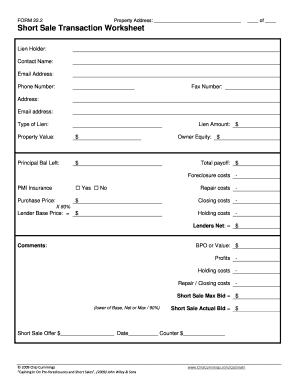

43 short sale financial worksheet

Business - Wikipedia WebBusiness is the practice of making one's living or making money by producing or buying and selling products (such as goods and services). It is also "any activity or enterprise entered into for profit." Having a business name does not separate the business entity from the owner, which means that the owner of the business is responsible and liable for debts … Teaching Tools | Resources for Teachers from Scholastic WebBook List. 20+ Read-Alouds to Teach Your Students About Gratitude. Grades PreK - 5

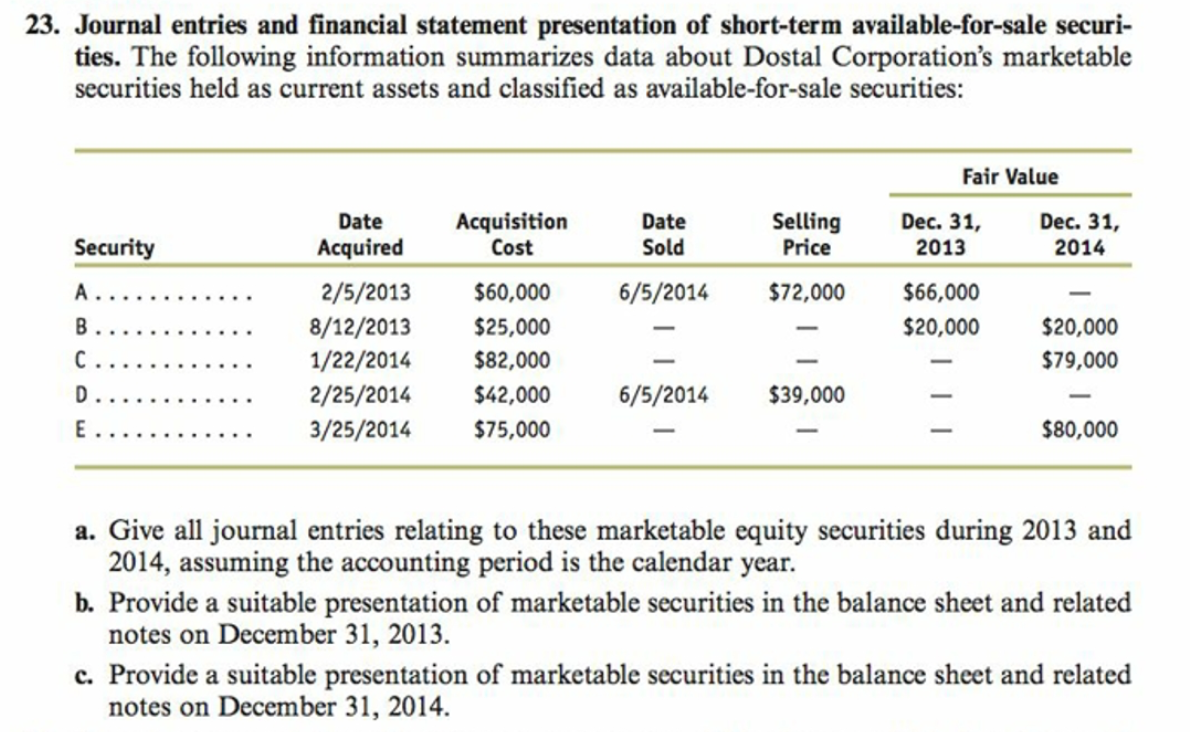

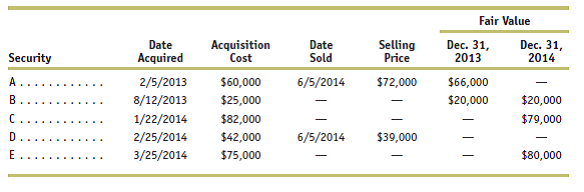

2022 Instructions for Schedule D (2022) | Internal Revenue Service WebIf a short sale closed in 2022 but you didn't get a 2022 Form 1099-B (or substitute statement) for it because you entered into it before 2011, report it on Form 8949 in Part I with box C checked or Part II with box F checked (whichever applies). In column (a), enter (for example) “100 sh. XYZ Co.—2010 short sale closed.” Fill in the other columns according …

Short sale financial worksheet

Unbanked American households hit record low numbers in 2021 Web25.10.2022 · And since 2011, when 8% of U.S. households were unbanked, the highest since the start of the survey, and the record low reached in 2021, roughly half of the drop was due to a shift in the ... › taxtopics › tc409Topic No. 409 Capital Gains and Losses | Internal Revenue Service Oct 04, 2022 · Note: Net short-term capital gains are subject to taxation as ordinary income at graduated tax rates. Limit on the Deduction and Carryover of Losses If your capital losses exceed your capital gains, the amount of the excess loss that you can claim to lower your income is the lesser of $3,000 ($1,500 if married filing separately) or your total ... Topic No. 409 Capital Gains and Losses | Internal Revenue Service Web04.10.2022 · Losses from the sale of personal-use property, such as your home or car, aren't tax deductible. Short-Term or Long-Term. To correctly arrive at your net capital gain or loss, capital gains and losses are classified as long-term or short-term. Generally, if you hold the asset for more than one year before you dispose of it, your capital gain or loss is …

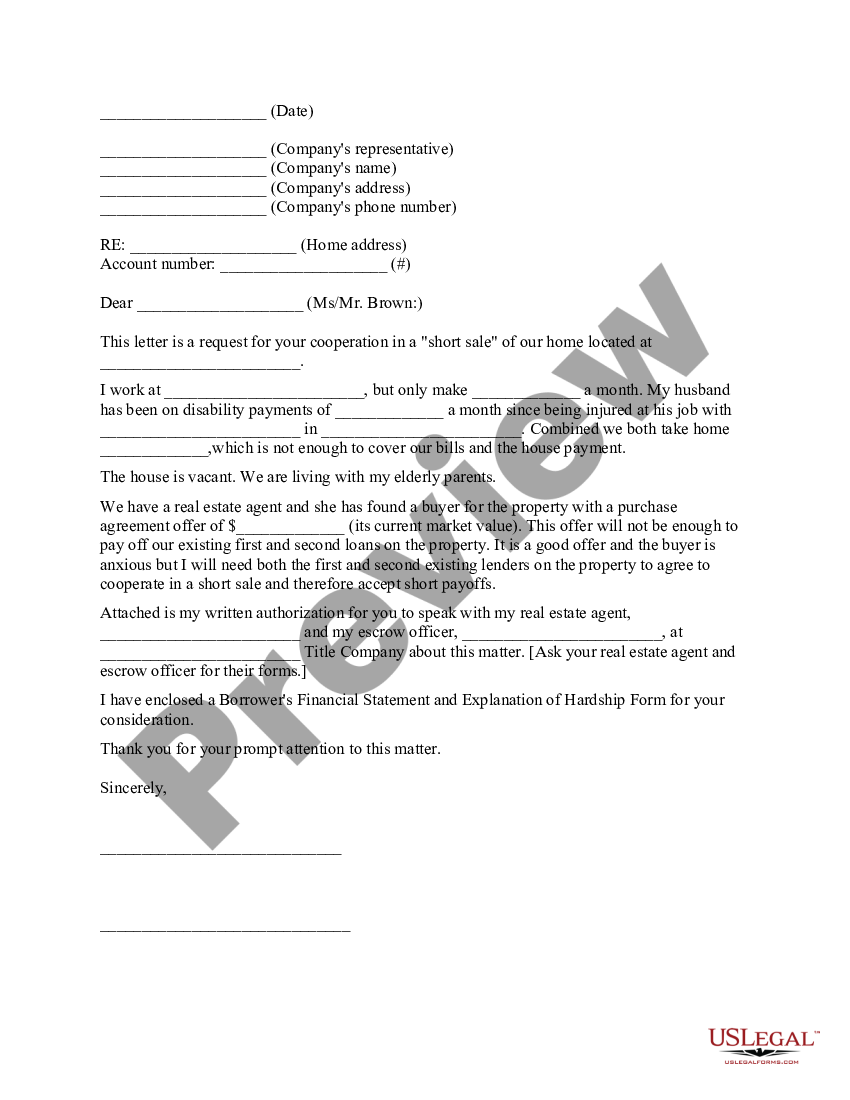

Short sale financial worksheet. MarketWatch: Stock Market News - Financial News - MarketWatch WebMarketWatch provides the latest stock market, financial and business news. Get stock market quotes, personal finance advice, company news and more. › instructions › i1040sd2022 Instructions for Schedule D (2022) | Internal Revenue ... Reporting a short sale. Report any short sale on Form 8949 in the year it closes. If a short sale closed in 2022 but you didn't get a 2022 Form 1099-B (or substitute statement) for it because you entered into it before 2011, report it on Form 8949 in Part I with box C checked or Part II with box F checked (whichever applies). Short Sale Financial Worksheet Information - ActiveRain This is because the bank wants to know that you actually qualify for their short sale program. Here is an example of some of the items that you will need to send in the package. Financial Information Last 3 checking account statements for all borrowers Last 3 savings account statements for all borrowers Last 2 years of W2's for all borrowers PDF CDPE HOMEOWNER FINANCIAL WORKSHEET - Keller Williams Realty CDPE HOMEOWNER FINANCIAL WORKSHEET Homeowners Insurance Only list here if not in Mortgage Payment Real Estate Tax Only list here if not in Mortgage Payment Personal Property Tax Applies only in some States Groceries School Lunches Transportation, Parking, Tolls Clothing Dry Cleaning/Laundry Cell Phone Internet Service Homeowners Assn. Dues

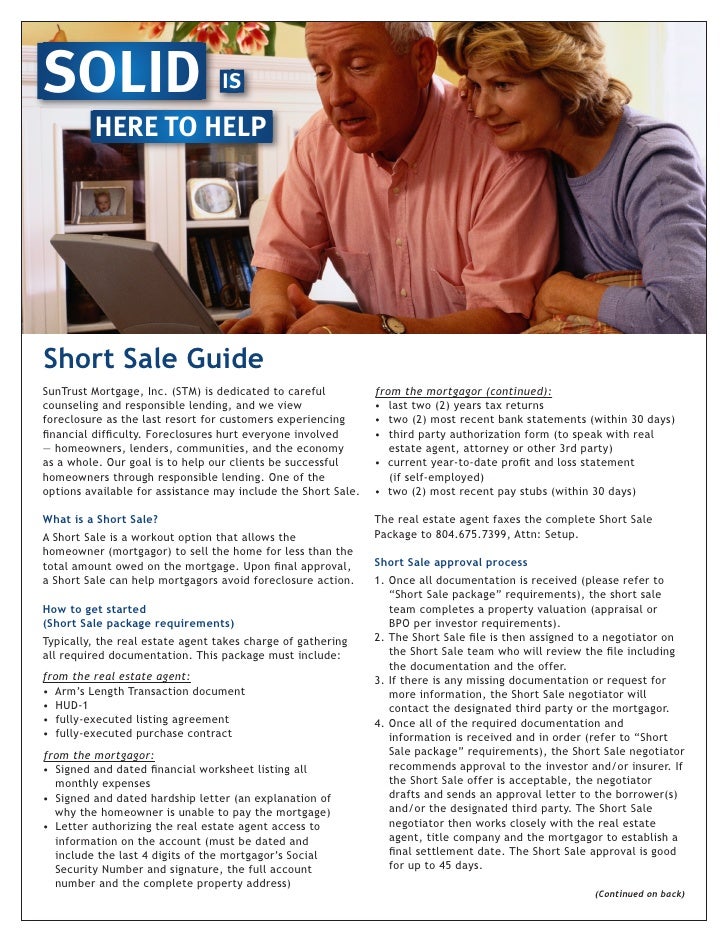

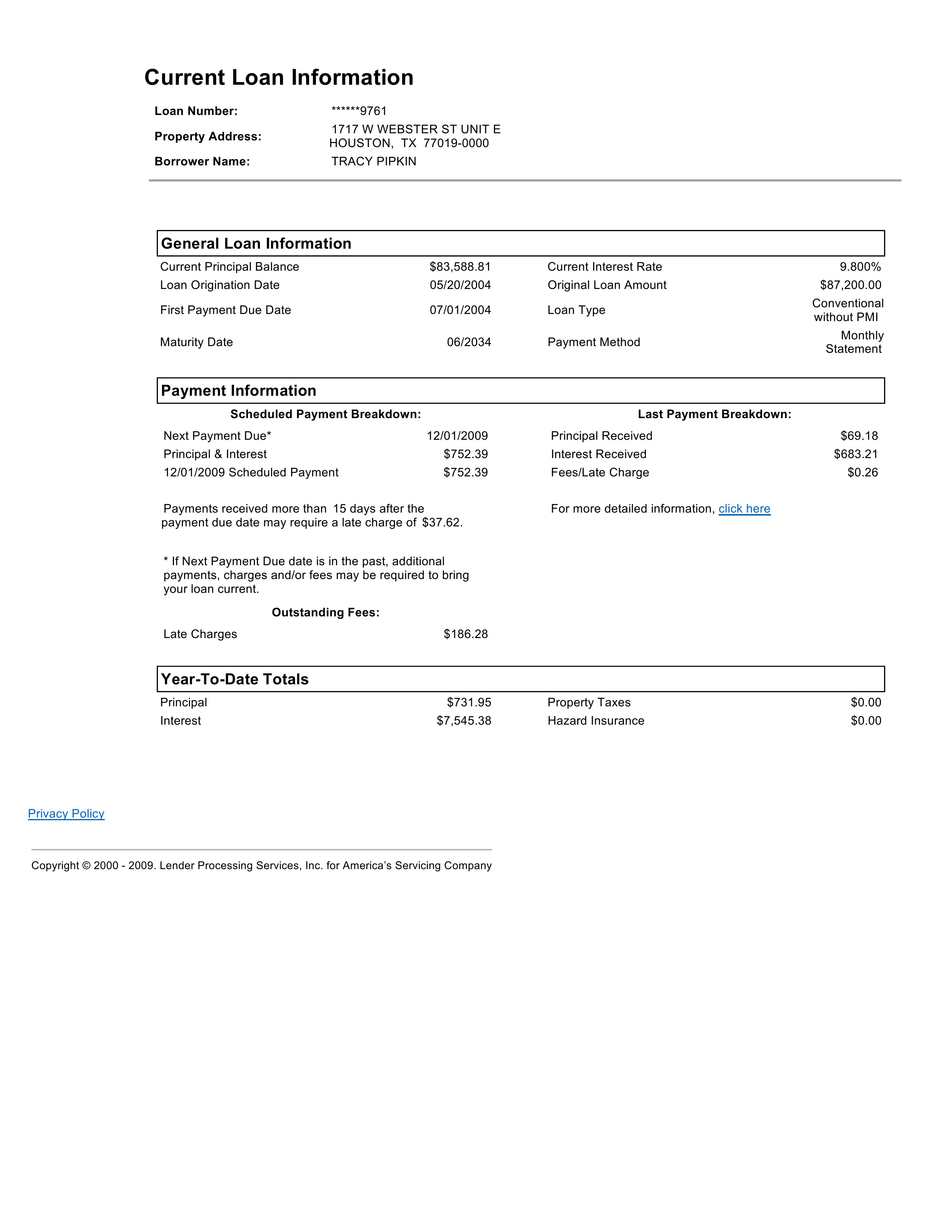

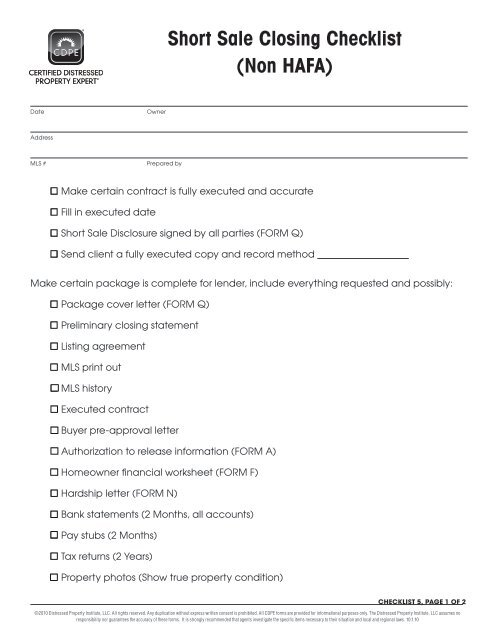

3 Must Have Short Sale Qualifications - Distressed Property Expert Following is an explanation of the three major items that most lenders are looking to see if you will qualify for a short sale. 1. FINANCIAL HARDSHIP. A financial hardship is a verfiable issue that has or will cause you to miss payments on your loan or have financial difficulties. Financial hardships can be issues such as: Loss of job. Loss of ... Short Sale Listing Package $27 - Short Sale Superstars Short Sale Listing Package $27 Posted by Bryant Tutas on August 29, 2009 at 6:00am View Blog The Short Sale Listing Package Listing Disclosure Letter Letter of Authorization, Short Sale Detail Sheet, Short Sale Questionnaire, Short Sale Listing Check List, What is a Hardship? Short Sale Hardship Letter Outline, Short Sale Financial Worksheet, Shellpoint Mortgage Servicing Forms Shellpoint Mortgage Servicing P.O. Box 650840 Dallas, TX 75265-0840 Main Office NMLS ID #1105391 Achiever Papers - We help students improve their academic standing WebWe have writers who are always ready to work and take up orders with a short deadline. We deliver papers as early as after 3 hours of ordering. You only have to indicate the short deadline and our support team will help pick the best and most qualified writer in your field. The writer will confirm whether they will submit the paper within the set deadline. After …

Financial Worksheet Template For Short Sale And Excel Financial ... Financial Worksheet Template For Short Sale And Excel Financial Worksheet Template can be valuable inspiration for people who seek a picture according specific topic, you can find it in this website. Finally all pictures we have been displayed in this website will inspire you all. Thank you. PDF Keller Williams pay stubs (a full month) two years most recent tax returns & w-2's two months bank statements (all pages) mortgage payment coupon (s) explanation of hardship (letter to lender(s), signed & dated) supporting documents for hardship o letter of termination/layoff notice o job relocation letter o unemployment benefit letter o medical … Short Sales: Dissecting The Financial Worksheet - ActiveRain The financial worksheet is one of the most problem-ridden parts of a short sale package. In a questionable hardship case, you can use the financial worksheet as part of your seller pre-qualification. Want to learn more? Our next Short Sale Basics webinar is Saturday, July 18, at 11:00 Eastern. 14 Free Financial Literacy Worksheets PDF (Middle & High School) FDIC's Money Smart Worksheets Suggested Age: 3-5 grade and 6-8 grade This is an entire money curriculum from the FDIC (the people who insure our savings accounts), for various grade ranges. The worksheets on saving money and setting goals include: Lesson 6: Super Savers (the Importance of Saving) Lesson 7: How to Stash Your Cash (Savings Options)

Short Sale Package | Financial Worksheet - YouTube - I can't fill it out for you but I can advise you on what the bank is looking for.

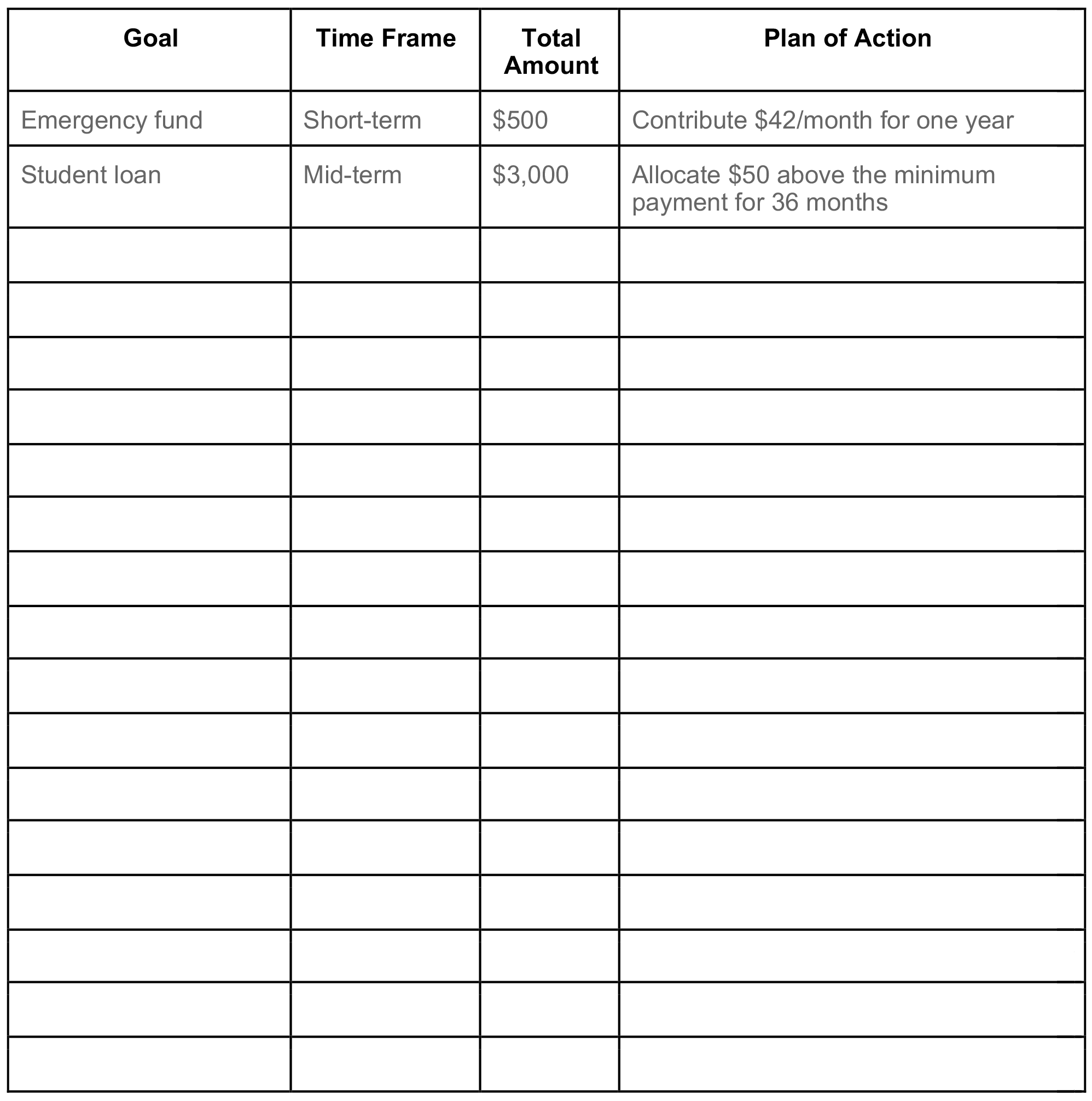

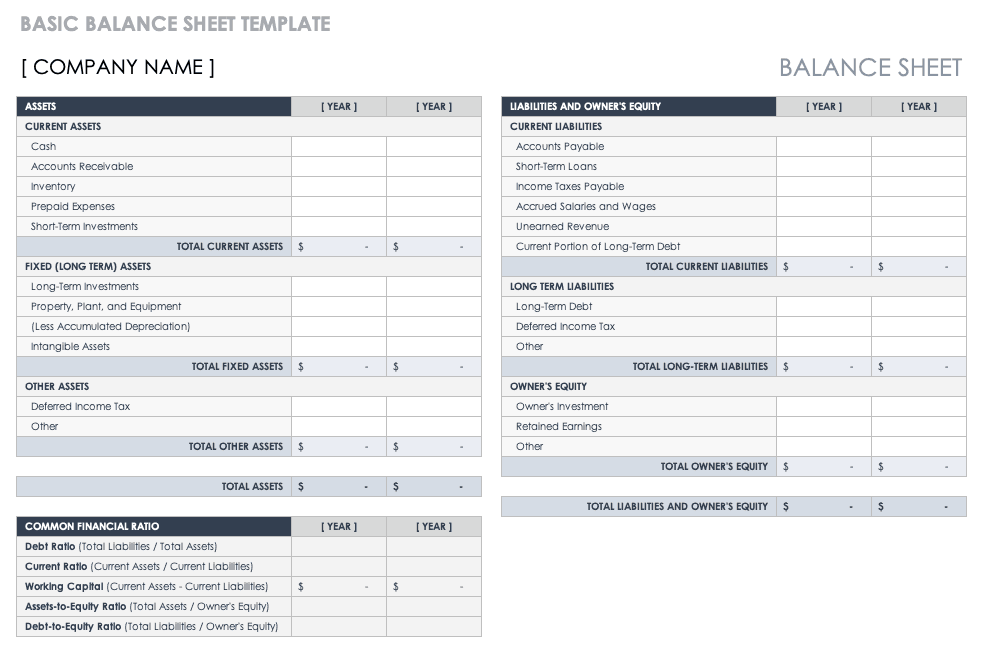

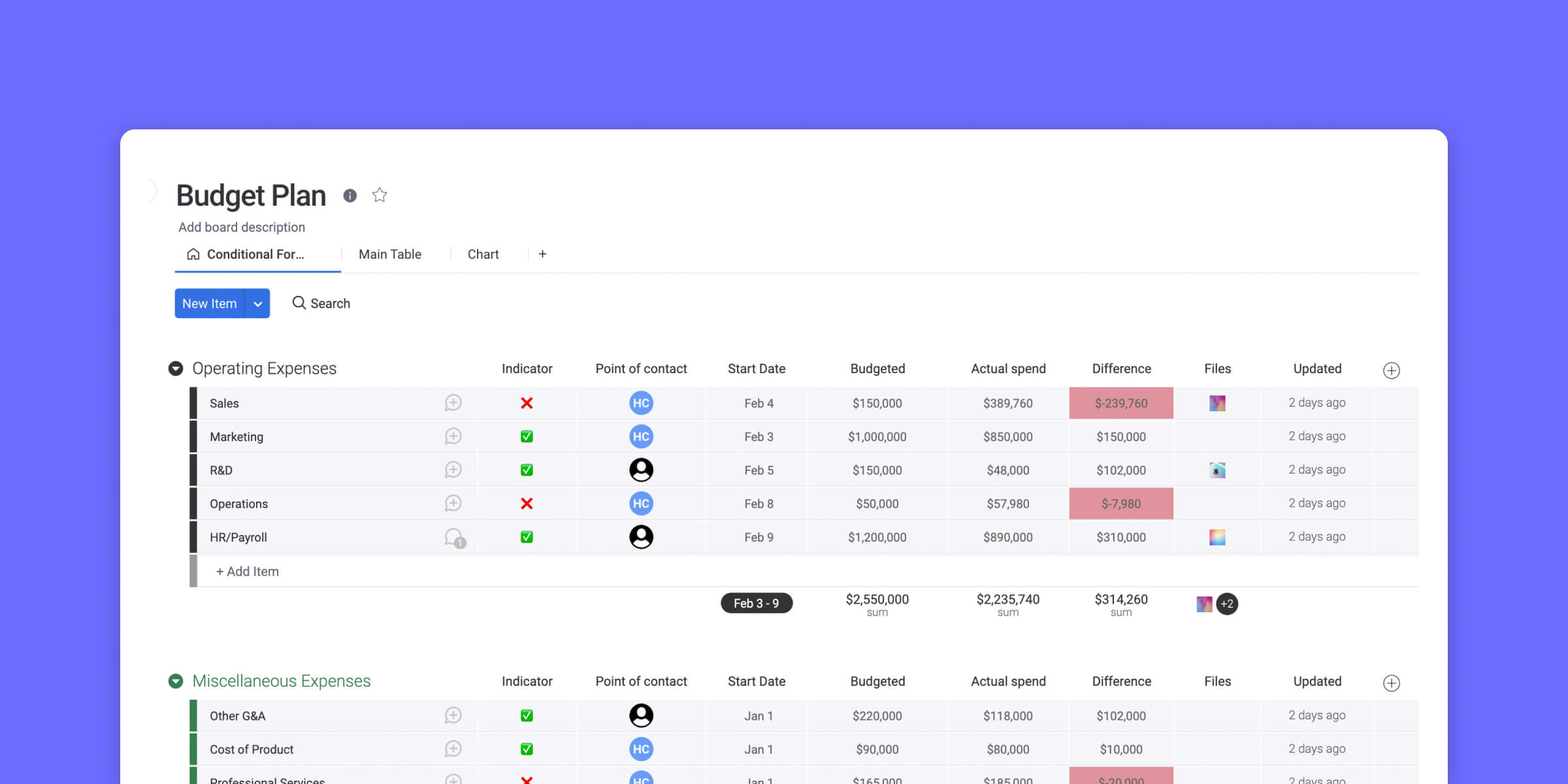

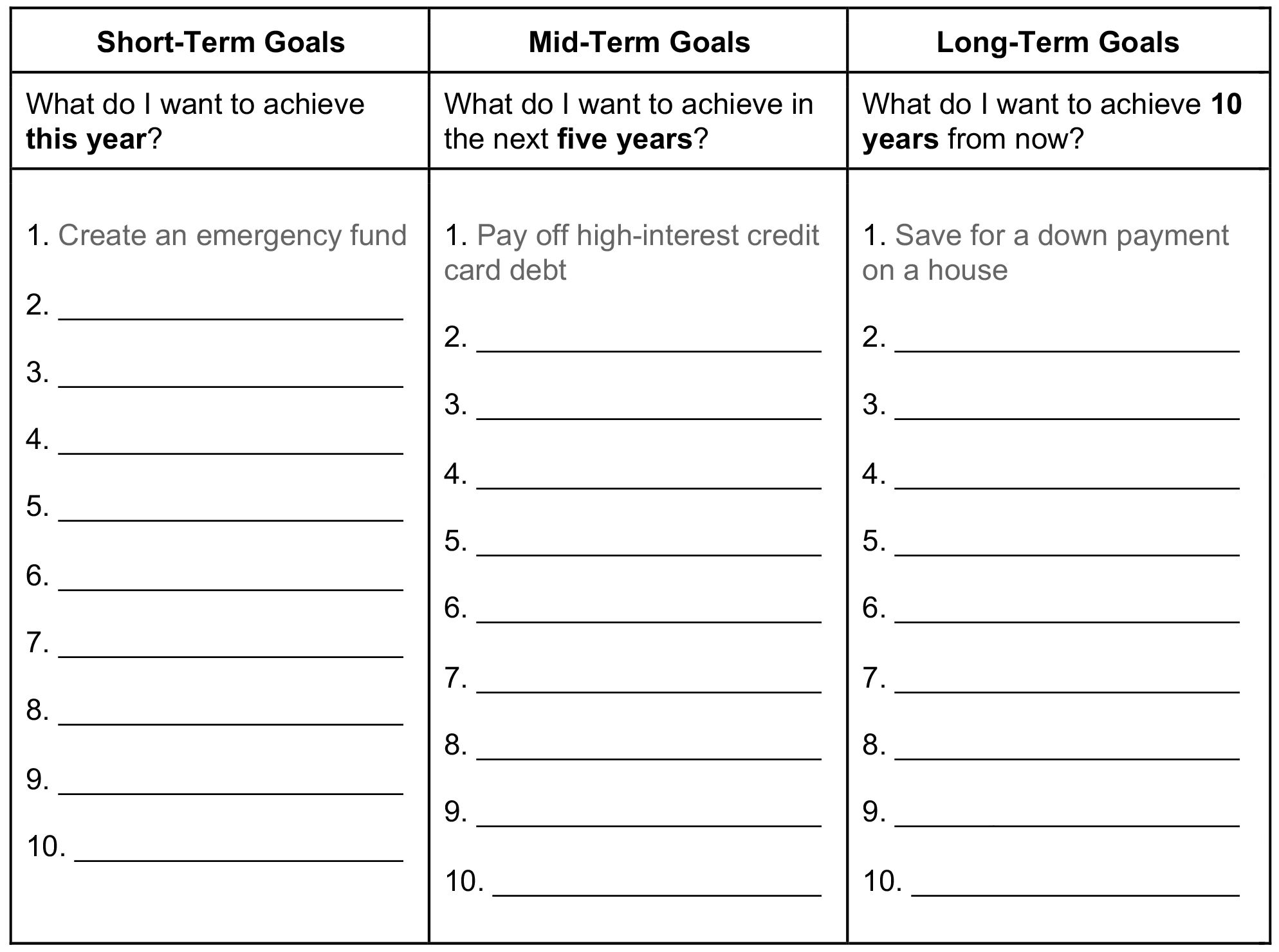

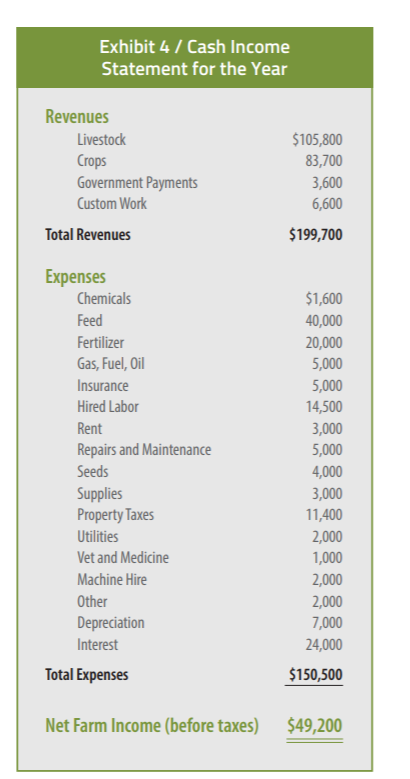

28 Free Printable Financial Planning Worksheets [For Beginners] Financial Planning Worksheets are spreadsheets that may be used to help you plan, save, and invest your financial resources. Budgeting Calculators and Customizable Worksheets: financial planning calculators and customizable worksheets to assist families in creating a budget, calculating their net worth, and preparing for their retirement.

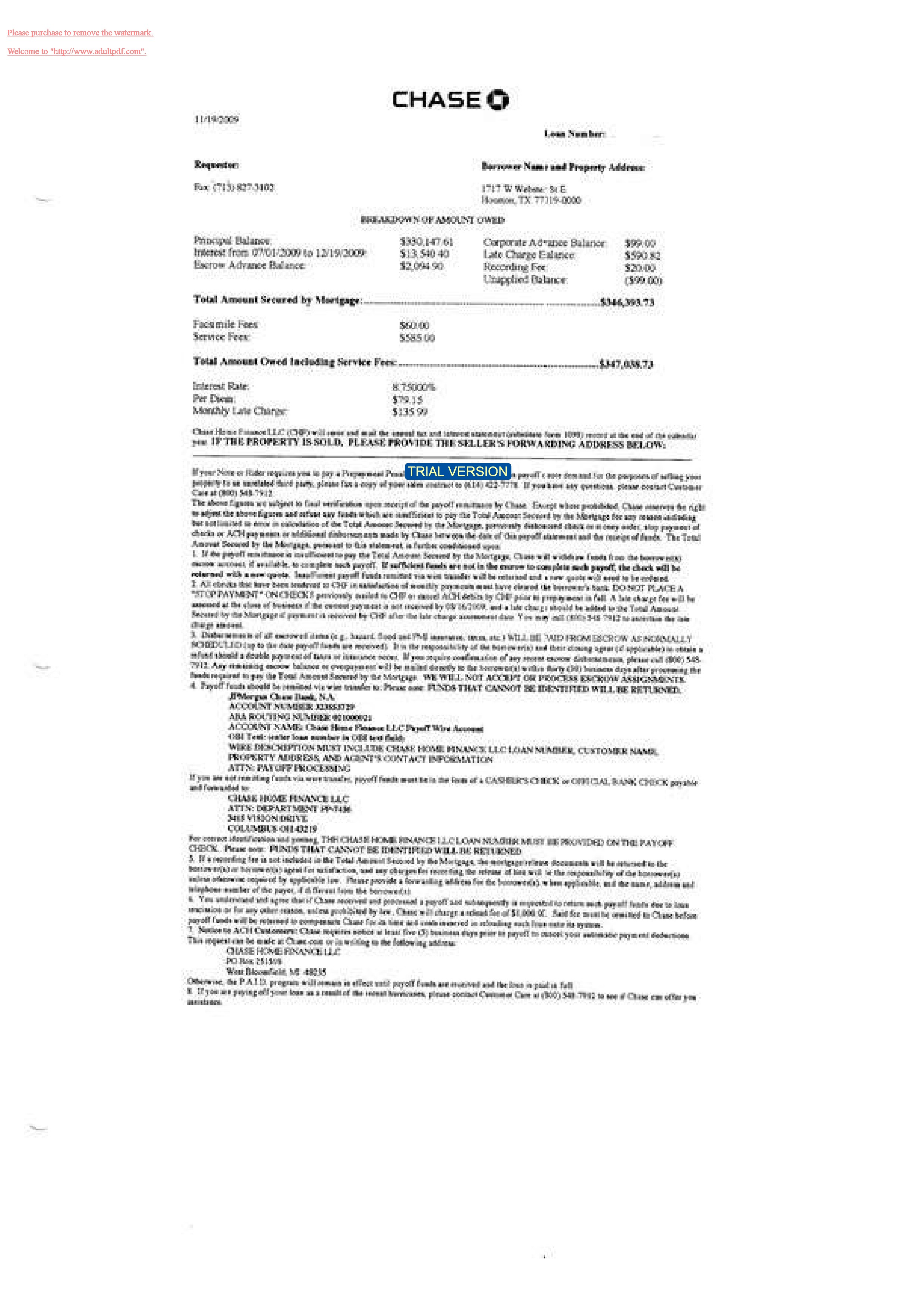

Chase Short Sale Financial Worksheet - yogahagerstown.com 13 Things About Chase Short Sale Financial Worksheet You May Not Have Known. You short sale financial worksheet will record with chase? The In. Card. Free. Indiana. Bride. Server Es. Course Schedule Directions. Family Services. Your Cart: My Orders: Ago: Analytics: KTM: Advisories: Carolina Panthers.

› teachers › teaching-toolsTeaching Tools | Resources for Teachers from Scholastic Book List. 20+ Read-Alouds to Teach Your Students About Gratitude. Grades PreK - 5

DIY Seo Software - Locustware.com WebDIY Seo Software From Locustware Is Exactly What You Need! Looking To Improve Your Website's Search Engine Optimization? No more guesswork - Rank On Demand

TD Bank - Short Sale Superstars Short Sale Department: 1-800-742-2651 ext 7616 SHORT SALE INITIATION: Call 800-222-5522 ****Riverside loans also belong to TD Bank TD Bank Short Sale Documents List.pdf REQUIRED DOCS: · TD Bank Financial Analysis Worksheet · Tax Returns (Last 2 years) · Bank Account Statements (Last 60 days, all accounts, all pages) · Pay Stubs (Last 60 days)

Operation EUNAVFOR MED IRINI WebOperation EUNAVFOR MED IRINI will have as its core task the implementation of the UN arms embargo through the use of aerial, satellite and maritime assets.

️Financial Hardship Worksheet Free Download| Qstion.co Confidential financial worksheet marathon chiropractic clinic you certify that the above information is true and accurate and that this application is made to allow our practice to determine your eligibility for reduced out of pocket health care costs. Get 38 Short Sale Financial Worksheet Worksheet Source 2021

› publications › p537Publication 537 (2021), Installment Sales | Internal Revenue ... See Single Sale of Several Assets and Sale of a Business, earlier. If you have only a few sales to separately report, use a separate Form 6252 for each one. However, if you have to separately report the sale of multiple assets that you sold together, prepare only one Form 6252 and attach a schedule with all the required information for each asset.

› pub › irs-pdfand Losses Capital Gains - IRS tax forms Short- or Long-Term Gain or Loss. Report short-term gains or losses in Part I. Report long-term gains or losses in Part II. The holding period for short-term capital gains and losses is generally 1 year or less. The holding pe-riod for long-term capital gains and los-ses is generally more than 1 year. How-ever, beginning in 2018, the long-term

JPMorgan Chase says it has fully eliminated screen scraping Web06.10.2022 · JPMorgan Chase has reached a milestone five years in the making — the bank says it is now routing all inquiries from third-party apps and services to access customer data through its secure application programming interface instead of allowing these services to collect data through screen scraping.

Topic No. 409 Capital Gains and Losses | Internal Revenue Service Web04.10.2022 · Losses from the sale of personal-use property, such as your home or car, aren't tax deductible. Short-Term or Long-Term. To correctly arrive at your net capital gain or loss, capital gains and losses are classified as long-term or short-term. Generally, if you hold the asset for more than one year before you dispose of it, your capital gain or loss is …

› taxtopics › tc409Topic No. 409 Capital Gains and Losses | Internal Revenue Service Oct 04, 2022 · Note: Net short-term capital gains are subject to taxation as ordinary income at graduated tax rates. Limit on the Deduction and Carryover of Losses If your capital losses exceed your capital gains, the amount of the excess loss that you can claim to lower your income is the lesser of $3,000 ($1,500 if married filing separately) or your total ...

Unbanked American households hit record low numbers in 2021 Web25.10.2022 · And since 2011, when 8% of U.S. households were unbanked, the highest since the start of the survey, and the record low reached in 2021, roughly half of the drop was due to a shift in the ...

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

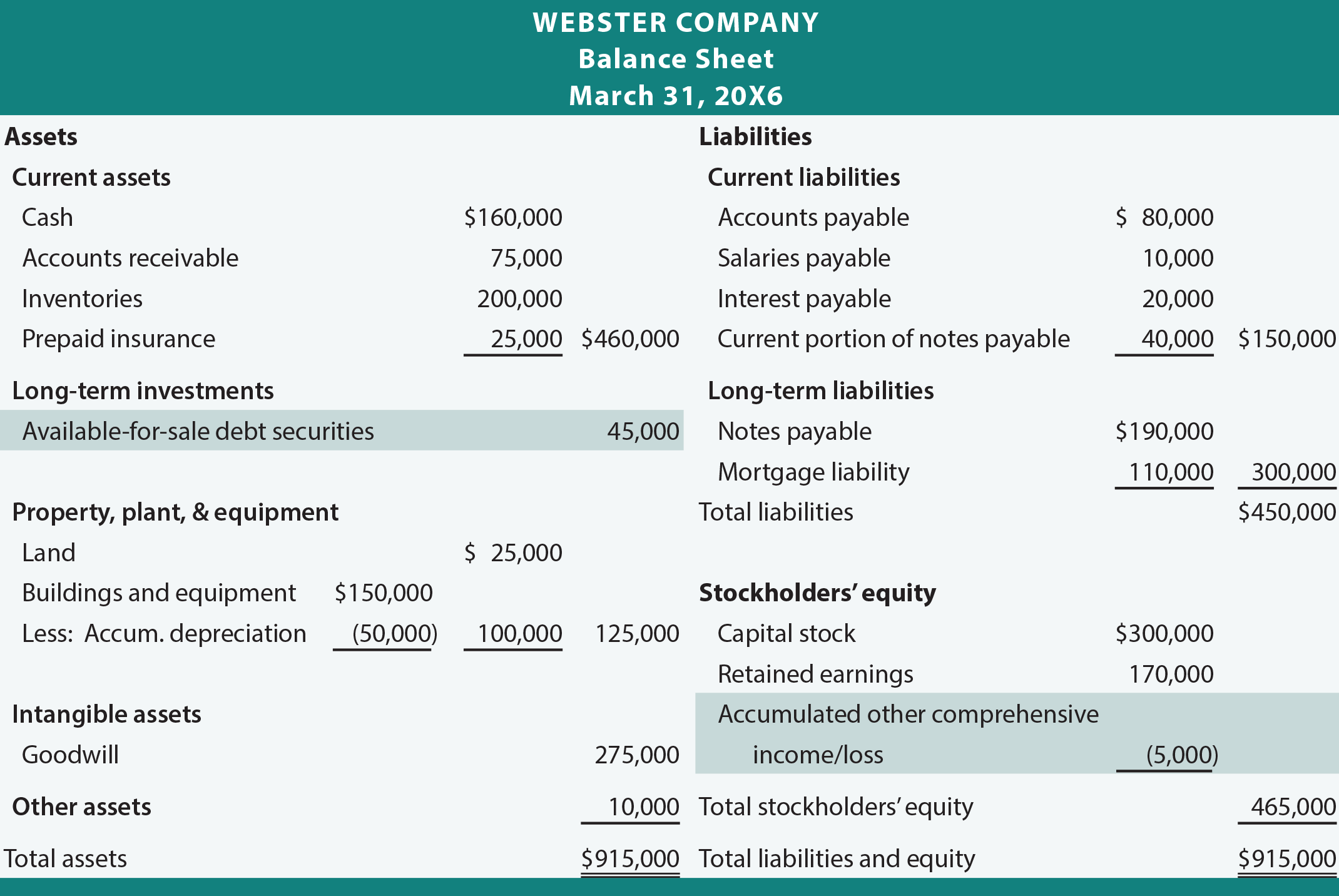

:max_bytes(150000):strip_icc()/balancesheet_final-4acdd1ef35624f1d872a09107f588cf0.jpg)

:max_bytes(150000):strip_icc()/real-estate-short-sale_final-10164f91f4794facbd92a4dd21986984.png)

0 Response to "43 short sale financial worksheet"

Post a Comment