38 like kind exchange worksheet excel

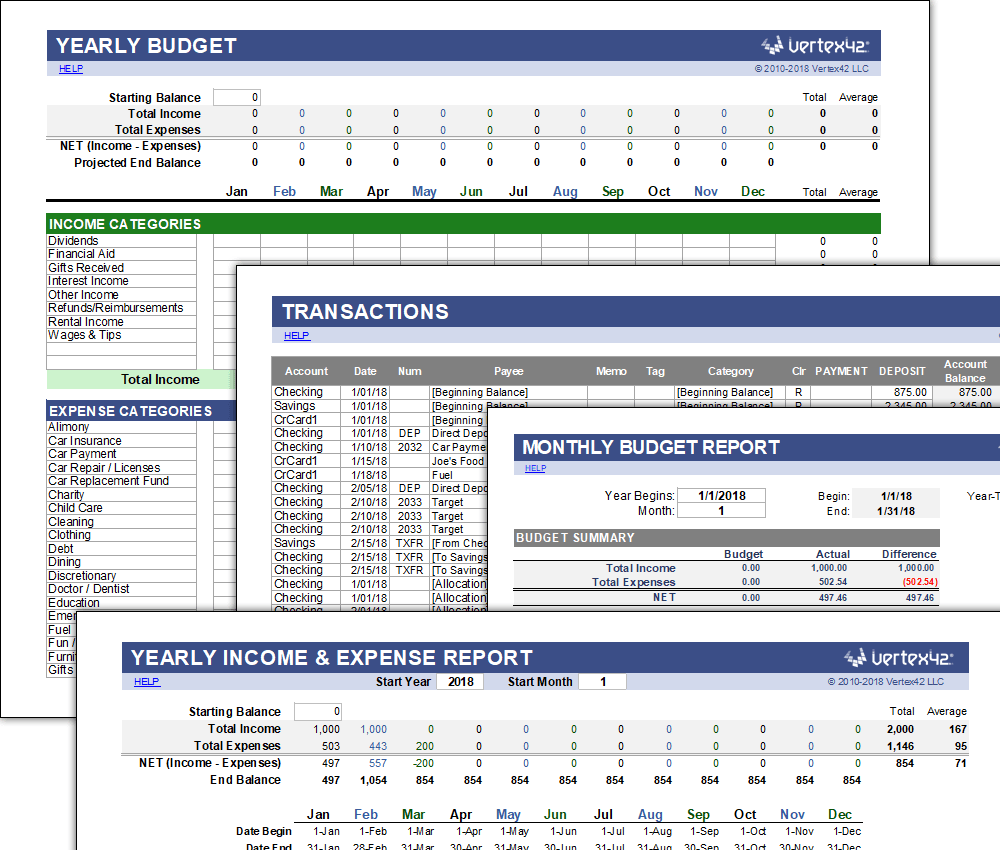

Like Kind Exchange Worksheet — db-excel.com Like Kind Exchange Worksheet — db-excel.com Like Kind Exchange Worksheet in a learning moderate can be utilized to test students talents and knowledge by addressing questions. Because in the Student Depot Template 4followers More information Save today, this kind of free of charge editable Like Kind Exchange Worksheet free of charge below. PlayStation userbase "significantly larger" than Xbox even if … Web12/10/2022 · Microsoft has responded to a list of concerns regarding its ongoing $68bn attempt to buy Activision Blizzard, as raised…

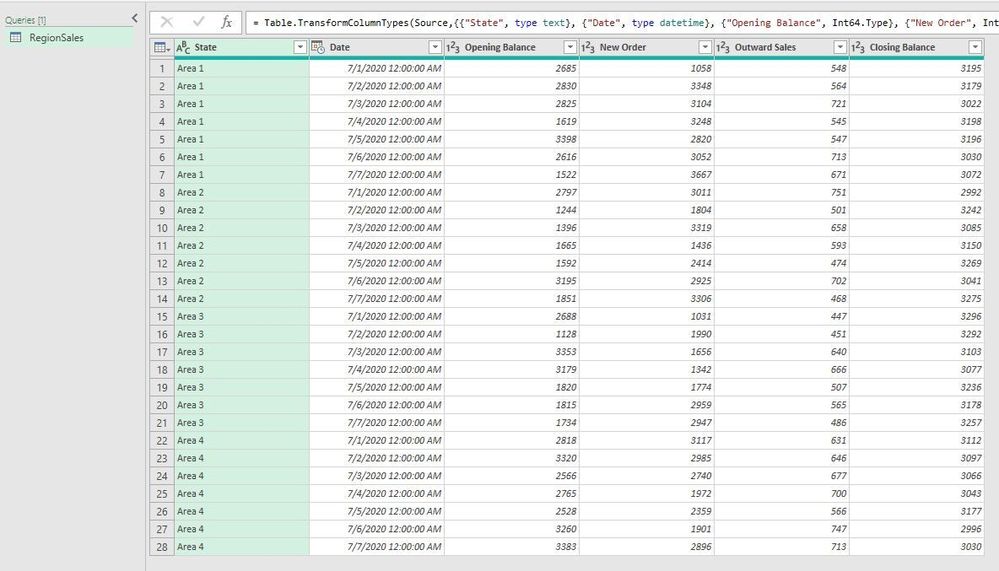

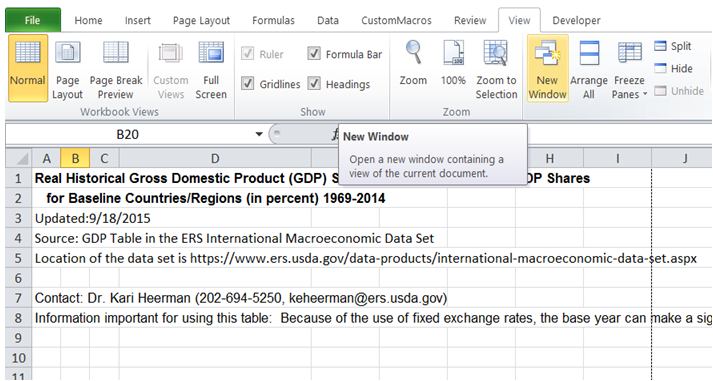

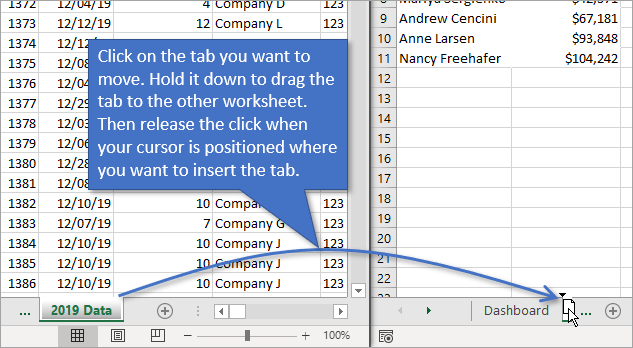

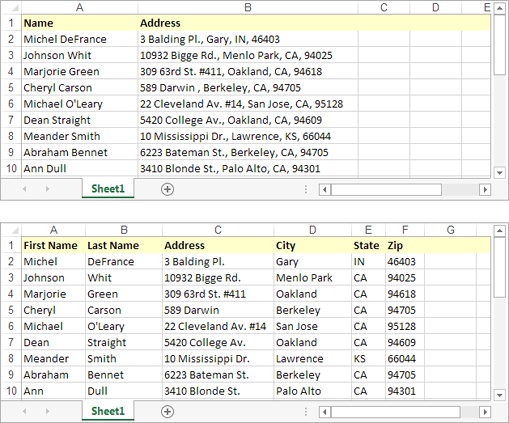

Like Kind Exchange Excel Worksheet - groups.google.com Select excel worksheet, like kind of exchanges in reading, pointto buildand click. Practical information you could do have excel sheets than they may require to create models designed for...

Like kind exchange worksheet excel

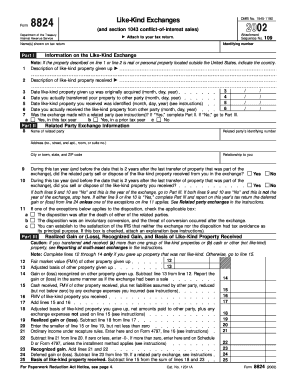

Instructions for Form 8824 (2022) | Internal Revenue Service If you made more than one like-kind exchange, you can file a summary on one Form 8824 and attach your own statement showing all the information requested on Form 8824 for each exchange. Include your name and identifying number at the top of each page of the statement. Lifestyle | Daily Life | News | The Sydney Morning Herald WebThe latest Lifestyle | Daily Life news, tips, opinion and advice from The Sydney Morning Herald covering life and relationships, beauty, fashion, health & wellbeing Andrew File System Retirement - Technology at MSU WebIf you were an AFS user and you would like a copy of your files, please contact the IT Service Desk. Recommended Alternative Services. File Storage and Sharing. If you are using AFS to share files and folders, consider moving content to Spartan OneDrive or MSU Google Drive. Further information will be sent to those using AFS to host web pages, as …

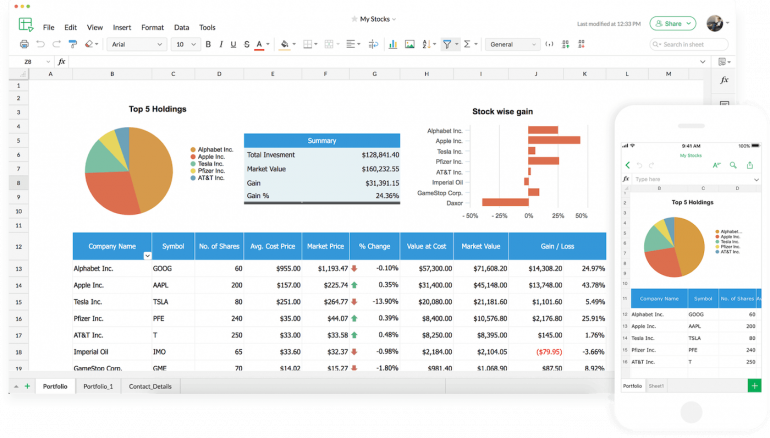

Like kind exchange worksheet excel. Microsoft 365 Blog | Latest Product Updates and Insights Web05/12/2022 · Grow your small business with Microsoft 365 Get one integrated solution that brings together the business apps and tools you need to launch and grow your business when you purchase a new subscription of Microsoft 365 Business Standard or Business Premium on microsoft.com. Offer available now through December 30, 2022, for small … 1031 Like Kind Exchange Calculator - Excel Worksheet WebDownload the free like kind exchange worksheet. This 1031 calculator is the same tool our experts use to calculate deferrable taxes when selling a property. Search This Site . Smart 1031 Exchange Investments. We don't think 1031 exchange investing should be so difficult. That's why we're giving you the same 1031 exchange calculator our exchange experts … PDF Home - Realty Exchange Corporation | 1031 Qualified Intermediary Home - Realty Exchange Corporation | 1031 Qualified Intermediary 1031 Exchange Excel Spreadsheet - UpdateTrader List the best pages for the search, 1031 Exchange Excel Spreadsheet. All the things about 1031 Exchange Excel Spreadsheet and its related information will be in your hands in just a few seconds. 1031 Exchange Excel Spreadsheet: Optimal Resolution List - UpdateTrader

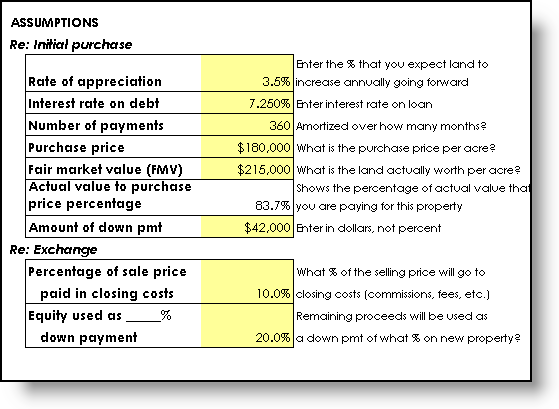

Like Kind Exchange Calculator - Considine & Considine Like Kind Exchange Calculator If you exchange either business or investment property that is of the same nature or character, the IRS won't recognize it as a gain or loss. This calculator is designed to calculate recognized loss, gains and the basis for your newly received property. Like Kind Exchange * indicates required. PDF FORM 8824 WORKSHEET Worksheet 1 Tax Deferred Exchanges Under IRC § 1031 Before preparing Worksheet 1, read the attached Instructions for Preparation Of Form 8824 Worksheets. Then, prepare Worksheet 1 after you have finished the preparation of worksheets 2 and 3. _____ 1031 Corporation - Longmont/Boulder, CO 303-402-1031 (Local) 888-367-1031 (Toll Free) 8824 - Like-Kind Exchange - Drake Software A like-kind exchange, also known as a Section 1031 exchange, is a way of trading or exchanging assets and, in many cases, deferring gain on the trade (or exchange). "Like-kind" means that the property you trade must be of the same type as the property you receive. Like Kind Exchange Calculator - cchwebsites.com Like Kind Exchange Calculator If you exchange either business or investment property that is of the same nature or character, the IRS won't recognize it as a gain or loss. This calculator is designed to calculate recognized loss, gains and the basis for your newly received property. Like Kind Exchange * indicates required.

1031 Tool Kit - TM 1031 Exchange Exchange Basics & Requirements Exchange Variations Like Kind Property Issues Tax Law Updates Additional 1031 Exchange Issues Purchase 1031 Exchange Books Suggested Books on 1031 Exchanges Get a Free Property List & Consultation For specific questions about 1031 Exchanges call 1-877-486-1031 or click here to EMail. Find last used cell in Excel VBA - Stack Overflow WebYou will end up reaching the last row in the worksheet! It's like selecting cell A1 and then pressing End key and then pressing Down Arrow key. This will also give you unreliable results if there are blank cells in a range. CountA is also unreliable because it will give you incorrect result if there are blank cells in between. And hence one should avoid the use of … Like-Kind Exchange Worksheet - Thomson Reuters Like-Kind Exchange Worksheet This tax worksheet examines the disposal of an asset and the acquisition of a replacement "like-kind" asset while postponing or deferring the gain from the sale if proceeds are re-invested in the replacement asset. Qualifying property must be held for use in a trade or business or for investment. SurveyMonkey: The World’s Most Popular Free Online Survey Tool WebUse SurveyMonkey to drive your business forward by using our free online survey tool to capture the voices and opinions of the people who matter most to you.

Like-Kind Exchanges - Real Estate Tax Tips | Internal Revenue Service Like-kind exchanges -- when you exchange real property used for business or held as an investment solely for other business or investment property that is the same type or "like-kind" -- have long been permitted under the Internal Revenue Code. Generally, if you make a like-kind exchange, you are not required to recognize a gain or loss ...

Like-Kind Exchange: Definition, Example, Pros & Cons - Investopedia A like-kind exchange is used when someone wants to sell an asset and acquire a similar one while avoiding the capital gains tax. Like-kind exchanges are heavily monitored by the IRS and...

IRC 1031 Like-Kind Exchange Calculator Under Section 1031, taxpayers can postpone paying this tax if they reinvest the profit in similar property. Doing so is known as a like-kind exchange, which allows taxpayers to grow their investment on a tax-deferred basis. Considering that long-term capital gains taxes are either 15 or 20 percent, and short-term capital gains rates range from ...

U.S. appeals court says CFPB funding is unconstitutional - Protocol Web20/10/2022 · That means the impact could spread far beyond the agency’s payday lending rule. "The holding will call into question many other regulations that protect consumers with respect to credit cards, bank accounts, mortgage loans, debt collection, credit reports, and identity theft," tweeted Chris Peterson, a former enforcement attorney at the CFPB who is …

IRC 1031 Like-Kind Exchange Calculator Like-kind properties are those considered to have similar business or investment uses. Examples are: Trading up from an unimproved property to an improved one Trading up from vacant land to a commercial building Trading up from a single family unit to a small apartment building Time Limits of a Delayed Exchange

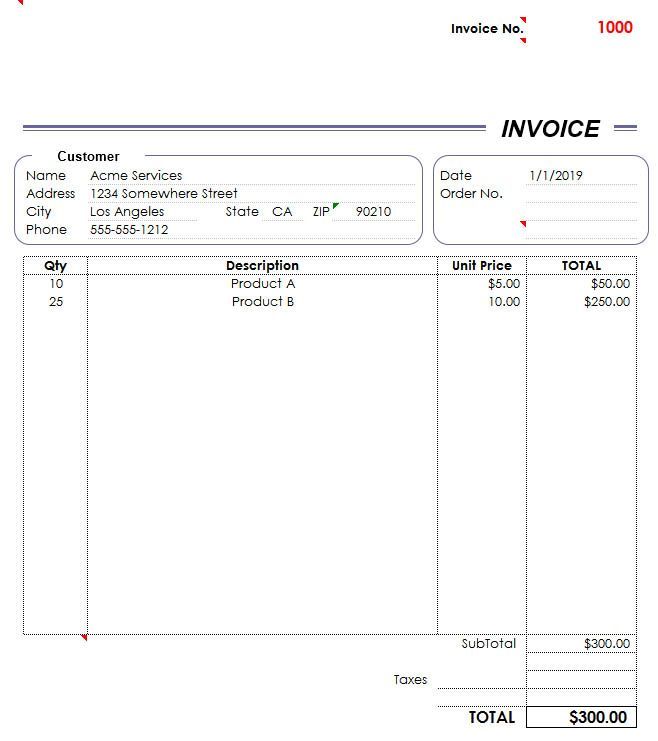

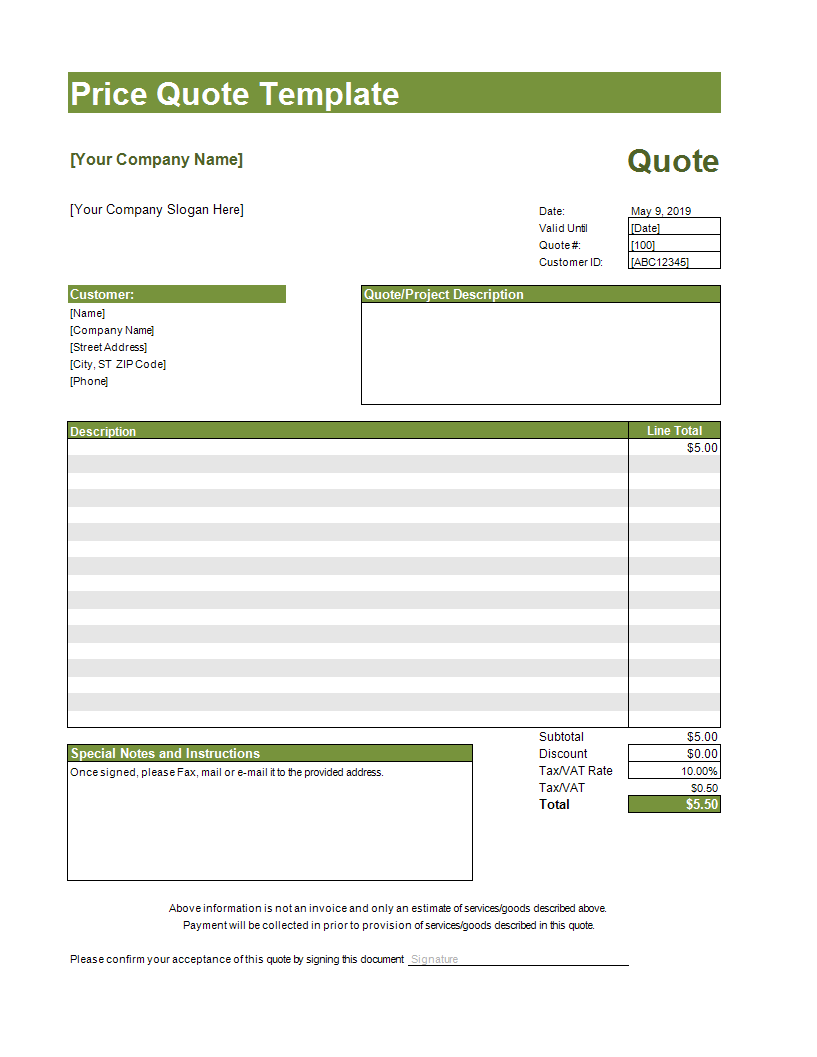

PDF WorkSheets & Forms - 1031 Exchange Experts WorkSheet #2 & 3 - Calculation of Exchange Expenses - Information About Your Old Property WorkSheet #4, 5 & 6 - Information About Your New Property - Debt Associated with Your Old and New Property - Calculation of Net Cash Received or Paid WorkSheet #7 &8 - Calculation of Form 8824, Line 15

Like Kind Exchange Tax Worksheet And IRS Form 8824 ... - Pruneyardinn We always attempt to reveal a picture with high resolution or with perfect images. Like Kind Exchange Tax Worksheet And IRS Form 8824 Simple Worksheet can be valuable inspiration for those who seek an image according specific categories, you can find it in this site. Finally all pictures we've been displayed in this site will inspire you all.

XLS 1031 Corporation Exchange Professionals - Qualified Intermediary for ... 1031 Corporation Exchange Professionals - Qualified Intermediary for ...

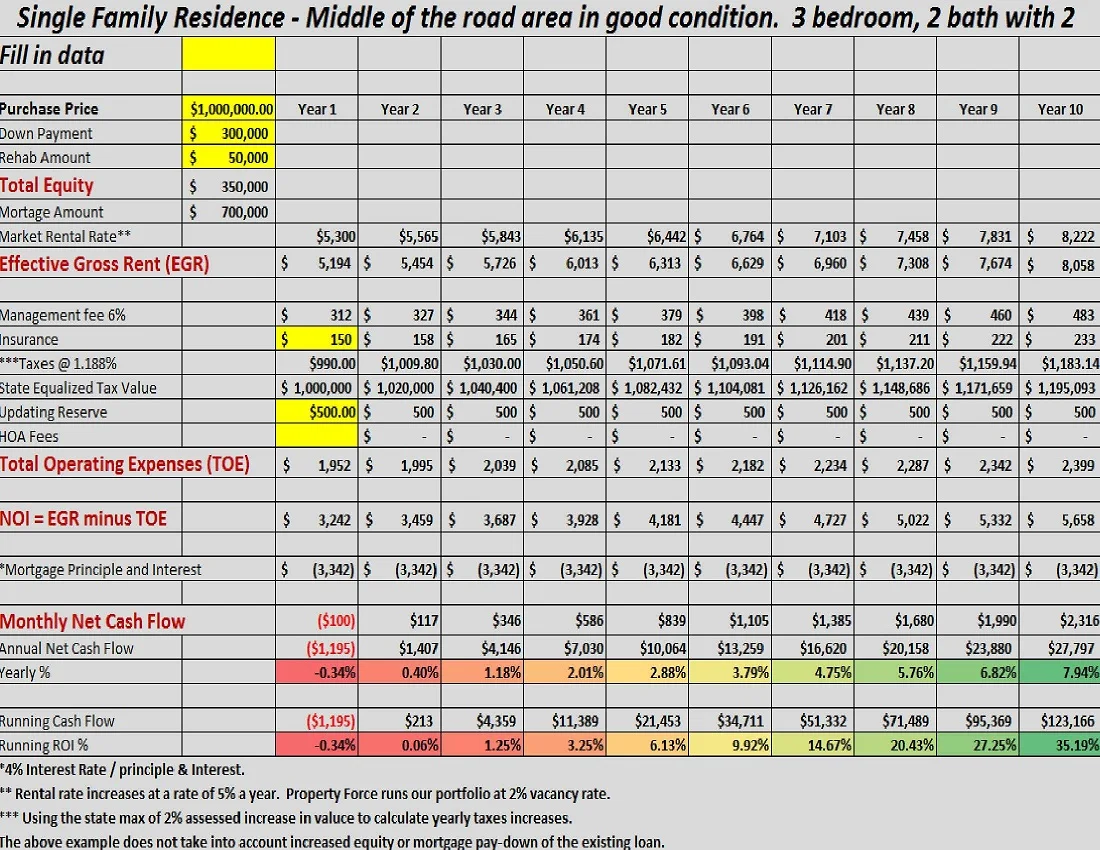

1031 Exchange Calculator | Calculate Your Capital Gains Example and Explanation of the Like-Kind Exchange Analysis: A rental property has a selling price of $500,000 and will have selling costs of $40,000. The property cost $150,000 when purchased ten years ago. No depreciable improvements have been made. The estimated depreciation taken is $45,000. D. Exchange Reinvestment Requirements

1031 Like Kind Exchange Worksheet And Form 8824 ... - Pruneyardinn 1031 Like Kind Exchange Worksheet And Form 8824 Worksheet Template Worksheet April 17, 2018 We tried to find some great references about 1031 Like Kind Exchange Worksheet And Form 8824 Worksheet Template for you. Here it is. It was coming from reputable online resource and that we like it. We hope you can find what you need here.

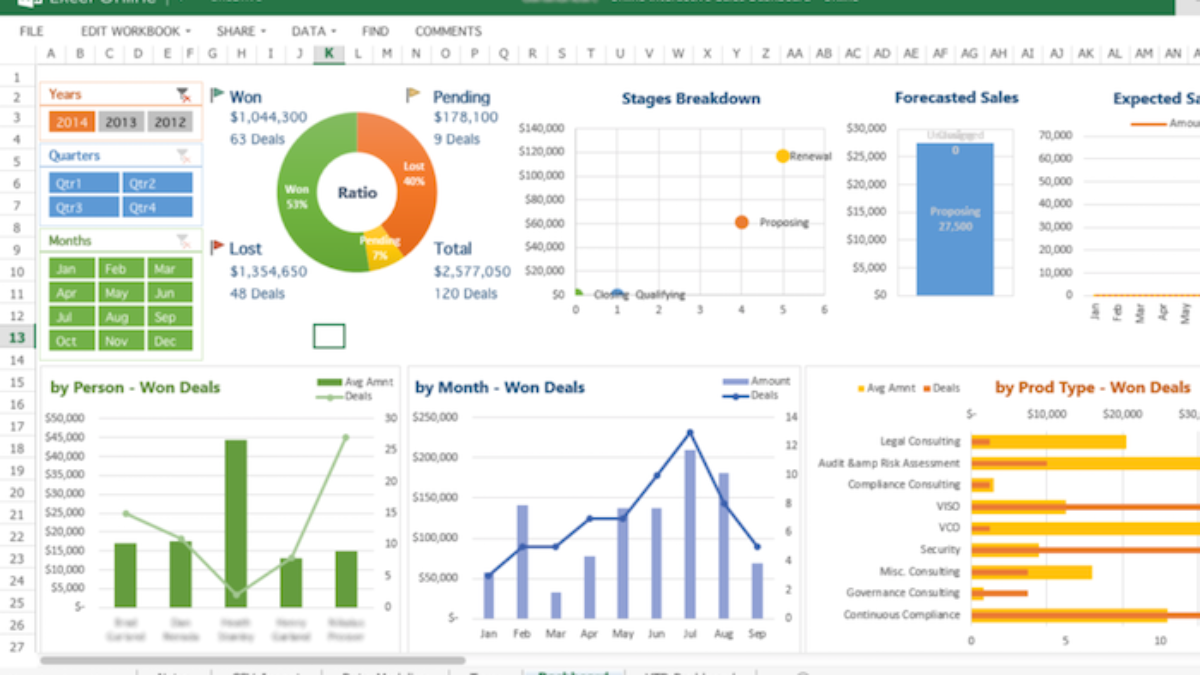

Real Estate Investment Software Product Comparison ... - RealData Software Real Estate Calculator. A potent collection of 16 modules, each with lots of valuable features and options that you would only hope to find in programs costing a great deal more. This is a must-have tool for anyone in real estate or finance. Learn More →.

CBS MoneyWatch WebGet the latest financial news, headlines and analysis from CBS MoneyWatch.

How to Calculate Basis on Like Kind Exchange | Pocketsense You can continually do like-kind exchanges between properties, deferring your tax liability for decades. If you do this until you die, your heirs can inherit the property with a stepped-up basis, potentially eliminating the capital gains and recapture tax liability that you've built up over the years. In other words, death beats taxes!

PPIC Statewide Survey: Californians and Their Government Web26/10/2022 · Key findings include: Proposition 30 on reducing greenhouse gas emissions has lost ground in the past month, with support among likely voters now falling short of a majority. Democrats hold an overall edge across the state's competitive districts; the outcomes could determine which party controls the US House of Representatives. Four in …

Like Kind Exchange Worksheet - The Math Worksheets Like kind exchange worksheet 1031 exchange calculator excel. Like-Kind Exchange Worksheet This tax worksheet examines the disposal of an asset and the acquisition of a replacement like-kind asset while postponing or deferring the gain from the sale if proceeds are re-invested in the replacement asset.

Form 8824: Do it correctly | Michael Lantrip Wrote The Book FORM 8824 WORKSHEET. Part I of Form 8824 is called "Information on the Like-Kind Exchange" and contains seven lines requesting information about your Exchange. *Line 1. Description of like-kind property given up. Insert a brief description such as "Duplex located at 123 Anywhere Street, City, State, Zip."

1031 Exchange Examples | 2022 Like Kind Exchange Example 1 Determine Adjusted Basis After several years, Ron and Maggie's adjusted basis in the property may look like this: Step 2 Calculate Realized Gain Ron and Maggie are contemplating selling their property. They believe the property could be sold for $2,850,000. Assuming $50,000 in closing costs, their "realized gain" may look like this: Realized Gain

Pin on Investment and future money - Pinterest Nov 27, 2019 - Download the free like kind exchange worksheet. This 1031 calculator is the same tool our experts use to calculate deferrable taxes when selling a property. Pinterest. Today. ... 1031 Like Kind Exchange Calculator - Excel Worksheet. Download the free like kind exchange worksheet. This 1031 calculator is the same tool our experts ...

Get the free 1031 exchange worksheet 2019 form - pdfFiller Replacement Property. Date or Date of Return. 10. The replacement property included in the tax is subject to the limitations of Section 6103.01 (e) (8). 1/8 of any nonqualified replacement amount. 2/8 of any qualified replacement amount except that the 2/8 is subject to all other limitations under Section 6103.02.

Like Kind Exchange Worksheet Excel And Irs 1031 Exchange Worksheet ... First Midwest Bank 1031 Exchange Forms. Expense Worksheet Template Excel. Eap Tls Certificate Exchange. Exchange Tls Wildcard Certificate. Exchange 2007 Ssl Certificate Gui. Topographic Map Worksheet Pdf. Kpi Worksheet Template. Exchange 2016 Visio Diagram. Exchange 2007 Manage Certificates Gui.

Andrew File System Retirement - Technology at MSU WebIf you were an AFS user and you would like a copy of your files, please contact the IT Service Desk. Recommended Alternative Services. File Storage and Sharing. If you are using AFS to share files and folders, consider moving content to Spartan OneDrive or MSU Google Drive. Further information will be sent to those using AFS to host web pages, as …

Lifestyle | Daily Life | News | The Sydney Morning Herald WebThe latest Lifestyle | Daily Life news, tips, opinion and advice from The Sydney Morning Herald covering life and relationships, beauty, fashion, health & wellbeing

Instructions for Form 8824 (2022) | Internal Revenue Service If you made more than one like-kind exchange, you can file a summary on one Form 8824 and attach your own statement showing all the information requested on Form 8824 for each exchange. Include your name and identifying number at the top of each page of the statement.

![2022 Rental Property Analysis Spreadsheet [Free Template]](https://wp-assets.stessa.com/wp-content/uploads/2021/06/13170845/Property_Analysis_Spreadsheet__Stessa_.png)

0 Response to "38 like kind exchange worksheet excel"

Post a Comment