38 schedule d tax worksheet 2014

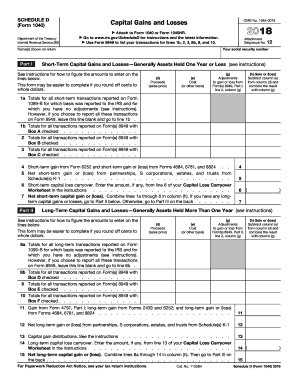

Schedule K-1 (Form 1065) - Tax Exempt Income, Non ... - Support This article focuses solely on the entry of the Tax Exempt Income, Non-Deductible Expenses, Distributions and Other Information.Learn more. These items are found on Box 18, Box 19 and Box 20 of the Schedule K-1 (Form 1065) Partner's Share of Income, Deductions, Credits, etc. Instructions for Schedule D (Form 1041) (2021) - IRS tax forms Gain or loss from a sale, exchange, or other disposition of virtual currency if held as a capital asset. See Notice 2014-21, 2014-16 I.R.B. 938. ... If you completed the Schedule D Tax Worksheet next instead of Part V of Schedule D, be sure to enter the amount from line 44 of the worksheet on line 1a of Schedule G, Part I, Form 1041.

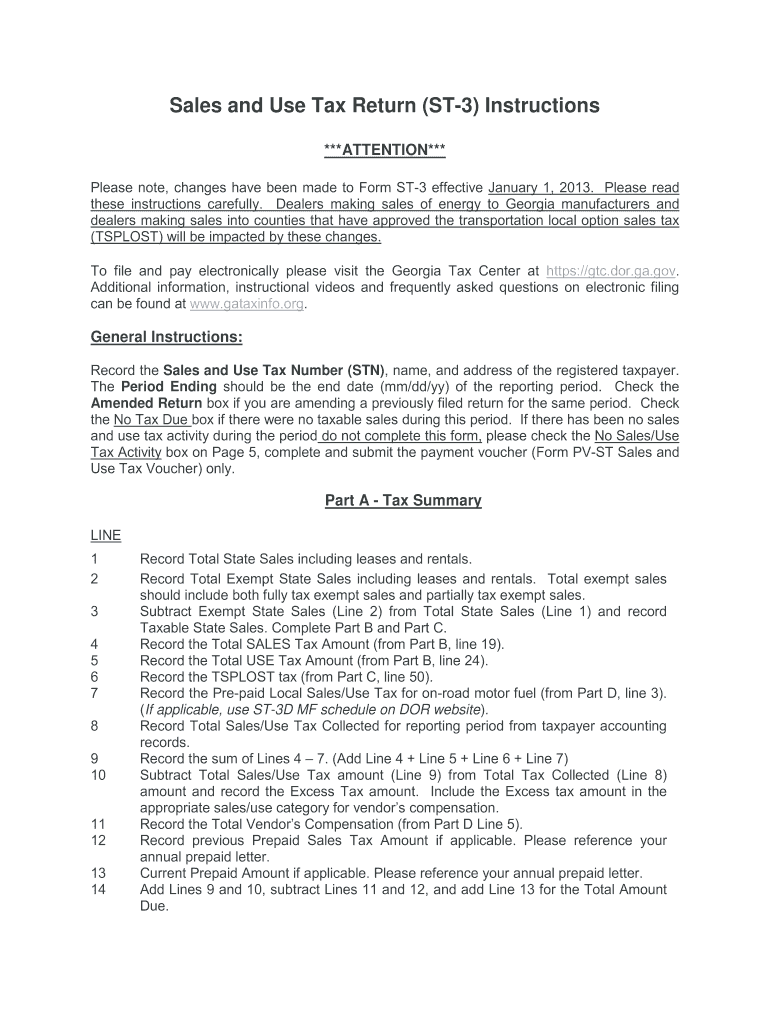

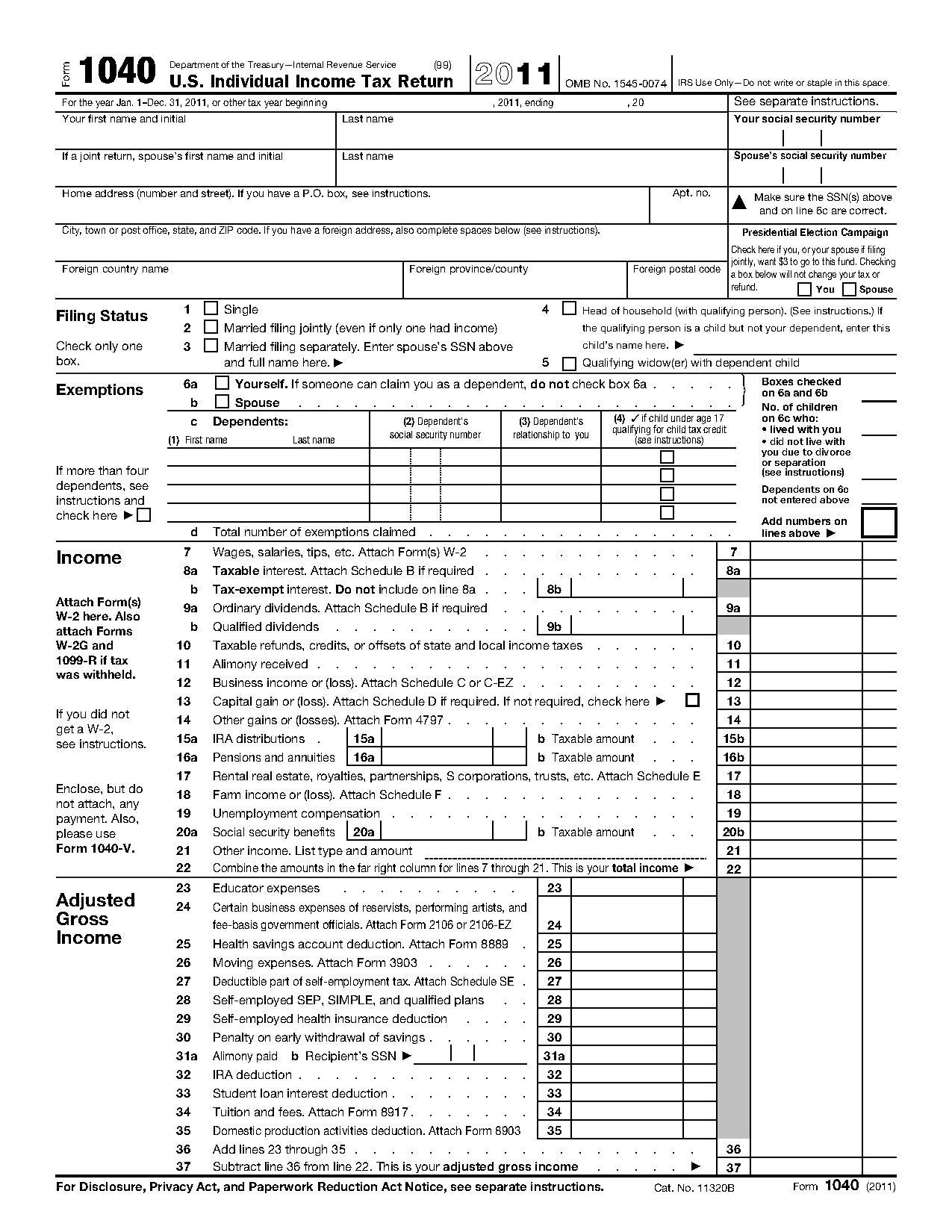

Schedule 1 Instructions for 2021 Taxes - Policygenius Dec 20, 2021 · Line 1 is where you write in the amount you earned from a tax refund, tax credit, or other offset for state and local income taxes. If you have this type of income, you probably received a 1099-G. There is a worksheet in the IRS instructions for Schedule 1 to help you determine how much income you need to report here. There are a few exceptions ...

Schedule d tax worksheet 2014

PDF Internal Revenue Service Department of the Treasury - IRS tax forms Tax Worksheet from the 2014 Instruc-tions for Form 1040; or The Schedule D Tax Worksheet in the 2014 Instructions for Schedule D. Enter the tax on line 4. Line 5 If you used Schedule J to figure your tax for: 2013 (that is, you entered the amount from the 2013 Schedule J, line 23, on line 44 of your 2013 Form ... PlayStation userbase "significantly larger" than Xbox even if ... Oct 12, 2022 · Microsoft has responded to a list of concerns regarding its ongoing $68bn attempt to buy Activision Blizzard, as raised by the UK's Competition and Markets Authority (CMA), and come up with an ... Schedule D - Viewing Tax Worksheet - TaxAct Schedule D - Viewing Tax Worksheet. If there is an amount on Line 18 (from the 28% Rate Gain Worksheet) or Line 19 (from the Unrecaptured Section 1250 Gain Worksheet) of Schedule D (Form 1040) Capital Gains and Losses, according to the IRS, the tax is calculated on the Schedule D Tax Worksheet instead of the Qualified Dividends and Capital Gain ...

Schedule d tax worksheet 2014. PDF SCHEDULE D Capital Gains and Losses - taxformfinder.org No. Complete the Schedule D Tax Worksheet in the instructions. Do not complete lines 21 and 22 below. 21 If line 16 is a loss, enter here and on Form 1040, line 13, or Form 1040NR, ... Schedule D (Form 1040) 2014 . Title: 2014 Form 1040 (Schedule D) Subject: Capital Gains and Losses Publication 535 (2021), Business Expenses | Internal Revenue ... Comments and suggestions. We welcome your comments about this publication and your suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. SCHEDULE D TAX WORKSHEET - Intuit Accountants Community Depreciation Recapture for sale of rental property on SchD Tax Wksht L35-40 Depreciation is 37k Total income on line 37 is less than L36(sum of Microsoft says a Sony deal with Activision stops Call of Duty ... Oct 21, 2022 · A footnote in Microsoft's submission to the UK's Competition and Markets Authority (CMA) has let slip the reason behind Call of Duty's absence from the Xbox Game Pass library: Sony and

PDF Schedule D 2014 - bradfordtaxinstitute.com No. Complete the Schedule D Tax Worksheet in the instructions. Do not complete lines 21 and 22 below. 21 If line 16 is a loss, enter here and on Form 1040, line 13, or Form 1040NR, line 14, the smaller of: ... Schedule D 2014 Author: Bradford Tax Institute Subject: Capital Gains and Losses Keywords: IRS Form; IRS; Internal Revenue Service ... 2022 Instructions for Schedule D (2022) | Internal Revenue ... Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero and lines 15 and 16 of Schedule D are gains or if you file Form 4952 and you have an amount on line 4g, even if you don’t need to file Schedule D. Otherwise, complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line ... PDF and Losses Capital Gains - IRS tax forms plete line 19 of Schedule D. If there is an amount in box 2c, see Exclusion of Gain on Qualified Small Business (QSB) Stock, later. If there is an amount in box 2d, in-clude that amount on line 4 of the 28% Rate Gain Worksheet in these instruc-tions if you complete line 18 of Sched-ule D. If you received capital gain distribu- Forms and Instructions (PDF) - IRS tax forms 2021. 12/09/2021. Inst 1120-S (Schedule D) Instructions for Schedule D (Form 1120S), Capital Gains and Losses and Built-In Gains. 2021. 01/07/2022. Form 8995-A (Schedule D) Special Rules for Patrons of Agricultural or Horticultural Cooperatives. 2021.

Publication 544 (2021), Sales and Other Dispositions of Assets Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. PDF Capital Gains and Losses - 1040.com 2014. Attachment Sequence No. 12. Name(s) shown on return . Your social security number. Part I Short-Term Capital Gains and Losses—Assets Held One Year or Less . See instructions for how to figure the amounts to enter on the lines below. This form may be easier to complete if you round off cents to whole dollars. (d) Proceeds (sales price ... PDF Capital Gains and Losses - IRS tax forms Schedule D Tax Worksheet: in the instructions. Do not: complete lines 21 and 22 below. 21 : If line 16 is a loss, enter here and on Form 1040, line 13, or Form 1040NR, line 14, the : smaller : of: ... 2014 Form 1040 (Schedule D) Author: SE:W:CAR:MP Subject: Capital Gains and Losses PDF Attach to Form 1041, Form 5227, or Form 990-T. Use Form 8949 to list ... 2014. Name of estate or trust . Employer identification number . Note: Form 5227 filers need to complete. only. Parts I and II. See instructions for how to figure the amounts to enter on the lines below. This form may be easier to complete if you round off cents to whole dollars. Part I Short-Term Capital Gains and Losses—Assets Held One Year ...

Schedule D Tax Worksheet Keep for Your Records - REGINFO.GOV Schedule D Tax Worksheet Keep for Your Records Complete this worksheet only if: • On Schedule D, line 14b, column (2), or line 14c, column (2), is more than zero, or • Both line 2b(1) of Form 1041 and line 4g of Form 4952 are more than zero. Exception: Do not use this worksheet to figure the estate's or trust's tax if line 14a, column (2), or line 15, column (2), of Schedule D or Form

Prior Year Products - IRS tax forms Prior Year Products. Instructions: Tips: More Information: Enter a term in the Find Box. Select a category (column heading) in the drop down. Click Find. Click on the product number in each row to view/download. Click on column heading to sort the list.

Changes to the 1040 Schedule D Will Make the 2014 Filing Season a Bit ... Tax preparers should also be aware of two additional changes impacting Schedule D and Form 8949 filing: (For estates and trusts) Many transactions that, in previous years, would have been reported by estates and trusts on Schedule D or Schedule D-1 must now be reported on Form 8949 if they have to be reported on a 2013 form.

PDF Free Forms Courtesy of FreeTaxUSA No. Complete the Schedule D Tax Worksheet in the instructions. Do not complete lines 21 and 22 below. 21 If line 16 is a loss, enter here and on Form 1040, line 13, or Form 1040NR, ... Schedule D (Form 1040) 2014 . Title: 2014 Tax Federal Capital Gains and Losses Author: FreeTaxUSA.com Subject: U.S. Individual Income Tax Return

Schedule D - Viewing Tax Worksheet - TaxAct If there is an amount on Line 18 (from the 28% Rate Gain Worksheet) or Line 19 (from the Unrecaptured Section 1250 Gain Worksheet) of Schedule D, according to the IRS the tax is calculated on the Schedule D Tax Worksheet instead of the Qualified Dividends and Capital Gain Tax Worksheet. To view the tax calculation on the Schedule D Tax Worksheet which will show the calculation of the tax which ...

PDF 2014 Instruction 1040 - TAX TABLE - IRS tax forms Cat. No. 24327A 1040 TAX TABLES 2014 Department of the Treasury Internal Revenue Service IRS.gov This booklet contains Tax Tables from the Instructions for Form 1040 only.

About Schedule D (Form 1040), Capital Gains and Losses Correction to the 2020 and 2021 Instructions for Schedule D (Form 1040), "Capital Loss Carryover Worksheet - Lines 6 and 14" -- 11-JULY-2022.

Irs Form Schedule D 2014 - kiowacountycolo.com Tools for tax pros exoo 2014 Schedule D Tax Worksheet Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero. Otherwise, complete the Qualified Dividends and Capital Gain Tax Worksheet in the Instructions for Form 1040, line 44 (or in the Instructions for Form 1040NR, line 42) to figure your tax. ...

Schedule D - Viewing Tax Worksheet - TaxAct Schedule D - Viewing Tax Worksheet. If there is an amount on Line 18 (from the 28% Rate Gain Worksheet) or Line 19 (from the Unrecaptured Section 1250 Gain Worksheet) of Schedule D (Form 1040) Capital Gains and Losses, according to the IRS, the tax is calculated on the Schedule D Tax Worksheet instead of the Qualified Dividends and Capital Gain ...

PlayStation userbase "significantly larger" than Xbox even if ... Oct 12, 2022 · Microsoft has responded to a list of concerns regarding its ongoing $68bn attempt to buy Activision Blizzard, as raised by the UK's Competition and Markets Authority (CMA), and come up with an ...

PDF Internal Revenue Service Department of the Treasury - IRS tax forms Tax Worksheet from the 2014 Instruc-tions for Form 1040; or The Schedule D Tax Worksheet in the 2014 Instructions for Schedule D. Enter the tax on line 4. Line 5 If you used Schedule J to figure your tax for: 2013 (that is, you entered the amount from the 2013 Schedule J, line 23, on line 44 of your 2013 Form ...

:max_bytes(150000):strip_icc()/Form1041Year2021-91aed92e44524bc99dbb7c21c1913264.png)

0 Response to "38 schedule d tax worksheet 2014"

Post a Comment