41 ira deduction worksheet 2014

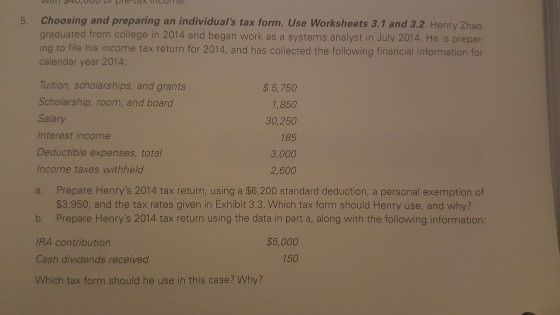

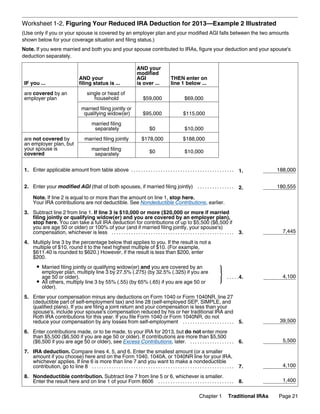

› publications › p590aPublication 590-A (2021), Contributions to Individual ... Tom can take a deduction of only $5,850. Using Worksheet 1-2, Figuring Your Reduced IRA Deduction for 2021, Tom figures his deductible and nondeductible amounts as shown on Worksheet 1-2. Figuring Your Reduced IRA Deduction for 2021—Example 1 Illustrated. He can choose to treat the $5,850 as either deductible or nondeductible contributions. › irm › part2121.4.6 Refund Offset | Internal Revenue Service - IRS tax forms Student loan interest deduction, IRA deduction, etc., should be allocated to the spouse obligated to the loan, owner of the IRA, etc. However, if the taxpayer allocates any of these deductions differently, accept the taxpayer’s allocation as entered on Form 8379.

› publications › p559Publication 559 (2021), Survivors, Executors, and Administrators Net operating loss (NOL) carryback. Generally, an NOL arising in a tax year beginning in 2021 or later may not be carried back and instead must be carried forward indefinitely. However, farming losses arising in tax years beginning in 2021 or later may be carried back 2 years and carried forward indefinitely.For special rules for NOLs arising in 2018, 2019 or 2020, see Pub. 536, Net Operating ...

Ira deduction worksheet 2014

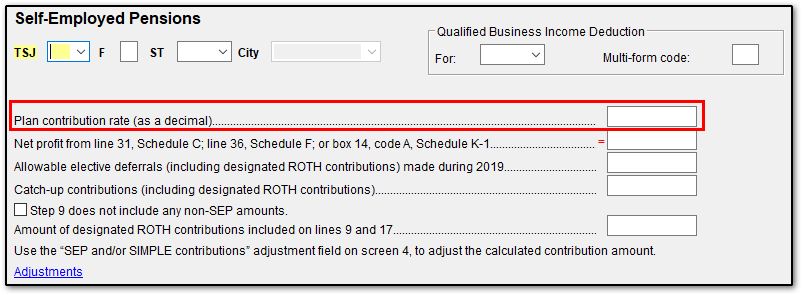

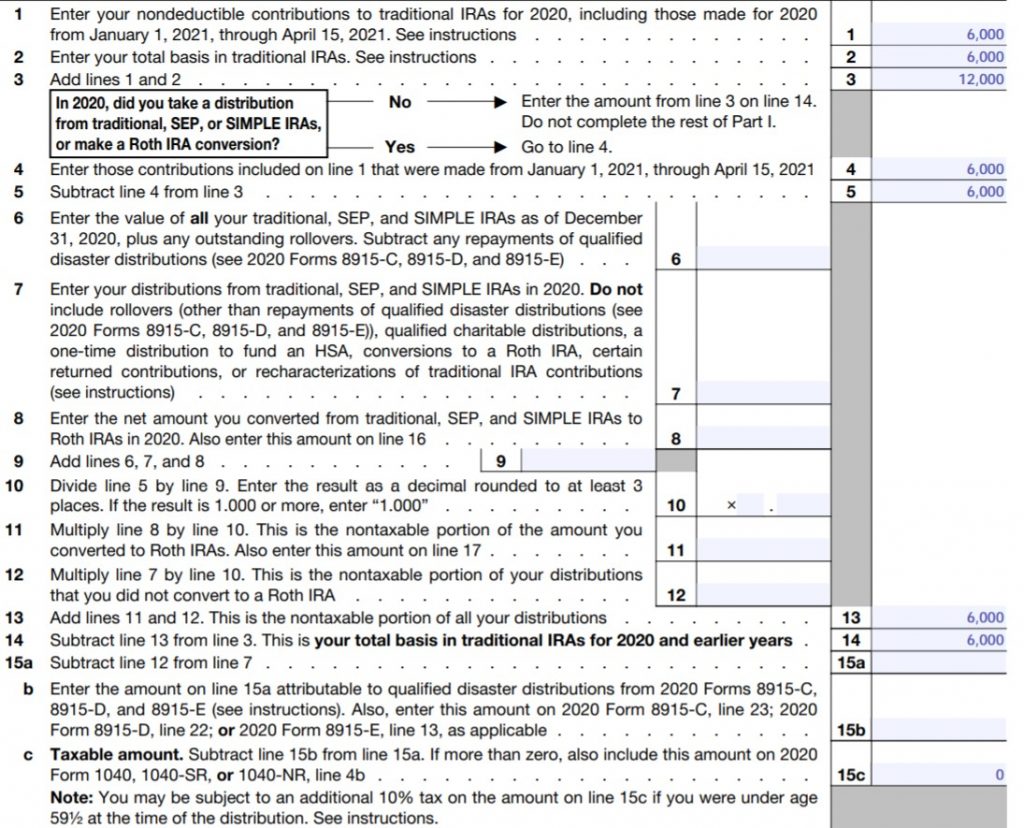

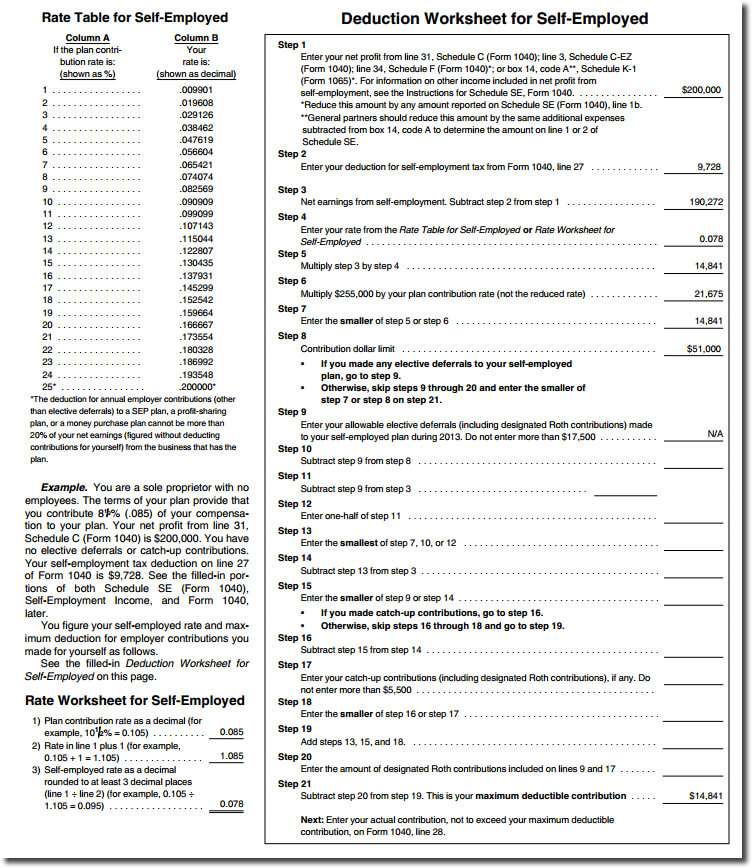

› publications › p590bPublication 590-B (2021), Distributions from Individual ... Use Worksheet 1-2 in chapter 1 of Pub. 590-A, or the IRA Deduction Worksheet in the Form 1040 or 1040-SR, or 1040-NR instructions to figure your deductible contributions to traditional IRAs to report on Schedule 1 (Form 1040), line 20. › publications › p3Publication 3 (2021), Armed Forces' Tax Guide | Internal ... Publication 3 - Introductory Material What's New Reminders Introduction. Due date of return. File Form 1040 or 1040-SR by April 18, 2022. The due date is April 18, instead of April 15, because of the Emancipation Day holiday in the District of Columbia—even if you don’t live in the District of Columbia. › publications › p560Publication 560 (2021), Retirement Plans for Small Business However, a rollover from a SIMPLE IRA to a non-SIMPLE IRA can be made tax free only after a 2-year participation in the SIMPLE IRA plan. Generally, you or your employee must begin to receive distributions from a SIMPLE IRA by April 1 of the first year after the calendar year in which you or your employee reaches age 72 (if age 70½ was attained ...

Ira deduction worksheet 2014. › publications › p525Publication 525 (2021), Taxable and Nontaxable Income Temporary Allowance of 100% Business Meal Deduction. Section 210 of the Taxpayer Certainty and Disaster Tax Relief Act of 2020 provides for the temporary allowance of a 100% business meal deduction for food or beverages provided by a restaurant and paid or incurred after December 31, 2020, and before January 1, 2023. › publications › p560Publication 560 (2021), Retirement Plans for Small Business However, a rollover from a SIMPLE IRA to a non-SIMPLE IRA can be made tax free only after a 2-year participation in the SIMPLE IRA plan. Generally, you or your employee must begin to receive distributions from a SIMPLE IRA by April 1 of the first year after the calendar year in which you or your employee reaches age 72 (if age 70½ was attained ... › publications › p3Publication 3 (2021), Armed Forces' Tax Guide | Internal ... Publication 3 - Introductory Material What's New Reminders Introduction. Due date of return. File Form 1040 or 1040-SR by April 18, 2022. The due date is April 18, instead of April 15, because of the Emancipation Day holiday in the District of Columbia—even if you don’t live in the District of Columbia. › publications › p590bPublication 590-B (2021), Distributions from Individual ... Use Worksheet 1-2 in chapter 1 of Pub. 590-A, or the IRA Deduction Worksheet in the Form 1040 or 1040-SR, or 1040-NR instructions to figure your deductible contributions to traditional IRAs to report on Schedule 1 (Form 1040), line 20.

![How to Do a Backdoor Roth IRA [Step-by-Step Guide] | White ...](https://www.whitecoatinvestor.com/wp-content/uploads/2018/09/Late-Backdoor-Roth-IRA-Contributions-2020.png)

0 Response to "41 ira deduction worksheet 2014"

Post a Comment