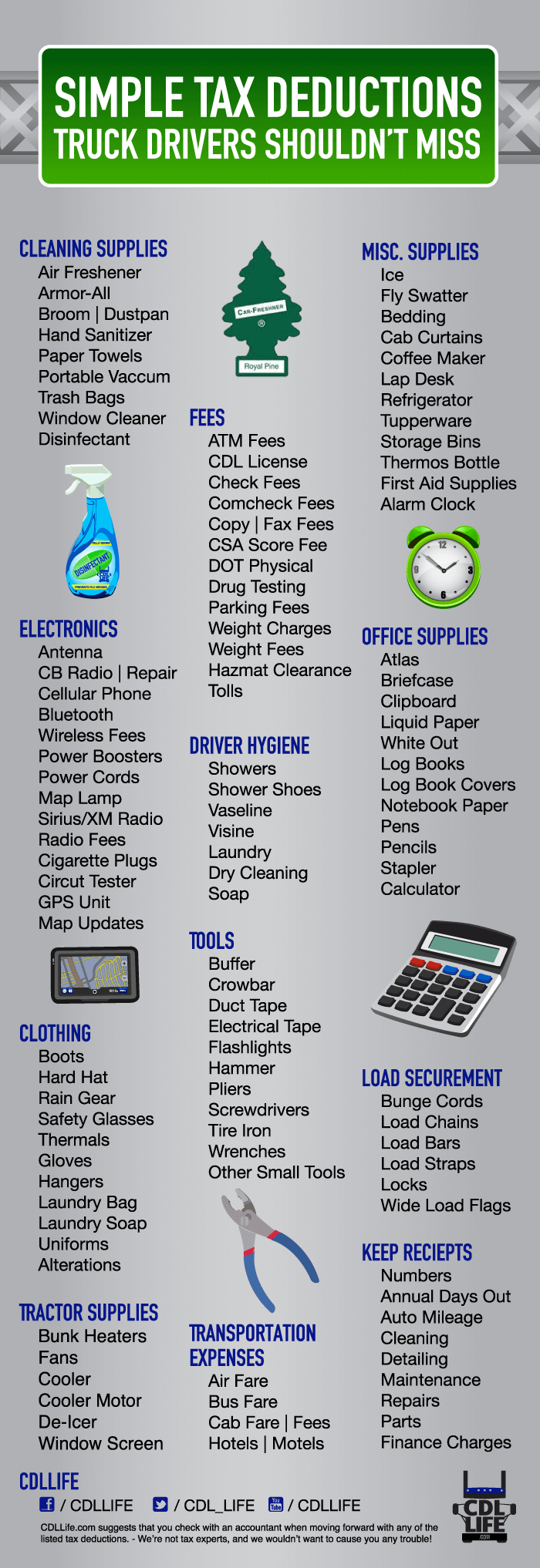

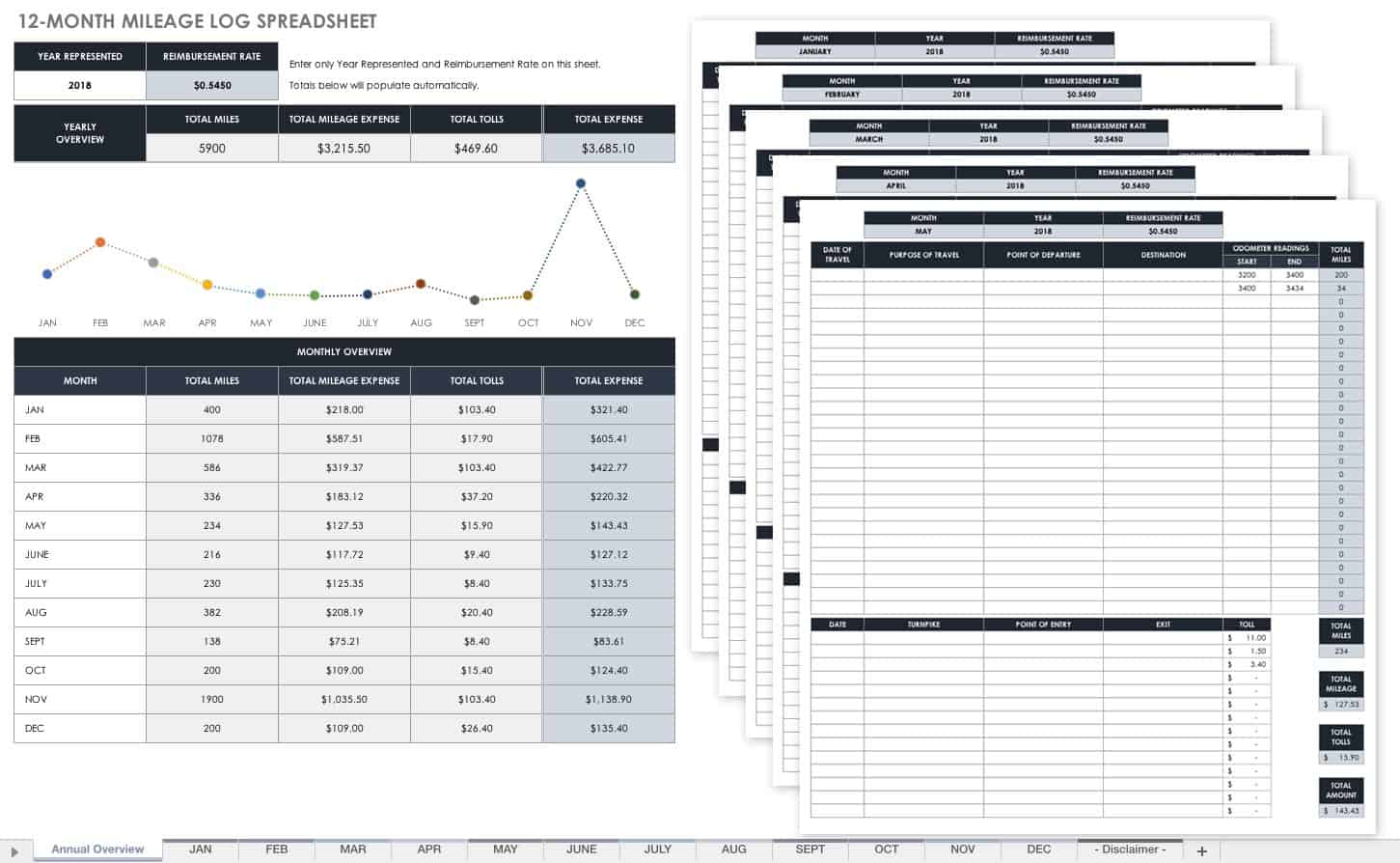

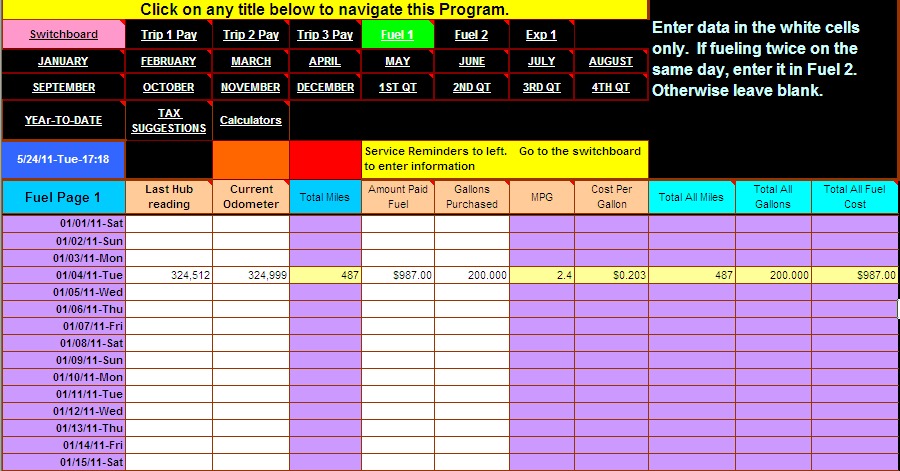

44 truck driver tax deductions worksheet

achieverpapers.comAchiever Papers - We help students improve their academic ... Professional academic writers. Our global writing staff includes experienced ENL & ESL academic writers in a variety of disciplines. This lets us find the most appropriate writer for any type of assignment. › publications › p946Publication 946 (2021), How To Depreciate Property Section 179 deduction dollar limits. For tax years beginning in 2021, the maximum section 179 expense deduction is $1,050,000. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds $2,620,000.Also, the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2021 is $26,200.

› publications › p463Publication 463 (2021), Travel, Gift, and Car Expenses ... Depreciation and section 179 deductions. Generally, the cost of a car, plus sales tax and improvements, is a capital expense. Because the benefits last longer than 1 year, you generally can’t deduct a capital expense.

Truck driver tax deductions worksheet

› blog › real-estate-agent-tax16 Real Estate Tax Deductions for 2022 | 2022 Checklist Hurdlr When your refer a new user to Gett, both of you will receive $20 in credit towards Gett rides. When a driver signs up for Gett they receive $500 after completing 20 rides and if they refer another driver, after 20 rides both receive $500. User referral: $20 per personDriver referral: $500 per person. Become a Gett Driver. Driver referral: $500 › publications › p17Publication 17 (2021), Your Federal Income Tax | Internal ... ITINs assigned before 2013 have expired and must be renewed if you need to file a tax return in 2022. If you previously submitted a renewal application and it was approved, you do not need to renew again unless you haven't used your ITIN on a federal tax return at least once for tax years 2018, 2019, or 2020.. Frivolous tax submissions. › moneywatchMoneyWatch: Financial news, world finance and market news ... Get the latest financial news, headlines and analysis from CBS MoneyWatch.

Truck driver tax deductions worksheet. › 2022/10/12 › 23400986Microsoft takes the gloves off as it battles Sony for its ... Oct 12, 2022 · Microsoft pleaded for its deal on the day of the Phase 2 decision last month, but now the gloves are well and truly off. Microsoft describes the CMA’s concerns as “misplaced” and says that ... › moneywatchMoneyWatch: Financial news, world finance and market news ... Get the latest financial news, headlines and analysis from CBS MoneyWatch. › publications › p17Publication 17 (2021), Your Federal Income Tax | Internal ... ITINs assigned before 2013 have expired and must be renewed if you need to file a tax return in 2022. If you previously submitted a renewal application and it was approved, you do not need to renew again unless you haven't used your ITIN on a federal tax return at least once for tax years 2018, 2019, or 2020.. Frivolous tax submissions. › blog › real-estate-agent-tax16 Real Estate Tax Deductions for 2022 | 2022 Checklist Hurdlr When your refer a new user to Gett, both of you will receive $20 in credit towards Gett rides. When a driver signs up for Gett they receive $500 after completing 20 rides and if they refer another driver, after 20 rides both receive $500. User referral: $20 per personDriver referral: $500 per person. Become a Gett Driver. Driver referral: $500

![Independent Contractor Expenses Spreadsheet [Free Template]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/6238fcf2e45bd9fa5a86e28d_schedule-c-categories.png)

![Ultimate Tax Guide for Uber & Lyft Drivers [Updated for 2022]](https://therideshareguy.com/wp-content/uploads/2021/01/cca53ec6-13d9-4780-980d-6127ac2dfd72_LyftTaxSummary2019_Page_1.jpg)

0 Response to "44 truck driver tax deductions worksheet"

Post a Comment