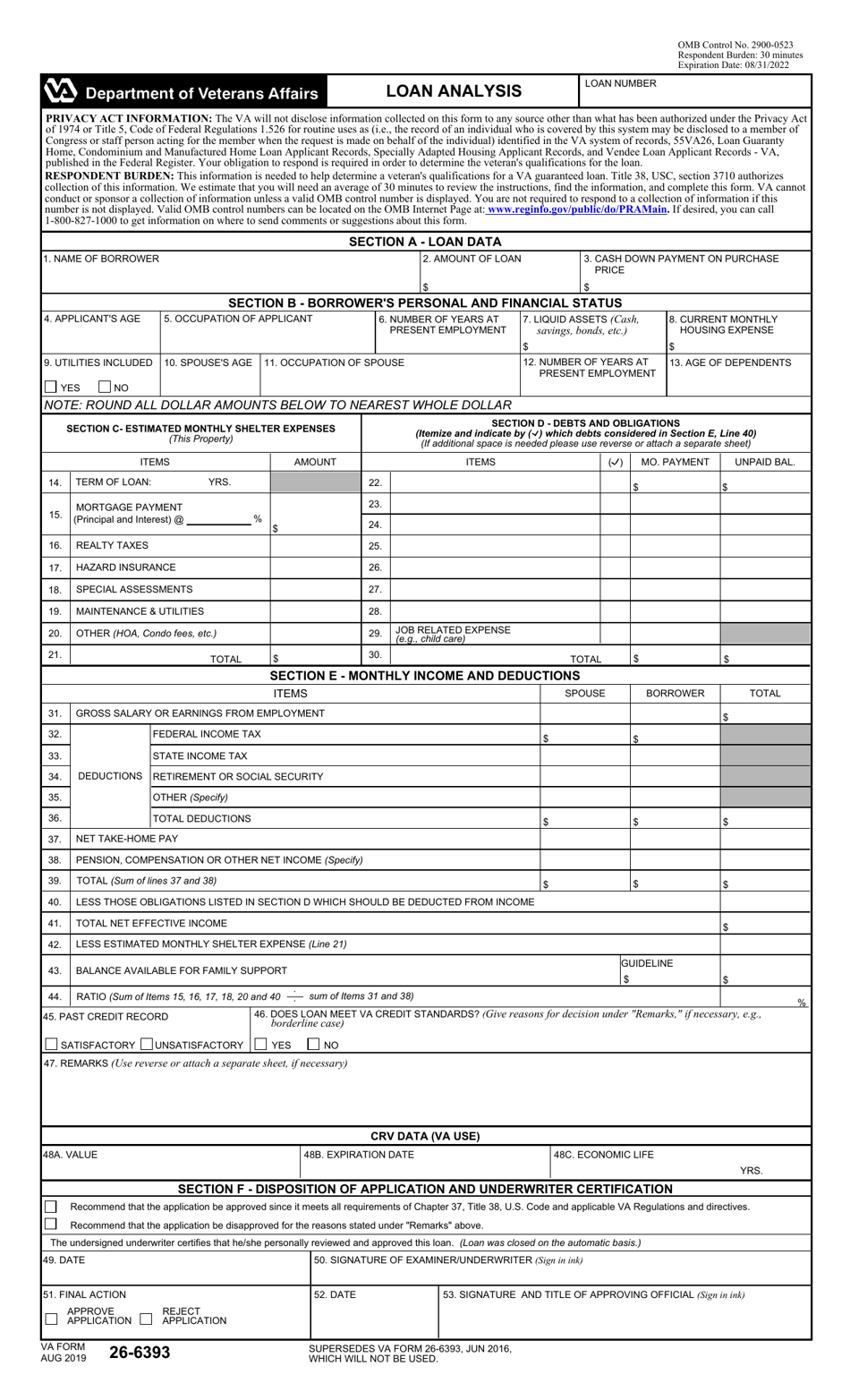

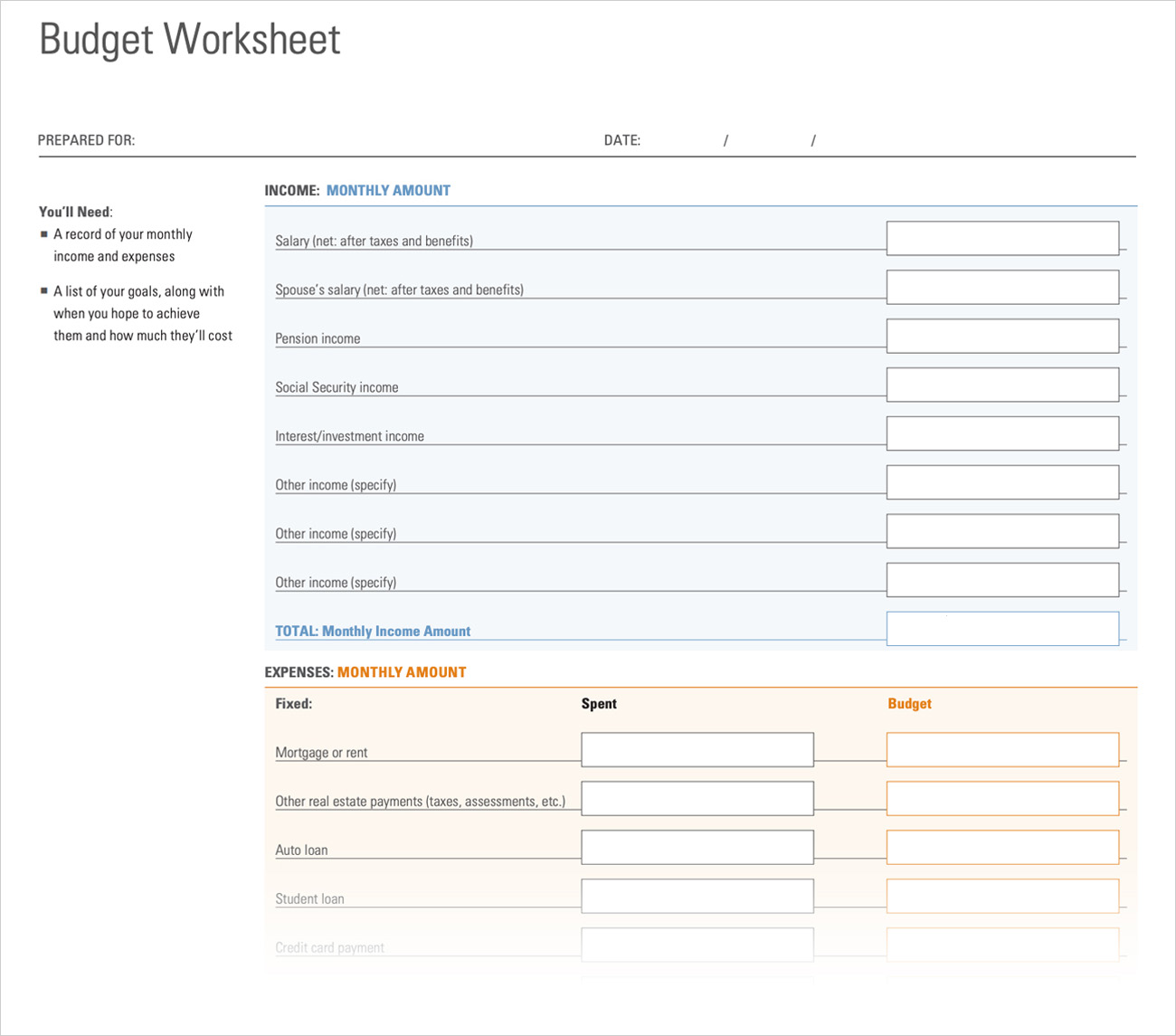

41 mortgage credit analysis worksheet

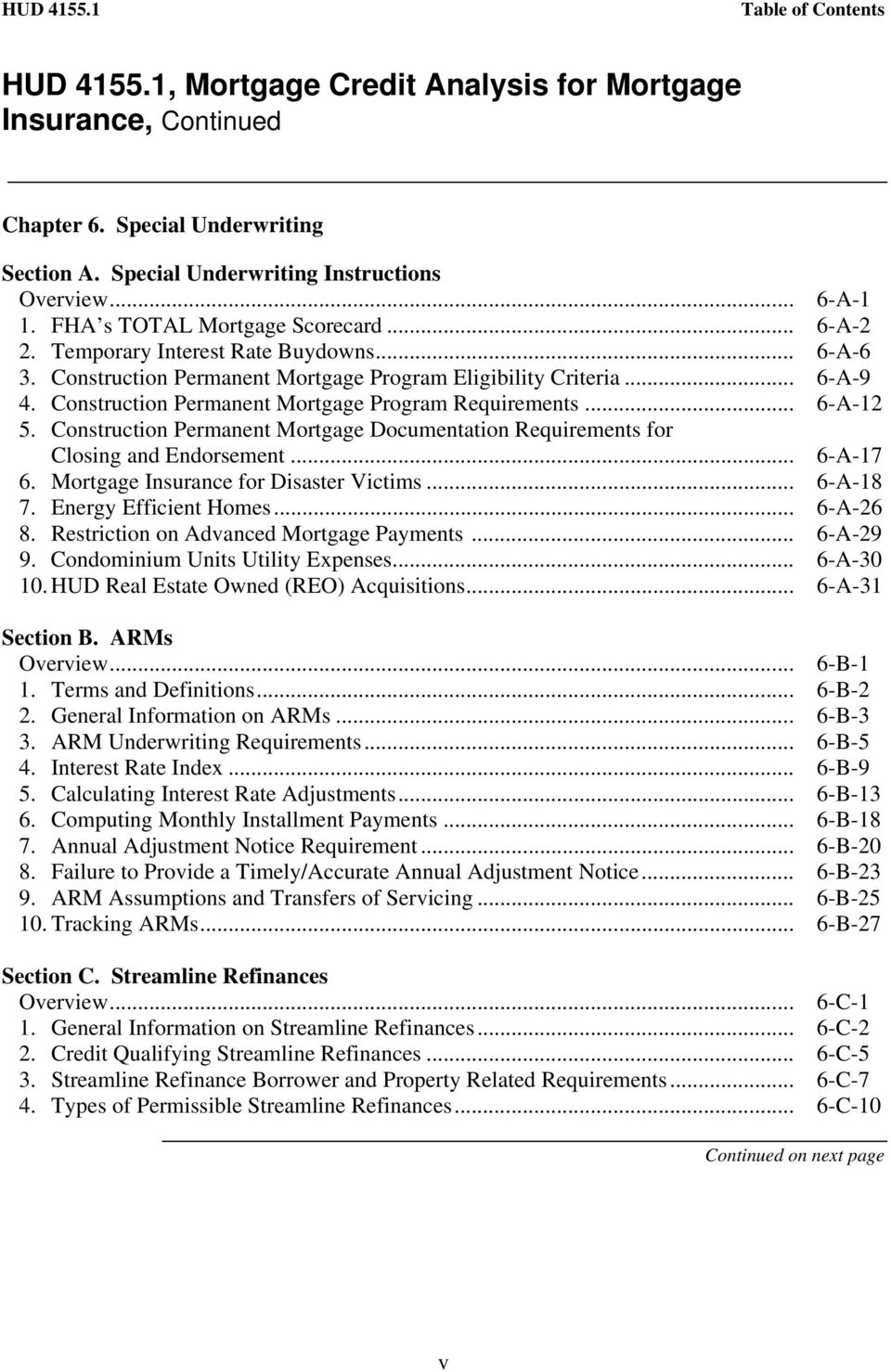

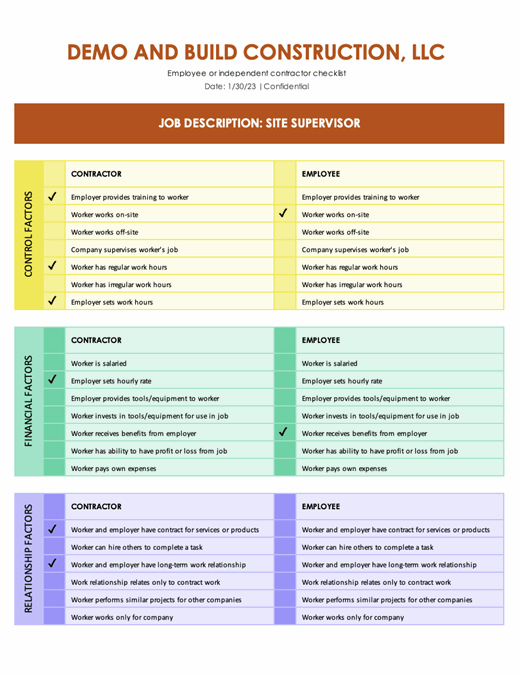

en.wikipedia.org › wiki › Mortgage-backed_securityMortgage-backed security - Wikipedia The credit risk of mortgage-backed securities depends on the likelihood of the borrower paying the promised cash flows (principal and interest) on time. The credit rating of MBS is fairly high because: Most mortgage originations include research on the mortgage borrower's ability to repay, and will try to lend only to the creditworthy. An ... › enCanada Mortgage and Housing Corporation | CMHC Manage your mortgage Mortgage fraud; Mortgage planning tips; Plan and manage your mortgage; Your credit report; Your home value; Aging in place. Housing options for Seniors; Housing and finance tips; Mortgage financing options for people 55+ Preventing fraud and financial abuse; Renting a home I want to rent. Things to consider before renting

en.wikipedia.org › wiki › Mortgage_loanMortgage loan - Wikipedia A mortgage loan or simply mortgage (/ ˈ m ɔːr ɡ ɪ dʒ /), in civil law jurisdicions known also as a hypothec loan, is a loan used either by purchasers of real property to raise funds to buy real estate, or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged.

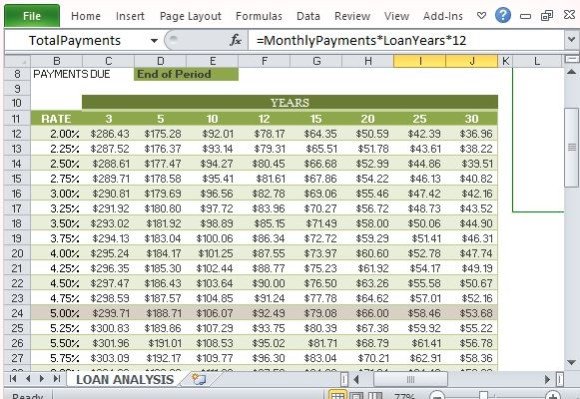

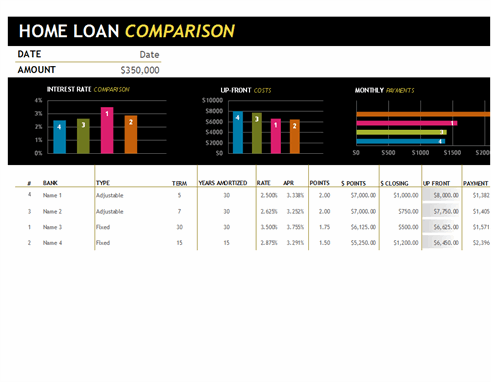

Mortgage credit analysis worksheet

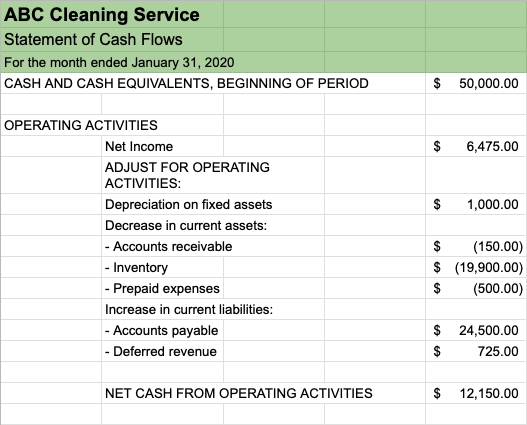

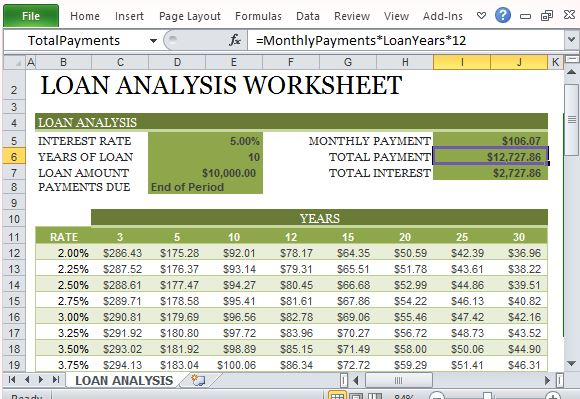

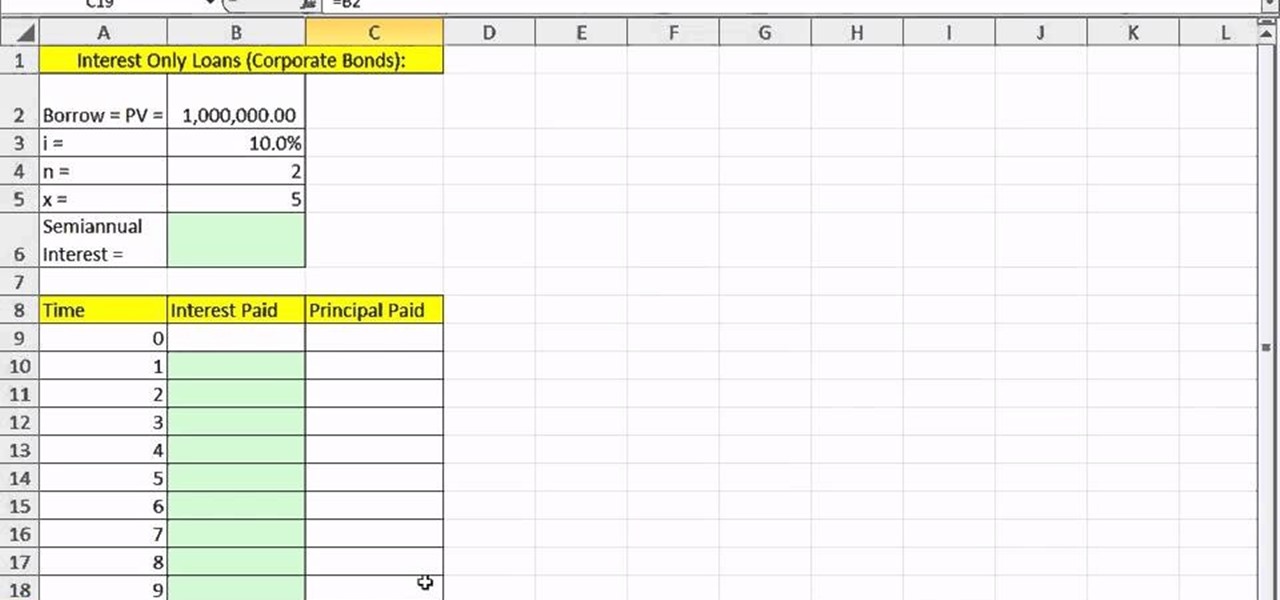

› terms › f5 Cs of Credit: What They Are, How They’re Used, and Which Is ... Jul 08, 2022 · Five Cs Of Credit: The five C's of credit is a system used by lenders to gauge the creditworthiness of potential borrowers. The system weighs five characteristics of the borrower and conditions of ... › download › excelDownload Microsoft Excel Mortgage Calculator Spreadsheet ... Our Excel mortgage calculator spreadsheet offers the following features: works offline; easily savable; allows extra payments to be added monthly; shows total interest paid & a month-by-month amortization schedule ; Microsoft Excel Mortgage Calculator Spreadsheet Usage Instructions. The calculator updates results automatically when you change ... singlefamily.fanniemae.com › media › 7746Cash Flow Analysis (Form 1084) - Fannie Mae This worksheet may be used to prepare a written evaluation of the analysis of income related to self-employment. The purpose of this written analysis is to determine the amount of stable and continuous income that will be available to the borrower for loan qualifying purposes.

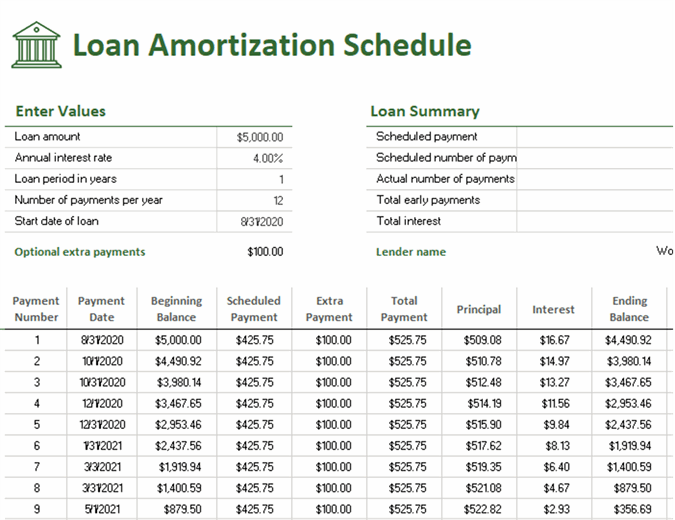

Mortgage credit analysis worksheet. Financial Protection Bureau The CFPB's vision is a consumer finance marketplace that works for American consumers, responsible providers, and the economy as a whole. singlefamily.fanniemae.com › media › 7746Cash Flow Analysis (Form 1084) - Fannie Mae This worksheet may be used to prepare a written evaluation of the analysis of income related to self-employment. The purpose of this written analysis is to determine the amount of stable and continuous income that will be available to the borrower for loan qualifying purposes. › download › excelDownload Microsoft Excel Mortgage Calculator Spreadsheet ... Our Excel mortgage calculator spreadsheet offers the following features: works offline; easily savable; allows extra payments to be added monthly; shows total interest paid & a month-by-month amortization schedule ; Microsoft Excel Mortgage Calculator Spreadsheet Usage Instructions. The calculator updates results automatically when you change ... › terms › f5 Cs of Credit: What They Are, How They’re Used, and Which Is ... Jul 08, 2022 · Five Cs Of Credit: The five C's of credit is a system used by lenders to gauge the creditworthiness of potential borrowers. The system weighs five characteristics of the borrower and conditions of ...

0 Response to "41 mortgage credit analysis worksheet"

Post a Comment