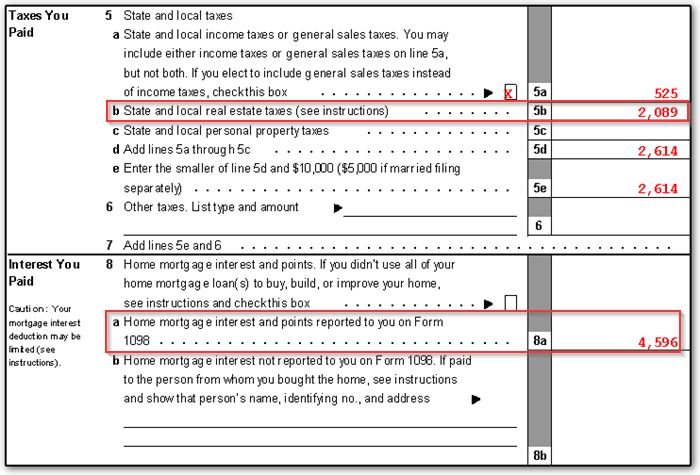

Federal Income Tax Deduction Worksheet Form - SignNow Quick steps to complete and e-sign Federal Income Tax Deduction Worksheet online: Use Get Form or simply click on the template preview to open it in the editor. Start completing the fillable fields and carefully type in required information. Use the Cross or Check marks in the top toolbar to select your answers in the list boxes. Alabama — Federal Income Tax Deduction Worksheet We last updated Alabama Federal Income Tax Deduction Worksheet in January 2022 from the Alabama Department of Revenue. This form is for income earned in tax year 2021, with tax returns due in April 2022.We will update this page with a new version of the form for 2023 as soon as it is made available by the Alabama government. Income Tax: Tax Liability & Deductions - Quiz & Worksheet - Study.com Worksheet Print Worksheet 1. Tax liability is calculated based on _____. taxable income standard deduction adjusted gross income gross income 2. What is TRUE about the tax code? The... About Schedule A (Form 1040), Itemized Deductions Use Schedule A (Form 1040 or 1040-SR) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. Current Revision Schedule A (Form 1040) PDF Instructions for Schedule A (Form 1040) | Print Version PDF | eBook (epub) EPUB Recent Developments

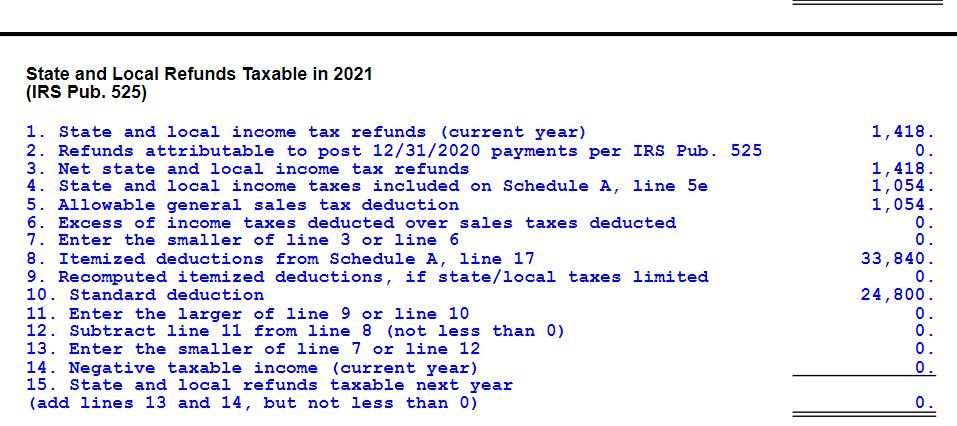

1040 (2021) | Internal Revenue Service Use the Qualified Dividends and Capital Gain Tax Worksheet or the Schedule D Tax Worksheet, whichever applies, to figure your tax. See the instructions for line 16 for details.. Line 3b. ... You should receive a Form 1099-R showing the total amount of any distribution from your IRA before income tax or other deductions were withheld. This ... Schedule 8812 Line 5 Worksheet - Intuit I can't find the Line 5 Worksheet for Schedule 8812 anywhere in my TurboTax output. Under File \ Print, I selected the option to have TurboTax generate "Tax Return, all calculation worksheets". There is no Line 5 worksheet to be found anywhere. The worksheet is used to determine the child tax credit amount based on income limitations, so it's a ... How to Calculate Deductions & Adjustments on a W-4 Worksheet If the standard deduction that you qualify for is higher than your itemized deductions, you should choose the standard deduction. On the other hand, deductions should be itemized if doing so will result in you paying lower taxes. The W-4 deductions worksheet asks you to select the larger of the two deductions on line three. Publication 501 (2021), Dependents, Standard Deduction, and Filing ... You can use the 2021 Standard Deduction Tables near the end of this publication to figure your standard deduction. Charitable contribution deduction. In 2021, you are allowed a charitable contribution deduction for cash contributions of up to $300 ($600 if your filing status is married filing jointly) if you don't itemize your deductions.

PDF 2022 Form W-4 - Internal Revenue Service payments for that income. If you prefer to pay estimated tax rather than having tax on other income withheld from your paycheck, see Form 1040-ES, Estimated Tax for Individuals. Step 4(b). Enter in this step the amount from the Deductions Worksheet, line 5, if you expect to claim deductions other than the basic standard deduction on your 2022 ...

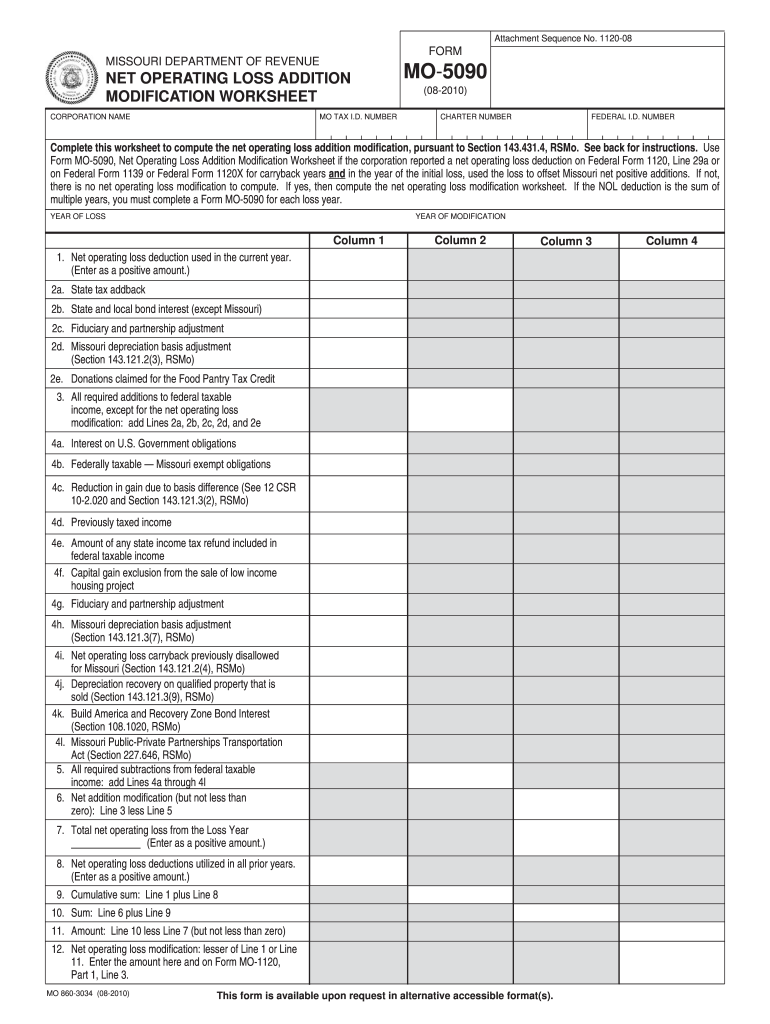

PDF Unincorporated Business Tax Worksheet of Changes in Tax Base Made by ... Investment income before deductions directly or indirectly attributable to investment income (from Form NYC-202 or NYC-202EIN, Schedule B, line 25(e), or from Form NYC-204, Schedule B, ... UNINCORPORATED BUSINESS TAX WORKSHEET OF CHANGES IN TAX BASE MADE BY INTERNAL REVENUE SERVICE AND/OR NEW YORK STATE DEPARTMENT OF TAXATION AND FINANCE ...

Rental Income and Expense Worksheet - Zillow To download the free rental income and expense worksheet template, click the green button at the top of the page. Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the "rental income" category or HOA dues, gardening service and utilities in the "monthly expense" category.

Income Tax Worksheet Download this income tax worksheet AKA income tax organizer to maximize your deductions and minimize errors and omissions. FileTax site offers FREE information to HELP YOU PLAN AND MANAGE YOUR STATE AND FEDERAL INCOME TAXES.

PDF Federal Income Tax Deduction Worksheet - Alabama Part II - Pursuant to Act 2022-37 (HB 231) which provides that any federal income tax reductions attributable to the federal child tax credit, the earned income tax credit, and the federal child and dependent care tax credits, the federal income tax deduction shall be calculated as if the in dividual paid the federal income tax that would

Foreign Earned Income - Exclusion and Foreign Tax Credit (or Deduction) Form 2555. This form allows an exclusion of up to $112,000 of your foreign earned income if you are a U.S. citizen or a U.S. resident alien living and working in a foreign country. All foreign earned income (for the individual taxpayer) should be combined on to one Form 2555. Up to two Forms 2555 can be e-filed per return, one for each taxpayer.

Publication 505 (2022), Tax Withholding and Estimated Tax Project the taxable income you will have for 2022 and figure the amount of tax you will have to pay on that income. Worksheet 1-4 Tax Computation Worksheets for 2022: ... When figuring your 2022 estimated tax, it may be helpful to use your income, deductions, and credits for 2021 as a starting point. Use your 2021 federal tax return as a guide ...

PDF 2 Deductions and Adjustments Worksheet - Internal Revenue Service of your income, and miscellaneous deductions. (For 1997, you may have to reduce your itemized deductions if your income is over $121,200 ($60,600 if married filing separately). Get Pub. 919 for details.) 1 1 $ $6,900 if married filing jointly or qualifying widow(er) $6,050 if head of household 2 $ 2 Enter: $4,150 if single $3,450 if married ...

Self-Employed Tax Deductions Worksheet (Download FREE) - Bonsai Internet and phone bills - The cost of wifi and a portion of your phone bill may qualify as a deductible expense Deduct the cost of meals - meals with clients or any meetings where you discuss work may count as a deduction. Travel costs - If you have to travel for your work/services, you can deduct the fees related to traveling

:max_bytes(150000):strip_icc()/Multiple-Jobs-Worksheet-96358d4a739f409d9965ab4359911d3b.jpg)

0 Response to "38 income tax deduction worksheet"

Post a Comment