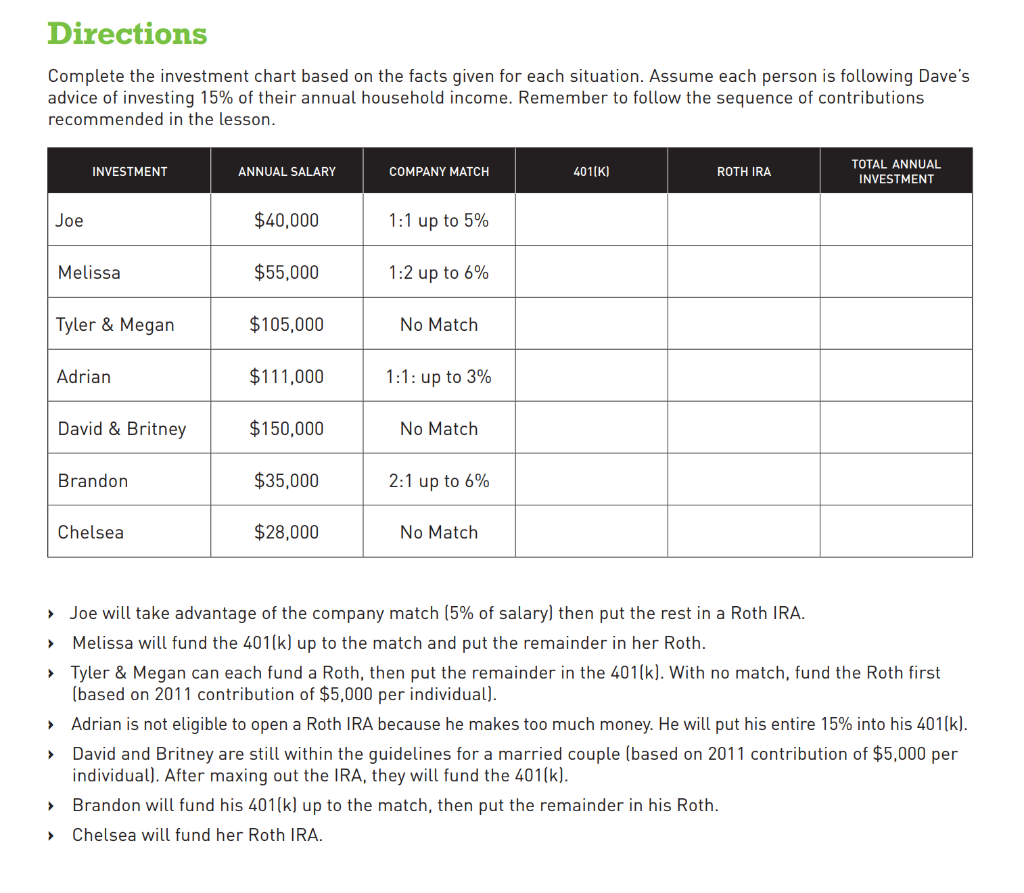

39 funding 401ks and roth iras worksheet

2022 2023 2024 Medicare Part B IRMAA Premium MAGI Brackets Oct 13, 2022 · Looks like Medicare just announced the irmaa income brackets for 2021 and Harry Sit was exactly right $88,000/ $176,000. I’m still waiting to do Roth conversions and/or stock capital gains this year until I get more info on future irmaa bracket possibilities. Not sure if they can dip below $85,000/ $170,000. Retirement Plans FAQs on Designated Roth Accounts - IRS When you roll over a distribution from a designated Roth account to a Roth IRA, the period that the rolled-over funds were in the designated Roth account does ...

Funding 401(k)s & Roth IRAs Chart.docx - Course Hero Funding 401(k)s & Roth IRAs Directions: Complete the investment chart based on the facts given for ... Complete Funding 401ks and Roth IRAs Worksheet.jpg.

Funding 401ks and roth iras worksheet

2022 2023 2024 Medicare Part B IRMAA Premium MAGI Brackets 13/10/2022 · Looks like Medicare just announced the irmaa income brackets for 2021 and Harry Sit was exactly right $88,000/ $176,000. I’m still waiting to do Roth conversions and/or stock capital gains this year until I get more info on future irmaa bracket possibilities. Not sure if they can dip below $85,000/ $170,000. It would be nice to know that 2022 ... Funding 401 K S And Roth Iras Worksheet Answers - Pinterest Dec 12, 2019 - A Funding 401 K S And Roth Iras Worksheet Answers is a few short questionnaires on a certain topic. A worksheet can be prepared for any ... Funding 401ks and roth iras worksheet answers? - Eyelight.vn Apr 14, 2022 ... Google search results: · Funding 401(k)s & Roth IRAs Chart. · Copy of Funding 401(k)'s and Roth IRA's – WORKSHEET · Complete Funding 401ks and Roth ...

Funding 401ks and roth iras worksheet. Roth & Traditional IRA Guidebook - Utah Retirement Systems Contributions to a Roth IRA are not deductible from your income ... Contribution Worksheet in ... (URS), then you subsequently deposit the funds to your. Forms & Applications | Charles Schwab For Schwab Bank, Schwab Global Account, 529 Plan and other forms and applications not listed here, view Additional Topics SEP IRA for an S Corp: The #1 Contribution Guide for 2022 26/10/2022 · Large contributions: In comparison to traditional IRAs, SEP IRAs allow high contributions ($57,000 for SEP IRA Vs. $6,000 + $1,000 for IRA). Easy setup and maintenance: SEP IRAs are easy to set up and manage in comparison to other plans. You have limited filing obligations, making it easier to manage the plan. Solved Activity: Funding 401(k)s and Roth IRAs Objective - Chegg Activity: Funding 401(k)s and Roth IRAs. Objective: The purpose of this activity is to learn to calculate 15% of an income to save for retirement and to ...

QLAC | Qualified Longevity Annuity Contracts - Annuity.org The U.S. Treasury Department in 2014 issued rules letting people with qualified retirement plans — such as traditional 401(k) plans, 403(b) plans or traditional individual retirement accounts (IRAs) — use retirement savings to purchase QLACs. But you cannot purchase a QLAC with a Roth IRA or an inherited IRA. Personal Defined Benefit Plan | Detailed ... - Charles Schwab Download, print, and fill out the Funding Proposal Worksheet. Return your completed Schwab Personal Defined Benefit Plan Funding Proposal Worksheet to Schwab. Schwab Personal Defined Benefit Department Charles Schwab & Co., Inc. P.O. Box 407 Richfield, OH 44286-0407 Fax: 800-977-8814 Roth IRA Conversion Calculator | Converting an IRA - Charles Schwab Use our Roth IRA Conversion Calculator to compare estimated future values and ... until you expect to take your first withdrawal from the converted funds. Funding a 401 K and Roth - financial lit Flashcards - Quizlet ROTH IRA. -Retirement account funded with after-tax dollars that subsequently ... same as 401k but is used for nonprofit organizations such as schools, ...

Funding_A_401k_And_Roth_IR... NAME: DATE: Funding 401(k)s and Roth IRAs Directions Complete the investment chart based on the. ... Complete Funding 401ks and Roth IRAs Worksheet.jpg. Modified Adjusted Gross Income (MAGI) - Obamacare Facts Jan 08, 2015 · MAGI is used to determine ObamaCare’s cost assistance and to claim and adjust tax credits on the Premium Tax Credit Form 8962.. You can find more details on Modified AGI from the IRS here or you can see the form 8962 instructions for calculating Modified AGI for the tax credit (TIP: use command find on those documents to find what you are looking for; make sure to check out the worksheet in ... SEP IRA for an S Corp: The #1 Contribution Guide for 2022 Oct 26, 2022 · Large contributions: In comparison to traditional IRAs, SEP IRAs allow high contributions ($57,000 for SEP IRA Vs. $6,000 + $1,000 for IRA). Easy setup and maintenance: SEP IRAs are easy to set up and manage in comparison to other plans. You have limited filing obligations, making it easier to manage the plan. Traditional 401k or Roth IRA Calculator - Bankrate.com Bankrate.com provides a FREE 401k or Roth IRA calculator and other 401(k) calculators to help consumers determine the best option for retirement possible.'

Forms & Applications | Charles Schwab Combining 401ks Other IRAs ... Roth IRA Apply Online: Not currently available ... Personal Defined Benefit Plan Funding Proposal Worksheet Download: SIMPLE IRA ...

Funding 401ks and roth iras worksheet answers? - Eyelight.vn Apr 14, 2022 ... Google search results: · Funding 401(k)s & Roth IRAs Chart. · Copy of Funding 401(k)'s and Roth IRA's – WORKSHEET · Complete Funding 401ks and Roth ...

Funding 401 K S And Roth Iras Worksheet Answers - Pinterest Dec 12, 2019 - A Funding 401 K S And Roth Iras Worksheet Answers is a few short questionnaires on a certain topic. A worksheet can be prepared for any ...

2022 2023 2024 Medicare Part B IRMAA Premium MAGI Brackets 13/10/2022 · Looks like Medicare just announced the irmaa income brackets for 2021 and Harry Sit was exactly right $88,000/ $176,000. I’m still waiting to do Roth conversions and/or stock capital gains this year until I get more info on future irmaa bracket possibilities. Not sure if they can dip below $85,000/ $170,000. It would be nice to know that 2022 ...

:max_bytes(150000):strip_icc()/roth_ira_401k_nesteggs_istock466132651-5bfc328ec9e77c00519bf2e6.jpg)

![How to Do a Backdoor Roth IRA [Step-by-Step Guide] | White ...](https://www.whitecoatinvestor.com/wp-content/uploads/2018/09/Late-Backdoor-Roth-IRA-Contributions-2020.png)

![How to Do a Backdoor Roth IRA [Step-by-Step Guide] | White ...](https://www.whitecoatinvestor.com/wp-content/uploads/2018/09/Backdoor-Roth-IRA-part-2-3.png)

![How to Do a Backdoor Roth IRA [Step-by-Step Guide] | White ...](https://www.whitecoatinvestor.com/wp-content/uploads/2020/06/Screen-Shot-2020-06-20-at-6.58.37-AM.png)

:max_bytes(150000):strip_icc()/GettyImages-137513511-572b9ffb5f9b58c34c6a8244.jpg)

0 Response to "39 funding 401ks and roth iras worksheet"

Post a Comment