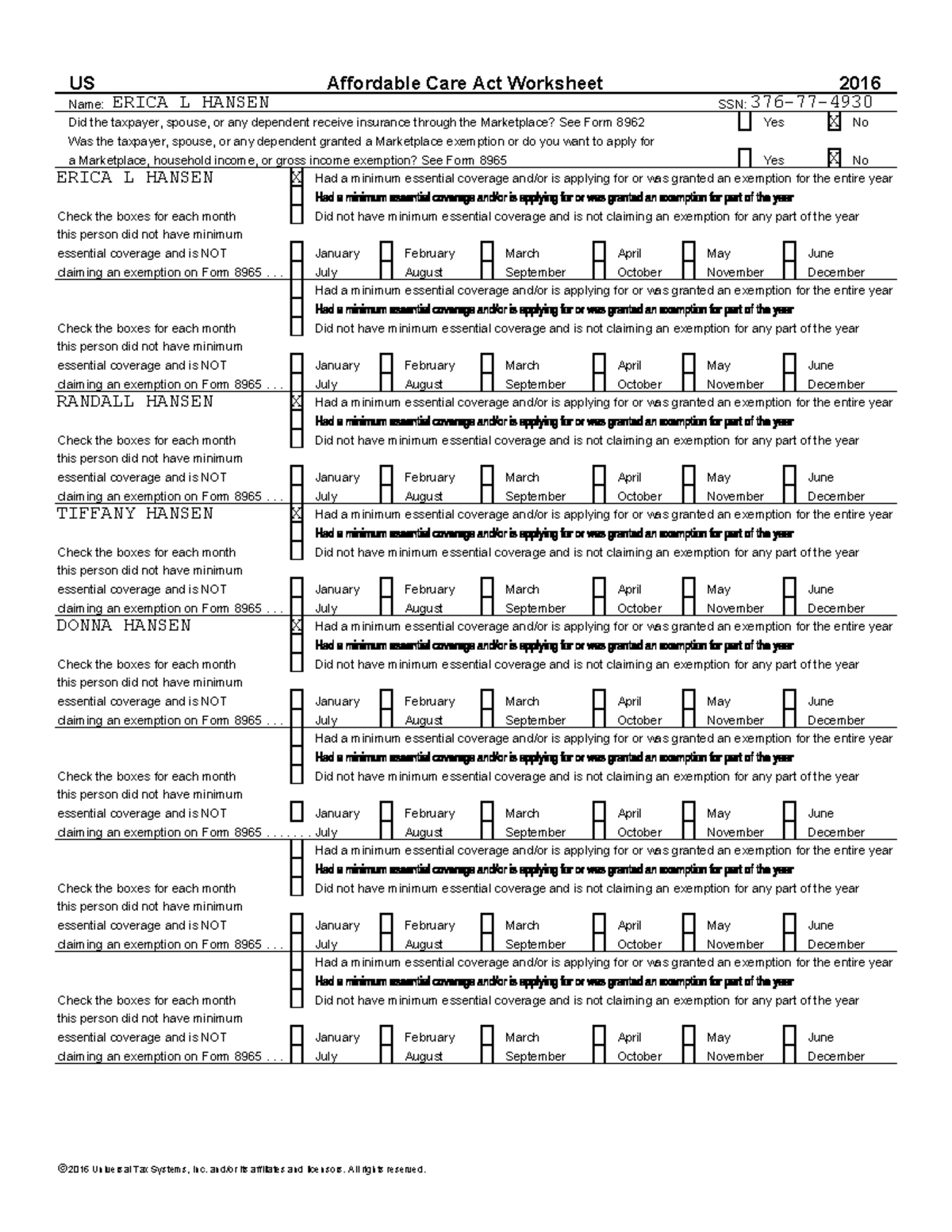

39 affordable care act worksheet form

form 2210 worksheet 29 Affordable Care Act Worksheet Form - Notutahituq Worksheet Information notutahituq.blogspot.com. worksheet. 8582 forms ssurvivor. 2210 irs underpayment fishermen templateroller. 2018 1040 social security worksheet « easy math worksheets. Random Posts. Heat Calculations Worksheet Answers; Affordable Care Act Worksheet - Fallcitylodge.com Affordable Care Act Worksheet Posted by admin on July 27, 2022 The legal obligation to assist these two prior born youngsters for the father or mother in search of the adjustment can be $119.00 from the Guideline Schedules for Weekly Support Payments.

Other Resources | CMS Affordable Care Act Innovation in the Marketplace Newsletters. September 2016 (PDF) October 2016 (PDF) ... Perspectives from Care Coordination and Beyond (PDF) Forms. May 16, 2012 Paperwork Reduction Act ... Instructions for 2014 Risk Corridors Discrepancy Worksheet (PDF) October 13, 2015 FAQs for User Fee Adjustment Data Submission (PDF 125 KB ...

Affordable care act worksheet form

Affordable Care Act | HFS - Illinois As part of the Affordable Care Act (ACA), uninsured Illinoisans have new options for health coverage either through the state's Medicaid program or through the Federal Health Insurance Marketplace (the Marketplace). These options make it more affordable to get health coverage and meet the federal requirement that all individuals have health ... Affordable Care Act Worksheet Form - theconsultingstudents.net Affordable Care Act Worksheet Form. Why does my form include a former dependent? Anthem Blue Cross network, and includes prepaid access to care at the UCSC Student Health Center for illness or injury. The law also requires VA to provide this information to the Internal Revenue Service. Modified Adjusted Gross Income under the Affordable Care Act ... Nov 05, 2013 · The Affordable Care Act definition of MAGI under the Internal Revenue Code [2] and federal Medicaid regulations [3] is shown below. For most individuals who apply for health coverage under the Affordable Care Act, MAGI is equal to Adjusted Gross Income. This document summarizes relevant federal regulations; it is not personalized tax or legal ...

Affordable care act worksheet form. Achiever Papers - We help students improve their academic … We will take care of all your assignment needs. We are a leading online assignment help service provider. We provide assignment help in over 80 subjects. You can request for any type of assignment help from our highly qualified professional writers. All your academic needs will be taken care of as early as you need them. Place an Order Affordable Care Act (ACA) - Glossary | HealthCare.gov The law has 3 primary goals: Make affordable health insurance available to more people. The law provides consumers with subsidies ("premium tax credits") that lower costs for households with incomes between 100% and 400% of the federal poverty level (FPL). If your income is above 400% FPL, you may still qualify for the premium tax credit in 2022. What is the Affordable Care Act? | HHS.gov What is the Affordable Care Act? The "Affordable Care Act" (ACA) is the name for the comprehensive health care reform law and its amendments. The law addresses health insurance coverage, health care costs, and preventive care. PDF Affordable Care Act Worksheet - Cordell Neher & Company, PLLC Affordable Care Act Worksheet Are you required to comply with the Act? How many employees does your Company employ: 200 or more fulltime (FT) employees. (Continue to Step 2. You are required to comply with the Act and must automatically enroll all FT employees in health insurance.)

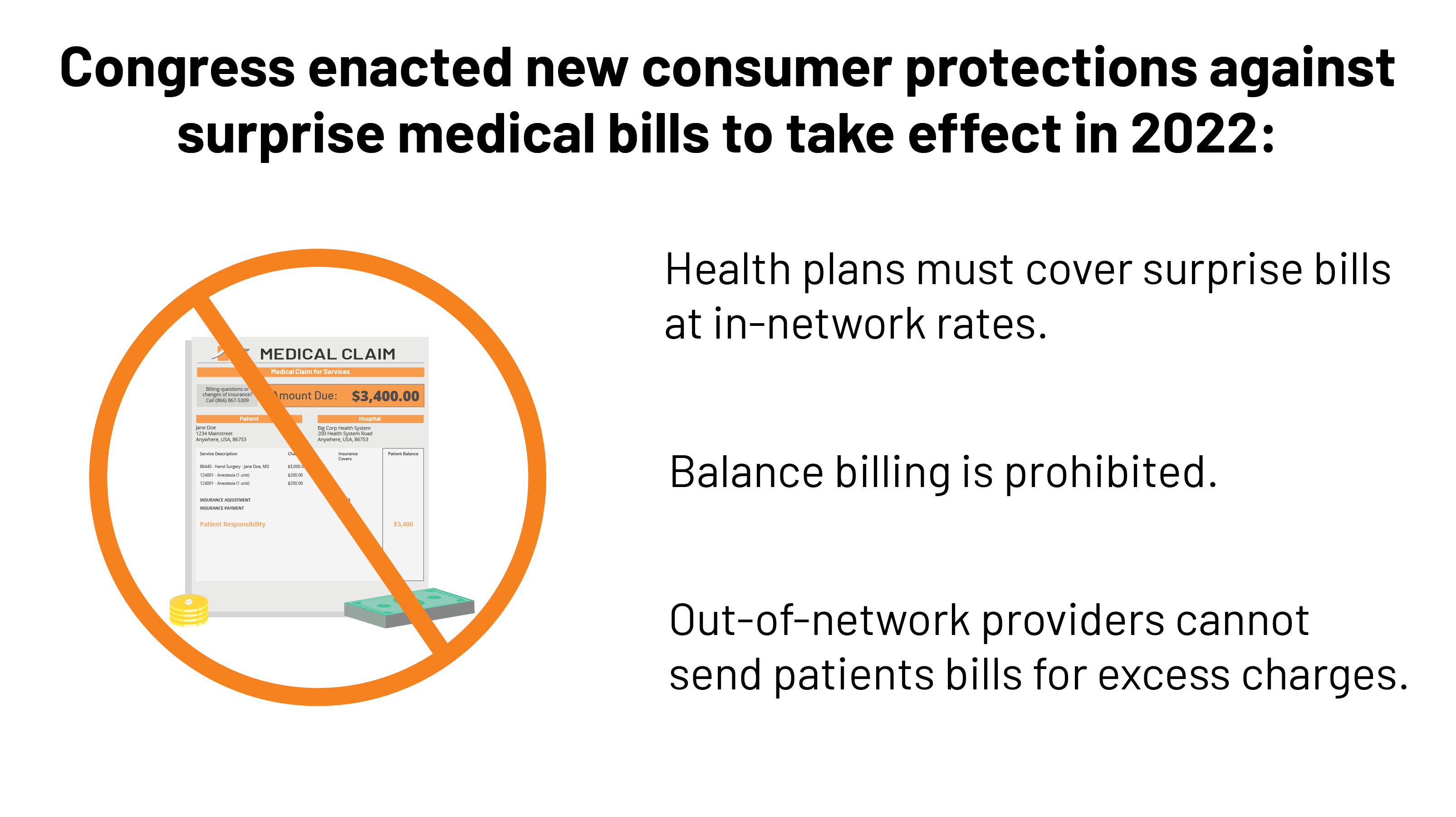

Home - ACP - Universal Service Administrative Company What is the Affordable Connectivity Program? The Affordable Connectivity Program (ACP) is a U.S. government program run by the Federal Communications Commission (FCC) program to help low-income households pay for internet service and connected devices like a laptop or tablet.. You are likely eligible if your household's income is below 200% of the Federal Poverty Line, or if you or someone ... Affordable Care Act Requirements for 2022-2023 - Workest Annual changes to the federal health insurance marketplace, coupled with Affordable Care Act (ACA) requirements, are meant to help both employees and employers get more fair coverage. Employers play a critical role in assisting employees in finding better and more affordable options. Open Enrollment for 2023 begins on November 1, 2022, and ends ... Affordable Care Act - Tax Guide • 1040.com - File Your Taxes Online Form 1095-A shows monthly coverage from the Health Insurance Marketplace and qualifies you for the Premium Tax Credit Form 1095-B shows monthly coverage from your healthcare provider Form 1095-C shows monthly coverage from some employer-provided insurance Some taxpayers may receive multiple forms, depending on when and how they were insured. Affordable Care Act - Wikipedia The Affordable Care Act (ACA), formally known as the Patient Protection and Affordable Care Act and colloquially known as Obamacare, is a landmark U.S. federal statute enacted by the 111th United States Congress and signed into law by President Barack Obama on March 23, 2010. Together with the Health Care and Education Reconciliation Act of 2010 amendment, it represents the U.S. healthcare ...

1040 (2021) | Internal Revenue Service - IRS tax forms Affordable Care Act — What You Need To Know. Requirement to reconcile advance payments of the premium tax credit. The premium tax credit helps pay premiums for health insurance purchased from the Marketplace. Eligible individuals may have advance payments of the premium tax credit made on their behalf directly to the insurance company. Affordable Care Act (ACA) reporting - Thomson Reuters Click the 1095-C Part II: Offer and Coverage button in the Affordable Care Act Information section to open the 1095-C Part II: Offer and Coverage dialog. Select the reporting year, Box 14 coverage code, enter the Box 15 premium amount, and select the Box 16 Safe Harbor code (if applicable). Adolescent Health | HHS Office of Population Affairs Gender-affirming care is a supportive form of healthcare that consists of an array of services. For young people, receiving this care early is crucial to overall health and well-being. In this resource, OPA describes research that demonstrates the importance of gender-affirming care as well as common terms and services. Assignment Essays - Best Custom Writing Services Get 24⁄7 customer support help when you place a homework help service order with us. We will guide you on how to place your essay help, proofreading and editing your draft – fixing the grammar, spelling, or formatting of your paper easily and cheaply.

Understand reporting requirements for the Affordable Care Act - QuickBooks Step 1: Determine your Applicable Large Employer (ALE) status. To determine your ALE status, you need to account for service-hours for your entire workforce, including full-time and part-time employees. Generally, if you have 50 full-time employees, you're considered an ALE. You'll do this each year and will apply to the next year.

What's the Affordable Care Act & How Does it Work? - Policygenius The Affordable Care Act is commonly called Obamacare or the ACA. It created the federal marketplace, healthcare.gov, where people can buy health insurance plans. Politicians continue to try and repeal Obamacare, but it looks safe for the near future. The Affordable Care Act, also called the ACA or Obamacare, is a health care reform law that ...

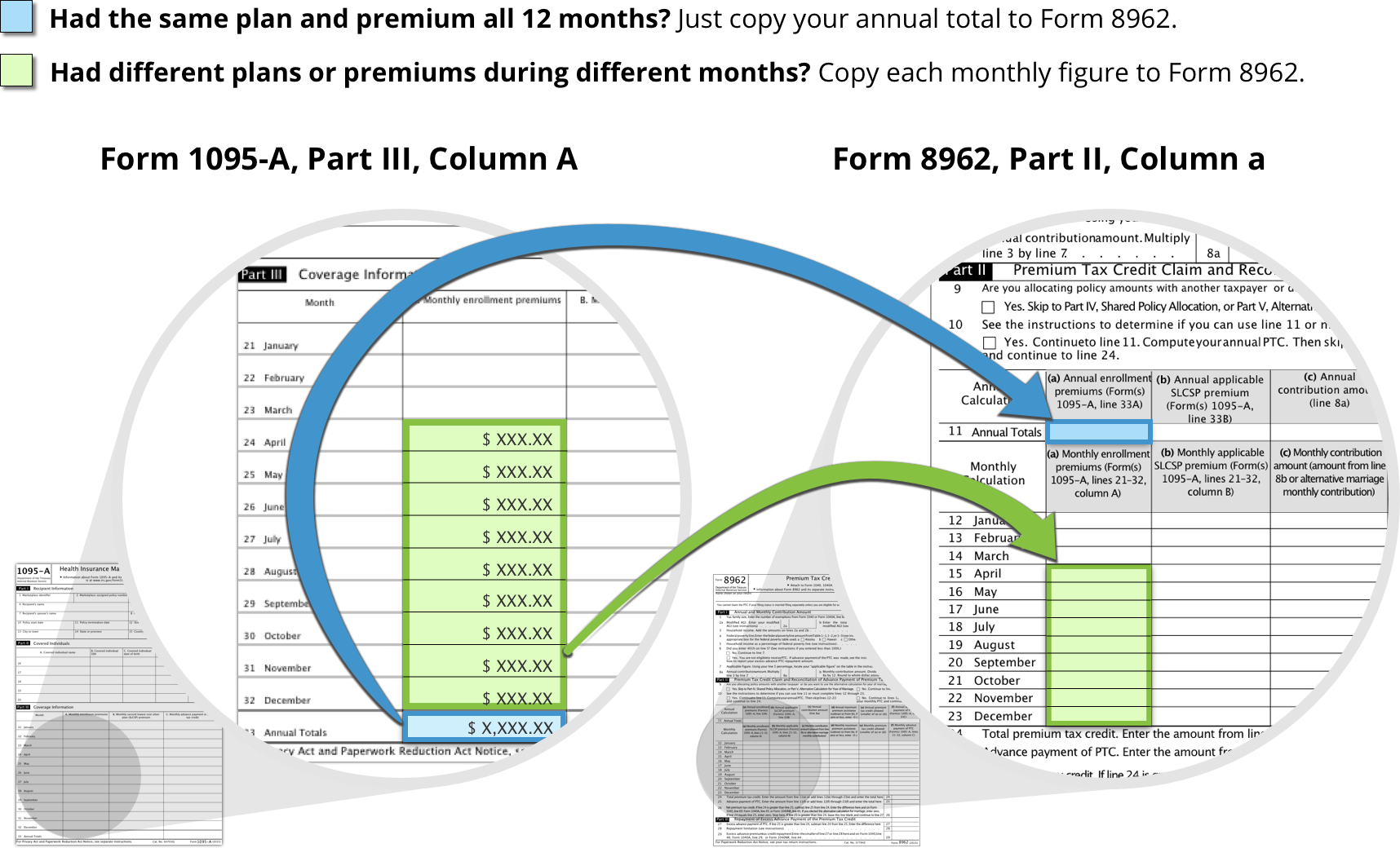

1040-US: Affordable Care Act - Form 1095-A, 1095-B, and 1095-C overview Form 1095-A is the reporting document for health insurance purchased through the Health Insurance Marketplace. Each person who, at the time of enrollment, expected to file a tax return and enrolled in a qualified health plan through the Health Insurance Marketplace will receive Form 1095-A or a similar statement for each policy.

Affordable Care Act | U.S. Department of Labor - DOL Affordable Care Act Nondiscrimination Provisions Applicable to Insured Group Health Plans Applicability to HRAs, Health FSAs, and Certain other Employer Healthcare Arrangements Automatic Enrollment Coverage of Preventive Services Early Retiree Reinsurance Program Employer Shared Responsibility Essential Health Benefits Excepted Benefits

Success Essays - Assisting students with assignments online We care about the privacy of our clients and will never share your personal information with any third parties or persons. ... Affordable Prices. We offer the lowest prices per page in the industry, with an average of $7 per page. Success Essays Features. Get All The Features For Free. $11.

Health Insurance Care Tax Forms, Instructions & Tools You'll use this form to "reconcile" — to find out if you used more or less premium tax credit than you qualify for. (Premium tax credits are sometimes known as "subsidies," "discounts," or "savings.") Form 8962, Premium Tax Credit (PDF, 110 KB) Form 8962 instructions (PDF, 348 KB) Form 1095-A, Health Insurance Marketplace ® Statement

Affordable Care Act | Internal Revenue Service - IRS tax forms Employers The Affordable Care Act includes requirements for employers regarding health care coverage. The size and structure of your workforce determines your responsibility. If you don't have employees, the information doesn't apply to you. Affordable Care Act Forms, Letters and Publications Form 8962, Premium Tax Credit PDF

Affordable Care Worksheets - K12 Workbook Worksheets are Affordable care act, Affordable care act, Manage your health care costs, Medicare, This document explains the different options for, Soa 2021 health care cost model user guide, 2019 instructions for schedule h form 990, Building a self care plan. *Click on Open button to open and print to worksheet.

Form 8965 - Affordability Worksheet - Support Step One in completing the Affordability Worksheet is to calculate the Affordability Threshold which is 8.16% of Household Income.the tax program will automatically pull into the Household Income calculation all amounts that have been previously entered into the tax return on behalf of the taxpayer and/or spouse.

Determining if an Employer is an Applicable Large Employer 29.9.2022 · Basic Information Two provisions of the Affordable Care Act apply only to applicable large employers (ALEs): The employer shared responsibility provisions; and The employer information reporting provisions for offers of minimum essential coverage Whether an employer is an ALE is determined each calendar year, and generally depends on the average …

Affordable Care Act Worksheets - K12 Workbook Displaying all worksheets related to - Affordable Care Act. Worksheets are Affordable care act, Affordable care act, 2019 instructions for schedule h form 990, This document explains the different options for, This document explains the aca configurations and when, Medicare, Affordable care act aca employee status code instructions, Guide to the acas employer reporting requirements.

Essential Tax Forms for the Affordable Care Act (ACA) The Affordable Care Act (ACA), also referred to as Obamacare, affects how millions of Americans will prepare their taxes in the new year. The Internal Revenue Service (IRS) has introduced a number of essential tax forms to accommodate the ACA: Form 1095-A, Form 1095-B, Form 1095-C, and Form 8962. TABLE OF CONTENTS The 1095 series for information

Unbanked American households hit record low numbers in 2021 25.10.2022 · The number of American households that were unbanked last year dropped to its lowest level since 2009, a dip due in part to people opening accounts to receive financial assistance during the ...

Affordable Care Act Estimator Tools | Internal Revenue Service 29.9.2022 · The Taxpayer Advocate Service has developed several tools for individuals and employers to help determine how the Affordable Care Act might affect them and to estimate ACA related credits and payments.. Under the recently enacted Tax Cuts and Jobs Act, taxpayers must continue to report coverage, qualify for an exemption, or pay the individual shared …

PDF Affordable Care Act - 2022 ACA Compliance Form Filing Submission Worksheet Affordable Care Act - 2022 ACA Compliance Form Filing Submission Worksheet . Attach this worksheet to the Compliance Checklist and Certification. Provide the following information (all entries are required and must be populated): 1. Company name: _____ 2. NAIC number: _____ 3.

Individual Shared Responsibility Provision | Internal Revenue … Under the Tax Cuts and Jobs Act, the amount of the individual shared responsibility payment is reduced to zero for months beginning after December 31, 2018. Beginning in Tax Year 2019, Forms 1040 and 1040-SR will not have the “full-year health care coverage or exempt” box and Form 8965, Health Coverage Exemptions, will no longer be used.

Publication 502 (2021), Medical and Dental Expenses 13.1.2022 · You can include only $270 per week as medical expenses. The $30 (10% × $300) allocated to household services can't be included. However, certain maintenance or personal care services provided for qualified long-term care can be included in medical expenses. See Maintenance and personal care services under Long-Term Care, earlier.

Fillable Welcome to the Affordable Care Act Worksheet for (Flightax) Welcome to the Affordable Care Act Worksheet for (Flightax) On average this form takes 16 minutes to complete The Welcome to the Affordable Care Act Worksheet for (Flightax) form is 1 page long and contains: 0 signatures 0 check-boxes 63 other fields Country of origin: US File type: PDF

Affordable Care Act Worksheet - Edu Stiemars Affordable Care Act Worksheet. If this box is marked, the medical health insurance premiums mechanically move to Schedule A. A deduction is allowed for the premiums paid, adjusted by the online Premium Tax Credit . The controlled expenses aren't shared and remain with the father or mother that doesn't get the parenting time credit score.

PDF Affordable Care Act - IRS tax forms Affordable Care Act 3-1 Introduction This lesson covers some of the tax provisions of the Affordable Care Act (ACA). You will learn how to deter-mine if taxpayers are eligible to receive the premium tax credit. A list of terms you may need to know is ... The form includes information about the coverage, who was covered, and when.

Modified Adjusted Gross Income under the Affordable Care Act ... Nov 05, 2013 · The Affordable Care Act definition of MAGI under the Internal Revenue Code [2] and federal Medicaid regulations [3] is shown below. For most individuals who apply for health coverage under the Affordable Care Act, MAGI is equal to Adjusted Gross Income. This document summarizes relevant federal regulations; it is not personalized tax or legal ...

Affordable Care Act Worksheet Form - theconsultingstudents.net Affordable Care Act Worksheet Form. Why does my form include a former dependent? Anthem Blue Cross network, and includes prepaid access to care at the UCSC Student Health Center for illness or injury. The law also requires VA to provide this information to the Internal Revenue Service.

Affordable Care Act | HFS - Illinois As part of the Affordable Care Act (ACA), uninsured Illinoisans have new options for health coverage either through the state's Medicaid program or through the Federal Health Insurance Marketplace (the Marketplace). These options make it more affordable to get health coverage and meet the federal requirement that all individuals have health ...

:max_bytes(150000):strip_icc()/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

![PDF] Affordable Care Act](https://i1.rgstatic.net/publication/239943452_Affordable_Care_Act/links/589b619a92851c942ddad86a/largepreview.png)

:max_bytes(150000):strip_icc()/imageedit_4_7778438120-f5a8a7aac0fd466ab91af5b4d29ebf6e.jpg)

0 Response to "39 affordable care act worksheet form"

Post a Comment