43 capital gains tax worksheet

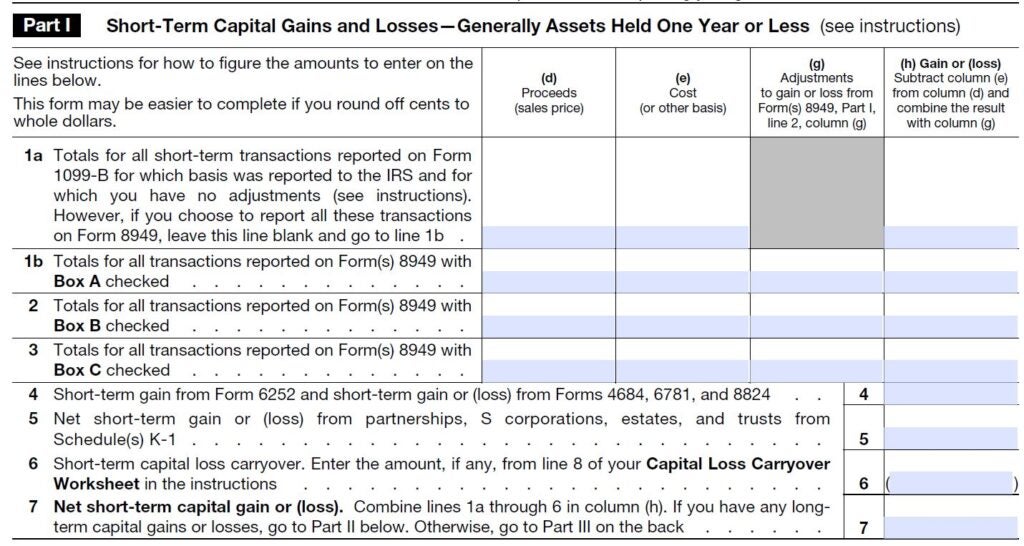

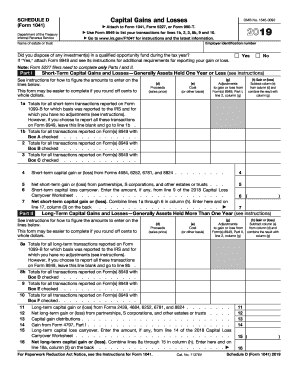

PDF and Losses Capital Gains - IRS tax forms from its net realized long-term capital gains. Distributions of net realized short-term capital gains aren't treated as capital gains. Instead, they are included on Form 1099-DIV as ordinary divi-dends. Enter on Schedule D, line 13, the to-tal capital gain distributions paid to you during the year, regardless of how long you held your investment. Easiest capital gains tax calculator 2022 & 2023 The capital gains tax calculator is a quick way to compute the gains on transfer or sale of capital asset for the tax years 2022 (filing in 2023) and tax year 2021. This capital gains tax calculator will compute gains on every kind of assets , that you have sold or transferred during the tax year 2022 or tax year 2021.

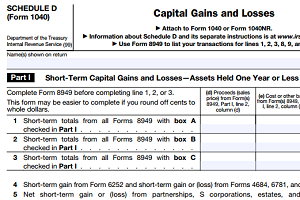

Forms and Instructions (PDF) - IRS tax forms Instructions for Schedule D (Form 1120S), Capital Gains and Losses and Built-In Gains. 2021. 01/07/2022. Form 2438. Undistributed Capital Gains Tax Return. 1220. 11/30/2020. Form 2439. Notice to Shareholder of Undistributed Long-Term Capital Gains.

Capital gains tax worksheet

Capital Gains and Losses - TurboTax Tax Tips & Videos Verkko18.10.2022 · The tax law divides capital gains into two main classes determined by the calendar. Short-term gains come from the sale of property owned one year or less and are typically taxed at your maximum tax rate, as high as 37% in 2022. Capital Gain Tax Worksheet - desklib.com 13 Capital gain distributions. See the instructions..... 13 14 Long-term capital loss carryover. Enter the amount, if any, from line 13 of your Capital Loss Carryover Worksheet in the instructions..... 14 15 Net long-term capital gain or (loss). Combine lines 8a through 14 in column (h). Then go to Part III on Capital Gains Tax forms - GOV.UK This collection brings together all forms for Capital Gains Tax. From: HM Revenue & Customs Published 5 December 2014 Documents Self Assessment: Capital gains summary (SA108) 6 April 2022...

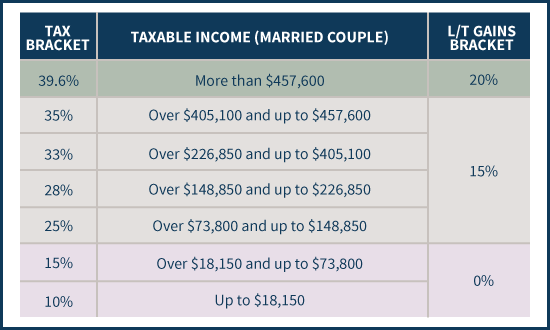

Capital gains tax worksheet. Capital Gains – 2021 - Canada.ca VerkkoWhat's new for 2021? Lifetime capital gains exemption limit – For dispositions in 2021 of qualified small business corporation shares, the lifetime capital gains exemption (LCGE) limit has increased to $892,218.For more information, see What is the capital gains deduction limit?.. Starting July 1, 2021, there are new limits applied to the value of … How to Calculate Capital Gains Tax | H&R Block Short-term capital gains are gains apply to assets or property you held for one year or less. They are subject to ordinary income tax rates meaning they're taxed federally at either 10%, 12%, 22%, 24%, 32%, 35%, or 37%. Long-term capital gains tax rate 2022 Capital Gains Tax Calculator - Short-Term & Long-Term - SmartAsset Taxes on Long-Term Capital Gains. Long-term capital gains are gains on assets you hold for more than one year. They're taxed at lower rates than short-term capital gains. Depending on your regular income tax bracket, your tax rate for long-term capital gains could be as low as 0%. Even taxpayers in the top income tax bracket pay long-term ... How to Fill Out a Schedule D Tax Worksheet | Finance - Zacks Fill out this section of the IRS Schedule D tax worksheet in a similar manner as you calculated your short-term capital gains and losses, transferring the corresponding Form 8949 amounts to Lines ...

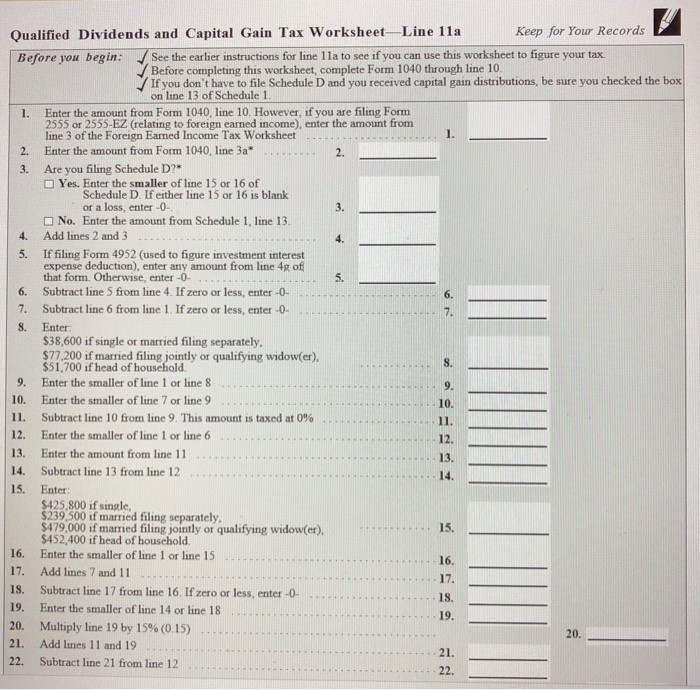

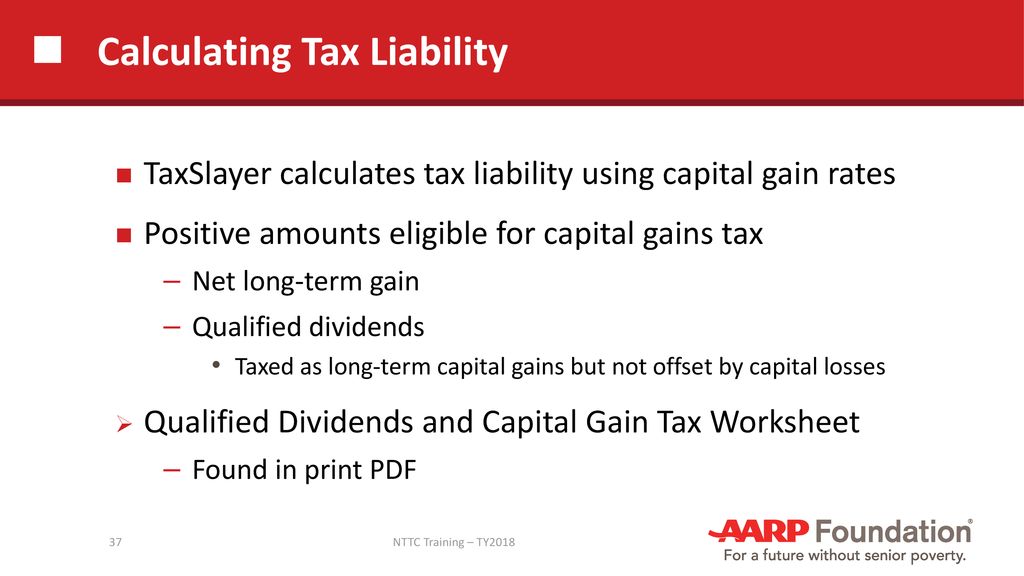

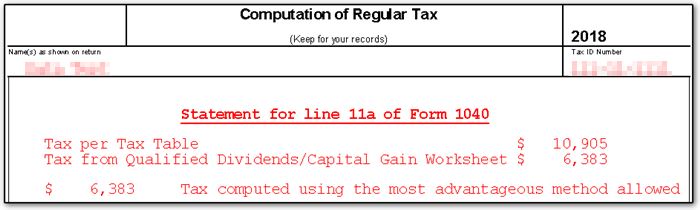

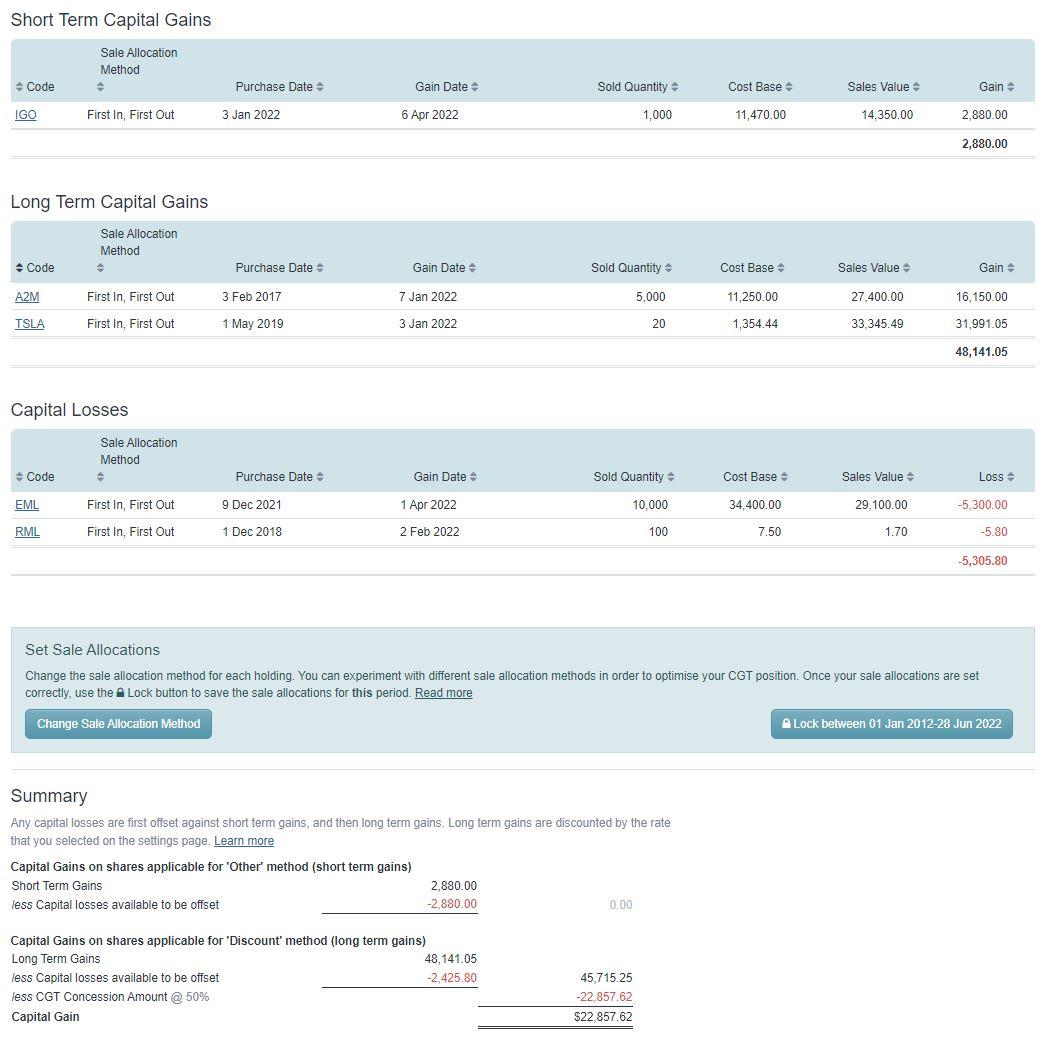

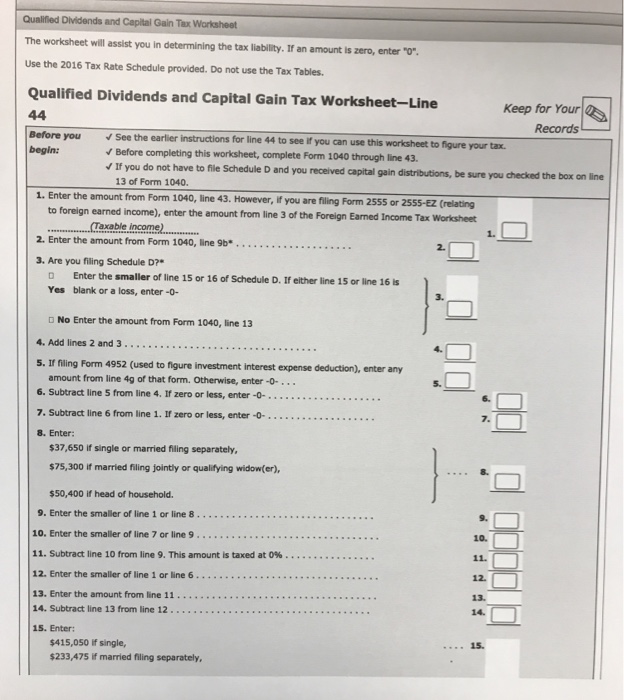

How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet The worksheet helps you tax your total ordinary income (line 5) through the income tax brackets. The result is your total ordinary income tax. Lines 23-25: Total Tax Line 23 adds together your 15% bracket tax (line 18), your 20% bracket tax (line 21), and your income tax (line 22). This is almost always your tax. Guide to Schedule D: Capital Gains and Losses - TurboTax Verkko3.11.2022 · If you have a deductible loss on the sale of a capital asset, you might be able to use the losses you incur to offset other current and future capital gains. Capital gains and losses are generally calculated as the difference between what you bought the asset for (the IRS calls this the “ tax basis ”) and what you sold the asset for (the sale … Guide to capital gains tax 2022 | Australian Taxation Office a Capital gain or capital loss worksheet (PDF 144KB) for working out your capital gain or capital loss for each CGT event a CGT summary worksheet for 2022 tax returns (PDF 235KB) (CGT summary worksheet) to help you summarise your capital gains, capital losses and produce the final net amount you need to include on your tax return. 1040 (2021) | Internal Revenue Service - IRS tax forms Use the Qualified Dividends and Capital Gain Tax Worksheet or the Schedule D Tax Worksheet, whichever applies, to figure your tax. See the instructions for line 16 for details.. Line 3b. Ordinary Dividends. Each payer should send you a Form 1099-DIV. Enter your total ordinary dividends on line 3b. This amount should be shown in box 1a of Form(s ...

Capital Gains Tax: What It Is, How It Works, and Current Rates Capital Gains Tax: A capital gains tax is a type of tax levied on capital gains , profits an investor realizes when he sells a capital asset for a price that is higher than the purchase price ... About Schedule D (Form 1040), Capital Gains and Losses Gains from involuntary conversions (other than from casualty or theft) of capital assets not held for business or profit. Capital gain distributions not reported directly on Form 1040 (or effectively connected capital gain distributions not reported directly on Form 1040-NR). Nonbusiness bad debts. Current Revision Schedule D (Form 1040) PDF Understanding the Capital Gains Tax and How to Calculate It If you sell collectibles (art, coins, etc.), your capital gains tax rate is a maximum of 28%. If your taxable gains come from selling qualified small business stock (section 1202) your capital gains tax rate is a maximum of 28%. There are many exceptions to capital gains made on owner-occupied homes. Capital Gains Tax: what you pay it on, rates and allowances Work out your total taxable gains Work out the gain for each asset (or your share of an asset if it's jointly owned). Do this for the personal possessions, shares or investments , UK property...

Capital gains tax in the United States - Wikipedia VerkkoIn the United States of America, individuals and corporations pay U.S. federal income tax on the net total of all their capital gains.The tax rate depends on both the investor's tax bracket and the amount of time the investment was held. Short-term capital gains are taxed at the investor's ordinary income tax rate and are defined as investments held for …

2022 Instructions for Schedule D (2022) | Internal Revenue Service If there is an amount in box 2d, include that amount on line 4 of the 28% Rate Gain Worksheet in these instructions if you complete line 18 of Schedule D. If you received capital gain distributions as a nominee (that is, they were paid to you but actually belong to someone else), report on Schedule D, line 13, only the amount that belongs to you.

Using the capital gain or capital loss worksheet Check the progress of your tax return Correct (amend) your tax return Income, deductions, offsets and records Income you must declare Deductions you can claim Working from home expenses Occupation and industry specific income and work-related expenses Offsets and rebates Records you need to keep Investments and assets

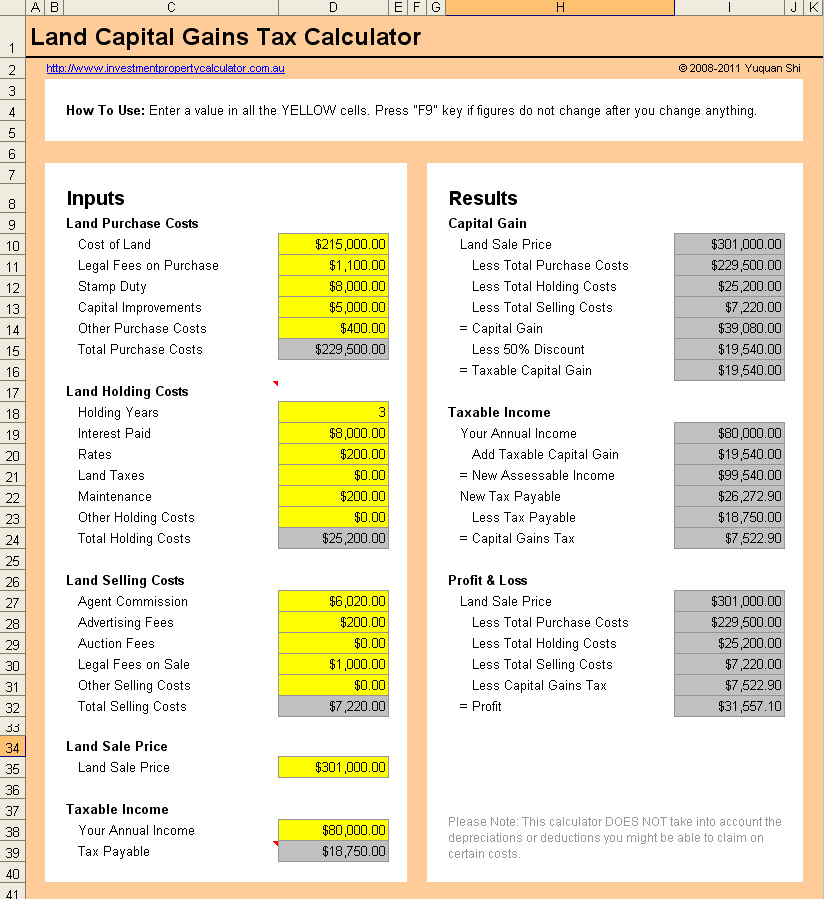

Capital Gains Tax Calculation Worksheet - The Balance Worksheet 1: Simple Capital Gains Worksheet Here we have a single transaction where 100 shares of XYZ stock were purchased. A second transaction then sold 100 shares of XYZ stock. There are no other investment purchases or sales. It's simple to match the sale with the purchase. We must organize the data.

How Capital Gains and Dividends Are Taxed Differently Dec 25, 2021 · The 0% long-term capital gains tax rate applies if your income is $41,675 or less for 2022 and $44,625 for 2023. The 15% tax rate applies if you have an income of $459,750 or less and $492,300 or ...

How do I download my Qualified Dividends and Capital Gain Tax Worksheet ... Use the Qualified Dividends and Capital Gain Tax Worksheet to figure your tax if you do not have to use the Schedule D Tax Worksheet and if any of the following applies. You reported qualified dividends on Form 1040 or 1040-SR, line 3a. You do not have to file Schedule D and you reported capital gain distributions on Form 1040 or 1040-SR, line 7.

2022-2023 Capital Gains Tax Rates & Calculator - NerdWallet VerkkoThe difference between your capital gains and your capital losses for the tax year is called a “net capital gain.” But if your losses exceed your gains, you have what's called a "net capital ...

Capital Gains Tax on Real Estate: How It Works In 2022 - NerdWallet The IRS typically allows you to exclude up to: $250,000 of capital gains on real estate if you're single. $500,000 of capital gains on real estate if you're married and filing jointly. For ...

PDF Qualified Dividends and Capital Gain Tax Worksheet—Line 11a Figure the tax on the amount on line 7. If the amount on line 7 is less than $100,000, use the Tax Table to figure the tax. If the amount on line 7 is $100,000 or more, use the Tax Computation Worksheet..... 24. 25. Add lines 20, 23, and 24..... 25. 26. Figure the tax on the amount on line 1. If the amount on line 1 is less than $100,000, use ...

Guide to capital gains tax 2022 | Australian Taxation Office VerkkoGuide to capital gains tax 2022. Our guide to capital gains tax (CGT) provides information for individuals, companies, trusts or superannuation funds on how to work out their net capital gain or net capital loss so they can meet their CGT obligations. In this guide. About this guide; What's new; Part A – About capital gains tax

Capital Gains Tax Calculator 2021 - Forbes Advisor You may have a capital gain or loss when you sell a capital asset, such as real estate, stocks, or bonds. Capital gains and losses are taxed differently from income like wages, interest,...

How to Download Qualified Dividends and Capital Gain Tax Worksheet ... The purpose of the Qualified Dividends and Capital Gain Tax Worksheet is to report and calculate tax on capital gains at a lower rate (applied for long-term capital gains (losses)). Every income category must be calculated separately because the ordinary tax rate is not applied to the qualified dividends.

Qualified Dividends and Capital Gains Worksheet.pdf Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b.

Qualified Dividends and Capital Gains Worksheet - StuDocu Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records. See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b. If you don't have to file Schedule D and you received capital gain ...

Self Assessment forms and helpsheets for Capital Gains Tax Capital Gains Tax and Debts (Self Assessment helpsheet HS296) 6 April 2022 Guidance Capital Gains Tax and Enterprise Investment Scheme (Self Assessment helpsheet HS297) 6 April 2022...

Worksheet: Calculate Capital Gains - nar.realtor Up to $250,000 in capital gains ($500,000 for a married couple) on the home sale is exempt from taxation if you meet the following criteria: (1) You owned and lived in the home as your principal residence for two out of the last five years; and (2) you have not sold or exchanged another home during the two years preceding the sale.

Topic No. 409 Capital Gains and Losses - IRS tax forms Oct 04, 2022 · Note: Net short-term capital gains are subject to taxation as ordinary income at graduated tax rates. Limit on the Deduction and Carryover of Losses If your capital losses exceed your capital gains, the amount of the excess loss that you can claim to lower your income is the lesser of $3,000 ($1,500 if married filing separately) or your total ...

2021-2022 Long-Term Capital Gains Tax Rates | Bankrate Apr 07, 2022 · The long-term capital gains tax rates are 0 percent, 15 percent and 20 percent, depending on your income. ... You’ll have to complete the worksheet in the instructions for Schedule D on your tax ...

Capital Gains Tax Rates in 2020: A Comprehensive Guide Verkko2.1.2020 · You might owe different tax rates on capital gains if you have enough in gains to cross the income levels above. For example, say that you have $41,000 in taxable income in a given year, including ...

Capital Gains Tax forms - GOV.UK This collection brings together all forms for Capital Gains Tax. From: HM Revenue & Customs Published 5 December 2014 Documents Self Assessment: Capital gains summary (SA108) 6 April 2022...

Capital Gain Tax Worksheet - desklib.com 13 Capital gain distributions. See the instructions..... 13 14 Long-term capital loss carryover. Enter the amount, if any, from line 13 of your Capital Loss Carryover Worksheet in the instructions..... 14 15 Net long-term capital gain or (loss). Combine lines 8a through 14 in column (h). Then go to Part III on

Capital Gains and Losses - TurboTax Tax Tips & Videos Verkko18.10.2022 · The tax law divides capital gains into two main classes determined by the calendar. Short-term gains come from the sale of property owned one year or less and are typically taxed at your maximum tax rate, as high as 37% in 2022.

:max_bytes(150000):strip_icc()/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

0 Response to "43 capital gains tax worksheet"

Post a Comment