39 tax and tip worksheet

Publication 17 (2021), Your Federal Income Tax | Internal ... Tip Income: Pub. 531, Reporting Tip Income: 8: ... Complete Form 4868 to use as a worksheet. If you think you may owe tax when you file your return, ... Privacy Impact Assessments - PIA | Internal Revenue Service Jan 24, 2022 · POPULAR FORMS & INSTRUCTIONS; Form 1040; Individual Tax Return Form 1040 Instructions; Instructions for Form 1040 Form W-9; Request for Taxpayer Identification Number (TIN) and Certification

Have you received a letter related to COVID-19 benefits? Don ... May 11, 2022 · personal income and expense worksheet; payment arrangement calculator; If you wish to set up a payment arrangement, you must call our agents. Unable to pay. If you are unable to pay your debt right now or unable to pay it at all, you should call the CRA to discuss your situation. We understand that these may be challenging times and are here to ...

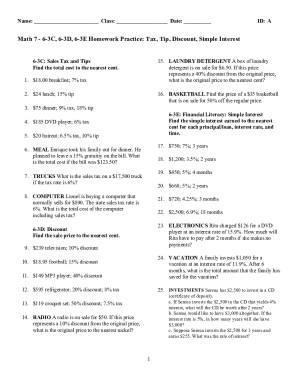

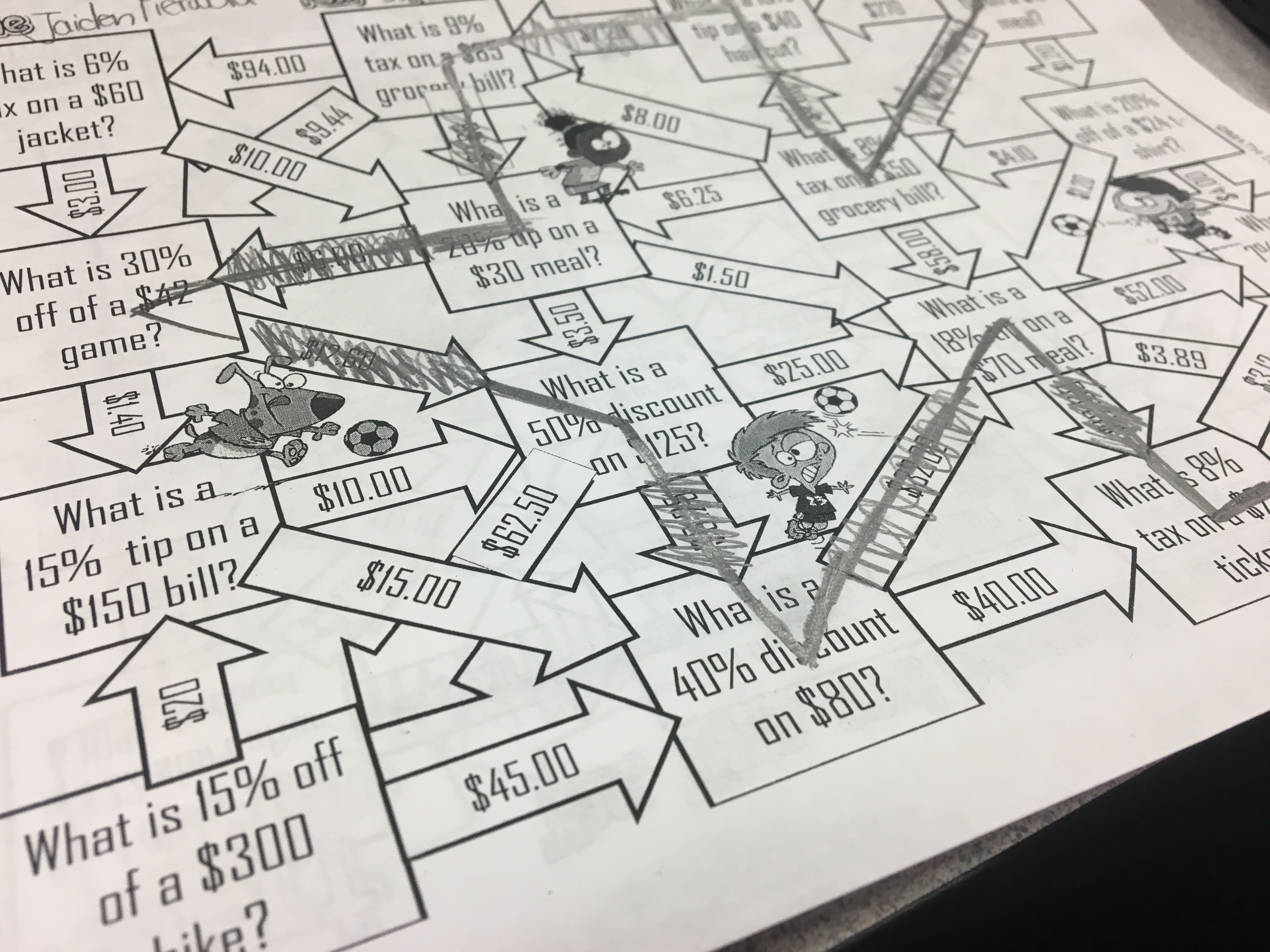

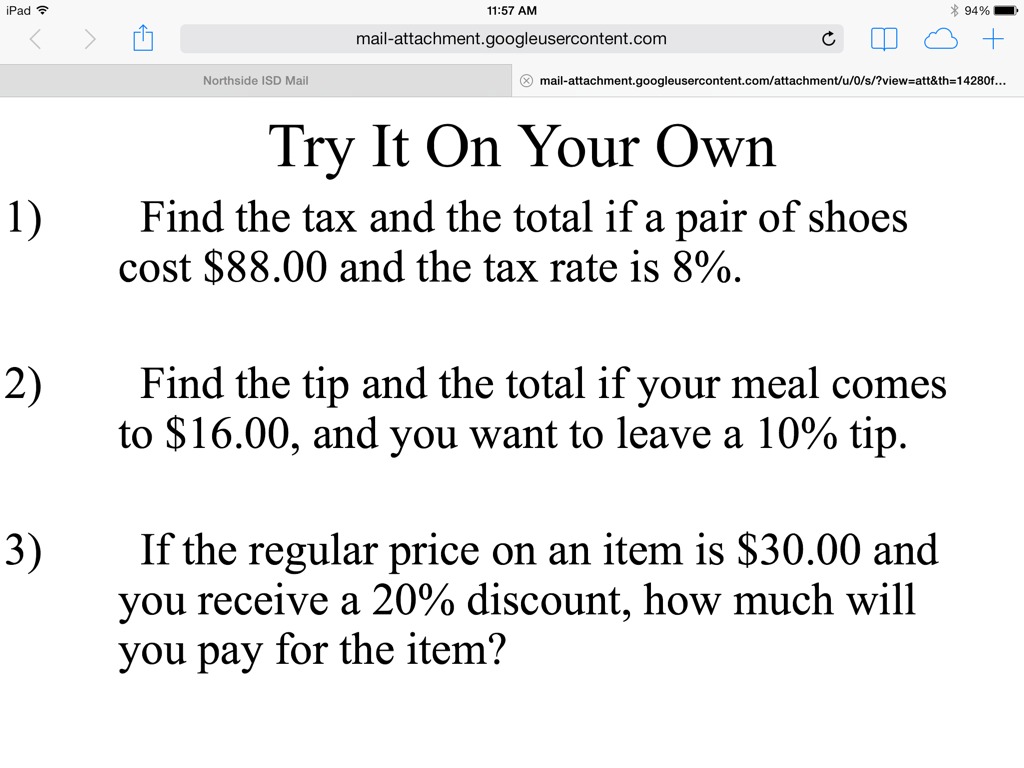

Tax and tip worksheet

Line 31285 – Home accessibility expenses - Canada.ca Completing your tax return. To claim home accessibility expenses complete line 31285 for Home accessibility expenses on the Federal Worksheet, and enter the amount from line 4 of your worksheet on line 31285 of your return. A maximum of $10,000 per year in eligible expenses can be claimed for a qualifying individual. 1040NOW 1040Now Federal / State Tax Forms. Please contact 1040Now Support (cs@1040now.com) if you find any Federal or State Tax Forms missing from our list. Federal Tax Forms Federal Tax Forms Not Supported State Tax Forms; 1040 Forms Supported: 1040 - INDIVIDUAL TAX RETURN / SCHEDULE 1-3 1040-SR - U.S. TAX RETURN FOR SENIORS Page 33 of 117 - IRS tax forms worksheet instead of a publication to find out if any of your benefits are taxable. Before you begin: 1. Enter the total amount from . box 5 of all your Forms SSA-1099 and Forms RRB-1099. Also, enter this amount on Form 1040, line 5a ..... 1. 2. Multiply line 1 by 50% (0.50)..... 2. 3. Combine the amounts from Form 1040, lines 1, 2b, 3b, 4b ...

Tax and tip worksheet. Page 33 of 117 - IRS tax forms worksheet instead of a publication to find out if any of your benefits are taxable. Before you begin: 1. Enter the total amount from . box 5 of all your Forms SSA-1099 and Forms RRB-1099. Also, enter this amount on Form 1040, line 5a ..... 1. 2. Multiply line 1 by 50% (0.50)..... 2. 3. Combine the amounts from Form 1040, lines 1, 2b, 3b, 4b ... 1040NOW 1040Now Federal / State Tax Forms. Please contact 1040Now Support (cs@1040now.com) if you find any Federal or State Tax Forms missing from our list. Federal Tax Forms Federal Tax Forms Not Supported State Tax Forms; 1040 Forms Supported: 1040 - INDIVIDUAL TAX RETURN / SCHEDULE 1-3 1040-SR - U.S. TAX RETURN FOR SENIORS Line 31285 – Home accessibility expenses - Canada.ca Completing your tax return. To claim home accessibility expenses complete line 31285 for Home accessibility expenses on the Federal Worksheet, and enter the amount from line 4 of your worksheet on line 31285 of your return. A maximum of $10,000 per year in eligible expenses can be claimed for a qualifying individual.

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

0 Response to "39 tax and tip worksheet"

Post a Comment