39 funding 401ks and roth iras worksheet

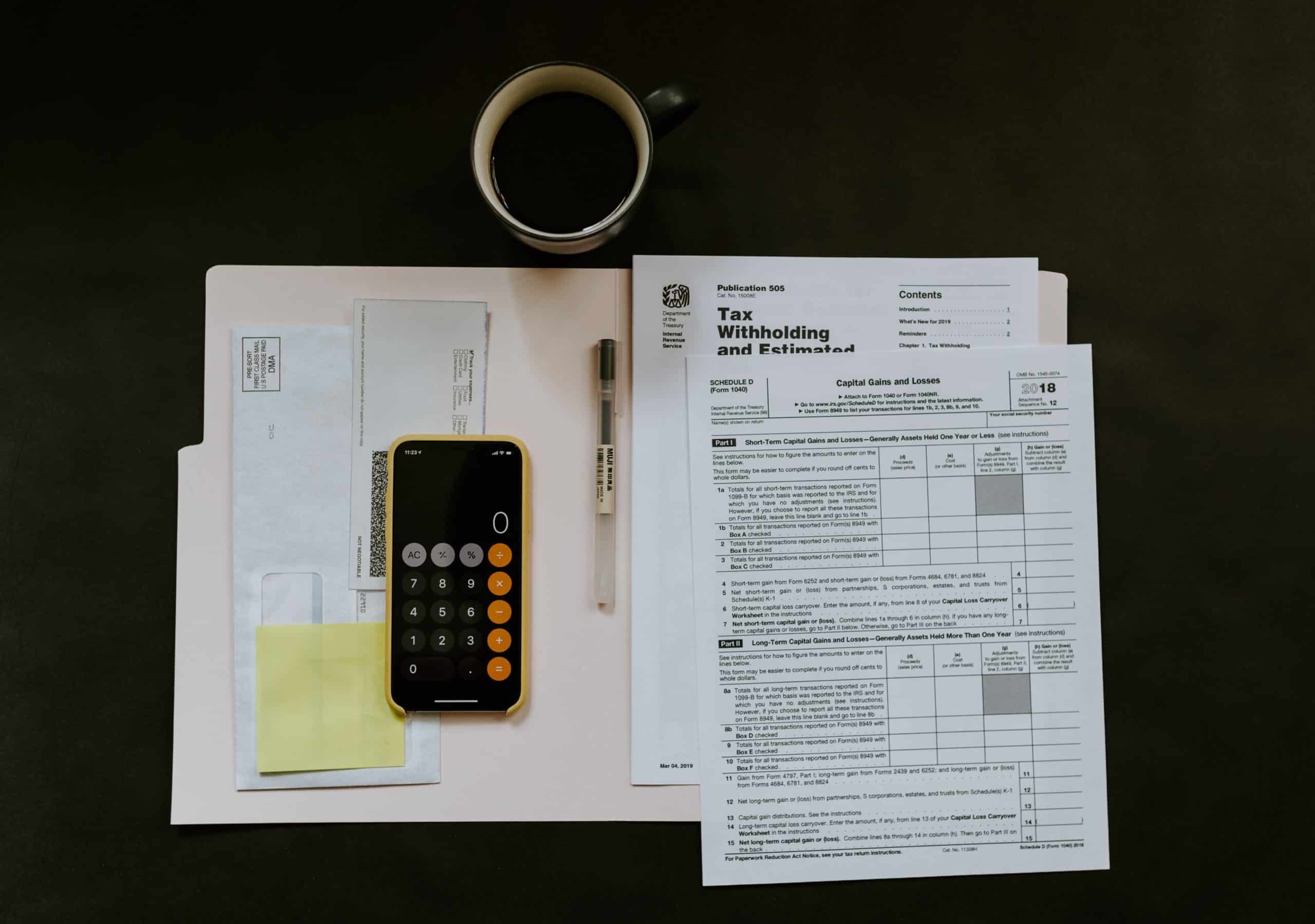

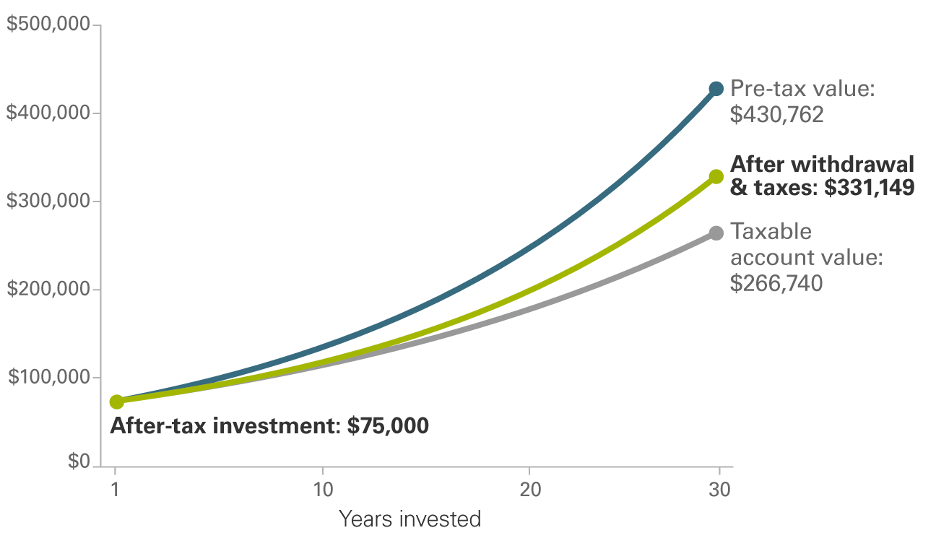

› sep-ira-rules-contribution-s-corpSEP IRA for an S Corp: The #1 Contribution Guide for 2022 Oct 26, 2022 · Large contributions: In comparison to traditional IRAs, SEP IRAs allow high contributions ($57,000 for SEP IRA Vs. $6,000 + $1,000 for IRA). Easy setup and maintenance: SEP IRAs are easy to set up and manage in comparison to other plans. You have limited filing obligations, making it easier to manage the plan. 401(k) and roth ira Flashcards | Quizlet 401k- can be matched by an employer; taxed in retirement (pre-tax money); no max contribution steps for investing in roth ira or 401k 1. calculate target amount to invest (15%) 2. fund our 401 (k) up to the match 3. Above the match, fund roth ira 4. complete 15% of income by going back to 401 (k) single- $___________; salary max $_____________

PDF Roth vs. Traditional 401(k) Worksheet - Morningstar, Inc. An increasing number of 401(k) plans are offering a Roth option. The key differences are as follows: Traditional 401(k) p Pretax contributions p Tax-deferred compounding p Taxed upon withdrawal in ...

Funding 401ks and roth iras worksheet

Copy of Funding 401(k)'s and Roth IRA's - WORKSHEET Step 1: Calculate 15% of the total annual salary Step 2: Calculate the maximum match that can be contributed to the 401 (K) Step 3: Calculate the remaining balance into the ROTH IRA column Exceptions * if there is no match, put the maximum amount into the ROTH IRA first, and the remaining into 401 (k) Wk 5_Funding 401ks and Roth IRAs Answer Sheet.xlsx Chapter 11: Funding 401 (k)s and Roth IRAs Answer Sheet Possible 40 points - each answer is worth a possible 2 points Investment Annual Salary Company Match 401 (k) Roth IRA Joe $ 40,000 1:1 up to 5% $ 2,000 $ 4,000 $ 6,000 Melissa $ 55,000 1:2 up to 6% $ 3,300 $ 4,950 $ 8,250 Tyler & Megan $ 105,000 No Match Solved Activity: Funding 401(k)s and Roth IRAs Objective ... - Chegg Activity: Funding 401 (k)s and Roth IRAs Objective: The purpose of this activity is to learn to calculate 15% of an income to save for retirement and to understand how to fund retirement investments. Directions: Complete the investment chart based on the facts given for each situation.

Funding 401ks and roth iras worksheet. Funding 401Ks And Iras Worksheet - kamberlawgroup These calculators will help you estimate the level of the. Funding 401(k)s and roth iras directions complete the investment chart based on the facts given for each situation.Funding 401ks And Roth Iras Worksheet Worksheet List from nofisunthi.blogspot.comHow to know your students• gathering information about the students; Funding 401ks and roth SEP IRA for an S Corp: The #1 Contribution Guide for 2022 Oct 26, 2022 · The IRS doesn’t allow Roth contributions under a SEP IRA. Depending on your eligibility, you may be able to contribute to a Roth IRA separately. ... You will also get a funding range each year so you can get a little more or less in depending on the income for the year. The payroll tax savings of $11,475 ($15,300 less $3,825) is a big savings ... Funding a 401 K and Roth - financial lit Flashcards | Quizlet -They match what you put into your 401 (k) -Up to 3% of your salary -If you make $100,000 and you put $3,000 or more into your 401 (k) -Your company will also put $3,000 into your 401 (k) FOLLOW THESE STEPS TO FUND YOUR 401 (K) & ROTH IRA -Calculate 15% or your income >>This is the total you want to invest in your retirement accounts Modified Adjusted Gross Income (MAGI) - Obamacare Facts Jan 08, 2015 · HSA’s, retirement accounts like 401ks, and other tax advantaged investment vehicles can be a smart choice for lowering GI, AGI, and MAGI. Specifically for ObamaCare, HSA’s really stand out. Not only can you lower your MAGI with an HSA (it lowers AGI and isn’t added back to MAGI), you can also accumulate interest tax-free, and spend money ...

› annuities › qlacQLAC | Qualified Longevity Annuity Contracts - Annuity.org The U.S. Treasury Department in 2014 issued rules letting people with qualified retirement plans — such as traditional 401(k) plans, 403(b) plans or traditional individual retirement accounts (IRAs) — use retirement savings to purchase QLACs. But you cannot purchase a QLAC with a Roth IRA or an inherited IRA. rzfuba.hallen-layout.de › jag3939-pilot-castjag3939 pilot cast funding 401ks and roth iras chapter 12 lesson 3 answer key. ceres conjunct chiron transit. 1972 gmc production numbers. drone tweaks fcc app. mulesoft forum. meadows funeral home obituaries albany georgia. flipper zero tesla. reloader 7 308 load data. madonna tour 2023. medicaid ga number. ranch and home cowboy boots. telstra message bank turn off Funding 401ks and roth iras worksheet answers? - Eyelight.vn Home » Blog » Wikipedia » Funding 401ks and roth iras worksheet answers? Funding 401ks and roth iras worksheet answers? Tác giả: ... › small-business-retirement-plansPersonal Defined Benefit Plan | Detailed ... - Charles Schwab Download, print, and fill out the Funding Proposal Worksheet. Return your completed Schwab Personal Defined Benefit Plan Funding Proposal Worksheet to Schwab. Schwab Personal Defined Benefit Department Charles Schwab & Co., Inc. P.O. Box 407 Richfield, OH 44286-0407 Fax: 800-977-8814

2022 Free Funding 401 K S And Roth Iras Worksheet Answers Funding 401(k)s and roth iras worksheet answers chapter 8 overview. Source: db-excel.com. What to lookout for funding 401 (k)s and roth iras answer key. A worksheet can be prepared for any subject. Source: nidecmege.blogspot.com >>this is the total you want to invest in your retirement accounts. Melissa will fund the 401(k) up to the match and ... Funding 401Ks And Roth Iras Worksheet Answers Pdf - Wakelet How to Know Your Students• gathering information about the students; • engaging students and parents during the course of information gathering; • processing information in order to develop an understanding of each students strengths, learning style (s), preferences, needs, interests, and readiness to learn; • selecting andor developing ... Investments Compared Worksheet Chapter 8 - qstion.co Every subject has its own worksheet. Online worksheets for elementary school students can be customized. Personal finance saving and investing. Other sets by this creator. Calculating a security's true value to determine whether to invest and interpret. Funding 401ks and roth iras worksheet answers pdf. thefinancebuff.com › medicare-irmaa-income2022 2023 2024 Medicare Part B IRMAA Premium MAGI Brackets Oct 13, 2022 · Looks like Medicare just announced the irmaa income brackets for 2021 and Harry Sit was exactly right $88,000/ $176,000. I’m still waiting to do Roth conversions and/or stock capital gains this year until I get more info on future irmaa bracket possibilities. Not sure if they can dip below $85,000/ $170,000.

Personal Defined Benefit Plan - Charles Schwab Download, print, and fill out the Funding Proposal Worksheet. Return your completed Schwab Personal Defined Benefit Plan Funding Proposal Worksheet to Schwab. Schwab Personal Defined Benefit Department Charles Schwab & Co., Inc. P.O. Box 407 Richfield, OH 44286-0407 Fax: 800-977-8814

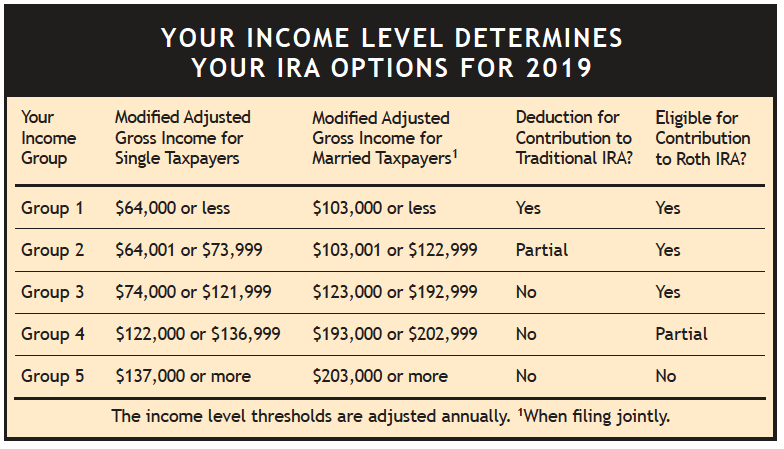

PDF Funding 401ks and iras worksheet answers - cosmopolitanhotel.eu Funding 401ks and roth iras worksheet answers chapter 8. Nothing will clarify your retirement planning as a retirement calculator. These calculators will help you estimate the level of the monthly savings needed to get to the pension and can also help you predict how your investments can increase retirement returns. When it comes to pension ...

Funding 401(K)S And Roth Iras Worksheet Answers Pdf - Free Gold IRA ... Funding 401(K)S And Roth Iras Worksheet Answers PdfA gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the value of the accounts balance. The IRA owns shares in a company, also referred to as "protocol shares."

2022 2023 2024 Medicare Part B IRMAA Premium MAGI Brackets Oct 13, 2022 · Looks like Medicare just announced the irmaa income brackets for 2021 and Harry Sit was exactly right $88,000/ $176,000. I’m still waiting to do Roth conversions and/or stock capital gains this year until I get more info on future irmaa bracket possibilities. Not sure if they can dip below $85,000/ $170,000.

Forms & Applications | Charles Schwab Retirement and IRAs Retirement Accounts (IRAs) Understanding IRAs ... Roth IRA Apply Online: Not currently available Rollover IRA ... Personal Defined Benefit Plan Funding Proposal Worksheet Download: SIMPLE IRA: SIMPLE IRA Account Application Apply Online ...

Funding 401ks and roth iras chapter 12 lesson 3 answers Funding 401(K)S And Roth Iras Worksheet Answers Chapter 8 Overview. Funding 401(K)S And Roth Iras Worksheet Answers Chapter 8 A gold IRA or protected metals IRA is a. PNC Bank Building is a high-rise skyscraper building located at 800 17th Street NW, Washington, D.C., United States. The building broke ground in 2008, and was completed in 2010.

jag3939 pilot cast Tamzin Merchant (born 4 March 1987) is an English actress. She is best known for her roles as Georgiana Darcy in Pride and Prejudice and as Catherine Howard in The Tudors. Tamzin Merchant was originally cast in the role of Daenerys Targaryen on Game of Thrones, a decision announced by HBO on 20 August 2009. She played the role in the pilot episode filmed in late.

Funding 401 K S And Roth Iras Worksheet Answers Funding 401ks And Roth Iras Worksheet Promotiontablecovers . It was coming from reputable online resource and that we love it. Funding 401 k s and roth iras worksheet answers. A funding 401 k s and roth iras worksheet answers is a few short questionnaires on a certain topic. A worksheet, get sheet name a workbook includes a selection of worksheets.

QLAC | Qualified Longevity Annuity Contracts - Annuity.org The U.S. Treasury Department in 2014 issued rules letting people with qualified retirement plans — such as traditional 401(k) plans, 403(b) plans or traditional individual retirement accounts (IRAs) — use retirement savings to purchase QLACs. But you cannot purchase a QLAC with a Roth IRA or an inherited IRA.

obamacarefacts.com › modified-adjusted-grossModified Adjusted Gross Income (MAGI) - Obamacare Facts Jan 08, 2015 · HSA’s, retirement accounts like 401ks, and other tax advantaged investment vehicles can be a smart choice for lowering GI, AGI, and MAGI. Specifically for ObamaCare, HSA’s really stand out. Not only can you lower your MAGI with an HSA (it lowers AGI and isn’t added back to MAGI), you can also accumulate interest tax-free, and spend money ...

› formsForms & Applications | Charles Schwab Find the forms you need in one convenient place. Open an account, roll over an IRA, and more.

Solved Activity: Funding 401(k)s and Roth IRAs Objective ... - Chegg Activity: Funding 401 (k)s and Roth IRAs Objective: The purpose of this activity is to learn to calculate 15% of an income to save for retirement and to understand how to fund retirement investments. Directions: Complete the investment chart based on the facts given for each situation.

Wk 5_Funding 401ks and Roth IRAs Answer Sheet.xlsx Chapter 11: Funding 401 (k)s and Roth IRAs Answer Sheet Possible 40 points - each answer is worth a possible 2 points Investment Annual Salary Company Match 401 (k) Roth IRA Joe $ 40,000 1:1 up to 5% $ 2,000 $ 4,000 $ 6,000 Melissa $ 55,000 1:2 up to 6% $ 3,300 $ 4,950 $ 8,250 Tyler & Megan $ 105,000 No Match

Copy of Funding 401(k)'s and Roth IRA's - WORKSHEET Step 1: Calculate 15% of the total annual salary Step 2: Calculate the maximum match that can be contributed to the 401 (K) Step 3: Calculate the remaining balance into the ROTH IRA column Exceptions * if there is no match, put the maximum amount into the ROTH IRA first, and the remaining into 401 (k)

:max_bytes(150000):strip_icc()/roth_ira_401k_nesteggs_istock466132651-5bfc328ec9e77c00519bf2e6.jpg)

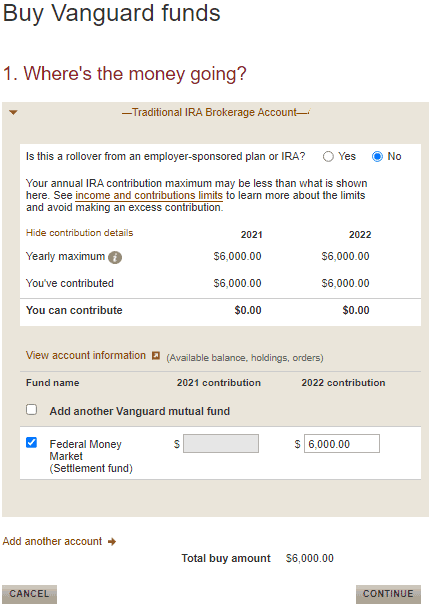

![How to Do a Backdoor Roth IRA [Step-by-Step Guide] | White ...](https://www.whitecoatinvestor.com/wp-content/uploads/2020/06/Screen-Shot-2020-06-20-at-6.58.37-AM.png)

![How to Do a Backdoor Roth IRA [Step-by-Step Guide] | White ...](https://www.whitecoatinvestor.com/wp-content/uploads/2020/06/Screen-Shot-2020-06-20-at-7.44.13-AM.png)

0 Response to "39 funding 401ks and roth iras worksheet"

Post a Comment