44 income tax worksheet excel

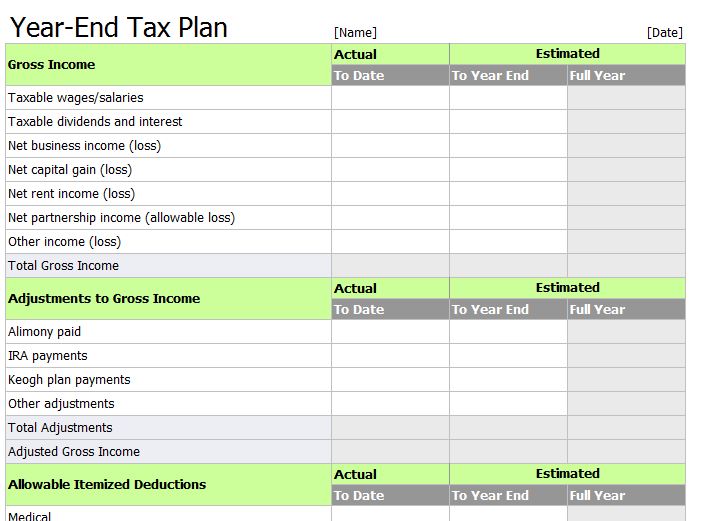

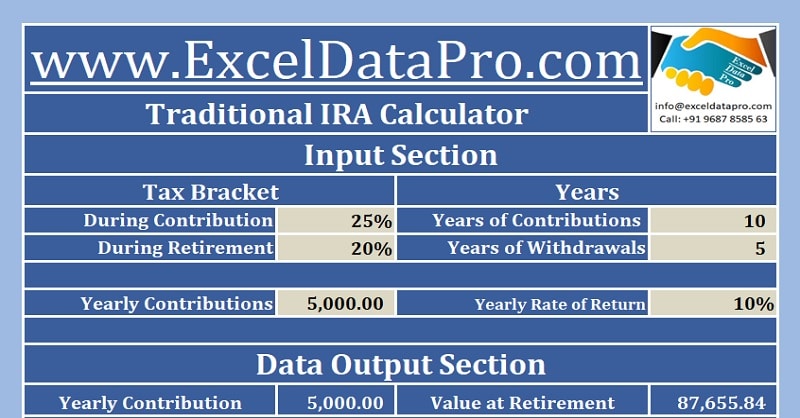

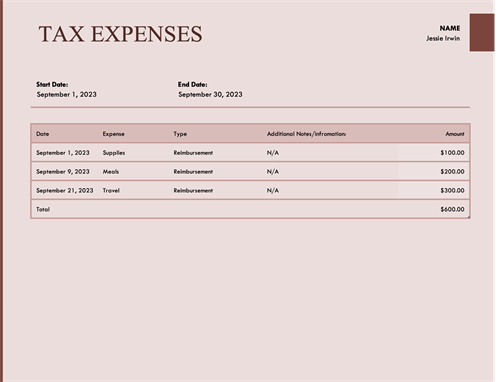

Download Free Federal Income Tax Templates In Excel Schedule B Calculator is an excel template that consists of calculations of taxable interest and ordinary dividends under Schedule B of Form 1040 and 1040A for federal income tax. Interests and dividend incomes received during a tax year are reported in Schedule B. Rental Income and Expense Worksheet - Rentals Resource Center Jan 01, 2021 · To download the free rental income and expense worksheet template, click the green button at the top of the page. Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the “rental income” category or HOA dues, gardening service and utilities in the “monthly expense” category.

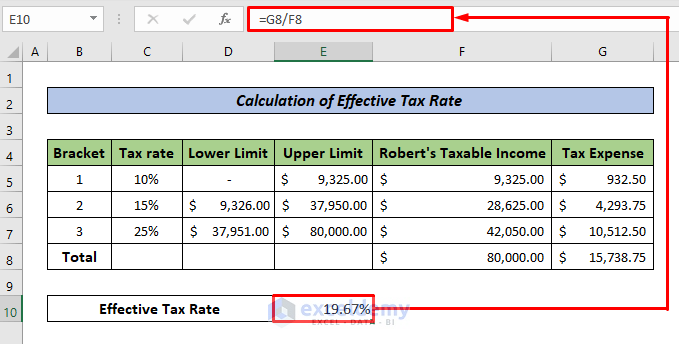

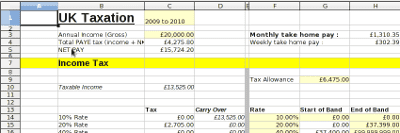

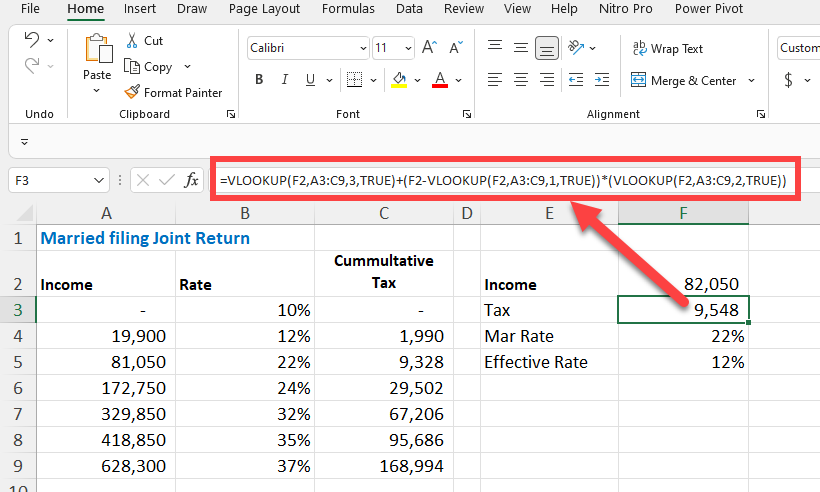

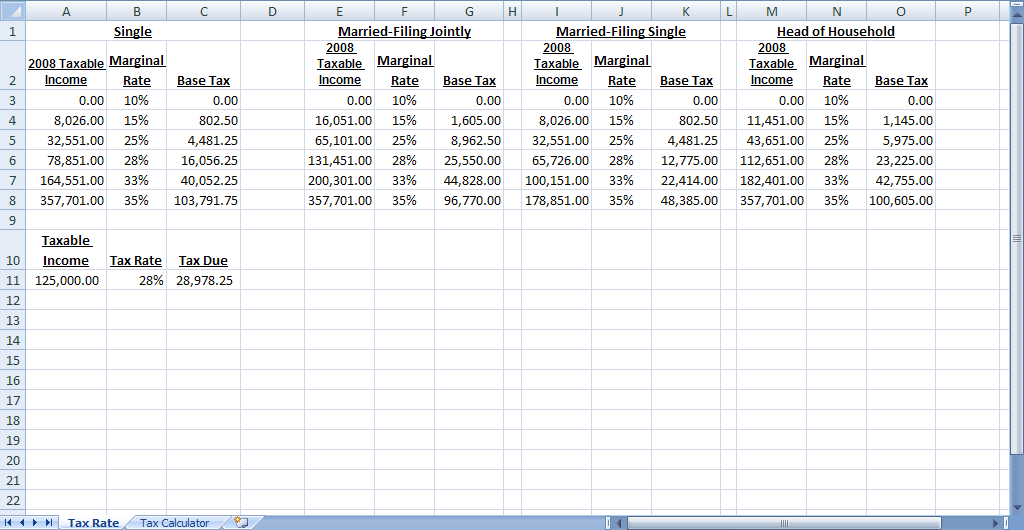

2022-2023 Federal Income Tax Brackets & Tax Rates - NerdWallet There are seven federal tax brackets for the 2022 tax year: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Your bracket depends on your taxable income and filing status. These are the rates for taxes due ...

Income tax worksheet excel

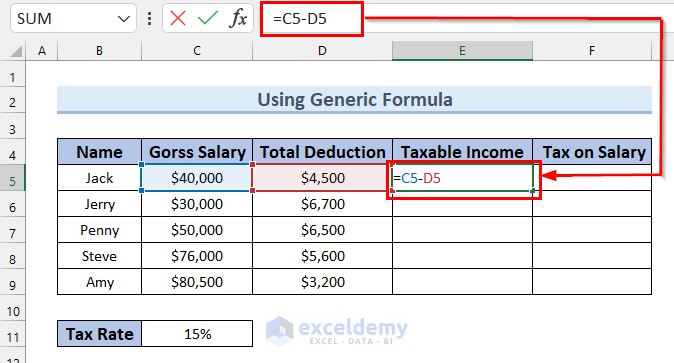

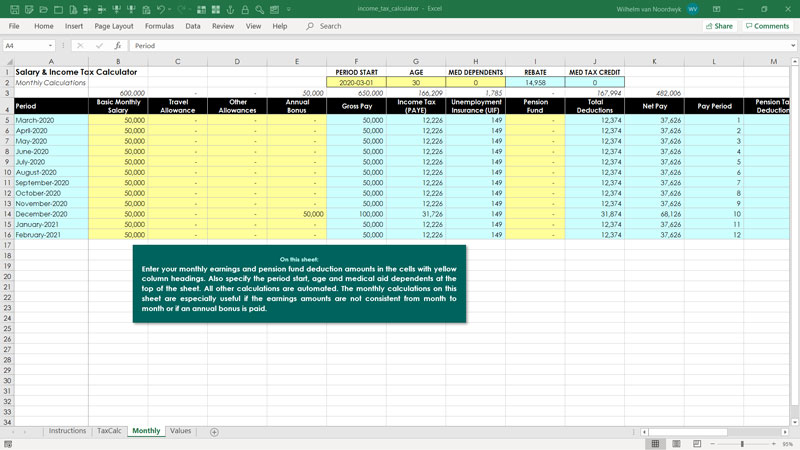

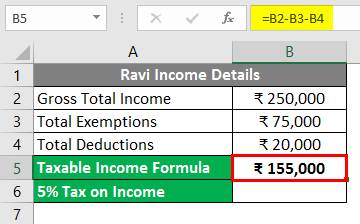

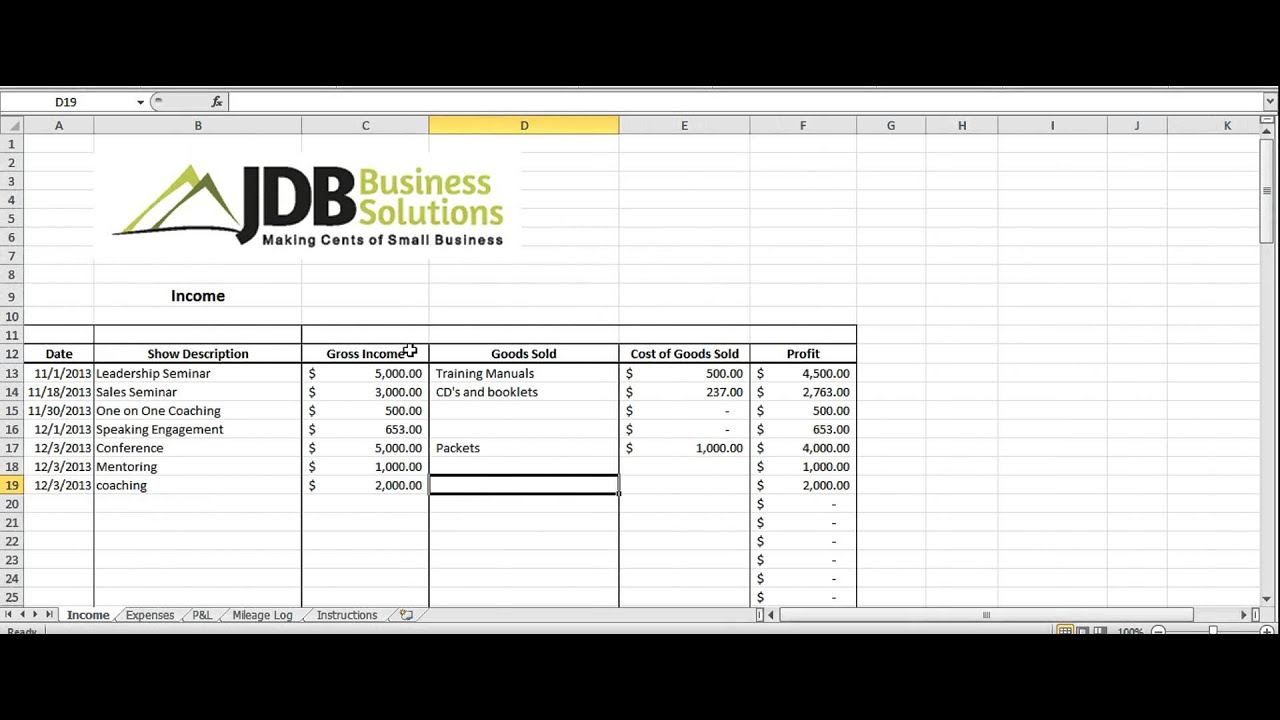

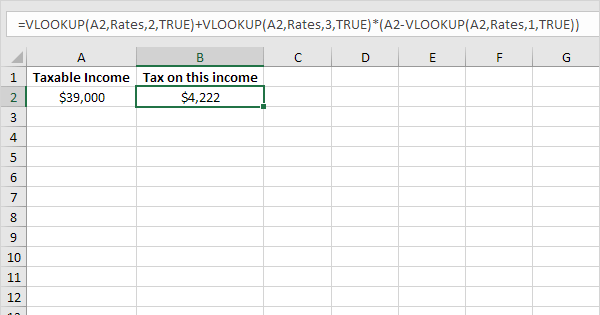

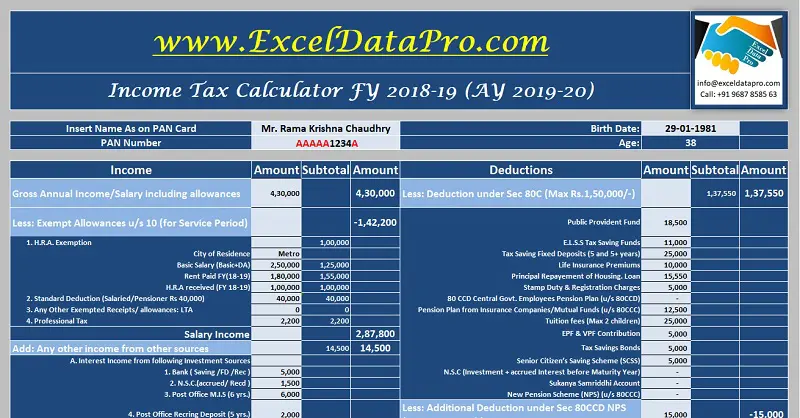

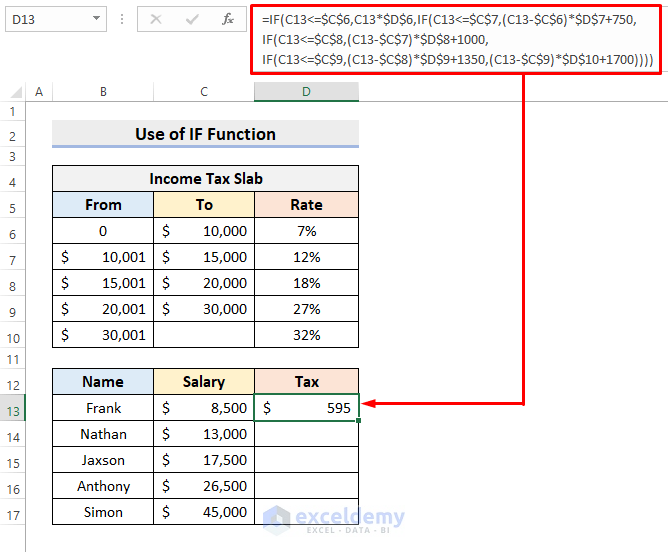

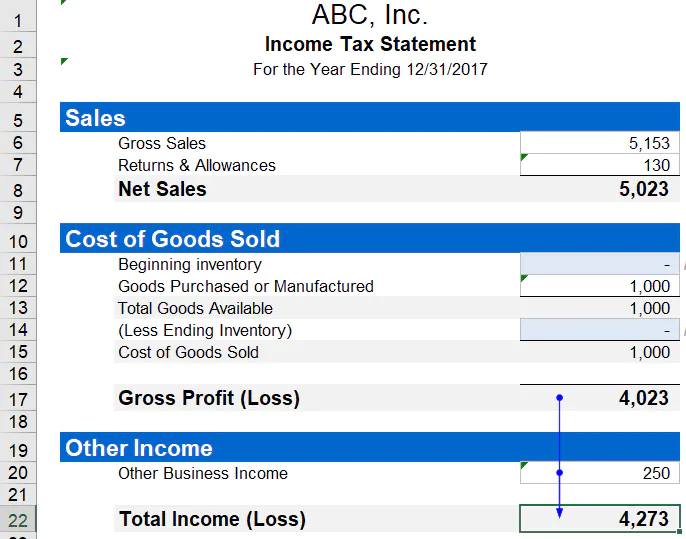

Free Excel Bookkeeping Templates - Beginner-Bookkeeping.com 14. Income Statement excel Template. Also known as profit and loss statement. All businesses need to know if a profit or loss is being made. An income statement basically totals the income, totals the expenses, and subtracts the expenses from the income to arrive at a profit or loss figure. Go to Income Statement... Free Tax Estimate Excel Spreadsheet for 2019/2020/2021 [Download] Dec 11, 2014 · Over the years I have fine-tuned my Excel spreadsheet to require as little input as necessary, especially when it comes to correctly calculate my income tax withholding, based on the various brackets. I tried to find an example for Excel that would calculate federal and state taxes based on the 2017/2018/2019/2020 brackets. What I found was ... Income tax calculating formula in Excel - javatpoint Step 5: See that worksheet after finding educational tax on all data. Step 6: Add the income tax and educational tax and store the result in E column. Note that the total tax is 15,50,150 on total income of Martina, Harry, Jacobe, and Mysha 65,30,000.

Income tax worksheet excel. Supplemental Income and Loss (From rental real estate ... Part I Income or Loss From Rental Real Estate and Royalties . Note: If you are in the business of renting personal property, use. Schedule C. See instructions. If you are an individual, report farm rental income or loss from . Form 4835 . on page 2, line 40. A. Did you make any payments in 2022 that would require you to file Form(s) 1099? Income tax calculating formula in Excel - javatpoint Step 5: See that worksheet after finding educational tax on all data. Step 6: Add the income tax and educational tax and store the result in E column. Note that the total tax is 15,50,150 on total income of Martina, Harry, Jacobe, and Mysha 65,30,000. Free Tax Estimate Excel Spreadsheet for 2019/2020/2021 [Download] Dec 11, 2014 · Over the years I have fine-tuned my Excel spreadsheet to require as little input as necessary, especially when it comes to correctly calculate my income tax withholding, based on the various brackets. I tried to find an example for Excel that would calculate federal and state taxes based on the 2017/2018/2019/2020 brackets. What I found was ... Free Excel Bookkeeping Templates - Beginner-Bookkeeping.com 14. Income Statement excel Template. Also known as profit and loss statement. All businesses need to know if a profit or loss is being made. An income statement basically totals the income, totals the expenses, and subtracts the expenses from the income to arrive at a profit or loss figure. Go to Income Statement...

![Independent Contractor Expenses Spreadsheet [Free Template]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/6349af5f4a6db36bd21473a4_1099-excel-template.png)

![Free Tax Estimate Excel Spreadsheet for 2019/2020/2021 [Download]](https://cdn.michaelkummer.com/wp-content/uploads/2014/12/calculate-tax-facebook.jpg?strip=all&lossy=1&ssl=1)

![Free Tax Estimate Excel Spreadsheet for 2019/2020/2021 [Download]](https://cdn.michaelkummer.com/wp-content/uploads/2014/12/calculate-tax-feature.jpg?strip=all&lossy=1&ssl=1)

![Free Tax Estimate Excel Spreadsheet for 2019/2020/2021 [Download]](https://cdn.michaelkummer.com/wp-content/uploads/2014/12/Screenshot-2018-07-05-17.53.15.jpg?strip=all&lossy=1&w=2560&ssl=1)

0 Response to "44 income tax worksheet excel"

Post a Comment