45 foreign earned income tax worksheet

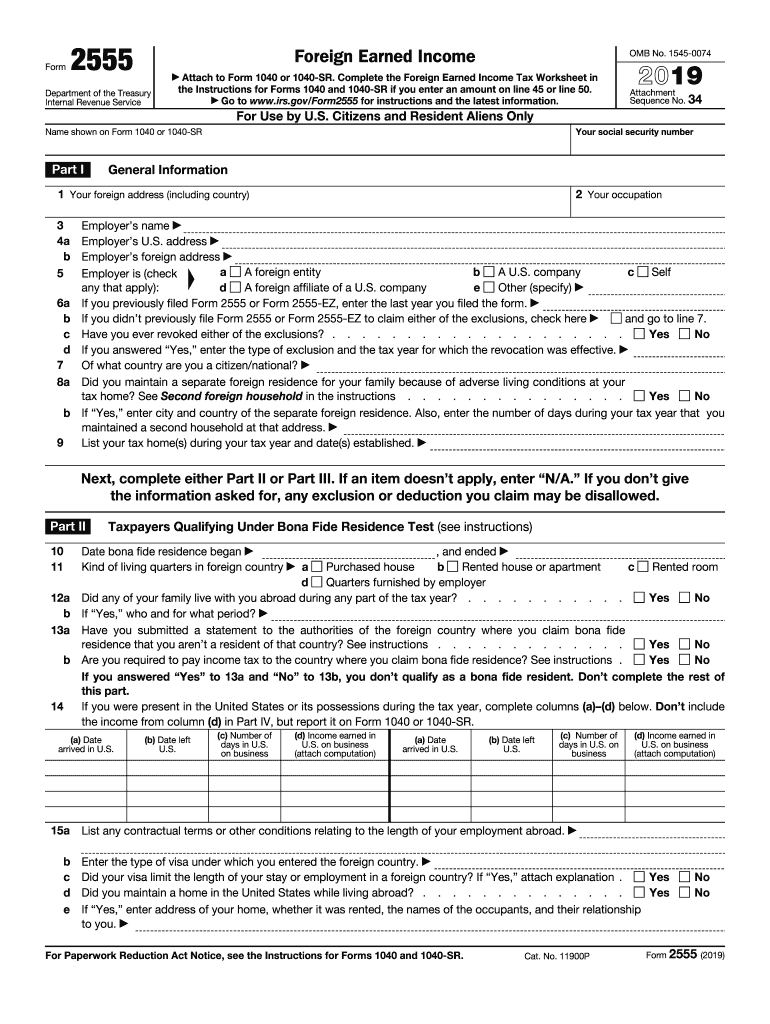

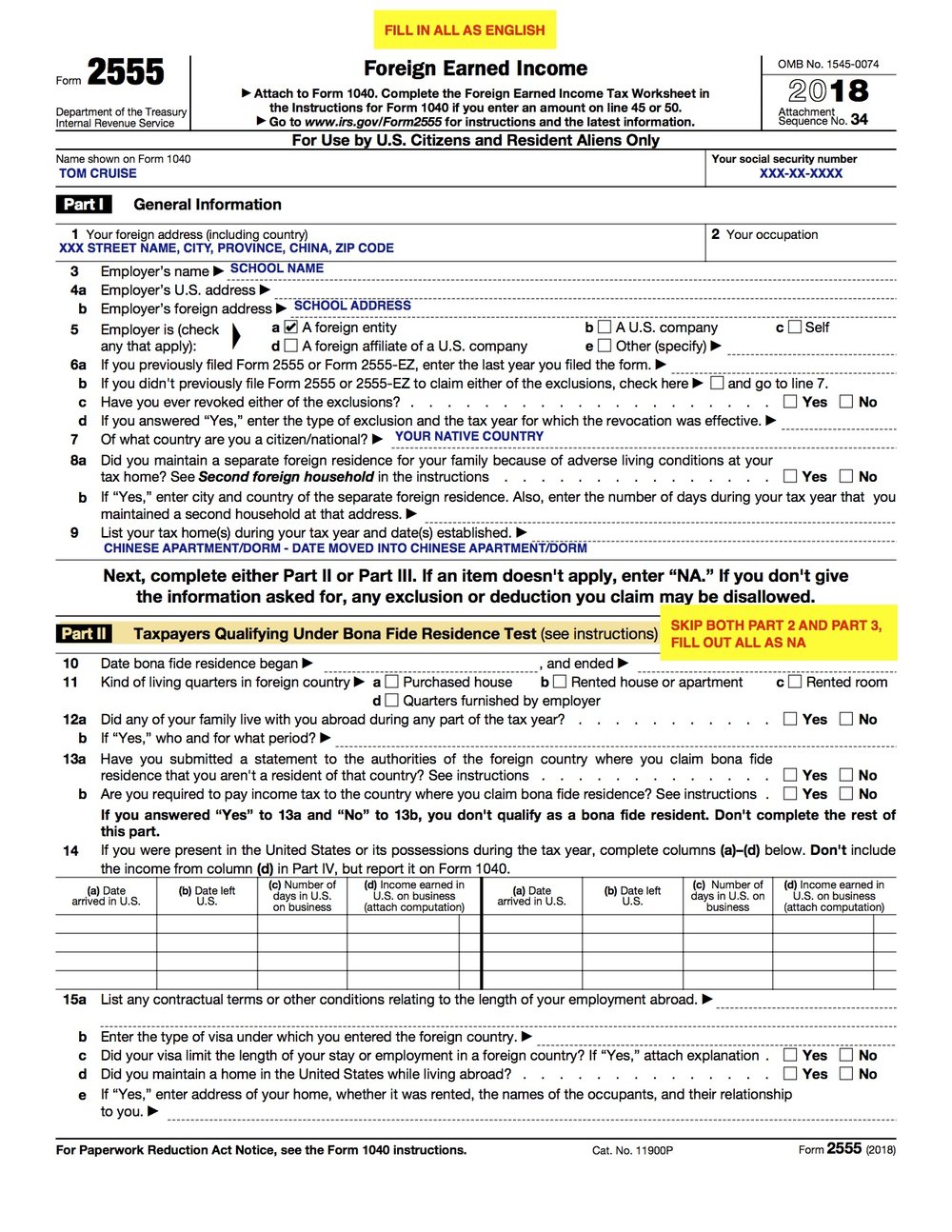

Instructions for Form 2555 (2022) | Internal Revenue Service When figuring your alternative minimum tax on Form 6251, you must use the Foreign Earned Income Tax Worksheet in the Instructions for Form 6251. Specific Instructions. Part I. Line 1. Enter your entire address, including city or town, state or province, country, and ZIP or foreign postal code. If using a military or diplomatic address, include ... PDF Foreign Earned Income Tax Worksheet Foreign Earned Income Tax Worksheet—Line 11a. Keep for Your Records. CAUTION! If Form 1040, line 10, is zero, don't complete this worksheet. 1. Enter the amount from Form 1040, line 10 ... or line 6 of your Schedule D Tax Worksheet by any of your capital gain excess not used in (1) above. 3. Reduce (but not below zero) the amount on your ...

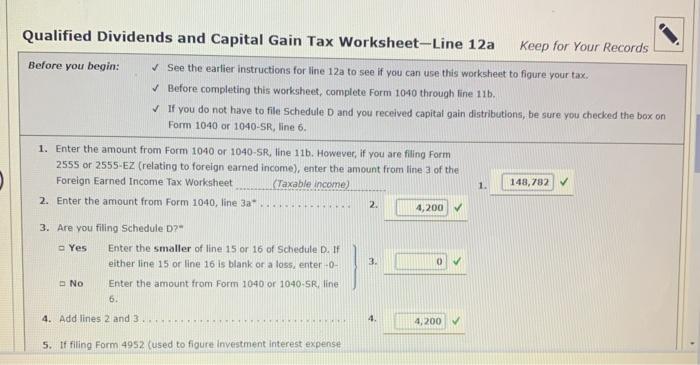

Completing Form 1040 and the Foreign Earned Income Tax Worksheet If you earned more than $100,000, use the tables found on page 77 of the IRS's Instructions for Form 1040. It is important to note that when you are claiming the Foreign Earned Income Exclusion, there is a special worksheet to complete to calculate your tax due for the year. This can be found on page 35 of the IRS's Instructions for Form 1040.

Foreign earned income tax worksheet

FEC Worksheet - Entering Foreign Earned Income in the Program - TaxAct You should instead complete the FEC (Foreign Employer Compensation) worksheet. This income will appear on Form 1040 U.S. Individual Income Tax Return, Line 1 (if entered in the Foreign Employer's Compensation Amount field) or Form 1040, Line 4 (if entered in the Foreign Pension Received or Taxable Amount of Foreign Pension fields). foreign earned income tax worksheet Foreign earned income tax worksheet. K1 2555 reduction albamv Foreign Income and Taxes. 16 Images about Foreign Income and Taxes : The Old Reader, The Go Curry Cracker 2018 Taxes - Go Curry Cracker! and also IRS Form 1040-ES- PDFelement to the Rescue. Foreign Earned Income Tax Worksheet - TaxAct While the Foreign Earned Income Tax Worksheet is linked to Federal Form 1040, it is only used if there is foreign earned income in the return (if the return is reporting an amount on Form 2555, Line 45 for the Foreign Earned Income Exclusion).If Form 2555 does not apply to the return, the tax amount will be determined directly from the tax tables put out by the IRS or Schedule D (Form 1040 ...

Foreign earned income tax worksheet. Foreign Earned Income Tax Worksheet - TaxAct While the Foreign Earned Income Tax Worksheet is linked to Line 44 of Federal Form 1040, it is only used if there is foreign earned income in the return (if the return is reporting an amount on Form 2555, Line 45 for the Foreign Earned Income Exclusion). If Form 2555 does not apply to the return, the tax amount will be determined directly from ... 1040 (2021) | Internal Revenue Service - IRS tax forms Foreign Earned Income Tax Worksheet. Foreign Earned Income Tax Worksheet—Line 16; Qualified Dividends and Capital Gain Tax Worksheet—Line 16; Line 19. Nonrefundable Child Tax Credit and Credit for Other Dependents. Form 8862, who must file. Payments. Line 25 Federal Income Tax Withheld. Line 25a—Form(s) W-2; Line 25b—Form(s) 1099; Line ... 1040-US: Form 2555 Foreign Earned Income Allocation Worksheet and Form ... The worksheets provide support for amounts reported on Form 2555 and Form 1116. All worksheets are designed to be submitted with the return. Form 2555 Foreign Earned Income Allocation Worksheet. The Form 2555 Foreign Earned Income Allocation Worksheet is designed to report the allocation between U.S. and foreign earned income. PDF 2022 Form 2555 - IRS tax forms If any of the foreign earned income received this tax year was earned in a prior tax year, or will be earned in a later tax year (such as a bonus), see the instructions. ... the Foreign Earned Income Tax Worksheet in the Instructions for Form 1040 if you enter an amount

Foreign Earned Income Tax Worksheet - TaxAct The Foreign Earned Income Tax Worksheet figures the applicable tax rate by combining the amounts (line 3) and subtracting from that tax calculation (line 4) the tax that would have been due on the foreign earned income (line 5). This does not apply tax directly on the FEI, but the exclusion does bump the tax rate up. ... Get Foreign Earned Income Tax Worksheet - US Legal Forms Fill out each fillable area. Ensure that the info you add to the Foreign Earned Income Tax Worksheet is updated and accurate. Add the date to the sample using the Date option. Select the Sign tool and create an electronic signature. You will find 3 available alternatives; typing, drawing, or uploading one. Foreign Income Worksheet - Capital Group Foreign Income Worksheet 2021 Worksheet instructions For each fund and share class owned, enter the Total Ordinary Dividends reported in Box 1a of Form 1099-DIV next to the fund's name in the worksheet. Foreign earned income tax worksheet HELP - Expat Forum For People ... Fundamentally, it changes the calculation of tax you pay on your income to reflect your AGI + excluded income but then only applies that tax rate on only your non-excluded income. Say you had an income of 110,000 and excluded 100,000. Before they introduced this change you would have looked up 10,000 in the tax tables.

PDF 2555 Foreign Earned Income - e-File Form 2555 Department of the Treasury Internal Revenue Service Foreign Earned Income aAttach to Form 1040 or 1040-SR.Complete the Foreign Earned Income Tax Worksheet in the Instructions for Forms 1040 and 1040-SR if you enter an amount on line 45 or line 50. Foreign Earned Income Exclusion | Internal Revenue Service - IRS tax forms Figuring the tax: If you qualify for and claim the foreign earned income exclusion, the foreign housing exclusion, or both, must figure the tax on your remaining non-excluded income using the tax rates that would have applied had you not claimed the exclusion(s). Use the Foreign Earned Income Tax Worksheet in the Form 1040 Instructions. Publication 54 (2021), Tax Guide for U.S. Citizens and Resident Aliens ... The maximum foreign earned income exclusion is adjusted annually for inflation. For 2021, the maximum exclusion has increased to $108,700. ... See the Instructions for Form 1040 and complete the Foreign Earned Income Tax Worksheet to figure the amount of tax to enter on Form 1040 or 1040-SR, line 16. If you must attach Form 6251, ... foreign earned income tax worksheet Form 2555 - Foreign Earned Income (2014) Free Download . form 2555 income earned tax application file foreign number australian taxation. Foreign Earned Income Tax Worksheet 2018 Pdf - Tax Walls taxwalls.blogspot.com. tax worksheet income earned foreign pdf. IRS Form 1040-ES- PDFelement To The Rescue pdf.wondershare.com

About Form 2555, Foreign Earned Income - IRS tax forms Information about Form 2555, Foreign Earned Income, including recent updates, related forms, and instructions on how to file. If you qualify, you can use Form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. ... About Form 1040, U.S. Individual Income Tax Return. About Form 8801, Credit for Prior Year ...

Figuring the Foreign Earned Income Exclusion - IRS tax forms In 2021, you received $20,000 for work you did in the foreign country in 2020. You can exclude $7,600 of the $20,000 from your income in 2021. This is the $107,600 maximum foreign earned income exclusion for 2020 minus the $100,000 you already excluded for that year. You must include the remaining $12,400 in income for 2021 ($20,000 - $7,600 ...

Foreign Earned Income Tax Worksheet - TaxAct While the Foreign Earned Income Tax Worksheet is linked to Line 11 of Federal Form 1040, it is only used if there is foreign earned income in the return (if the return is reporting an amount on Form 2555, Line 45 for the Foreign Earned Income Exclusion). If Form 2555 does not apply to the return, the tax amount will be determined directly from ...

Get Foreign Earned Income Tax Worksheet - US Legal Forms The following tips will allow you to fill out Foreign Earned Income Tax Worksheet quickly and easily: Open the document in the full-fledged online editor by clicking Get form. Fill in the necessary boxes that are marked in yellow. Press the arrow with the inscription Next to jump from field to field. Use the e-signature solution to add an ...

Foreign Earned Income Tax Worksheet - TaxAct While the Foreign Earned Income Tax Worksheet is linked to Federal Form 1040, it is only used if there is foreign earned income in the return (if the return is reporting an amount on Form 2555, Line 45 for the Foreign Earned Income Exclusion).If Form 2555 does not apply to the return, the tax amount will be determined directly from the tax tables put out by the IRS or Schedule D (Form 1040 ...

foreign earned income tax worksheet Foreign earned income tax worksheet. K1 2555 reduction albamv Foreign Income and Taxes. 16 Images about Foreign Income and Taxes : The Old Reader, The Go Curry Cracker 2018 Taxes - Go Curry Cracker! and also IRS Form 1040-ES- PDFelement to the Rescue.

FEC Worksheet - Entering Foreign Earned Income in the Program - TaxAct You should instead complete the FEC (Foreign Employer Compensation) worksheet. This income will appear on Form 1040 U.S. Individual Income Tax Return, Line 1 (if entered in the Foreign Employer's Compensation Amount field) or Form 1040, Line 4 (if entered in the Foreign Pension Received or Taxable Amount of Foreign Pension fields).

:max_bytes(150000):strip_icc()/1040-NR2021-59bde80441114cfa9cb43d182e899b8b.jpeg)

0 Response to "45 foreign earned income tax worksheet"

Post a Comment